Noticias del mercado

-

17:02

China's leading economic index increased markedly in the last month

The research results, published by Conference Board, showed that at the end of June leading economic index (the LEI) for China increased 0.5 percent to a level of 150.6 points (2010 = 100), after rising 0.5 percent in May and lower 0.1 percent in April. Within six months (from December 2015 to June 2016) index added 1.4 percent, coinciding with the change from the previous six-month period (November 2015 to May 2016).

Recall, the leading economic index is a weighted average, which is calculated based on a number of macroeconomic indicators. The index characterizes the development of the economy over the next 6 months. There is also a rule of thumb that the output value of the indicator in the negative area for three months in succession is an indication of slowing down of the economy.

Meanwhile, the coincident economic indicator (the CEI) increased 1.1 percent in June, to a level of 151.8 points (2010 = 100), after rising by 0.3 percent in May and April. For the six-month period (June) the index rose by 2.6 percent compared with an increase of 1.6 percent over the previous six months (to May).

-

16:40

-

16:30

U.S.: Crude Oil Inventories, July -2.342 (forecast -2.1)

-

16:04

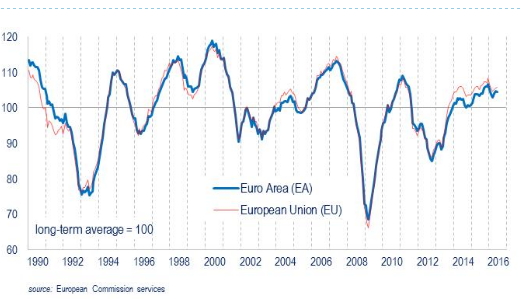

Eu consumer confidence a little lower in July

In July 2016, the DG ECFIN flash estimate of the consumer confidence indicator decreased in the EU (by a marked 1.8 points to -7.6) and the euro area (by 0.7 points to 7.9) compared to June.

In June, after two consecutive months of improved readings, the Economic Sentiment Indicator (ESI) remained broadly unchanged in both the euro area (-0.2 points to 104.4) and the EU (+0.1 points to 105.7).

-

16:00

Eurozone: Consumer Confidence, July -7.9 (forecast -8)

-

15:48

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0950 (EUR 555m) 1.0975 (375m) 1.1000 (1.3bln)

USD/JPY: 104.00 (USD 263m) 106.75 (200m)

GBP/USD 1.3100 (GBP 1.3bln) 1.3200 (1.2bln)

AUD/USD 0.7475 (AUD 517m) 0.7550 (353m)

USD/CAD 1.3000 (USD 397m)

NZD/USD 0.7200 (NZD 275m)

-

15:35

Morgan Stanley on USD dynamics

The US dollar strengthened, as positive data on the US economy led to increased expectations of rate hikes by the Federal Reserve. However, Morgan Stanley, still prefer to sell the US currency.

Growing expectations of tighter monetary policy at this time were relatively weak, "so the dollar did not demonstrate a significant gain," says the investment bank.

In addition, Morgan Stanley indicate "ongoing outflow of funds in higher-yielding currencies and assets" that usually occurs in part due to the dollar.

-

13:51

Orders

EUR/USD

Offers : 1.1020 1.1050 1.1080 1.1100 1.1125-30 1.1150

Bids: 1.0975-80 1.0950 1.0930 1.0900 1.0880 1.0850 1.0800

GBP/USD

Offers : 1.3225-30 1.3250 1.3270-75 1.3290-1.3300 1.3320 1.3350 1.3380 1.3400

Bids: 1.3180 1.3150 1.3130-35 1.3100 1.3060 1.3020 1.3000

EUR/GBP

Offers : 0.8425 0.8450 0.8470 0.8485 0.8500 0.8530

Bids: 0.8375-80 0.8360 0.8350 0.8325-30 0.8300 0.8285 0.8255-60

EUR/JPY

Offers : 117.00 117.50 117.70 118.00 118.25 118.50 119.00

Bids: 116.50 116.25 116.00 115.50 115.00 114.60 114.00

USD/JPY

Offers : 106.25-30 106.50 106.70 107.00 107.50

Bids: 105.80 105.60 105.30-35 105.00 104.80 104.50-60 104.20 104.00

AUD/USD

Offers : 0.7520 0.7550 0.7580 0.7600 0.7620 O.7635 0.7650-55

Bids: 0.7475-80 0.7450 0.7420 0.7400

-

13:26

Bank of England post Brexit report: as yet, there was no clear evidence of a sharp general slowing in activity

This Update generally covers business conditions in the month preceding the EU referendum, but also provides a summary of intelligence gathered following the vote to leave the EU.

•The annual rate of activity growth had remained moderate and little changed in the month up to the EU referendum. Consumer spending and construction output growth had eased a little, offset by a pickup in manufacturing growth from a low base. There had been further signs of uncertainty leading to delays in decision-taking, including on capital spending, hiring and property investment.

