Noticias del mercado

-

22:07

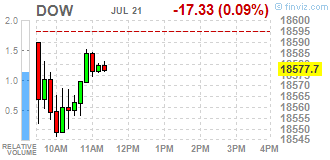

Major US stock indexes finished trading with a moderate decrease

Major US stock indexes fell modestly on Thursday, a day after the Dow and S & P reached their record highs, as investors assessed mixed quarterly results of companies, as well as upbeat economic data.

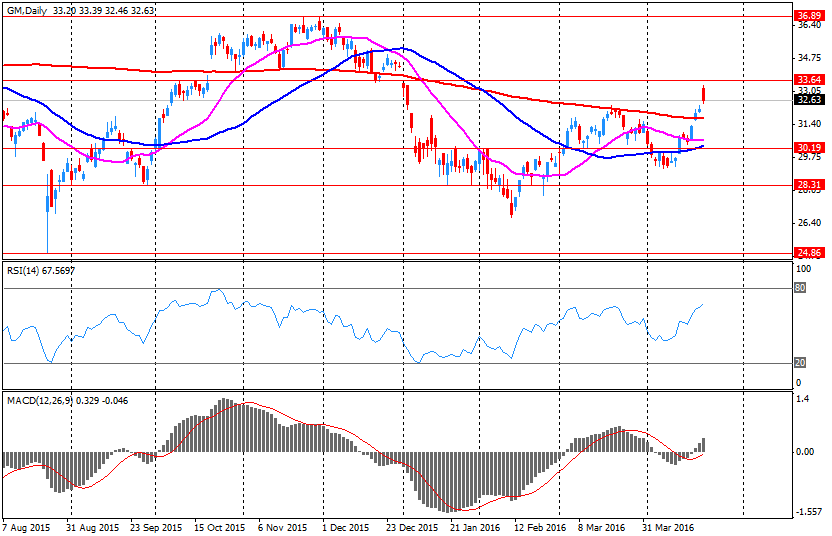

The focus of investors were shares of American Express Company (AXP), Intel (INTC), General Motors (GM) and Travelers (TRV). The first two reported after the end of yesterday's session. Declassified reports from companies were mixed. American Express showed a quarterly profit of $ 2.10 per share, which is $ 0.36 higher than the average forecast of analysts. At the same time the company's revenue was $ 8.235 billion, which is less than analysts had forecast $ 8.342 billion. Earnings from Intel to $ 0.59 per share, topping analysts' average forecast of $ 0.06. The company's revenue increased by 2.6% compared to the same period last year to $ 13.533 billion, which is almost coincided with the average forecast of analysts. Revenue and net profit of General Motors exceeded the average expectations of analysts: the company's profit amounted to $ 1.86 per share versus $ 1.29 in the second quarter of 2015 and the average analyst forecast of $ 1.51; the company's revenue was $ 42.40 billion, which is 11% more, and 13.6% higher than the average forecast of analysts.

With regard to statistics, the report submitted by the Federal Reserve Bank of Philadelphia, showed that the index of business activity in the manufacturing sector unexpectedly fell in July, reaching a level of 2.9 points compared with 4.7 points in June. Economists had expected an increase of this indicator to the level of +5 points.

In addition, initial applications for state unemployment benefits fell by 1000 and to reach a seasonally adjusted 253,000 for the week ended July 16th. This is the lowest value since April. The data for the previous week were not revised.

However, according to the National Association of Realtors, home sales in the secondary market rose by 1.1% to a seasonally adjusted annual rate reached 5.57 million in June from a revised level of 5.51 with a decrease in May.

Almost all the components of DOW index showed a decline (26 of 30). Outsiders were shares of Intel Corporation (INTC, -4,31%). Most remaining shares rose McDonald's Corp. (MCD, + 0,83%).

Almost all sectors of the S & P ended the day in negative territory. The leader turned utilities sector (+ 0.5%). The decline led by industrial goods sector (-0.6%).

At the close:

Dow -0.42% 18,517.23 -77.80

Nasdq -0.31% 5,073.90 -16.03

S & P -0.36% 2,165.16 -7.86

-

21:00

Dow -0.58% 18,487.44 -107.59 Nasdaq -0.43% 5,068.09 -21.84 S&P -0.49% 2,162.37 -10.65

-

18:00

European stocks closed: FTSE 100 -29.10 6699.89 -0.43% DAX +14.20 10156.21 +0.14% CAC 40 -3.51 4376.25 -0.08%

-

17:52

Oil futures are trading in negative territory

Oil prices show a slight decline, as the market has concerns about global oversupply. Investors also continue to analyze yesterday's data on US petroleum inventories.

Recall, the US Department of Energy announced that crude oil inventories fell more than expected, but gasoline inventories unexpectedly rose. In the week 9-15 July oil stocks fell by 2.3 million barrels to 519.4 million barrels. Analysts had forecast a decline of 2.1 million barrels. Gasoline stocks rose by 911,000 barrels to 241 million barrels, while analysts had expected a decrease of 100,000 barrels. The utilization of refining capacity rose by 0.9% to 93.2%, exceeding the estimate (+ 0.2%). US domestic oil production rose to 8.494 million barrels per day versus 8.485 million barrels per day in the previous week. In addition, the total amount of oil is still at historic highs.

"The growing petroleum stocks worsened the already gloomy forecasts on demand for WTI for the first half of the year. The glut of the fuel market threatens to weaken demand for crude oil. The three major North Asian economies (South Korea, China, Japan) also show signs that their domestic markets are oversaturated with fuel, "- noted analysts at BMI Research.

Meanwhile, Bank of America Merrill Lynch forecast that Brent crude oil in 2017 could grow by up to $ 70 per barrel due to the growth of consumption in China. According to experts, the average price of oil by the end of 2017 will amount to $ 61 per barrel and at the end of 2018 - $ 70 per barrel.

