Noticias del mercado

-

17:04

US business activity for the services sector fell in July

Activity in the US service sector grew at the slowest pace in five months, although firms across the sector signaled that the slowdown will be temporary and have stepped up hiring in anticipation of better business.

Preliminary index of purchasing managers in the services sector by Markit Economics reached 50.9 this month, up from 51.4 in June. Economists had expected the index to rise to 52.0. The preliminary value reflects about 85% of responses that come in the final reading.

While the decline was unexpected and marked the lowest growth rate since March, the index still points to expansion, with a reading above 50.

Markit report on services sector is a snapshot of domestic demand, which measures the health of bars and restaurants, dry cleaners, and salons. Head for the majority of American jobs, a sector offset a smaller, but much weaker manufacturing sector. In recent months, the growth rate slowed down, as the uncertainty in the economy and the elections in 2016 gave some consumers and businesses pause.

In July, many service providers have reported a modest increase in new orders, although some firms said that the muted economic conditions affected the activity. Underpinned by expectations of growth in the coming months is that companies in the service sector added jobs better pace in three months. Respondents indicated plans to expand the business and hope to improve the economic conditions at Markit said, adding that some experts expect that activity will increase after the presidential election later this year.

"The US service sector is stuck in low gear at the beginning of the third quarter," said Andrew Harker, senior economist at Markit, but "more encouraging was the rebound in business confidence following the June survey, suggesting that a return to a stronger growth will be possible after the soft current period comes to an end. "

-

16:33

Consumer confidence in US remained almost unchanged in July

The data from the Conference Board showed that consumer confidence indicator decreased slightly in July, reaching 97.3 points (1985 = 100) compared with 97.4 in June (revised from 98.0). Analysts had forecast a drop to 95.9 index. the current situation index rose to 118.3 from 116.6 in June, while the expectations index fell from 84.6 to 83.3.

"Consumer confidence remained stable in July after the improvement in June. Consumers were somewhat more positive about current business and labor market conditions, suggesting that the economy will continue to grow at a moderate pace. Expectations for business conditions and labor market conditions, and as personal income prospects, fell slightly, as consumers continued to show a cautious optimism about growth in the short term - said Lynn Franco, director of economic indicators in the Conference Board.

Consumers' estimation of current conditions improved slightly in June. The share of those who said that business conditions are "good" increased from 26.8 percent to 28.1 percent. Meanwhile, the proportion saying that conditions are "bad" business, also increased, from 18.3 percent to 19.0 percent. Consumers' estimation of the labor market situation has not changed much since June. The proportion of those who say that jobs are "plentiful" decreased from 23.2 percent to 23.0 percent, however, the proportion of those who reported that jobs are "hard to get" and declined to 23.7 percent from 22 , 3 percent.

Optimism about consumers' short-term outlook was slightly less favorable in July. The proportion of consumers expecting improved business conditions in the next six months, down from 16.6 percent to 15.9 percent, while the share of those who expect conditions to deteriorate, increased from 11.2 percent to 12, 3 per cent. Forecast of consumers in respect of the labor market was also more favorable than in June. The share expecting more jobs virtually unchanged at 14.0 percent in the coming months, while the number of those who predict fewer jobs decreased from 17.7 percent to 17.0 percent. The proportion of consumers expecting their incomes growth fell from 18.2 percent to 16.6 percent, while the share of those who expect a decline in revenues, decreased from 11.3 percent to 10.8 percent.

-

16:31

United States: the volume of new home sales rose sharply at the end of June

Sales of new buildings increased significantly in June, topping analysts' estimates, and pointing to the steady improvement in the US housing market. This was reported by the Ministry of Commerce.

According to data, seasonally adjusted sales of new homes rose in June by 3.5% compared with the previous month, reaching an annual rate of 592,000 units. Last rate of increase turned out to be the strongest since February 2008. Economists had expected sales amount to 560 000. The figure for May was revised up to 572,000 from 551,000.

Compared with June 2015 sales of new buildings increased by 25.4%. In broader terms, in the first six months of 2016 sales increased by 10.1% per annum confident.

The Ministry of Commerce said that the increase in new home sales was backed up by historically low interest rates. The average rate on 30-year mortgage with a fixed rate was 3.57% in June, compared to 3.98% in June 2015.

