Noticias del mercado

-

22:12

Major US stock indexes rose slightly on Friday

On Friday, the major US stock indexes gained slightly against the publication of quarterly reports. The focus of investors were shares of AT & T (T), Starbucks (SBUX), Visa (V), General Electric (GE) and Honeywell (HON). The first three reports published neutral after the session Thursday. The last two reported before the start of the session. In the course of trading was also influenced by the US statistical data. It became known that the index of business activity in the manufacturing sector rose more than expected. The July data signaled a further recovery of business conditions across the US manufacturing industry. Preliminary manufacturing PMI index rose to 52.9 in July, compared with 51.3 in June, and pointed to the strong improvement in the general business environment.

Most components of the DOW index finished trading in positive territory (21 of 10). Outsider were shares of General Electric Company (GE, -1,72%). Most remaining shares increased American Express Company (AXP, + 1,36%).

Most of the S & P sectors showed an increase. Conglomerates sectors fell most (-0.3%). The leader turned utilities sector (+ 1.0%).

At the close:

Dow + 0.29% 18,570.85 +53.62

Nasda + 0.52% 5,100.16 +26.26

S & P + 0.46% 2,175.03 +9.86

-

21:00

Dow +0.21% 18,555.69 +38.46 Nasdaq +0.51% 5,099.72 +25.82 S&P +0.39% 2,173.64 +8.47

-

19:00

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Friday, led by mixed corporate earning results.

Most of Dow stocks in positive area (20 of 30). Top looser - General Electric Company (GE, -2,19%). Top gainer - American Express Company (AXP, +1,21%).

Almost all S&P sectors in positive area. Top looser - Industrial goods (-0,6%). Top gainer - Utilities (+0,8%).

At the moment:

Dow 18464.00 +28.00 +0.15%

S&P 500 2166.50 +8.50 +0.39%

Nasdaq 100 4660.50 +22.25 +0.48%

Oil 43.91 -0.84 -1.88%

Gold 1322.20 -8.80 -0.66%

U.S. 10yr 1.55 -0.01

-

18:00

European stocks closed: FTSE 100 +30.59 6730.48 +0.46% DAX -8.75 10147.46 -0.09% CAC 40 +4.85 4381.10 +0.11%

