Noticias del mercado

-

16:48

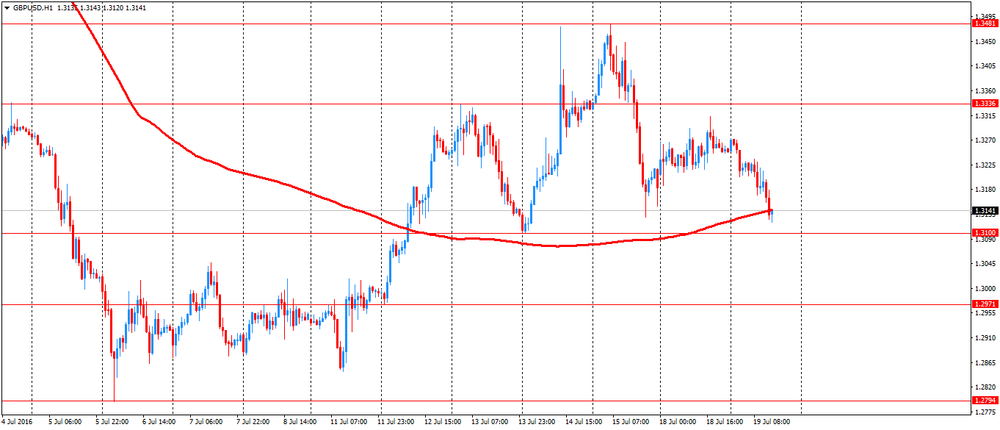

Sell Gbp/Usd - Morgan Stanley trade of the week

Currency investors should consider selling GBP/USD this week, advises Morgan Stanley in its weekly FX pick to clients.

"The BoE have made it clear that they will ease further this summer, most likely at the August meeting when they have run through new forecasts on the economy. More important for GBP is the environment that economic data will come in weaker as business activity slows down. Sure, the political risks have reduced as a Prime Minister and cabinet have been appointed. The GBP reaction going forward will be in response to monetary policy expectations as a result of weakness in data. The markets will pay particular attention to survey data between now and August 4.

From the GBP side, our view goes beyond immediate trade and growth shocks, and is focused on reduced prospects for investment, and what we see as an unsustainable current account deficit. The risk to this trade is that the broader USD weakness limits any downside in GBPUSD for now," MS argues.

We like to sell GBPUSD at 1.3500 with a target of 1.2500 and stop at 1.3800.

*MS maintains a limit order to sell GBP/USD in its portfolio with the same trade levels. Via efxnews.

-

16:28

ECB Seen in Search for "Comparatively Uncontroversial" Option - Dow Jones

According to Dow Jones Newswires, since the European Central Bank's inflation target is likely to remain unattainable for some considerable time, the bank will have to leave open the option to extend the duration of its asset purchase program, says Christian Reicherter, analyst at DZ Bank. It doesn't expect any adjustments to be made to key interest rates or to the purchase program at the upcoming meeting Thursday, but looks for changes in September. According to DZ Bank, one of the "comparatively uncontroversial" options which the ECB could take to further broaden the available universe of German government securities would be to raise the issue limit for bonds without a CAC-clause, Mr. Reicherter says.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0990-1.1000 (EUR 544m) 1.1100 (1.1bln) 1.1145 (356m)

USD/JPY: 105.35-50 (USD 441m)

GBP/USD 1.3200 (GBP 821m) 1.3500 (824m)

EUR/GBP 0.8300 (EUR 596m)

AUD/USD 0.7600 (AUD 380m) 0.7625 (290m)

USD/CAD 1.2960-65 (USD 400m)

NZD/USD 0.7200 (NZD 200m)

-

15:42

IMF cuts global growt forecasts

- 2016 UK growth forecast reduced to 1.7% from 1.9% in April. 2017 growth at 1.3% from 2.2% in April

- IMF would've revised 2017 global growth forecast slightly upward if not for Brexit

- Japan growth forecast cut to 0.3% from 0.5%. Improves 2017 to 0.1% from a -0.1% contraction

- raises China 2016 growth forecasts to 6.6% from 6.5%. Sees 2017 growth slowing to 6.2%

- Global growth could fall to 2.8% in 2016 and 2017 under its severe alternative scenario of UK - EU divorce negotiations going badly, financial stress intensifying

-

14:44

US: housing starts and building permits rose significantly

Building Permits

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,153,000. This is 1.5 percent (±1.3%) above the revised May rate of 1,136,000, but is 13.6 percent (±0.6%) below the June 2015 estimate of 1,334,000. Single-family authorizations in June were at a rate of 738,000; this is 1.0 percent (±1.5%)* above the revised May figure of 731,000. Authorizations of units in buildings with five units or more were at a rate of 384,000 in June.