The cost of the September futures on US light crude oil WTI fell to 45.23 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 46.62 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:40

WSE: Session Results

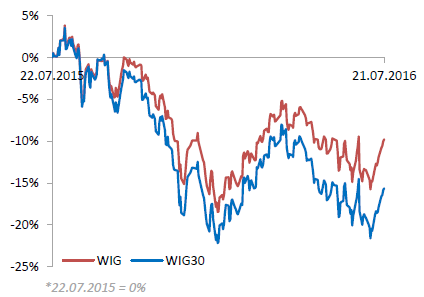

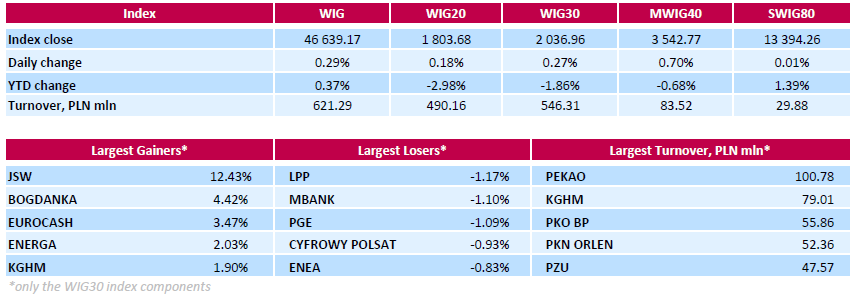

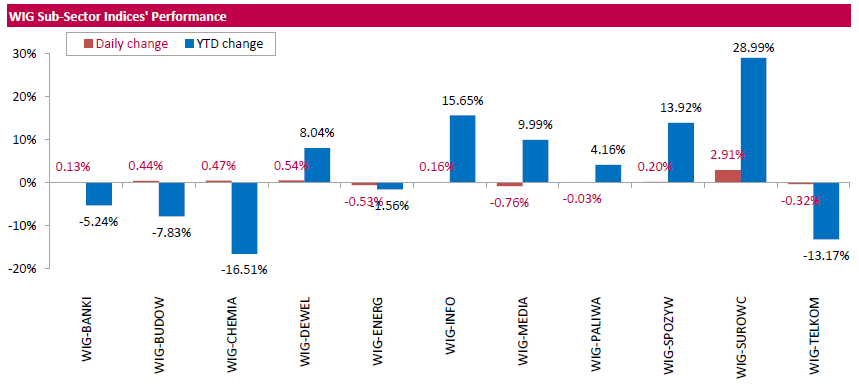

Polish equity market closed higher on Thursday. The broad market measure, the WIG index, advanced by 0.29%. Sector-wise, materials (+2.91%) fared the best, while media stocks (-0.76%) fell the most.

The large-cap stocks' benchmark, the WIG30 Index, added 0.27%. In the index basket, coking coal miner JSW (WSE: JSW) was the strongest performer, climbing by 12.43%. It was followed by thermal coal miner BOGDANKA (WSE: LWB), FMCG-wholesaler EUROCASH (WSE: EUR) and genco ENERGA (WSE: ENG), which jumped by 4.42%, 3.47% and 2.03% respectively. At the same time, the biggest decliners were clothing retailer LPP (WSE: LPP), bank MBANK (WSE: MBK) and genco PGE (WSE: PGE), dropping by 1.17%, 1.1% and 1.09% respectively.

-

17:30

Gold price moderately increased

Gold has risen in price moderately, retreating from a three-week low. Support for precious metals gave the ECB meeting results as well as changes in risk appetite.

ECB does not changed the parameters of monetary policy: the basic rate remained at a record low of 0% and the deposit rate at -0.4%. At the same time, the head of the Central Bank Draghi signaled in September, a possible further easing. In September, the ECB economists will present the new forecasts for growth and inflation, allowing a more clear asses of the probability of slowing down economic recovery. As for the impact of Brexit, he said that everything will depend on how long the negotiations will take place between the UK and the EU on the new conditions of interaction, as well as the results of these negotiations. . "It is too early to judge the impact of this risk," - Draghi said, adding that Brexit increased problems for the European economy, given the geopolitical uncertainties. Also he said that ECB is ready to use all available instruments in the framework of the mandate in the case of lower probability of achieving the inflation target of about 2% over the coming years.

A further increase in gold prices holds back the strengthening of the US currency on the back of positive housing data. The National Association of Realtors said that home sales in the secondary market increased by 1.1 percent and reached a seasonally adjusted annual rate of 5.57 million in June from a revised level of 5.51 in May. Sales are currently up 3.0 percent from June 2015 and remain at the highest annual rate since February 2007 (5.79 million.). Experts point out that recently presented statistics on the US increases the likelihood of the Fed raising interest rates. This is unlikely to happen at the July meeting of the central bank, but closer to the end of the year. Currently, the market players assess the chances of a rate hike of 43% in December.

-

17:30

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes were little changed on Thursday, a day after the Dow and the S&P hit fresh record highs and as investors digested a mixed bag of earning reports as well as upbeat economic data. Intel (INTC) shares were down after the chipmaker reported revenue growth slowed at its key data center business. Also dragging on the Dow was Travelers (TRV) and American Express (AXP), both of which fell after disappointing quarterly reports.

However, economic data was upbeat. A report showed jobless claims unexpectedly fell last week, hitting a three-month low as the labor market continues to gather momentum.

Dow stocks mixed (15 vs 15). Top looser - Intel Corporation (INTC, -4,23%). Top gainer - Caterpillar Inc. (CAT, +1,81%).

All S&P sectors in positive area. Top gainer - Basic Materials (+0,6%).

At the moment:

Dow 18503.00 -28.00 -0.15%

S&P 500 2166.75 -0.75 -0.03%

Nasdaq 100 4653.25 +2.75 +0.06%

Oil 45.45 -0.30 -0.66%

Gold 1323.70 +4.40 +0.33%

U.S. 10yr 1.60 +0.02

-

16:41

Existing home sales climbed 1.1% in US to an annual rate of 5.57 million in June

Reflecting a greater share of sales to first-time buyers, the National Association of Realtors released a report on Thursday showing an unexpected increase in U.S. existing home sales in the month of June.

