Noticias del mercado

-

16:45

Bloomberg: the level of consumer confidence in the US fell sharply at the end of last week

The research results published by Bloomberg have shown that the index of US consumer confidence fell sharply last week.

According to data for the week ending 7 August, the index of consumer comfort fell to three-month low, and reached 41.8 points compared with 43.0 points the previous week (31 July). The average value of the index amounted to 43 since the beginning of 2016.

With regard to the components of the index, the decline was recorded on all indicators. Personal finance sensor has fallen by 3.1 points to 53.4 points, reaching a nine-month low, and recorded the largest weekly decline in more than two years. The average value of this index since the beginning of the year amounted to 56.5 points. As for the consumer climate, which shows if now is the time to purchase goods and services, declined from 37.5 points to 37.4 points, the lowest level since mid-December 2015. The average value since the beginning of 2016 amounted to 39.5 points. Meanwhile, the index that assesses views on the economy as a whole fell to 34.7 points from 35.0 the previous week, but remained above the average of the year (34.3 points).

-

16:05

Russian Federation trade balance surplus decreased by 41.4% in June to $ 8.114 billion - CB

The surplus of the trade balance in June 2016 amounted to 8.114 billion dollars according to data published on the CBR website.

Compared with the same period of 2015 (13.85 billion dollars), the trade surplus fell by 41.4% in June 2016.

Exports in June totaled 24.11 billion dollars (a decrease of 19.8% compared to June 2015), while imports were equal to 15.99 billion dollars (a decrease of 1.4% compared to June 2015).

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0920-25 (EUR 773m) 1.0940-50 (913m) 1.1050 (334m) 1.1100 (574m) 1.1130-35 (522m) 1.1190-1.1200 (1.045bln)

USDJPY 100.00 (USD 410m) 101.00 (781m) 102.00 (270m) 102.25 (300m) 102.45-55 (500m) 103.00 (1.52bln) 103.50 (1.27bln) 104.00 (590m)

GBPUSD 1.2995-1.3000 (GBP 473m) 1.3180 (210m)

AUDUSD 0.7420 (AUD 288m) 0.7600 (376m)

USDCAD 1.2975 (USD 260m) 1.3000 (345m) 1.3025 (316m) 1.3115-20 (450m)

NZDUSD 0.7075 (NZD 200m) 0.7200 (287m)

AUDNZD 1.0700 (AUD 318m) 1.0750 (AUD 636m)

-

14:46

Canadian New Housing Price Index rose 0.1% in June driven mainly by new housing prices in Toronto, Oshawa and Vancouver

The New Housing Price Index (NHPI) rose 0.1% in June, following a 0.7% increase in May. The advance, driven mainly by new housing prices in Toronto and Oshawa and Vancouver, was moderated by decreases in Calgary and Edmonton.

The combined region of Toronto and Oshawa (+0.5%) was the top contributor to the national gain among the census metropolitan areas covered by the survey. Builders reported higher labour costs, market conditions and new list prices as the reasons for the increase. New house prices in Vancouver advanced 0.4%, reflecting market conditions.

The largest monthly price gains in June were observed in St. Catharines-Niagara (+1.2%) and Windsor (+0.9%). Builders in St. Catharines-Niagara cited market conditions as the main reason for the rise, the eighth consecutive monthly increase. Builders in Windsor reported higher material costs and land development fees.

Prices were unchanged in 8 of the 21 metropolitan areas surveyed.

-

14:44

US import and export prices higher in July

Prices for U.S. imports advanced 0.1 percent in July, the U.S. Bureau of Labor Statistics reported today, following a 0.6-percent rise the previous month. In July, increasing nonfuel prices more than offset a downturn in fuel prices. The price index for U.S. exports rose 0.2 percent in July, after advancing 0.8 percent in June.

U.S. import prices continued to advance in July, ticking up 0.1 percent. Prices for imports have not recorded a monthly decrease over the past 5 months and increased 3.0 percent since last declining in February. Prior to July, the increases were driven by rising fuel prices. In contrast, in July, nonfuel prices led the advance and fuel prices recorded a decrease. Despite the recent increases, import prices remain down on an over-the-year basis, falling 3.7 percent over the past 12 months. Import prices have not recorded a 12-month advance since 2 years ago when the index rose 0.9 percent between July 2013 and July 2014.

