Noticias del mercado

-

22:07

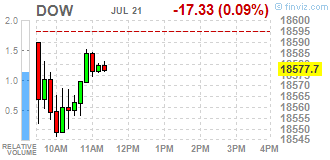

Major US stock indexes finished trading with a moderate decrease

Major US stock indexes fell modestly on Thursday, a day after the Dow and S & P reached their record highs, as investors assessed mixed quarterly results of companies, as well as upbeat economic data.

The focus of investors were shares of American Express Company (AXP), Intel (INTC), General Motors (GM) and Travelers (TRV). The first two reported after the end of yesterday's session. Declassified reports from companies were mixed. American Express showed a quarterly profit of $ 2.10 per share, which is $ 0.36 higher than the average forecast of analysts. At the same time the company's revenue was $ 8.235 billion, which is less than analysts had forecast $ 8.342 billion. Earnings from Intel to $ 0.59 per share, topping analysts' average forecast of $ 0.06. The company's revenue increased by 2.6% compared to the same period last year to $ 13.533 billion, which is almost coincided with the average forecast of analysts. Revenue and net profit of General Motors exceeded the average expectations of analysts: the company's profit amounted to $ 1.86 per share versus $ 1.29 in the second quarter of 2015 and the average analyst forecast of $ 1.51; the company's revenue was $ 42.40 billion, which is 11% more, and 13.6% higher than the average forecast of analysts.

With regard to statistics, the report submitted by the Federal Reserve Bank of Philadelphia, showed that the index of business activity in the manufacturing sector unexpectedly fell in July, reaching a level of 2.9 points compared with 4.7 points in June. Economists had expected an increase of this indicator to the level of +5 points.

In addition, initial applications for state unemployment benefits fell by 1000 and to reach a seasonally adjusted 253,000 for the week ended July 16th. This is the lowest value since April. The data for the previous week were not revised.

However, according to the National Association of Realtors, home sales in the secondary market rose by 1.1% to a seasonally adjusted annual rate reached 5.57 million in June from a revised level of 5.51 with a decrease in May.

Almost all the components of DOW index showed a decline (26 of 30). Outsiders were shares of Intel Corporation (INTC, -4,31%). Most remaining shares rose McDonald's Corp. (MCD, + 0,83%).

Almost all sectors of the S & P ended the day in negative territory. The leader turned utilities sector (+ 0.5%). The decline led by industrial goods sector (-0.6%).

At the close:

Dow -0.42% 18,517.23 -77.80

Nasdq -0.31% 5,073.90 -16.03

S & P -0.36% 2,165.16 -7.86

-

21:00

Dow -0.58% 18,487.44 -107.59 Nasdaq -0.43% 5,068.09 -21.84 S&P -0.49% 2,162.37 -10.65

-

18:00

European stocks closed: FTSE 100 -29.10 6699.89 -0.43% DAX +14.20 10156.21 +0.14% CAC 40 -3.51 4376.25 -0.08%

