Noticias del mercado

-

17:52

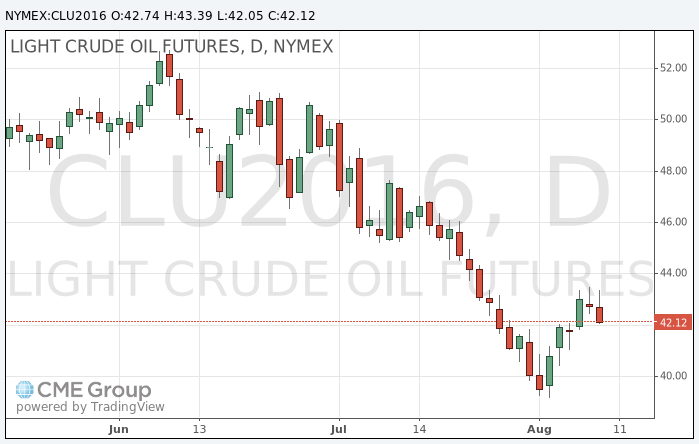

Oil fell after US inventories data

Oil prices fell after the US Department of Energy data showed an unexpected increase in oil inventories.

Energy Information Administration reported an increase of reserves by 1.06 million barrels, while markets expected a decline of 800,000 barrels. World oil reserves remain above average levels after several years of very high production in the US and other countries.

EIA raised the forecast for oil production in the US this year. However, as reported by the department, the production will be below 2015 levels.

OPEC reported that July production rose by 45,000 barrels per day versus 33.11 million barrels per day in June. Saudi Arabia told OPEC that its production in July reached a historical maximum of 10.67 million barrels per day.

On Monday it was reported that OPEC may undergo an informal meeting on which the restriction of production will be discussed. However, markets are skeptical that the cartel would take serious action against low oil prices. Investors point out that the OPEC members could not agree on a freezing of oil production in the past. Even if an agreement is reached on the freeze, the impact on prices will be limited, since most of the oil-producing countries are already using almost all the available production capacity, said Capital Economics economist Thomas Pugh.

The cost of the September futures on WTI fell to 42.05 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 44.11 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:31

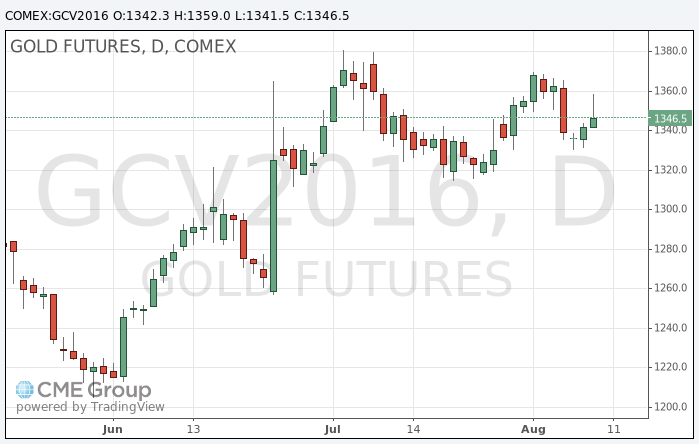

Gold price rose than reversals

Gold prices rose sharply during the European trade, with continued growth in the previous session as investors reconsidered the likelihood that the Federal Reserve will raise interest rates this year.

Later, during the US session, gold prices retreated from highs against the dollar strength.

A day earlier, gold rose $ 5.40, or 0.4%, after disappointing US economic data forced market participants to revise the expectations of the next increase in interest rates in the US, putting pressure on the dollar.

For the year gold has risen in price by almost 26% to date, helped by concerns about global economic growth and expectations of monetary stimulus.

Stocks of the world's largest gold exchange-traded fund SPDR Gold Shares on Tuesday fell by 0.12 percent to 972.62 tons.

The cost of the October gold futures on COMEX rose to $ 1,359.00 an ounce.

-

16:38

US crude oil inventories up 1.1 mln barrels last week

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending August 5, 2016, 255,000 barrels per day less than the previous week's average. Refineries operated at 92.2% of their operable capacity last week. Gasoline production increased last week, averaging 10.1 million barrels per day. Distillate fuel production decreased last week, averaging over 4.7 million barrels per day.

U.S. crude oil imports averaged 8.4 million barrels per day last week, down by 334,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 8.4 million barrels per day, 11.5% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 930,000 barrels per day. Distillate fuel imports averaged 184,000 barrels per day last week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.1 million barrels from the previous week. At 523.6 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories decreased by 2.8 million barrels last week, but are well above the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories decreased by 2.0 million barrels last week but are near the upper limit of the average range for this time of year. Propane/propylene inventories rose 2.0 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories increased by 2.5 million barrels last week.

-

09:58

Oil trading lower

This morning, New York crude oil futures for WTI fell by -0.96% to $ 42.34 and Brent oil futures were down -0.80% to $ 44.53 per barrel. Thus, the black gold is traded lower on the background of data from the Energy Information Administration (EIA). EIA lowered its forecast for the average oil price in 2016 to 41.6 dollars per barrel, as well as increased forecast for production of hydrocarbons in 2017 to 8.31 million barrels per day. Also, according to experts, a continuing excess of oil and oil products putting preasure on prices, while the alleged meeting of manufacturers is unlikely to announce a significantly supply reduction.

-

00:36

Commodities. Daily history for Aug 09’2016:

(raw materials / closing price /% change)

Oil 42.75-0.05%

Gold 1,346.60-0.01%

-