Prices for U.S. exports increased 0.2 percent in July, after rising 2.4 percent over the 3 previous months. In July, higher nonagricultural prices more than offset a decrease in agricultural prices.

The price index for exports last recorded a 1-month decline when the index edged down 0.1 percent in March. Even accounting for the recent advances, export prices declined 3.0 percent over the past 12 months and have not increased on an over-the-year basis since the index advanced 0.4 percent in August 2014. -

14:41

US: 75 consecutive weeks of initial claims below 300,000

In the week ending August 6, the advance figure for seasonally adjusted initial claims was 266,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 269,000 to 267,000. The 4-week moving average was 262,750, an increase of 3,000 from the previous week's revised average. The previous week's average was revised down by 500 from 260,250 to 259,750.

There were no special factors impacting this week's initial claims. This marks 75 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:30

Canada: New Housing Price Index, MoM, June 0.1% (forecast 0.3%)

-

14:30

U.S.: Initial Jobless Claims, 266 (forecast 265)

-

14:30

U.S.: Import Price Index, July 0.1% (forecast -0.3%)

-

14:30

U.S.: Continuing Jobless Claims, 2155 (forecast 2140)

-

13:50

Orders

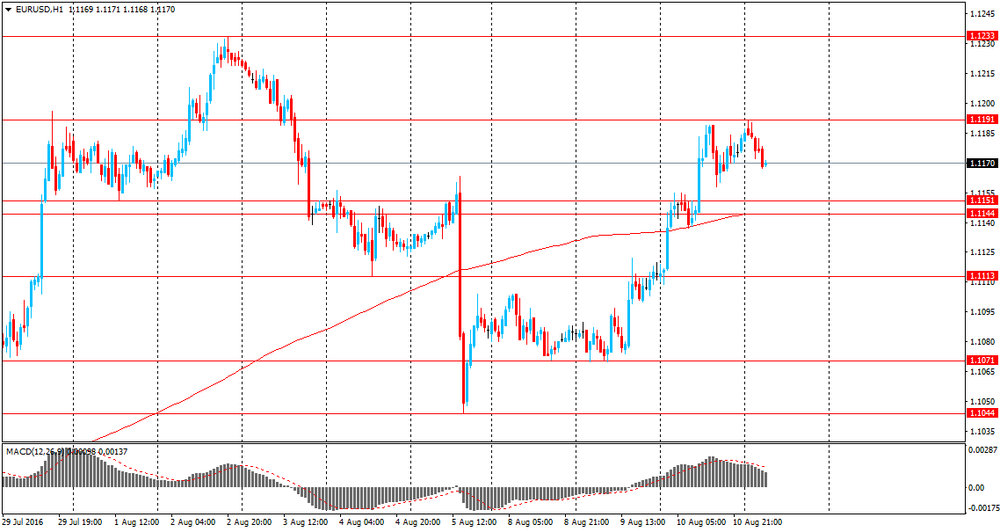

EUR/USD

Offers 1.1165 1.1175-80 1.1200 1.1230 1.1250 1.1280 1.1300

Bids 1.1130 1.1115 1.1100 1.1070 1.1050-55 1.1020-25 1.1000-05

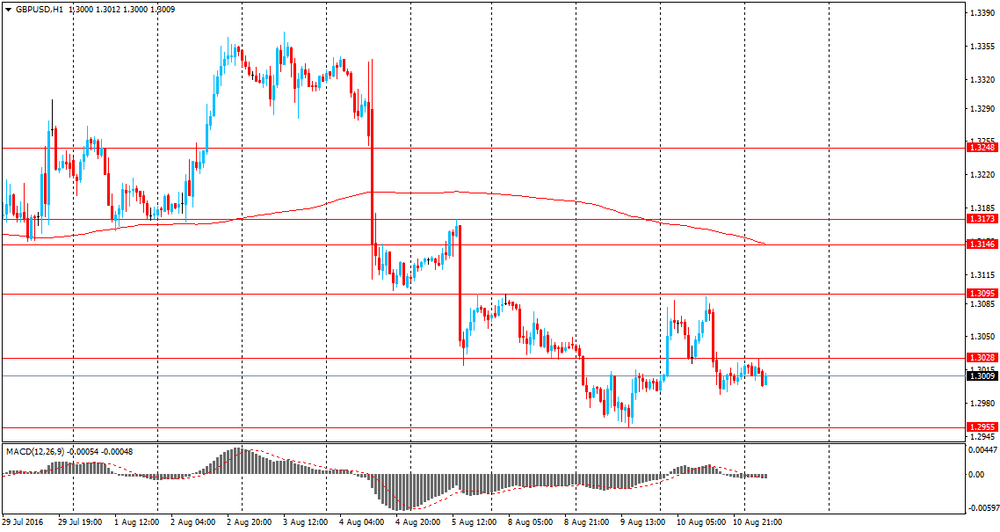

GBP/USD

Offers 1.3000 1.3020-25 1.3065 1.3080 1.3095-05 1.3130 1.3150

Bids 1.2970 1.2950 1.2930 1.2900 1.2880 1.2850

EUR/GBP

Offers 0.8600 0.8625-30 0.8655-60 0.8685 0.8700

Bids 0.8570 0.8550 0.8535 0.8520 0.8500 0.8475-80 0.8450

EUR/JPY

