Noticias del mercado

-

17:54

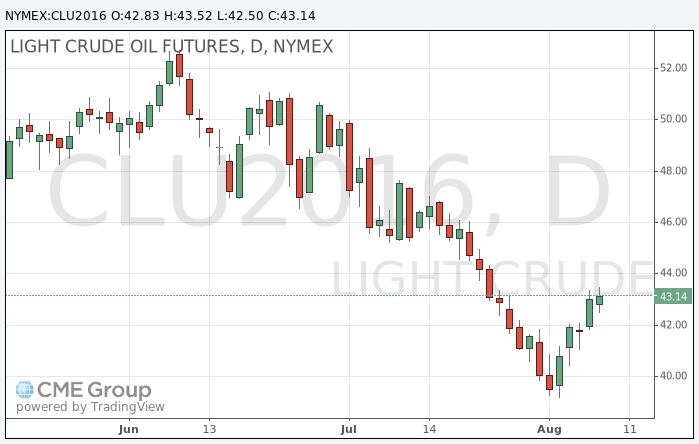

Oil rose today

Today, during the American session oil rose while market participants expect the publication of fresh weekly report on US oil and petroleum products.

The American Petroleum Institute is scheduled to release its report on stocks today, while government data expected on Wednesday may show the decrease in inventories by 1.0 million barrels for the week ending 5 August.

Gasoline stocks are expected to decline by 1.2 million barrels, while, according to analysts, distillate stocks, including heating oil and diesel fuel, will increase by 375,000 barrels.

On Monday in New York crude oil futures jumped $ 1.22, or 2.92%, as renewed hopes for an agreement between the exporters supported the market by freezing production.

Despite the recent growth, the market experts believe that increased fuel product inventories amid slowing global demand growth, most likely, will put pressure on prices in the short term.

Futures for WTI crude oil lost nearly 17% this year after falling from highs above $ 50 per barrel reached in early June amid signs of recovery in the US drilling activity combined with higher fuel product inventory.

According to Baker Hughes, the number of drilling rigs in the US increased by 7 to 381 last week, increasing the sixth week in a row and the ninth week of the last ten.

Number of oil rigs in the United States increases the sixth consecutive week, increasing concern about the over-saturation of the oil market.

A day earlier, the price of Brent crude rose $ 1.12, or 2.53%, as sentiment rose amid renewed hopes for an agreement on exporting production freeze.

According to some sources, several OPEC members, including Venezuela, Ecuador and Kuwait, want to revive the idea of limits on oil production in an attempt to stabilize the market this fall.

Qatar's Energy Minister Mohammed bin Saleh Al Sada, who has served as president of OPEC this year, has confirmed that the cartel will hold an informal meeting of 26-28 September at the International Energy Forum in Algiers.

Nevertheless, market participants are still skeptical about this meeting. Earlier this year, an attempt to freeze level of production was not a success because of Iran's refusal to participate in the initiative.

Meanwhile, Venezuela's oil minister Eulogio del Pino said that the meeting of OPEC and countries outside the cartel could take place "in the coming weeks", but Alexander Novak, Minister of Energy of Russia sees no grounds for the resumption of freeze negotiations.

Brent lost almost 15% from the high in early June, $ 52.80, as the prospects for increasing exports from the Middle East and North African countries, such as Iran, Libya and Nigeria, have raised concern that an excess of oil will reduce demand from refiners.

The cost of the September futures on WTI rose to 43.52 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 45.77 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:29

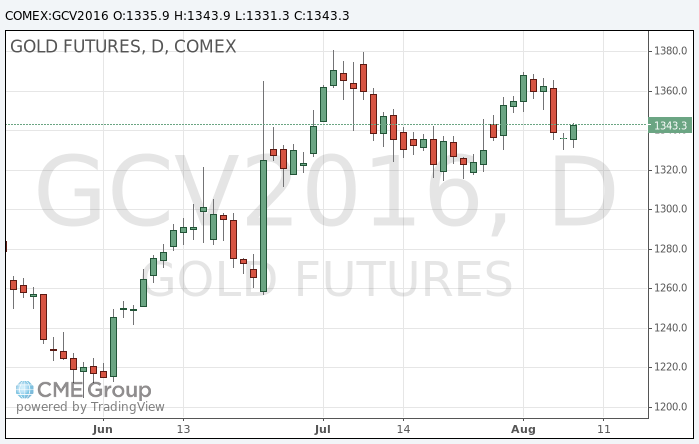

Gold price increased moderately

Gold moved from decline to growth, but fears that the US Federal Reserve may raise interest rates this year undermining the interest in the metal.

According to the data by CME Group Fed Watch, traders' views on the possible lUS interest rates hike in December is now divided exactly evenly.

"Gold is generally settled at a higher range between $ 1.335 and $ 1.365, - said the chief commodities analyst at Saxo Bank Ole Hansen -. I think we are waiting for clues, especially the dollar, as investors are not ready to force without the support of a weaker dollar. "

The dollar was little changed against the currency basket on Tuesday. Stock markets rose due to investors' appetite for risk.

Senior Fed official Jerome Powell said on Monday that the increased risk of a long phase of slow growth of the US economy points to the need for lower interest rates than previously expected.

Stocks of the world's largest gold exchange-traded fund SPDR Gold Shares on Monday fell by 6.5 tons, it is the strongest one-day outflow in the past month.

The cost of the October futures on COMEX gold rose to $ 1,343.90 an ounce.

-

09:52

Oil trading lower

This morning, New York crude oil futures for WTI fell by -0.93% to $ 42.62 and Brent oil futures were down -0.99% to $ 44.92 per barrel. Thus, the black gold is trading lower on the background of concerns about the glut of world markets, as well as investors booked profits after the nearly 3 percent gain in the previous session. Venezuela's oil minister said that in the near future OPEC and non-OPEC countries will meet, looking for support to revive the oil markets. OPEC officials said that a freeze of production can be on the table at the planned meeting in September. Russia said that sees no reason to freeze production at current levels

-

00:31

Commodities. Daily history for Aug 08’2016:

(raw materials / closing price /% change)

Oil 42.87 -0.35%

Gold 1,341.00 -0.02%

-