Noticias del mercado

-

22:16

U.S.: Total Vehicle Sales, mln, July 17.88 (forecast 17.1)

-

16:52

GlobalDairyTrade auction results

The price of dairy products increased by 6.6% after it remained unchanged at the previous auction. It is worth emphasizing the latter increase was the most significant since the beginning of October 2015.

Dairy products make up a significant proportion of New Zealand's exports, so the dynamics of their prices has a direct impact on the New Zealand dollar. After the announcement of the results of the auction a NZD / USD rose to 0.7231.

-

16:14

Canadian manufacturing output improves in July

Canadian manufacturers indicated another improvement in business conditions during July, underpinned by modest rises in output, new orders and employment levels. However, there were signs of weaker demand from export markets, as highlighted by a renewed drop in new work from abroad. Meanwhile, exchange rate depreciation against the U.S. dollar continued to push up overall input costs in July, with survey respondents citing higher steel prices in particular. The headline figure derived from the survey is the Markit Canada Manufacturing Purchasing Managers' Index™ (PMI™), which is designed to provide timely indications of changes in prevailing business conditions in the Canadian manufacturing sector. PMI readings above 50.0 signal an improvement in business conditions, while readings below 50.0 signal deterioration. At 51.9 in July, the seasonally adjusted Markit Canada Manufacturing PMI was up fractionally from 51.8 in June and above the neutral 50.0 value for the fifth consecutive month. This signalled a moderate improvement in overall business conditions, but the latest reading was still weaker than the average since the survey began in October 2010 (52.5).

-

15:49

Option expiries for today's 10:00 ET NY cut

AUD/USD 0.7370 (AUD 1.2bln) 0.7445-60 (760m) 0.7520 (1.1bln) 0.7570 (270m) 0.7600 (320m)

USD/CAD 1.3000 (USD 1.3bln)

-

15:34

Fed Kaplan: World production and consumption of oil will gain balance in the 1st half of 2017

- Oil prices will remain volatile until the end of the year

- Kaplan expects further bankruptcies, mergers and acquisitions in the energy sector in the current year

- Data on GDP for the 1st and 2nd quarter were disappointing

- Dallas Fed still expects GDP growth for the year as a whole at the level of 2% due to strong consumer demand

- Dallas Fed predicts decline in the proportion of economically active population to 61% by 2024

- I am sure that the general inflation will touch 2% in the medium term

- China's GDP growth is likely to slow

- It takes time to exert the influence of Brexit

- The stimulus should be reduced gradually and patiently

- The neutral rate decreased significantly over the last few years

- Reduced rates complicates the use of monetary policy

- Needed structural reforms and measures of fiscal policy to support economies

-

14:35

US: personal income rose 0.2% in June

Personal income increased $29.3 billion (0.2 percent) in June according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $24.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $53.0 billion (0.4 percent).

Real DPI increased 0.1 percent in June and Real PCE increased 0.3 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent. The increase in personal income in June primarily reflected increases in private wages and salaries and nonfarm proprietors' income that were partly offset by decreases in personal dividend income and personal interest income.

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, June 1.6%

-

14:30

U.S.: Personal spending , June 0.4% (forecast 0.3%)

-

14:30

U.S.: Personal Income, m/m, June 0.2% (forecast 0.3%)

-

14:30

U.S.: PCE price index ex food, energy, m/m, June 0.1% (forecast 0.1%)