Offers 113.30-35 113.50 113.85 114.00 114.50 114.80 115.00

Bids 112.80-85 112.50 112.00-10 111.85 111.50 111.00

USD/JPY

Offers 101.50 101.80 102.00 102.25-30 102.60 102.80-85 103.00

Bids 101.10 101.00 100.70-75 100.50 100.25 100.00

AUD/USD

Offers 0.7720 0.7750-55 0.7785 0.7800 0.7835 0.7850 0.7900

Bids 0.7680-85 0.76650 0.7650 0.7620 0.7600 0.7585 0.7565 0.7570 0.7550

-

13:19

GBP: 10 Reason Why Negative Rates Could Happen In The UK - Credit Suisse

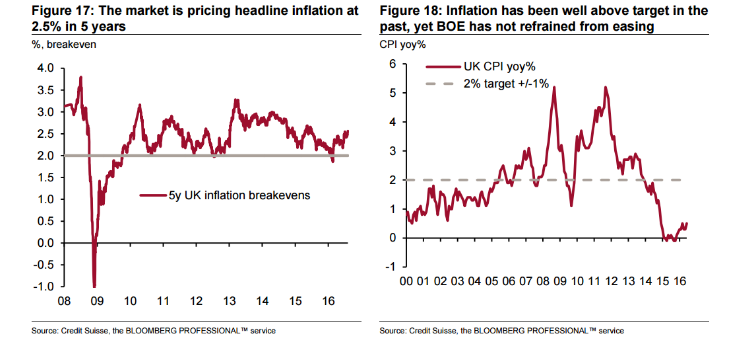

"We identify 10 reasons why negative rates could end up happening in the UK:

1. The UK economy has simply become much less predictable now to rule any option out: Most economists see a quick, shallow recession - yet Carney himself admitted last week that there is no perfect way to 'model' the UK economy post-Brexit. Even McCafferty said he "prefers to learn as we go, providing some stimulus while using our available ammunition cautiously."

2. 'Never' is a temporary concept for central banks. What is deemed appropriate and effective in 'exceptional' policy has fluctuated as conditions surprise in an 'exceptional' way too. In 2010 ECB QE/corporate bond buying was unfeasible. In 2015 the MPC was adamant the next UK rate move would be higher; not an ultra-dovish cut with QE. Kuroda shunned negative rates in Japan just days before BOJ cut negative.

3. The MPC may be trying to rein in expectations at the moment. The MPC knows many central banks that provided too honest a forward guidance recently have suffered from disappointing markets later (e.g. ECB in December 2015, BOJ in January and Riksbank in February). We believe part of the reason why a shrewd Bank of England may want to appear so shut to even discussing negative rates may just be to avoid fueling market expectations - especially before Brexit effects become clear.

