Noticias del mercado

-

17:47

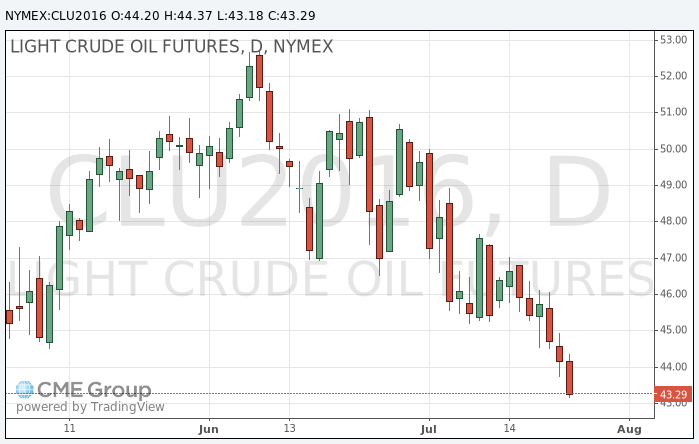

Oil was sold today

Oil prices have decreased 1 on the inventories data that showed a groth at the distribution center in the US Cushing by about 1 million barrels.

According to the report of Genscape, supply of "black gold" in the United States in Cushing for the week rose by 1 million barrels.

Cushing is the largest terminal for oil products in the world. Its storage capacity up to 73 million barrels, or about 13% of the total volume of US. There are several important pipelines converge, which moves oil from fields to refineries on the Gulf Coast.

Cushing is also the main place of the pricing of futures contracts on the North American benchmark WTI (West Texas Intermediate), the most actively traded futures contracts for crude oil in the world.

Rates of growth was the highest this year, according to the Commission on the Futures trading in commodities (CFTC) of the USA.

The cost of Brent crude oil fell below $ 45 a barrel for the first time since early May.

The decline in oil prices due to continued growth in the world's petroleum reserves under adverse demand forecasts.

"The mood of participants is bleak, - stated Commerzbank. Financial investors continue to leave the market, and this creates pressure on prices."

According to Barclays that global oil demand in the third quarter of 2016 by 66% lower than in the same period a year earlier, due to the slowdown in the global recovery.

This is evidence of an increase in stocks of petroleum products throughout the world, causing experts concern that oil demand from refiners may be reduced.

So, in spite of the peak driving season, gasoline inventories in the US rose to 900K barrels last week, and their increase was observed for the fourth time in the last five weeks.

China reported an increase in gasoline exports in June to a record 1.1 million tons, which is twice higher than the previous year's level.

Meanwhile, the number of employees in the United States oil rigs in the previous week increased by 14 to 371, and the growth of this indicator continued the 4th week in a row, according to the Baker Hughes.

The cost of the September futures on US light crude oil WTI fell to 43.18 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 44.75 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:28

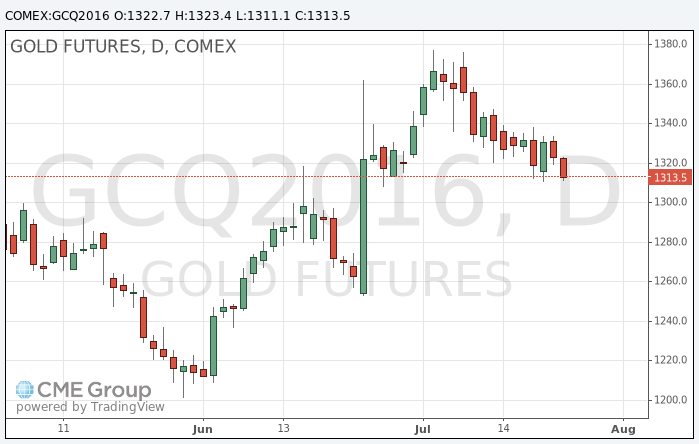

Gold little changed while we expect central banks meetings this week

During today's trading the price of cold had limited activity, while investors eyed central bank meetings this week. The meeting of the Federal Reserve is scheduled for 26-27 July, and the Bank of Japan - July 28-29.

As predicted, the Fed will not change the interest rate at the end of its two-day meeting on Wednesday, but market participants will closely monitor the FOMC statement on monetary policy in the search for fresh guidance on the timing of interest rate increase in the next few months.

The market expects that Bank of Japan, on the contrary, will continue easing monetary policy at its meeting on Friday, further lowering rates and expanding the volume of asset purchases.

On Friday, prices lost $ 7.60, or 0.57%, as the renewed expectations of Fed rate hike this year boosted the US dollar, as investors prefer to invest in rising equity markets instead of buying safe assets.

For the week gold fell $ 4.40, or 0.26%, demonstrating a decline 2 weeks in a row.

Newly published encouraging US statistical data reinforced speculation that the Federal Reserve may raise interest rates before the end of the year. Currently federal funds futures estimate December 45% compared with less than 20% a week ago, and 9% at the beginning of the month.

On Friday, the USD index rose to 97.59, the highest since March 10. On Monday, the index kept at 97.47 against the background of differences of monetary policy.

Strengthening of the US dollar, as a rule, is putting pressure on gold, because gold drops appeal as an alternative asset and increases in the price of dollar-denominated commodities for holders of other currencies.

The precious metal was supported amid growing expectations that the world's central banks are stepping up monetary stimulus in the near future to counteract the negative economic consequences of Brexit.

For the year gold has risen in price by almost 25%, helped by concerns about global economic growth and expectations of monetary stimulus. Expectations of monetary stimulus tend to increase the demand for gold, as the precious metal is seen by investors as a safe store of value and inflation hedge.

Earlier, in July, prices have risen to more than two-year high of $ 1377.50 as fears about the global economy after the referendum in the UK led investors resort to safe assets.

The cost of the August gold futures on COMEX fell to $ 1311.10 per ounce.

-

17:14

Commerzbank forecast: If oil drops below $ 45, the fall will increase

At the beginning of the week, Brent crude was trading just slightly above the 2.5-month low of $ 45 per barrel, reached on Friday. Brent finished the week lower by 4%. Among the participants of the market pessimism reigned. Financial investors continue to exit from the market, thereby putting increased pressure on the oil quotations. According to the CFTC, in the week to July 19 the number of net long speculative positions on WTI fell by 18 400 to 136 100 contracts. This is the third reduction in the past four weeks, bringing the number of net long positions to their lowest level since the beginning of March this year. Meanwhile, the index is now likely to continue to fall. Most likely, the number of net long speculative positions on the brand also will be reduced.

It should be noted that the positions on the long Brent were much larger than WTI. Most of these positions were open at $ 45 at least, so that if the quotes fall below this level, we can see a new wave of speculative sales, which will strengthen the tendency to decrease. The trigger for the decline may make current data on drilling activity in the US, made public by oilfield services company Baker Hughes on Friday. According to the report the number of active oil drilling in the country last week rose for the fourth consecutive time. However, it would be premature to assume that this will lead to an increase in US oil production. Although drilling activity is currently at its highest level since the end of March this year, it is still 30% below the begining of the year.

-

09:46

Oil lower in early trading

This morning New York futures for WTI were down 0.23% to $ 44.08 and Brent oil futures fell by 0.26% to $ 45.98 per barrel. Thus the black little changed, amid fears of traders with an excess of raw materials on the global market and lower demand for it among refineries. Also Baker Hughes oil rigs in US increase by 14 to 371.

-

00:34

Commodities. Daily history for Jul 22’2016:

(raw materials / closing price /% change)

Oil 44.26 +0.16%

Gold 1,322.10 -0.10%

-