•Following the EU referendum, business uncertainty had risen markedly. Many firms had only just begun to formulate new business strategies in response to the vote and, for the time being, were seeking to maintain 'business as usual'. A majority of firms spoken with did not expect a near-term impact from the result on their investment or staff hiring plans. But around a third of contacts thought there would be some negative impact on those plans over the next twelve months. As yet, there was no clear evidence of a sharp general slowing in activity - source: Bank of England.

-

13:01

Schaeuble will meet with UK minister Hammond for bilateral talks at G20 meeting

-

G20 expected to focus on creating conditions for sustainable growth, strengthen economic resilience

-

G20 unlikely to debate more stimulus, will focus on structural reform

-

will push for further measures to fight global tax evasion

-

-

12:54

Major stock indexes in Europe show a positive trend

Today European stocks started rising as investors evaluate corporate reporting of large companies. In addition, market participants are waiting for the meeting of the European Central Bank (ECB), which will take place on Thursday. Investors generally do not expect any action, however, will closely follow the comments Central Bank president, Mario Draghi on the possible extension of QE in connection with the decision of the UK to leave the EU.

At the same time, investors remain cautious after the International Monetary Fund has revised downwards its forecast for global economic growth for 2016 to 3.1% from 3.2%, although it expects a rebound to 3.4% in 2017.

Statistics on the labor market of the UK provided support. The unemployment rate in the UK fell to its lowest level in more than 10 years in May, the Office for National Statistics said on Wednesday.

The unemployment rate fell to 4.9 percent in the three months to May from 5.6 percent a year earlier.

The last time the index was lower was the period from July to September 2005. Expected rate was 5 percent.

At the same time, the employment rate amounted to 74.4 percent, the highest since comparable records began in 1971.

Average weekly earnings, including bonuses, increased by 2.3 percent, and earnings excluding bonuses rose by 2.2 percent compared with a year earlier.

The level of claims for unemployment benefits remained steady at 2.2 percent in June, in line with expectations. The number of people claiming unemployment benefits rose slightly to 400 in May.

Shares of software developer SAP SE rose by more than 3%, as the company's profit exceeded market expectations in the last quarter.

Quotes of ASML, Europe's largest manufacturer of equipment for the production of semiconductors, rose 1.6% on better-than-expected profitability forecast for 2016.

Shares of Man Group, the world's largest hedge fund management company fell by 4.1%.

The price of shares of Nordea Bank are growing due to strong quarterly numbers.

Shares of Swiss pharmaceutical companies Lonza increased by 5.2% due to improved forecast for 2016 at the maximum in the history of the company's profit growth in the first half.

Shares of Bayer rose 0.2%, despite the statement by Monsanto that the proposal of the German companie for $ 64 billion is "financially inadequate", amid speculation that the board will support the offer of $ 130 per share.

At the moment:

FTSE 6716.77 19.40 0.29%

DAX 10122.52 141.28 1.42%

CAC 4382.21 52.08 1.20%

-

12:02

ZEW-CS-Indicator for the economic sentiment in Switzerland has fallen by 13.5 points

In July, the ZEW-CS-Indicator for the economic sentiment in Switzerland has fallen by 13.5 points to a reading of 5.9 points. The Brexit vote is likely to be partly responsible for the decline in Swiss economic sentiment. The ZEW-CS-Indicator, however, remains in the positive. The share of financial experts expecting the economic situation to improve still outweighs the share of surveyed experts expecting a decline in the economic situation. The ZEW-CS-Indicator reflects the expectations of the surveyed financial market experts regarding the economic development in Switzerland on a six-month time horizon. It is calculated monthly by the Mannheim Centre for European Economic Research (ZEW) in cooperation with Credit Suisse (CS), Zurich.

The assessment of the current economic situation in Switzerland declined by 6.2 points in July, to a reading of exactly 0.0 points. The vast majority of financial experts - almost 90 per cent - considers the economic situation to be "normal". There is, however, some uncertainty regarding the economic outlook. Approximately two thirds of experts expect the situation to remain unchanged. The fact that the ZEW-CS-Indicator is slightly in the positive indicates that there are slightly more optimists than pessimists among the respondents.

-

11:20

Review of financial and economic press: Trump officially nominated as Republican presidential candidate

D/W

Trump officially nominated as presidential candidate for Republicans

Donald Trump has officially nominated as a candidate for US president and was supported by the majority of the delegates of the party congress in Cleveland during the vote on Tuesday. Thus, Trump will fight for the presidency against former US Secretary of State Hillary Clinton, which is expected to be nominated in the coming week at the Democratic party congress.

