Noticias del mercado

-

22:18

US stocks closed

Earnings from McDonald's Corp. to Caterpillar Inc. tugged U.S. stocks in opposite directions, leaving benchmark indexes little changed as investors turned attention to Wednesday's Federal Reserve policy decision.

Housing data that showed the biggest gain in new-home sales in eight years bolstered optimism in the economy and raised the specter that the Fed may strike a more hawkish tone on rates after its two-day meeting. Apple Inc. is slated to report results after the close of trading.

The rally that pushed the S&P 500 up for four straight weeks has faltered as the Fed kicks off a two-day meeting, with economists estimating the central bank will keep borrowing costs unchanged at its conclusion on Wednesday. Traders will also focus on earnings, with 45 companies in the S&P 500 scheduled to report results on Tuesday, including Apple Inc.

Traders are pricing in less than even odds of a rate increase until at least March 2017. While recent economic data have beaten forecasts, Chair Janet Yellen and her colleagues have emphasized a gradual pace of tightening. On Tuesday, data showed consumer confidence fell by less than forecast, while new-home sales rose in June to the highest level in more than eight years. Home prices in 20 U.S. cities rose less than projected in May from a year earlier.

-

21:00

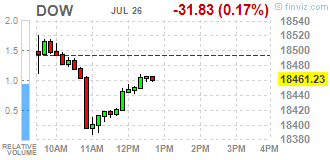

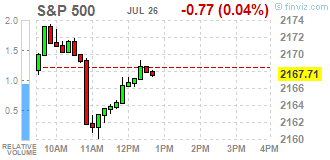

DJIA 18441.50 -51.56 -0.28%, NASDAQ 5105.61 7.98 0.16%, S&P 500 2166.25 -2.23 -0.10%

-

19:00

Wall Street. Major U.S. stock-indexes demonstrated mixed dynamics

Major U.S. stock-indexes demonstrated mixed dynamics as a number of companies (including McDonald's (MCD)), provided disappointing quarterly results. McDonald's reported Q2 earnings of $1.45 per share, beating analysts' consensus estimate of $1.39. At the same time, the company's quarterly revenues reduced by 3.6% y/y to $6.265 bln, strictly in-line with analysts' consensus estimate. Market participants are waiting for earnings reports from Apple (AAPL) and Twitter (TWTR), which are set to be published after the market's close. In addition, investors remain cautious ahead of the U.S.Federal Reserve meeting this week.

Dow stocks mixed (15 in positive area, 15 in negative). Top looser - McDonald's Corp. (MCD, -4.18%). Top gainer - Caterpillar Inc. (CAT, +4.03%).

Almost all S&P sectors in positive area. Top gainer - Conglomerates (+1.2%). Top looser - Utilities (-0.4%).

At the moment:

Dow 18388.00 -32.00 -0.17%

S&P 500 2162.50 +0.25 +0.01%

Nasdaq 100 4661.75 +8.00 +0.17%

Crude Oil 42.83 -0.30 -0.70%

Gold 1319.30 -0.20 -0.02%

U.S. 10yr 1.57 0.00

-

18:20

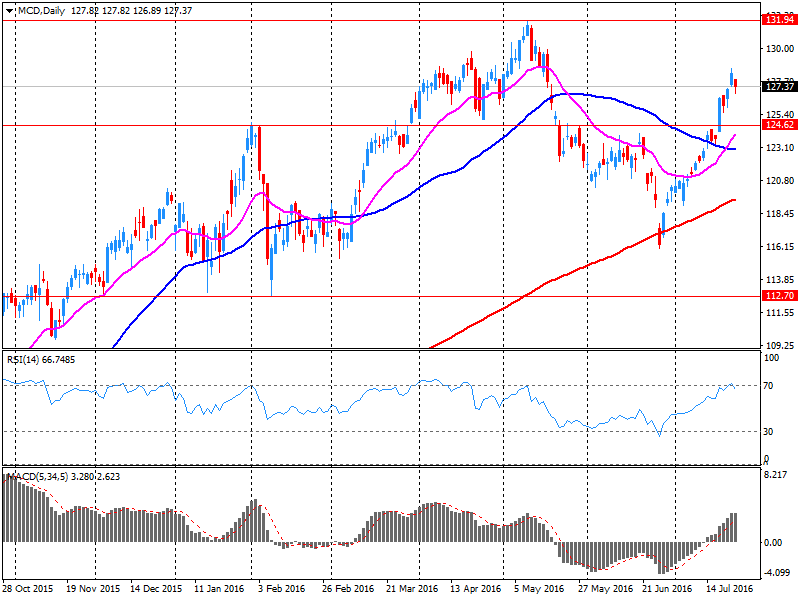

WSE: Session Results

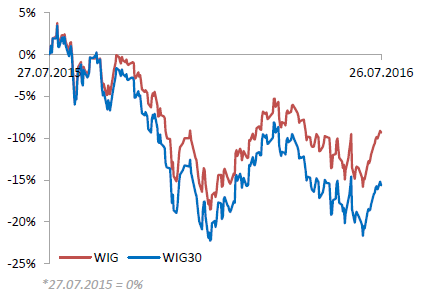

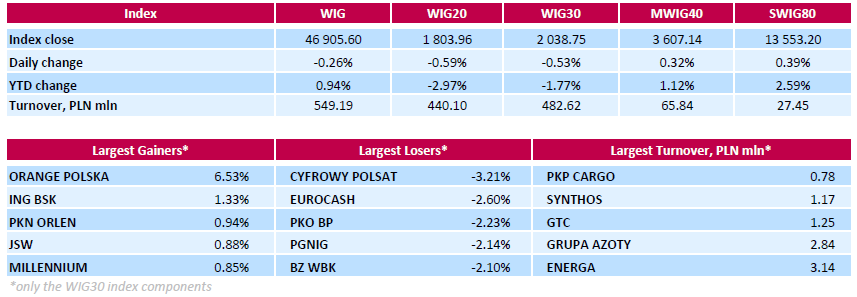

Polish equity market closed lower on Tuesday. The broad market benchmark, the WIG Index, fell by 0.26%. Sector performance within the WIG Index was mixed. Media stocks (-2.19%) tumbled the most, while telecoms (+5.25%) fared the best.

The large-cap stocks dropped by 0.53%, as measured by the WIG30 Index. In the index basket, media group CYFROWY POLSAT (WSE: CPS) recorded the biggest drop, down 3.21%. It was followed by FMCG-wholesaler EUROCASH (WSE: EUR), oil and gas producer PGNIG (WSE: PGN) and two banks PKO BP (WSE: PKO) and BZ WBK (WSE:BZW), declining by 2.1%-2.6%. At the same time, telecommunication services provider ORANGE POLSKA (WSE: OPL) was the strongest performer, climbing by 6.53%.

-

18:00

European stocks closed: FTSE 6724.03 13.90 0.21%, DAX 10247.76 49.52 0.49%, CAC 4394.77 6.77 0.15%

-

15:53

WSE: After start on Wall Street

The market in the US started from moderate pros that looks comfortable in the ongoing from several days consolidation. A series of lower shadow indicates that strong demand is still present. Nevertheless contracts set new session highs what improves sentiment in Europe. Today begins a two-day meeting of the FOMC and tomorrow's message will be the first one, which may have influence on the market.

Since yesterday, almost completely nothing happening on the market of the zloty, which pairs USD / PLN and EUR / PLN entered into apathy. These fluctuations are a response to changes in the eurodollar. It also shows that foreign capital does not perform at the moment major movements in our market. This is evident also on the Warsaw Stock Exchange, especially after today turnover (only PLN 300 mln on the WIG20).