-

14:29

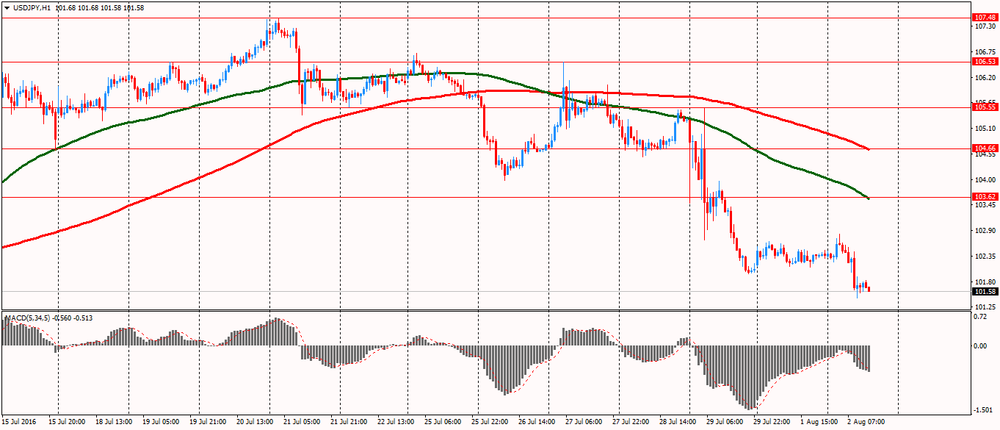

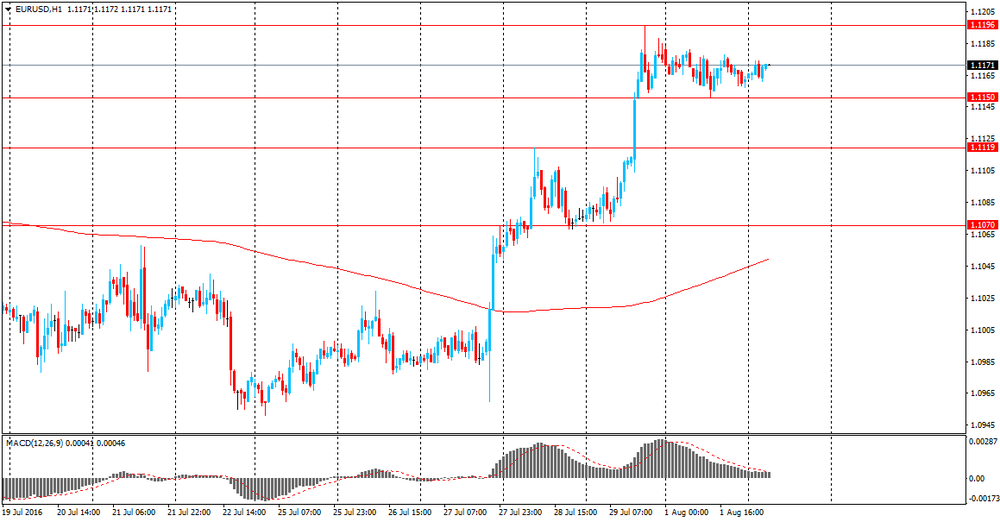

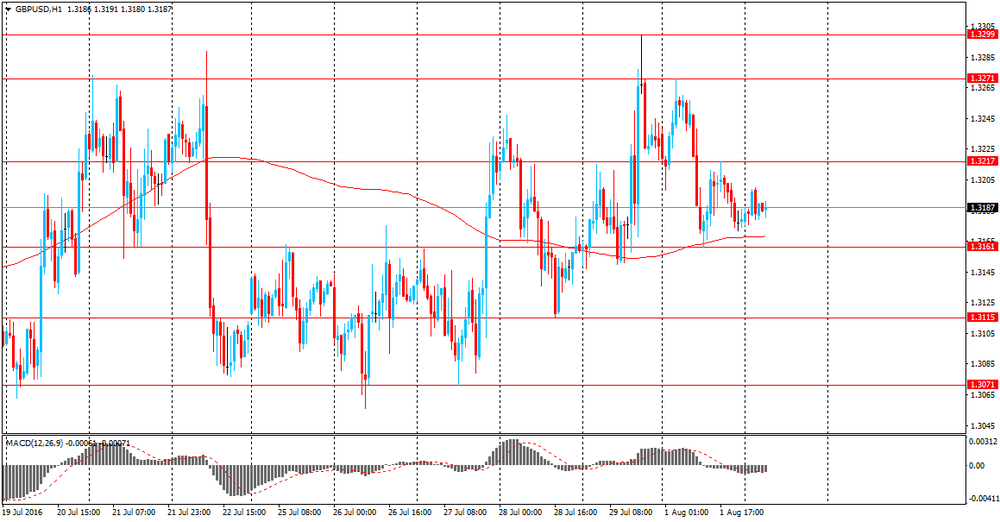

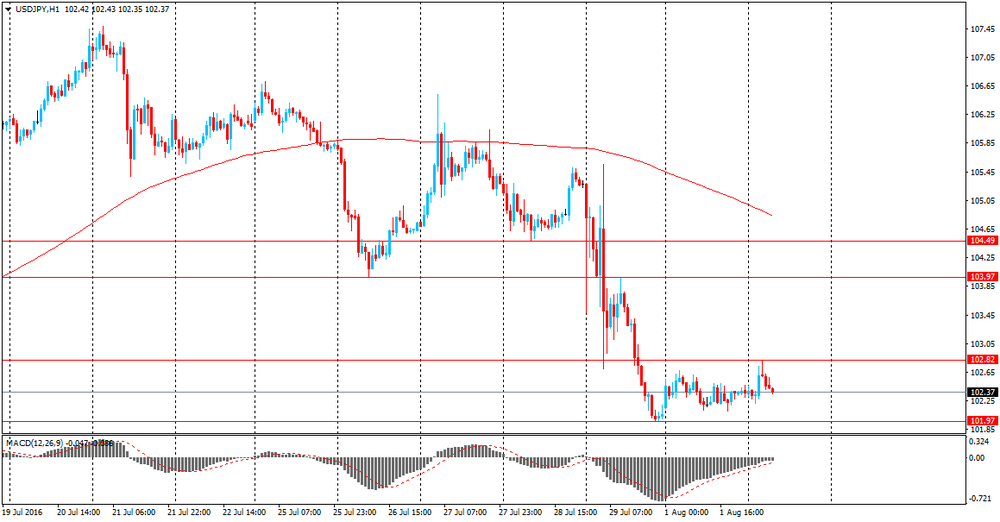

European session review: US dollar fell against major currencies

The following data was published:

(Time / country / index / period / previous value / forecast)

Switzerland 7:15 Retail sales, y / y in June -1.7% -1.6% Revised to -3.9%

Switzerland 7:30 PMI in the manufacturing sector in July 51.6 51.7 50.1

8:30 UK index of business activity in the construction sector, m / m in July 46 43.8 45.9

9:00 Eurozone Producer Price Index m / m in June 0.6% 0.4% 0.7%

9:00 Eurozone Producer Price Index y / y in June -3.9% -3.5% -3.1%

The US dollar fell to a fresh five-week low against a basket of major currencies on Tuesday after reports of additional measures to stimulate the economy in Japan, while the lowered expectations of growth in the US putting pressure on the US currency before the end of the year.

