Noticias del mercado

-

22:39

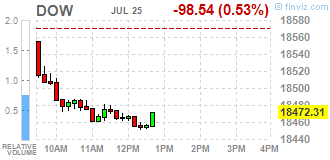

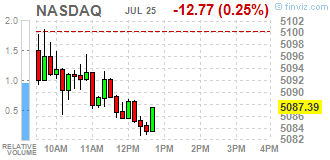

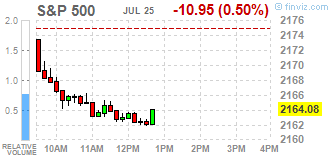

U.S. stocks closed

U.S. stocks retreated from records as a tumble in the price of crude sank energy shares with investors looking to central-bank policy decisions later in the week.

Earnings remain in focus, with companies including Texas Instruments Inc., Sprint Corp. and Gilead Sciences Inc. scheduled to report earnings Monday. Profits and sales have broadly topped projections so far this season, and analysts have eased their estimates for declines in net income.

Energy shares sank 2 percent for the biggest drop in a month. Chesapeake Energy Corp. and Devon Energy Corp. fell at least 4.4 percent to pace declines. Materials producers also fell, as gains in the dollar damped demand for products denominated in the currency.

Among stocks moving, Yahoo! Inc. lost 2.7 percent and Verizon Communications Inc. slipped after the internet portal agreed to sell its main web business to the wireless carrier. In earnings news, Roper Technologies Inc. fell the most in the S&P 500 after missing profit estimates. Micron Technology Inc. jumped 6 percent after adopting a poison pill takeover defense.

The S&P 500 reached a seventh all-time high in 10 sessions on Friday, after going more than 13 months without a record. The advances came as companies showed signs of breaking a four-quarter-long decline in sales, fueling optimism that a long-awaited rebound in earnings is at hand. Still, further stock gains may be harder to combine, according to Kully Samra, a client manager at Charles Schwab Corp., which has $2.4 trillion in client assets.

-

21:00

DJIA 18465.42 -105.43 -0.57%, NASDAQ 5092.08 -8.08 -0.16%, S&P 500 2165.07 -9.96 -0.46%

-

18:57

Wall Street. Major U.S. stock-indexes retreated from record levels, dragged down by energy shares

Major U.S. stock-indexes retreated from record levels as weak oil prices weighed on energy shares. Exxon (XOM) and Chevron (CVX) lost around 2 percent, dragging down the S&P and the Dow. In addition, investors turned cautious ahead of the U.S.Federal Reserve meeting this week.

Most of Dow stocks in negative area (26 of 30). Top looser - Chevron Corporation (CVX, -2,26%).. Top gainer - Nike Inc. (NKE, +0,21%).

All S&P sectors in negative area. Top looser - Basic Materials (-0,6%).

At the moment:

Dow 18381.00 -97.00 -0.52%

S&P 500 2156.25 -11.25 -0.52%

Nasdaq 100 4645.25 -12.00 -0.26%

Crude Oil 43.00 -1.19 -2.69%

Gold 1320.20 -3.20 -0.24%

U.S. 10yr 1.56 -0.01

-

18:02

WSE: Session Results

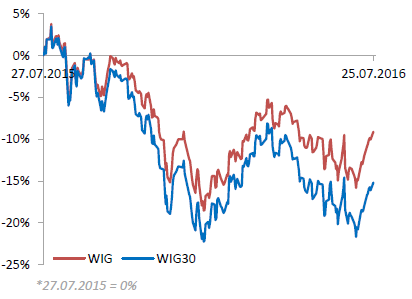

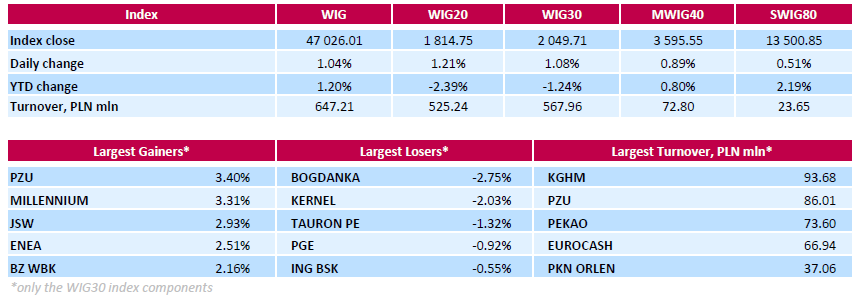

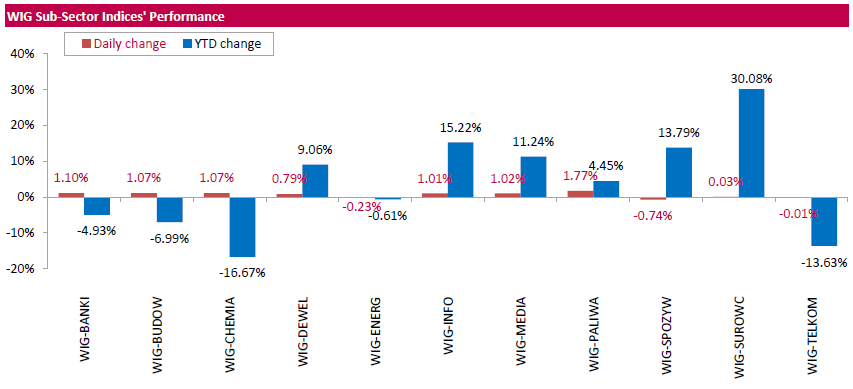

Polish equity market closed higher on Monday. The broad market benchmark, the WIG Index, surged by 1.04%. The WIG sub-sector indices were mainly higher, with oil and gas stocks' measure (+1.77%) outperforming.

The large-cap stocks grew by 1.08%, as measured by the WIG30 Index. Within the index components, insurer PZU (WSE: PZU) and bank MILLENNIUM (WSE: MIL) recorded the biggest gains, up 3.4% and 3.31% respectively. Other major advancers were coking coal miner JSW (WSE: JSW), genco ENEA (WSE: ENA), bank BZ WBK (WSE: BZW) and oil refiner PKN ORLEN (WSE: PKN), adding between 2.05% and 2.93%. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB) and agricultural producer KERNEL (WSE: KER) led a handful of decliners, dropping by 2.75% and 2.03% respectively.