NAR said existing home sales climbed 1.1 percent to an annual rate of 5.57 million in June from a downwardly revised 5.51 million in May.

Economists had expected existing home sales to dip to 5.48 million from the 5.53 million originally reported for the previous month.

With the unexpected increase, existing home sales reached their highest level since hitting 5.79 million in February of 2007.

NAR chief economist Lawrence Yun said, "Existing sales rose again last month as more traditional buyers and fewer investors were able to close on a home despite many competitive areas with unrelenting supply and demand imbalances."

"Sustained job growth as well as this year's descent in mortgage rates is undoubtedly driving the appetite for home purchases," he added.

The report also said the median existing-home price was $247,700 in June, up 3.7 percent from $238,900 in May and up 4.8 percent from $236,300 in June of 2015.

Additionally, NAR said there were 2.12 million existing homes available for sale at the end of June, down 0.9 percent from 2.14 million at the end of May.

The unsold inventory represents 4.6 months of supply at the current sales pace compared to 4.7 months of supply in the previous month.

-

16:14

WSE: After start on Wall Street

Mario Draghi press conference from the investors point of view was a disappointment. After the lack of changes in interest by the BoE, it seems that the next central bank begins to slightly underestimate the negative impact of Brexit.

As one would expect the Americans began with cosmetic minuses of 0.1 percent of withdrawal for the S&P500. Fluctuation range combined with a lack of decisiveness today puts Americans in one row with market. Start with a lower opening allows, however, to try to rebuild the market, which can still revive trade in Europe at the end of the session.

-

16:00

U.S.: Existing Home Sales , June 5.57 (forecast 5.48)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (2.5bln) 1.1100 (748m) 1.1150 (500m)

USD/JPY: 104.00-20 (USD 500m) 105.80 (385m) 106.75 (700m) 107.00 (651m)

GBP/USD 1.3000 (GBP 605m)

USD/CAD 1.3175 (USD 397m)

NZD/USD 0.7200 (NZD 200m)

-

15:32

U.S. Stocks open: Dow -0.04%, Nasdaq +0.08%, S&P -0.01%

-

15:21

Before the bell: S&P futures -0.07%, NASDAQ futures +0.08%

U.S. index futures were little changed.

Global Stocks:

Nikkei 16,810.22 +128.33 +0.77%

Hang Seng 21,981.7 +118.01 +0.45%

Shanghai 3,039.19 +11.29 +0.37%

FTSE 6,703.91 -25.08 -0.37%

CAC 4,361.16 -18.60 -0.42%

DAX 10,102.91 -39.10 -0.39%

Crude $45.53 (-0.48%)

Gold $1321.30 (+0.15%)

-

15:04

Manufacturing activity in the Philadelphia region fell slightly in July

Manufacturing activity in the Philadelphia region fell slightly in July, according to firms responding to this month's Manufacturing Business Outlook Survey. Although the indicator for current general activity turned negative, indicators for new orders and shipments were positive. Employment was flat at the reporting firms this month. Firms reported higher prices paid for materials and other inputs in July, but prices received for manufactured goods were relatively steady. The survey's index of future activity improved slightly, and firms expect growth in new orders and shipments over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, fell from 4.7 in June to -2.9 this month. For nine of the past 11 months, this diffusion index has been negative (see Chart 1). Twenty-two percent of the firms reported an increase in activity, 3 points lower than last month, and the percent of firms that reported decreases rose from 20 to 25. Fifty-one percent of the firms reported steady activity this month, similar to the share that reported steady activity last month.

-

14:53

US unemployment claims continue to decline

In the week ending July 16, the advance figure for seasonally adjusted initial claims was 253,000, a decrease of 1,000 from the previous week's unrevised level of 254,000. The 4-week moving average was 257,750, a decrease of 1,250 from the previous week's unrevised average of 259,000. There were no special factors impacting this week's initial claims. This marks 72 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

182.18

0.94(0.5186%)

120

ALCOA INC.

AA

10.5

-0.13(-1.223%)

39938

Amazon.com Inc., NASDAQ

AMZN

742.16

2.21(0.2987%)

15146

American Express Co

AXP

64.29

0.13(0.2026%)

887

Apple Inc.

AAPL

100.07

0.20(0.2003%)

100859

AT&T Inc

T

42.75

-0.02(-0.0468%)

12448

Barrick Gold Corporation, NYSE

ABX

21.1

-0.47(-2.179%)

80888

Boeing Co

BA

134.95

0.29(0.2154%)

3980

Caterpillar Inc

CAT

79.95

0.21(0.2634%)

810

Chevron Corp

CVX

105.65

-0.39(-0.3678%)

500

Cisco Systems Inc

CSCO

30.01

0.09(0.3008%)

30586

Citigroup Inc., NYSE

C

44.6

0.25(0.5637%)

9428

E. I. du Pont de Nemours and Co

DD

67.5

0.01(0.0148%)

100

Facebook, Inc.

FB

121.08

0.47(0.3897%)

115484

Ford Motor Co.

F

13.64

-0.01(-0.0733%)

57476

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.18

-0.27(-2.1687%)

221004

General Electric Co

GE

32.94

0.01(0.0304%)

54467

General Motors Company, NYSE

GM

31.36

0.11(0.352%)

7118

Goldman Sachs

GS

162.01

0.60(0.3717%)

3671

Google Inc.

GOOG

739

2.04(0.2768%)

2288

Hewlett-Packard Co.

HPQ

14.11

0.06(0.427%)

230

HONEYWELL INTERNATIONAL INC.

HON

119.66

0.31(0.2597%)

200

Intel Corp

INTC

35.37

0.22(0.6259%)

39818

International Business Machines Co...

