Noticias del mercado

-

17:08

Nintendo shares plummet 18% after investors lose some interest in Pokemon Go

According to CNN, shares in Nintendo plummeted the daily limit of 18% on Monday after the legendary gaming company told investors that Pokemon Go will have only a "limited" effect on its bottom line.

Why? Nintendo isn't the only company with a stake in the hit augmented reality game, and it might be earning a smaller share of game profits than investors had expected.

Pokemon Go was actually developed and distributed by a company called Niantic. Both Nintendo and The Pokemon Company, one of its subsidiaries, have invested in the privately-held Niantic.

The three companies collaborated on the game. But Niantic has other investors that stand to profit, including Google.

Nintendo also owns 32% of The Pokemon Company, which controls the merchandising and licensing of the Pokemon franchise. The subsidiary will receive a licensing fee as well as payment "for collaboration in the development and operations" of the game.

-

16:07

Central Bank of China: the downward pressure is still high, but China can achieve the growth goal

"Downward pressure on the Chinese economy remains quite strong, but the country is able to ensure the GDP growth of more than 6.5 percent this year," - said Bai Chong, Policy Advisor at the central bank and a professor at Tsinghua University.

"The pressure on the economy is still quite large, but there should be no problem for us to achieve growth of more than 6.5 percent," - said Bai.

"China's has already done a lot with monetary policy", adding that he agreed with the assessment that the tax cuts would be more effective in promoting growth than lower interest rates.

"We did a lot in terms of adjustment of monetary policy but fiscal policy should also have to be more appropriate in the current environment." - Said Bai.

Recall, China has set a target for GDP growth this year in the range of 6.5 percent to 7.0 percent. At the end of 2015 the economy grew by 6.9 percent, the weakest pace in 25 years.

-

15:49

Option expiries for today's 10:00 ET NY cut

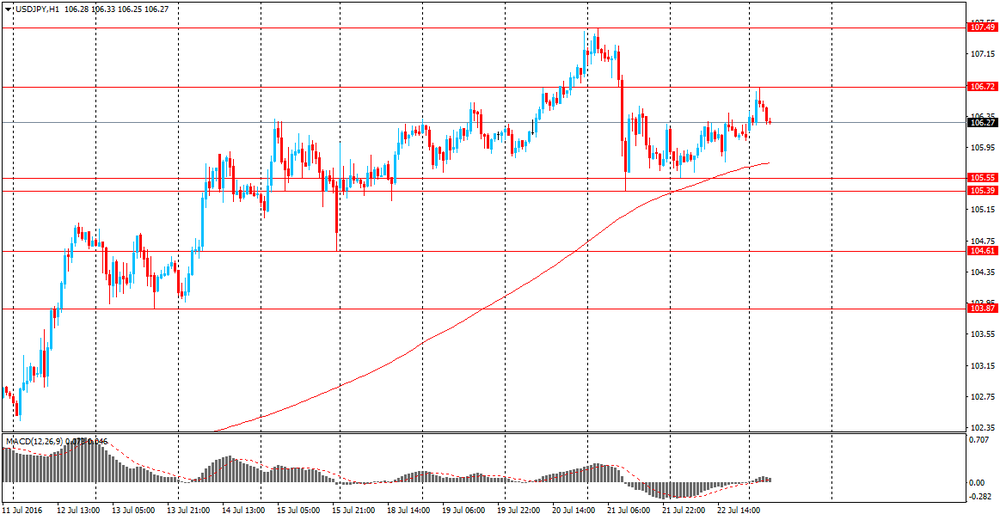

USDJPY: 104.60 (USD 480m) 104.85 (446m) 106.50 (200m)

USDCHF 0.9700 (USD 253m)

NZDUSD 0.7015 (NZD 389m)

-

14:42

European session review: US dollar fell moderatly against the euro

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Germany IFO business climate index in July 108.7 107.5 108.3

08:00 Germany IFO current conditions index July 114.5 114 114.7

10:00 UK Balance industrial orders Confederation of British Industry in July -2 -4

The euro rose moderately against the dollar, partially recovering from Friday's lows. Particular support was provided by positive data on Germany, pointed to the economy's resilience to the impacts of Brexit. The research results, published by the Ifo Institute, showed that in July, business sentiment in Germany deteriorated less than expected. According to the data, the business climate index fell to 108.3 points vs 108.7 points in June. Analysts had forecast a drop to 107.5 index. The index of business expectations dropped to 102.2 vs. 103.1 in June, while the current conditions index rose to 114.7 from 114.6.

