Noticias del mercado

-

16:33

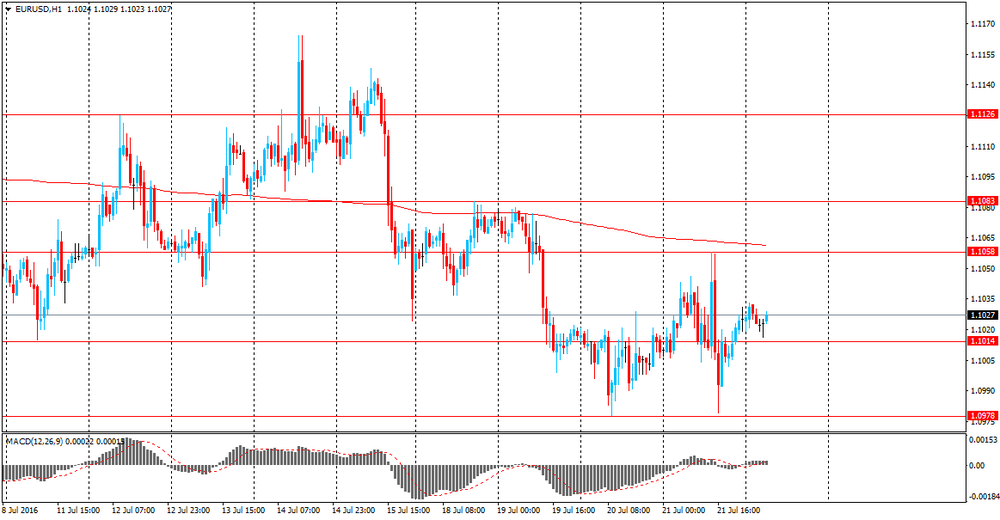

EUR/USD Post-ECB and Ahead Of Next Week's FOMC: En-Route To 1.08 - BTMU

"The message from Draghi was as expected - we need more time to assess the economic data in the aftermath of recent events like Brexit and the attempted coup in Turkey. By the next meeting on 8th September, the outlook will be a little clearer and the ECB will have the updated staff forecasts to make a more informed decision.

That message certainly leaves the door open for action at that meeting although there was no strong or explicit signal about action by then. But certainly the general tone of his statement and comments point to the ECB still being concerned about downside risks to inflation.

For the week ahead, the advance PMIs tomorrow might give some indication of the hit to business confidence post-Brexit when markets in Europe fell sharply. The risks to those reports seem to be to the downside.

Next week, the key event is the FOMC announcement on 27th July. Given the general flow of economic data, the statement from the FOMC is likely to be more optimistic about the outlook which could fuel further upward pressure on short-term yields in the US, thus providing some modest support for the dollar" - via efxnews.

-

16:07

ECB said to see no current urgency for September QE action - zerohedge

-

16:05

US: index of business activity in the manufacturing sector grew more than expected

The July data signaled a further recovery of business conditions across the US;s manufacturing sector, led by sustained expansion of incoming new orders and the very growth in production for eight months. Creation of new jobs was strengthened in July, the latest increase in jobs was the fastest in the last 12 months. At the same time, input price inflation rose at the fastest pace since November 2014, but selling prices rose only slightly.

Markit data showed that seasonally adjusted preliminary manufacturing purchasing managers index rose to 52.9 in July, compared with 51.3 in June, and pointed to the strong improvement in the general business environment.

In addition, the index continues to recover from its post-crisis low, recorded in May, the latest reading been the strongest since October 2015. The acceleration of growth in output, new orders and employment had a key positive effect in July.

-

15:45

U.S.: Manufacturing PMI, July 52.9 (forecast 51.6)

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0950 (EUR 1.3bln) 1.1000 (655m) 1.1050 (428m) 1.1075-80 (603m)

USD/JPY: 106.50 (USD 270m) 107.00 (250m) 108.00 (815m)

-

14:39

Retail sales in Canada up 0.2%

Retail sales rose 0.2% to $44.3 billion in May. Higher sales at food and beverage stores and gasoline stations more than offset lower sales at motor vehicle and parts dealers.

