Noticias del mercado

-

17:47

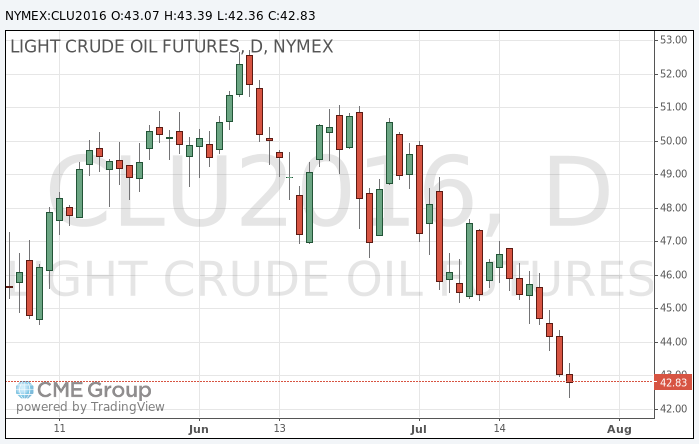

Oil prices show a negative dynamic

Oil quotes fell again after a brief rebound from three-month lows during the morning trading.

The price of WTI fell below $ 43 for the first time since April.

Market sentiment was becoming more "bearish" in connection with the continuing glut of oil market.

Oil had previously received some support from a weaker dollar, which has lost more than 1% against the yen.

Later today, the American Petroleum Institute will release its report, while the government report, published on Wednesday, may show that crude oil inventories fell by 2.5 million barrels for the week ending 22 July.

According to forecasts, gasoline stocks are expected to increase by 675,000 barrels, while distillate stocks, including heating oil and diesel fuel will rise by 700,000 barrels, according to some analysts.

A day earlier, New York WTI crude oil lost $ 1.06, or 2.4%, as concerns over the glut of global reserves increased against the background of recovery of drilling activity in the US.

On Friday, oil services provider Baker Hughes reported that the number of drilling rigs in the US increased by 14 to 371, gaining the fourth week in a row and the seventh week of the last eight.

Growing drilling activity in the US has increased speculation that production may increase in the coming weeks, renewing concerns about excess inventories.

Concerns about the growth of stocks of gasoline have additional pressure on the prices asUS gasoline inventories are well above the upper limit of the average range, says EIA.

In the last session, Brent crude was under pressure as prospects for increasing exports from Libya and Iraq have raised concern that an excess of oil will reduce demand from refiners.

The cost of the September futures on WTI fell to 42.36 dollars per barrel.

September futures price for Brent fell to 44.14 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:30

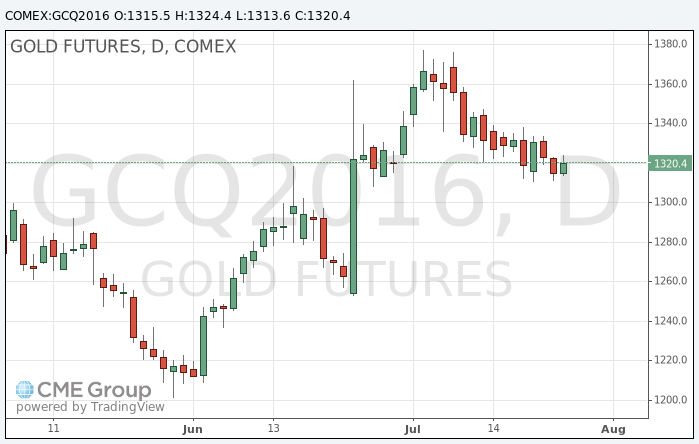

Gold price moderately increased

During today's trading price of gold rose slightly, but continued to remain at one-month low as investors cautiously awaiting the outcome of the two-day meeting that will determine the monetary policy of the Federal Reserve System.

Investors will wait for guidance related to the possibility of higher interest rates. Minutes of the previous Fed meeting showed that Fed officials are divided about the state of the national economy and whether it will be able to survive the rise in interest rates.

Traders do not expect the Fed to raise interest rates at the meeting in July, but recently published strong economic data led investors to think about the possibility of a rate hike in September. Despite the economic uncertainty factors, observed in recent months, the probability of rate hikes before the end of the year increased to 48%, based on the key interest rate futures Commerzbank.

If the Fed decides to raise interest rates in September, it will be negative for gold, says Nitesh Shah, an analyst at London-based ETF Securities. However, anxiety over the weak prospects for the European economy to support gold, as investors continue to be interested in safe heaven assets, the analyst added.

"It's fair to note the strong US economic data, but some investors continued to transfer funds to safe-haven assets, reinforcing the case of negative developments", - adds Shah. He expects that not the most positive economic outlook in Europe will continue to support gold, in spite of the improvement in US economic data.

Gold rose sharply as investors turned to safe-haven assets after Brexit. Then prices started to decline, and recently fell to a three-week low. However, some analysts believe that the decline in gold is a good opportunity to buy the metal.

"Investors are once again turning to the gold market correction over the past two weeks, probably dragged, -. Shah said -. All the factors for growth of gold is stored."

The cost of the August gold futures on the COMEX rose to $ 1324.40 per ounce.

-

09:48

Oil is rising

This morning, New York futures for WTI crude oil rose by + 0.21% to $ 43.22 and crude oil futures for Brent rose by + 0.29% to $ 45.29 per barrel. Thus, the black gold is trading in the plus, amid falling dollar against other major currencies, but investors continue to fear a surplus of ron the market. The market also expects the release of the American Petroleum Institute data and on Wednesday, the data from the US Department of Energy, which investors watch with great attention.

-

01:02

Commodities. Daily history for Jul 25’2016:

(raw materials / closing price /% change)

Oil 43.05 -0.19%

Gold 1,315.30 -0.32%

-