Noticias del mercado

-

21:00

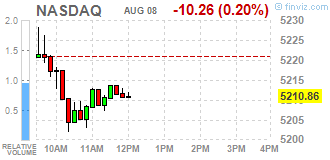

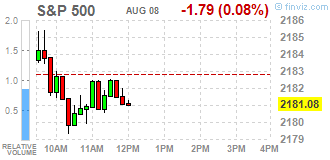

DJIA 18511.82 -31.71 -0.17%, NASDAQ 5206.69 -14.43 -0.28%, S&P 500 2178.99 -3.88 -0.18%

-

18:09

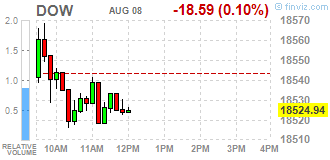

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes failed to hold on to its gains after opening at a record high on Monday as a drop in healthcare stocks offset the impact of higher oil prices and a strong jobs report. Oil prices rose nearly 3 percent after a report in the Wall Street Journal last week that some OPEC members had called for a freeze in production.

Dow stocks mixed (15 vs 15). Top gainer - Exxon Mobil Corporation (XOM, +1.08%). Top looser - Merck & Co., Inc. (MRK, -2.11%).

S&P sectors also mixed. Top gainer - Basic Materials (+1.2%). Top looser - Healthcare (-1.0%).

At the moment:

Dow 18461.00 +7.00 +0.04%

S&P 500 2177.00 +0.25 +0.01%

Nasdaq 100 4774.75 -8.25 -0.17%

Oil 43.04 +1.24 +2.97%

Gold 1341.60 -2.80 -0.21%

U.S. 10yr 1.58 -0.01

-

17:58

European stocks closed: FTSE 6809.13 15.66 0.23%, DAX 10432.36 65.15 0.63%, CAC 4415.46 4.91 0.11%

-

17:37

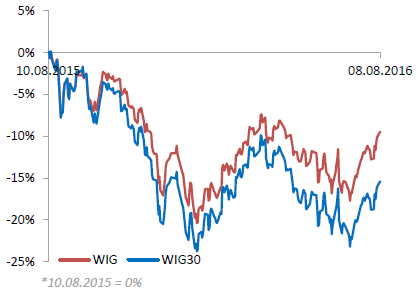

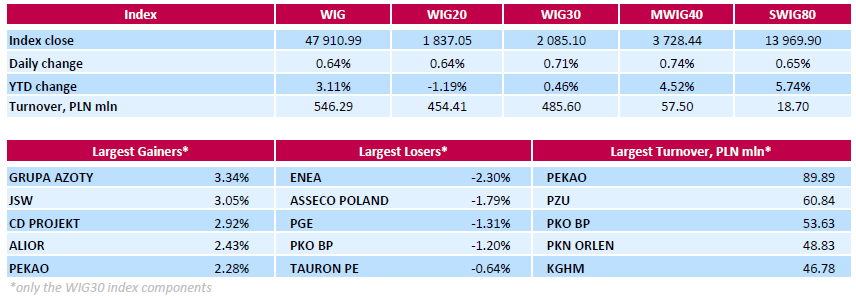

WSE: Session Results

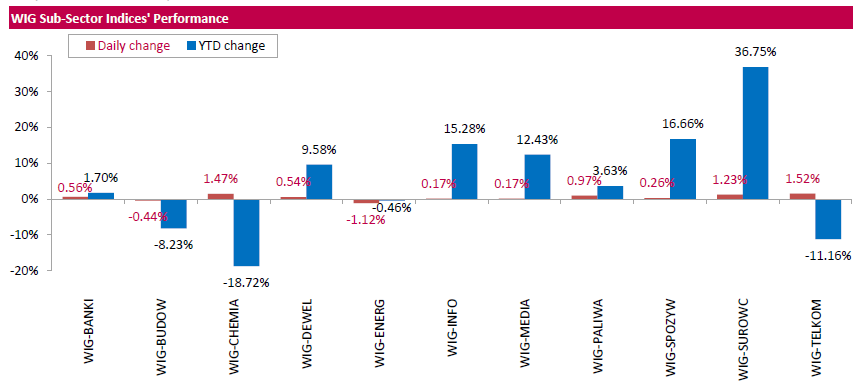

Polish equity market closed higher on Monday. The broad measure, the WIG index, recorded a 0.64% surge. Except for utilities (-1.12%) and construction sector (-0.44%) every sector in the WIG Index advanced, with telecommunication services (+1.52%) outperforming.