Sales were up in 6 of 11 subsectors, representing 51% of retail trade.

After removing the effects of price changes, retail sales in volume terms edged up 0.1% in May.

-

14:36

Canadian CPI higher than forecasts. Usd/Cad fell

Prices rose in all major components in the 12 months to June, with the shelter index and the household operations, furnishings and equipment index contributing the most to the year-over-year gain in consumer prices.

The shelter index rose 1.6% in the 12 months to June, after increasing 1.4% in May. This acceleration was partly attributable to the homeowners' replacement cost index, which was up more year over year in June (+3.5%) than in May (+2.7%). Additionally, fuel oil prices were down less on a year-over-year basis in June (-13.2%) compared with May (-17.3%). The natural gas index posted a larger decline in the 12 months to June than in the previous month.

Food prices were up 1.3% year over year in June, following a 1.8% gain in May. Prices for food purchased from stores rose 0.8% in the 12 months to June, as the fresh or frozen beef index (-3.3%) registered its first year-over-year decrease since August 2010. Consumers paid 2.1% less for dairy products in June compared with the same month a year earlier. Prices for food purchased from restaurants advanced 2.6% on a year-over-year basis in June, matching the rise in May.

-

14:34

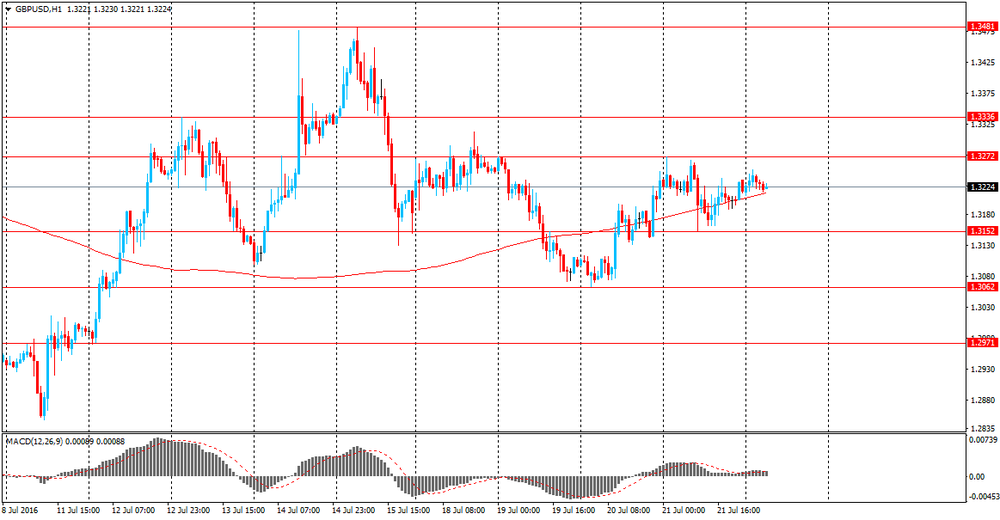

European session review: the pound fell markedly on the business activity data

The following data was published:

(Time / country / index / period / previous value / forecast)

7:00 France Business activity index in the services sector (preliminary data) July 49.9 49.5 50.3

France 7:00 PMI in the manufacturing sector (preliminary data) July 48.3 48.6 48

Germany 7:30 PMI in the service sector (preliminary data) July 53.7 53.2 54.6

Germany 7:30 PMI in the manufacturing sector (preliminary data) July 54.5 53.5 53.7

8:00 Eurozone PMI in the manufacturing sector (preliminary data) July 52.8 51.9 52

8:00 Eurozone business activity index in the services sector (preliminary data) July 52.8 52.3 52.7

8:30 UK PMI index for the services sector in July 52.3 48.9 47.4

8:30 UK PMI Manufacturing Index July 52.1 47.8 49.1

The British pound fell against the US dollar after the weak economic reports from UK have raised concern about the UK's growth prospects after the decision of the country to leave the EU. The activity of the private sector fell at the strongest pace since the beginning of 2009 after Brexit, revealed Friday the preliminary survey results from Markit.