-

18:00

European stocks closed: FTSE 6710.13 -20.35 -0.30%, DAX 10198.24 50.78 0.50%, CAC 4388.00 6.90 0.16%

-

17:47

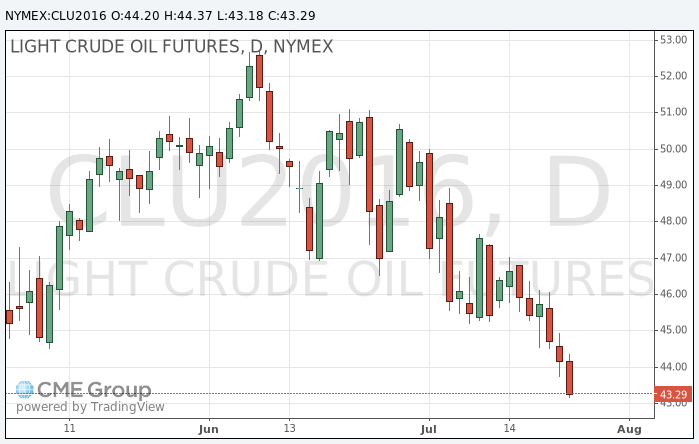

Oil was sold today

Oil prices have decreased 1 on the inventories data that showed a groth at the distribution center in the US Cushing by about 1 million barrels.

According to the report of Genscape, supply of "black gold" in the United States in Cushing for the week rose by 1 million barrels.

Cushing is the largest terminal for oil products in the world. Its storage capacity up to 73 million barrels, or about 13% of the total volume of US. There are several important pipelines converge, which moves oil from fields to refineries on the Gulf Coast.

Cushing is also the main place of the pricing of futures contracts on the North American benchmark WTI (West Texas Intermediate), the most actively traded futures contracts for crude oil in the world.

Rates of growth was the highest this year, according to the Commission on the Futures trading in commodities (CFTC) of the USA.

The cost of Brent crude oil fell below $ 45 a barrel for the first time since early May.

The decline in oil prices due to continued growth in the world's petroleum reserves under adverse demand forecasts.

"The mood of participants is bleak, - stated Commerzbank. Financial investors continue to leave the market, and this creates pressure on prices."

According to Barclays that global oil demand in the third quarter of 2016 by 66% lower than in the same period a year earlier, due to the slowdown in the global recovery.

This is evidence of an increase in stocks of petroleum products throughout the world, causing experts concern that oil demand from refiners may be reduced.

So, in spite of the peak driving season, gasoline inventories in the US rose to 900K barrels last week, and their increase was observed for the fourth time in the last five weeks.

China reported an increase in gasoline exports in June to a record 1.1 million tons, which is twice higher than the previous year's level.

Meanwhile, the number of employees in the United States oil rigs in the previous week increased by 14 to 371, and the growth of this indicator continued the 4th week in a row, according to the Baker Hughes.

The cost of the September futures on US light crude oil WTI fell to 43.18 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 44.75 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:28

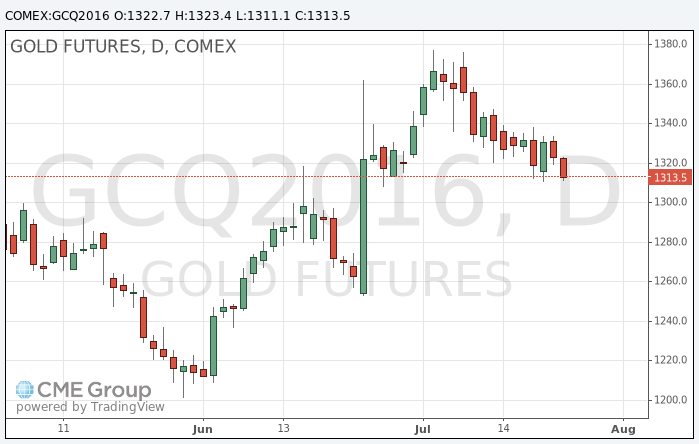

Gold little changed while we expect central banks meetings this week

During today's trading the price of cold had limited activity, while investors eyed central bank meetings this week. The meeting of the Federal Reserve is scheduled for 26-27 July, and the Bank of Japan - July 28-29.

As predicted, the Fed will not change the interest rate at the end of its two-day meeting on Wednesday, but market participants will closely monitor the FOMC statement on monetary policy in the search for fresh guidance on the timing of interest rate increase in the next few months.

The market expects that Bank of Japan, on the contrary, will continue easing monetary policy at its meeting on Friday, further lowering rates and expanding the volume of asset purchases.

On Friday, prices lost $ 7.60, or 0.57%, as the renewed expectations of Fed rate hike this year boosted the US dollar, as investors prefer to invest in rising equity markets instead of buying safe assets.

For the week gold fell $ 4.40, or 0.26%, demonstrating a decline 2 weeks in a row.

Newly published encouraging US statistical data reinforced speculation that the Federal Reserve may raise interest rates before the end of the year. Currently federal funds futures estimate December 45% compared with less than 20% a week ago, and 9% at the beginning of the month.

On Friday, the USD index rose to 97.59, the highest since March 10. On Monday, the index kept at 97.47 against the background of differences of monetary policy.

Strengthening of the US dollar, as a rule, is putting pressure on gold, because gold drops appeal as an alternative asset and increases in the price of dollar-denominated commodities for holders of other currencies.

The precious metal was supported amid growing expectations that the world's central banks are stepping up monetary stimulus in the near future to counteract the negative economic consequences of Brexit.

For the year gold has risen in price by almost 25%, helped by concerns about global economic growth and expectations of monetary stimulus. Expectations of monetary stimulus tend to increase the demand for gold, as the precious metal is seen by investors as a safe store of value and inflation hedge.

Earlier, in July, prices have risen to more than two-year high of $ 1377.50 as fears about the global economy after the referendum in the UK led investors resort to safe assets.

The cost of the August gold futures on COMEX fell to $ 1311.10 per ounce.

-

17:14

Commerzbank forecast: If oil drops below $ 45, the fall will increase

At the beginning of the week, Brent crude was trading just slightly above the 2.5-month low of $ 45 per barrel, reached on Friday. Brent finished the week lower by 4%. Among the participants of the market pessimism reigned. Financial investors continue to exit from the market, thereby putting increased pressure on the oil quotations. According to the CFTC, in the week to July 19 the number of net long speculative positions on WTI fell by 18 400 to 136 100 contracts. This is the third reduction in the past four weeks, bringing the number of net long positions to their lowest level since the beginning of March this year. Meanwhile, the index is now likely to continue to fall. Most likely, the number of net long speculative positions on the brand also will be reduced.