Housing Starts

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,189,000. This is 4.8 percent (±13.5%)* above the revised May estimate of 1,135,000, but is 2.0 percent (±12.9%)* below the June 2015 rate of 1,213,000. Single-family housing starts in June were at a rate of 778,000; this is 4.4 percent (±15.8%)* above the revised May figure of 745,000. The June rate for units in buildings with five units or more was 392,000.

-

14:38

European session review: the pound fell despite higher inflation

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 UK Producer Price Index (m / m) June 0.2% 0.1% Revised to 0.2% 0.2%

8:30 UK producers selling prices index, y / y in June -0.6% -0.7% Revised to -0.5% -0.4%

8:30 UK producers purchase prices index m / m 2.2% Revised June from 2.6% 1.1% 1.8%

8:30 UK purchasing producer prices index, y / y in June -4.4% -3.9% Revised to -0.8% -0.5%

8:30 UK Retail Price Index m / m in June 0.3% 0.2% 0.4%

8:30 UK Retail Price Index y / y in June 1.4% 1.5% 1.6%

8:30 UK Consumer Price Index m / m in June 0.2% 0.1% 0.2%

8:30 UK consumer price index base value, y / y in June 1.2% 1.3% 1.4%

8:30 UK Consumer Price Index y / y in June 0.3% 0.4% 0.5%

9:00 Eurozone index of sentiment in the business environment from the ZEW Institute in July 20.2 -14.7

9:00 Germany Sentiment Index in the business environment of the institute ZEW July 19.2 9.1 -6.8

The British pound fell, although inflation data in the UK was higher than forecast. According to analysts, it signals the market belief that the Bank of England at its meeting scheduled for August 4, will resort to change the monetary policy.

Initially, the pound being able to overcome the barrier of $ 1.32, however, turned out to be a temporary increase.

The weakness of the pound, which is observed after Brexit, obviously, put upward pressure on inflation, but the economic stimululus by the Bank of England is still expected.

Markets are preparing for the possibility that the International Monetary Fund (IMF) will cut its economic forecast.

In the UK, inflation accelerated more than expected in June, showed the data of the Office for National Statistics on Tuesday.

Consumer prices rose 0.5 percent year on year in June, faster than the growth of 0.3 percent recorded in May. Inflation was expected to rise to 0.4 percent.

Core inflation, which excludes energy, food, alcoholic beverages and tobacco, rose to 1.4 percent from 1.2 percent in May.On a monthly basis, consumer prices rose 0.2 percent in June as in May, above expectations of a growth by 0.1 percent.

In another report ONS showed that the index of producer prices has decreased by 0.4 percent compared to the previous year.

On a monthly basis, the index for Producer Price rose by 0.2 percent for the second month in a row.

Purchase prices of manufacturers registered a slower annual decline of 0.5 percent after easing 4.4 percent in May. Economists had forecast a 0.8 percent drop in June.

On a monthly basis the index of purchase prices of manufacturers advanced 1.8 percent, compared with the growth of 2.2 percent in the previous month and an increase of 1.1 percent forecast.

On Monday, the pound jumped to session highs after a Bank of England official said he was not sure that he would support lowering the interest rate at the August meeting of the central bank.

Minutes published last Thursday clearly demonstrated the intention of the bank to ease monetary policy next month to counter the adverse economic impact of Brexit.

The Bank of England kept interest rates at 0.5%, which was a surprise to the markets.

At the same time, Moody's warned that the creditworthiness of the United Kingdom is under pressure after the decision to leave the EU.

Moody's reported that the medium-term prospects for the British economy may be reduced if it fails to reach a new trade agreement with Europe, but also noted that economic growth will slow down significantly in the near future.

The rating agency forecast UK growth in 2016 at 1.5% and nearly 1% in 2017.