-

15:32

U.S. Stocks open: Dow -0.05%, Nasdaq +0.02%, S&P -0.01%

-

15:27

Before the bell: S&P futures -0.01%, NASDAQ futures +0.13%

U.S. index futures were little changed as investors awaited a Federal Reserve update for clues on the trajectory of interest-rate increases and weighed earnings reports.

Global Stocks:

Nikkei 16,383.04 -237.25 -1.43%

Hang Seng 22,129.73 +136.29 +0.62%

Shanghai 3,050.18 +34.35 +1.14%

FTSE 6,728.57 +18.44 +0.27%

CAC 4,390.81 +2.81 +0.06%

DAX 10,234.19 +35.95 +0.35%

Crude $42.50 (-1.46%)

Gold $1320.00 (+0.04%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.4

-0.09(-0.858%)

10750

3M Co

MMM

177.56

-2.07(-1.1524%)

4453

ALTRIA GROUP INC.

MO

68.79

-0.01(-0.0145%)

400

Amazon.com Inc., NASDAQ

AMZN

741.17

1.56(0.2109%)

9021

Apple Inc.

AAPL

97.25

-0.09(-0.0925%)

103371

AT&T Inc

T

42.78

-0.16(-0.3726%)

2355

Barrick Gold Corporation, NYSE

ABX

20.12

0.29(1.4624%)

98845

Caterpillar Inc

CAT

78

-0.69(-0.8769%)

103360

Chevron Corp

CVX

102.42

-0.65(-0.6306%)

4250

Cisco Systems Inc

CSCO

30.9

0.11(0.3573%)

2385

Citigroup Inc., NYSE

C

43.98

-0.06(-0.1362%)

12545

Deere & Company, NYSE

DE

78.3

0.38(0.4877%)

10000

E. I. du Pont de Nemours and Co

DD

69.79

0.91(1.3211%)

4700

Exxon Mobil Corp

XOM

91.5

-0.70(-0.7592%)

10722

Facebook, Inc.

FB

121.9

0.27(0.222%)

93498

Ford Motor Co.

F

13.74

0.06(0.4386%)

69070

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.65

-0.73(-5.8966%)

1142584

General Electric Co

GE

31.6

-0.04(-0.1264%)

4342

General Motors Company, NYSE

GM

32.26

0.20(0.6238%)

2523

Google Inc.

GOOG

740

0.23(0.0311%)

1683

HONEYWELL INTERNATIONAL INC.

HON

115.65

0.16(0.1385%)

150

Intel Corp

INTC

34.68

-0.01(-0.0288%)

7863

International Business Machines Co...

IBM

162.55

-0.10(-0.0615%)

402

Johnson & Johnson

JNJ

125

0.11(0.0881%)

568

JPMorgan Chase and Co

JPM

63.71

-0.16(-0.2505%)

325

McDonald's Corp

MCD

124.2

-3.20(-2.5118%)

490671

Microsoft Corp

MSFT

56.63

-0.10(-0.1763%)

10122

Nike

NKE

57

-0.14(-0.245%)

6240

Pfizer Inc

PFE

36.84

0.06(0.1631%)

525

Procter & Gamble Co

PG

85.8

0.00(0.00%)

100

Starbucks Corporation, NASDAQ

SBUX

58.72

0.77(1.3287%)

55815

Tesla Motors, Inc., NASDAQ

TSLA

227.03

-2.98(-1.2956%)

57508

The Coca-Cola Co

KO

45.55

-0.02(-0.0439%)

3429

Twitter, Inc., NYSE

TWTR

18.58

-0.07(-0.3753%)

96758

United Technologies Corp

UTX

106.5

1.85(1.7678%)

32981

Verizon Communications Inc

VZ

55.7

-0.17(-0.3043%)

40042

Visa

V

79.11

0.17(0.2154%)

1185

Wal-Mart Stores Inc

WMT

73.74

-0.01(-0.0136%)