It should be noted that the positions on the long Brent were much larger than WTI. Most of these positions were open at $ 45 at least, so that if the quotes fall below this level, we can see a new wave of speculative sales, which will strengthen the tendency to decrease. The trigger for the decline may make current data on drilling activity in the US, made public by oilfield services company Baker Hughes on Friday. According to the report the number of active oil drilling in the country last week rose for the fourth consecutive time. However, it would be premature to assume that this will lead to an increase in US oil production. Although drilling activity is currently at its highest level since the end of March this year, it is still 30% below the begining of the year.

-

17:08

Nintendo shares plummet 18% after investors lose some interest in Pokemon Go

According to CNN, shares in Nintendo plummeted the daily limit of 18% on Monday after the legendary gaming company told investors that Pokemon Go will have only a "limited" effect on its bottom line.

Why? Nintendo isn't the only company with a stake in the hit augmented reality game, and it might be earning a smaller share of game profits than investors had expected.

Pokemon Go was actually developed and distributed by a company called Niantic. Both Nintendo and The Pokemon Company, one of its subsidiaries, have invested in the privately-held Niantic.

The three companies collaborated on the game. But Niantic has other investors that stand to profit, including Google.

Nintendo also owns 32% of The Pokemon Company, which controls the merchandising and licensing of the Pokemon franchise. The subsidiary will receive a licensing fee as well as payment "for collaboration in the development and operations" of the game.

-

16:07

Central Bank of China: the downward pressure is still high, but China can achieve the growth goal

"Downward pressure on the Chinese economy remains quite strong, but the country is able to ensure the GDP growth of more than 6.5 percent this year," - said Bai Chong, Policy Advisor at the central bank and a professor at Tsinghua University.

"The pressure on the economy is still quite large, but there should be no problem for us to achieve growth of more than 6.5 percent," - said Bai.

"China's has already done a lot with monetary policy", adding that he agreed with the assessment that the tax cuts would be more effective in promoting growth than lower interest rates.

"We did a lot in terms of adjustment of monetary policy but fiscal policy should also have to be more appropriate in the current environment." - Said Bai.

Recall, China has set a target for GDP growth this year in the range of 6.5 percent to 7.0 percent. At the end of 2015 the economy grew by 6.9 percent, the weakest pace in 25 years.

-

15:49

Option expiries for today's 10:00 ET NY cut

USDJPY: 104.60 (USD 480m) 104.85 (446m) 106.50 (200m)

USDCHF 0.9700 (USD 253m)

NZDUSD 0.7015 (NZD 389m)

-

15:48

WSE: After start on Wall Street

The market in the United States opened with a slight decrease, which fairly quickly began to grow. The scale of the changes may not be large, but the descent of contracts to session lows indicates pressure of supply side, which from the point of view of European stock markets is a negative surprise. In this context the DAX react with cosmetic decline and the WIG20 remains stable. Did not change the level of activity of trading on the Warsaw Stock Exchange. In addition we have empty calendar macro today, which does not help. Afternoon on the Warsaw parquet is marked by consolidation and a lack of ideas for further trade.

-

15:33

U.S. Stocks open: Dow -0.18%, Nasdaq -0.01%, S&P -0.12%

-

15:22

Before the bell: S&P futures -0.02%, NASDAQ futures -0.04%

U.S. index futures held steady, after equities capped their longest run of weekly gains since March amid optimism over corporate earnings.

Global Stocks:

Nikkei 16,620.29 -6.96 -0.04%

Hang Seng 1,993.44 +29.17 +0.13%

Shanghai 3,016.8 +3.99 +0.13%

FTSE 6,726.64 -3.84 -0.06%

CAC 4,400.43 +19.33 +0.44%

DAX 10,231.24 +83.78 +0.83%

Crude $43.50 (-1.56%)

Gold $1316.70 (-0.51%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.54

-0.03(-0.2838%)

11500

Amazon.com Inc., NASDAQ

AMZN

747

2.14(0.2873%)

10042

American Express Co

AXP

64.2

-0.08(-0.1245%)

100

Apple Inc.

AAPL

98.4

-0.26(-0.2635%)

60138

AT&T Inc

T

42.95

-0.16(-0.3711%)

7572

Barrick Gold Corporation, NYSE

ABX

20.36

-0.19(-0.9246%)

26819

Boeing Co

BA

132.32

-1.15(-0.8616%)

1325

Cisco Systems Inc

CSCO

30.76

0.05(0.1628%)

6609

Citigroup Inc., NYSE

C

44.3

-0.00(-0.00%)

16661

Deere & Company, NYSE

DE

78.85

-1.27(-1.5851%)

5399

Facebook, Inc.

FB

121.59

0.59(0.4876%)

74651

Ford Motor Co.

F

13.88

0.04(0.289%)

33767

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.58

-0.09(-0.7103%)

64620

General Electric Co

GE

31.95

-0.11(-0.3431%)

48059

General Motors Company, NYSE

GM

32.17

0.01(0.0311%)

6319

Goldman Sachs

GS

160.19

-0.22(-0.1371%)

550

Google Inc.

GOOG

742.95

0.21(0.0283%)

1201

Home Depot Inc

HD

136.67

0.15(0.1099%)

650

HONEYWELL INTERNATIONAL INC.

HON

115.57

-0.04(-0.0346%)

300

Intel Corp

INTC

34.57

-0.09(-0.2597%)

6046

International Business Machines Co...

IBM

161.67

-0.40(-0.2468%)

2310

Johnson & Johnson

JNJ

125.03

-0.00(-0.00%)

355

JPMorgan Chase and Co

JPM

64.1

0.06(0.0937%)

800

McDonald's Corp

MCD

128.2

-0.06(-0.0468%)

3065

Microsoft Corp

MSFT

56.45

-0.12(-0.2121%)

11034

Pfizer Inc

PFE

36.75

0.01(0.0272%)

2447

Starbucks Corporation, NASDAQ

SBUX

57.7

-0.20(-0.3454%)

2065

Tesla Motors, Inc., NASDAQ

TSLA

222.6

0.33(0.1485%)

9804

Twitter, Inc., NYSE

TWTR

18.36

-0.01(-0.0544%)

42133

Verizon Communications Inc

VZ

56.49

0.39(0.6952%)

10550

Visa

V

79.99

0.08(0.1001%)

1657

Walt Disney Co

DIS

97.5

-0.21(-0.2149%)

2000

Yahoo! Inc., NASDAQ

YHOO

38.9

-0.48(-1.2189%)

517546

Yandex N.V., NASDAQ

YNDX

21.18

-0.05(-0.2355%)

520

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Hewlett Packard Enterprise (HPE) upgraded to Buy from Neutral at Citigroup

Downgrades:

Deere (DE) downgraded to Underweight from Neutral at Piper Jaffray

Other:

-

14:42

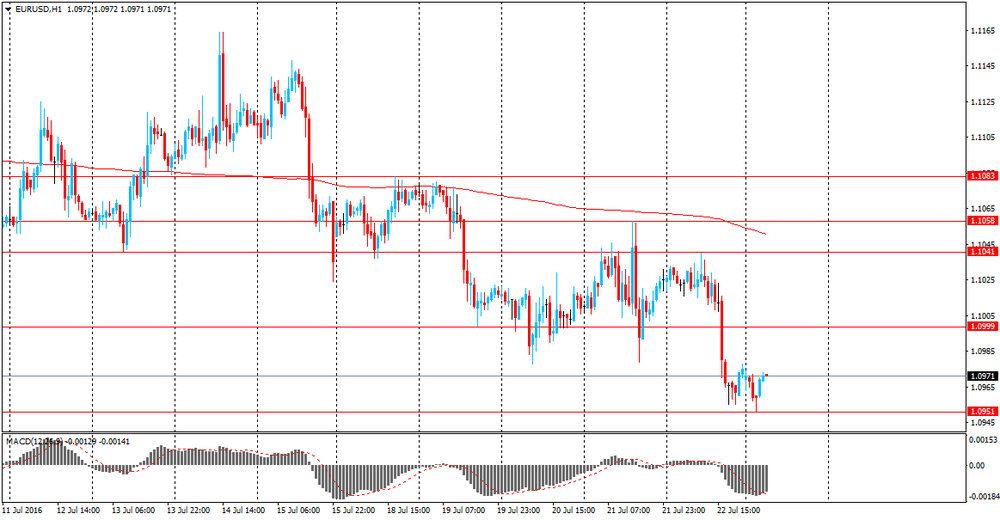

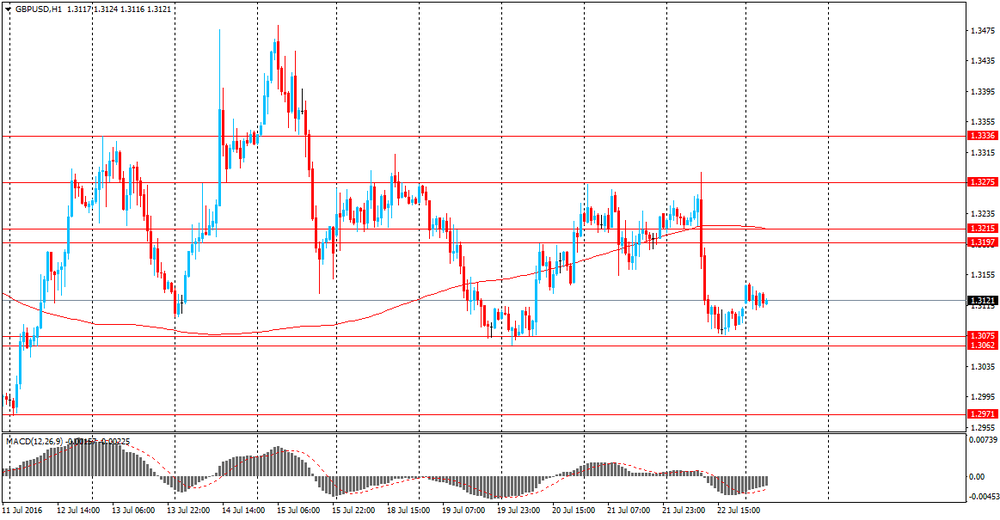

European session review: US dollar fell moderatly against the euro

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Germany IFO business climate index in July 108.7 107.5 108.3

08:00 Germany IFO current conditions index July 114.5 114 114.7

10:00 UK Balance industrial orders Confederation of British Industry in July -2 -4

The euro rose moderately against the dollar, partially recovering from Friday's lows. Particular support was provided by positive data on Germany, pointed to the economy's resilience to the impacts of Brexit. The research results, published by the Ifo Institute, showed that in July, business sentiment in Germany deteriorated less than expected. According to the data, the business climate index fell to 108.3 points vs 108.7 points in June. Analysts had forecast a drop to 107.5 index. The index of business expectations dropped to 102.2 vs. 103.1 in June, while the current conditions index rose to 114.7 from 114.6.

In addition, investors are gradually getting ready for the Fed meeting, which will take place this week. Despite the fact that the published recent data on the US increase the likelihood of the Fed raising rates, it is unlikely to happen at the July meeting. According to a Reuters survey results, just over half of the 100 economists expect the Fed raising rates in the 4th quarter to 0.50-0.75 percent to 0.25-0.50 percent currently. The change is likely to occur in December. Futures on the federal funds assess the probability of a rate hike in July 4%. Meanwhile, the chances increase to 39% in December.

The British pound consolidated against the dollar, while remaining near the opening level. Experts point out that in the background of almost empty economic calendar the British pound largely focused on changes in risk appetite. Little influence has also had a report of the Confederation of British Industry (CBI). As it became known, according to data for the current month industrial new orders balance fell to -4 compared to -2 in June. However, the latest reading was slightly better than the average forecast (-6). Meanwhile, the index of orders for the next three months dropped to +6 in July from 23 in June. Quarterly figures showed that total orders balance within three months (July) rose to +9 versus -4 in the previous three months (in April), reaching annual maximum. But the index of expected new orders fell during this period to 0 (at least from January 2012). In addition, it was reported that the quarterly business optimism balance fell to -47 from -5 in the previous three months (April). The last value is the lowest since January 2009.

Later this week, investors will be watching the results of the UK business and consumer surveys in the hope of receiving signals on how Brexit impacts the economy.

EUR / USD: during the European session, the pair rose to $ 1.0996.

GBP / USD: during the European session, the pair is trading in the $ 1.3108- $ 1.3161 range.