In addition, investors are gradually getting ready for the Fed meeting, which will take place this week. Despite the fact that the published recent data on the US increase the likelihood of the Fed raising rates, it is unlikely to happen at the July meeting. According to a Reuters survey results, just over half of the 100 economists expect the Fed raising rates in the 4th quarter to 0.50-0.75 percent to 0.25-0.50 percent currently. The change is likely to occur in December. Futures on the federal funds assess the probability of a rate hike in July 4%. Meanwhile, the chances increase to 39% in December.

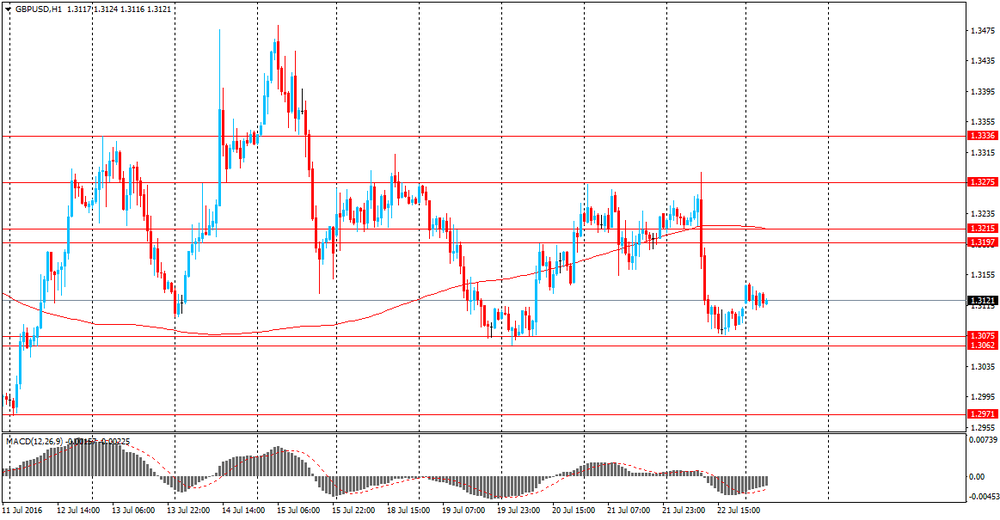

The British pound consolidated against the dollar, while remaining near the opening level. Experts point out that in the background of almost empty economic calendar the British pound largely focused on changes in risk appetite. Little influence has also had a report of the Confederation of British Industry (CBI). As it became known, according to data for the current month industrial new orders balance fell to -4 compared to -2 in June. However, the latest reading was slightly better than the average forecast (-6). Meanwhile, the index of orders for the next three months dropped to +6 in July from 23 in June. Quarterly figures showed that total orders balance within three months (July) rose to +9 versus -4 in the previous three months (in April), reaching annual maximum. But the index of expected new orders fell during this period to 0 (at least from January 2012). In addition, it was reported that the quarterly business optimism balance fell to -47 from -5 in the previous three months (April). The last value is the lowest since January 2009.

Later this week, investors will be watching the results of the UK business and consumer surveys in the hope of receiving signals on how Brexit impacts the economy.