The large-cap stocks rose by 0.71%, as measured by the WIG30 Index. Chemical producer GRUPA AZOTY (WSE: ATT) and coking coal miner JSW (WSE: JSW) led the pack up, rising by 3.34% and 3.05% respectively. The other notable gainers were videogame developer CD PROJEKT (WSE: CDR) and two banks ALIOR (WSE: ALR) and PEKAO (WSE: PEO), advancing by 2.92%, 2.43% and 2.28% respectively. On the other side of the ledger, genco ENEA (WSE: ENA) posted the sharpest decline of 2.3%. It was followed by IT-company ASSECO POLAND (WSE: ACP), genco PGE (WSE: PGE) and bank PKO BP (WSE: PKO), plunging by 1.79%, 1.31%and 1.2% respectively.

-

15:55

WSE: After start on Wall Street

Quotations on Wall Street began with a modest growth of 0.1%. Indeed, the mood is not bad, but the market is pushed rather by momentum than new impulses, which together with the going to the end the resulting season will be less in the near future.

On the Warsaw market the afternoon phase brought new highs on the sWIG80 index, which sets new this year highs. Sentiment on the broad market remains very good. On the other hand, in the segment of blue chips does not occur any changes, at low turnover and low volatility no much happens. The Pekao (WSE: PEO) shares are supported by the press info about the possibility of lack of sales of shares by UniCredit, and PKO BP (WSE: PKO) is overwhelmed by possibility of increase capital buffers. The turnover in the amount of PLN 300 mln among large companies does not make a big impression.

-

15:34

U.S. Stocks open: Dow +0.04%, Nasdaq +0.07%, S&P +0.07%

-

15:19

Before the bell: S&P futures +0.09%, NASDAQ futures +0.11%

U.S. stock-index futures rose edged higher.

Global Stocks:

Nikkei 16,650.57 +396.12 +2.44%

Hang Seng 22,494.76 +348.67 +1.57%

Shanghai 3,004.72 +28.02 +0.94%

FTSE 6,782.61 -10.86 -0.16%

CAC 4,415.47 +4.92 +0.11%

DAX 10,429.17 +61.96 +0.60%

Crude $42.53 (+1.75%)

Gold $1341.80 (-0.19%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.55

0.05(0.4762%)

9600

Amazon.com Inc., NASDAQ

AMZN

767.12

1.14(0.1488%)

14177

American Express Co

AXP

65.83

0.31(0.4731%)

860

AMERICAN INTERNATIONAL GROUP

AIG

59.36

0.26(0.4399%)

1120

Apple Inc.

AAPL

107.74

0.26(0.2419%)

118226

Barrick Gold Corporation, NYSE

ABX

21.27

0.03(0.1412%)

71873

Boeing Co

BA

132.75

1.02(0.7743%)

1000

Caterpillar Inc

CAT

83

0.44(0.5329%)

200

Cisco Systems Inc

CSCO

31.16

0.12(0.3866%)

6816

Citigroup Inc., NYSE

C

45.74

0.02(0.0437%)

23119

Exxon Mobil Corp

XOM

88.05

0.49(0.5596%)

9339

Facebook, Inc.

FB

125.58

0.43(0.3436%)

99889

Ford Motor Co.

F

12.25

0.06(0.4922%)

5370

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.47

0.24(1.9624%)

80560

General Electric Co

GE

31.38

0.10(0.3197%)

2575

General Motors Company, NYSE

GM

30.95

0.15(0.487%)

3425

Goldman Sachs

GS

162.49

0.40(0.2468%)

170

Google Inc.

GOOG

783.49

1.27(0.1624%)

2693

Intel Corp

INTC

34.99

0.01(0.0286%)

819

International Business Machines Co...

