Noticias del mercado

-

22:12

U.S. stocks rose

U.S. stocks rose, lifting the S&P 500 Index within striking distance of an all-time high, amid a mix of corporate results as investors await data Friday on the strength of the American economy. Stimulus bets influenced currency markets ahead of the Bank of Japan's policy meeting.

The S&P 500 staged an afternoon comeback to end five points below its record after falling as much as 0.4 percent. Earnings from Ford Motor Co. to Facebook Inc. tugged indexes in opposite directions. Google parent Alphabet Inc. surged almost 5 percent at 4:10 p.m. after its profit topped estimates. Amazon.com Inc. slipped 1 percent in late trading.

The dollar weakened on the Federal Reserve's assurance that it will raise rates gradually, while the yen erased gains before the BOJ stimulus decision. The pound slid on bets the Bank of England will lower rates next week. Oil slipped toward $41 a barrel, approaching a bear market.

While the prospects for additional central-bank support bolstered equities, better-than-forecast economic data and corporate earnings that broadly beat projections have also helped lift the S&P 500 this month. The gauge posted seven records in 10 days in a midmonth stretch, and it's rebounded 18 percent since its low in February. It's up 6 percent this year -- one of the best gains in developed-world equities.

Ford sank 8.2 percent after earnings missed estimates. General Motors Co. dropped 3.3 percent. Whole Foods Markets Inc. sank 9.5 percent on poor results. Facebook climbed to a record on sales that topped forecasts. MasterCard Inc., the second-largest U.S. payments network, advanced after saying profit rose 6.7 percent as customer card spending increased.

-

21:01

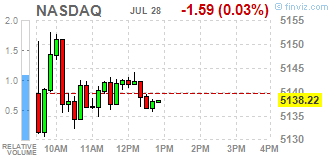

DJIA 18452.89 -19.28 -0.10%, NASDAQ 5151.42 11.61 0.23%, S&P 500 2169.14 2.56 0.12%

-

18:54

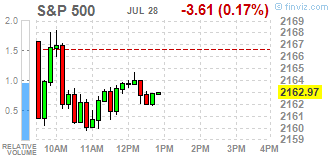

Wall Street. Major U.S. stock-indexes demonstrate moderate declines

Major U.S. stock-indexes demonstrated moderate declines amid disappointing data from the U.S. Labor Department, as well as mixed earnings reports that are unlikely to help to clarify the strength of the economy. In addition, investors continued to assess the implications of the Federal Reserve's most recent statement.

U.S. Labor Department revealed that the number of people claiming unemployment benefits grew to to 266,000 for the week ended July 22. That was above analysts' expectations of 260,000.

Focus is on Facebook (FB) and Ford Motor (F). Facebook posted its financials after yesterday's session. The company's results significantly exceeded analysts' expectations. Facebook's shares rose 0.52%.

The quarterly results of Ford Motor (F) disappointed investors, as posted profit missed analysts' expectations. The Ford's shares plunged by 9.65%. The shares of other automakers were also under pressure, with General Motors (GM) tumbling by 3.76% and Fiat Chrysler (FCAU) falling by 5.45%.

Investors also expect the release of quarterly results of Amazon.com Inc. (AMZN) and Alphabet Inc. (GOOG), which are set to be published after the market's close today.

.

Most of Dow stocks in negative area (22 of 30). Top loser - The Boeing Company (BA, -2.46%). Top gainer - Apple Inc. (AAPL, +0.74%).

Most of S&P sectors in negative area. Top loser - Basic Materials (-0.65%). Top gainer - Conglomerates (+0.82%).

At the moment:

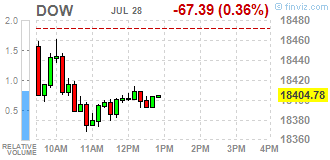

Dow 18321.00 -69.00 -0.38%

S&P 500 2156.25 -4.25 -0.20%

Nasdaq 100 4696.00 -11.75 -0.25%

Crude Oil 41.08 -0.84 -2.00%

Gold 1340.70 +6.20 +0.46%

U.S. 10yr 1.51 -0.01

-

18:00

European stocks closed: FTSE 6721.06 -29.37 -0.44%, DAX 10274.93 -44.62 -0.43%, CAC 4420.58 -26.38 -0.59%