1435

Walt Disney Co

DIS

96.95

-0.44(-0.4518%)

9290

Yahoo! Inc., NASDAQ

YHOO

38.11

-0.21(-0.548%)

27441

Yandex N.V., NASDAQ

YNDX

20.72

-0.30(-1.4272%)

7300

-

14:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Walt Disney (DIS) downgraded to Market Perform from Outperform at FBR Capital; target lowered to $108 from $111

Yahoo! (YHOO) downgraded to Equal-Weight from Overweight at Morgan Stanley

Other:

Starbucks (SBUX) added to Conviction Buy List at Goldman

-

14:37

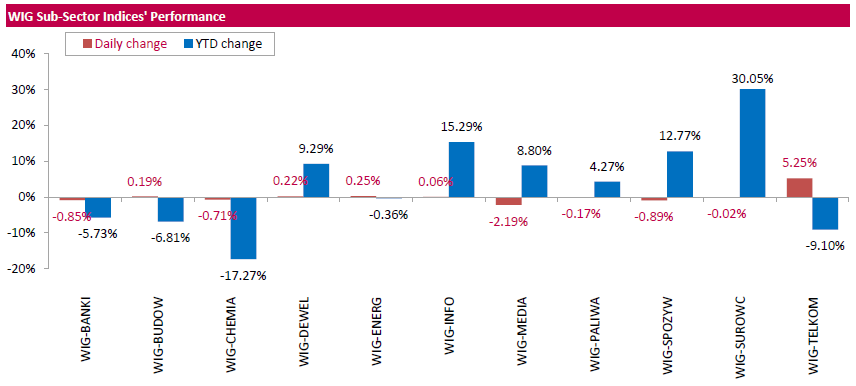

Company News: McDonald's (MCD) Q2 EPS beat analysts’ estimate

McDonald's reported Q2 FY 2016 earnings of $1.45 per share (versus $1.26 in Q2 FY 2015), beating analysts' consensus estimate of $1.39.

The company's quarterly revenues amounted to $6.265 bln (-3.6% y/y), strictly in-line with analysts' consensus estimate.

MCD fell to $123.00 (-3.45%) in pre-market trading.

-

14:23

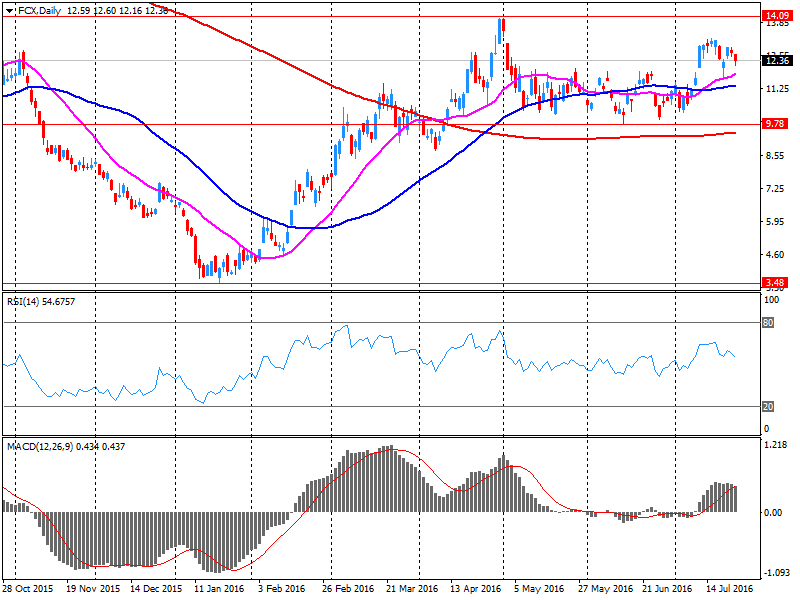

Company News: Freeport-McMoRan (FCX) Q2 results miss analysts’ estimates

Freeport-McMoRan reported Q2 FY 2016 loss of $0.02 per share (versus income of $0.14 in Q2 FY 2015), missing analysts' consensus estimate of a loss of $0.01.

