Noticias del mercado

-

22:16

Major US stock indexes added about one percent

Major stock indexes rose on Friday on positive labor market data. As it became known today, employment in the US rose more than expected in July, and wages rose, which should support expectations of faster economic growth and raise the probability of a Federal Reserve interest rates this year. The number of people employed in non-farm payrolls increased by 255,000 jobs last month as hiring increased in general after the upwardly revised 292,000 surge in June. This Department of Labor said on Friday. The unemployment rate remained unchanged at 4.9% as more people entered the labor market. Underlining the strength of the labor market, average hourly wages rose by as much as eight cents. The May employment data have been revised up to 24,000 from the previously reported 11,000.

Oil prices fell moderately, losing previously-earned positions. Pressure on the quotes had a widespread appreciation of the US dollar against the background of positive data on employment.

Almost all the components of DOW index in positive territory (27 of 30). Most remaining shares rose Merck & Co. Inc. (MRK, + 10.38%). Outsider were shares of Verizon Communications Inc. (VZ, -0.55%).

Almost all sectors of the S & P ended the day in positive territory. The leader turned conglomerates sector (+ 3.2%). Most utilities sector fell (-1.1%).

-

21:00

DJIA +0.88% 18,512.75 +160.70 Nasdaq +1.04% 5,219.89 +53.64 S&P +0.73% 2,180.04 +15.79

-

18:43

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Friday as U.S. employment increased more than expected in July and wages picked up, bolstering expectations of an acceleration in economic growth and raising the probability of a Federal Reserve interest rate hike this year. Nonfarm payrolls rose by 255,000 jobs after an upwardly revised 292,000 surge in June, with hiring broadly based across sectors of the economy, the Labor Department said on Friday. The unemployment rate was unchanged at 4.9% as more people entered the labor market. Highlighting job market strength, average hourly earnings increased a healthy eight cents and workers put in more hours. In addition, 18,000 more jobs were created in May and June than previously reported.

Almost of Dow stocks in positive area (27 of 30). Top gainer - Merck & Co. Inc. (MRK, +7.50%). Top looser - Verizon Communications Inc. (VZ, -0.45%).

Most of S&P sectors also in positive area. Top gainer - Conglomerates (+2.0%). Top looser - Utilities (-0.7%).

At the moment:

Dow 18440.00 +167.00 +0.91%

S&P 500 2177.00 +17.75 +0.82%

Nasdaq 100 4794.00 +50.25 +1.06%

Oil 41.52 -0.41 -0.98%

Gold 1344.70 -22.70 -1.66%

U.S. 10yr 1.57 +0.07

-

18:00

European stocks closed: FTSE 100 +53.31 6793.47 +0.79% DAX +139.35 10367.21 +1.36% CAC 40 +64.92 4410.55 +1.49%