-

17:55

WSE: Session Results

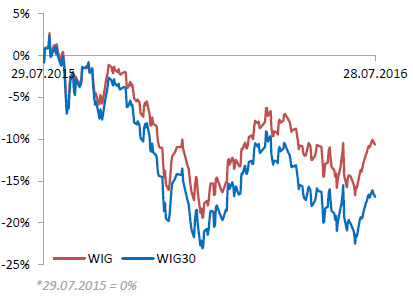

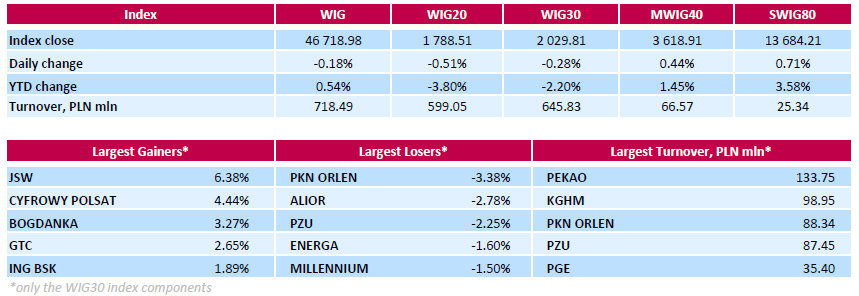

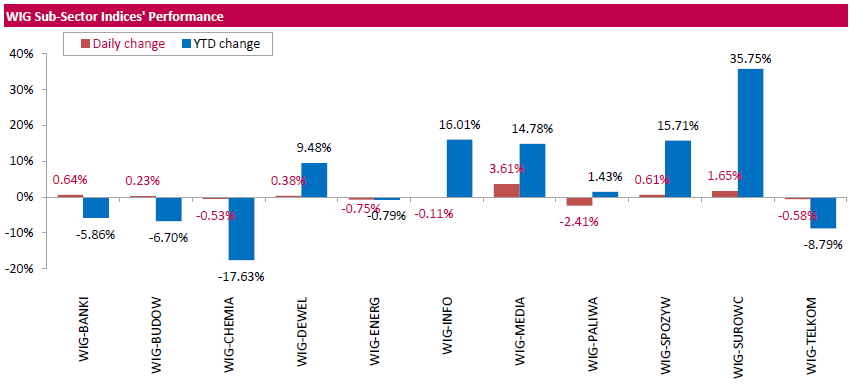

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, declined by 0.18%. Sector performance within the WIG Index was mixed. Media (+3.61%) outperformed, while oil and gas (-2.41%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.28%. In the index basket, the decliners were led by oil refiner PKN ORLEN (WSE: PKN), which tumbled by 3.38%. Other major laggards were bank ALIOR (WSE: ALR), insurer PZU (WSE: PZU) and genco ENERGA (WSE: ENG), which plunged by 2.78%, 2.25% and 1.60% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the gainers, jumping by 6.38%, partially supported by an analyst upgrade. It was followed by media group CYFROWY POLSAT (WSE: CPS), thermal coal miner BOGDANKA (WSE: LWB) and property developer GTC (WSE: GTC), which advanced by 4.44%, 3.27% and 2.65% respectively.

-

15:52

WSE: After start on Wall Street

In the afternoon, we met weekly data from the US labor market. The number of applications for unemployment benefits in the US rose at the about 14 thousand, what is a result of slightly higher than forecast, but remains at a very low level, and 73 weeks in a row is below the critical limit of 300 thousand. From the point of view of investors is not important information because it does not lead to any changes.

The market in the United States opens in neutral and remains with a well-known consolidation. The Federal Reserve and the data from the labor market have not proved an important stimulus, and today it is difficult to expect changes as a result of the empty calendar.

-

15:33

U.S. Stocks open: Dow +0.15%, Nasdaq -0.17%, S&P -0.05%

-

15:08

Before the bell: S&P futures -0.06%, NASDAQ futures -0.10%

U.S. index futures were little changed as investors assessed a mixed bag of corporate earnings and the Fed's yesterday statement.

Global Stocks:

Nikkei 16,476.84 -187.98 -1.13%

Hang Seng 22,174.34 -44.65 -0.20%

Shanghai 2,994.98 +2.98 +0.10%

FTSE 6,743.64 -6.79 -0.10%

CAC 4,452.35 +5.39 +0.12%

DAX 10,311.25 -8.300 -0.08%

Crude $42.01 (+0.21%)

Gold $1341.30 (+1.10%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.75

0.08(0.7498%)

17962

ALTRIA GROUP INC.

MO

68.81

0.88(1.2954%)

17960

Amazon.com Inc., NASDAQ

AMZN

739.63

4.04(0.5492%)

9804

Apple Inc.