IBM

162.47

0.37(0.2283%)

1335

Johnson & Johnson

JNJ

124.5

0.26(0.2093%)

795

JPMorgan Chase and Co

JPM

66.05

-0.25(-0.3771%)

13774

McDonald's Corp

MCD

119.68

0.47(0.3943%)

960

Merck & Co Inc

MRK

63.33

-0.53(-0.8299%)

134565

Microsoft Corp

MSFT

58.05

0.09(0.1553%)

6239

Nike

NKE

56.24

0.39(0.6983%)

171

Pfizer Inc

PFE

35.45

0.01(0.0282%)

1950

Starbucks Corporation, NASDAQ

SBUX

56.02

0.12(0.2147%)

925

Tesla Motors, Inc., NASDAQ

TSLA

227.5

-2.53(-1.0999%)

25902

The Coca-Cola Co

KO

43.64

0.16(0.368%)

1527

Twitter, Inc., NYSE

TWTR

18.27

0.01(0.0548%)

52556

Verizon Communications Inc

VZ

53.55

-0.09(-0.1678%)

1517

Wal-Mart Stores Inc

WMT

74.15

0.39(0.5287%)

9155

Walt Disney Co

DIS

96.18

0.35(0.3652%)

4830

Yahoo! Inc., NASDAQ

YHOO

38.99

0.00(0.00%)

1000

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Merck (MRK) upgraded to Outperform from Neutral at Credit Suisse; target $73

Downgrades:

JPMorgan Chase (JPM) downgraded to Neutral from Buy at Citigroup

Other:

-

13:24

WSE: Mid session comment

The first half of today's trade eventually brought no decent activity, the turnover in the segment of blue chips is slightly above PLN 200 mln. In turn, the WIG20 index stood at around the level of 1830 points and the march towards the level of 1,850 points was stopped. Small increases are still hold, but compare with growth of the DAX (more than 0.9%) the Warsaw Stock Exchange today once again is weaker and not so willing to larger increases.

-

12:53

Major stock indexes in Europe are gaining

European stocks traded in the green zone, heading for its largest three-day increase in more than three weeks. The market has optimism about global economic growth and a rise in price of shares of the banking and mining sectors dominates early trading.

Investors also drew attention to the statistics on Germany and the euro zone. Ministry of Economy of Germany said that the seasonally adjusted industrial production in June increased by 0.8% compared with the previous month. Economists had expected an increase of 0.7%. Manufacturing output increased by 1.5%, whereas in construction it fell by 0,5%. The data also showed that in the 2nd quarter, the industrial sector recorded a decline of 1% compared to the 1st quarter. " Overall, today's data weakened fears of a hard landing of the German economy in the 2nd quarter" said ING economist Carsten Brzeski

A survey presented by Sentix research group, showed that investor sentiment in the euro area improved significantly in August, as markets have examined the initial shock of the UK decision to leave the European Union. According to the data, investors confidence indicator rose in August to 4.2 points compared with 1.7 points in July. Analysts had expected the index to rise only 3.0 points. The sub-index of expectations rose in August to 4.8 points versus -2.0 points in July. However, the sub-index assessing the current conditions in the euro area deteriorated to 3.8 points from 5.5 points, reaching its lowest level since February last year. Investors more positively assess the prospects of Germany - the expectations index rose to 7.0 from 2.7 in July.

The composite index of Europe's largest enterprises Stoxx 600 rose 0.2 percent. Over the past three days, the index rose by about 2 percent. Stocks rose sharply on Friday as US employment data surpassed expectations. Fresh stimulus measures from the Bank of England to help the economy cope with the consequences of Brexit also supported the markets.

Barclays Plc's shares rose 3.3 percent after analysts at Exane BNP Paribas upgraded the lender securities rating to "buy" from "neutral."

The capitalization of BHP Billiton and Anglo American rose 3.4 percent, pushing up the shares of mining companies, which was caused by the increase in commodity prices.

Mediobanca SpA shares rose 3.2 percent amid reports that the French investor Vincent Bollore could increase its 7.9 percent stake in the Italian investment bank to 23 percent.

At the moment:

FTSE 100 +9.04 6802.51 + 0.13%

DAX +95.07 10462.28 + 0.92%

CAC 40 +23.99 4434.54 + 0.54%

-

09:58

Positive start on major stock exchanges: FTSE 100 6,797.52 + 57.36 + 0.85%, DAX 10,414.11 + 46.90 + 0.45%

-

09:16

WSE: After opening

WIG20 index opened at 1828.23 points (+0.15%)*

WIG 47701.25 0.20%

WIG30 2075.29 0.23%

mWIG40 3698.81 -0.06%

*/ - change to previous close

The futures market (FW20U1620) began a new week of a rise of 0.22% (opening 1833 pts.). The German DAX also gained at the opening and in a larger scale for almost 0.5%.

The cash market started from the level of 1828 points with pretty good, as on Monday, activity and desire continuation of Friday's gains.