-

17:49

WSE: Session Results

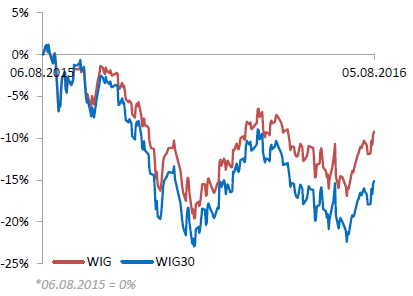

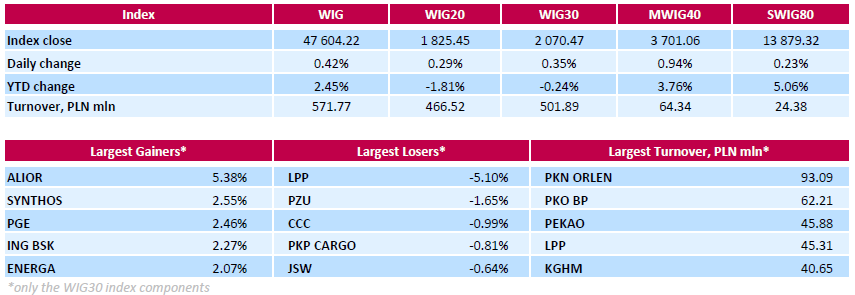

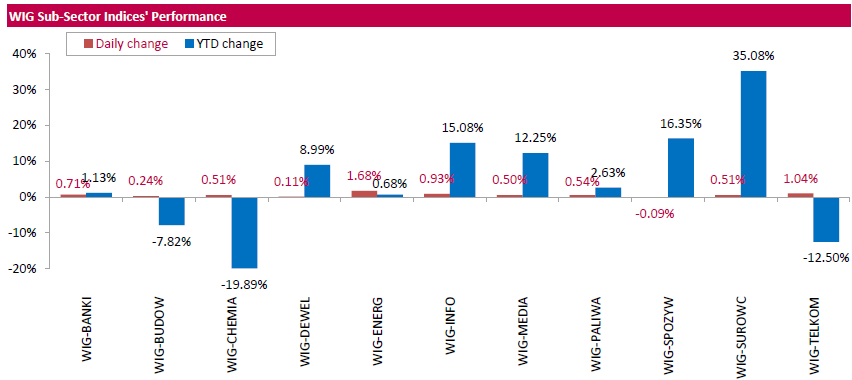

Polish equity market advanced on Friday. The broad market measure, the WIG Index, added 0.42%. All sectors, but for food industry (-0.09%), rose, with utilities (+1.68%) outpacing.

The large-cap companies' measure, the WIG30 Index, grew 0.35%. Within the index components, bank ALIOR (WSSE: ALR) led the gainers, recording advance of 5.38%. Other major outperformers were chemical producer SYNTHOS (WSE: SNS), bank ING BSK (WSE: ING), FMCG-wholesaler EUROCASH (WSE: EUR) and three gencos PGE (WSE: PGE), ENERGA (WSE: ENG) and ENEA (WSE: ENA), surging by 1.53%-2.55%. On the other side of the ledger, clothing retailer LPP (WSE: LPP) continued to plunge, losing 5.1%, after Thursday's announcement of 2Q and 1H results. It was followed by insurer PZU (WSE: PZU), footwear retailer CCC (WSE: CCC) and railway freight transport operator PKP CARGO (WSE: PKP), dropping 1.65%, 0.99% and 0.81% respectively.

-

15:48

WSE: After start on Wall Street

The data from the US labor market for July were very good (change in employment in the private sector 217 thousand vs. forecast 170 thousand). The strong reading will be the basis for speculation about interest rate hike at the September FOMC meeting.

The data show that the weak May readings was only an incidental event, and the American labor market is still in very good condition. The data supported the start of trading on Wall Street and clearly strengthened the demand side on the Warsaw Stock Exchange, where the WIG20 index is currently rising by 0.43% (1,828 pts.)

-

15:32

U.S. Stocks open: Dow +0.53%, Nasdaq +0.43%, S&P +0.34%

-

15:12

Before the bell: S&P futures +0.14%, NASDAQ futures +0.11%

U.S. stock-index futures rose after a second month of stronger payrolls data bolstered optimism that slow but steady economic growth remains on track.

Global Stocks:

Nikkei 16,254.45 -0.44 0.00%

Hang Seng 22,146.09 +313.86 +1.44%

Shanghai 2,977 -5.4258 -0.18%

FTSE 6,767.12 +26.96 +0.40%

CAC 4,390.69 +45.06 +1.04%

DAX 10,317.8 +89.94 +0.88%

Crude $41.84 (-0.21%)

Gold $1366.80 (-0.04%)

-

14:54

Wall Street. Stocks before the bell

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.49

0.09(0.8654%)

7890

Amazon.com Inc., NASDAQ

AMZN

763.26

2.49(0.3273%)

30736

American Express Co

AXP

64.2

0.26(0.4066%)

3332

Apple Inc.

AAPL

106.33

0.46(0.4345%)

110036

AT&T Inc

T

43.15

0.07(0.1625%)

1007

Barrick Gold Corporation, NYSE

ABX

21.71

-0.66(-2.9504%)

271994

Boeing Co

BA

131.4

0.19(0.1448%)

2117

Chevron Corp

CVX

100.43

0.04(0.0398%)

3730

Citigroup Inc., NYSE

C

44.32

0.48(1.0949%)

59431

Exxon Mobil Corp

XOM

87.53

0.05(0.0572%)

2250

Facebook, Inc.

FB

124.95

0.59(0.4744%)

196548

Ford Motor Co.