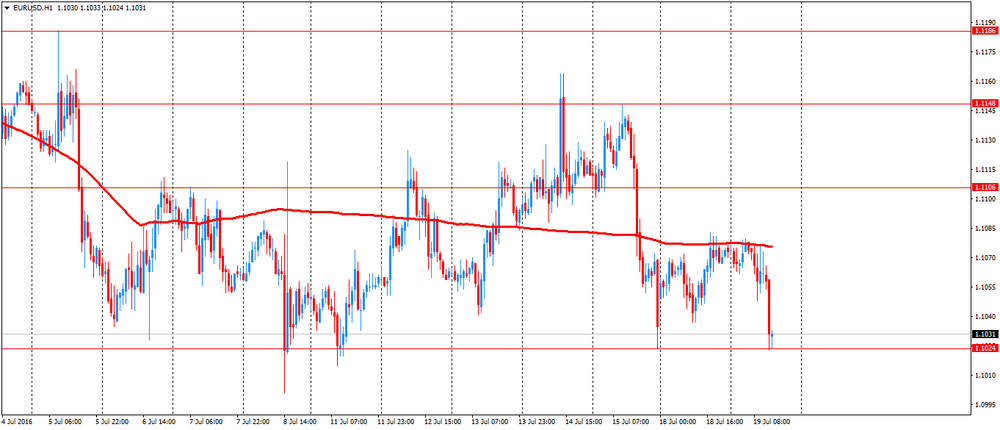

The euro fell against the US dollar after weak data from the ZEW institute. The indicator of economic sentiment in Germany fell in July to its lowest level in more than three years from Brexit fears and, consequently, uncertainty for the economy.

The index of sentiment in the business environment fell to -6.8 from 19.2 in June. The last reading was the lowest since November 2012 and well below the long-term average of 24.3 points.

"Brexit surprised the majority of financial market experts. The uncertainty about the consequences of the vote for the German economy is largely responsible for the significant decline in economic sentiment," said ZEW President Achim Wambach.

"In particular, concerns about export prospects and stability of the European banking and financial system, probably will fall heavily on the economic outlook."

The index of current conditions fell to 49.8 from 54.5. Economists expected the index to be 51.8.

The indicator of the current economic situation declined by 2.4 points to minus 12.4 points.

EUR / USD: during the European session, the pair fell to $ 1.1023

GBP / USD: during the European session, the pair fell to $ 1.3120

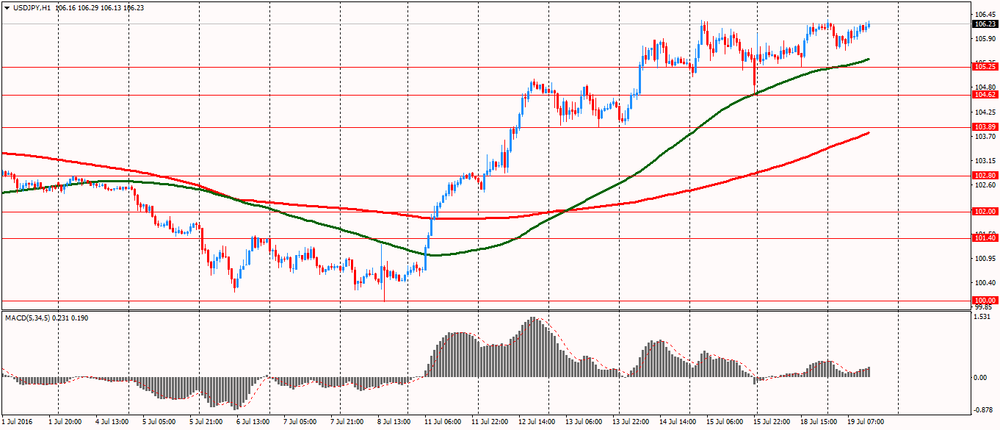

USD / JPY: during the European session, the pair rose to Y106.29

-

14:30

U.S.: Building Permits, June 1153 (forecast 1150)

-

14:30

U.S.: Housing Starts, June 1189 (forecast 1170)

-

13:51

Reuters: UK will not invoke EU Article 50 this year, government lawyer says

According to Reuters, Britain will not begin its formal divorce from the European Union by invoking Article 50 of the Lisbon Treaty this year, a government lawyer told the High Court on Tuesday.

Lawyer Jason Coppell indicated however that the government's current position could change.

"The current position is that notification will not occur before the end of 2016," Coppell said.

Prime Minister Theresa May has said article 50, which starts a two-year countdown to exit, should not be triggered this year.

Coppell was speaking at the start of the first of a series of lawsuits brought by individuals to demand that the British government win legislative approval from parliament before triggering Article 50.