-

17:45

WSE: Session Results

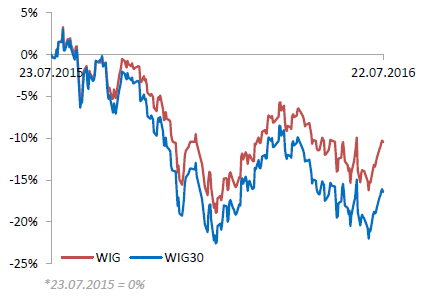

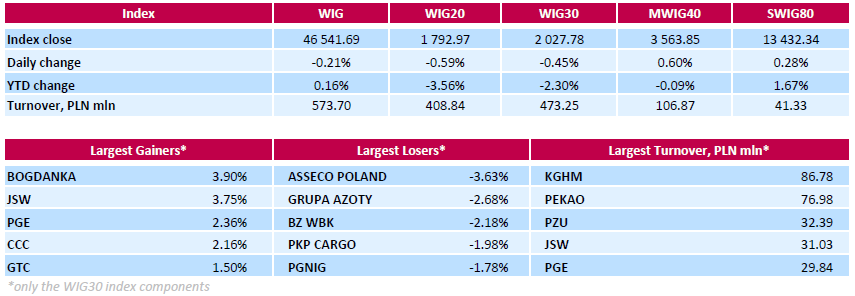

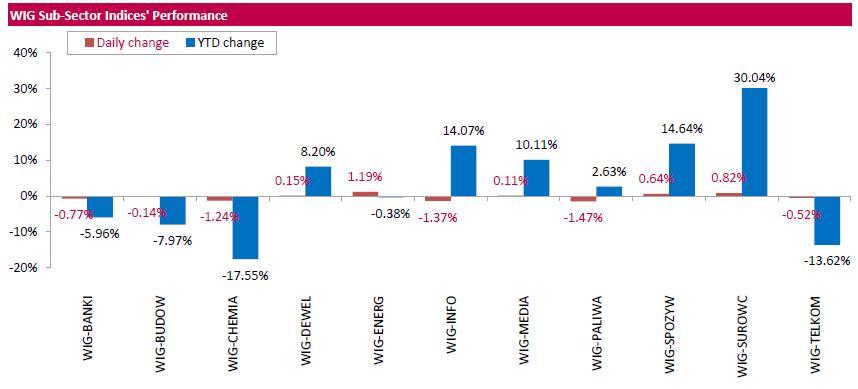

Polish equity market closed lower on Friday. The broad market benchmark, the WIG Index, lost 0.21%. Sector-wise, oil and gas (-1.47%) was the worst-performing group, while utilities (+1.19%) outpaced.

The large-cap stocks' measure, the WIG30 Index, fell by 0.45%. In the index basket, IT-company ASSECO POLAND (WSE: ACP) led the underperformers with a 3.63% drop, followed by chemical producer GRUPA AZOTY (WSE: ATT), bank BZ WBK (WSE: BZW) and railway freight transport operator PKP CARGO (WSE: PKP), plunging by 2.68%, 2.18% and 1.98% respectively. On the other side of the ledger, two coal miners BOGDANKA (WSE: LWB) and JSW (WSE: JSW) were the session's best performers, gaining 3.9% and 3.75% respectively. Among other major advancers were genco PGE (WSE: PGE) and footwear retailer CCC (WSE: CCC), jumping by 2.36% and 2.16% respectively.

-

15:48

WSE: After start on Wall Street

The market on Wall Street began relatively neutral. On the threshold of the last session of the week, the chart of the S&P500 indicates shortness of breath of bulls after last week's success and breaking to new all-time highs.

On the Warsaw market about half an hour ago was a total boredom, but with the approach of the opening of Wall Street bulls have more to say. Approach in the vicinity of 1,800 points suggests that on that level the game may be played at the end of the session. Given that the mWIG40 and the sWIG80 move up, breadth of the market is growing, and it gives a good base to play for the bulls side.

-

15:34

U.S. Stocks open: Dow 0.00%, Nasdaq -0.01%, S&P -0.01%

-

15:23

Before the bell: S&P futures +0.15%, NASDAQ futures +0.16%

U.S. index futures inched higher, after equities slipped from all-time highs on Thursday, as investors weighed mixed earnings reports..

Global Stocks:

Nikkei 16,627.25 -182.97 -1.09%

Hang Seng 21,964.27 -36.22 -0.16%

Shanghai 3,012.43 -26.58 -0.87%

FTSE 6,727.35 +27.46 +0.41%

CAC 4,379.5 +3.25 +0.07%

DAX 10,152.22 -3.99 -0.04%

Crude $45.70 (-0.11%)

Gold $1324.10 (-0.52%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.66

0.05(0.4713%)

48127

ALTRIA GROUP INC.

MO

69.08

0.07(0.1014%)

1260

Amazon.com Inc., NASDAQ

AMZN

747.16

1.44(0.1931%)

32482

American Express Co

AXP

63.28

-1.20(-1.861%)

28602

AMERICAN INTERNATIONAL GROUP

AIG

54.57

-0.00(-0.00%)

1916

Apple Inc.

AAPL

100.13

0.17(0.1701%)

57769

AT&T Inc

T

42.7

-0.01(-0.0234%)

3613

Barrick Gold Corporation, NYSE

ABX

20.32

0.41(2.0593%)

102951

Boeing Co

BA

135

0.28(0.2078%)

414

Caterpillar Inc

CAT

80.3

0.61(0.7655%)

11488

Chevron Corp

CVX

105.59

-0.00(-0.00%)

3386

Cisco Systems Inc

CSCO

30.64

0.01(0.0326%)

715

Citigroup Inc., NYSE

C

44.4

-0.07(-0.1574%)

8290

Exxon Mobil Corp

XOM

93.93

0.00(0.00%)

4745

Facebook, Inc.

FB

122.16

0.24(0.1969%)

128324

Ford Motor Co.