-

17:40

WSE: Session Results

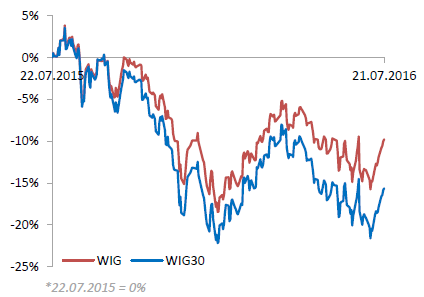

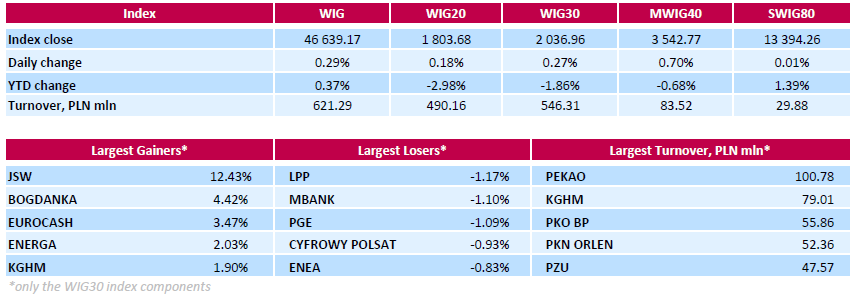

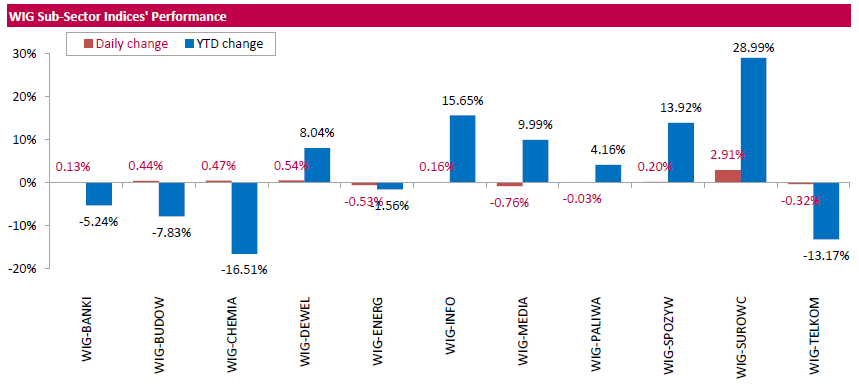

Polish equity market closed higher on Thursday. The broad market measure, the WIG index, advanced by 0.29%. Sector-wise, materials (+2.91%) fared the best, while media stocks (-0.76%) fell the most.

The large-cap stocks' benchmark, the WIG30 Index, added 0.27%. In the index basket, coking coal miner JSW (WSE: JSW) was the strongest performer, climbing by 12.43%. It was followed by thermal coal miner BOGDANKA (WSE: LWB), FMCG-wholesaler EUROCASH (WSE: EUR) and genco ENERGA (WSE: ENG), which jumped by 4.42%, 3.47% and 2.03% respectively. At the same time, the biggest decliners were clothing retailer LPP (WSE: LPP), bank MBANK (WSE: MBK) and genco PGE (WSE: PGE), dropping by 1.17%, 1.1% and 1.09% respectively.

-

17:30

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes were little changed on Thursday, a day after the Dow and the S&P hit fresh record highs and as investors digested a mixed bag of earning reports as well as upbeat economic data. Intel (INTC) shares were down after the chipmaker reported revenue growth slowed at its key data center business. Also dragging on the Dow was Travelers (TRV) and American Express (AXP), both of which fell after disappointing quarterly reports.

However, economic data was upbeat. A report showed jobless claims unexpectedly fell last week, hitting a three-month low as the labor market continues to gather momentum.

Dow stocks mixed (15 vs 15). Top looser - Intel Corporation (INTC, -4,23%). Top gainer - Caterpillar Inc. (CAT, +1,81%).

All S&P sectors in positive area. Top gainer - Basic Materials (+0,6%).

At the moment:

Dow 18503.00 -28.00 -0.15%

S&P 500 2166.75 -0.75 -0.03%

Nasdaq 100 4653.25 +2.75 +0.06%

Oil 45.45 -0.30 -0.66%

Gold 1323.70 +4.40 +0.33%

U.S. 10yr 1.60 +0.02

-

16:14

WSE: After start on Wall Street

Mario Draghi press conference from the investors point of view was a disappointment. After the lack of changes in interest by the BoE, it seems that the next central bank begins to slightly underestimate the negative impact of Brexit.

As one would expect the Americans began with cosmetic minuses of 0.1 percent of withdrawal for the S&P500. Fluctuation range combined with a lack of decisiveness today puts Americans in one row with market. Start with a lower opening allows, however, to try to rebuild the market, which can still revive trade in Europe at the end of the session.

-

15:32

U.S. Stocks open: Dow -0.04%, Nasdaq +0.08%, S&P -0.01%

-

15:21

Before the bell: S&P futures -0.07%, NASDAQ futures +0.08%

U.S. index futures were little changed.

Global Stocks:

Nikkei 16,810.22 +128.33 +0.77%

Hang Seng 21,981.7 +118.01 +0.45%

Shanghai 3,039.19 +11.29 +0.37%

FTSE 6,703.91 -25.08 -0.37%

CAC 4,361.16 -18.60 -0.42%

DAX 10,102.91 -39.10 -0.39%

Crude $45.53 (-0.48%)

Gold $1321.30 (+0.15%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

182.18

0.94(0.5186%)

120

ALCOA INC.

AA

10.5

-0.13(-1.223%)

39938

Amazon.com Inc., NASDAQ

AMZN

742.16

2.21(0.2987%)

15146

American Express Co

AXP

64.29

0.13(0.2026%)

887

Apple Inc.