The company's quarterly revenues amounted to $3.334 bln (-15.3% y/y), missing analysts' consensus estimate of $3.684 bln.

FCX fell to $11.61 (-6.22%) in pre-market trading.

-

14:05

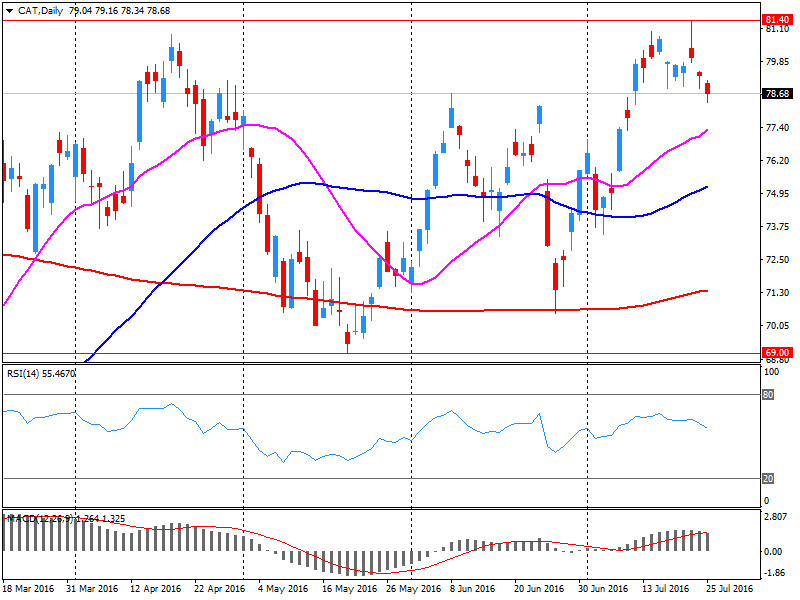

Company News: Caterpillar (CAT) Q2 results beat analysts’ forecasts

Caterpillar reported Q2 FY 2016 earnings of $1.09 per share (versus $1.27 in Q2 FY 2015), beating analysts' consensus estimate of $0.96.

The company's quarterly revenues amounted to $10.342 bln (-16% y/y), beating analysts' consensus estimate of $10.131 bln.

CAT fell to $77.97 (-0.91%) in pre-market trading.

-

13:52

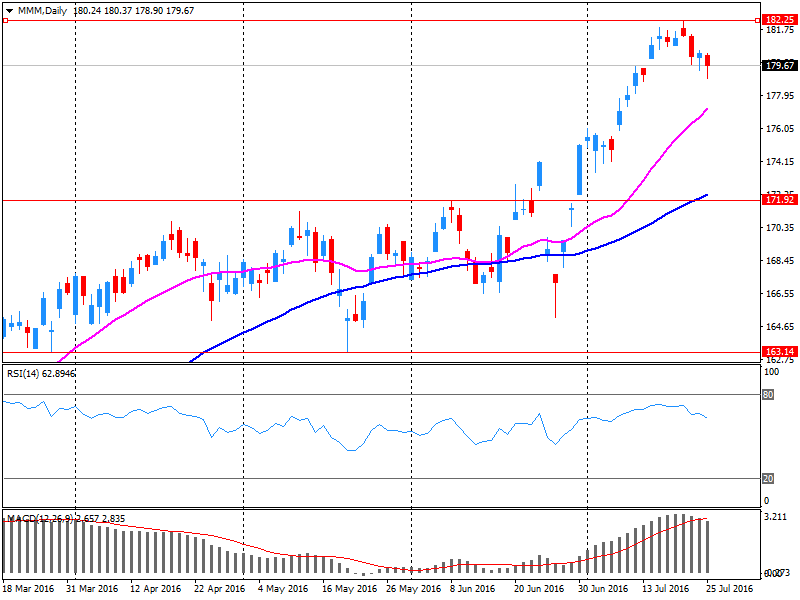

Company News: 3M Company (MMM) Q2 EPS beat analysts’ forecast

3M Company reported Q2 FY 2016 earnings of $2.08 per share (versus $2.02 in Q2 FY 2015), beating analysts' consensus estimate of $2.07.