The yen has strengthened the position after Japanese Prime Minister Shinzo Abe announced fresh stimulus to revitalize the Japanese economy.

The program includes 13.5 trillion yen of financial measures, of which about 7.5 trillion yen account for direct costs of stimulus measures over the next two years.

On Monday, the Institute for Supply Management said its index of business activity in the manufacturing sector fell to 52.6 last month from June's 53.2. Analysts had expected the index to decline in July to 53.0.

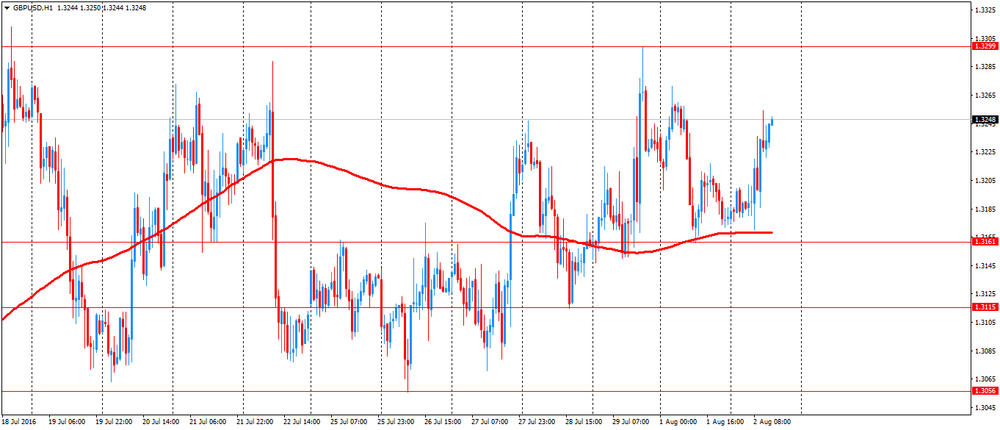

The pound rose against the dollar, despite the weak data on business activity in the construction sector. UK construction sector contracted less than expected in July, showed on Tuesday the results of a survey published by Markit.