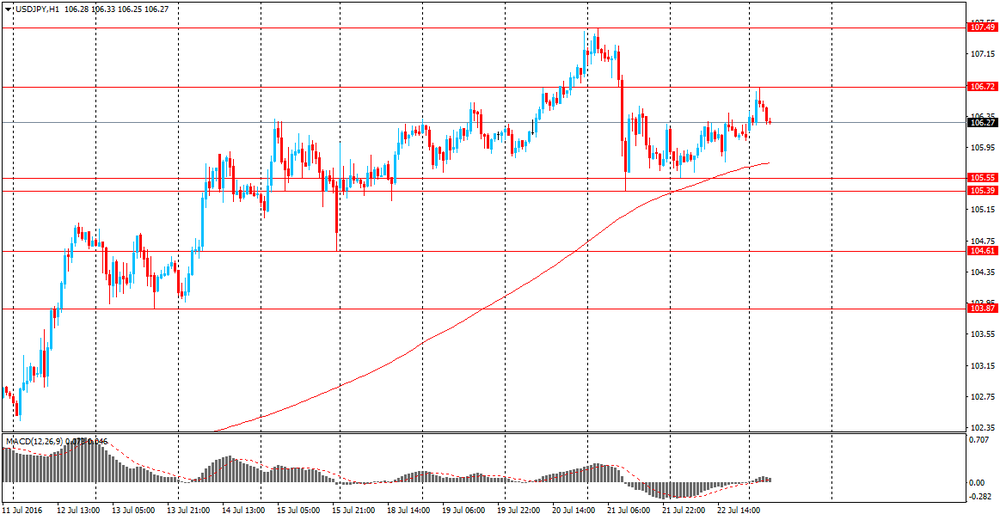

USD / JPY: during the European session, the pair fell to Y106.00, but then rebounded slightly.

-

14:09

Orders

EUR/USD

Offers 1.0980 1.1000 1.1025.30 1.1050 1.1080 1.1100 1.1125-30 1.1150 1.1180 1.1200

Bids 1.0950 1.0930 1.0900 1.0880 1.0850 1.0800

GBP/USD

Offers 1.3155-60 1.3180-85 1.3200 1.3250 1.3270-75 1.3290-1.3300

Bids 1.3100 1.3080 1.3050 1.3000 1.2980 1.2950

EUR/GBP

Offers 0.8350-60 0.8375-80 0.8400 0.8425 0.8450 0.8470 0.8485 0.8500

Bids 0.8330 0.8300 0.8285 0.8255-60 0.8230 0.8200 0.8150 0.8100

EUR/JPY

Offers 116.80 117.00 117.50 117.80 118.00 118.30 118.50 119.00

Bids 116.20 116.00 115.50 115.00 114.85 114.50

USD/JPY

Offers 106.20-25 106.50 106.70 106.85 107.00 107.25 107.50 107.80 108.00

Bids 105.80-85 105.50 105.30-35 105.00 104.80 104.65 104.50

AUD/USD

Offers 0.7500 0.7520 0.7550 0.7580 0.7600 0.7620 O.7635 0.7650-55

Bids 0.7450 0.7420 0.7400 0.7385 0.7370 0.7350 0.7300

-

14:01

Earnings Season in U.S.: Major Reports of the Week

July 26

Before the Open:

3M Company (MMM). Consensus EPS $2.07, Consensus Revenue $7710.77 mln.

Caterpillar (CAT). Consensus EPS $0.96, Consensus Revenue $10127.95 mln.

DuPont (DD). Consensus EPS $1.10, Consensus Revenue $6979.50 mln.

Freeport-McMoRan (FCX). Consensus EPS -$0.01, Consensus Revenue $3684.28 mln.

McDonald's (MCD). Consensus EPS $1.39, Consensus Revenue $6265.41 mln.

United Tech (UTX). Consensus EPS $1.68, Consensus Revenue $14692.67 mln.

Verizon (VZ). Consensus EPS $0.94, Consensus Revenue $30984.40 mln.

After the Close:

Apple (AAPL). Consensus EPS $1.39, Consensus Revenue $42135.16 mln.

Twitter (TWTR). Consensus EPS $0.09, Consensus Revenue $607.41 mln.

July 27

Before the Open:

Altria (MO). Consensus EPS $0.80, Consensus Revenue $5007.24 mln.

Boeing (BA). Consensus EPS $2.47, Consensus Revenue $24247.74 mln.

Coca-Cola (KO). Consensus EPS $0.58, Consensus Revenue $11638.47 mln.

After the Close:

Barrick Gold (ABX). Consensus EPS $0.15, Consensus Revenue $2073.46 mln.

Facebook (FB). Consensus EPS $0.81, Consensus Revenue $6007.47 mln.

July 28

Before the Open:

Ford Motor (F). Consensus EPS $0.60, Consensus Revenue $36278.36 mln.

Intl Paper (IP). Consensus EPS $0.84, Consensus Revenue $5313.96 mln.

Yandex N.V.(YNDX). Consensus EPS $9.08, Consensus Revenue $17563.74 mln.

After the Close:

Alphabet (GOOG). Consensus EPS $8.06, Consensus Revenue $20767.03 mln.

Amazon (AMZN). Consensus EPS $1.12, Consensus Revenue $29572.97 mln.

July 29

Before the Open:

Chevron (CVX). Consensus EPS $0.34, Consensus Revenue $29683.44 mln.

Exxon Mobil (XOM). Consensus EPS $0.64, Consensus Revenue $64001.29 mln.

Merck (MRK). Consensus EPS $0.91, Consensus Revenue $9788.12 mln.

-

13:49

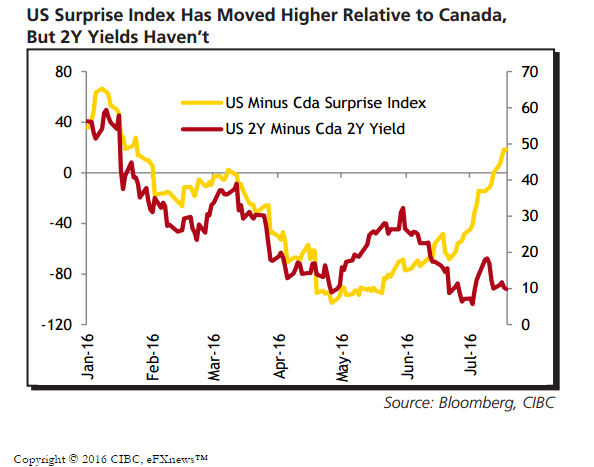

USD/CAD Where To Target? - CIBC

"CAD has weakened modestly against the greenback in recent weeks, reflecting the dip in oil prices from highs above $50 last month. However, the depreciation would have been worse if interest rate spreads had tracked comparative movements in the surprise indexes for Canada and the US, and added a further headwind to the C$.

Short-term interest rates in Canada have moved up since the BoC deepened its concerns over financial vulnerabilities, in the process nearly ruling out another rate cut this year.

However, with the Fed likely to move closer to a December rate hike, rate spreads should move in favour of the US, with USDCAD grinding steadily higher towards our year-end target of 1.35".

-

13:09

WSE: Mid session comment

The first half of trading on the Warsaw Stock Exchange confirmed the positive behavior of the first bars, where the approach of 1% was maintained, and even increased slightly. Thus, output above the 1,800 points level remains in force.