4. Negative rates can be 'designed' to be less painful. NIRP is not 'one size fits all'. Theoretically, schemes can be tailored to disproportionately attribute effects among agents, depending upon desired and undesired side effects. The SNB's negative sight deposit rate only applies to entities that hold deposits over a high exemption threshold.

5. Rate cuts seem to be a 'powerful' tool in the UK: Some structural factors about the UK economy suggest to us that interest rates have a faster and cleaner transmission to households than in other places.

6. QE may reach problems sooner than expected: As detailed in the macro section earlier, market size and operational limits of UK QE are already becoming apparent just two days into purchases.

7. High headline inflation need not exclude further rate cuts: Negative rates may be seen as a useful tool for such a 'deflation' setup (e.g., by Riksbank, ECB, BOJ).

8. Can fiscal easing 'permanently fill the slack' in the longer term? November's UK Autumn Statement is widely expected to mark a shift from current austerity. ...If fiscal policy no longer takes the pinch, BOE may have little option but to eventually fill the gap. PM Theresa May has so far welcomed higher spending, but we question the true political appetite of creating a legacy defined by deep budget deficits.

9. Negative rates may just accelerate the UK's rebalancing: Negative rates in Switzerland/Japan were intended to prevent currency appreciation due to excessive capital inflows. This context differs from the UK - where the natural trend for GBP is already skewed to depreciation, and where there is the reverse problem of attracting inflows to fund the still large, sticky current account deficit. .

10. If all other options seem exhausted, the BOE may need to send a dovish signal: If the UK's recession is deeper and longer than expected, the BOE may simply have few options but to open the door to further easing. It is unclear what would be more damaging for investor confidence- refraining from negative rates due to bank profitability concerns, or signaling that the central bank has run out of options. Negative rates may even be less awkward than other measures - e.g., FX interventions are frowned upon by the US Treasury.

Conclusion: We believe the arguments we make above for negative rates are still outweighed by the ample and well-understood reasons against negative rates in the UK. But the debate is certainly not as straightforward or binary as the BOE has made it to sound this week. The situation is simply too fluid for never saying never".

Copyright © 2016 Credit Suisse, eFXnews™

-

12:06

Italian trade balance decreased in June

In June 2016 seasonally-adjusted data, compared to May 2016, decreased by 0.4% for outgoing flows and are stationary for incoming flows. Exports grew by 0.3% for non EU countries and fell by 0.9% for EU countries. Imports increased by 0.4% for EU countries and decreased by 0.5% for non EU countries. During the second quarter 2016, seasonally-adjusted data, in comparison with the previous quarter, increased by 2.4% for exports and by 1.8% for imports.

In June 2016, compared with the same month of the previous year, exports decreased by 0.5% and imports by 6.1%. Outgoing flows increased by 1.3% for EU countries while decreased by 2.8% for non EU countries. Incoming flows fell by 1.1 for EU area and by 13.0% for non EU area. The trade balance in June amounted to +4,7 billion Euros (+1,2 billion Euros for EU area and +3,5 billion Euros for non EU countries).

-

11:02

Italy's consumer prices decreased as initially estimated in July

Italy's consumer prices decreased as initially estimated in July, final figures from the statistical office Istat showed Thursday.

The consumer price index edged down 0.1 percent year-over-year in July, confirming the flash data, following a 0.4 percent drop in June. It was the sixth month of decline in a row.

Excluding energy and unprocessed food, core inflation accelerated to 0.6 percent in July from 0.5 percent in the previous month.

On a monthly basis, consumer prices rose 0.2 percent from June, when it increased by 0.1 percent.

That was in line with the flash report published on July 29. It was the third successive monthly climb.

The EU measure of inflation, or HICP, dropped 0.2 percent annually in July, revised from a 0.1 percent fall reported earlier. In June, the rate of decline was also 0.2 percent.

Month-on-month, the harmonized index of consumer prices dipped 1.9 percent in July, above the previous estimate of a 1.8 percent fall - RTTnews.