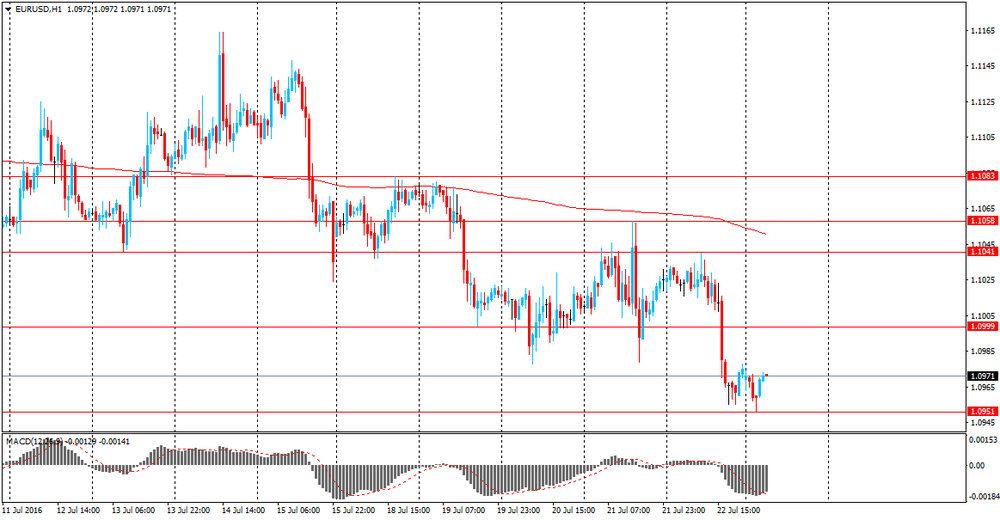

EUR / USD: during the European session, the pair rose to $ 1.0996.

GBP / USD: during the European session, the pair is trading in the $ 1.3108- $ 1.3161 range.

USD / JPY: during the European session, the pair fell to Y106.00, but then rebounded slightly.

-

14:09

Orders

EUR/USD

Offers 1.0980 1.1000 1.1025.30 1.1050 1.1080 1.1100 1.1125-30 1.1150 1.1180 1.1200

Bids 1.0950 1.0930 1.0900 1.0880 1.0850 1.0800

GBP/USD

Offers 1.3155-60 1.3180-85 1.3200 1.3250 1.3270-75 1.3290-1.3300

Bids 1.3100 1.3080 1.3050 1.3000 1.2980 1.2950

EUR/GBP

Offers 0.8350-60 0.8375-80 0.8400 0.8425 0.8450 0.8470 0.8485 0.8500

Bids 0.8330 0.8300 0.8285 0.8255-60 0.8230 0.8200 0.8150 0.8100

EUR/JPY

Offers 116.80 117.00 117.50 117.80 118.00 118.30 118.50 119.00

Bids 116.20 116.00 115.50 115.00 114.85 114.50

USD/JPY

Offers 106.20-25 106.50 106.70 106.85 107.00 107.25 107.50 107.80 108.00

Bids 105.80-85 105.50 105.30-35 105.00 104.80 104.65 104.50

AUD/USD

Offers 0.7500 0.7520 0.7550 0.7580 0.7600 0.7620 O.7635 0.7650-55

Bids 0.7450 0.7420 0.7400 0.7385 0.7370 0.7350 0.7300

-

13:49

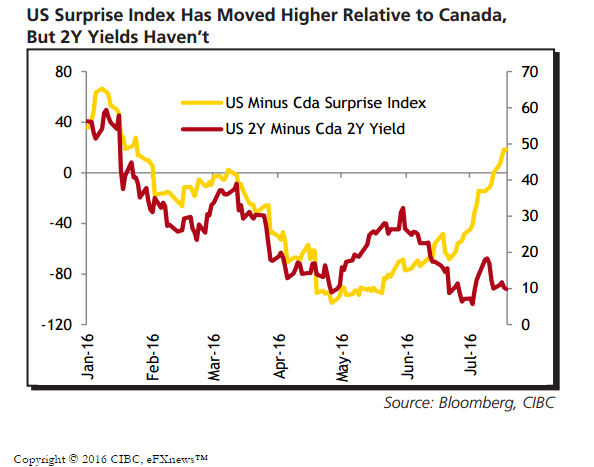

USD/CAD Where To Target? - CIBC

"CAD has weakened modestly against the greenback in recent weeks, reflecting the dip in oil prices from highs above $50 last month. However, the depreciation would have been worse if interest rate spreads had tracked comparative movements in the surprise indexes for Canada and the US, and added a further headwind to the C$.