IBM

159.59

0.01(0.0063%)

4601

Johnson & Johnson

JNJ

126

0.75(0.5988%)

5118

JPMorgan Chase and Co

JPM

64.1

0.24(0.3758%)

13461

McDonald's Corp

MCD

126.5

0.00(0.00%)

6413

Microsoft Corp

MSFT

55.7

2.61(4.9162%)

1345026

Pfizer Inc

PFE

36.65

0.01(0.0273%)

4188

Procter & Gamble Co

PG

85.54

0.0395(0.0462%)

3006

The Coca-Cola Co

KO

45.72

0.09(0.1972%)

1518

UnitedHealth Group Inc

UNH

143.13

0.54(0.3787%)

844

Verizon Communications Inc

VZ

55.31

-0.39(-0.7002%)

8575

Visa

V

78.98

0.26(0.3303%)

2318

Walt Disney Co

DIS

99.09

-0.38(-0.382%)

14730

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:American Express (AXP) reiterated with an Underperform at RBC Capital Mkts; target $57

American Express (AXP) reiterated with a Buy at Compass Point; target $74

Intel (INTC) target raised to $38 from $36 at Mizuho

AT&T (T) removed from Franchise Pick List at Jefferies; Buy, target $44

Amazon (AMZN) target raised to $900 from $790 at Goldman -

14:38

ECB, Draghi: ongoing recovery and rise in CPI. Eur/Usd on the rise

- ECB sees rates remaining at present or lower levels for an extended period of time

- Sees ongoing recovery and rise in CPI

- ECB will monitor developments closely

- New staff forecasts will help ECB assess conditions

- Recovery to continue at moderate pace

- ECB still sees support from low oil prices

- Inflation to remain low in coming months

- Inflation should pick up later in 2016

- Early survey showed no major inflation impact from Brexit

- Will be monitoring for further Brexit influences

- If there are problems, ECB will use all instruments if needed

- Bank equity prices are of some significance for policy makers

*via forexlive

-

14:30

U.S.: Initial Jobless Claims, 253 (forecast 265)

-

14:30

Canada: Wholesale Sales, m/m, May 1.8% (forecast 0.2%)

-

14:30

U.S.: Continuing Jobless Claims, 2128 (forecast 2145)

-

14:30

U.S.: Philadelphia Fed Manufacturing Survey, July -2.9 (forecast 5)

-

13:59

Orders

EUR/USD

Offers : 1.1050 1.1080 1.1100 1.1125-30 1.1150 1.1180 1.1200 1.1230 1.1250

Bids: 1.1000 1.0975-80 1.0950 1.0930 1.0900 1.0880 1.0850 1.0800

GBP/USD

Offers : 1.3270-75 1.3290-1.3300 1.3320 1.3350 1.3380 1.3400

Bids: 1.3220-25 1.3200 1.3180 1.3150 1.3120 1.3100 1.3080 1.3050

EUR/GBP

Offers : 0.8350 0.8370-75 0.8400 0.8425 0.8450 0.8470 0.8485 0.8500 0.8530

Bids: 0.8300 0.8285 0.8255-60 0.8230 0.8200 0.8150 0.8100

EUR/JPY

Offers : 118.00 118.30 118.50 119.00 119.50 120.00

Bids: 117.50 117.00 116.50 116.25 116.00 115.50 115.00

USD/JPY

Offers : 107.00 107.25 107.50 107.80 108.00 108.50

Bids: 106.55-60 106.40 106.20 106.00 105.80 105.60 105.30-35 105.00

AUD/USD

Offers : 0.7520 0.7550 0.7580 0.7600 0.7620 O.7635 0.7650-55

Bids: 0.7480 0.7450 0.7420 0.7400

-

13:53

ECB holds rates

"At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases.

Regarding non-standard monetary policy measures, the Governing Council confirms that the monthly asset purchases of €80 billion are intended to run until the end of March 2017, or beyond, if necessary, and in any case until it sees a sustained adjustment in the path of inflation consistent with its inflation aim.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:30 CET today".

-

13:51

Company News: General Motors (GM) Q2 results beat analysts’ expectations

General Motors reported Q2 FY 2016 earnings of $1.86 per share (versus $1.29 in Q2 FY 2015), beating analysts' consensus estimate of $1.51.

The company's quarterly revenues amounted to $42.400 bln (+11% y/y), missing analysts' consensus estimate of $37.319 bln.

GM rose to $33.25 (+5.59%) in pre-market trading.

-

13:45

Eurozone: ECB Interest Rate Decision, 0% (forecast 0%)

-

13:38

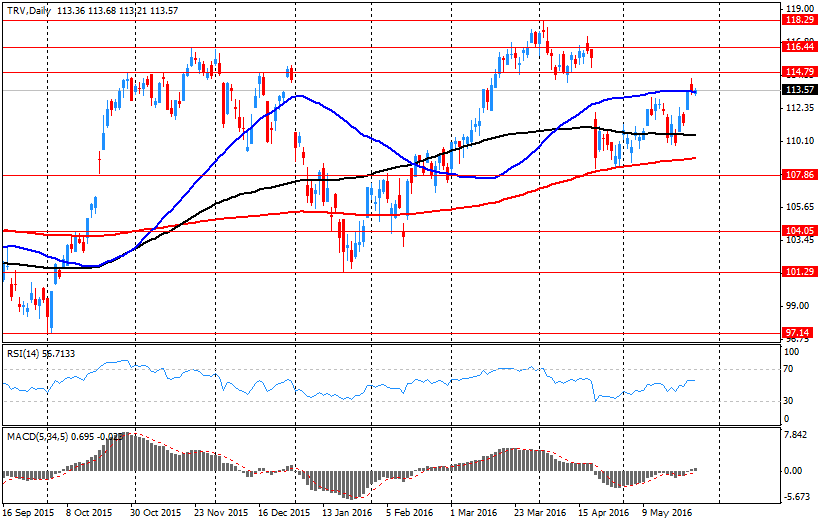

Company News: Travelers (TRV) Q2 EPS beat analysts’ estimate

Travelers reported Q2 FY 2016 earnings of $2.20 per share (versus $2.52 in Q2 FY 2015), beating analysts' consensus estimate of $2.05.