Purchasing Managers' Index from Markit / Chartered Institute of Purchasing and Supply fell to 45.9 in July from 46.0 in June. According to forecasts, the index was expected to decline to 43.8.

The index has been below the neutral level of 50.0 for the second month in a row, reflecting a reduction in the sector.

The index signaled the fastest decline in production in the construction sector since June 2009. The companies said that the weaker order books continued to act as a brake on economic activity in July.

Uncertainty after the referendum on EU membership was the main factor that affected the business activity in July, especially in the sector of commercial construction, Markit said.

Respondents indicated increased risk aversion and reduced investment spending among customers, despite the large number of speculative inquiries in anticipation of lower charges, said Tim Moore, senior economist at Markit.

"While there is little evidence of an imminent turn in business conditions, environmental factors seem to soften the fall of the British business optimism among construction companies."

The euro rose against the US dollar, supported by data on producer prices. Eurozone producer prices rose for the second month in a row in June, according to Eurostat.

Industrial producer prices rose by 0.7 percent for the month in June, slightly faster than the 0.6 percent rise in May.

On an annual basis, producer prices fell at a slower pace of 3.1 percent in June, after falling 3.8 percent the previous month, which was revised from a 3.9 percent fall reported initially.

Excluding energy, producer prices rose by 0.2 percent for the month, while they fell by 1.0 percent from June 2015.

Energy prices fell by 8.7 percent annually in June, while they rose by 2.4 percent compared to the previous month.

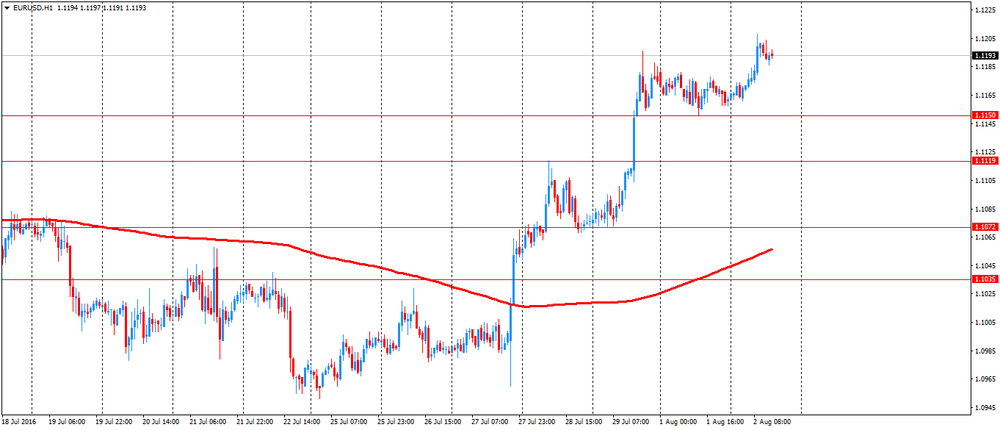

EUR / USD: during the European session, the pair rose to $ 1.1208

GBP / USD: during the European session, the pair rose to $ 1.3254

USD / JPY: during the European session, the pair fell to Y101.44

-

14:07

A Spike Higher In EUR/USD and a Short Squeeze In GBP/USD? - Societe Generale

"The US economy is still trundling along at a 2%-ish rate, unable to deliver an investment-led acceleration but unlikely to see these weak figures persist as long as there is any slack left in the labour market. So the soggy data, combined with the sense that the global economy is still comfortably away from stalling speed, merely reinforce the pressure on investors to search for yield, wherever and whenever they can find it.