AAPL

104.31

7.64(7.9032%)

4208997

AT&T Inc

T

42.38

0.00(0.00%)

4474

Barrick Gold Corporation, NYSE

ABX

20.62

0.17(0.8313%)

45981

Boeing Co

BA

137.5

2.65(1.9651%)

172227

Caterpillar Inc

CAT

82.42

-0.33(-0.3988%)

5709

Chevron Corp

CVX

102.61

-0.07(-0.0682%)

770

Cisco Systems Inc

CSCO

30.91

0.03(0.0971%)

16933

Citigroup Inc., NYSE

C

44.22

0.07(0.1586%)

25189

E. I. du Pont de Nemours and Co

DD

69.53

0.37(0.535%)

1872

Exxon Mobil Corp

XOM

91.5

-0.03(-0.0328%)

5074

Facebook, Inc.

FB

122.43

1.21(0.9982%)

431905

Ford Motor Co.

F

13.83

-0.03(-0.2165%)

62069

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.71

0.03(0.2366%)

103109

General Electric Co

GE

31.54

0.07(0.2224%)

12787

General Motors Company, NYSE

GM

32.05

-0.10(-0.311%)

662

Goldman Sachs

GS

161.35

0.19(0.1179%)

1490

Google Inc.

GOOG

739.94

1.52(0.2058%)

3358

Intel Corp

INTC

35.09

0.00(0.00%)

47843

International Business Machines Co...

IBM

162.45

0.33(0.2036%)

1135

Johnson & Johnson

JNJ

125.3

0.15(0.1199%)

655

JPMorgan Chase and Co

JPM

64.1

-0.03(-0.0468%)

5337

McDonald's Corp

MCD

121.8

0.09(0.0739%)

6954

Merck & Co Inc

MRK

58.36

0.00(0.00%)

600

Microsoft Corp

MSFT

56.74

-0.02(-0.0352%)

20181

Pfizer Inc

PFE

36.88

0.05(0.1358%)

3385

Procter & Gamble Co

PG

85.31

0.04(0.0469%)

1394

Starbucks Corporation, NASDAQ

SBUX

58.3

-0.01(-0.0172%)

2266

Tesla Motors, Inc., NASDAQ

TSLA

229.1

-0.41(-0.1786%)

8838

The Coca-Cola Co

KO

44.22

-0.66(-1.4706%)

227847

Twitter, Inc., NYSE

TWTR

16.42

-2.03(-11.0027%)

1347813

United Technologies Corp

UTX

108.5

0.61(0.5654%)

3418

UnitedHealth Group Inc

UNH

141.5

-0.20(-0.1411%)

700

Verizon Communications Inc

VZ

54.84

0.03(0.0547%)

3260

Walt Disney Co

DIS

96.96

0.27(0.2792%)

4090

Yahoo! Inc., NASDAQ

YHOO

38.84

0.08(0.2064%)

3117

Yandex N.V., NASDAQ

YNDX

21.2

0.07(0.3313%)

1934

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Apple (AAPL) upgraded to Buy from Long-term Buy at Hilliard Lyons

Downgrades:

Facebook (FB) downgraded to Neutral from Buy at Monness Crespi & Hardt

Other:

Facebook (FB) target raised to $160 from $155 at Axiom Capital

Facebook (FB) target raised to $150 from $140 at Mizuho

Facebook (FB) target raised to $150 from $130 at Needham

Facebook (FB) target raised to $185 at Piper Jaffray

Facebook (FB) target raised to $150 at Cowen; Outperform

Facebook (FB) target raised to $170 from $165 at RBC Capital Mkts

Coca-Cola (KO) target lowered to $50 from $54 at Stifel

-

13:59

Company News: Intl Paper (IP) Q2 EPS beat analysts’ estimate

Intl Paper reported Q2 FY 2016 earnings of $0.92 per share (versus $0.97 in Q2 FY 2015), beating analysts' consensus estimate of $0.84.

The company's quarterly revenues amounted to $5.322 bln (-6.9% y/y), generally in-line with analysts' consensus estimate of $5.314 bln.

IP closed Wednesday's trading session at $45.59 (-0.02%).