AAPL

100.07

0.20(0.2003%)

100859

AT&T Inc

T

42.75

-0.02(-0.0468%)

12448

Barrick Gold Corporation, NYSE

ABX

21.1

-0.47(-2.179%)

80888

Boeing Co

BA

134.95

0.29(0.2154%)

3980

Caterpillar Inc

CAT

79.95

0.21(0.2634%)

810

Chevron Corp

CVX

105.65

-0.39(-0.3678%)

500

Cisco Systems Inc

CSCO

30.01

0.09(0.3008%)

30586

Citigroup Inc., NYSE

C

44.6

0.25(0.5637%)

9428

E. I. du Pont de Nemours and Co

DD

67.5

0.01(0.0148%)

100

Facebook, Inc.

FB

121.08

0.47(0.3897%)

115484

Ford Motor Co.

F

13.64

-0.01(-0.0733%)

57476

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.18

-0.27(-2.1687%)

221004

General Electric Co

GE

32.94

0.01(0.0304%)

54467

General Motors Company, NYSE

GM

31.36

0.11(0.352%)

7118

Goldman Sachs

GS

162.01

0.60(0.3717%)

3671

Google Inc.

GOOG

739

2.04(0.2768%)

2288

Hewlett-Packard Co.

HPQ

14.11

0.06(0.427%)

230

HONEYWELL INTERNATIONAL INC.

HON

119.66

0.31(0.2597%)

200

Intel Corp

INTC

35.37

0.22(0.6259%)

39818

International Business Machines Co...

IBM

159.59

0.01(0.0063%)

4601

Johnson & Johnson

JNJ

126

0.75(0.5988%)

5118

JPMorgan Chase and Co

JPM

64.1

0.24(0.3758%)

13461

McDonald's Corp

MCD

126.5

0.00(0.00%)

6413

Microsoft Corp

MSFT

55.7

2.61(4.9162%)

1345026

Pfizer Inc

PFE

36.65

0.01(0.0273%)

4188

Procter & Gamble Co

PG

85.54

0.0395(0.0462%)

3006

The Coca-Cola Co

KO

45.72

0.09(0.1972%)

1518

UnitedHealth Group Inc

UNH

143.13

0.54(0.3787%)

844

Verizon Communications Inc

VZ

55.31

-0.39(-0.7002%)

8575

Visa

V

78.98

0.26(0.3303%)

2318

Walt Disney Co

DIS

99.09

-0.38(-0.382%)

14730

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:American Express (AXP) reiterated with an Underperform at RBC Capital Mkts; target $57

American Express (AXP) reiterated with a Buy at Compass Point; target $74

Intel (INTC) target raised to $38 from $36 at Mizuho

AT&T (T) removed from Franchise Pick List at Jefferies; Buy, target $44

Amazon (AMZN) target raised to $900 from $790 at Goldman -

13:51

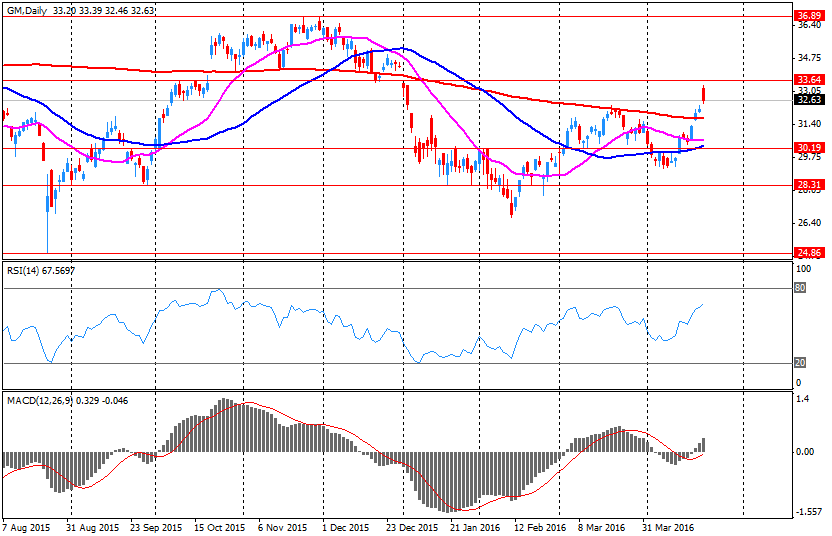

Company News: General Motors (GM) Q2 results beat analysts’ expectations

General Motors reported Q2 FY 2016 earnings of $1.86 per share (versus $1.29 in Q2 FY 2015), beating analysts' consensus estimate of $1.51.