The stronger reading of the Ifo index started trading in Germany, which helps to our parquet. The only drawback is the level of turnover, which does not impress. In the mid-session the WIG20 index was at the level of 1,813 points (+1.14%) with PLN 167 mln turnover.

-

12:59

Major stock indices in Europe show gains

European stocks resumed their growth, approaching the six-month highs, helped by positive data on Germany and corporate news.

The research results, published by the Ifo Institute, showed that in July, business sentiment in Germany deteriorated less than expected, indicating the economy's resilience to the impacts of Brexit. According to the data, the business climate index fell to 108.3 points from 108.7 points in June. Analysts had forecast a drop to 107.5. The index of business expectations dropped to 102.2 vs. 103.1 in June, while the current conditions index rose to 114.7 from 114.6, both better than forecasts.

Support fpr indices also have tje G20 meeting outcome. Finance ministers and heads of central banks of the G20 expressed their determination on the issue of strengthening economic growth. "We are taking measures to build confidence and support growth. In light of recent events, we reaffirm our determination to use all policy tools - monetary, fiscal and structural - individually and collectively to achieve our goal - to ensure strong, sustainable and balanced growth.".

At the same time, investors are cautious on the eve of US and Japan events this week, the central bank meetings. Despite the fact that the recent strong US data increases the likelihood of the Fed raising rates, it is unlikely to happen at the July meeting. According to a Reuters survey results, just over half of the 100 economists expect the Fed to raise rates in the 4th quarter to 0.50-0.75 percent to 0.25-0.50 percent currently. The change is likely to occur in December. With regard to the meeting of the Central Bank of Japan, Bloomberg's survey revealed that 78% of respondents belive that is likely the Central Bank decides to increase ETF purchases. Also not ruled out further reduction in interest rates and an increase in government bond purchases

The composite index of Europe's largest enterprises Stoxx 600 is trading with an increase of 0.6 percent.

William Hill Plc Quotes jumped 6.1 percent amid reports that 888 Holdings Plc and The Rank Group are considering a joint takeover bid for the bookmaker.

Cost of Ericsson AB increased by 3.2 percent, as the Chief Executive Officer has resigned after more than six years in the company's management.

SEB SA Shares rose 6.5 percent after the company said it is seeking to increase its operating result from activity by more than 10 percent.

Share price of Baer Group Ltd. rose 4% after the profit growth in the first half of the year exceeded expectations.

The cost of Air France-KLM Group fell 2.6 percent after Societe Generale SA analysts advised selling shares of the airline.

At the moment:

FTSE 100 +8.51 6738.99 + 0.13%

DAX +89.72 10237.18 + 0.88%

CAC 40 +30.42 4411.52 + 0.69%

-

12:51

Manufacturing prospects muted after Brexit – CBI

Manufacturing output and domestic orders saw firm growth over the past quarter, but both are expected to slow over the next three months, according to the latest quarterly CBI Industrial Trends Survey.

Following a slowdown in activity towards the end of 2015, which spilled over into the first half of this year, the survey of 506 manufacturers shows that the sector had a decent recovery over the three months to July. Output rose at its fastest in two years, while domestic orders and employment also improved. Export orders were flat, but improved on the fall seen in the previous quarterly survey.

But despite this improvement in activity, optimism about the business situation over the past quarter fell at the fastest pace since January 2009, in the aftermath of the referendum result. Meanwhile, the outlook for the next three months is set to soften, with expectations for total new orders growth at their lowest since January 2012, output growth set to ease and headcount expected to fall slightly.

Looking ahead to the coming quarter, concerns over economic and political conditions abroad as a constraint on exports orders are at their highest level since 1983. Yet, competitiveness in international markets has improved at the strongest pace in over six years, with a further boost expected next quarter. As a result, export orders are set to rise at an above-average pace over the next quarter.

-

12:00

United Kingdom: CBI industrial order books balance, July -4

-

11:36

-

11:00

Option expiries for today's 10:00 ET NY cut

USD/JPY: 104.60 (USD 480m) 104.85 (446m) 106.50 (200m)

USD/CHF 0.9700 (USD 253m)

NZD/USD 0.7015 (NZD 389m)

-

10:31

Review of financial and economic press: a way out of the EU can be decided by the end of the year

newspaper. ru

Britain's Ministry of Finance: a way out of the EU can be decided by the end of the year

Uncertainty regarding the way that UK will leave UE can be eliminated by the end of 2016, Finance Minister Philip Hammond said. "Uncertainty starts to fade when we will be able to define more clearly the type of agreement, on which we will focus in the work with the EU in the future".

Finance ministers and heads of central banks of the G20 expressed their determination on the issue of strengthening economic growth, reports Reuters. "We are taking measures to build confidence and support growth. In light of recent events, we reaffirm our determination to use all policy tools - monetary, fiscal and structural - individually and collectively to achieve our goal - to ensure strong, sustainable and balanced growth".

US Treasury urged European banks to provide a clear balance

European banks should provide a clear balance and ask the head of the US Treasury, Jack Lew.

China's Ministry of Finance has identified a key challenge for the G20

China's Finance Minister Lou Jiwei said that to ensure the balanced growth of the world economy is the key challenge for the G20.

The head of the National Committee of the US Democrats announced the resignation

The head of the Democratic National Committee (DNC) Debbie Wasserman Schultz will resign after the etters to the committee scandal, which could damage the election campaign of former US presidential candidate Bernie Sanders, reports CNBC.

-

10:20

German Ifo business climate index rose in July amid weakening Brexit risks

The German Ifo business climate index rose to 108.3 from 108.7 the previous months. Current assessment registered 114.7 points vs 114.0 forecasts. The previous value was revised higher to 114.60 from 114.5. Expectations rose to 102.2 vs 101.6 forecasts. IFO president Fuest said that German economy remains resilient but automotive sector reported pessimistic expectations.

-

10:00

Germany: IFO - Business Climate, July 108.3 (forecast 107.5)

-

10:00

Germany: IFO - Current Assessment , July 114.7 (forecast 114)

-

09:46

Oil lower in early trading

This morning New York futures for WTI were down 0.23% to $ 44.08 and Brent oil futures fell by 0.26% to $ 45.98 per barrel. Thus the black little changed, amid fears of traders with an excess of raw materials on the global market and lower demand for it among refineries. Also Baker Hughes oil rigs in US increase by 14 to 371.

-

09:37

Major stock exchanges open higher: FTSE 100 6,730.48 + 30.59 + 0.46%, DAX 10,166.62 + 19.16 + 0.19%

-

09:18

WSE: After opening

WIG20 index opened at 1798.64 points (+0.32%)

WIG 46781.98 0.52%

WIG30 2040.24 0.61%

mWIG40 3573.61 0.27%

*/ - change to previous close

The futures market (WSE: FW20U1620) began from increase of 0.28% to 1,805 points. Contracts on the DAX also rose at the opening but in a slightly smaller scale.