-

10:22

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0920-25 (EUR 773m) 1.0940-50 (913m) 1.1050 (334m) 1.1100 (574m) 1.1130-35 (522m) 1.1190-1.1200 (1.045bln)

USD/JPY 100.00 (USD 410m) 101.00 (781m) 102.00 (270m) 102.25 (300m) 102.45-55 (500m) 103.00 (1.52bln) 103.50 (1.27bln) 104.00 (590m)

GBP/USD 1.2995-1.3000 (GBP 473m) 1.3180 (210m)

AUD/USD 0.7420 (AUD 288m) 0.7600 (376m)

USD/CAD 1.2975 (USD 260m) 1.3000 (345m) 1.3025 (316m) 1.3115-20 (450m)

NZD/USD 0.7075 (NZD 200m) 0.7200 (287m)

AUD/NZD 1.0700 (AUD 318m) 1.0750 (AUD 636m)

-

09:22

French inflation lower in July - Insee

In July 2016, the Consumer Prices Index (CPI) declined by 0.4% over a month, after an increase by 0.1% in June. Seasonally adjusted, it was stable in July after an upturn by 0.1% in June. Year-on-year, the CPI rose by 0.2%, as in the previous month.

This month-on-month drop was mainly due to summer sales, underlying the seasonal fall in prices of manufactured products. Besides, energy prices fell back because of petroleum products. Conversely, prices of some services related to tourism expanded seasonally. Finally, food prices were very slightly up.

-

08:37

Asian session review: RBNZ cuts as expected, New Zealand dollar rose

During the Asian session was observed on NZD/USD a "buy the rumors, sell the news" scenario after RBNZ cuts rates by 0.25%, as expected.

The Reserve Bank of New Zealand lowered its key interest rate by a quarter percentage point to a record low of 2.00%, and signaled the likelihood of further policy easing in order to accelerate inflation and curb the growth of the New Zealand currency.

The pound traded in a narrow range with a slight decline after the last Bank of England was unable to acquire sufficient amount of long-term government bonds as part of its quantitative easing program the size of 1.17 billion pounds, Bid to Cover: 0.96. The Bank of England announced its intention to include the missing 52 million pounds in the second half of the six-month program of asset purchases.

Also published today data on the index of housing prices in the UK. According to the Royal Institute of certified real estate appraisers (RICS), UK house price index increased by 5% in June, lower than the previous value of 16% and +6% expectations. According to the RICS report, house prices in the UK grew the slowest pace in three years. The Index decrease was due to the result of the referendum as well as changes in tax legislation.

The New Zealand dollar rose after the Reserve Bank of New Zealand lowered its key interest rate by 25 bps to a record low of 2.00% and signaled further easing of its monetary policy. Central bank's decision coincided with market expectations. RBNZ said in the July economic report that is likely to further easing policies to ensure the stabilization of inflation in the middle of 1-3% range. Currently, the annual inflation rate is only 0.4%, far below the target range. Reserve Bank of New Zealand Governor Graeme Wheeler said the annual inflation is expected to weaken in the third quarter, but to increase in the fourth quarter.

RBNZ also made it clear that the exchange rate remains a source for concern. Wheeler said that the trade-weighted index of the New Zealand dollar is considerably higher than anticipated in the June statement.

Wheeler also said that inflation in house prices remains high, but the planned macroprudential measures should reduce the risks to the financial system.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1160-70 range

GBP / USD: during the Asian session, the pair is trading in $ 1.2995-1.3010 range