In that context it's hard to be bullish of the dollar, unfortunately. Yield support is absent, and CFTC positioning data show dollar longs being cautiously rebuilt, and the GDP data will go a long way towards keeping the Fed inactive through the presidential elections. Not a good mix. Beware, in particular, a short squeeze in GBP/USD and a spike higher in EUR/USD.

UK PMI and CBI data were dire, and we'll get more PMI figures at the start of the week. We'll get a rate cut and more asset purchases from the BOE as well. Sterling is doomed to fall. And yet...the market is geared up for MPC easing, braced for bad data and short sterling already" - efxnews.

-

12:08

MPC, Charlie Bean: BOE rate cut won't have a huge economic impact

-

Given the data post-Brexit, some sort of stimulus is warranted

-

Fiscal policy is key after the vote

-

Is surprised by the extent of the BOE steer on stimulus

-

Doesn't rule out joint action between the BOE and Treasury

*via forexlive

-

-

12:06

Switzerland: Retail sales continue to decline

Swiss retail sales continued to decline in June, data released by the Federal Statistical Office on Tuesday.

Retail sales declined by 3.9 percent year on year in June, faster than the decline of 1.7 percent recorded in May. In addition, the decline was larger than expected (- 2 percent).

On a monthly basis, retail trade turnover recorded a decline of 0.5 percent in June.

Except for service stations, retail sales fell 0.5 percent in May. Sales of food, drinks and tobacco fell by 0.7 percent and non-food sales were down 0.6 percent.

In nominal terms, the total turnover of retail trade decreased by 4.6 percent in June compared with the previous year. The decline continued in January 2015, and that was the biggest decline since January 2003, said the Bureau of Statistics.

In monthly terms, the nominal retail trade turnover fell by 3.9 per cent in June.

-

11:07

Euro Zone producer prices increased in June

In June 2016, compared with May 2016, industrial producer prices rose by 0.7% in the euro area (EA19) and by 0.8% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In May 2016 prices increased by 0.6% in both zones. In June 2016, compared with June 2015, industrial producer prices decreased by 3.1% in the euro area and by 2.9% in the EU28.

The 0.7% increase in industrial producer prices in total industry in the euro area in June 2016, compared with May 2016, is due to rises of 2.4% in the energy sector, of 0.3% for intermediate goods and of 0.1% for both capital goods and non-durable consumer goods, while prices remained stable for durable consumer goods. Prices in total industry excluding energy increased by 0.2%.

-

11:01

EUR/USD: Gains Unlikely Sustainable - BTMU

"USD: The US dollar weakened by 0.6% on a DXY index basis in July with all of that depreciation and some more coming on the final trading day of the month in response to weaker than expected real GDP data for Q2. Real GDP growth has now been very subdued for three quarters, averaging just 1.0% over that period, adding more uncertainty to the economic outlook. However, we expect better growth rates in Q3 and Q4 and for the Federal Reserve to raise the federal funds rate in December.

Risks are skewed to the downside for the dollar over the short-term with economic uncertainty reinforced by political uncertainty ahead of the presidential election on 8th November. While downside risks are evident we still expect the dollar to be broadly stable as weak growth abroad and central bank easing in response provides support for the dollar. Once the election has passed and the Fed lifts rates as economic and political uncertainties fade, the dollar is set to perform well.

EUR: The increased economic and political uncertainty in the US that is set to weigh on the US dollar is likely to result in continued stability for the EUR/USD rate.

There are now perhaps greater upside risks over the short-term given the euro-zone large current account surplus will add to the attraction of the euro in circumstances of increased uncertainty.

However, any gains for the euro are unlikely to be sustained given eurorelated risks may also intensify. Increasing episodes of terrorism ahead of key elections in France and Germany next year which follow the constitutional reform referendum in Italy in October mean scope for EUR appreciation is limited".

