Noticias del mercado

-

22:06

Major US stock indexes finished trading in positive territory

Major stock indexes rose on Wednesday thanks to strong quarterly report to Microsoft, which boosted optimism about the prospects for the quarterly results. According to the published report, the fourth quarter of 2016 fiscal year the company's profit according to the results reached $ 0.69 per share, which was at $ 0.11 above the average forecast of analysts. Quarterly revenue Microsoft has increased by 2.1% compared to the same period in 2015 to $ 22.64 billion, while analysts had forecast $ 22.137 billion.

Growth indices also contributed to the positive dynamics of oil prices after data showed that weekly crude oil inventories fell. US Department of Energy reported that crude oil inventories fell more than expected, but gasoline inventories unexpectedly rose. According to the report, during the week of 9-15 July crude oil inventories fell by 2.3 million barrels to 519.4 million barrels, while remaining at high levels by historical standards for a given period of the year. Analysts had forecast a decline of 2.1 million. Barrels. Oil reserves in Cushing terminal rose na189 000 barrels to 64.1 million barrels.

After the close of the trading session is expected to publish quarterly reports of American Express (AXP) and Intel (INTC).

DOW index components closed mostly in positive territory (21 of 30). Outsider were shares of The Walt Disney Company (DIS, -1,29%). More rest up shares Microsoft Corporation (MSFT, + 6,04%).

Almost all sectors of the S & P showed an increase. conglomerates (-0.4%) sectors fell most. The leader turned out to be the technology sector (+ 1.3%).

At the close:

Dow + 0.19% 18,595.10 +36.09

Nasdaq + 1.06% 5,089.93 +53.56

S & P + 0.43% 2,173.02 +9.24

-

21:00

Dow +0.30% 18,615.40 +56.39 Nasdaq +1.12% 5,092.70 +56.33 S&P +0.49% 2,174.42 +10.64

-

18:01

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Wednesday, as Microsoft strong results boosted optimism regarding the health of quarterly earnings. Also helping stocks was a reversal in oil prices, with Brent crude up nearly 1%, after data shows weekly crude inventories fell slightly more than expected.

Most of Dow stocks in positive area (21 of 30). Top looser - The Walt Disney Company (DIS, -1,44%). Top gainer - Microsoft Corporation (MSFT, +6,57%).

Almost all S&P sectors in positive area. Top looser - Conglomerates (-0,3%). Top gainer - Technology (+1,2%).

At the moment:

Dow 18538.00 +58.00 +0.31%

S&P 500 2167.75 +9.00 +0.42%

Nasdaq 100 4649.00 +42.50 +0.92%

Oil 45.76 +0.31 +0.68%

Gold 1320.70 -11.60 -0.87%

U.S. 10yr 1.59 +0.03

-

18:00

European stocks closed: FTSE 100 6,728.99 +31.62 +0.47% CAC 40 4,379.76 +49.63 +1.15% DAX 10,142.01 +160.77 +1.61%

-

17:45

Oil quotes show a positive trend

Oil prices fell sharply, by updating the two-month minimum, but soon returned and moved into positive territory. The reason for such fluctuations were mixed data on US petroleum inventories.

US Department of Energy reported that crude oil inventories fell more than expected, but gasoline inventories unexpectedly rose. According to the report, during the week of 9-15 July crude oil inventories fell by 2.3 million barrels to 519.4 million barrels, while remaining at high levels by historical standards Analysts had forecast a decline of 2.1 million barrels. Oil reserves in Cushing terminal rose 189 000 barrels to 64.1 million barrels. Gasoline stocks rose by 911,000 barrels to 241 million barrels, while analysts had expected a decrease of 100,000 barrels. Distillate stocks fell by 214,000 barrels to 152.8 million barrels. Analysts had expected inventories to increase by 700,000 barrels. The utilization of refining capacity rose by 0.9% to 93.2%, exceeding analysts' estimates (+ 0.2%). At the same time, oil production in the US rose to 8.494 million barrels per day versus 8.485 million barrels per day in the previous week. Experts say the report is consistent with the latest data from the API report yesterday. Recall, US crude stocks fell by 2.3 million., To 520.9 million barrels. The median forecast assumed a reduction of 2.1 million barrels.

Recently, Barclays analysts noted that Brent prices may reach $ 85 per barrel by 2019, one year earlier than previously expected. In 2017, the bank's experts forecast the average price for a barrel of Brent at $ 57, in 2018 - $ 77.

The cost of the September futures on US light crude oil WTI rose to 45.76 dollars per barrel.