However, housing stocks remain scarce, which has upward pressure on housing prices. Recall data released last week showed that in late June on the secondary market was a 4.6-month supply of homes available for sale. As for the market of new buildings, housing inventory at the end of June it was sufficient for 4.9 months of sales, which is the lowest value in more than a year. The median sales price of new homes in June was $ 306,700, which is 6.1% more compared to the previous year.

-

16:00

U.S.: Richmond Fed Manufacturing Index, July 10 (forecast -4)

-

16:00

U.S.: Consumer confidence , July 97.3 (forecast 95.9)

-

16:00

U.S.: New Home Sales, June 592 (forecast 560)

-

15:50

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1000 (EUR 1.1bln) 1.1025-30 (413m) 1.1100 (568m)

USDJPY: 104.75 (USD 280m) 106.25 (295m) 106.50 (363m) 107.00 (1bln)

GBPUSD 1.2900 (GBP 496m) 1.3100 (562m) 1.3250 (598m)

AUDUSD 0.7435-40 (AUD 800m) 0.7475 (476m) 0.7500 (270m)

-

15:45

U.S.: Services PMI, July 50.9 (forecast 52)

-

15:18

Belgium’s business barometer rose again slightly in July

The National Bank of Belgium's business barometer rose again slightly in July, on the heels of a sharp increase in June. The business climate has shown divergent trends among the branches of activity surveyed. For instance, the indicator has picked up again in the building industry and the third consecutive improvement was recorded in business-related services. On the other hand, after a big improvement last month, the business situation deteriorated slightly in the manufacturing industry. Retailers also appeared to be more pessimistic, like last month. All the components of the indicator have firmed up in the building industry and especially those relating to changes on the previous month in terms of both order books or use of equipment. In contrast to last month, the improvement in the business-related services sector is based exclusively on an upward revision of forecasts, for firms' own activity as well as for general market demand.

-

15:16

US: Home prices continue to appreciate across the country - S&P Case-Shiller raport

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.0% annual gain in May, the same as the prior month. The 10-City Composite posted a 4.4% annual increase, down from 4.7% the previous month. The 20-City Composite reported a year-over-year gain of 5.2%, down from 5.4% in April. Portland, Seattle, and Denver reported the highest year-over-year gains among the 20 cities over each of the last four months. In May, Portland led the way with a 12.5% year-over-year price increase, followed by Seattle at 10.7%, and Denver with a 9.5% increase. Eight cities reported greater price increases in the year ending May 2016 versus the year ending April 2016.

"Home prices continue to appreciate across the country," says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. "Overall, housing is doing quite well. In addition to strong prices, sales of existing homes reached the highest monthly level since 2007 as construction of new homes showed continuing gains. The SCE Housing Expectations Survey published by the New York Federal Reserve Bank shows that consumers expect home prices to continue rising, though at a somewhat slower pace.

-

15:02

U.S.: S&P/Case-Shiller Home Price Indices, y/y, May 5.2% (forecast 5.5%)

-

15:00

Belgium: Business Climate, July 1 (forecast -0.6)

-

14:22

European session review: the US dollar on the back foot

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 UK approved applications for mortgage loans on the BBA figures, th. June 41.8 40.2 40.1

The pound rose markedly against the US dollar, fully recovering after falling in the first half of the session. Support for currency had BOE representative Martin Weale, which said it will vote in favor of encouraging the British economy. "After the publication of extremely weak data on business activity I have revised the views about the economic outlook".. Recall recently Weale said that need more evidence to consider voting for lower interest rates.

He will not give a clear answer to the question whether he would support a rate cut at the next BoE meeting on 4 August. This will be the second meeting of the Central Bank after the referendum. Recall, the Bank of England surprised markets in July, leaving interest rates unchanged, but the minutes of the meeting showed that most politicians are expected to support the launch of additional measures to stimulate the economy in August. "The Bank of England during the August meeting may announce new stimulus package, which may include a purchase scheme of corporate bonds in the secondary market, which has not been used since 2013". - Noted Natixis Asset Management experts.

A slight pressure on the pound from British Bankers Association (BBA) data. The report stated that the number of mortgage approvals fell in June to 40,103 compared to 41,842 in May. Experts forecasted the figure at 40 200. The last reading was the lowest since March 2015. "Banking data this month reflects the uncertainty that was felt on the eve of the EU referendum - says Rebecca Harding, chief economist at BBA -. Business borrowing fell in June for the first time in 2016, making it clear that investment decisions were postponed until the end of voting."