F

13.94

0.20(1.4556%)

1917747

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.53

0.23(1.8699%)

129750

General Electric Co

GE

32.74

-0.04(-0.122%)

4201

General Motors Company, NYSE

GM

32.7

1.21(3.8425%)

2389699

Goldman Sachs

GS

161.77

0.00(0.00%)

816

Home Depot Inc

HD

137.41

0.00(0.00%)

2459

Intel Corp

INTC

34.6

-1.09(-3.0541%)

1114259

International Business Machines Co...

IBM

161.11

-0.25(-0.1549%)

807

Johnson & Johnson

JNJ

125.05

-0.09(-0.0719%)

2789

JPMorgan Chase and Co

JPM

63.93

0.00(0.00%)

5863

McDonald's Corp

MCD

126.06

-0.00(-0.00%)

4081

Microsoft Corp

MSFT

56.01

0.10(0.1789%)

44845

Nike

NKE

58

0.24(0.4155%)

3012

Pfizer Inc

PFE

36.8

0.12(0.3272%)

3965

Starbucks Corporation, NASDAQ

SBUX

57.63

0.09(0.1564%)

6339

Tesla Motors, Inc., NASDAQ

TSLA

224.54

-3.82(-1.6728%)

73131

Travelers Companies Inc

TRV

116.5

-0.51(-0.4359%)

5478

Twitter, Inc., NYSE

TWTR

18.69

0.13(0.7004%)

63339

UnitedHealth Group Inc

UNH

143.05

0.03(0.021%)

510

Visa

V

79.65

0.29(0.3654%)

8957

Walt Disney Co

DIS

98.22

0.00(0.00%)

3295

Yahoo! Inc., NASDAQ

YHOO

39.25

0.35(0.8997%)

306706

-

14:44

Upgrades and downgrades before the market open

Upgrades:

UnitedHealth (UNH) upgraded to Buy at Argus

Downgrades:

Facebook (FB) downgraded to Neutral from Buy at BTIG Research

Twitter (TWTR) downgraded to Mkt Perform from Outperform at Raymond James

Other:General Motors (GM) target raised to $34 from $32 at RBC Capital Mkts

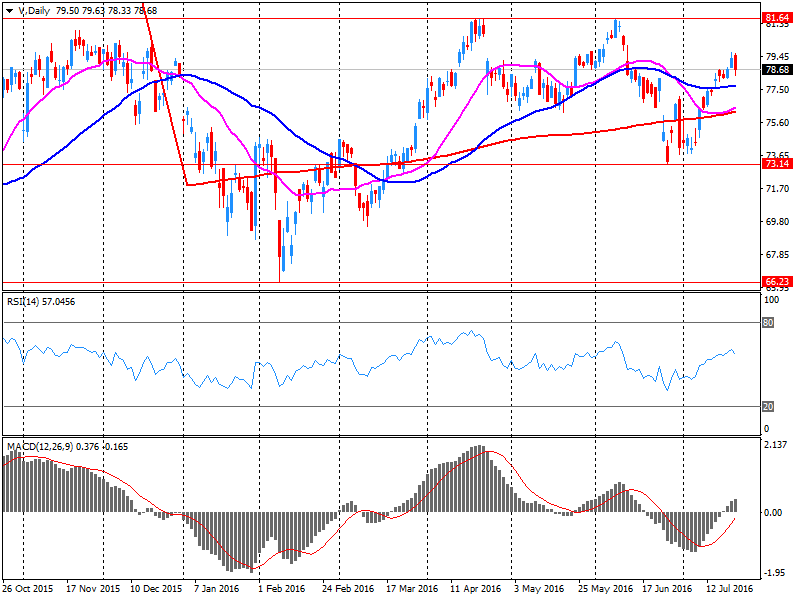

Visa (V) target raised to $91 from $86 at Stifel

Procter & Gamble (PG) target raised to $92 from $85 at Stifel

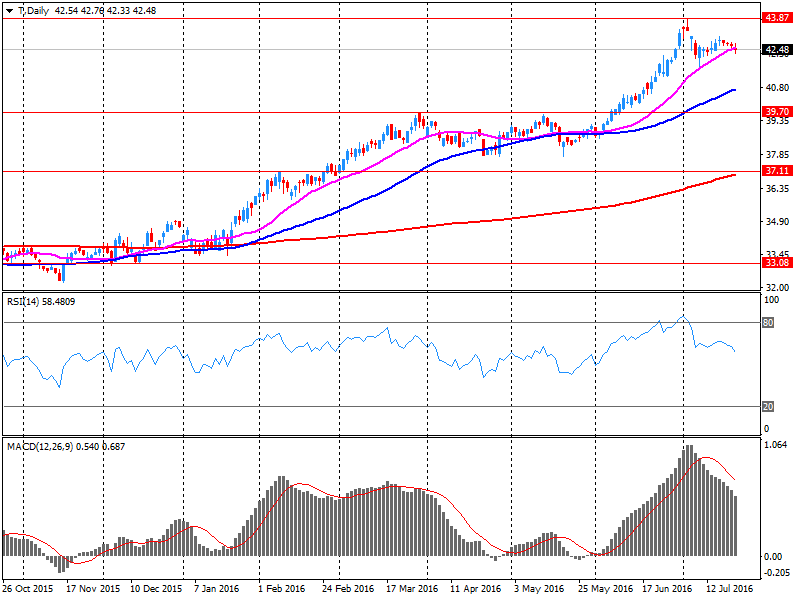

AT&T (T) target raised to $42 from $38 at FBR Capital

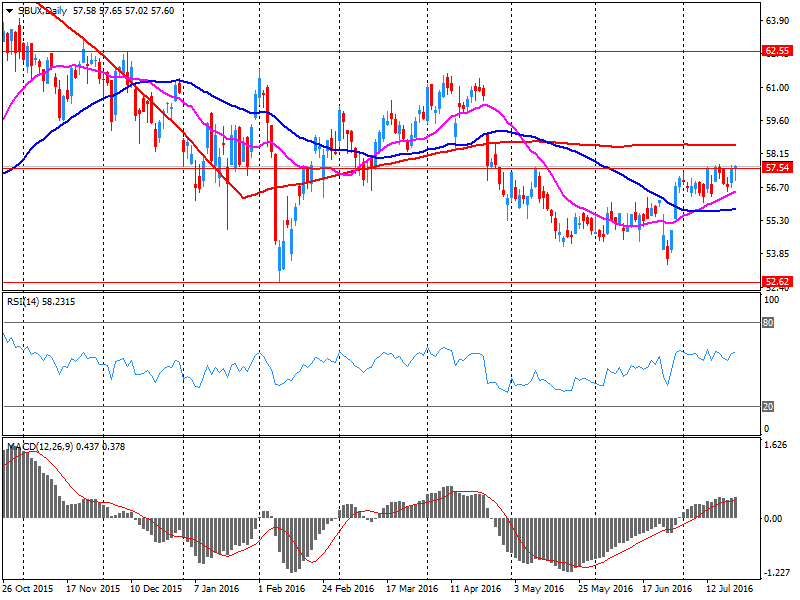

Starbucks (SBUX) reiterated with an Outperform at RBC Capital Mkts, target $68

-

14:16

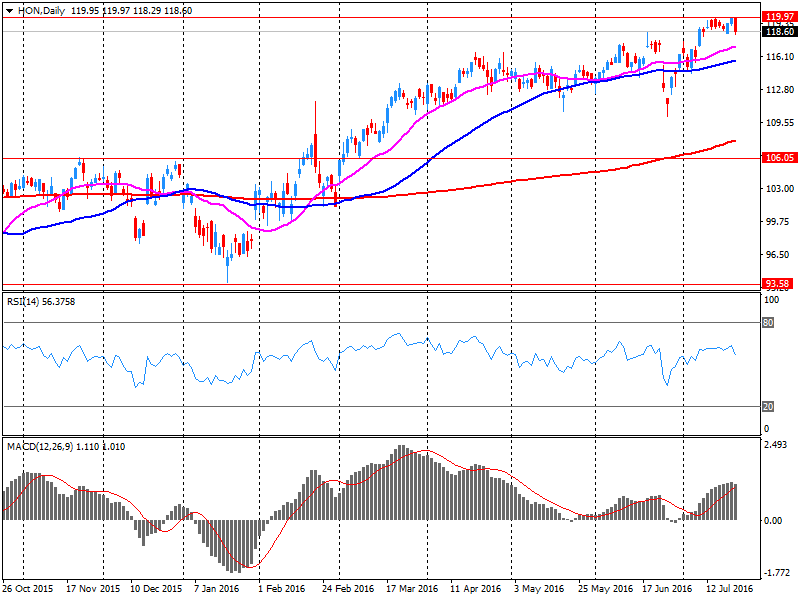

Company News: Honeywell (HON) Q2 EPS beat analysts’ estimate

Honeywell reported Q2 FY 2016 earnings of $1.66 per share (versus $1.51 in Q2 FY 2015), beating analysts' consensus estimate of $1.64.

The company's quarterly revenues amounted to $9.991 bln (+2.2% y/y), missing analysts' consensus estimate of $10.136 bln.

HON fell to $116.00 (-2.24%) in pre-market trading.

-

14:01

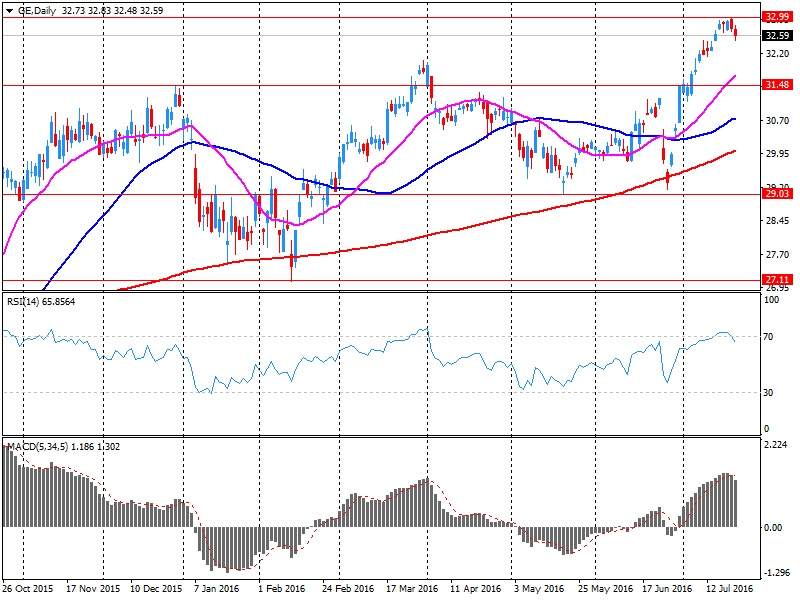

Company News: General Electric (GE) Q2 results beat analysts’ expectations

General Electric reported Q2 FY 2016 earnings of $0.51 per share (versus $0.28 in Q2 FY 2015), beating analysts' consensus estimate of $0.46.

The company's quarterly revenues amounted to $33.494 bln (+14.6% y/y), beating analysts' consensus estimate of $31.574 bln.

GE fell to $31.80 (-2.42%) in pre-market trading.

-

13:52

Company News: Visa (V) Q3 EPS beat analysts’ estimate

Visa reported Q3 FY 2016 earnings of $0.69 per share (versus $0.74 in Q3 FY 2015), beating analysts' consensus estimate of $0.67.

The company's quarterly revenues amounted to $3.630 bln (+3.2% y/y), generally in-line with analysts' consensus estimate of $3.640 bln.

V closed Thursday's trading session at $78.79 (-0.72%).

-

13:33

Company News: Starbucks (SBUX) reports Q3 EPS in line with analysts' forecast

Starbucks reported Q3 FY 2016 earnings of $0.49 per share (versus $0.42 in Q3 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $5.238 bln (+7.3% y/y), missing analysts' consensus estimate of $5.337 bln.

SBUX fell to $56.12 (-2.57%) in pre-market trading.