The composite output index fell to a 87-month low of 47.7 in July from 52.4 in June. A value below 50 points to contraction.

Purchasing Managers' Index in the services sector fell more than expected to 47.4, 88 month low, from 52.3 in the previous month. The expected level was 48.9.

Manufacturing PMI reached 49.1, compared with 52.1 in June, but above the expected level of 47.8. It was the lowest for 41 months.

"The UK economy has suffered because of the sharp fall in output and new orders following the referendum on EU membership, as uncertainty prevailed" said David Noble.

The true extent of the impact of this uncertainty remains to be seen in the next month, said Noble.

Weak PMI reinforced concerns about slowing growth in the UK, as investors continue to assess the economic impact of Brexit.

At the same time, the dollar was supported after positive US statistics, published on Thursday, boosted optimism about the US economy.

The data showed that sales in the secondary housing market in the US unexpectedly rose in June by 1.1% to 5.57 million units, while a separate report showed that the number unemployment claims unexpectedly fell last week by 1000 to 253000.

The euro was almost unchanged against the US dollar after the release of positive euro-zone data, while the markets assess the decision of the European Central Bank to leave the parameters of monetary policy unchanged.

The euro strengthened the position for a short time after ECB President Mario Draghi said that European markets have coped with the volatility as a result of Brexit, showing "encouraging stability", but confirmed that if necessary, the central bank is ready to act, using all available means.

Draghi also said that the recovery in the euro area still faces a number of challenges for macroeconomic forecasts and downside risks prevail, citing Brexit, slow growth in developing countries and the lack of structural reforms, significant threats to the region's economy.

The comments came after the ECB kept interest rates unchanged at a record low 0.0% that was the expected decision.

Earlier Friday, Markit index of business activity in the euro area (for the production and service sectors) declined from 53.1 in June to 52.9 in July, remaining above the forecasted 52.5.

Germany's manufacturing PMI fell in July to 53.7 from 54.5. The index for the services sector rose to 54.6 this month from 53.7.

The index of business activity in the manufacturing sector in France fell to 50.0 in July from 49.6, while the index of business activity in the services sector rose to 50.3 from 49.9.

EUR / USD: during the European session, the pair rose to $ 1.1040 and then dropped to $ 1.1008

GBP / USD: during the European session, the pair fell to $ 1.3084

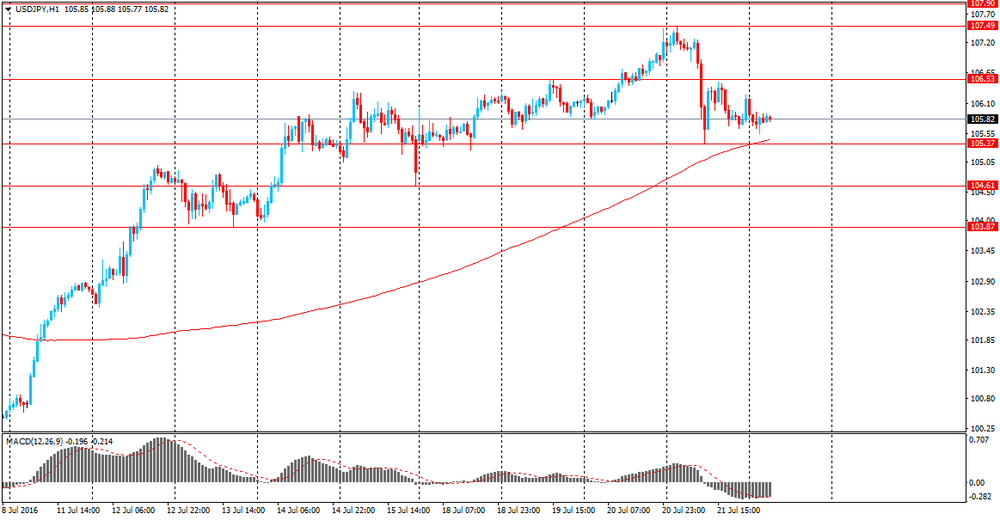

USD / JPY: during the European session, the pair rose to Y106.28

-

14:31

Canada: Bank of Canada Consumer Price Index Core, y/y, June 2.1% (forecast 2%)