Copyright © 2016 BTMU, eFXnews™

-

11:01

Eurozone: Producer Price Index, MoM , June 0.7% (forecast 0.4%)

-

11:01

Eurozone: Producer Price Index (YoY), June -3.1% (forecast -3.5%)

-

10:38

UK's construction sector PMI below 50

July data signalled a further downturn in UK construction output, but the rate of contraction was only fractionally faster than that seen during the previous survey period. At the same time, new order volumes dropped at a slower pace than the three-and-a-half year low seen in June. Anecdotal evidence suggested that economic uncertainty following the EU referendum was the main factor weighing on business activity in July, especially in the commercial building sector.

However, there were also reports suggesting that demand patterns had been more resilient than expected, and some firms linked new enquiries from international clients to exchange rate depreciation. The seasonally adjusted Markit/CIPS UK Construction Purchasing Managers' Index registered 45.9 in July, down fractionally from 46.0 in June and below the 50.0 no-change threshold for the second month running. The latest reading signalled the fastest overall decline in construction output since June 2009. This largely reflected the steepest fall in commercial building for over six-and-a-half years, alongside a drop in civil engineering activity for the first time in 2016. Residential construction also declined at a solid pace in July, but the rate of contraction eased from June's three-and-a-half year low.

-

10:31

United Kingdom: PMI Construction, July 45.9 (forecast 43.8)

-

09:30

Switzerland: Manufacturing PMI, July 50.1 (forecast 51.7)

-

09:28

Spanish employment continue to improve

The number of unemployed people registered at the offices of the Public Employment Services has dropped in July in 83,993 persons in relation to the previous month. This is the largest decline in July since 1997. Thus, the total number of registered unemployed stood at 3,683,061, the lowest since August 2009. During the last 8 years in this month, registered unemployment decreased by an average of 37,000 people. In seasonally adjusted terms, unemployment one month reduced by 48,573 persons in July. This is the largest reduction of the entire series in July.

-

09:12

Today’s events:

At 10:15 GMT FOMC member Robert Kaplan will deliver a speech

At 23:50 GMT the minutes of the Bank of Japan on monetary policy

-

09:04

Asian session review: The Australian dollar traded mixed

The Australian dollar fell sharply, reaching a minimum of $ 0.7480 after the Reserve Bank of Australia lowered its benchmark interest rate by 25 bps to 1.5%, but in the course of trading regained lost ground.

According to data published last week, in the second quarter, inflation fell to 1.5%, well below the central bank's target range of 2% -3%. RBA worry that low inflation can affect the mood of companies and households. According to the current forecast of the central bank, inflation returns to the target range until mid-2018.

In August 2013, the Australian central bank set the rate at 2.5% - this was the lowest level in the last 60 years. Nevertheless, due to the slowdown in economic growth the central bank decided to lower it again in February of last year to 2.25%, and three months later there was a new slide - to historically record low of 2%. In May of this year, the Central Bank, fearing the threat of deflation, lowered the rate to 1.75%, and today - another quarter percentage point.

The deficit of foreign trade of Australia rose sharply and amounted to AUD $ -3,2 billion from A $ -2.42 billion in May. Analysts had forecast a deficit of A $ -2,0 billion.

The trade balance - the indicator published by the Australian Bureau of Statistics, and assessing the ratio between exports and imports of goods. Export performance is an important indicator of the rate of growth of the Australian economy, while import indicates the level of domestic demand. Reduced demand for exports from Australia, leads to an increase in the trade deficit, which has a negative impact on the Australian dollar.

Export dropped in June 1.0% compared to a 1.0% increase in May.

Imports increased by 2.0% in June as in May.

Building permits, published by the Australian Bureau of Statistics, decreased by -2.9% in June, below analyst expectations of 0.5%. Previous value of the index was revised from -5.2% to -5.4%. The annual rate of building permits fell to -5.9%, -9.2% prior to the year after the fall.

Permits for the construction of private homes fell 2.3%. The construction of apartments in the private sector decreased by 2.4%

The New Zealand Dollar was down against the US dollar on the back of falling oil prices. Published today, the quarterly report of the Reserve Bank of New Zealand showed that inflation expectations have remained stable, but low in the third quarter. The expectations about the pace of growth in consumer prices in the 24 months ahead in the third quarter was 1.65% versus 1.64% in the second quarter. Inflation expectations for the next 12 months were equal to 1.26% against 1.22% in the previous quarter.