The euro rose against the dollar moderately, but then fell back to the opening level, on expectations of the Fed meeting. Given the recent statistical data on the US, as well as statements by some members of the Fed, interest rates this year may be raised at least once. However, experts do not expect that tomorrow. Rather, the July session may mark only some improvement in the tone of the accompanying statements under the influence of recent economic reports. Reuters latest survey found that just over half of the 100 economists expect the Fed to raise interest rates in the 4th quarter to 0.50-0.75 percent. The change is likely to occur in December.

Later today, investors' attention will be drawn to the statistics of the US, namely, the business activity index for the services sector, the index of consumer confidence, and a report on new home sales.

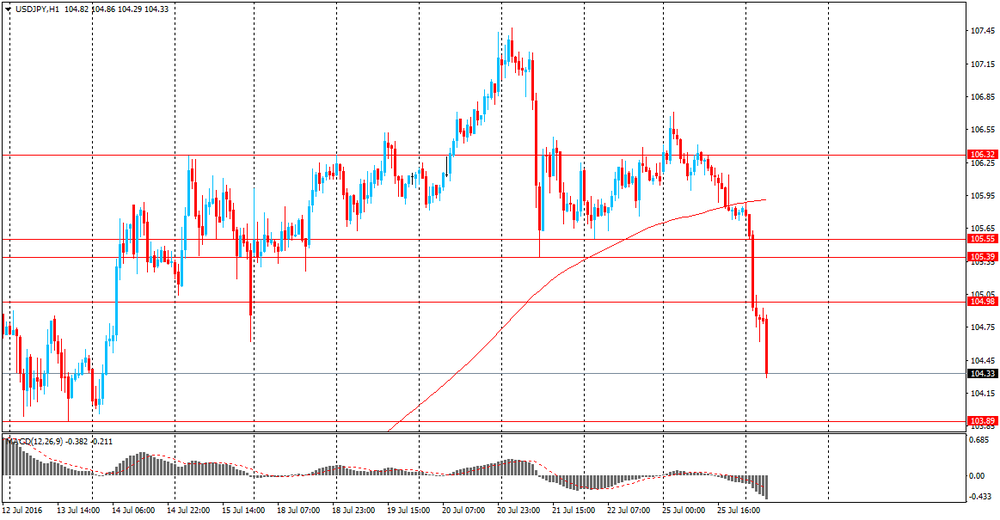

The yen has strengthened considerably against the dollar, reaching its highest level since July 14. The main reason for such dynamics were talks about new stimulus. Now the Japanese government says the program will amount of 6 trillion, of which $ 2 trillion is in the form of a supplementary budget. Earlier it was expected that the size of the program will amount to 20-30 trillion. In addition, the budget expenditures are likely to be financed by the supplementary budget, rather than by the Bank of Japan. This suggests that the Central Bank does not intend to use "helicopter money."

According to the Bloomberg survey, 78% of respondents expect easing. Most likely, at the upcoming meeting the Bank of Japan will decide to increase ETF purchases. Also was not ruled out further reduction in interest rates and increased government bond purchases.

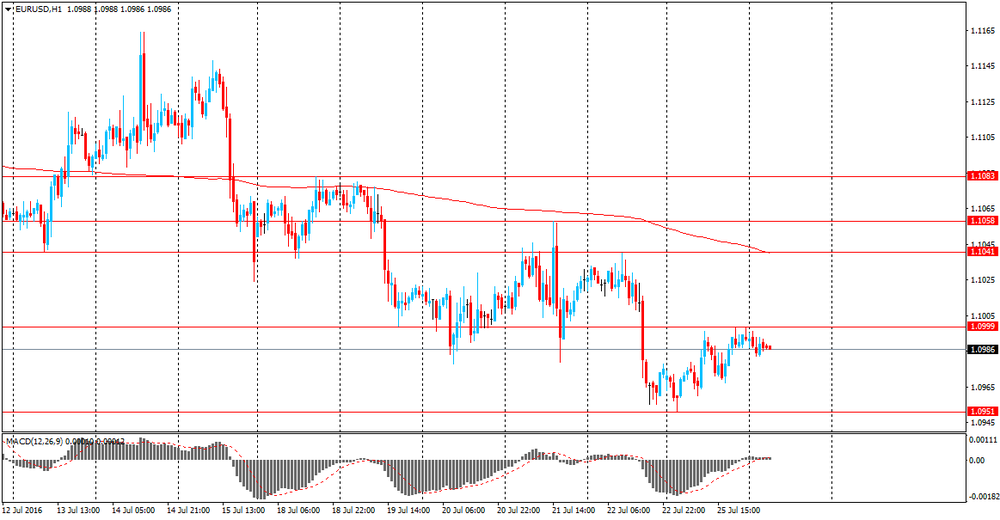

EUR / USD: during the European session, the pair rose to $ 1.1029, but then fell back to $ 1.0990