September futures price for Brent crude rose to 47.08 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:30

Gold price fell by about 1%

The value of gold dropped today, reaching its lowest level in three weeks, which was due to increased risk appetite and strengthening of the dollar against a basket of major currencies.

Precious metals are also under pressure against the background of the increased likelihood of the Fed raising interest rates after the publication of strong US data. This is unlikely to happen at the July meeting of the central bank, but closer to the end of the year. Currently, the market players assess the chances of a rate hike at 42% in December. Increase in interest rates by the Fed this year, putting pressure on the precious metal, competing with higher-yielding assets in the period of growth rate.

"After the release of positive US data, investors revised their estimates on Fed rate increase. In addition, some speculators preferred to take profits after a good rally in early July.", - said Commerzbank analyst Daniel Briesemann. It is worth emphasizing thay since the beginning of this year, gold rose in price by about 25 percent.

International Monetary Fund, however, has reduced its global growth forecasts for the next two years, citing the uncertainty regarding Brexit.

Investors are also waiting for the outcome of the ECB meeting to be held tomorrow. Economists say that the ECB is likely to refrain from further easing, but it can make changes to the bond buying program by expanding the list of assets available for the acquisition.

The cost of the August gold futures on the COMEX trading at $ 1317.70 per ounce.

-

17:02

China's leading economic index increased markedly in the last month

The research results, published by Conference Board, showed that at the end of June leading economic index (the LEI) for China increased 0.5 percent to a level of 150.6 points (2010 = 100), after rising 0.5 percent in May and lower 0.1 percent in April. Within six months (from December 2015 to June 2016) index added 1.4 percent, coinciding with the change from the previous six-month period (November 2015 to May 2016).

Recall, the leading economic index is a weighted average, which is calculated based on a number of macroeconomic indicators. The index characterizes the development of the economy over the next 6 months. There is also a rule of thumb that the output value of the indicator in the negative area for three months in succession is an indication of slowing down of the economy.

Meanwhile, the coincident economic indicator (the CEI) increased 1.1 percent in June, to a level of 151.8 points (2010 = 100), after rising by 0.3 percent in May and April. For the six-month period (June) the index rose by 2.6 percent compared with an increase of 1.6 percent over the previous six months (to May).

-

16:40

-

16:34

US crude oil inventories decline more than expected

U.S. crude oil refinery inputs averaged about 16.9 million barrels per day during the week ending July 15, 2016, 319,000 barrels per day more than the previous week's average. Refineries operated at 93.2% of their operable capacity last week. Gasoline production decreased last week, averaging just about 10.1 million barrels per day. Distillate fuel production decreased last week, averaging 5.0 million barrels per day. U.S. crude oil imports averaged over 8.1 million barrels per day last week, up by 293,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged 8.0 million barrels per day, 5.9% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 897,000 barrels per day. Distillate fuel imports averaged 190,000 barrels per day last week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.3 million barrels from the previous week. At 519.5 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories increased by 0.9 million barrels last week, and are well above the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week. Distillate fuel inventories decreased by 0.2 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories rose 0.1 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories increased by 2.6 million barrels last week.

-

16:30

U.S.: Crude Oil Inventories, July -2.342 (forecast -2.1)

-

16:04

Eu consumer confidence a little lower in July

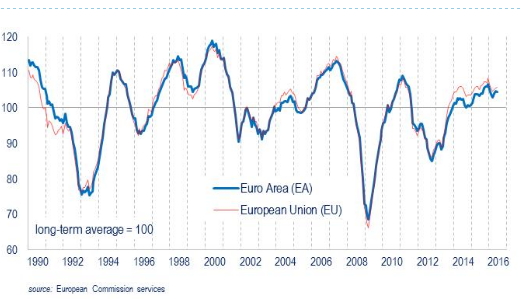

In July 2016, the DG ECFIN flash estimate of the consumer confidence indicator decreased in the EU (by a marked 1.8 points to -7.6) and the euro area (by 0.7 points to 7.9) compared to June.

In June, after two consecutive months of improved readings, the Economic Sentiment Indicator (ESI) remained broadly unchanged in both the euro area (-0.2 points to 104.4) and the EU (+0.1 points to 105.7).

-

16:00

Eurozone: Consumer Confidence, July -7.9 (forecast -8)

-

15:48

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0950 (EUR 555m) 1.0975 (375m) 1.1000 (1.3bln)

USD/JPY: 104.00 (USD 263m) 106.75 (200m)

GBP/USD 1.3100 (GBP 1.3bln) 1.3200 (1.2bln)

AUD/USD 0.7475 (AUD 517m) 0.7550 (353m)

USD/CAD 1.3000 (USD 397m)

NZD/USD 0.7200 (NZD 275m)

-

15:46

WSE: After start on Wall Street

The market on Wall Street started another upward session, however, the dynamics of the march toward the all-time records weakened and the market caught short of breath after three weeks of increases.