-

13:06

WSE: Mid session comment

The first half of the session brought clear stabilization of the WIG20 in the region of 1,790 points, however, less than PLN 143 mln of turnover on the WIG20 index indicates that the session is a little sleepy, and it may be time irretrievably lost by investors waiting for volatility. At 13:00 (Warsaw time) the WIG20 index was at the level of 1,788 points (-0.82%).

-

12:44

Company News: AT&T (T) posts Q2 financials in line with analysts' estimates

AT&T reported Q2 FY 2016 earnings of $0.72 per share (versus $0.69 in Q2 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $40.500 bln (+22.7% y/y), generally in-line with analysts' consensus estimate of $40.623 bln.

T closed Thursday's trading session at $42.52 (-0.44%).

-

12:42

Major stock indices in Europe trading mixed

Today European stocks traded with less dynamic, while investors analyzed data on business activity.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading 0,3% - to 339.42 points.

On Friday research organization Markit Economics released preliminary PMI data for July.

Eurozone private sector expanded at its weakest pace in six years in July. The composite output index fell to 52.9 in July, the 18-month low, from 53.1 in June. However, the index is above the expected level of 52.5. The index signals a slight weakening in the growth of output in the industrial sector and the services sector.

Purchasing Managers' Index in the services sector fell slightly to 52.7 from 52.8 in June. The index was expected to drop to 52.3. At the same time, the manufacturing PMI fell more than expected to 51.9 from 52.8 in the previous month. Economists had forecast a reading of 52 in July.

"The euro area economy has shown remarkable resilience to Brexit and terrorist attacks in France," said Chris Williamson, chief economist at Markit. The overall rate of economic growth has remained unchanged to a large extent, suggesting that GDP growth will be weak, but sufficiently stable at annual rate of about 1.5 percent, Williamson said.

At the same time, the UK private sector activity contracted at the strongest pace since the beginning of 2009 after "Brexit". The composite output index fell to a 87-month low of 47.7 in July from 52.4 in June. Below 50 points showing contraction.

Purchasing Managers' Index in the services sector fell more than expected to 47.4, 88-month low, from 52.3 in the previous month. The expected level was 48.9. Manufacturing PMI reached 49.1, compared with 52.1 in June, but above the expected level of 47.8. It was the lowest for 41 months.

"The UK economy has suffered because of the sharp fall in output and new orders following the referendum on EU membership, as uncertainty prevailed," said David Noble. The true extent of the impact remains to be seen in the next month, said Noble.

Shares of the largest mining companies BHP Billiton, Glencore and Anglo American fell by 1.7%, 0.9% and 2.2% amid falling commodity prices.

Price of oil-producing firms Tullow Oil and BP Plc dropped 2.8% and 0.6% respectively. Brent crude quotes during trading on Friday fell below $ 46 a barrel for the first time since mid-May.

Capitalization of Banco de Sabadell SA fell by 6.4%. Net profit fell 31% compared with the 1st quarter and amounted to 173.3 million euros in the second quarter, while the experts polled by FactSet had expected the figure at 235 million euros.

Quotes of the Swiss chocolate manufacturer Lindt fell by 0.2%, despite the fact that the company's revenue increased by 6.6% in the first half of the year, to 1.5 billion Swiss francs ($ 1.52 billion), while profit increased by 11% , to 72.2 million francs.

British chain stores Marks & Spencer fell 2.6% after Barclays downgraded recommendations on them to the "below the market level." It became known earlier that retail sales in the UK in June decreased by 0.9% compared to May due to the referendum on withdrawal from the EU and the bad weather, reducing the sale of clothing and food.

The market value of the British operator Vodafone Group Plc Communications jumped 3.6%. Revenues, exchange rates fluctuations and the acquisition of assets in April-June increased by 2.2% in annual terms, while experts expect an average increase of 1.9%.

At the moment:

FTSE 6709.56 9.67 0.14%

DAX 10135.58 -20.63 -0.20%

CAC 4373.86 -2.39 -0.05%

-

09:15

WSE: After opening

WIG20 index opened at 1800.87 points (-0.16%)*

WIG 46513.80 -0.27%

WIG30 2027.69 -0.46%

mWIG40 3546.24 0.10%

*/ - change to previous close

Trading on the cash (spot) market, as well as on the futures market began from downward move. Among the blue chips we may see a definite advantage of red color with a negative distinction, among others, PKO and KGHM. As a result, the WIG20 falls below the minimum specified in yesterday's session and we have to make it clear that it does not look encouraging.