The company's quarterly revenues amounted to $7.662 bln (-0.3% y/y), slightly missing analysts' consensus estimate of $7.711 bln.

MMM fell to $176.91 (-1.51%) in pre-market trading.

-

13:32

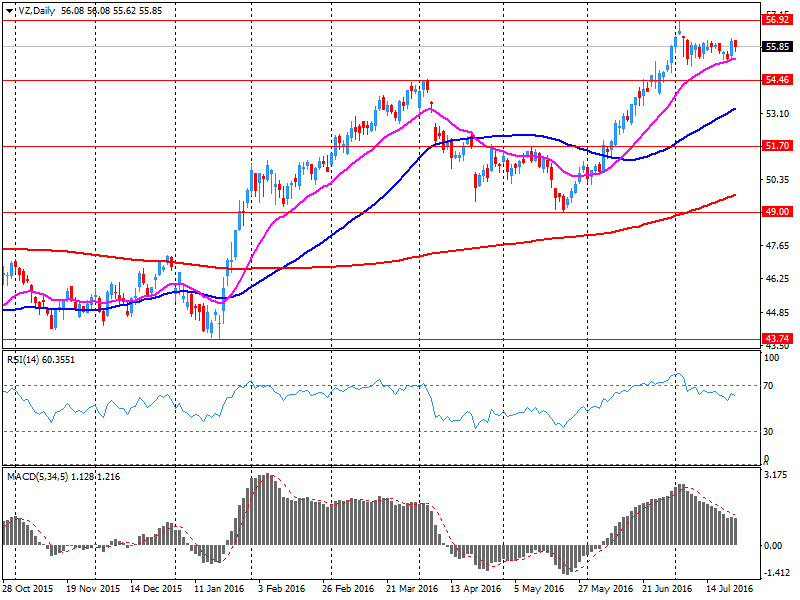

Company News: Verizon (VZ) Q2 EPS beat analysts’ estimate

Verizon reported Q2 FY 2016 earnings of $0.94 per share (versus $1.04 in Q2 FY 2015), beating analysts' consensus estimate of $0.93.

The company's quarterly revenues amounted to $30.532 bln (-5.3% y/y), slightly missing analysts' consensus estimate of $30.968 bln.

VZ closed Monday's trading session at $55.87 (-0.41%).