Short-term interest rates in Canada have moved up since the BoC deepened its concerns over financial vulnerabilities, in the process nearly ruling out another rate cut this year.

However, with the Fed likely to move closer to a December rate hike, rate spreads should move in favour of the US, with USDCAD grinding steadily higher towards our year-end target of 1.35".

-

12:51

Manufacturing prospects muted after Brexit – CBI

Manufacturing output and domestic orders saw firm growth over the past quarter, but both are expected to slow over the next three months, according to the latest quarterly CBI Industrial Trends Survey.

Following a slowdown in activity towards the end of 2015, which spilled over into the first half of this year, the survey of 506 manufacturers shows that the sector had a decent recovery over the three months to July. Output rose at its fastest in two years, while domestic orders and employment also improved. Export orders were flat, but improved on the fall seen in the previous quarterly survey.

But despite this improvement in activity, optimism about the business situation over the past quarter fell at the fastest pace since January 2009, in the aftermath of the referendum result. Meanwhile, the outlook for the next three months is set to soften, with expectations for total new orders growth at their lowest since January 2012, output growth set to ease and headcount expected to fall slightly.

Looking ahead to the coming quarter, concerns over economic and political conditions abroad as a constraint on exports orders are at their highest level since 1983. Yet, competitiveness in international markets has improved at the strongest pace in over six years, with a further boost expected next quarter. As a result, export orders are set to rise at an above-average pace over the next quarter.

-

12:00

United Kingdom: CBI industrial order books balance, July -4

-

11:36

-

11:00

Option expiries for today's 10:00 ET NY cut

USD/JPY: 104.60 (USD 480m) 104.85 (446m) 106.50 (200m)

USD/CHF 0.9700 (USD 253m)

NZD/USD 0.7015 (NZD 389m)

-

10:31

Review of financial and economic press: a way out of the EU can be decided by the end of the year

newspaper. ru

Britain's Ministry of Finance: a way out of the EU can be decided by the end of the year

Uncertainty regarding the way that UK will leave UE can be eliminated by the end of 2016, Finance Minister Philip Hammond said. "Uncertainty starts to fade when we will be able to define more clearly the type of agreement, on which we will focus in the work with the EU in the future".

Finance ministers and heads of central banks of the G20 expressed their determination on the issue of strengthening economic growth, reports Reuters. "We are taking measures to build confidence and support growth. In light of recent events, we reaffirm our determination to use all policy tools - monetary, fiscal and structural - individually and collectively to achieve our goal - to ensure strong, sustainable and balanced growth".

US Treasury urged European banks to provide a clear balance

European banks should provide a clear balance and ask the head of the US Treasury, Jack Lew.

China's Ministry of Finance has identified a key challenge for the G20

China's Finance Minister Lou Jiwei said that to ensure the balanced growth of the world economy is the key challenge for the G20.

The head of the National Committee of the US Democrats announced the resignation

The head of the Democratic National Committee (DNC) Debbie Wasserman Schultz will resign after the etters to the committee scandal, which could damage the election campaign of former US presidential candidate Bernie Sanders, reports CNBC.

-

10:20

German Ifo business climate index rose in July amid weakening Brexit risks

The German Ifo business climate index rose to 108.3 from 108.7 the previous months. Current assessment registered 114.7 points vs 114.0 forecasts. The previous value was revised higher to 114.60 from 114.5. Expectations rose to 102.2 vs 101.6 forecasts. IFO president Fuest said that German economy remains resilient but automotive sector reported pessimistic expectations.

-

10:00

Germany: IFO - Current Assessment , July 114.7 (forecast 114)

-

10:00

Germany: IFO - Business Climate, July 108.3 (forecast 107.5)

-

09:10

Today’s events:

At 07:30 GMT Statement by RBNZ Governor, Wheeler

At 10:00 GMT CBI report on changes in the volume of industrial orders

At 15:30 GMT the United States will hold an auction of 3-month bills

At 15:30 GMT the United States will hold an auction of 6-month bills

At 17:00 GMT the United States will hold an auction of 2-year bonds

-

08:55

ANZ about NZD / USD

During the Asian session NZD / USD traded just below $ 0.7000, after falling last week on expectations that the Reserve Bank of New Zealand will lower its benchmark interest rate next month.