-

14:30

Canada: Retail Sales, m/m, May 0.2% (forecast 0.0%)

-

14:30

Canada: Consumer Price Index m / m, June 0.2% (forecast 0.1%)

-

14:30

Canada: Retail Sales ex Autos, m/m, May 0.9% (forecast 0.3%)

-

14:30

Canada: Consumer price index, y/y, June 1.5% (forecast 1.4%)

-

14:30

Canada: Retail Sales YoY, May 3.6%

-

12:00

Italy's industrial orders and sales decreased in May

Italy's industrial orders and sales decreased in May after rising in the previous month, figures from the statistical office ISTAT showed Friday.

Industrial orders declined 2.8 percent from April, when they rose 0.9 percent. Domestic market orders decreased for a third straight month, down 0.6 percent. Foreign orders fell 5.7 percent after an 8.2 percent jump in the previous month.

Compared to a year ago, industrial orders decreased 4.2 percent in May following an 11.3 percent slump in the previous month. That was second consecutive annual decline.

Industrial turnover declined 1.1 percent from April, when sales rose 2.1 percent. Domestic sales decreased 1.1 percent and sales abroad shrunk 1.2 percent.

On a year-on-year basis, industrial sales fell 2.7 percent after a 0.1 percent gain in the previous month.

-

11:02

Review of financial and economic press: Donald Trump has officially agreed to run for US president

D/W

Donald Trump has officially agreed to run for US president

Donald Trump has officially agreed to run for US president from the Republican Party. He stated this on Friday night, 22 July, the last day of the party's congress in Cleveland. In his speech, the politician said that "violence and crime, who found refuge in our society, will soon be brought to an end".

Paris, London ready to give time to prepare Brexit

France is ready to provide the UK time to prepare the negotiations on the exit from the European Union. French President Francois Hollande said that before the start of negotiations on Brexit should be no preliminary discussions and meetings.

newspaper. ru

MasterCard will buy a 90% stake in the largest payment system in the UK

MasterCard payment system operator has agreed to buy a controlling share (92.4%) in the UK payments VocaLink system, which handles most payments in the UK and Northern Ireland, Bloomberg reported. The deal amounted to $ 920 million.

The ECB again kept its key interest rate at a record low

The Governing Council of the European Central Bank has left its benchmark interest rate at a record low of 0%, according to a press release from the regulator. The rate on deposits maintained at minus 0.4%, margin rate remained at around 0.25%.

-

11:00

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0950 (EUR 1.3bln) 1.1000 (655m) 1.1050 (428m) 1.1075-80 (603m)

USD/JPY: 106.50 (USD 270m) 107.00 (250m) 108.00 (815m)

-

10:36

UK services activity lowest since 2009. The pound declined

The UK economy opened the third quarter on a weak footing. Output and new orders both fell for the first time since the end of 2012, while service providers' optimism about the coming 12 months slumped to a seven-and-a-half year low. The headline Markit Flash UK Composite Output Index - which is compiled using the same methodology as Flash PMI data published for the euro area, the United States and Japan - fell to 47.7 in July, its lowest reading since April 2009. Data were collected between July 12-21. The weaker performance of the UK economy during July was especially striking when looking at the month-on-month movements in the index levels. The Composite Output and the Composite New Orders indices fell by 4.7 and 6.8 points respectively since June, the steepest drops registered in the series histories. The 10.4 point decline in the Services Business Expectations Index was also the largest on record. Output and new orders fell in both the manufacturing and service sectors during July. A number of firms linked this to ongoing uncertainty pre- and post-EU referendum, with reports especially prevalent among service providers. The downturn in services was also more marked than that seen in manufacturing. Services activity and new orders both fell at the quickest rates in over seven years, with series-record month-onmonth drops in the respective index levels.