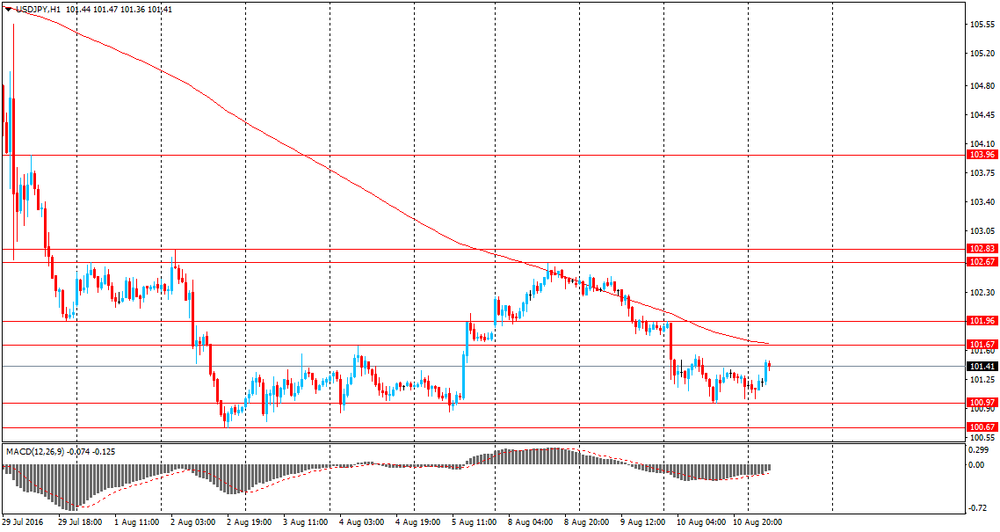

USD / JPY: during the Asian session, the pair was trading in Y101.00-101.40 range

-

08:28

Options levels on thursday, August 11, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1287 (4561)

$1.1263 (3389)

$1.1230 (2209)

Price at time of writing this review: $1.1165

Support levels (open interest**, contracts):

$1.1104 (2066)

$1.1047 (3868)

$1.0972 (5342)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 47772 contracts, with the maximum number of contracts with strike price $1,1250 (4818);

- Overall open interest on the PUT options with the expiration date September, 9 is 54084 contracts, with the maximum number of contracts with strike price $1,1000 (5342);

- The ratio of PUT/CALL was 1.13 versus 1.15 from the previous trading day according to data from August, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (2477)

$1.3206 (1913)

$1.3110 (1199)

Price at time of writing this review: $1.3008

Support levels (open interest**, contracts):

$1.2891 (2027)

$1.2794 (2263)

$1.2696 (1078)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 29978 contracts, with the maximum number of contracts with strike price $1,3300 (2477);

- Overall open interest on the PUT options with the expiration date September, 9 is 25023 contracts, with the maximum number of contracts with strike price $1,2800 (2263);

- The ratio of PUT/CALL was 0.83 versus 0.82 from the previous trading day according to data from August, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

USD/CAD Hgher, EUR/USD Lower Medium-Term - Bank of America Merrill

"Despite the very strong NFP report on Friday, this did not translate into USD buying either over the week in total or on Friday itself from hedge funds or real money clients. Indeed technicals do not yet signal a reason to broadly buy USD.

We remain medium-term bullish USD, and in the near-term still like USD/CAD higher

EUR was sold for the third consecutive week by hedge funds, and we note four weeks of EUR selling by real money clients following a period of EUR buying that has persisted since the end of last year. Strong and persistent corporate EUR selling has abated however.

We like EUR/USD lower in the medium term, but will need to see more priced in for Fed hikes this year to provide momentum".

Copyright © 2016 BofAML, eFXnews™

-

08:16

House prices in UK below expectations - RICS

UK house price index published by the Royal Institution of Chartered Surveyors increased by 5% in June, lower than the previous value of 16% and below +6% expectations. This report reflects the state of the housing market and the economy as a whole, since the real estate market is very sensitive to the business cycle. The decline is a negative factor for the British currency

According to the RICS report, house prices in July grew the slowest pace in three years due to the result of the referendum, as well as changes in tax legislation. There is not only a sharp drop in sales, but the reduction in the number of offers.

-

08:12

Inflation expectations declined 0.2% in Australia

The expected inflation rate (30‐per‐cent trimmed mean measure), reported in the Melbourne Institute Survey of Consumer Inflationary Expectations, fell in August, to 3.5 per cent from 3.7 per cent in July.