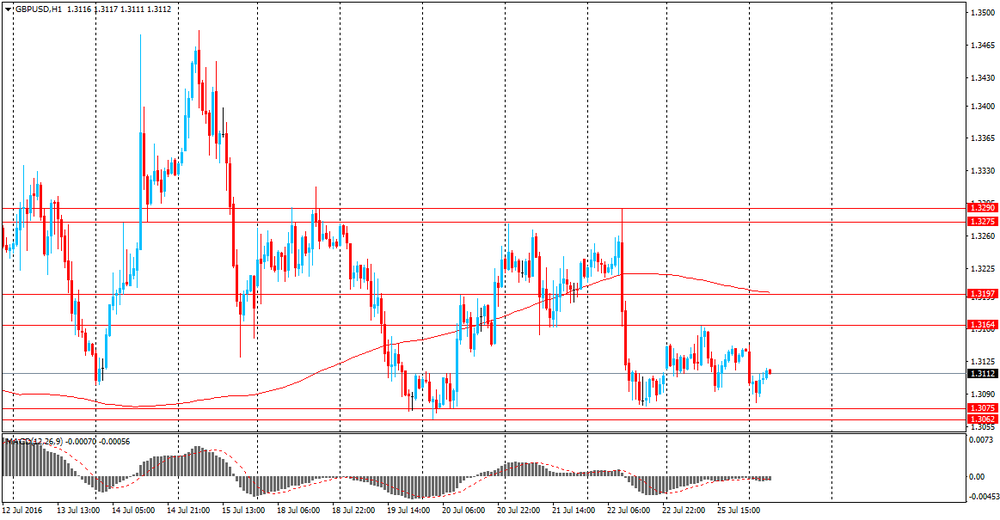

GBP / USD: during the European session, the pair fell to $ 1.3056 and then rose to $ 1.3150

USD / JPY: during the European session, the pair fell to Y103.98

-

13:50

Orders

EUR/USD

Offers 1.1025.30 1.1050 1.1075-80 1.1100 1.1125-30 1.1150 1.1180 1.1200

Bids 1.0980-85 1.0950 1.0930 1.0900 1.0880 1.0850 1.0800

GBP/USD

Offers 1.3100 1.3125-30 1.3155-60 1.3180-85 1.3200 1.3250 1.3300

Bids 1.3050 1.3020 1.3000 1.2980 1.2950 1.2900

EUR/GBP

Offers 0.8425-30 0.8450 0.8470 0.8485 0.8500 0.8525 0.8550

Bids 0.8400 0.8385 0.8365 0.8350 0.8330 0.8300 0.8285 0.8255-60

EUR/JPY

Offers 115.00 115.60 115.80 116.00 116.40 116.80 117.00 117.50 117.80 118.00

Bids 114.30 114.00 113.75 113.50 113.00 112.80 112.50 112.00

USD/JPY

Offers 104.50 104.80 105.00 105.30 105.50 105.80

Bids 104.00 103.75-85 103.40-50 103.00 102.85 102.50 102.00

Offers 0.7550 0.7580 0.7600 0.7620 O.7635 0.7650-55 0.7700

Bids 0.7500 0.7485 0.7450 0.7420 0.7400 0.7385 0.7370 0.7350

-

13:04

EU Commission spokesman: we are thinking about sanctions on Spain and Portugal tomorrow - Bloomberg

-

12:55

Major stock indices in Europe trading mixed

European stocks traded without significant dynamic, since the rise in price of commodity producers offset by a decrease in shares of banks and energy companies.

Little influence had statements by the of the Bank of England Martin Weale. Noted that he assesses the economic outlook different now after the publication of extremely weak data on business activity in the services sector. Recall a week before the release of this report Weale said that he needed more evidence to consider lowering interest rates. He will not give a clear answer to the question whether he would support a rate cut at the next BoE meeting on 4 August. It should be emphasized, it will be the second meeting of the Central Bank after Britain voted in favor of withdrawal from the EU. The Bank of England surprised markets in July, leaving interest rates unchanged, but the minutes of the meeting showed that most politicians are expected to support the launch of additional measures to stimulate the economy in August. "The Bank of England during the August meeting may announce new stimulus package, which may include the purchase of corporate bonds the central bank has in the secondary market of corporate bonds purchase scheme which was not used in 2013, "- noted Natixis Asset Management.