The company's quarterly revenues amounted to $42.400 bln (+11% y/y), missing analysts' consensus estimate of $37.319 bln.

GM rose to $33.25 (+5.59%) in pre-market trading.

-

13:38

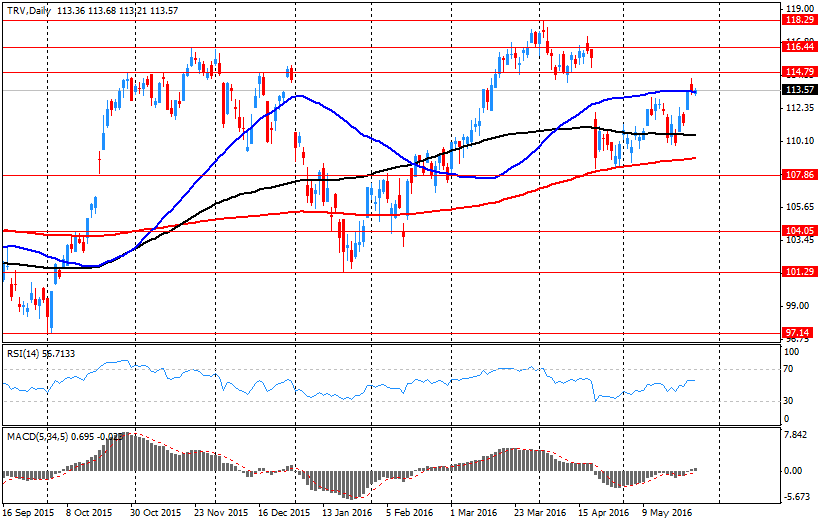

Company News: Travelers (TRV) Q2 EPS beat analysts’ estimate

Travelers reported Q2 FY 2016 earnings of $2.20 per share (versus $2.52 in Q2 FY 2015), beating analysts' consensus estimate of $2.05.

The company's quarterly revenues amounted to $6.067 bln (+2.3% y/y), missing analysts' consensus estimate of $6.131 bln.

TRV closed Wednesday's trading session at $117.01 (-0.03%).

-

13:09

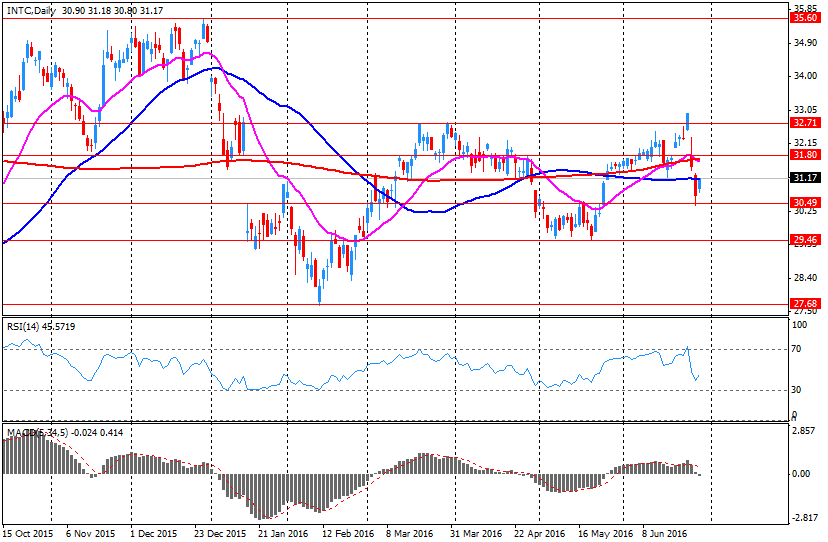

Company News: Intel (INTC) Q2 EPS beat analysts’ estimate

Intel reported Q2 FY 2016 earnings of $0.59 per share (versus $0.55 in Q2 FY 2015), beating analysts' consensus estimate of $0.53.

The company's quarterly revenues amounted to $13.533 bln (+2.6% y/y), generally in-line with analysts' consensus estimate of $13.545 bln.

INTC fell to $34.80 (-2.49%) in pre-market trading.