With larger companies less of the aforementioned reasons behaves PKO BP, also goes down ENE (WSE: ENA). The rest of the shares from the WIG20 index are on the green side of the market.

-

08:30

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.5%, CAC40 + 0.2%, FTSE + 0.1%

-

08:27

WSE: Before opening

The US equity market represented by the S&P500 index set the new highs. The S&P500 seriously breached the upper limit of the earlier stabilization, which today should lead to continuing growth within the movement confirmed on Friday. So far contracts for the S&P500 are stable and do not deviate from Friday's closing.

The morning data from China (stronger decline in exports and imports) did not translate into significant declines in the Asian stock markets. Apart from a strong increase in the Nikkei (more than 2%) moods are rather balanced and increases in China reached 0.3%. However, more expensive is copper, which means that the Chinese data were accepted peacefully.

The macro calendar today does not contain key macro data, there is also lack of the vital macro-economic publications from our local market.

Warsaw on Friday was weaker and less prone to growth. Our entire region was weaker, so it was not the only ailment of the WSE. Attitude remains positive and the previous highs on the WSE were affected. The Polish Financial Supervisory Authority decided to ask the Financial Stability Committee on the identification of the bank PKO BP (WSE: PKO) as important for the Polish financial system institutions. The PFSA would therefore imposed on the bank in the form of an additional buffer equivalent to 0.75 percent of total risk exposure. From the shareholders point of view it would not be a positive message.

-

07:23

Global Stocks

European stocks had their best session in three weeks Friday, still bolstered by the Bank of England's ramped-up stimulus efforts on Thursday, with an upbeat U.S. jobs report also providing an added boost.

The Stoxx Europe 600 SXXP, +1.05% popped up 1.1% to close at 341.38, the strongest percentage rise since July 12, according to FactSet data. All but the health-care sector ended higher. The financial SXFR, +1.44% and basic-material SXPR, +1.82% sectors were the best performers.

U.S. stocks rallied to close higher Friday after a stellar jobs report outstripped Wall Street expectations, showing sustained improvement in a labor market that has been spotty over the past few months.

Friday's equity rally nudged the S&P 500 and Nasdaq Composite to close at all-time closing highs.

The S&P 500 index SPX, +0.86% finished up 18.62 points, or 0.9%, to 2,182.87, marking the large-cap benchmark's first record since July 22.

The Nasdaq Composite Index COMP, +1.06% climbed 54.87 points, or 1.1%, to close at 5,221.12, for its first record in more than a year, when it finished at 5,218.86 on July 20, 2015.

The Dow Jones Industrial Average DJIA, +1.04% surged 191.48 points, or 1%, to finish at 18,543.53, as shares of Merck & Co. Inc. MRK, +10.41% skyrocketed 10.4% to lead the blue-chip gauge.

The U.S. economy added 255,000 jobs last month, which follows a stellar gain in June, demonstrating that the economy is still healthy, despite relatively muted gross domestic product. The unemployment rate was unchanged at 4.9% even as the labor-force participation rate edged up to 62.8%, suggesting the labor market is tightening.

Investors flocked to higher-yielding assets on Monday after strong U.S. jobs data on Friday lifted confidence - driving up Asian stocks and the Australian dollar.

Although the strong U.S. data dampened the safe-haven appeal of government debt with Japanese 10-year bond futures tanking in early trade, futures markets were only pricing in a U.S. rate hike only in 2017 as other major central banks looked set to add more stimulus in the coming weeks.

Japan .N225 and Australian markets led regional gainers while mainland China shares .SSEC slipped in early trade as data at the weekend showed a further decline in China's foreign exchange reserves.

The strong U.S. jobs data was a rare bright spot of data in the global economic landscape with Australia's central bank and the Bank of England cutting interest rates last week and New Zealand set to follow in coming days.

-

00:42

Stocks. Daily history for Aug 05’2016:

(index / closing price / change items /% change)

Nikkei 225 16,254.45 -0.44 0.00%

Shanghai Composite 2,977 -5.4258 -0.18%

S&P/ASX 200 5,497.41 +21.60 +0.39%FTSE 100

FTSE 100 6,793.47 +53.31 +0.79%

Xetra DAX 10,367.21 +139.35 +1.36%

CAC 40 4,410.55 +64.92 +1.49%

S&P 500 2,182.87 +18.62 +0.86%

Dow Jones Industrial Average 18,543.53 +191.48 +1.04%

S&P/TSX Composite 14,648.77 +119.99 +0.83%

-