-

13:48

Orders

EUR/USD

Offers : 1.1080 1.1100 1.1125-30 1.1150 1.1170 1.1185 1.1200

Bids: 1.1050 1.1030 1.1000 1.0975-80 1.0950 1.0930 1.0900

GBP/USD

Offers : 1.3225-30 1.3250 1.3270-75 1.3290-1.3300 1.3320 1.3350 1.3380 1.3400

Bids: 1.3180 1.3150 1.3130-35 1.3100 1.3060 1.3020 1.3000

EUR/GBP

Offers : 0.8400-05 0.8420-25 0.8450 0.8470 0.8485 0.8500

Bids: 0.8380 0.8360 0.8350 0.8325-30 0.8300 0.8285 0.8255-60 0.8230 0.8200

EUR/JPY

Offers : 117.50 117.70 118.00 118.25 118.50 119.00

Bids: 116.85 116.50 116.25 116.00 115.50 115.00 114.60 114.00

USD/JPY

Offers : 106.20 106.30-35 106.50 106.70 107.00 107.50

Bids: 105.80 105.60 105.30-35 105.00 104.80 104.50-60 104.20 104.00 103.80 103.50

AUD/USD

Offers : 0.7550 0.7580 0.7600 0.7620 O.7635 0.7650-55 0.7680 0.7700

Bids: 0.7500 0.7485 0.7470 0.7450 0.7420 0.7400

-

13:06

Turkish central bank cuts overnight rate by 0.25 %

-

13:05

Russia and Turkey will resume charter flights until the end of the year

Russia and Turkey will resume charter flights until the end of the year. Such an opinion was expressed by the executive director of the Association of Tour Operators of Russia (ATOR) Maya Lomidze, in an interview.

"The attempt of military coup in Turkey is strongly reflected in the significant decline of demand".

Earlier Lomidze stated that recent developments in Turkey could lead to the delayed restoration of charter flights.

On the night of July 16 a rebel group was attempted o a military coup. The main conflicts were in Ankara and Istanbul. The country's leadership has announced that the coup is suppressed. According to the latest information, 208 Turkish citizens were killed and 100 rebels were killed, about 1.5 thousand people were injured.

-

11:52

UK house price index up 8.1%

-

the average price of a property in the UK was £211,230

-

the annual price change for a property in the UK was 8.1%

-

the monthly price change for a property in the UK was 1.1%

-

the monthly index figure for the UK was 110.8 (January 2015 = 100)

The timing of the stamp duty tax seems to have cooled demand in recent months, but this follows an extended period of increases in activity. Following a 6.2% fall on the month in April 2016, the volume of lending approvals for house purchases recovered slightly, by 1.3% in May. However, approvals on a monthly basis are still below the levels seen in the 10 months before the stamp duty changes. Following a strong increase in sales in the month prior to the stamp duty changes (March 2016), UK home sales fell by 42.3% in April 2016 to their lowest level since May 2013.

-

-

11:34

Germany and EU Economic Sentiment caught up in Brexit Vote. This is how EU and UK data will look like in the next months?

The ZEW Indicator of Economic Sentiment for Germany decreased sharply in July 2016. The index has decreased by 26.0 points compared to the previous month, now standing at minus 6.8 points (long-term average: 243 points). This is the indicator's lowest reading since November 2012. "The Brexit vote has surprised the majority of financial market experts. Uncertainty about the vote's consequences for the German economy is largely responsible for the substantial decline in economic sentiment. In particular, concerns about the export prospectus and the stability of the European banking and financial system are likely to be a burden".

-

11:00

Germany: ZEW Survey - Economic Sentiment, July -6.8 (forecast 9.1)

-

11:00

Eurozone: ZEW Economic Sentiment, July -14.7

-

10:35

Better inflation from UK but the pound's reaction is limited so far

The Consumer Prices Index (CPI) rose by 0.5% in the year to June 2016, compared with a 0.3% rise in the year to May.

The June rate is a little above the position seen for most of 2016, though it is still relatively low historically.

Rises in air fares, prices for motor fuels and a variety of recreational and cultural goods and services were the main contributors to the increase in the rate.

These upward pressures were partially offset by falls in the price of furniture and furnishings and accommodation services.

CPIH (not a National Statistic) rose by 0.8% in the year to June 2016, up from 0.7% in May.