Investors are also awaiting the Federal Reserve and Bank of Japan meetings. Given the recent data on the US, as well as statements by the Fed, interest rates this year may be increased for at least one more time, but this is unlikely to happen at the July meeting. Futures on the federal funds assess the probability of a rate hike in July to 1.2%. Meanwhile, the chances for a hike in December are 43%. Reuters latest survey found that just over half of the 100 economists expect the Fed to raise interest rates in the 4th quarter to . The change rate is likely to occur in December.

The composite index of Europe's largest enterprises Stoxx 600 fell 0.2 percent.

Shares of Rio Tinto Group and BHP Billiton Ltd. increased by at least 1.8 percent.

Shares of Commerzbank AG fell 4.9 percent after one of the key indicators of the strength of the capital fell in the second quarter.

The cost of BP Plc fell 2.2 percent amid the reduction in quarterly profit.

Orange SA capitalization fell by 3.8 percent, despite the fact that the rate of decline in revenues and quarterly earnings in line with estimates.

Faurecia shares rose 3.8 percent, as the company has improved its target for 2016.

AMS AG Cost increased by 5.7 per cent after the company reported for the production of semiconductors a higher amount of gains than expected.

At the moment:

FTSE 100 +8.81 6718.94 + 0.13%

DAX -3.94 10194.30 -0.04%

CAC 40 4368.70 -19.30 -0.44%

-

11:38

Bank of England policymaker Martin Weale would opt for immediate stimulus

According to rttnews, Bank of England policymaker Martin Weale shifted his monetary policy stance after the release of negative business survey results and now favors an immediate stimulus to the economy.

"I see things rather differently from what I would have done had we not had those numbers and the material point is that they were collected after July 12, so after the initial shock of the referendum," Weale said in the interview with the Financial Times.

In the June 23rd referendum, 52 percent Britons opted to leave the European Union in a surprise move.

In a speech last week, the policymaker said the uncertainty from "Brexit" suggested waiting for firmer evidence before taking any action. He also rejected the argument that markets would be disappointed were there to be no easing in August.

"What I said last week is that I would like more information as well as more reflection and I have had more information. Although you can't say there's a clear signal, if you spend all the time waiting for a clear signal, it never comes," said Weale.

As monetary policy works with a delay, even an action in August is unlikely to give quick boost to the economy, he added.

"If we're talking about having an effect by the end of the year, there is very little that the bank can do," Weale said.

The BoE rate-setter is set to step down on August 8, ending his second three-year term.

-

10:46

UK: this month’s High Street Banking data reflects the Brexit uncertainty

Gross mortgage borrowing of £12.2bn in the month was 4% higher than in June 2015. Borrowing in the first half of 2016 was £79.9bn compared with £63.6bn in the same period of 2015.

Net mortgage borrowing is 3% higher than a year ago.

Consumer credit continues to show annual growth of over 6% possibly reflecting uncertainty and in the case of personal loans and overdrafts favourable interest rates.

House purchase approval numbers have bounced back a little from the low numbers seen in April (following the surge in the first few months of 2016) but are still some 11% lower than in June 2015. However in the first half of 2016 numbers were 5.5% higher than in the same period of 2015.

Remortgaging approvals were 13% higher than in June 2015.

Other advances were 15% higher than a year ago.

"This month's High Street Banking data reflects the uncertainty that was felt ahead of the EU referendum.

Business borrowing in June dropped for the first time in 2016, signalling that investment decisions were being delayed until after the vote.

Mortgage lending and approvals also fell back in June but remain above the low levels seen in April following the introduction of the stamp duty surcharge.

Overall, business confidence was clearly fragile in anticipation of the outcome of the vote, but these results are not a verdict on the health of the economy post-Brexit. We won't start to see that data come through until the autumn and any trends before then should not be over-interpreted"

-

10:45

FOMC On Hold This Week; BoJ: 50% Probability Further Easing This Week - UBS

USD: FOMC Rate Decision (Jul. 27)

UBS expects the FOMC to leave rates unchanged in its upcoming meeting, and hike only in December by 25bps. By that time, the Fed will have a half-year of evidence with which to assess the post-referendum impact on the financial markets and economy, as well as gauge the strength in domestic economy.