The US dollar traded in a narrow range against the euro after Friday showed widespread fall as weak data exacerbated concerns about economic growth and the increase in US Federal Reserve interest rates this year.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1160-80 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3179-85 range

USD / JPY: during the Asian session, the pair was trading in Y102.00 - 102.05 range

-

08:35

Options levels on tuesday, August 2, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1268 (3039)

$1.1236 (3367)

$1.1215 (2911)

Price at time of writing this review: $1.1176

Support levels (open interest**, contracts):

$1.1126 (1853)

$1.1089 (2917)

$1.1045 (3130)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 39256 contracts, with the maximum number of contracts with strike price $1,1300 (3763);

- Overall open interest on the PUT options with the expiration date August, 5 is 52188 contracts, with the maximum number of contracts with strike price $1,0900 (6556);

- The ratio of PUT/CALL was 1.33 versus 1.31 from the previous trading day according to data from August, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.3502 (1854)

$1.3403 (2006)

$1.3306 (1675)

Price at time of writing this review: $1.3188

Support levels (open interest**, contracts):

$1.3094 (2614)

$1.2997 (1951)

$1.2898 (852)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 27947 contracts, with the maximum number of contracts with strike price $1,3400 (2006);

- Overall open interest on the PUT options with the expiration date August, 5 is 26798 contracts, with the maximum number of contracts with strike price $1,2950 (3100);

- The ratio of PUT/CALL was 0.96 versus 0.93 from the previous trading day according to data from August, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Building approvals in Australia down 2.9% in June

The number of dwellings approved fell 0.9 per cent in June 2016, in trend terms, according to data released by the Australian Bureau of Statistics (ABS) today. This is the second successive monthly fall.

Dwelling approvals decreased in June in Western Australia (5.2 per cent), Tasmania (3.7 per cent), Queensland (3.2 per cent), Australian Capital Territory (2.8 per cent) and Victoria (0.1 per cent), but increased in the Northern Territory (3.6 per cent), South Australia (1.6 per cent) and New South Wales (0.8 per cent) in trend terms.

In trend terms, approvals for private sector houses fell 0.6 per cent in June. Private sector house approvals fell in Western Australia (3.5 per cent), Victoria (0.6 per cent), Queensland (0.5 per cent) and South Australia (0.3 per cent). Private sector house approvals rose in New South Wales (0.9 per cent).

In seasonally adjusted terms, total dwelling approvals decreased 2.9 per cent, with both total other residential dwelling approvals (3.4 per cent) and total houses (2.4 per cent) recording falls.

The value of total building approved rose 1.2 per cent in June, in trend terms, and has risen for six months. The value of residential building rose 0.1 per cent while non-residential building rose 3.7 per cent.

-

08:20

The trade balance of Australia below expectations in June

The deficit of foreign trade of Australia rose sharply and amounted to AUD $ -3,2 billion from A $ -2.42 billion in May. Analysts had forecast a deficit of A $ -2,0 billion.

The trade balance - the indicator published by the Australian Bureau of Statistics, and assessing the ratio between exports and imports of goods. Export performance is an important indicator of the rate of growth of the Australian economy, while import indicates the level of domestic demand. Reduced demand for exports from Australia, leads to an increase in the trade deficit, which has a negative impact on the Australian dollar.

Export dropped in June 1.0% compared to a 1.0% increase in May.

Imports increased by 2.0% in June as in May.

-

08:13

Full statement by Glenn Stevens, RBA governor

"At its meeting today, the Board decided to lower the cash rate by 25 basis points to 1.50 per cent, effective 3 August 2016.

The global economy is continuing to grow, at a lower than average pace. Several advanced economies have recorded improved conditions over the past year, but conditions have become more difficult for a number of emerging market economies. Actions by Chinese policymakers are supporting the near-term growth outlook, but the underlying pace of China's growth appears to be moderating.

Commodity prices are above recent lows, but this follows very substantial declines over the past couple of years. Australia's terms of trade remain much lower than they had been in recent years.