In August, the proportion of respondents (excluding respondents in the 'don't know' category) expecting the inflation rate to fall within the 0‐5 per cent range increased to 67.9 per cent from 67.0 per cent in July. This is attributable to the increases in the proportions of respondents expecting no price change and

those expecting prices to rise by 2 per cent or less. The weighted mean of responses within this range decreased to 2.2 per cent in August from 2.4 per cent in July, indicating that the distribution of response within the 0‐5 per cent range is shifting towards its lower end.

-

08:07

RBA Governor Stevens: monetary policy alone not enough

Reserve Bank of Australia Governor Glenn Stevens said monetary policy alone cannot dial up growth, but it should be accompanied by fiscal policy.

"I have serious reservations about the extent of reliance on monetary policy around the world," Stevens said in his final speech as governor on Wednesday.

"It isn't that the central banks were wrong to do what they could, it is that what they could do was not enough, and never could be enough, fully to restore demand after a period of recession associated with a very substantial debt build-up," Stevens said.

There needs to be realism about how much monetary policy can do, including pushing inflation up quickly.

Supporting inflation targeting, Stevens said that it has operated with requisite degree of flexibility. The framework bends with the circumstances, while retaining its essential integrity.

In the period of very low inflation, the bank may adjust monetary policy to lift inflation back to the target in short order, Stevens observed. However, this could create more problems than they solve - RTTnews.

-

08:05

The Reserve Bank of New Zeeland reduced the Official Cash Rate (OCR) by 25 basis points to 2.0 percent.

RBNZ said: global growth is below trend despite being supported by unprecedented levels of monetary stimulus. Significant surplus capacity remains across many economies and, along with low commodity prices, is suppressing global inflation. Some central banks have eased policy further since the June Monetary Policy Statement, and long-term interest rates are at record lows. The prospects for global growth and commodity prices remain uncertain. Political risks are also heightened.

Weak global conditions and low interest rates relative to New Zealand are placing upward pressure on the New Zealand dollar exchange rate. The trade-weighted exchange rate is significantly higher than assumed in the June Statement. The high exchange rate is adding further pressure to the export and import-competing sectors and, together with low global inflation, is causing negative inflation in the tradables sector. This makes it difficult for the Bank to meet its inflation objective. A decline in the exchange rate is needed.

Domestic growth is expected to remain supported by strong inward migration, construction activity, tourism, and accommodative monetary policy. However, low dairy prices are depressing incomes in the dairy sector and reducing farm spending and investment. High net immigration is supporting strong growth in labour supply and limiting wage pressure.

House price inflation remains excessive and has become more broad-based across the regions, adding to concerns about financial stability. The Bank is consulting on stronger macro-prudential measures that should help to mitigate financial system risks arising from the rapid escalation in house prices.

Headline inflation is being held below the target band by continuing negative tradables inflation. Annual CPI inflation is expected to weaken in the September quarter, reflecting lower fuel prices and cuts in ACC levies. Annual inflation is expected to rise from the December quarter, reflecting the policy stimulus to date, the strength of the domestic economy, reduced drag from tradables inflation, and rising non-tradables inflation. Although long-term inflation expectations are well-anchored at 2 percent, the sustained weakness in headline inflation risks further declines in inflation expectations.

-

00:59

Currencies. Daily history for Aug 10’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1182 +0,61%

GBP/USD $1,3012 +0,15%

USD/CHF Chf0,9744 -0,72%

USD/JPY Y101,17 -0,67%

EUR/JPY Y113,14 -0,04%

GBP/JPY Y131,63 -0,53%

AUD/USD $0,7709 +0,57%

NZD/USD $0,7269 +1,46%

USD/CAD C$1,3076 -0,33%

-

00:00

Schedule for today, Thursday, Aug 11’2016

(time / country / index / period / previous value / forecast)

01:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

12:30 Canada New Housing Price Index, MoM June 0.7% 0.3%

12:30 U.S. Continuing Jobless Claims 2138 2140

12:30 U.S. Initial Jobless Claims 269 272

12:30 U.S. Import Price Index July 0.2% -0.3%

22:30 New Zealand Business NZ PMI July 57.7

22:45 New Zealand Retail Sales, q/q Quarter II 0.8% 1%

22:45 New Zealand Retail Sales YoY Quarter II 4.8%

-