-

10:30

United Kingdom: Purchasing Manager Index Services, July 47.4 (forecast 48.9)

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , July 49.1 (forecast 47.8)

-

10:10

Euro Zone services PMI edges higher in July

Euro area business activity growth edged lower in July, according to the Markit Eurozone Flash PMI, dropping to an 18-month low. July's flash PMI reading of 52.9 compared to 53.1 in the prior two months and signalled only a marginal easing in the rate of growth of output across both manufacturing and services. However, the overall pace of growth remained only slightly slower than the average seen so far this year, and employment rose at the fastest rate for almost five-and-a-half years as companies boosted capacity in line with the overall upturn in the economy. Rates of expansion moderated slightly in both sectors, slipping to a one-and-a-half year nadir in services but merely easing to a two-month low in manufacturing. The relatively stronger performance in manufacturing was helped by a further upturn in new export orders, in turn linked to the weaker euro. However, export growth slowed fractionally from June's six-month high, in part due to weakened sales to the UK which were often blamed on the UK referendum and the weakening pound.

-

10:00

Eurozone: Manufacturing PMI, July 51.9 (forecast 52)

-

10:00

Eurozone: Services PMI, July 52.7 (forecast 52.3)

-

09:34

German economic growth accelerates at the start of third quarter - Markit PMI

Output growth in Germany's private sector accelerated at the start of the third quarter, as highlighted by the Markit Flash Germany Composite Output Index rising from June's 54.4 to 55.3. The index reached its highest level in 2016 so far with both manufacturers and service providers reporting stronger expansions. The trend in new business remained positive in July, with companies reporting a nineteenth successive monthly rise in new workloads. Some panellists commented on particularly strong demand from foreign markets. Indeed, manufacturers reported a solid increase in new export orders, with the pace of expansion the second-best in almost two-and-a-half years. In an effort to increase capacity at their units, companies continued to hire new staff during July. The current sequence of job creation now stretches to 33 months, with the latest increase the most marked in nearly six years. Service providers reported a particularly strong rise in employment. With employment levels rising sharply, the rate at which backlogs of work accumulated slowed markedly during July and was only fractional overall. On the prices front, there was a further pick-up in input cost inflation, with the respective rate of increase the highest since May of last year. It was the first time in a year that both manufacturers and service providers recorded increased input prices. Anecdotal evidence partly attributed this to higher steel prices, raw material shortages and rising wages.

-

09:30

Germany: Services PMI, July 54.6 (forecast 53.2)

-

09:30

Germany: Manufacturing PMI, July 53.7 (forecast 53.5)

-

09:09

French manufacturing PMI a little higher in June

The latest flash France PMI data signalled that private sector output stabilised in July. The Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, registered 50.0, up from 49.6 in June. Service providers signalled a marginal rise in activity during July, the third increase in the past four months. On the other hand, manufacturing output fell for the fourth consecutive month, although the pace of contraction eased to the slowest in that sequence. Panellists reported generally subdued trends in consumption, in some cases referencing the Nice attack as having further weighed on activity. New business across the French private sector returned to growth in July, albeit marginal overall. Higher intakes of new work were centred on the service sector, where growth quickened since June. Manufacturers in contrast reported that new orders decreased at the sharpest rate in three months. That said, manufacturers' new export orders showed a more encouraging trend, increasing slightly for the first time since December 2015. Anecdotal evidence pointed to a number of new contracts being secured from clients based outside Europe. Employment in the French private sector remained broadly unchanged in July, ending a two-month period of decline. Service providers reported a slight rise in staffing levels, whereas manufacturers signalled a fifth successive decline.