It seems that at current levels forces of supply and demand are in balance and the market is waiting for another impulse, which will allow for a new assessment of market conditions.

Today's volatility on the WIG20 did not provide us with attractions. Virtually drift beyond the area of variation at several points and nothing happens on the market . It is worth noting that at this stage the image of the WSE is relatively weaker in relation to the environment.

-

15:35

Morgan Stanley on USD dynamics

The US dollar strengthened, as positive data on the US economy led to increased expectations of rate hikes by the Federal Reserve. However, Morgan Stanley, still prefer to sell the US currency.

Growing expectations of tighter monetary policy at this time were relatively weak, "so the dollar did not demonstrate a significant gain," says the investment bank.

In addition, Morgan Stanley indicate "ongoing outflow of funds in higher-yielding currencies and assets" that usually occurs in part due to the dollar.

-

15:33

U.S. Stocks open: Dow +0.23%, Nasdaq +0.46%, S&P +0.22%

-

15:07

Before the bell: S&P futures +0.19%, NASDAQ futures +0.24%

U.S. index futures advanced, after equities slipped from a record, as the earnings season spurred optimism corporate health is robust enough to support stock gains.

Global Stocks:

Nikkei 16,681.89 -41.42 -0.25%

Hang Seng 21,882.48 +209.28 +0.97%

Shanghai Composite 3,028.34 -8.26 -0.27%

FTSE 6,699.91 +2.54 +0.04%

CAC 4,367.07 +36.94 +0.85%

DAX 10,118.26 +137.02 +1.37%

Crude $45.01 (-0.97%)

Gold $1317.00 (-1.15%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

182.18

0.94(0.5186%)

120

ALCOA INC.

AA

10.5

-0.13(-1.223%)

39938

Amazon.com Inc., NASDAQ

AMZN

742.16

2.21(0.2987%)

15146

American Express Co

AXP

64.29

0.13(0.2026%)

887

Apple Inc.

AAPL

100.07

0.20(0.2003%)

100859

AT&T Inc

T

42.75

-0.02(-0.0468%)

12448

Barrick Gold Corporation, NYSE

ABX

21.1

-0.47(-2.179%)

80888

Boeing Co

BA

134.95

0.29(0.2154%)

3980

Caterpillar Inc

CAT

79.95

0.21(0.2634%)

810

Chevron Corp

CVX

105.65

-0.39(-0.3678%)

500

Cisco Systems Inc

CSCO

30.01

0.09(0.3008%)

30586

Citigroup Inc., NYSE

C

44.6

0.25(0.5637%)

9428

E. I. du Pont de Nemours and Co

DD

67.5

0.01(0.0148%)

100

Facebook, Inc.

FB

121.08

0.47(0.3897%)

115484

Ford Motor Co.

F

13.64

-0.01(-0.0733%)

57476

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.18

-0.27(-2.1687%)

221004

General Electric Co

GE

32.94

0.01(0.0304%)

54467

General Motors Company, NYSE

GM

31.36

0.11(0.352%)

7118

Goldman Sachs

GS

162.01

0.60(0.3717%)

3671

Google Inc.

GOOG

739

2.04(0.2768%)

2288

Hewlett-Packard Co.

HPQ

14.11

0.06(0.427%)

230

HONEYWELL INTERNATIONAL INC.

HON

119.66

0.31(0.2597%)

200

Intel Corp

INTC

35.37

0.22(0.6259%)

39818

International Business Machines Co...

IBM

159.59

0.01(0.0063%)

4601

Johnson & Johnson

JNJ

126

0.75(0.5988%)

5118

JPMorgan Chase and Co

JPM

64.1

0.24(0.3758%)

13461

McDonald's Corp

MCD

126.5

0.00(0.00%)

6413

Microsoft Corp

MSFT

55.7

2.61(4.9162%)

1345026

Pfizer Inc

PFE

36.65

0.01(0.0273%)

4188

Procter & Gamble Co

PG

85.54

0.0395(0.0462%)

3006

The Coca-Cola Co

KO

45.72

0.09(0.1972%)

1518

UnitedHealth Group Inc

UNH

143.13

0.54(0.3787%)

844

Verizon Communications Inc

VZ

55.31

-0.39(-0.7002%)

8575

Visa

V

78.98

0.26(0.3303%)

2318

Walt Disney Co

DIS

99.09

-0.38(-0.382%)

14730

-

14:44

Upgrades and downgrades before the market open

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Walt Disney (DIS) downgraded to Hold from Buy at Stifel