JPY: BoJ Monetary Policy Meeting (Jul. 29)

Our economists think, at the same time as government economic measures are being drawn up, the BoJ will conduct additional easing at 50% probability for July, 30% for Sept, 10% for Oct-Dec, and 10% for no easing this year.

-

10:31

United Kingdom: BBA Mortgage Approvals, June 40.1 (forecast 40.2)

-

10:31

United Kingdom: BBA Mortgage Approvals, June 40.1 (forecast 40.2)

-

10:18

Spain's producer prices declined at a slower annual pace

Spain's producer prices declined at a slower annual pace for a second straight month in June, data from the statistical office INE showed Tuesday.

The producer price index decreased 4.7 percent year-on-year following a 5.6 percent fall in May. In April, the measure dropped 6 percent.

Excluding energy, the decline was 0.7 percent after a 1 percent drop in the previous month.

Compared to the previous month, the producer price index rose 1.8 percent in June after a 0.8 percent climb in the previous month - rtt.

-

10:18

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 1.1bln) 1.1025-30 (413m) 1.1100 (568m)

USD/JPY: 104.75 (USD 280m) 106.25 (295m) 106.50 (363m) 107.00 (1bln)

GBP/USD 1.2900 (GBP 496m) 1.3100 (562m) 1.3250 (598m)

AUD/USD 0.7435-40 (AUD 800m) 0.7475 (476m) 0.7500 (270m)

-

09:24

Major indices little changed after opening: FTSE 100 6,710.13-20.350-0.30%, DAX 10,212.62 + 14.38 + 0.14%

-

09:22

Today’s events:

At 15:30 GMT the United States will hold an auction of 4-week bills

At 17:00 GMT the United States will hold an auction of 5-year bonds

-

08:45

Japan Economy Minister Nobuteru Ishihara: Economic growth will not improve without reforms

- Potential growth rates will not improve without structural reforms

- It is important to take measures to continue with fiscal reforms

- It is important to link wage growth to economic growth

- Wages, employment improved and created a virtuous cycle

-

08:27

Asian session review: yen rises

The US dollar fell against the yen below Y105,00 the first time from July 15. The growth of the yen this week, mainly caused by the uncertainty of the US Federal Reserve and the Bank of Japan meetings, which will be held later this week.

The message that the Japanese government is likely to announce a package of fiscal stimulus measures amounting to 6 trillion yen, calculated for a few years, have disappointed investors, who had hoped that the amount of stimulation will be close to 10 trillion yen.

In addition, the budget expenditures, apparently, will be funded by supplementary budget, rather than by the Bank of Japan. This confirms the fact that the central bank does not intend to resort to helicopter money".

Today begins a two-day meeting of the US Federal Reserve. Investors expect that the central bank will leave monetary policy unchanged, but the text of the bank statement will be closely examined for the future prospects of interest rates.

"I do not think they put something in motion at this meeting - said Mark McCormick of TD Securities -. I believe that Fed officials will take a wait and see attitude until the markets will be ready to tighten policy."

Investors are more optimistic about the outlook for interest rates, with the market now seen 48% chance the Fed's tightening policy in December. This has contributed to the growth of the dollar, because of the increase in borrowing costs, making it more attractive to investors.

The New Zealand Dollar little changed after the publication of important data on the trade balance. As reported by the New Zealand Bureau of Statistics, the trade balance in June was $ 127mln, which is lower than the previous value of $ 358mln, but slightly above analysts' expectations $ 125mln. In annual terms, there is a trade deficit of $ -3.310 billion after $ -3,633mlrd

The trade balance reflects the balance between exports and imports. A positive value reflects a balance surplus, a negative - the deficit.

According to BNZ senior economist Doug Steel, "given the negative factors in the form of low world commodity prices, especially for dairy products, and the strong New Zealand dollar, external trade in goods in New Zealand still looks good."

Exports of goods and services from New Zealand rose by $ 4.26 billion, down slightly from the previous value of $ 4.57 billion.

Imports in July also fell below the previous value and amounted to $ 4.13 billion after rising $ 4.22 billion in the previous month.