F

12.16

0.08(0.6623%)

46112

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.42

0.10(0.8117%)

94810

General Electric Co

GE

31.23

0.06(0.1925%)

32293

Goldman Sachs

GS

159.2

1.15(0.7276%)

1901

Google Inc.

GOOG

773.84

2.23(0.289%)

2610

Johnson & Johnson

JNJ

124.5

0.64(0.5167%)

753

JPMorgan Chase and Co

JPM

65.2

0.64(0.9913%)

27559

Merck & Co Inc

MRK

63.97

6.13(10.5982%)

4945285

Microsoft Corp

MSFT

57.65

0.26(0.453%)

7718

Pfizer Inc

PFE

35.15

0.00(0.00%)

1764

Starbucks Corporation, NASDAQ

SBUX

55.7

0.28(0.5052%)

6800

Tesla Motors, Inc., NASDAQ

TSLA

230.49

-0.12(-0.052%)

9256

Twitter, Inc., NYSE

TWTR

18.27

0.14(0.7722%)

127557

Visa

V

79.7

0.22(0.2768%)

163

Wal-Mart Stores Inc

WMT

73.5

0.20(0.2729%)

100

Walt Disney Co

DIS

95.44

0.28(0.2942%)

2822

Yahoo! Inc., NASDAQ

YHOO

39

0.08(0.2055%)

2733

Yandex N.V., NASDAQ

YNDX

21.64

0.18(0.8388%)

1800

-

13:19

Major stock indices in Europe show a positive trend

Stock indexes in Western Europe continue to rise after rising the previous day on optimism about the measures of central banks of the world and the strong statements of a number of large companies.

European shares rose yesterday and today continue to demonstrate strenght after the Bank of England lower its key interest rate to a new historic low of 0.25% and to extend the program for the purchase of government bonds by 60 billion pounds. Also, BoE announced plans to provide commercial banks of the country up to 100 billion pounds of soft loans.

The head of the Bank of England Governor Mark Carney, as previously President of the European Central Bank Mario Draghi pledged to do everything necessary to support economies experiencing a negative impact due to the British decision to withdraw from the EU structure.

The composite index of Europe's largest enterprises Stoxx 600 increased by 0.3% - up to 338.7652 points.

Shares of German Evonik Industries rose 3.9% as its profit in the 2nd quarter fell weaker than forecasts.

Price of LafargeHolcim cement producer jumped by 5.3% thanks to a strong financial performance for the last quarter.

The capitalization of the German manufacturer Hugo Boss rose by 6.6%, despite the worsening profit outlook for the current year. Revenue decreased in the last quarter, but turned out to be better than the average market forecast.

Meanwhile, Europe's biggest insurer Allianz SE has cut its net profit in the 2nd quarter almost in half due to the growth of payments to cover damage caused by natural disasters. Quotes decreased by 4.2%.

The market value of the British bank Royal Bank of Scotland fell by 4%, as its loss in the last quarter turned out to be more than analysts' expectations.

Shares of pharmaceutical company Novo Nordisk fell 6.6% after the largest producer of insulin in the world worsened the forecasts for the current year, noting the increased competition in the US, as negative impact on medicine prices.

Stocksof Hikma Pharmaceuticals PLC jumped 3% after reports that revenue from generic drugs in the first half of the year fell more than previously expected, due to some new products slow approval process.

At the moment:

FTSE 6757.99 17.83 0.26%

DAX 10241.91 14.05 0.14%

CAC 4366.22 20.59 0.47%

-

13:01

WSE: Mid session comment

Today's trade is characterized by low turnover and low volatility. There is no surprise, the markets are waiting for data from the US. European indices are drifting at the levels seen at the start of trading. Lack of emotions, and any may only appear closer to 14:30 (Warsaw time). In the mid-session the WIG20 index was at 1,819 points (-0.08%) and with the turnover of PLN 170 mln.

-

09:15

WSE: After opening

WIG20 index opened at 1822.66 points (+0.13%)*

WIG 47451.97 0.09%

WIG30 2065.80 0.13%

mWIG40 3669.76 0.09%

*/ - change to previous close

Beginning on the futures market was held in the area of yesterday's close, with a slight predominance of green. The situation in our environment has not substantially changed, and on the basis of yesterday's session in Warsaw, it appears that the market is prepared to fight for output above the downward trend line on the WIG and WIG20.