Verizon (VZ) downgraded to Perform from Outperform at Oppenheimer

Other:Microsoft (MSFT) target raised to $62 from $57 at BMO Capital Markets

Microsoft (MSFT) target raised to $60 from $55 at Wunderlich

Microsoft (MSFT) target raised to $60 from $58 at Stifel

UnitedHealth (UNH) target raised to $165 at RBC Capital Mkts

Johnson & Johnson (JNJ) target raised to $133 at RBC Capital Mkt

Goldman Sachs (GS) target raised to $150 from $145 at RBC Capital Mkts -

13:51

Orders

EUR/USD

Offers : 1.1020 1.1050 1.1080 1.1100 1.1125-30 1.1150

Bids: 1.0975-80 1.0950 1.0930 1.0900 1.0880 1.0850 1.0800

GBP/USD

Offers : 1.3225-30 1.3250 1.3270-75 1.3290-1.3300 1.3320 1.3350 1.3380 1.3400

Bids: 1.3180 1.3150 1.3130-35 1.3100 1.3060 1.3020 1.3000

EUR/GBP

Offers : 0.8425 0.8450 0.8470 0.8485 0.8500 0.8530

Bids: 0.8375-80 0.8360 0.8350 0.8325-30 0.8300 0.8285 0.8255-60

EUR/JPY

Offers : 117.00 117.50 117.70 118.00 118.25 118.50 119.00

Bids: 116.50 116.25 116.00 115.50 115.00 114.60 114.00

USD/JPY

Offers : 106.25-30 106.50 106.70 107.00 107.50

Bids: 105.80 105.60 105.30-35 105.00 104.80 104.50-60 104.20 104.00

AUD/USD

Offers : 0.7520 0.7550 0.7580 0.7600 0.7620 O.7635 0.7650-55

Bids: 0.7475-80 0.7450 0.7420 0.7400

-

13:26

Bank of England post Brexit report: as yet, there was no clear evidence of a sharp general slowing in activity

This Update generally covers business conditions in the month preceding the EU referendum, but also provides a summary of intelligence gathered following the vote to leave the EU.

•The annual rate of activity growth had remained moderate and little changed in the month up to the EU referendum. Consumer spending and construction output growth had eased a little, offset by a pickup in manufacturing growth from a low base. There had been further signs of uncertainty leading to delays in decision-taking, including on capital spending, hiring and property investment.

•Following the EU referendum, business uncertainty had risen markedly. Many firms had only just begun to formulate new business strategies in response to the vote and, for the time being, were seeking to maintain 'business as usual'. A majority of firms spoken with did not expect a near-term impact from the result on their investment or staff hiring plans. But around a third of contacts thought there would be some negative impact on those plans over the next twelve months. As yet, there was no clear evidence of a sharp general slowing in activity - source: Bank of England.

-

13:06

WSE: Mid session comment

The first half of trading brought the output of European indices on a daily maximums. The DAX and the CAC are rising - appropriately - by 1.4 percent and 1.1 percent and significantly depart from the Warsaw Stock Exchange, on which the biggest rise in the praises have small companies - the sWIG80 index grow by 0.8 per cent. In fact the WIG20 hovering around yesterday's close and moves under the line of resistance and under the psychological barrier of 1,800 points. The market seems to be frozen after Monday's growth, but ignoring the upward pressure from the environment will not be easy and the further increases in Europe will affect an attack on the resistance at 1,800 points and may change the picture of the session in Warsaw. At the halfway point of the session the WIG20 index was at 1,792 points (-0.04%) with the turnover amounted to PLN 215 mln.

-

13:01

Schaeuble will meet with UK minister Hammond for bilateral talks at G20 meeting

-

G20 expected to focus on creating conditions for sustainable growth, strengthen economic resilience

-

G20 unlikely to debate more stimulus, will focus on structural reform

-

will push for further measures to fight global tax evasion

-

-

12:54

Major stock indexes in Europe show a positive trend

Today European stocks started rising as investors evaluate corporate reporting of large companies. In addition, market participants are waiting for the meeting of the European Central Bank (ECB), which will take place on Thursday. Investors generally do not expect any action, however, will closely follow the comments Central Bank president, Mario Draghi on the possible extension of QE in connection with the decision of the UK to leave the EU.

At the same time, investors remain cautious after the International Monetary Fund has revised downwards its forecast for global economic growth for 2016 to 3.1% from 3.2%, although it expects a rebound to 3.4% in 2017.

Statistics on the labor market of the UK provided support. The unemployment rate in the UK fell to its lowest level in more than 10 years in May, the Office for National Statistics said on Wednesday.