-

13:18

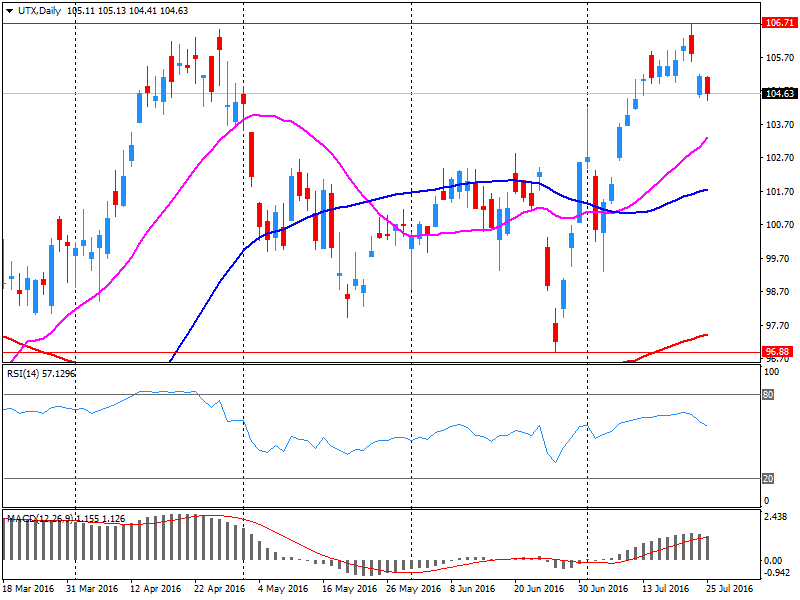

Company News: United Tech (UTX) Q2 results beat analysts’ estimates

United Tech reported Q2 FY 2016 earnings of $1.82 per share (versus $1.81 in Q2 FY 2015), beating analysts' consensus estimate of $1.68.

The company's quarterly revenues amounted to $14.874 bln (+1.3% y/y), beating analysts' consensus estimate of $14.693 bln.

UTX closed Monday's trading session at $104.65 (-0.46%).

-

13:07

WSE: Mid session comment

First half of trading on the Warsaw Stock Exchange was marked by the return of most of yesterday's approach and return to the level of 1,800 points in the case of the WIG20 index. Weaker are banks, which may result from the inferior attitude of banks in Europe, where Commerzbank results were bad adopted. The German DAX after declines returned on the green side of the market, and discount of the CAC40 dwindled to 0.2%. We may see that investors are looking for a balance, and the DAX maintains a slight upward trend of recent days.

At the halfway point of the session the WIG20 index reached the level of 1, 801 points (-0,73%).

-

13:01

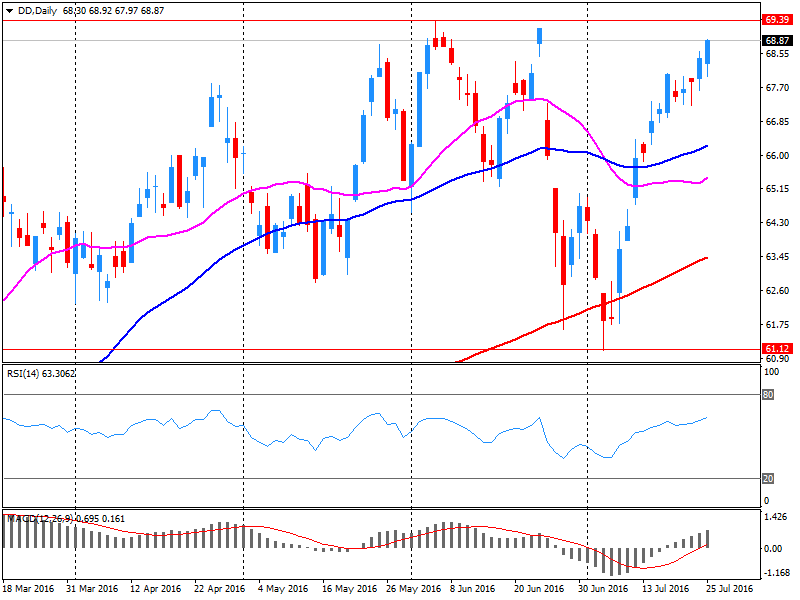

Company News: DuPont (DD) Q2 results beat analysts’ expectations

DuPont reported Q2 FY 2016 earnings of $1.24 per share (versus $1.18 in Q2 FY 2015), beating analysts' consensus estimate of $1.10.

The company's quarterly revenues amounted to $7.061 bln (-0.8% y/y), beating analysts' consensus estimate of $6.980 bln.

DD closed Monday's trading session at $68.88 (+0.66%).