-

13:42

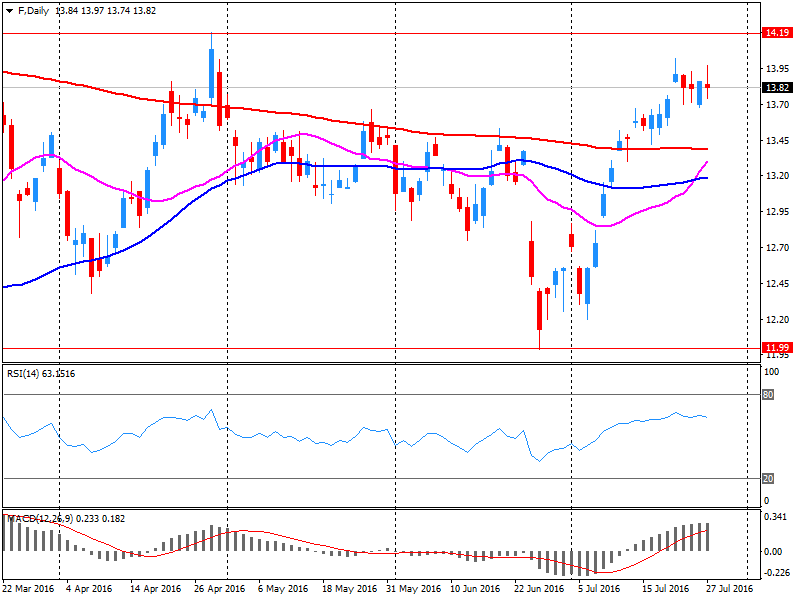

Company News: Ford Motor (F) Q2 EPS miss analysts’ estimate

Ford Motor reported Q2 FY 2016 earnings of $0.52 per share (versus $0.47 in Q2 FY 2015), missing analysts' consensus estimate of $0.60.

The company's quarterly revenues amounted to $37.000 bln (+5.4% y/y), beating analysts' consensus estimate of $36.279 bln.

F fell to $12.88 (-6.94%) in pre-market trading.

-

13:09

WSE: Mid session comment

The first half of today's session showed clearly that the Warsaw Stock Exchange remains true to its independence, especially when located near resistance. The round level of 1,800 points well act as a barrier for demand. While the blue chips sector caught short of breath and is on the verge of breaking, generating a signal that could be an invitation to expand profit taking, the second and third line are doing much better. The mWIG40 increases (+0,12%) and even more stable behaves the sWIG80 (+0,25%), so the sentiment among these companies is still good

At the halfway point of listing the WIG20 index was at the level of 1,786 points (-0,61%).

-

13:04

Major stock indices in Europe declined

European stocks traded slightly downward. Investors analyzed a mixed corporate reporting, as well as waiting for the results of stress tests in the euro zone, which will be published tomorrow.

Focus was also are the results of the July meeting of the Fed. Recall, as expected the Fed left interest rates unchanged, but gave no clear signals about future plans. Investors slightly reduced the likelihood of a rate hike in September, although the Central Bank has improved the economic outlook and said that short-term risks to the economy declined.

According to CME Group, futures on interest rates Fed point to 18% probability of a rate hike in September.

Some support the market have the latest data on Germany and the euro zone. Germany Ministry of Labor said that the number of applications for unemployment benefits in July fell by 7,000 after declining in June 6000. The unemployment rate in July remained at the level of 6.1%, in line with expectations.

Meanwhile, the European Commission reported that the index of economic sentiment rose in July to 104.6 points compared with 104.4 points in June. Experts expect that figure will drop to 103.7 points. Sentiment among consumers fell in July from -7.2 points to -7.9 points, confirming the initial assessment and forecasts. Sentiment in the services sector rose to 11.1 from 10.9 in June (revised from 10.8). Analysts had expected a decline to 10.3. Meanwhile, the index of business optimism in industry rose to -2.4 points to -2.8 points in June. It was expected that the index would fall to -3.4 points. Sentiment Index in the business community has improved to 0.39 points versus 0.22 points in June. Analysts predicted that the rate will fall to 0.17 points. Sentiment index for the retail sector rose to 1.8 from 0.8, and the confidence index for construction reached a level of -16.3 versus -18.2 in June.

The composite index of Europe's largest enterprises Stoxx 600 lost 0.4%.

Shares of the banking sector shows the largest decline among the 19 industry groups in anticipation of the stress tests outcomes "Markets are now digest all previous successes after a decline due to Brexit, - said Philippe Gijsels BNP Paribas -. Corporate profits were generally good, except for a few companies. Investors can exercise some caution on the eve of the meeting of the Bank of Japan and after a strong rally, which may indicate some overbought ".