-

09:00

France: Manufacturing PMI, July 48.6 (forecast 48)

-

09:00

France: Services PMI, July 50.3 (forecast 49.5)

-

08:37

Options levels on friday, July 22, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1224 (3949)

$1.1153 (1919)

$1.1102 (806)

Price at time of writing this review: $1.1028

Support levels (open interest**, contracts):

$1.0963 (3163)

$1.0936 (4270)

$1.0904 (3950)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 38705 contracts, with the maximum number of contracts with strike price $1,1200 (3949);

- Overall open interest on the PUT options with the expiration date August, 5 is 49466 contracts, with the maximum number of contracts with strike price $1,0900 (7166);

- The ratio of PUT/CALL was 1.28 versus 1.30 from the previous trading day according to data from July, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.3507 (1876)

$1.3410 (2008)

$1.3314 (948)

Price at time of writing this review: $1.3241

Support levels (open interest**, contracts):

$1.3183 (461)

$1.3087 (1629)

$1.2991 (1644)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 25910 contracts, with the maximum number of contracts with strike price $1,3400 (2008);

- Overall open interest on the PUT options with the expiration date August, 5 is 24850 contracts, with the maximum number of contracts with strike price $1,2950 (2789);

- The ratio of PUT/CALL was 0.96 versus 0.98 from the previous trading day according to data from July, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:35

Asian session review: the dollar weakened slightly

The euro strengthened slightly against the US dollar after yesterday's decline on the results of the ECB meeting. As expected, the ECB has decided not to change the monetary policy: the key rate remained at a record low of 0% and the deposit rate at -0.4%. At the same time, the head of the Central Bank Draghi signaled in September a possible further easing. In September, the ECB economists will present the new forecasts for growth and inflation, allowing a more clear asses of the probability of slowing down economic recovery. As for the Brexit impact, he said that everything will depend on how long the negotiations will take place between the UK and the EU on the new conditions of interaction, as well as the results of these negotiations. "It is too early to judge the impact" - Draghi said, adding that Brexit was a problem for the European economy, given the geopolitical uncertainties. He also said to use all available instruments in the framework of the mandate in the case of reducing the probability of achieving the inflation target over the coming years, if necesary.

The market is expecting the indexes of business activity in the service sector and in manufacturing for July: at 07:00 GMT the report from France, 07:30 GMT - Germany, at 08:00 GMT - the eurozone and in the 08:30 GMT Britain. According to forecasts, the euro zone manufacturing PMI index fell to 52.0 from 52.8 in June, and the index for the services sector worsened to 53.5 from 54.5.

The Japanese yen traded in a narrow range around yesterday's lows. Bank of Japan Kuroda, denied the possibility of "helicopter money", thereby weakening the expectations of radical stimulus measures. "There is neither necessary nor possible", - said Kuroda.

Recent statements by Kuroda largely repeated his earlier statement that the government and the central bank should make decisions on fiscal and monetary policy, rather than a coordinated action within the framework of "distributing money" program. Kuroda said that if necessary, he will strengthen the measures namely - a wide-ranging program of asset purchases and negative rates. "We have a very strong policy framework", and I do not think there are significant limitations for further easing, Kuroda said.

Also holding back the further growth of the yen was today's preliminary data on the index of business activity in the manufacturing sector of Japan. Business activity in July was 49.0, higher than the previous value of 48.1 and analysts' expectations of 48.3. Despite the small increase the PMI index still remains below 50. The new export orders fell at the fastest pace in more than three and a half years and amounted to 44.0. The appreciation of the yen was leading to a decrease in global competitiveness.

Canadian dollar depreciates during today's session amid lower oil prices. Brent crude fell 0.3% to $ 46.34 per barrel.

Today at 12:30 GMT, Canada will release retail sales data for May and a report on consumer prices for June. The sales are expected to remain unchanged, while consumer prices to rose by 0.1%.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1015-25 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3210-30 range

USD / JPY: during the Asian session, the pair was trading in Y105.55-80 range

-

08:16

First major economic data from UK post-Brexit - Manufacturing and Services special edition to provide first glimpse of Brexit effect. Watch the pound

Source is releasing a one off Flash data to help provide clarity on the potential impact of the UK's EU referendum on the economy. This data is based on more than 70% of the survey responses.