The company's quarterly revenues amounted to $6.067 bln (+2.3% y/y), missing analysts' consensus estimate of $6.131 bln.

TRV closed Wednesday's trading session at $117.01 (-0.03%).

-

13:09

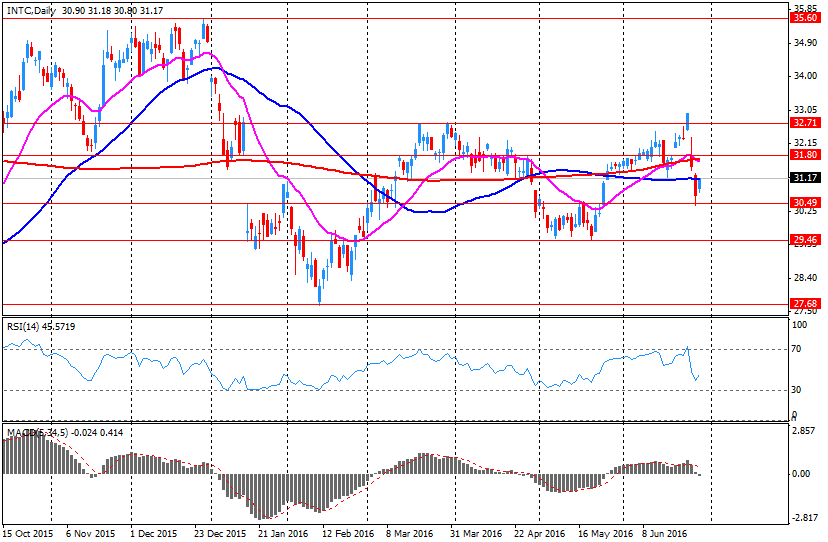

Company News: Intel (INTC) Q2 EPS beat analysts’ estimate

Intel reported Q2 FY 2016 earnings of $0.59 per share (versus $0.55 in Q2 FY 2015), beating analysts' consensus estimate of $0.53.

The company's quarterly revenues amounted to $13.533 bln (+2.6% y/y), generally in-line with analysts' consensus estimate of $13.545 bln.

INTC fell to $34.80 (-2.49%) in pre-market trading.

-

13:05

WSE: Mid session comment

European exchanges do not show too much optimism today before the press conference of the ECB. Initial gains were converted at a loss which, although not large, however, show caution before continuing yesterday's approach. The disappointing trade in Europe and the weakness of our market brought the WIG20 index on the red side of the quotations. Volatility is not large and there is a mood of anticipation. In the mid-session the WIG20 index was at the level of 1,794 points (-031%) and with turnover amounted to PLN 215 million.

-

12:58

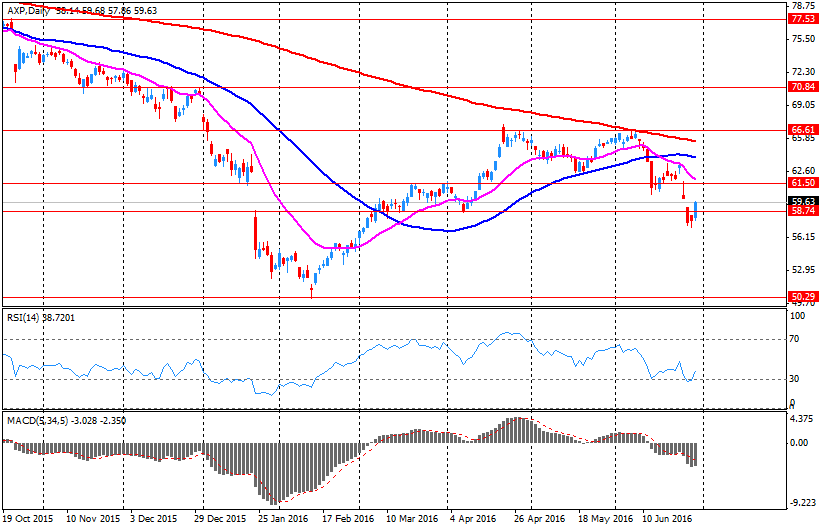

Company News: American Express (AXP) Q2 EPS beat analysts’ forecast

American Express reported Q2 FY 2016 earnings of $2.10 per share (versus $1.42 in Q2 FY 2015), beating analysts' consensus estimate of $1.74.

The company's quarterly revenues amounted to $8.235 bln (-0.6% y/y), missing analysts' consensus estimate of $8.342 bln.

AXP fell $63.70 (-1.21%) in pre-market trading.

-

12:57

Major stock indices in Europe show a negative trend

In today's trading, European stock indices trading down after the stock prices of airlines and tourism sector declined.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0,3% - to 339.67 points.

Investors' attention is directed to the meeting of the European Central Bank, which will take place later today. The ECB probably will not change its monetary policy after a meeting despite the threat of a slowdown in economic recovery in the euro zone after the UK decision to withdraw from the EU, believe experts interviewed by various media outlets.

However, many analysts expect a slight reduction in central bank interest rates on deposits in the coming months from the current -0.4%, as well as the extension of the program of quantitative easing (QE) already at the September meeting.

EasyJet Plc's shares fell during trading on 4,7%. British low-cost airline has reduced its revenue by 2.6% in the third fiscal quarter and warned that political turmoil in Europe raises concerns regarding the booking volume of tickets.

Meanwhile, the German airline Deutsche Lufthansa said that the recent series of terrorist attacks has led to a decrease in demand. This can lead to a decrease in profit for the Lufthansa this year, the company said. Lufthansa shares fell in price by 7.8%.

Shares of International Consolidated Airlines Group (IAG), which owns the airline British Airways, as well as tour operator TUI fell during trading by 3.5%.