The unemployment rate fell to 4.9 percent in the three months to May from 5.6 percent a year earlier.

The last time the index was lower was the period from July to September 2005. Expected rate was 5 percent.

At the same time, the employment rate amounted to 74.4 percent, the highest since comparable records began in 1971.

Average weekly earnings, including bonuses, increased by 2.3 percent, and earnings excluding bonuses rose by 2.2 percent compared with a year earlier.

The level of claims for unemployment benefits remained steady at 2.2 percent in June, in line with expectations. The number of people claiming unemployment benefits rose slightly to 400 in May.

Shares of software developer SAP SE rose by more than 3%, as the company's profit exceeded market expectations in the last quarter.

Quotes of ASML, Europe's largest manufacturer of equipment for the production of semiconductors, rose 1.6% on better-than-expected profitability forecast for 2016.

Shares of Man Group, the world's largest hedge fund management company fell by 4.1%.

The price of shares of Nordea Bank are growing due to strong quarterly numbers.

Shares of Swiss pharmaceutical companies Lonza increased by 5.2% due to improved forecast for 2016 at the maximum in the history of the company's profit growth in the first half.

Shares of Bayer rose 0.2%, despite the statement by Monsanto that the proposal of the German companie for $ 64 billion is "financially inadequate", amid speculation that the board will support the offer of $ 130 per share.

At the moment:

FTSE 6716.77 19.40 0.29%

DAX 10122.52 141.28 1.42%

CAC 4382.21 52.08 1.20%

-

12:49

Company News: Microsoft (MSFT) quarterly results beat analysts’ estimates

Microsoft reported Q4FY 2016 earnings of $0.69 per share (versus $0.62 in Q4 FY 2015), beating analysts' consensus estimate of $0.58.

The company's quarterly revenues amounted to $22.642 bln (+2.1% y/y), beating analysts' consensus estimate of $22.137 bln.

MSFT rose to $55.39 (+4.33%) in pre-market trading.

-

12:02

ZEW-CS-Indicator for the economic sentiment in Switzerland has fallen by 13.5 points

In July, the ZEW-CS-Indicator for the economic sentiment in Switzerland has fallen by 13.5 points to a reading of 5.9 points. The Brexit vote is likely to be partly responsible for the decline in Swiss economic sentiment. The ZEW-CS-Indicator, however, remains in the positive. The share of financial experts expecting the economic situation to improve still outweighs the share of surveyed experts expecting a decline in the economic situation. The ZEW-CS-Indicator reflects the expectations of the surveyed financial market experts regarding the economic development in Switzerland on a six-month time horizon. It is calculated monthly by the Mannheim Centre for European Economic Research (ZEW) in cooperation with Credit Suisse (CS), Zurich.

The assessment of the current economic situation in Switzerland declined by 6.2 points in July, to a reading of exactly 0.0 points. The vast majority of financial experts - almost 90 per cent - considers the economic situation to be "normal". There is, however, some uncertainty regarding the economic outlook. Approximately two thirds of experts expect the situation to remain unchanged. The fact that the ZEW-CS-Indicator is slightly in the positive indicates that there are slightly more optimists than pessimists among the respondents.

-

11:20

Review of financial and economic press: Trump officially nominated as Republican presidential candidate

D/W

Trump officially nominated as presidential candidate for Republicans

Donald Trump has officially nominated as a candidate for US president and was supported by the majority of the delegates of the party congress in Cleveland during the vote on Tuesday. Thus, Trump will fight for the presidency against former US Secretary of State Hillary Clinton, which is expected to be nominated in the coming week at the Democratic party congress.

IMF: Brexit weaken global economic growth

Due to Brexit the International Monetary Fund had to be adjust forecasts for the world economy. According to estimates of financial organizations, global economic growth in 2016 will be 3.1 percentage points and a year later - 3.4 percentage points. This is 0.1 percentage points lower than the IMF predicted in April.

newspaper. ru

Russia increased its oil production

In the first half of 2016, oil production increased by 2.9% in Russia, while gas production decreased by 2.1%, according to Rosstat.

BBC

Angela Eagle came out of the race for the post of Labour leader

Angela Eagle came out of the race for the post of head of the Labor Party and supported Owen Smith in his fight against the current party leader Jeremy Corbin.

RBC

Saudi Arabia reduced its oil reserves to nearly two-year low

Oil reserves in Saudi Arabia dropped in May to the lowest level since August 2014. Against the background of oversupply and domestic demand growth Riyadh moves to increase reserves spending.