Our opening seems to be adjusting to a successful Friday session in New York, but runs below the highs of the last day of the previous week. We are located on known levels of consolidation around the level of 1800 points.

The cash market (the WIG20 index) opens with an increase of 0.32% to 1,798 points. In Frankfurt, the opening is upward, but barely reaches 0.1%. In Warsaw, moods tend to be better than in Western Europe and the spot market follows in the footsteps of early positive behavior contracts. The market takes on new highs of growth and boosters already reaches 1%. The increases are fairly widely spread and also apply to the small and medium-sized companies. It is quite surprising behavior in the face of a rather balanced attitude of environment. As we may see, the Warsaw Stock Exchange maintains its individuality.

-

09:10

Today’s events:

At 07:30 GMT Statement by RBNZ Governor, Wheeler

At 10:00 GMT CBI report on changes in the volume of industrial orders

At 15:30 GMT the United States will hold an auction of 3-month bills

At 15:30 GMT the United States will hold an auction of 6-month bills

At 17:00 GMT the United States will hold an auction of 2-year bonds

-

08:55

ANZ about NZD / USD

During the Asian session NZD / USD traded just below $ 0.7000, after falling last week on expectations that the Reserve Bank of New Zealand will lower its benchmark interest rate next month.

According to ANZ analysts, the central bank's comments have led to some decline in the New Zealand dollar, but they doubt that the currency will weaken significantly in the absence of relevant global factors.

On Tuesday is scheduled for release the external trade in goods data. According to the median forecast, a positive balance of foreign trade in goods in June amounted to NZ $ 150 million against the NZ $ 358 million in May. In June 2015 the negative balance of foreign trade amounted to NZ $ 182 million.

-

08:40

Asian session review: yen little changed

The yen fell in the beginning of the session, but in the course of trading recover lost ground against the backdrop of more positive than expected data on the trade balance of Japan. Total Japan's trade surplus in June amounted to ¥ 692.8 billion, above analysts' expectations of ¥ 494.8 Bln. The previous value was revised from ¥ -41 billion to ¥ -40,6mlrd.

Exports fell -7.4% in June, year on year, after falling 11.3% in May. Analysts had expected a decline to -11.6. Exports to the US fell by 6.5%, exports to Asia fell 10.6% and 10.0% in China.

Imports fell by -18.8% while analysts had expected a drop to -19.7%. The previous value was -13.8%

The adjusted trade surplus amounted to Y 335.0 billion in June, after rising to Y269.8 billion in May.

In June, Japan's exports were lower than expected, but the trade surplus is due to a large fall in imports

Also today, the Government of Japan in its quarterly report, observed a light easing of moderate economic recovery. Has also left an overall assessment of the economy unchanged, but reduced the assessment of business confidence in the government also noted that Brexit increased global economic uncertainty.

The coincident index - the composite indicator that tracks the current state of the Japanese economy in May was 109.9, lower than the previous value of 112.0 and indicates a decline in economic activity in Japan. The index of leading indicators in May amounted to 99.7 after 100 in April.

Since the beginning of the trading session, the US dollar continued to rise against the euro, by updating the monthly highs, which was caused by correction of positions before the weekend, and very good data from US business activity. According to analysts recent US data increases the likelihood of the Fed raising interest rates. This is unlikely to happen at the July meeting, but closer to the end of the year. Futures on the federal funds currently estimate a probability of 20% for a rate hike in September. Meanwhile, the chances increase in December to 40% compared with less than 20% a week ago, and 9% at the beginning of the month.

According to Reuters latest survey, just over half of the 100 economists expect the Fed to raise rates in the fourth quarter to 0.75 percent compared with 0.25-0.50 percent currently. The change is likely to occur in December, as the November meeting of the Central Bank will begin in just a few days before the election on 8 November. The rest of the respondents forecast growth in the third quarter, most likely in September.

EUR / USD: during the Asian session, the pair was trading in the $ 1.0950-75 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3110-30 range

USD / JPY: during the Asian session, the pair was trading in 106.10-15 range

-

08:27

WSE: Before opening

At the beginning of the new week, investors sentiment remains balanced. Asia is dominated by light increases and contracts in the US slightly go down after Friday's rally on Wall Street of 0.5%. This indicates the possibility of stabilizing the WIG20 around the level of 1,800 points, which on Friday once again has not been defeated. In the short term the upward trend is still valid, but as shown by the last sessions, a stop would be something natural in present location of the index.

In the macro calendar the most important event will of course be Wednesday's FOMC decision on interest rates in the US. Today we will know the index of Ifo Institute from Germany. German data will be closely watched in the context of a negative surprise in the case of the ZEW index. During the weekend, in Germany, there were a series of attacks, which may somewhat undermine sentiment. Recent months, however, indicates that investors with each attack less likely to consider it. This time, however, may worry the country and the number of attacks. So far, Germany were considered safer from France, but this may change.

-

08:24

Mixed start expected on the major stock exchanges in Europe: DAX -0,1%, FTSE 100 + 0,1%, CAC 40 -0.1%

-

08:23

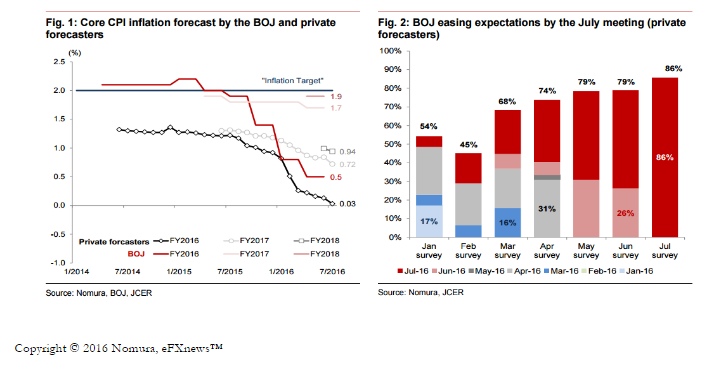

3 easing measures from the Bank of Japan this week - Nomura

"We expect the BOJ to decide on additional easing at the meeting this week (28-29 July), as widely anticipated by the market.

Our economists expect the BOJ to announce a policy package including: 1) additional purchases of ETFs (to JPY6trn/year) and REITs (to JPY180bn/year); 2) the introduction of negative rates on current loan support programs; and 3) IOER cut to -20bp from -10bp. We agree with this view and also see this policy package as the most likely outcome from this week's meeting.

