Noticias del mercado

-

17:45

Oil rose on IEA statements

Oil prices rose in today's trading due to forecasts of the International Energy Agency (IEA) for the restoration of the black gold market in the next few months, after several years of over-production.

The IEA, which advises major developed economies on energy policy, forecast that oil production will decrease in the third quarter for the first time in more than two years.

The oil market will begin to recover in the second half of 2016, but the process will be slow and painful amid weakening global demand and increased supply from countries outside OPEC, the International Energy Agency said on Thursday.

In its monthly report, the IEA said that is waiting for a significant reduction of world oil reserves in the next few months, which should reduce the excess on the market, continuing from 2014 amid rising supply from OPEC and non-OPEC countries.

"The fall of oil has returned ..." glut "in the headlines". The organization claims that, according to its data, in the second quarter surplus on the market will almost vanish, and in the third quarter is expected to significantly decline.

"Reduction of stocks of petroleum products will increase the refinery's appetite for oil and help to create a basis for a sustainable recovery of oil balance."

However, this process will be slow, because the stocks in developed countries reached a record 3,093 billion barrels.

The growth in global demand is expected to slow down from 1.4 million barrels per day in 2016 to 1.2 million barrels per day in 2017.

According to the IEA, in 2017 mining producers, not OPEC, will rise by 0.3 million barrels per day, compared with a rise of 0.2 million in the previous forecast.

Due to the slowdown in demand and an increase in production countries outside OPEC, the IEA lowered its forecast for OPEC crude oil production in 2017 by 0.2 million barrels per day to 33.5 million barrels per day.

This figure is close to the level of 33.39 million barrels per day in July, when production in Saudi Arabia, Kuwait and the UAE has reached record levels, pushing total shipments from OPEC to eight-year highs.

The greatest growth this year is observed in Iran and Iraq, where oil production increased by 560,000 and 500,000 barrels per day, respectively, the IEA said.

Oil prices fell sharply on Wednesday after the release of the Energy Information Administration data, according to which the US oil reserves rose for the week ending August 5 at 1.06 million barrels to 523.6 million barrels. Analysts had expected crude oil inventories to fell by 1.03 million barrels.

The cost of the September futures on US light crude oil WTI (Light Sweet Crude Oil) rose to 43.06 dollars per barrel.

September futures price for North Sea petroleum mix of Brent crude rose to 45.61 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:24

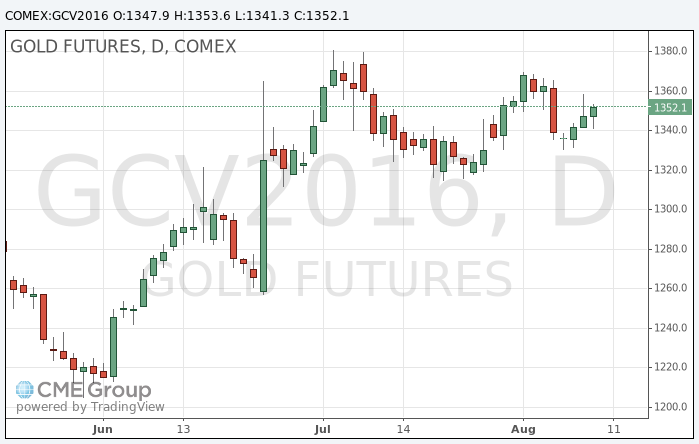

Gold price show a moderate increase

Gold prices rose moderately against the background of uncertainty regarding US monetary policy outlook, although the recovery of the dollar prompted some buyers to fix the recent gains in early trading.

Investors expect that the Fed will raise rates again in December, supported by positive economic data, but other countries are increasingly seeking to enhance the stimulation of the economy. The Reserve Bank of New Zealand cut rates today.

World stock indices hovered near one-year highs on Thursday as oil prices fell for the third consecutive day, as investors are not particularly responded to the decline in interest rates in New Zealand.

A day earlier, gold has risen in price by $ 5.20, or 0.39%.

According to Fed Watch CME, traders estimate the probability of a FED hike in December to 40%. Earlier this week, the probability was about 50%. The chances of a hike in September is now about 9% compared with 20% a few days ago.

The precious metal rose earlier this month above $ 1370, as the disappointing US economic data led market participants to revise the expectations of the next US rate increase.

For the year gold has risen in price by almost 26% to date, helped by concerns about global economic growth and expectations of monetary stimulus.

Investment demand for gold reached a record high for the first half of the level in January-June this year, revealed on Thursday a report of the World Gold Council, linking interest in the metal with a sharp rise in popularity in exchange-traded funds (ETF.

The cost of the October gold futures on COMEX rose to $ 1,353.60 an ounce.

-

11:04

IEA cuts 2017 oil demand growth forecast by 100k bpd to 1.2mln bpd

- forecast reduced on dimmer economic outlook following Brexit vote.

- raises 2017 non-OPEC oil output growth forecast by 200k bpd to 300m bpd.

- our balances show essentially no oversupply during H2 2016. Hefty draw from stocks in Q3.

- stock draw will increase refiners' appetite for oil asnd help pave the way to a sustained tightening of crude balance.

*via forexlive.

-

09:55

Oil little changed in early trading

This morning, New York crude oil futures for WTI fell by -0.24% to $ 41.61 and Brent oil futures were down -0.20% to $ 43.96 per barrel. Thus, the black gold is traded slightly lower on the background of data on reserves of fossil fuels in the United States. According to data published by the US Department of Energy, the amount of oil reserves for the week ended July 29 rose by 1.06 million barrels - up to 523.6 million barrels. This is 37.7% above the average for this time of the year for the last five years. In addition, the pressure on the black gold had record volumes of oil production in Saudi Arabia which has announced an increase in production up to 10.67 million b / d in July.

-

01:01

Commodities. Daily history for Aug 10’2016:

(raw materials / closing price /% change)

Oil 41.49 -0.53%

Gold 1,352.30 +0.03%

-