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , June -0.4% (forecast -0.5%)

-

10:30

United Kingdom: HICP, Y/Y, June 0.5% (forecast 0.4%)

-

10:30

United Kingdom: Retail prices, Y/Y, June 1.6% (forecast 1.5%)

-

10:30

United Kingdom: HICP, m/m, June 0.2% (forecast 0.1%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , June -0.5% (forecast -0.8%)

-

10:30

United Kingdom: Retail Price Index, m/m, June 0.4% (forecast 0.2%)

-

10:30

United Kingdom: Producer Price Index - Input (MoM), June 1.8% (forecast 1.1%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, June 1.4% (forecast 1.3%)

-

10:30

United Kingdom: Producer Price Index - Output (MoM), June 0.2% (forecast 0.2%)

-

10:00

Review of financial and economic press: Moody's put Turkey’s rating on review for downgrade

D / W

FAZ: The EU at a crossroads

Kerry: US-EU free trade area can compensate for the damage caused by Brexit

After the decision of the UK to withdraw from the EU Secretary of State John Kerry said the European Union has increased importance of the transatlantic trade and investment partnership agreements (TTIP). Speaking on Monday, July 18 at a meeting of EU foreign ministers in Brussels, Kerry said that the free trade agreement between the US and the European Union could serve as a counterweight to the negative economic consequences of Brexit. According to him, the US administration intends to reach an agreement with the European partners on this issue this year.

newspaper. ru

Bloomberg: Moody's put the rating of Turkey on review for downgrade

International rating agency Moody`s Investors Service placed the long-term credit rating of Turkey to the list of downward revision after the country was in an attempted military coup, Bloomberg writes.

IMF: Inflation in Venezuela in 2017 could exceed 1600%

The rise in prices in Venezuela at the end of this year may reach 480%, and exceeded 1640% next year, writes the Wall Street Journal, referring to the International Monetary Fund (IMF).

Stabilization of the Greek economy

The Greek authorities intend to hold a series of major reforms in the autumn, according to the Ministry of Finance Euclid Tsakalotosa. "The Greek government will conduct major reforms in the autumn. six or seven bills will be introduced, which will help the development of the economy ", - he said after talks with European Commissioner for Economy and Finance Pierre Moscovici.

Bank of America's profit for the second quarter fell by almost 20%

The second-largest US bank, Bank of America (BofA), reported a drop in quarterly profit by 19.4%, Reuters reported with reference to the report of the bank.

-

10:00

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0990-1.1000 (EUR 544m) 1.1100 (1.1bln) 1.1145 (356m)

USD/JPY: 105.35-50 (USD 441m)

GBP/USD 1.3200 (GBP 821m) 1.3500 (824m)

EUR/GBP 0.8300 (EUR 596m)

AUD/USD 0.7600 (AUD 380m) 0.7625 (290m)

USD/CAD 1.2960-65 (USD 400m)

NZD/USD 0.7200 (NZD 200m)

-

09:14

Citi: Core inflation in Australia in the second quarter will be 0.3%

Citi analysts said that core inflation in Australia in the second quarter will be 0.3%, and this will be enough to convince the Reserve Bank of Australia to cut its key interest rate by 25 basis points at the August meeting.

If inflation goes above this level, the lowering of the rates in August will be less likely, especially given the recent data that pointed to improvement in business sentiment and an increase in the number of jobs to full-time employment.

The ANZ also believe that the RBA will lower the key interest rate in August. "Core inflation in the second quarter is likely to remain low and the labor market has lost momentum in the current year, which could lead to a decrease in the key rate".

-

08:32

Options levels on tuesday, July 19, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1243 (3761)

$1.1211 (2190)

$1.1163 (1497)

Price at time of writing this review: $1.1072

Support levels (open interest**, contracts):

$1.0983 (3117)

$1.0914 (3749)

$1.0874 (6872)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 36244 contracts, with the maximum number of contracts with strike price $1,1200 (3761);

- Overall open interest on the PUT options with the expiration date August, 5 is 47534 contracts, with the maximum number of contracts with strike price $1,0900 (6872);

- The ratio of PUT/CALL was 1.31 versus 1.36 from the previous trading day according to data from July, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.3509 (1395)

$1.3412 (1910)

$1.3317 (710)

Price at time of writing this review: $1.3216

Support levels (open interest**, contracts):

$1.3088 (973)

$1.2991 (1390)