Financial markets have been gradually stabilizing following the initial shock of the Brexit vote. USD/JPY is now trading around 106, while Japanese equity prices have recovered by about 12% from the bottom after the Brexit vote. USD/JPY is at almost the same level as ahead of the June meeting, while Japanese equity prices are higher now.

Although calmer market conditions may be a reason for the BOJ to stay on the side lines again for now, we see three reasons to expect BOJ easing this week: 1) further weakness in underlying inflation momentum; 2) much more elevated expectations for easing; and 3) political incentives to demonstrate a joint effort to stimulate the economy with fiscal stimulus".

-

08:19

EU Commission President, Juncker: there is no deadline for Brexit talks - Reuters

-

UK will have no access to EU internal market if it does not comply to EU rules

-

Turkey in no place to become EU member any time soon

-

if Turkey reintroduces death penalty the EU would stop access process immediately

-

-

08:16

Japan: trade surplus 692.8 billion yen in June

Japan had a merchandise trade surplus 692.8 billion yen in June, the Ministry of Finance said on Monday.

That beat forecasts for 474.4 billion yen following the upwardly revised 40.6 billion yen deficit in May (originally -40.7 billion).

Exports were down 7.4 percent on year, topping forecasts for a fall of 11.3 percent, which would have been unchanged from, the previous month.

Imports tumbled an annual 18.8 percent, also exceeding expectations for a fall of 20.0 percent following the 13.8 percent drop a month earlier.

-

07:16

Global Stocks

European stocks ended Friday little changed, but posted weekly gains, as investors sifted through corporate earnings reports for reasons to cheer after the European Central Bank failed to deliver a boost the previous day.

The marginal decline in equities picked up from a downward move from Thursday, when the pan-European index shed 0.1% after the ECB decided to leave monetary policy unchanged. The bank, lead by President Mario Draghi, expects its interest rates to remain at the present level or lower for an "extended period," and it plans to continue its bond-buying program until at least March 2017.

U.S. stocks rose cautiously Friday to notch a fourth week of gains, with a rally by telecom shares offsetting weakness in the industrial sector as investors awaited next week's Federal Reserve policy statement.

The S&P 500 Index SPX, +0.46% advanced 9.86 points, or 0.5%, to close at a new all-time high of 2,175.03, boosted by 1.3% jumps in both telecom and utilities, sectors typically viewed as defensive.

The Dow Jones Industrial Average DJIA, +0.29% rose 53.62 points, or 0.3%, to close at 18,570.85, led by gains in Visa Inc. V, +1.42% American Express Co. AXP, +1.34% and Microsoft Corp. MSFT, +1.38% offsetting declines in General Electric Co. GE, -1.63% and Caterpillar Inc. CAT, -0.79% The gains come after the blue-chip gauge snapped its nine-session win streak on Thursday.

Meanwhile, the Nasdaq Composite Index COMP, +0.52% rose 26.26 points, or 0.5%, to close at 5,100.16, its highest close of 2016.

Asian shares held near nine-month highs on Monday as worries over the impact of Britain's Brexit vote eased amid efforts to maintain growth, while the dollar was buoyed by a run of solid U.S. economic data.

Policy makers from the Group of 20 countries agreed to work to support global growth and better share the benefits of trade, in a weekend meeting dominated by the impact of Britain's exit from Europe and fears of rising protectionism.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent to stand just below its nine-month peak hit on Thursday. Japan's Nikkei .N225 rose 0.4 percent.

-

07:13

Options levels on monday, July 25, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1172 (3430)

$1.1134 (1980)

$1.1071 (1159)

Price at time of writing this review: $1.0976

Support levels (open interest**, contracts):

$1.0916 (4487)

$1.0889 (3918)

$1.0856 (7295)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 40040 contracts, with the maximum number of contracts with strike price $1,1200 (3814);

- Overall open interest on the PUT options with the expiration date August, 5 is 49838 contracts, with the maximum number of contracts with strike price $1,0900 (7295);

- The ratio of PUT/CALL was 1.24 versus 1.28 from the previous trading day according to data from July, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.3405 (1968)

$1.3308 (1138)

$1.3212 (1655)

Price at time of writing this review: $1.3136

Support levels (open interest**, contracts):

$1.2988 (1643)

$1.2891 (876)

$1.2794 (1819)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 26622 contracts, with the maximum number of contracts with strike price $1,3400 (1968);

- Overall open interest on the PUT options with the expiration date August, 5 is 25158 contracts, with the maximum number of contracts with strike price $1,2950 (2790);

- The ratio of PUT/CALL was 0.95 versus 0.96 from the previous trading day according to data from July, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:05

Nikkei 225 16,708.09 +0.49%, Shanghai Composite 3,010.51 -0.08%, S&P/ASX 200 5,528.3 +0.55%

-

01:50

Japan: Trade Balance Total, bln, June 693 (forecast 494.8)

-

00:34

Commodities. Daily history for Jul 22’2016:

(raw materials / closing price /% change)

Oil 44.26 +0.16%

Gold 1,322.10 -0.10%

-

00:33

Stocks. Daily history for Jun Jul 22’2016:

(index / closing price / change items /% change)

Nikkei 225 16,627.25 -182.97 -1.09%

Shanghai Composite 3,012.43 -26.5831 -0.87%

S&P/ASX 200 5,498.19 -14.21 -0.26%

CAC 40 4,381.1 +4.85 +0.11%

FTSE 100 6,730.48 +30.59 +0.46%

Xetra DAX 10,147.46 -8.75 -0.09%

S&P 500 2,175.03 +9.86 +0.46%

Dow Jones 18,570.85 +53.62 +0.29%

S&P/TSX Composite 14,600.66 +34.83 +0.24%

-

00:32

Currencies. Daily history for Jul 22’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $ 1,1095 +0,63%

GBP/USD $1,3110 -0,82%

USD/CHF Chf0,9865 +0,09%

USD/JPY Y106,08 -0,08%

EUR/JPY Y116,42 -0,56%

GBP/JPY Y139,07 -0,69%

AUD/USD $0,7463 -0,38%

NZD/USD $0,6999 +0,04%

USD/CAD C$1,3128 +0,32%

-

00:00

Schedule for today, Monday, Jul 25’2016:

(time / country / index / period / previous value / forecast)

08:00 Germany IFO - Business Climate 108.7 107.5

08:00 Germany IFO - Current Assessment 114.5 114

10:00 United Kingdom CBI industrial order books balance -2

22:45 New Zealand Trade Balance, mln 358

-