-

08:11

RBNZ To Cut Rates On 3 Further Occasions; NZD/USD To 0.62 - Goldman Sachs

In a scheduled "Economic Update" published on Thursday, the RBNZ signalled a significant strengthening in its easing bias, and dovish shift across its views on domestic inflation and domestic/global growth. At the heart of many of these changes is renewed concern about the elevated NZD. In our view, these changes make clear that the RBNZ is positioning for a deeper easing cycle, notwithstanding ongoing risks to financial stability from rising house prices.

Overall, given recent progress to mitigate these latter risks (efforts we expect will intensify), the RBNZ's published policy sensitivities, our forecast depreciation in the NZD, and below-consensus growth outlook, we now expect the RBNZ will cut rates on three further occasions in August 2016 (-25bp), November 2016 (-25bp) and March 2017 (-25bp). This implies the OCR will finish this cycle at a low of 1.50% (-50bp lower than our previous forecast).

We continue to forecast NZ$/US$ at 68, 64, 62 in 3, 6 and 12 months, respectively.

-

08:08

Sentiment in the Chinese business community increased in July - MNI

Sentiment in the Chinese business community from the MNI was 55.5, higher than the previous value of 54.5

The indicator of business sentiment in China from by MNI, whose data are based on a monthly survey of Chinese business leaders, monitors and forecasts economic conditions in China, and provides important information before official government data. Companies that participated in the study, registered in the domestic stock market or in Hong Kong, although some of them also have a foreign registration. The research group consists of about 75% of manufacturing companies and 25% - non-manufacturing.

According to MNI the sentiment indicator in July increased with the improvement in new orders and the availability of credit.

-

08:02

Japan's manufacturing sector contracted again in July

Japan's manufacturing sector contracted again in July but the pace of deterioration slowed, flash survey data from Markit showed Friday.

The manufacturing Purchasing Managers' Index rose to 49 in July from 48.1 in June. A reading below 50 indicates contraction in the sector.

Output and new orders shrank at a slower pace in July. International demand fell at the sharpest rate in over three-and-a-half years.

At the same time, employment growth accelerated and backlogs of work dropped at a slower rate.

"On a more positive note, the stronger yen/dollar rate helped to ease inflationary pressures as input prices decreased at the fastest rate since November 2009," Amy Brownbill, economist at Markit, said.

-

04:00

Japan: Manufacturing PMI, July 49 (forecast 48.3)

-

00:34

Currencies. Daily history for Jul 21’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1025 +0,15%

GBP/USD $1,3217 -0,13%

USD/CHF Chf0,9856 -0,15%

USD/JPY Y106,17 -0,97%

EUR/JPY Y117,07 -0,81%

GBP/JPY Y140,03 -1,33%

AUD/USD $0,7491 +0,27%

NZD/USD $0,6996 +0,44%

USD/CAD C$1,3086 +0,11%

-

00:01

Schedule for today, Friday, Jul 22’2016:

(time / country / index / period / previous value / forecast)

02:00 Japan Manufacturing PMI (Preliminary) July 48.1 48.3

07:00 France Services PMI (Preliminary) July 49.9 49.5

07:00 France Manufacturing PMI (Preliminary) July 48.3 48

07:30 Germany Services PMI (Preliminary) July 53.7 53.2

07:30 Germany Manufacturing PMI (Preliminary) July 54.5 53.5

08:00 Eurozone Manufacturing PMI (Preliminary) July 52.8 52

08:00 Eurozone Services PMI (Preliminary) July 52.8 52.3

12:30 Canada Consumer Price Index m / m June 0.4% 0.1%

12:30 Canada Retail Sales, m/m May 0.9% 0.0%

12:30 Canada Retail Sales YoY May 4.6%

12:30 Canada Retail Sales ex Autos, m/m May 1.3% 0.3%

12:30 Canada Consumer price index, y/y June 1.5% 1.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June 2.1% 2%

12:30 U.S. Chicago Federal National Activity Index June -0.51

13:45 U.S. Manufacturing PMI (Preliminary) July 51.3 51.6

-