-

11:07

Oil little changed in early trading

This morning, the New York futures for WTI trading flat and crude oil futures for Brent rose by + 0.13% to $ 46.72 per barrel. Thus, the black gold is trading slightly up on the background of official data on US oil inventories. American Petroleum Institute data showed that the reserves of black gold in the US fell by 2.3 million barrels to 520.9 million over the week. Energy Information Administration to publish official data on stocks later today. China Statistical Office reported that the production of gasoline in China has grown by 8.7% in June, while year on year to 11 million tons, which is yet another sign of saturation of petroleum products market.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), July 5.9

-

10:47

UK unemployment rate down to 4.9%. Average earnings stable

Between the 3 months to February 2016 and March to May 2016, the number of people in work increased. The number of unemployed people and the number of people not working and not seeking or available to work (economically inactive) fell.

There were 31.70 million people in work, 176,000 more than for the 3 months to February 2016 and 624,000 more than for a year earlier.

There were 23.19 million people working full-time, 401,000 more than for a year earlier. There were 8.52 million people working part-time, 223,000 more than for a year earlier.

The employment rate (the proportion of people aged from 16 to 64 who were in work) was 74.4%, the highest since comparable records began in 1971.

There were 1.65 million unemployed people (people not in work but seeking and available to work), 54,000 fewer than for the 3 months to February 2016, 201,000 fewer than for a year earlier and the lowest since March to May 2008.

The unemployment rate was 4.9%, down from 5.6% for a year earlier. The last time it was lower was for July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.3% including bonuses and by 2.2% excluding bonuses compared with a year earlier.

-

10:30

United Kingdom: Claimant count , June 0.4 (forecast 3.5)

-

10:30

United Kingdom: ILO Unemployment Rate, May 4.9% (forecast 5%)

-

10:30

United Kingdom: Average Earnings, 3m/y , May 2.3% (forecast 2.3%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, May 2.2% (forecast 2.3%)

-

10:06

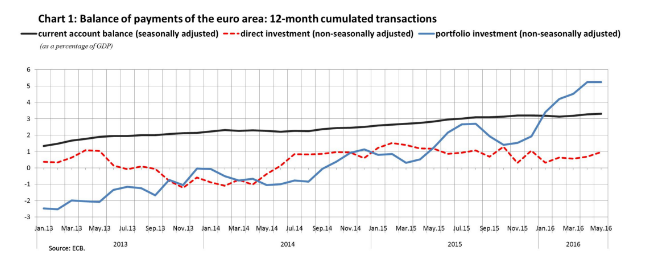

Euro Area current account continue to improve. Europe is the region with the biggest trade balance and current account surplus

The current account of the euro area recorded a surplus of €30.8 billion in May 2016. This reflected surpluses for goods (€30.6 billion), services (€5.9 billion) and primary income (€3.2 billion), which were partly offset by a deficit in secondary income (€8.9 billion).

The 12-month cumulated current account for the period ending in May 2016 recorded a surplus of €347.1 billion (3.3% of euro area GDP), compared with one of €289.7 billion (2.8% of euro area GDP) for the 12 months to May 2015. This development was mostly due to an increase in the surplus for goods (from €294.7 billion to €365.0 billion) and, to a lesser extent, to a decrease in the deficit for secondary income (from €137.9 billion to €123.3 billion). These were partly offset by decreases in the surpluses for both services (from €66.8 billion to €61.5 billion) and primary income (from €66.1 billion to €43.8 billion).

-

10:00

Eurozone: Current account, unadjusted, bln , May 15.4

-

09:46

The pound in focus again as we await the UK employment report. Will the data support GBP or the fall will continue?

-

09:36

Positive start for major stock exchanges: DAX 10,052.09 + 70.85 + 0.71%, FTSE 100 6,725.42 + 30.00 + 0.45%, CAC 40 4,357.7 + 27.57 + 0.64%

-

09:14

WSE: After opening

WIG20 index opened at 1797.25 points (+0.27%)

WIG 46414.89 0.35%

WIG30 2026.88 0.44%

mWIG40 3499.92 0.31%

*/ - change to previous close

After the publication of the PPI in Germany, contracts for European indices clearly strengthened which contributed to a positive start of spot trading. This move of contracts set the mood also for the Warsaw market and here it is worth to remember the relative strength of our parquet , which in this case would be happy with such an external benefited optimism.