According to ANZ analysts, the central bank's comments have led to some decline in the New Zealand dollar, but they doubt that the currency will weaken significantly in the absence of relevant global factors.

On Tuesday is scheduled for release the external trade in goods data. According to the median forecast, a positive balance of foreign trade in goods in June amounted to NZ $ 150 million against the NZ $ 358 million in May. In June 2015 the negative balance of foreign trade amounted to NZ $ 182 million.

-

08:40

Asian session review: yen little changed

The yen fell in the beginning of the session, but in the course of trading recover lost ground against the backdrop of more positive than expected data on the trade balance of Japan. Total Japan's trade surplus in June amounted to ¥ 692.8 billion, above analysts' expectations of ¥ 494.8 Bln. The previous value was revised from ¥ -41 billion to ¥ -40,6mlrd.

Exports fell -7.4% in June, year on year, after falling 11.3% in May. Analysts had expected a decline to -11.6. Exports to the US fell by 6.5%, exports to Asia fell 10.6% and 10.0% in China.

Imports fell by -18.8% while analysts had expected a drop to -19.7%. The previous value was -13.8%

The adjusted trade surplus amounted to Y 335.0 billion in June, after rising to Y269.8 billion in May.

In June, Japan's exports were lower than expected, but the trade surplus is due to a large fall in imports

Also today, the Government of Japan in its quarterly report, observed a light easing of moderate economic recovery. Has also left an overall assessment of the economy unchanged, but reduced the assessment of business confidence in the government also noted that Brexit increased global economic uncertainty.

The coincident index - the composite indicator that tracks the current state of the Japanese economy in May was 109.9, lower than the previous value of 112.0 and indicates a decline in economic activity in Japan. The index of leading indicators in May amounted to 99.7 after 100 in April.

Since the beginning of the trading session, the US dollar continued to rise against the euro, by updating the monthly highs, which was caused by correction of positions before the weekend, and very good data from US business activity. According to analysts recent US data increases the likelihood of the Fed raising interest rates. This is unlikely to happen at the July meeting, but closer to the end of the year. Futures on the federal funds currently estimate a probability of 20% for a rate hike in September. Meanwhile, the chances increase in December to 40% compared with less than 20% a week ago, and 9% at the beginning of the month.

According to Reuters latest survey, just over half of the 100 economists expect the Fed to raise rates in the fourth quarter to 0.75 percent compared with 0.25-0.50 percent currently. The change is likely to occur in December, as the November meeting of the Central Bank will begin in just a few days before the election on 8 November. The rest of the respondents forecast growth in the third quarter, most likely in September.

EUR / USD: during the Asian session, the pair was trading in the $ 1.0950-75 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3110-30 range

USD / JPY: during the Asian session, the pair was trading in 106.10-15 range

-

08:23

3 easing measures from the Bank of Japan this week - Nomura

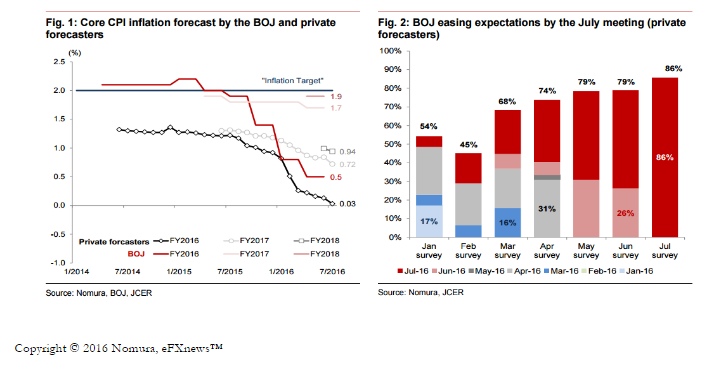

"We expect the BOJ to decide on additional easing at the meeting this week (28-29 July), as widely anticipated by the market.