IMF: Brexit weaken global economic growth

Due to Brexit the International Monetary Fund had to be adjust forecasts for the world economy. According to estimates of financial organizations, global economic growth in 2016 will be 3.1 percentage points and a year later - 3.4 percentage points. This is 0.1 percentage points lower than the IMF predicted in April.

newspaper. ru

Russia increased its oil production

In the first half of 2016, oil production increased by 2.9% in Russia, while gas production decreased by 2.1%, according to Rosstat.

BBC

Angela Eagle came out of the race for the post of Labour leader

Angela Eagle came out of the race for the post of head of the Labor Party and supported Owen Smith in his fight against the current party leader Jeremy Corbin.

RBC

Saudi Arabia reduced its oil reserves to nearly two-year low

Oil reserves in Saudi Arabia dropped in May to the lowest level since August 2014. Against the background of oversupply and domestic demand growth Riyadh moves to increase reserves spending.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), July 5.9

-

10:47

UK unemployment rate down to 4.9%. Average earnings stable

Between the 3 months to February 2016 and March to May 2016, the number of people in work increased. The number of unemployed people and the number of people not working and not seeking or available to work (economically inactive) fell.

There were 31.70 million people in work, 176,000 more than for the 3 months to February 2016 and 624,000 more than for a year earlier.

There were 23.19 million people working full-time, 401,000 more than for a year earlier. There were 8.52 million people working part-time, 223,000 more than for a year earlier.

The employment rate (the proportion of people aged from 16 to 64 who were in work) was 74.4%, the highest since comparable records began in 1971.

There were 1.65 million unemployed people (people not in work but seeking and available to work), 54,000 fewer than for the 3 months to February 2016, 201,000 fewer than for a year earlier and the lowest since March to May 2008.

The unemployment rate was 4.9%, down from 5.6% for a year earlier. The last time it was lower was for July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.3% including bonuses and by 2.2% excluding bonuses compared with a year earlier.

-

10:30

United Kingdom: Claimant count , June 0.4 (forecast 3.5)

-

10:30

United Kingdom: ILO Unemployment Rate, May 4.9% (forecast 5%)

-

10:30

United Kingdom: Average Earnings, 3m/y , May 2.3% (forecast 2.3%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, May 2.2% (forecast 2.3%)

-

10:06

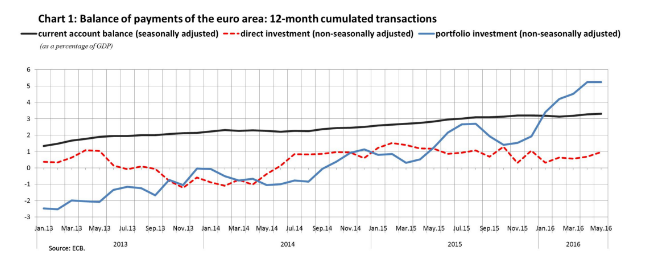

Euro Area current account continue to improve. Europe is the region with the biggest trade balance and current account surplus

The current account of the euro area recorded a surplus of €30.8 billion in May 2016. This reflected surpluses for goods (€30.6 billion), services (€5.9 billion) and primary income (€3.2 billion), which were partly offset by a deficit in secondary income (€8.9 billion).

The 12-month cumulated current account for the period ending in May 2016 recorded a surplus of €347.1 billion (3.3% of euro area GDP), compared with one of €289.7 billion (2.8% of euro area GDP) for the 12 months to May 2015. This development was mostly due to an increase in the surplus for goods (from €294.7 billion to €365.0 billion) and, to a lesser extent, to a decrease in the deficit for secondary income (from €137.9 billion to €123.3 billion). These were partly offset by decreases in the surpluses for both services (from €66.8 billion to €61.5 billion) and primary income (from €66.1 billion to €43.8 billion).

-

10:00

Eurozone: Current account, unadjusted, bln , May 15.4

-

09:46

The pound in focus again as we await the UK employment report. Will the data support GBP or the fall will continue?

-

09:05

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0950 (EUR 555m) 1.0975 (375m) 1.1000 (1.3bln)

USD/JPY: 104.00 (USD 263m) 106.75 (200m)

GBP/USD 1.3100 (GBP 1.3bln) 1.3200 (1.2bln)

AUD/USD 0.7475 (AUD 517m) 0.7550 (353m)

USD/CAD 1.3000 (USD 397m)

NZD/USD 0.7200 (NZD 275m)

-

08:34

Moody’s UK outlook negative

-

negative outlook on UK banking system reflects post-Brexit uncertainty

-

UK's future trade relationship with EU will lead to reduced confidence, lower investment, consumer spending in UK

-

expects UK banks to see asset quality worsen

-

UK banks operating environment to weaken

-

bank profitability to come under pressure

-

expects BOE to continue to support the banking system through on-going provision of contingent liquidity support

-

-

08:24

Bulk of Brexit impact likely behind us but we stay short Gbp/Usd - BNPP

"Attention will now turn to releases later in the week: May employment data (Wednesday), June retail sales (Thursday) and the services and manufacturing PMIs (Friday). Our expectation is that the PMIs will show a sharp post-Brexit weakening, with our economists forecasting the composite index at its lowest level since December 2012.