-

09:05

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0950 (EUR 555m) 1.0975 (375m) 1.1000 (1.3bln)

USD/JPY: 104.00 (USD 263m) 106.75 (200m)

GBP/USD 1.3100 (GBP 1.3bln) 1.3200 (1.2bln)

AUD/USD 0.7475 (AUD 517m) 0.7550 (353m)

USD/CAD 1.3000 (USD 397m)

NZD/USD 0.7200 (NZD 275m)

-

08:59

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0,2%, FTSE 100 + 0,3%, CAC 40 + 0.3%

-

08:34

Moody’s UK outlook negative

-

negative outlook on UK banking system reflects post-Brexit uncertainty

-

UK's future trade relationship with EU will lead to reduced confidence, lower investment, consumer spending in UK

-

expects UK banks to see asset quality worsen

-

UK banks operating environment to weaken

-

bank profitability to come under pressure

-

expects BOE to continue to support the banking system through on-going provision of contingent liquidity support

-

-

08:26

WSE: Before opening

Tuesday's session on Wall Street ended with a modest changes in the major indexes. DJIA recorded a slight increase, the S&P500 slight decline, while the Nasdaq lost at the and of 0.4 per cent.

Such hesitation of bulls side after several days of growth is a warning that Wall Street may get ready for a correction after three weeks of increases.

It would appear that Asian markets are preparing for such a scenario. The Nikkei lost now 0.25 percent and in the currency market we may see a slight strengthening of the dollar against the euro and the strengthening of the yen to the dollar, which is a classic combination of model "risk off".

Contracts for the German DAX and peaceful behavior of futures on the S&P500 signal rather flat start of the day in Europe.

During today's session, we will know the data on the Polish consumer sentiment; the trade balance of the Euro area and the packet of data on the labor market from the UK. More broadly, investors are waiting for tomorrow's ECB meeting. The most important element influencing the mood is, therefore, the season of publication of the quarterly results in the US.

-

08:24

Bulk of Brexit impact likely behind us but we stay short Gbp/Usd - BNPP

"Attention will now turn to releases later in the week: May employment data (Wednesday), June retail sales (Thursday) and the services and manufacturing PMIs (Friday). Our expectation is that the PMIs will show a sharp post-Brexit weakening, with our economists forecasting the composite index at its lowest level since December 2012.

On balance we think deterioration in activity data and rising expectations for BoE easing should push GBPUSD lower in the near-term, even if the bulk of the Brexit impact on the GBP is likely behind us.

We are short GBPUSD from 1.3350 targeting 1.2800".

*BNPP is short GBP/USD from July 14.

-

08:23

Options levels on wednesday, July 20, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1230 (3839)

$1.1161 (1254)

$1.1102 (579)

Price at time of writing this review: $1.1012

Support levels (open interest**, contracts):

$1.0957 (3122)

$1.0897 (4086)

$1.0861 (6987)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 36834 contracts, with the maximum number of contracts with strike price $1,1200 (3839);

- Overall open interest on the PUT options with the expiration date August, 5 is 48727 contracts, with the maximum number of contracts with strike price $1,0900 (6987);

- The ratio of PUT/CALL was 1.32 versus 1.31 from the previous trading day according to data from July, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.3407 (1924)

$1.3310 (952)

$1.3213 (1319)

Price at time of writing this review: $1.3097

Support levels (open interest**, contracts):

$1.2986 (1560)

$1.2890 (868)

$1.2793 (1627)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 23383 contracts, with the maximum number of contracts with strike price $1,3400 (1924);

- Overall open interest on the PUT options with the expiration date August, 5 is 22603 contracts, with the maximum number of contracts with strike price $1,2950 (2567);

- The ratio of PUT/CALL was 0.97 versus 0.92 from the previous trading day according to data from July, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:14

Aussie lending index lower in June

The Australian economy took a step backwards in June, the latest survey from Westpac bank revealed on Wednesday as its leading economic index slid 0.22 percent.

That follows the 0.21 percent increase in May.

The outlook component climbed to -0.14 percent in June from -0.37 in May.

Supporting the index were gains in commodity prices, the share market and dwelling approvals - countered by deterioration in aggregate monthly hours worked.

-

08:10

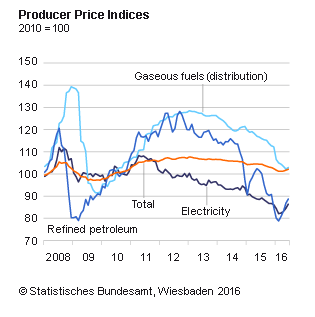

German producer prices up 0.4% in June

In June 2016 the index of producer prices for industrial products fell by 2.2% compared with the corresponding month of the preceding year. In May 2016 the annual rate of change all over also had been -2.7%.

Compared with the preceding month May 2016 the overall index rose by 0.4% in June 2016 (+0,4% in May and +0.1% in April 2016).