EUR / USD: during the Asian session, the pair is trading in the $ 1.0980-1.1010 range

GBP / USD: during the Asian session, the pair is trading in the $ 1.3080-1.3110 range

USD / JPY: on Asian session the pair fell to Y104.40

-

08:20

Producer prices in Japan were up 0.2 percent on year in June

Producer prices in Japan were up 0.2 percent on year in June, the Bank of Japan said on Tuesday. That was unchanged from the previous month, and it topped forecasts for an increase of 0.1 percent. On a monthly basis, producer prices were flat for the second straight month. For the second quarter of 2016, prices were up 0.2 percent on year and 0.3 percent on quarter.

-

08:19

Options levels on tuesday, July 26, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1213 (3832)

$1.1135 (2021)

$1.1077 (1427)

Price at time of writing this review: $1.1015

Support levels (open interest**, contracts):

$1.0937 (4630)

$1.0907 (3879)

$1.0871 (7381)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 40472 contracts, with the maximum number of contracts with strike price $1,1200 (3832);

- Overall open interest on the PUT options with the expiration date August, 5 is 50015 contracts, with the maximum number of contracts with strike price $1,0900 (7381);

- The ratio of PUT/CALL was 1.24 versus 1.24 from the previous trading day according to data from July, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.3406 (1957)

$1.3308 (1100)

$1.3212 (1646)

Price at time of writing this review: $1.3109

Support levels (open interest**, contracts):

$1.2990 (1850)

$1.2893 (856)

$1.2796 (1695)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 26635 contracts, with the maximum number of contracts with strike price $1,3400 (1957);

- Overall open interest on the PUT options with the expiration date August, 5 is 25451 contracts, with the maximum number of contracts with strike price $1,2950 (2790);

- The ratio of PUT/CALL was 0.96 versus 0.95 from the previous trading day according to data from July, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:16

Consumer sentiment in Australia by ANZ improved

Consumer sentiment in Australia by ANZ in the week that ended July 24 amounted to 115.5, which is higher than the value of the last week, 114.9. The report says that the details of the calculation of indicators were mixed, however, the majority more positive than before.

-

08:13

Japan finance minister, Aso: we have yet to decide on size of economic stimulus package. USD/JPY down over 100 pips

- the government leaves actual policy measures in hands of BOJ

- hope BOJ will continue utmost efforts toward price target

-

08:10

New Zealand trade surplus increased in June

New Zealand posted a merchandise trade surplus of NZ$127 million in June, Statistics New Zealand said on Tuesday - representing 3.0 percent of exports.

The headline figure missed expectations for a surplus of NZ$150 million and was down from NZ$358 million in May.

Exports came in at NZ$4.26 billion, beating forecasts for NZ$4.22 billion and down from NZ$4.57 billion in the previous month.

Imports were at NZ$4.13 billion - matching forecasts and down from NZ$4.22 billion a month earlier.

For the second quarter of 2016, Goods exports jumped 5.8 percent to NZ$12.7 billion. Meat and edible offal led the rise in exports, up 8.3 percent (NZ$125 million).

Goods imports added 0.5 percent to NZ$12.8 billion. Capital goods led the rise in imports, up 15 percent (NZ$361 million). Intermediate goods fell 3.8 percent (NZ$198 million).

The quarterly trade deficit was NZ$173 million (1.4 percent of exports), and it marked the ninth consecutive quarterly trade deficit since March 2014.

Year to date, the trade deficit is NZ$3.313 billion versus forecasts for NZ$3.30 billion after showing a NZ$3.633 billion shortfall a month earlier.

-

01:01

Currencies. Daily history for Jul 25’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0992 -0,94%

GBP/USD $1,3136 +0,20%

USD/CHF Chf0,9858 -0,07%

USD/JPY Y105,83 -0,24%

EUR/JPY Y116,33 -0,08%

GBP/JPY Y139,02 -0,04%

AUD/USD $0,7467 +0,05%

NZD/USD $0,6994 -0,07%

USD/CAD C$1,3218 +1,00%

-

00:45

New Zealand: Trade Balance, mln, June 127

-

00:01

Schedule for today, Tuesday, Jul 26’2016:

(time / country / index / period / previous value / forecast)

08:30 United Kingdom BBA Mortgage Approvals June 42.2

13:00 Belgium Business Climate July 0.7

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y May 5.4% 5.5%

13:45 U.S. Services PMI (Preliminary) July 51.4 52

14:00 U.S. Richmond Fed Manufacturing Index July -7

14:00 U.S. New Home Sales June 551 557

14:00 U.S. Consumer confidence July 98 95.7

-