The yesterday's downward session in the US and today's decline in the Nikkei by over 1 percent suggest that after nearly two weeks of good atmosphere for which the impetus was information about the planned implementation of additional monetary stimulation packages in Japan, demand at least has been saturated.

-

08:52

WSE: Before opening

Thursday's session on Wall Street ended modest declines in the major indexes, which gave up from 0.3 to 0.4 per cent in response to weaker corporate earnings and weaker attitude of other markets even the response to the passivity of central banks in Japan and Europe.

The contract for the DAX is trading now below the base index closing and the beginning of European markets is expected to cons. A neutral scenario in the morning will quickly be shifted by reactions to the preliminary readings of PMI indices in Europe, which will dominate the first hour of trading.

In the following hours there is no plans for important macro reports, so attention will shift back on Wall Street, and the results of local companies, the most important of which is the report of General Electric, a company once recognized for the US economy in miniature, and today, well exposed to foreign markets and therefore, having insight into the condition of the global economy.

Despite all these elements Friday is not going to be particularly exciting.

-

08:36

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,6%, FTSE 100 -0,4%, CAC 40 -0.4%

-

07:06

Global Stocks

European stocks edged lower on Thursday, as a drop in the shares of major airlines offset gains in some banks, propped up by signals of support for the sector from the European Central Bank.

The pan-European STOXX 600 index and similar FTSEurofirst 300 both closed 0.1 percent lower.

Airline stocks fell amid fears some consumers may avoid travelling abroad for holidays after last week's attack in Nice, for which militant group Islamic State claimed responsibility, and attempted coup in Turkey.

U.S. stocks closed lower Thursday, ending the Dow industrials' nine-session win streak - its longest since March 2013. The main indexes retreated from record levels set on Wednesday, as investors turned cautious ahead of a number of central bank policy meetings next week. A drop in oil prices CLQ6 also weighed on energy and materials stocks. The Dow Jones Industrial Average DJIA, -0.42% fell 77.80 points, 0.4% to 18,517.23, the S&P 500 index SPX, -0.36% declined 7.86 points, or 0.4% to 2,165.16, while the Nasdaq Composite Index COMP, -0.31% ended the session 16.03 points, or 0.3%, lower at 5,073.90.

Asian stocks dipped on Friday after weak corporate results halted Wall Street's record run overnight, while the yen held to large gains made after the Bank of Japan governor downplayed the need for "helicopter money" stimulus.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.4 percent. It remained close to its nine-month high seen on Thursday, and is headed for a fractional 0.1 percent gain on the week.

China's CSI 300 index .CSI300 and the Shanghai Composite .SSEC both slipped 0.4 percent. The former is poised for a loss of 1 percent for the week, and the latter 0.9 percent.

New Zealand .NZ50 shares continued their record-setting trend, climbing 0.3 percent to hit a fresh all-time high on Thursday. They're headed for a 2.3 percent gain for the week.

Japan's Nikkei .N225 slid 0.9 percent, dragged down by the yen's 1 percent rally on Thursday. The index is still up 1 percent in a week during which it touched an eight-week high thanks to an initially weaker yen and hopes of fiscal and monetary stimulus.

-

04:07

NIKKEI 16,633.52 -176.70 -1.05%, HANG SENG 21,894.21 -106.28 -0.48%

-

00:40

Stocks. Daily history for Jun Jul 21’2016:

(index / closing price / change items /% change)

FTSE 100 6,699.89 -29.10 -0.43%

Xetra DAX 10,156.21 +14.20 +0.14%

S&P 500 2,165.17 -7.85 -0.36%

Dow Jones 18,517.23 -77.80 -0.42%

Hang Seng 22,000.49 +118.01 +0.54%

Nikkei 225 16,810.22 +128.33 +0.77%

-