European stock exchanges started the day slightly better than expectations. The CAC grow by 0.5 percent, and the DAX by 0.3 percent. The Warsaw Stock Exchange keeps distance, but modest booster on the WIG20 by 0.2 percent is enough to go over 1819 points and draw of a new wave of maximum growth. The problem is only turnover, which indicates that investors do not want to stay ahead of US data.

-

08:21

WSE: Before opening

Thursday's session on Wall Street ended with minimal changes in the major indexes. The S&P500 rose by 0.02 per cent. Investors are waiting for today's publication of data from the US labor market, which may indicate whether it may soon lead to interest rate hikes in the US. The market consensus assumes that the number of new jobs will increase by 180 thousand. The unemployment rate in July is expected to be 4.8 percent against 4.9 percent in June.

The significance of this report does not seem as important as the report to be published the next month, which will be the last one before the September FOMC meeting. Today's data would have really hard to pass up with a forecast for plus to market frightened of a rate hike in September or in minus that concerns have been raised about the condition of the economy.

Currently the market valuation of probability of increase by Fed interest rates until the end of the year is just over 37 percent.

We may assume that the neutral end in the US yesterday will encourage neutral beginnings of sessions in Europe.

The WIG20 index reached yesterday the area of Tuesday's maximum and still is in a consolidation after the July wave of growth.

Some investors may expect a simple continuation of gains from Tuesday and Thursday, although from the technical point of view any new content does not appear.

-

07:15

Global Stocks

European stocks booked a solid gain Thursday as the Bank of England embarked on an aggressive stimulus plan that includes its first rate cut in seven years and a revival of a bond-buying program.

The Stoxx Europe 600 SXXP, +0.67% rose 0.7% to close at 337.84 as all sectors rose, led by the financial SXFR, +0.63% and oil and gas SXER, +1.52% groups.

The pan-European index extended its reach after the Bank of England, spurred by Gov. Mark Carney, cut the benchmark rate by 25 basis points to a record low 0.25% and expanded its quantitative-easing program to £435 billion ($579 billion) from £375 billion. It also plans to start buying £10 billion in corporate bonds and make billions of pounds available in ultracheap loans to banks through its new Term Funding Scheme.

U.S. stocks relinquished modest gains to end mostly flat Thursday as investors awaited the closely watched jobs report due Friday. An earlier bounce for equities, following the Bank of England's decision to cut its key interest rate for the first time in seven years faded as Wall Street wrestled with mixed economic reports.

The S&P 500 index SPX, +0.02% closed virtually flat at 2,164.25, with the tech and materials the only two sectors finishing in positive territory.

The Dow Jones Industrial Average DJIA, -0.02% ended near break-even at 18,352.05, with the blue-chip benchmark limited by a 1% fall in shares of Walt Disney Co. DIS, -0.97% offsetting a 1% gain in Visa Inc. V, +0.98%

The Nasdaq Composite Index COMP, +0.13% closed up 6.51 points, or 0.1%, at 5,166.25.

Asian shares followed global stock markets higher on Friday after the Bank of England launched a larger-than-expected post-Brexit stimulus package that sent the British pound tumbling.

An overnight rally in crude oil prices also sharpened risk appetites, but some caution before the July U.S. non-farm payrolls report later on Friday limited gains.

Japan's Nikkei .N225 advanced 0.3 percent, on track for a loss of 1.6 percent for the week.

China's CSI 300 index .CSI300 climbed 0.1 percent, set to end the week flat. The Shanghai Composite .SSEC was little changed, poised for a 0.1 percent weekly gain.

-

00:40

Stocks. Daily history for Aug 04’2016:

(index / closing price / change items /% change)

Nikkei 225 16,254.89 +171.78 +1.07%

Shanghai Composite 2,982.65 +4.19 +0.14%

S&P/ASX 200 5,475.81 +10.09 +0.18%

FTSE 100 6,740.16 +105.76 +1.59%

CAC 40 4,345.63 +24.55 +0.57%

Xetra DAX 10,227.86 +57.65 +0.57%

S&P 500 2,164.25 +0.46 +0.02%

Dow Jones 18,352.05 -2.95 -0.02%

S&P/TSX Composite 14,528.78 +16.73 +0.12%

-