Shares of the Swedish-Swiss electrical group ABB Ltd. rose during trading by 1,3%. ABB, one of the world leaders in the production of industrial robots and electrical equipment, cut its net profit in the 2nd quarter of 2016 by 31% due to restructuring costs -. to $ 406 million which exceeded the average market forecast of $ 393 million.

Cost of Hermes International shares jumped 3%. The French fashion house has announced an increase in revenue in the first six months of 2016 by 6% - up to 2.4 billion euros.

SABMiller shares rose 0.3% on the information that the US Justice Department approved the merger with the Belgian brewer Anheuser-Busch InBev (AB InBev), removing thus one of the last major obstacles to the transaction volume of about $ 108 billion .

Shares of Swiss pharmaceutical company Roche GS dropped by 0.5%, despite the fact that it has confirmed its forecast for 2016 and reported on the level of sales in the first half of this year, higher than expected.

At the moment

FTSE 6701.77 -27.22 -0.40%

DAX 10124.91 -17.10 -0.17%

CAC 4361.98 -17.78 -0.41%

-

12:14

The risks seem to be skewed to the upside for the EUR heading into the ECB - UBS

"No additional stimulus; focus on UK referendum, Italian banks. We don't expect the ECB to deliver any new monetary policy stimulus this week (21 July). Instead, the UK vote to leave the EU will likely be the key focus, while the issues in the Italian banking system are likely to feature highly as well. The ECB will also have an opportunity to comment on the first TLTRO2 auction (results announced on 24 June) and on its Eurozone Bank Lending Survey for Q2, which will be released on 19 July.

Extension of QE beyond March 2017 seems increasingly likely. While the ECB is likely to argue that the UK vote to leave the EU increases the downside risk to growth and inflation, we do not expect it to deliver substantial monetary easing on 21 July. Instead, we expect the ECB to maintain its 'wait and see' mode and continue to focus on the implementation of its measures from March. Nevertheless, we think the to-be-expected deceleration in Eurozone growth will likely skew the ECB's decision further towards an extension of asset purchases beyond March 2017, with a decision likely due on 8 September or 8 December. In other words, we consider it rather unlikely by now that the ECB would switch off QE in April 2017

EUR will focus on the ECB's overall signal for direction. Most of the solutions to enlarge the pool of assets available for purchase could result in steeper curves. But, as we discuss, the link between curve steepness and EUR/USD direction is tentative at best. Instead, what matters for the currency is the overall monetary policy signal and whether it leads to a higher level of EUR rates.Market is already quite dovishly positioned, which may imply upside EUR risks

As we discuss, the market is likely already assigning a non-trivial probability to outcomes that lead to a drastic increase in the pool of assets. This has dragged the level of rates lower and equates to a dovish signal. In the absence of strong evidence to this end, however, we think the risks seem to be skewed to the upside for the EUR heading into the ECB meeting on Thursday".

-

11:46

Greek finance minister Tsakalotos: discussing detailed debt relief measures

- Greek debt payments must be affordable within Greece's economic situation

-

11:02

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (2.5bln) 1.1100 (748m) 1.1150 (500m)

USD/JPY: 104.00-20 (USD 500m) 105.80 (385m) 106.75 (700m) 107.00 (651m)

GBP/USD 1.3000 (GBP 605m)

USD/CAD 1.3175 (USD 397m)

NZD/USD 0.7200 (NZD 200m)

-

10:47

UK public sector net borrowing lower in June. “Informations reflect pre-referendum assumptions”

Public sector net borrowing (excluding public sector banks) decreased by £2.3 billion to £25.6 billion in the current financial year-to-date (April to June 2016), compared with the same period in 2015.

Public sector net borrowing (excluding public sector banks) decreased by £2.2 billion to £7.8 billion in June 2016, compared with June 2015.

Public sector net debt (excluding public sector banks) at the end of June 2016 was £1,620.7 billion, equivalent to 84.0% of gross domestic product (GDP); an increase of £47.6 billion compared with June 2015.

Central government net cash requirement decreased by £0.9 billion to £24.8 billion in the current financial year-to-date (April to June 2016), compared with the same period in 2015.

Due to the volatility of the monthly data, the cumulative financial year-to-date borrowing figures provide a better indication of the progress of the public finances than the individual months.

The data presented in this bulletin presents the latest fiscal position of the public sector as at 30 June 2016 and does not reflect any significant impact of the EU Referendum result announced on 24 June 2016. Estimates for the latest period always contain a substantial element of forecast information which currently reflect pre-referendum assumptions.

-

10:40

UK retail sales down 0.9% in June. Data up to 2nd July

The volume of retail sales in June 2016 is estimated to have increased by 4.3% compared with June 2015.

The underlying pattern in the quantity bought, as suggested by the 3 month on 3 month movement, increased by 1.6%.

Compared with May 2016, the quantity bought in the retail industry is estimated to have decreased by 0.9%.

Average store prices (including petrol stations) fell by 2.5% in June 2016 compared with June 2015.

The amount spent in the retail industry decreased by 0.9% compared with May 2016, and increased by 1.5% compared with June 2015.

The value of online sales increased by 14.1% in June 2016 compared with June 2015, and increased by 0.5% compared with May 2016.

-

10:37

BoJ’s Kuroda: No Need, Possibility For Helicopter Money - BBC

-

10:31

United Kingdom: PSNB, bln, June -7.31 (forecast -9.2)

-

10:30

United Kingdom: Retail Sales (MoM), June -0.9% (forecast -0.6%)

-

10:30

United Kingdom: Retail Sales (YoY) , June 4.3% (forecast 5%)

-

10:15

Some BOJ members said the need to weigh policy more carefully - Bloomberg. Usd/Jpy lower

-

10:13

Oil is gaining in early trading

This morning, New York crude oil futures WTI rose by + 0.35% $ 45.91 and crude oil futures for Brent rose by + 0.36% to $ 47.34 per barrel. Thus, the black gold is trading in positive territory, amid the release of data from the US Energy Information Administration which showed a cut in oil reserves the ninth week in a row, but surprised on growth in gasoline inventories. US crude stocks fell for the week by 2.34 million barrels, while inventories remained at 519.5 million barrels. But gasoline inventories rose 0.91 million barrels, while analysts had expected gasoline stocks to remain unchanged.