In June 2016 energy prices decreased by 6.5% compared with May 2015, prices of intermediate goods by 2.0% and prices of non-durable consumer goods by 0.2%. In contrast prices of capital goods rose by 0.6% and prices of durable consumer goods by 1.3%.

The overall index disregarding energy decreased by 0.7% compared with June 2015 and rose slightly by 0.2% compared with May 2016.

-

08:00

Germany: Producer Price Index (MoM), June 0.4% (forecast 0.2%)

-

08:00

Germany: Producer Price Index (YoY), June -2.2% (forecast -2.4%)

-

08:00

Germany: Producer Price Index (MoM), June 0.4% (forecast 0.2%)

-

07:20

Global Stocks

European stock markets retreated from a three-week high on Tuesday, as disappointing corporate updates and lackluster economic sentiment data from Germany soured the investing mood.

The Stoxx Europe 600 index SXXP, -0.41% lost 0.4% to 337.32, after closing at the highest level since June 23 - the day of the U.K.'s Brexit referendum - on Monday.

The Dow Jones Industrial Average extended its winning streak to eight sessions and finished at a record high close for a sixth straight day on Tuesday even as the broader market retreated on disappointing quarterly results from Netflix Inc.

The Dow industrials DJIA, +0.14% gained 25.96 points, or 0.1%, to close at 18,559.01 as McDonald's Corp. MCD, +2.18% and Johnson & Johnson JNJ, +1.71% offset declines in Microsoft Corp. MSFT, -1.61% and Goldman Sachs Group Inc. GS, -1.18% shares.

The S&P 500 SPX, -0.14% edged down 3.11 points, or 0.1%, to end at 2,163.78. The Nasdaq Composite COMP, -0.38% shed 19.41 points, or 0.4%, to finish at 5,036.37. For the month so far, the tech-heavy index has climbed over 4%, though it is up just 0.6% year-to-date, trailing 6% gains for the S&P and the Dow.

Asian stocks stepped back early on Wednesday after a record run on Wall Street showed signs of petering out, while the dollar hovered near a four-month high against a basket of currencies following upbeat U.S. data.

Global risk appetite, which has recovered rapidly from the Brexit shock late in June, received a sobering reminder after the International Monetary Fund (IMF) cut its global growth forecasts for the next two years on Tuesday, citing uncertainty over Britain's looming exit from the European Union.

-

07:06

-

04:02

Nikkei 225 16,602.87 -120.44 -0.72 %, Hang Seng 21,751.69 +78.49 +0.36 %, Shanghai Composite 3,032.81 -3.78 -0.12 %

-

00:38

Commodities. Daily history for Jul 19’2016:

(raw materials / closing price /% change)

Oil 44.57 -0.18%

Gold 1,332.30 +0.02%

-

00:35

Stocks. Daily history for Jun Jul 19’2016:

(index / closing price / change items /% change)

Nikkei 225 16,723.31 +225.46 +1.37 %

Hang Seng 21,673.2 -129.98 -0.60 %

S&P/ASX 200 5,451.25 -7.22 -0.13 %

Shanghai Composite 3,036.2 -7.37 -0.24 %

FTSE 100 6,697.37 +1.95 +0.03 %

CAC 40 4,330.13 -27.61 -0.63 %

Xetra DAX 9,981.24 -81.89 -0.81 %

S&P 500 2,163.78 -3.11 -0.14 %

NASDAQ Composite 5,036.37 -19.41 -0.38 %

Dow Jones 18,559.01 +25.96 +0.14 %

-

00:30

Currencies. Daily history for Jul 19’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1017 -0,51%

GBP/USD $1,3097 -1,16%

USD/CHF Chf0,9855 +0,33%

USD/JPY Y106,14 +0,01%

EUR/JPY Y116,94 -0,50%

GBP/JPY Y139,03 -1,14%

AUD/USD $0,7506 -0,96%

NZD/USD $0,7055 +0,04%

USD/CAD C$1,302 +0,54%

-

00:03

Schedule for today, Wednesday, Jul 20’2016:

(time / country / index / period / previous value / forecast)

06:00 Germany Producer Price Index (MoM) June 0.4% 0.2%

06:00 Germany Producer Price Index (YoY) June -2.7% -2.4%

08:00 Eurozone Current account, unadjusted, bln May 34

08:30 United Kingdom Average Earnings, 3m/y May 2.0% 2.3%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May 2.3% 2.4%

08:30 United Kingdom Claimant count June -0.4 4

08:30 United Kingdom ILO Unemployment Rate May 5% 5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 19.4

14:00 Eurozone Consumer Confidence (Preliminary) July -7.3 -8

14:30 U.S. Crude Oil Inventories July -2.546

-