Noticias del mercado

-

17:46

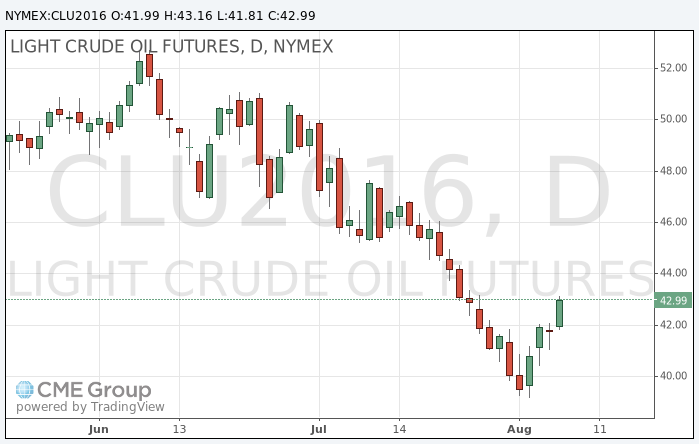

Oil prices continued to rise

Oil prices continued to rise after a report that a number of OPEC members have renewed calls to limit production, but analysts warned of downside maintaining fundamental factors that led to the fall of oil prices.

the prices rose after the message in the Wall Street Journal mentioned that some OPEC members urged again to freeze production at current levels, to limit the supply, which consistently exceeds demand.

Qatar's Energy Minister said on Monday that the oil market is moving to restore the balance.

At the same time, excess oil and petroleum products continues to put pressure on the market.

Fuel exports from China in July rose more than 50 percent on an annual basis to a record monthly figure of 4.57 billion tons, official data showed.

"It would be surprising if we quickly reached the level of $ 60 per barrel, - said Bjarne Shildrop analyst at SEB. There is a lot of oil and we need no more."

The number of drilling rigs in the US increased the sixth week in a row to 381, while investors increased bets against the strengthening of oil prices.

Due to a number of factors, analysts have warned that global markets have not coped with the physical excess, which could again lead to a fall in prices before the beginning of a sustainable recovery.

The cost of the September futures on WTI rose to 43.16 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 45.56 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:31

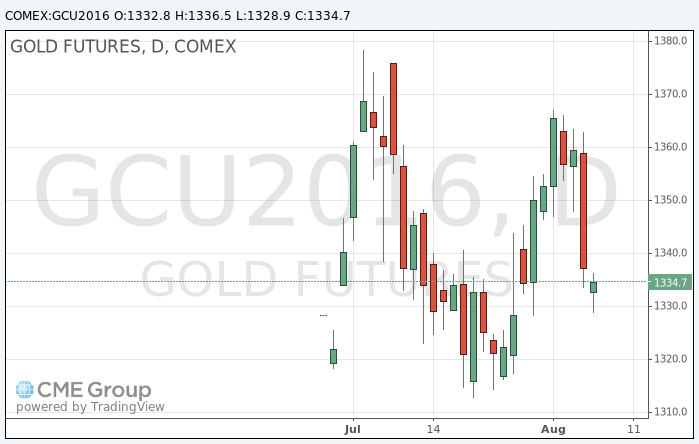

Gold rose moderately

Gold recovered after a decline earlier in the day and after a strong labor market data in the United States that increased the likelihood of a Fed interest rate hike.

The number of people employed in the US economy, excluding the agriculture sector in July rose for the second month in a row, giving the market confidence in the near future.

"The price of gold in the morning is under pressure. This is a continuation of the reaction to Friday's data -.. Said ABN AMRO analyst Georgette Boele -. Expectations for a rate hike rise are increasing after Friday."

According to the futures market, the likelihood of the Fed raising interest rates this year reached 47%, said Commerzbank.

Physical demand for gold in countries such as China and India generally restrained. In the future, analysts expect a quiet trading course this week, while it is likely a further decline of the price.

"If there is no new signs of deterioration in the economic situation, the demand for safe-haven assets weakened," - said Warren Kreytsig of Julius Baer.

Stocks of the world's largest gold exchange-traded fund SPDR Gold rose on Thursday by 0.37 percent to 973.21 tons.

The cost of gold September futures on COMEX rose to $ 1,336.50 an ounce.

-

11:32

Oil is gaining in early trading

This morning, the New York futures for WTI rose + 1.39% to $ 42.37 and crude oil futures for Brent rose by + 1.26% to $ 44.84 per barrel. Thus, the black gold is trading in the plus on the background of the release of data on the number in the US rig. According to the Baker Hughes, the number of active rigs in the US rose last week by 7 units, to 381, the highest figure since March. The index was rising for six straight weeks. Also Sanford Bernstein analysts fear the reduction in the rate of growth in world demand for fuel due to the deterioration of global macroeconomic indicators. In addition, statistical data from China pointed to a decline in exports in July, by 4.4% in annual terms, while imports fell by 12.5%.

-

00:44

Commodities. Daily history for Aug 05’2016:

(raw materials / closing price /% change)

Oil 41.93+0.31%

Gold 1,339.10-0.39%

-