-

09:41

Major stock markets in Europe trading lower: FTSE 100 6,715.69-13.30-0.20%, DAX 10,140.57-1.44-0.01%

-

09:16

WSE: After opening

WIG20 index opened at 1800.15 points (-0.01%)*

WIG 46487.36 -0.04%

WIG30 2029.93 -0.08%

mWIG40 3515.20 -0.08%

*/ - change to previous close

The cash market opens neutral, from the level pf 1,800 points. PKN Orlen (WSE: PKN) opened with light increases after yesterday's weaker session, but this does not mean that the results have been well received. Besides gains were quickly cast. Surrounded the DAX gained approx. 0.5%, and after a successful session yesterday we may see the desire of issue for the new post-Brexit highs. Moods are still so good and increases are favorable. However, the WSE habit is to stay a little resistant to it.

-

09:03

Today’s events:

At 09:00 GMT France will hold an auction of 10-year bonds

At 11:45 GMT ECB's decision on the interest rate

At 12:30 GMT the ECB Press Conference

-

08:31

Options levels on thursday, July 21, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1226 (3887)

$1.1154 (1722)

$1.1101 (704)

Price at time of writing this review: $1.1028

Support levels (open interest**, contracts):

$1.0955 (3014)

$1.0898 (4048)

$1.0862 (6978)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 37870 contracts, with the maximum number of contracts with strike price $1,1200 (3887);

- Overall open interest on the PUT options with the expiration date August, 5 is 49314 contracts, with the maximum number of contracts with strike price $1,0900 (6978);

- The ratio of PUT/CALL was 1.30 versus 1.32 from the previous trading day according to data from July, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.3505 (1486)

$1.3408 (1985)

$1.3311 (947)

Price at time of writing this review: $1.3229

Support levels (open interest**, contracts):

$1.3180 (460)

$1.3085 (1450)

$1.2989 (1665)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 24783 contracts, with the maximum number of contracts with strike price $1,3400 (1985);

- Overall open interest on the PUT options with the expiration date August, 5 is 24224 contracts, with the maximum number of contracts with strike price $1,2950 (2659);

- The ratio of PUT/CALL was 0.98 versus 0.97 from the previous trading day according to data from July, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

WSE: Before opening

Wednesday's session on the New York stock markets has brought further growth and new records of height for the S&P500 and the Dow Jones indices. For quotations of shares were helpful the better than expected quarterly results of companies. About more than 6 percent rallied trading of Microsoft after the release of better than expected quarterly results. Morgan Stanley shares also rose after the company reported a better-than-expected quarterly report.

Today begins the season of domestic resulting after this morning report was published by PKN Orlen. Differences between the publication and the expectations are not significant and certainly we may not speak of a greater surprise in one or the other side.

Yesterday the WIG20 index, thanks to a successful end, close at resistance of 1,800 pts., which gives hope for the possibility of its defeat today. The mood in the world are good, and inflows into emerging market funds are big. It is true that yesterday evening a state of emergency was declared in Turkey, which is not good news, but the last Monday showed, the Warsaw Stock Exchange is not prone to the negative reaction to information from Turkey.

The most important information of the day will be a press conference after the ECB meeting and although we do not expect policy easing now, Mario Draghi may send some suggestions for the future.

-

08:17

Morgan Stanley on what to expect from ECB

"Market focus will be on Draghi's first press conference after finding out about the Brexit vote.

Forecasts are not expected to be updated at this meeting so markets will have to wait until September until any change in policy but the tone will be closely watched. Inflation expectations as measured by the 5y5y swap have bounced to 1.35% from the lows of 1.25% last week but are still not expecting inflation to reach 2% for more than a decade. The ECB should be focused on financial market and banking stability which is addressed via LTRO facilities. Note that yesterday's release of the ECB Bank lending survey, while mostly done before the Brexit referendum, was quite upbeat about credit suggesting that LTROs had improved bank profitability. The equity markets may disagree, having fallen 17% since the March ECB meeting, but we do expect the ECB to acknowledge relatively calm market post the Brexit vote. Draghi could acknowledge that there will be business uncertainty after the Brexit vote, which if translates into lower growth and inflation, would require further easing

What would make EUR move lower?

If Draghi reverses his statement from March, now saying that interest rates could be cut further then it would weaken EURUSD on the day but only lastingly weaken the currency if there are expectations of more than a 20bp cut.

Suggestions of an extension of QE won't be able to weaken the EUR as further corporate bond purchases would not be able to bring down long term government bond yields sufficiently. Rates investors will be watching for any clues on how the ECB could tweak current government bond purchase programme rules to allow for any extension of QE without hitting bond availability limits, though this type of discussion could likely be left until the September meeting.

We are now forecasting EURUSD towards 1.18 by the end of this year and are still long EURGBP".

-

08:14

RBNZ: monetary policy will continue to be accommodative and further policy easing will be required

The Reserve Bank of New Zealand said monetary policy will continue to be accommodative and further policy easing will be required to ensure that future average inflation settles near the middle of the target range.

Headline inflation is being held below the target band by continuing negative tradables inflation, the bank said Thursday.

The bank noted that the high exchange rate is adding pressure to the dairy and manufacturing sectors, together with weak global inflation, is holding down tradable goods inflation.

This makes it difficult for the bank to meet its inflation objective. "A decline in the exchange rate is needed," the bank said.

RBNZ observed that despite rising capacity pressures and some recent increase in fuel prices, the stronger currency implies that the outlook for inflation has weakened since the June Statement.

-

08:10

Australia’s non-mining recovery remains on track according to the June quarter NAB Business Survey

Australia's non-mining recovery remains on track according to the June quarter NAB Business Survey.