On balance we think deterioration in activity data and rising expectations for BoE easing should push GBPUSD lower in the near-term, even if the bulk of the Brexit impact on the GBP is likely behind us.

We are short GBPUSD from 1.3350 targeting 1.2800".

*BNPP is short GBP/USD from July 14.

-

08:23

Options levels on wednesday, July 20, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1230 (3839)

$1.1161 (1254)

$1.1102 (579)

Price at time of writing this review: $1.1012

Support levels (open interest**, contracts):

$1.0957 (3122)

$1.0897 (4086)

$1.0861 (6987)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 36834 contracts, with the maximum number of contracts with strike price $1,1200 (3839);

- Overall open interest on the PUT options with the expiration date August, 5 is 48727 contracts, with the maximum number of contracts with strike price $1,0900 (6987);

- The ratio of PUT/CALL was 1.32 versus 1.31 from the previous trading day according to data from July, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.3407 (1924)

$1.3310 (952)

$1.3213 (1319)

Price at time of writing this review: $1.3097

Support levels (open interest**, contracts):

$1.2986 (1560)

$1.2890 (868)

$1.2793 (1627)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 23383 contracts, with the maximum number of contracts with strike price $1,3400 (1924);

- Overall open interest on the PUT options with the expiration date August, 5 is 22603 contracts, with the maximum number of contracts with strike price $1,2950 (2567);

- The ratio of PUT/CALL was 0.97 versus 0.92 from the previous trading day according to data from July, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:14

Aussie lending index lower in June

The Australian economy took a step backwards in June, the latest survey from Westpac bank revealed on Wednesday as its leading economic index slid 0.22 percent.

That follows the 0.21 percent increase in May.

The outlook component climbed to -0.14 percent in June from -0.37 in May.

Supporting the index were gains in commodity prices, the share market and dwelling approvals - countered by deterioration in aggregate monthly hours worked.

-

08:10

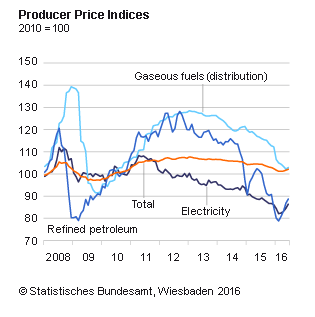

German producer prices up 0.4% in June

In June 2016 the index of producer prices for industrial products fell by 2.2% compared with the corresponding month of the preceding year. In May 2016 the annual rate of change all over also had been -2.7%.

Compared with the preceding month May 2016 the overall index rose by 0.4% in June 2016 (+0,4% in May and +0.1% in April 2016).

In June 2016 energy prices decreased by 6.5% compared with May 2015, prices of intermediate goods by 2.0% and prices of non-durable consumer goods by 0.2%. In contrast prices of capital goods rose by 0.6% and prices of durable consumer goods by 1.3%.

The overall index disregarding energy decreased by 0.7% compared with June 2015 and rose slightly by 0.2% compared with May 2016.

-

08:00

Germany: Producer Price Index (MoM), June 0.4% (forecast 0.2%)

-

08:00

Germany: Producer Price Index (YoY), June -2.2% (forecast -2.4%)

-

08:00

Germany: Producer Price Index (MoM), June 0.4% (forecast 0.2%)

-

07:06

-

00:30

Currencies. Daily history for Jul 19’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1017 -0,51%

GBP/USD $1,3097 -1,16%

USD/CHF Chf0,9855 +0,33%

USD/JPY Y106,14 +0,01%

EUR/JPY Y116,94 -0,50%

GBP/JPY Y139,03 -1,14%

AUD/USD $0,7506 -0,96%

NZD/USD $0,7055 +0,04%

USD/CAD C$1,302 +0,54%

-

00:03

Schedule for today, Wednesday, Jul 20’2016:

(time / country / index / period / previous value / forecast)

06:00 Germany Producer Price Index (MoM) June 0.4% 0.2%

06:00 Germany Producer Price Index (YoY) June -2.7% -2.4%

08:00 Eurozone Current account, unadjusted, bln May 34

08:30 United Kingdom Average Earnings, 3m/y May 2.0% 2.3%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May 2.3% 2.4%

08:30 United Kingdom Claimant count June -0.4 4

08:30 United Kingdom ILO Unemployment Rate May 5% 5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 19.4

14:00 Eurozone Consumer Confidence (Preliminary) July -7.3 -8

14:30 U.S. Crude Oil Inventories July -2.546

-