-

09:24

Major indices little changed after opening: FTSE 100 6,710.13-20.350-0.30%, DAX 10,212.62 + 14.38 + 0.14%

-

09:17

WSE: After opening

WIG20 index opened at 1812.16 points (-0.14%)

WIG 46997.25 -0.06%

WIG30 2046.45 -0.16%

mWIG40 3600.50 0.14%

*/ - change to previous close

The futures market started the session from a fall of 0.11% to 1,811 points. The cash market (WIG20 index) opened with a drop of 0.14% to 1,812 points. In Euroland the opening of the session and the first bars run neutrally. Locally company results are accepted peacefully and share prices both of Millennium (WSE: MIL) and Orange (WSE: OPL) does not differ much from yesterday's close. The same morning does not bring greater changes and the session begins roughly where yesterday was over.

-

08:42

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0,4%, FTSE 100 + 0,3%, CAC 40 + 0.1%

-

08:21

WSE: Before opening

Yesterday's session in the US ended with a decline of 0.3%, and in the morning the American contracts are traded on neutral levels. This means that there has not been a larger correction, and the side trend close to maxima continues. This is a good news for the Warsaw market, which ended yesterday's session high and today may have relative easy start. The moods in Asia are balanced and on most parquets there are no major changes. In plus stands out Hong Kong with an increase of more than 1% and in minus falls Tokyo with a loss of approx. 1,2% as a result of the strengthening yen.

Investors on the Warsaw Stock Exchange must remember that at the end of the week in the Parliament is to appear presidential draft of law on foreign currency loans. This means that this week will be important from the point of view of local banks.

In today's macro calendar's most important publication will be consumer confidence index Conference Board, but like yesterday's Ifo, it should not permanently affect moods, as these will depend on the upcoming decision of major central banks, that is what tomorrow will announce the Fed and the BoJ on Friday.

-

07:15

Global Stocks

European stocks ended a volatile session with small gains as optimism over upbeat earnings and deal-related news outweighed a slump in oil prices.

The Stoxx Europe 600 SXXP, +0.18% rose 0.2% to settle at 340.93, posting its first rise in three sessions.

U.S. stocks retreated from record levels to close lower Monday, as investors turned cautious ahead of a busy week of earnings and central bank meetings.

Stocks pared early losses, but the S&P 500 SPX, -0.30% closed down 6.55 points, or 0.3%, at 2,168.48, with all sectors finishing lower except consumer discretionary, which logged a fractional gain.

The Dow Jones Industrial Average DJIA, -0.42% finished down 77.79 points, or 0.4%, at 18,493.06, trimming what had been a 118-point deficit.

Meanwhile the Nasdaq Composite Index COMP, -0.05% shed 2.53 points, or 0.1%, to close at 5,097.63. Earlier in the session, the index had been down nearly 18 points.

The Federal Reserve kicks off its monetary policy meeting on Tuesday and will announce its decision on Wednesday at 2 p.m. Eastern time. The central bank is widely expected to hold interest rates steady and stop short of signaling a possible rate increase in September because of continued uncertainty about the economic outlook.

Caution gripped Asian markets on Tuesday, sending the safe-haven yen scampering higher ahead of central bank meetings in the United States and Japan, while a fresh skid in oil dampened energy stocks.

Japan's Nikkei .N225 shed 1.5 percent, with investors seemingly unimpressed by a Nikkei report the government planned a direct fiscal stimulus of around 6 trillion yen ($56 billion) over the next few years.

-

04:04

Nikkei 225 16,390.13 -1.38%, Shanghai Composite 3,014.5 -0.04%, S&P/ASX 200 5,516.5 -0.31%

-

01:01

Stocks. Daily history for Jun Jul 25’2016:

(index / closing price / change items /% change)

Nikkei 225 16,620.29 -0.04%

Shanghai Composite 3,016.8 +0.13%

S&P/ASX 200 5,533.56 +0.64%

CAC 40 4,388 +0.16%

Xetra DAX 10,198.24 +0.50%

FTSE 100 6,710.13 -0.30%

S&P 500 2,168.48 -0.30%

Dow Jones 18,493.06 -0.42%

S&P/TSX Composite 14,498.1 -0.70%

-