-

13:05

WSE: Mid session comment

European exchanges do not show too much optimism today before the press conference of the ECB. Initial gains were converted at a loss which, although not large, however, show caution before continuing yesterday's approach. The disappointing trade in Europe and the weakness of our market brought the WIG20 index on the red side of the quotations. Volatility is not large and there is a mood of anticipation. In the mid-session the WIG20 index was at the level of 1,794 points (-031%) and with turnover amounted to PLN 215 million.

-

12:58

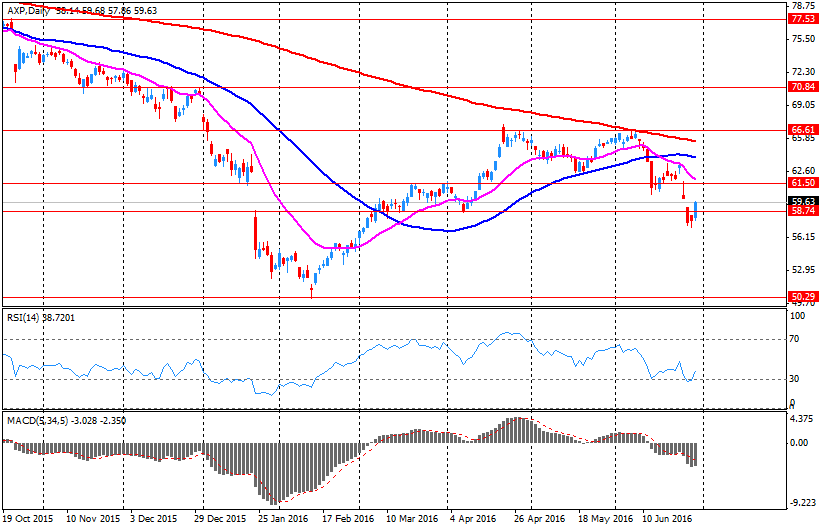

Company News: American Express (AXP) Q2 EPS beat analysts’ forecast

American Express reported Q2 FY 2016 earnings of $2.10 per share (versus $1.42 in Q2 FY 2015), beating analysts' consensus estimate of $1.74.

The company's quarterly revenues amounted to $8.235 bln (-0.6% y/y), missing analysts' consensus estimate of $8.342 bln.

AXP fell $63.70 (-1.21%) in pre-market trading.

-

12:57

Major stock indices in Europe show a negative trend

In today's trading, European stock indices trading down after the stock prices of airlines and tourism sector declined.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0,3% - to 339.67 points.

Investors' attention is directed to the meeting of the European Central Bank, which will take place later today. The ECB probably will not change its monetary policy after a meeting despite the threat of a slowdown in economic recovery in the euro zone after the UK decision to withdraw from the EU, believe experts interviewed by various media outlets.

However, many analysts expect a slight reduction in central bank interest rates on deposits in the coming months from the current -0.4%, as well as the extension of the program of quantitative easing (QE) already at the September meeting.

EasyJet Plc's shares fell during trading on 4,7%. British low-cost airline has reduced its revenue by 2.6% in the third fiscal quarter and warned that political turmoil in Europe raises concerns regarding the booking volume of tickets.

Meanwhile, the German airline Deutsche Lufthansa said that the recent series of terrorist attacks has led to a decrease in demand. This can lead to a decrease in profit for the Lufthansa this year, the company said. Lufthansa shares fell in price by 7.8%.

Shares of International Consolidated Airlines Group (IAG), which owns the airline British Airways, as well as tour operator TUI fell during trading by 3.5%.

Shares of the Swedish-Swiss electrical group ABB Ltd. rose during trading by 1,3%. ABB, one of the world leaders in the production of industrial robots and electrical equipment, cut its net profit in the 2nd quarter of 2016 by 31% due to restructuring costs -. to $ 406 million which exceeded the average market forecast of $ 393 million.

Cost of Hermes International shares jumped 3%. The French fashion house has announced an increase in revenue in the first six months of 2016 by 6% - up to 2.4 billion euros.

SABMiller shares rose 0.3% on the information that the US Justice Department approved the merger with the Belgian brewer Anheuser-Busch InBev (AB InBev), removing thus one of the last major obstacles to the transaction volume of about $ 108 billion .

Shares of Swiss pharmaceutical company Roche GS dropped by 0.5%, despite the fact that it has confirmed its forecast for 2016 and reported on the level of sales in the first half of this year, higher than expected.