Shares of Royal Dutch Shell Plc fell 2.5 percent after the company reported that the amount of profit was less than half the average analysts' estimates

Quotes of Lloyds Banking Group Plc fell 3.7 percent amid falling outlook for capital formation in 2016 that increased concerns about rising dividends.

The cost of Dialog Semiconductor Plc sank 7.1 percent as the company cut its forecast for full-year sales

Capitalization of JCDecaux SA decreased by 7 percent after the company's statement that the expected slowdown in the UK will influence the local advertising market

Saipem SpA shares fell 9 percent after lowering profit and sales forecasts for 2016.

At the moment:

FTSE 100 6731.58 -18.85 -0.28%

DAX -5.45 10314.10 -0.05%

CAC -8.35 4438.61 -0.19%

-

12:53

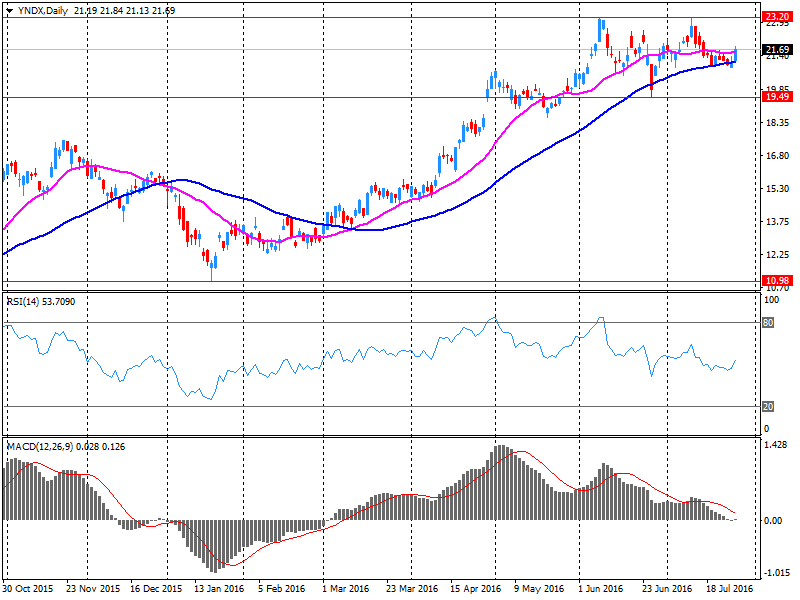

Company News: Yandex N.V.(YNDX) Q2 results beat analysts’ expectations

Yandex N.V.reported Q2 FY 2016 earnings of RUB 12.05 per share (versus RUB 8.63 in Q2 FY 2015), beating analysts' consensus estimate of RUB 9.26.

The company's quarterly revenues amounted to RUB 18.040 bln (+29.6% y/y), beating analysts' consensus estimate of RUB 17.611 bln.

YNDX rose to $22.38 (+3.09%) in pre-market trading.

-

12:25

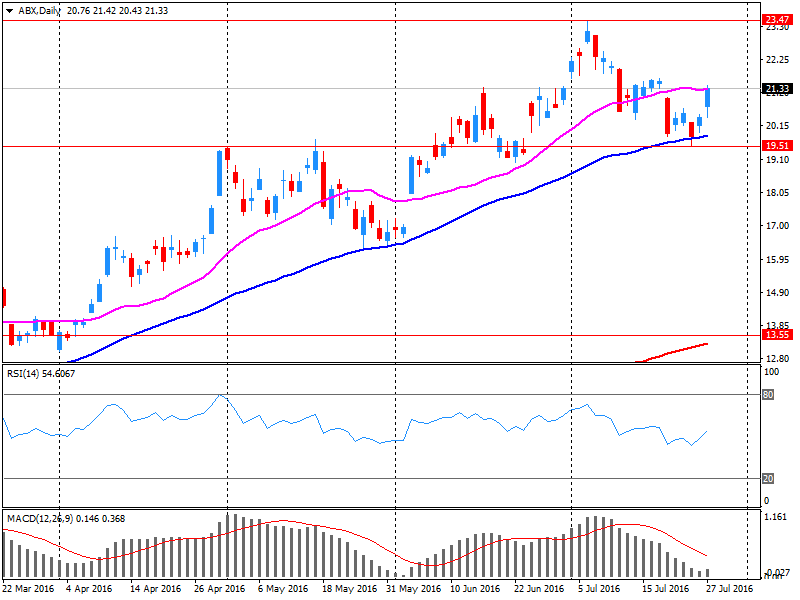

Company News: Barrick Gold (ABX) Q2 results miss analysts’ estimates

Barrick Gold reported Q2 FY 2016 earnings of $0.14 per share (versus loss of $0.01 in Q2 FY 2015), missing analysts' consensus estimate of $0.15.