$1.2894 (752)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 22759 contracts, with the maximum number of contracts with strike price $1,3400 (1910);

- Overall open interest on the PUT options with the expiration date August, 5 is 20964 contracts, with the maximum number of contracts with strike price $1,2950 (2400);

- The ratio of PUT/CALL was 0.92 versus 0.90 from the previous trading day according to data from July, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:19

UK’s CPI is the main event of the day. Although most of the data was compiled before Brexit we will have a clear view about its impacts. Keep an eye on the pound

-

08:16

ECB may keep its dovish policy stance - Citi

The ECB will announce the rate decision this week. Although we expect the ECB may keep the interest rate and monetary policy unchanged, it may keep its dovish policy stance and may announce to extend QE in September, which may undermine EUR.

EUR/USD may find resistance at 1.1199. The pair may range trade between 1.0782-1.1199, with downside bias.

-

08:12

On Thursday, the RBNZ will assess the current economic situation

New Zealand's dollar fell after the Reserve Bank of New Zealand has recently announced its intention to present a new assessment of the economic situation on Thursday.

Analysts at Barclays recommended a sell on NZD/USD this week with the target of $ 0.7005. "On Thursday, the RBNZ will assess the current economic situation, and, according to our forecast, in the eve of this event, the kiwi will remain under pressure". The new assessment of the economic situation may create conditions for lowering rates at the next meeting of the RBNZ, which takes place on August 11th.

Commonwealth Bank of Australia said that NZD/USD, may be strong despite the prospect of further rate cut and expect to finds support in $ 0.6900 area.

-

08:07

Reserve Bank of Australia meeting minutes: Inflation will remain low for quite some time

- we watch the economic data and especially data on inflation, housing market, employment, to determine when it is necessary to change rates

- labor costs are very low

- housing market indicators in recent years have been mixed

- employment data more ambiguous

- commodity prices have strengthened, the Australian dollar exchange rate in line with expectations

- revision of the forecasts in August will help to identify the policy rate

-

08:03

Reserve Bank of New Zealand proposed changes to loan-to-value restrictions

The Reserve Bank of New Zealand proposed changes to loan-to-value restrictions to mitigate risks from financial stability stemming from property overheating.

In a consultation paper, released Tuesday, the bank said investors should deposit at least 40 for a home loan.

"No more than 5 percent of bank lending to residential property investors across New Zealand would be permitted with an LVR of greater than 60 percent," the bank said.

The proposed restriction is set to simplify the LVR policy by removing the current distinction between lending in Auckland and the rest of the country.

The banking system is heavily exposed to the property market and investor lending has been increasing rapidly, RBNZ Governor Graeme Wheeler said. The proposed restrictions recognize the higher risks associated with such lending, he added.

Wheeler observed that a sharp correction in house prices is a key risk to the financial system, and there are clear signs that this risk is increasing across the country.

The consultations will conclude on August 10 and new restrictions will take effect on September 1.

-

00:31

Currencies. Daily history for Jul 18’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1073 +0,34%

GBP/USD $1,3249 +0,50%

USD/CHF Chf0,9822 +0,01%

USD/JPY Y106,13 +1,20%

EUR/JPY Y117,52 +1,56%

GBP/JPY Y140,61 +1,68%

AUD/USD $0,7578 +0,05%

NZD/USD $0,7052 -0,88%

USD/CAD C$1,295 -0,12%

-

00:03

Schedule for today, Tuesday, Jul 19’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Meeting's Minutes

08:30 United Kingdom Producer Price Index - Output (MoM) June 0.1% 0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) June -0.7% -0.5%

08:30 United Kingdom Producer Price Index - Input (MoM) June 2.6% 1.1%

08:30 United Kingdom Producer Price Index - Input (YoY) June -3.9% -0.8%

08:30 United Kingdom Retail Price Index, m/m June 0.3% 0.2%

08:30 United Kingdom Retail prices, Y/Y June 1.4% 1.5%

08:30 United Kingdom HICP, m/m June 0.2% 0.1%

08:30 United Kingdom HICP ex EFAT, Y/Y June 1.2% 1.3%

08:30 United Kingdom HICP, Y/Y June 0.3% 0.4%

09:00 Eurozone ZEW Economic Sentiment July 20.2

09:00 Germany ZEW Survey - Economic Sentiment July 19.2 9.1

12:30 U.S. Housing Starts June 1164 1170

12:30 U.S. Building Permits June 1138 1150

-