At the moment

FTSE 6701.77 -27.22 -0.40%

DAX 10124.91 -17.10 -0.17%

CAC 4361.98 -17.78 -0.41%

-

09:41

Major stock markets in Europe trading lower: FTSE 100 6,715.69-13.30-0.20%, DAX 10,140.57-1.44-0.01%

-

09:16

WSE: After opening

WIG20 index opened at 1800.15 points (-0.01%)*

WIG 46487.36 -0.04%

WIG30 2029.93 -0.08%

mWIG40 3515.20 -0.08%

*/ - change to previous close

The cash market opens neutral, from the level pf 1,800 points. PKN Orlen (WSE: PKN) opened with light increases after yesterday's weaker session, but this does not mean that the results have been well received. Besides gains were quickly cast. Surrounded the DAX gained approx. 0.5%, and after a successful session yesterday we may see the desire of issue for the new post-Brexit highs. Moods are still so good and increases are favorable. However, the WSE habit is to stay a little resistant to it.

-

08:23

WSE: Before opening

Wednesday's session on the New York stock markets has brought further growth and new records of height for the S&P500 and the Dow Jones indices. For quotations of shares were helpful the better than expected quarterly results of companies. About more than 6 percent rallied trading of Microsoft after the release of better than expected quarterly results. Morgan Stanley shares also rose after the company reported a better-than-expected quarterly report.

Today begins the season of domestic resulting after this morning report was published by PKN Orlen. Differences between the publication and the expectations are not significant and certainly we may not speak of a greater surprise in one or the other side.

Yesterday the WIG20 index, thanks to a successful end, close at resistance of 1,800 pts., which gives hope for the possibility of its defeat today. The mood in the world are good, and inflows into emerging market funds are big. It is true that yesterday evening a state of emergency was declared in Turkey, which is not good news, but the last Monday showed, the Warsaw Stock Exchange is not prone to the negative reaction to information from Turkey.

The most important information of the day will be a press conference after the ECB meeting and although we do not expect policy easing now, Mario Draghi may send some suggestions for the future.

-

07:13

Global Stocks

European stocks rose Wednesday, hovering near their strongest levels in four weeks, but mining stocks were dragged lower after a round of lackluster updates from metals producers.

The Stoxx Europe 600 SXXP, +1.03% gained 1% to close at 340.81, the highest finish since June 23, according to FactSet. That date is when the U.K. Brexit vote was held, with the result putting the country on track toward leaving the European Union.

The European Central Bank on Thursday will issue its first monetary policy decision since the Brexit vote. While ECB President Mario Draghi may offer strong hints of more easing, analysts widely expect very little action from the central bank on Thursday.

U.S. stocks closed at record highs after trading within a narrow range Wednesday, buoyed by a surge in tech stocks after a flurry of corporate earnings beat lowered expectations.

The S&P 500 index SPX, +0.43% traded within a 12-point range Wednesday and closed up 9.24 points, or 0.4%, at 2,173.02, it's sixth record close in eight sessions.

The Dow Jones Industrial Average DJIA, +0.19% which traded within a 66-point range, closed up 36.02 points, or 0.2%, at 18,595.03, it's seventh record close in as many sessions.

Meanwhile, the Nasdaq Composite Index COMP, +1.06% advanced 53.56 points, or 1.1%, to close at 5,089.93, trading within a 44-point range following a big open.

Asian stocks climbed to nine-month highs on Thursday, helped by a pickup in capital inflows and a recovery in global oil prices, while the dollar stood strong on growing bets of a U.S. rate increase as early as September.

-

04:06

Nikkei 225 16,909.92 +228.03 +1.37%, Hang Seng 22,004.86 +122.38 +0.56%, Shanghai Composite 3,029.93 +2.03 +0.07%

-

00:35

Stocks. Daily history for Jun Jul 20’2016:

(index / closing price / change items /% change)

Nikkei 225 16,681.89 -41.42 -0.25 %

Hang Seng 21,882.48 +209.28 +0.97 %

S&P/ASX 200 5,488.72 +37.47 +0.69 %

Shanghai Composite 3,028.34 -8.26 -0.27 %

FTSE 100 6,728.99 +31.62 +0.47 %

CAC 40 4,379.76 +49.63 +1.15 %

Xetra DAX 10,142.01 +160.77 +1.61 %

S&P 500 2,173.02 +9.24 +0.43 %

NASDAQ Composite 5,089.93 +53.56 +1.06 %

Dow Jones 18,595.03 +36.02 +0.19 %

-