Leading indicators also suggest the outlook remains positive, although momentum has eased a little. Despite that, firms are continuing to suggest quite strong investment intentions for the next 12 months, consistent with the steady rise in capacity utilisation rates, while near-term employment intentions improved and longer-term employment intentions remained relatively solid. Inflation measures in the Survey remained subdued, which may point to another soft CPI outcome for Q2, while inflation expectations for the next 3 months point to a continuation of this trend.

The NAB Quarterly Business Survey provides valuable insight into Australian business, and offers a more in-depth probe into the conditions facing Australian business than the monthly survey, and also provides extra information about how firms perceive the outlook for their respective industries. Business conditions improved a little further in the June quarter, rising 1 point to +11 index points, which is well above the long-run average - largely supported by very high trading conditions and profits. According to NAB Group Chief Economist Alan Oster, "firms were still reporting business conditions consistent with an ongoing recovery in the non-mining sector". "There was a slight moderation in business confidence, but given the build-up of economic and political uncertainties since the start of the year, this is still a good result", said Mr Oster. "Additionally, the Monthly NAB Business Survey actually suggested business confidence lifted towards the end of the quarter."

-

08:05

Japan's all industry activity dropped for the first time in three months

Japan's all industry activity dropped for the first time in three months in May, the Ministry of Economy, Trade and Industry reported Thursday.

The all industry activity index slid 1 percent month-on-month in May, reversing a 0.8 percent rise in April. This was the first increase in three months but slightly slower than the expected drop of 1.1 percent.

Growth in construction activity slowed to 1.5 percent from 2 percent. At the same time, industrial production slid 2.6 percent, in contrast to a 0.5 percent rise in April.

Likewise, tertiary industry activity declined 0.7 percent, offsetting a 0.7 percent rise in April.

On a yearly basis, all industry activity climbed 0.5 percent in May in contrast to April's 0.2 percent decrease.

-

08:00

Switzerland: Trade Balance, June 3.55 (forecast 3.49)

-

07:13

Global Stocks

European stocks rose Wednesday, hovering near their strongest levels in four weeks, but mining stocks were dragged lower after a round of lackluster updates from metals producers.

The Stoxx Europe 600 SXXP, +1.03% gained 1% to close at 340.81, the highest finish since June 23, according to FactSet. That date is when the U.K. Brexit vote was held, with the result putting the country on track toward leaving the European Union.

The European Central Bank on Thursday will issue its first monetary policy decision since the Brexit vote. While ECB President Mario Draghi may offer strong hints of more easing, analysts widely expect very little action from the central bank on Thursday.

U.S. stocks closed at record highs after trading within a narrow range Wednesday, buoyed by a surge in tech stocks after a flurry of corporate earnings beat lowered expectations.

The S&P 500 index SPX, +0.43% traded within a 12-point range Wednesday and closed up 9.24 points, or 0.4%, at 2,173.02, it's sixth record close in eight sessions.

The Dow Jones Industrial Average DJIA, +0.19% which traded within a 66-point range, closed up 36.02 points, or 0.2%, at 18,595.03, it's seventh record close in as many sessions.

Meanwhile, the Nasdaq Composite Index COMP, +1.06% advanced 53.56 points, or 1.1%, to close at 5,089.93, trading within a 44-point range following a big open.

Asian stocks climbed to nine-month highs on Thursday, helped by a pickup in capital inflows and a recovery in global oil prices, while the dollar stood strong on growing bets of a U.S. rate increase as early as September.

-

06:31

Japan: All Industry Activity Index, m/m, May -1.0% (forecast -1%)

-

04:06

Nikkei 225 16,909.92 +228.03 +1.37%, Hang Seng 22,004.86 +122.38 +0.56%, Shanghai Composite 3,029.93 +2.03 +0.07%

-

00:41

Commodities. Daily history for Jul 20’2016:

(raw materials / closing price /% change)

Oil 47,16 +1.00%

Gold 1,315.80 -0.27%

-

00:35

Stocks. Daily history for Jun Jul 20’2016:

(index / closing price / change items /% change)

Nikkei 225 16,681.89 -41.42 -0.25 %

Hang Seng 21,882.48 +209.28 +0.97 %

S&P/ASX 200 5,488.72 +37.47 +0.69 %

Shanghai Composite 3,028.34 -8.26 -0.27 %

FTSE 100 6,728.99 +31.62 +0.47 %

CAC 40 4,379.76 +49.63 +1.15 %

Xetra DAX 10,142.01 +160.77 +1.61 %

S&P 500 2,173.02 +9.24 +0.43 %

NASDAQ Composite 5,089.93 +53.56 +1.06 %

Dow Jones 18,595.03 +36.02 +0.19 %

-

00:32

Currencies. Daily history for Jul 20’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1009 -0,07%

GBP/USD $1,3234 +1,04%

USD/CHF Chf0,9871 +0,16%

USD/JPY Y107,20 +0,99%

EUR/JPY Y118,02 +0,92%

GBP/JPY Y141,89 +2,02%

AUD/USD $0,7471 -0,47%

NZD/USD $0,6965 -1,29%

USD/CAD C$1,3072 +0,40%

-

00:03

Schedule for today, Thursday, Jul 21’2016:

(time / country / index / period / previous value / forecast)

04:30 Japan All Industry Activity Index, m/m May 1.3% -1%

06:00 Switzerland Trade Balance June 3.79 3.49

08:30 United Kingdom PSNB, bln June -9.14 -9.2

08:30 United Kingdom Retail Sales (MoM) June 0.9% -0.6%

08:30 United Kingdom Retail Sales (YoY) June 6% 5%

11:45 Eurozone ECB Interest Rate Decision 0% 0%

12:30 Eurozone ECB Press Conference

12:30 Canada Wholesale Sales, m/m May 0.1% 0.2%

12:30 U.S. Continuing Jobless Claims 2149 2145

12:30 U.S. Initial Jobless Claims 254 265

12:30 U.S. Philadelphia Fed Manufacturing Survey July 4.7 5

14:00 U.S. Existing Home Sales June 5.53 5.48

-