The company's quarterly revenues amounted to $2.012 bln (-9.8% y/y), missing analysts' consensus estimate of $2.073 bln.

ABX fell to $21.24 (-0.52%) in pre-market trading.

-

09:18

WSE: After opening

WIG20 index opened at 1791.55 points (-0.34%)*

WIG 46780.65 -0.05%

WIG30 2033.44 -0.10%

mWIG40 3600.11 -0.08%

*/ - change to previous close

On the Warsaw market contracts started from cosmetic minus (-0.22%). The same FOMC message has not changed much and the market remains in consolidation.

The WIG20 index started today's session with downward move by 0.34% to 1,791 points. At the same time, the German DAX opened with a loss of less than half. The little gains on Pekao may be a good news in the context of yesterday discounts. The market itself is moving on well-known yesterday levels and its image remains neutral.

-

08:22

WSE: Before opening

The highlight of the last hours of the financial markets was the end of the Fed meeting. Nothing special has been passed in the message and the Fed left its key interest rate in the range of 0.25-0.5%, while stating that the short-term risk to the US economic growth weakened.

The probability of increases after yesterday's meeting did not change significantly, where possible deadline for such a move is now estimated on December (approx. 40%) after the US presidential election. After this message, the price of gold rose and the dollar weakened.

In the morning, most Asian parquet on the little lost, led by the Nikkei falling by 1,0%. Contracts in the US are stable, but the expectations indicate the possibility of light falls on the opening in Europe.

From the point of view of the Warsaw Stock Exchange it is a neutral picture of the situation. There is no strong impulse to snatch the market from around 1,800 points. Investors will continue to focus its attention on the banking sector, we are still waiting for the results of stress tests of European banks (Friday) and the law on foreign currency loans in Poland (by the end of the week).

-

08:22

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,1%, FTSE 100 -0,1%, CAC 40 -0.2%

-

07:15

Global Stocks

European stocks finished higher Wednesday, with surges in shares of French firms LVMH Moët Hennessy Louis Vuitton and Peugeot SA helping to offset a drop in Deutsche Bank AG shares after the German lender's profit plunged.

The Stoxx Europe 600 SXXP, +0.43% rose 0.4% to end at 342.74.

U.S. stocks ended slightly lower Wednesday after the Federal Reserve said improving economic conditions could justify an interest-rate hike as soon as September. The S&P 500 SPX, -0.12% shed 3 points, or 0.1% to 2,166, as declines in utilities and consumer-staples shares weighed on the index. The Dow industrials DJIA, -0.01% finished flat at 18,472, despite a strong performance by Apple Inc. AAPL, +6.50% which reported stronger-than-expected quarterly earnings late Tuesday. The Nasdaq Composite gained 30 points, or 0.6%, to 5,139. Economic data released Wednesday seemed to contradict the Fed's sanguine outlook. Durable-goods orders sank in June at the fastest clip in nearly two years.

Asian stocks edged up on Thursday after the Federal Reserve provided an positive assessment of the world's largest economy and lifted risk sentiment.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.2 percent after briefly climbing to its highest level since August 2015.

Australian shares rose 0.4 percent and Shanghai .SSEC gained 0.3 percent, trimming some of the heavy 1.9 percent loss suffered the previous day.

News that Chinese regulators are planning a tough clampdown on wealth management products to curb risks to the country's banking system had weighed heavily on Chinese stocks, but investors are still wading through the details.

Japan's Nikkei fell 0.7 percent, hurt by a stronger yen and nerves before the Bank of Japan's monetary policy decision on Friday.

-

04:03

Nikkei 22516,521.49 -0.86%, Shanghai Composite 2,981.46 -0.35%, S&P/ASX 200 5,557.2 +0.32%

-

00:36

Stocks. Daily history for Jun Jul 27’2016:

(index / closing price / change items /% change)

Nikkei 225 16,664.82 +1.72%

Shanghai Composite 2,991.12 -1.94%

CAC 40 4,446.96 +1.19%

FTSE 100 6,750.43 +0.39%

Xetra DAX 10,319.55 +0.70%

S&P 500 2,166.58 -0.12%

Dow Jones 18,472.17 -0.01%

S&P/TSX Composite 14,546.54 -0.02%

-