Financial markets have continued to function effectively. Funding costs for high-quality borrowers remain low and, globally, monetary policy remains remarkably accommodative.

In Australia, recent data suggest that overall growth is continuing at a moderate pace, despite a very large decline in business investment. Other areas of domestic demand, as well as exports, have been expanding at a pace at or above trend. Labour market indicators continue to be somewhat mixed, but are consistent with a modest pace of expansion in employment in the near term.

Recent data confirm that inflation remains quite low. Given very subdued growth in labour costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time.

Low interest rates have been supporting domestic demand and the lower exchange rate since 2013 is helping the traded sector. Financial institutions are in a position to lend for worthwhile purposes. These factors are all assisting the economy to make the necessary economic adjustments, though an appreciating exchange rate could complicate this.

Supervisory measures have strengthened lending standards in the housing market. Separately, a number of lenders are also taking a more cautious attitude to lending in certain segments. The most recent information suggests that dwelling prices have been rising only moderately over the course of this year, with considerable supply of apartments scheduled to come on stream over the next couple of years, particularly in the eastern capital cities. Growth in lending for housing purposes has slowed a little this year. All this suggests that the likelihood of lower interest rates exacerbating risks in the housing market has diminished.

Taking all these considerations into account, the Board judged that prospects for sustainable growth in the economy, with inflation returning to target over time, would be improved by easing monetary policy at this meeting".

-

08:11

RBA cuts interest rate. AUD/USD little changed

Australia's central bank lowered its key interest rate for the first time in three months.

The board of the Reserve Bank of Australia governed by Glenn Stevens on Tuesday reduced the cash rate to 1.50 percent from 1.75 percent. The outcome of the meeting came in line with expectations.

The bank last slashed its rate by 25 basis points in May, which was the first reduction in a year.

The Board judged that prospects for sustainable growth in the economy, with inflation returning to target over time, would be improved by easing monetary policy at this meeting.

Low interest rates supported domestic demand and the lower exchange rate since 2013 helped the traded sector. Although these factors assisted the economy to make the necessary economic adjustments, an appreciating exchange rate could complicate this, the bank noted.

Policymakers said the likelihood of lower interest rates exacerbating risks in the housing market has diminished.

-

07:02

Japan: Consumer Confidence, July 42.3 (forecast 42.2)

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 1.5% (forecast 1.5%)

-

03:31

Australia: Building Permits, m/m, June -2.9% (forecast 0.5%)

-

03:30

Australia: Trade Balance , June -3.19 (forecast -2)

-

00:34

Currencies. Daily history for Aug 01’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1162 -0,12%

GBP/USD $1,3179 -0,36%

USD/CHF Chf0,9678 -0,15%

USD/JPY Y102,36 +0,29%

EUR/JPY Y114,26 +0,18%

GBP/JPY Y134,88 -0,06%

AUD/USD $0,7534 -0,86%

NZD/USD $0,7167 -0,54%

USD/CAD C$1,3127 +0,72%

-

00:01

Schedule for today, Tuesday, Aug 02’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Building Permits, m/m June -5.2% 0.5%

01:30 Australia Trade Balance June -2.22 -2

04:30 Australia Announcement of the RBA decision on the discount rate 1.75% 1.5%

04:30 Australia RBA Rate Statement

05:00 Japan Consumer Confidence July 41.8

07:15 Switzerland Retail Sales (MoM) June 0.2%

07:15 Switzerland Retail Sales Y/Y June -1.6%

07:30 Switzerland Manufacturing PMI July 51.6 51.4

08:30 United Kingdom PMI Construction July 46 43.8

09:00 Eurozone Producer Price Index, MoM June 0.6% 0.4%

09:00 Eurozone Producer Price Index (YoY) June -3.9% -3.5%

12:30 U.S. Personal Income, m/m June 0.2% 0.3%

12:30 U.S. Personal spending June 0.4% 0.4%

12:30 U.S. PCE price index ex food, energy, m/m June 0.2% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y June 1.6%

20:00 U.S. Total Vehicle Sales, mln July 16.7

23:30 Australia AIG Services Index July 51.3

23:50 Japan Monetary Policy Meeting Minutes

-