Our economists expect the BOJ to announce a policy package including: 1) additional purchases of ETFs (to JPY6trn/year) and REITs (to JPY180bn/year); 2) the introduction of negative rates on current loan support programs; and 3) IOER cut to -20bp from -10bp. We agree with this view and also see this policy package as the most likely outcome from this week's meeting.

Financial markets have been gradually stabilizing following the initial shock of the Brexit vote. USD/JPY is now trading around 106, while Japanese equity prices have recovered by about 12% from the bottom after the Brexit vote. USD/JPY is at almost the same level as ahead of the June meeting, while Japanese equity prices are higher now.

Although calmer market conditions may be a reason for the BOJ to stay on the side lines again for now, we see three reasons to expect BOJ easing this week: 1) further weakness in underlying inflation momentum; 2) much more elevated expectations for easing; and 3) political incentives to demonstrate a joint effort to stimulate the economy with fiscal stimulus".

-

08:19

EU Commission President, Juncker: there is no deadline for Brexit talks - Reuters

-

UK will have no access to EU internal market if it does not comply to EU rules

-

Turkey in no place to become EU member any time soon

-

if Turkey reintroduces death penalty the EU would stop access process immediately

-

-

08:16

Japan: trade surplus 692.8 billion yen in June

Japan had a merchandise trade surplus 692.8 billion yen in June, the Ministry of Finance said on Monday.

That beat forecasts for 474.4 billion yen following the upwardly revised 40.6 billion yen deficit in May (originally -40.7 billion).

Exports were down 7.4 percent on year, topping forecasts for a fall of 11.3 percent, which would have been unchanged from, the previous month.

Imports tumbled an annual 18.8 percent, also exceeding expectations for a fall of 20.0 percent following the 13.8 percent drop a month earlier.

-

07:13

Options levels on monday, July 25, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1172 (3430)

$1.1134 (1980)

$1.1071 (1159)

Price at time of writing this review: $1.0976

Support levels (open interest**, contracts):

$1.0916 (4487)

$1.0889 (3918)

$1.0856 (7295)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 40040 contracts, with the maximum number of contracts with strike price $1,1200 (3814);

- Overall open interest on the PUT options with the expiration date August, 5 is 49838 contracts, with the maximum number of contracts with strike price $1,0900 (7295);

- The ratio of PUT/CALL was 1.24 versus 1.28 from the previous trading day according to data from July, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.3405 (1968)

$1.3308 (1138)

$1.3212 (1655)

Price at time of writing this review: $1.3136

Support levels (open interest**, contracts):

$1.2988 (1643)

$1.2891 (876)

$1.2794 (1819)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 26622 contracts, with the maximum number of contracts with strike price $1,3400 (1968);

- Overall open interest on the PUT options with the expiration date August, 5 is 25158 contracts, with the maximum number of contracts with strike price $1,2950 (2790);

- The ratio of PUT/CALL was 0.95 versus 0.96 from the previous trading day according to data from July, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:50

Japan: Trade Balance Total, bln, June 693 (forecast 494.8)

-

00:32

Currencies. Daily history for Jul 22’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $ 1,1095 +0,63%

GBP/USD $1,3110 -0,82%

USD/CHF Chf0,9865 +0,09%

USD/JPY Y106,08 -0,08%

EUR/JPY Y116,42 -0,56%

GBP/JPY Y139,07 -0,69%

AUD/USD $0,7463 -0,38%

NZD/USD $0,6999 +0,04%

USD/CAD C$1,3128 +0,32%

-

00:00

Schedule for today, Monday, Jul 25’2016:

(time / country / index / period / previous value / forecast)

08:00 Germany IFO - Business Climate 108.7 107.5

08:00 Germany IFO - Current Assessment 114.5 114

10:00 United Kingdom CBI industrial order books balance -2

22:45 New Zealand Trade Balance, mln 358

-