Noticias del mercado

-

21:00

DJIA 18617.12 121.46 0.66%, NASDAQ 5228.15 23.57 0.45%, S&P 500 2185.73 10.24 0.47%

-

18:01

European stocks closed: FTSE 6914.71 48.29 0.70%, DAX 10742.84 91.95 0.86%, CAC 4503.95 51.94 1.17%

-

17:45

Oil rose on IEA statements

Oil prices rose in today's trading due to forecasts of the International Energy Agency (IEA) for the restoration of the black gold market in the next few months, after several years of over-production.

The IEA, which advises major developed economies on energy policy, forecast that oil production will decrease in the third quarter for the first time in more than two years.

The oil market will begin to recover in the second half of 2016, but the process will be slow and painful amid weakening global demand and increased supply from countries outside OPEC, the International Energy Agency said on Thursday.

In its monthly report, the IEA said that is waiting for a significant reduction of world oil reserves in the next few months, which should reduce the excess on the market, continuing from 2014 amid rising supply from OPEC and non-OPEC countries.

"The fall of oil has returned ..." glut "in the headlines". The organization claims that, according to its data, in the second quarter surplus on the market will almost vanish, and in the third quarter is expected to significantly decline.

"Reduction of stocks of petroleum products will increase the refinery's appetite for oil and help to create a basis for a sustainable recovery of oil balance."

However, this process will be slow, because the stocks in developed countries reached a record 3,093 billion barrels.

The growth in global demand is expected to slow down from 1.4 million barrels per day in 2016 to 1.2 million barrels per day in 2017.

According to the IEA, in 2017 mining producers, not OPEC, will rise by 0.3 million barrels per day, compared with a rise of 0.2 million in the previous forecast.

Due to the slowdown in demand and an increase in production countries outside OPEC, the IEA lowered its forecast for OPEC crude oil production in 2017 by 0.2 million barrels per day to 33.5 million barrels per day.

This figure is close to the level of 33.39 million barrels per day in July, when production in Saudi Arabia, Kuwait and the UAE has reached record levels, pushing total shipments from OPEC to eight-year highs.

The greatest growth this year is observed in Iran and Iraq, where oil production increased by 560,000 and 500,000 barrels per day, respectively, the IEA said.

Oil prices fell sharply on Wednesday after the release of the Energy Information Administration data, according to which the US oil reserves rose for the week ending August 5 at 1.06 million barrels to 523.6 million barrels. Analysts had expected crude oil inventories to fell by 1.03 million barrels.

The cost of the September futures on US light crude oil WTI (Light Sweet Crude Oil) rose to 43.06 dollars per barrel.

September futures price for North Sea petroleum mix of Brent crude rose to 45.61 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:38

WSE: Session Results

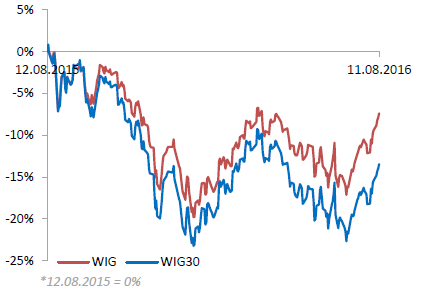

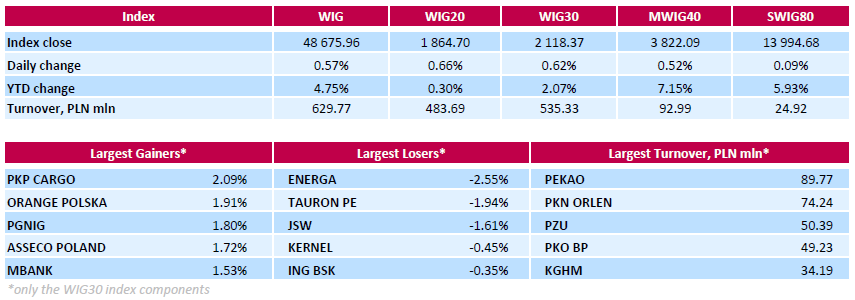

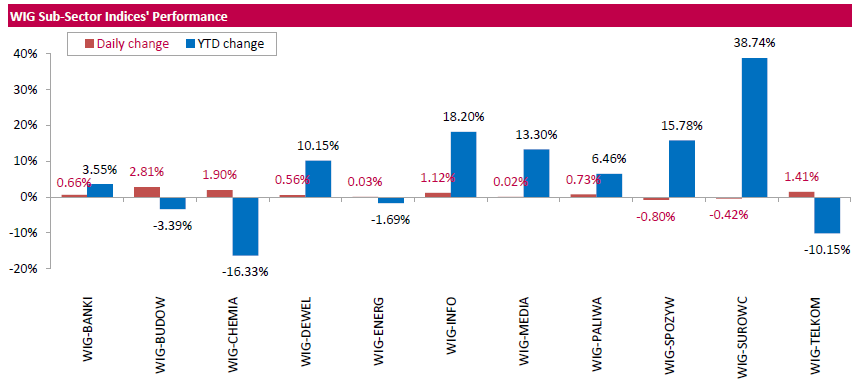

Polish equities advanced on Thursday. The broad market measure, the WIG Index, added 0.57%. Except for materials (-0.42%) and food (-0.80%), every sector in the WIG Index rose, with construction (+2.81%) outperforming.

The large-cap stocks' measure, the WIG30 Index, grew by 0.62%. In the index basket, railway freight transport operator PKP CARGO (WSE: PKP) led the gainers with a 2.09% advance, followed by telecommunication services provider ORANGE POLSKA (WSE: OPL), oil and gas producer PGNIG (WSE: PGN) and IT-company ASSECO POLAND (WSE: ACP), surging by 1.91%, 1.8% and 1.72% respectively. On the other side of the ledger, genco ENERGA (WSE: ENG) was the poorest performer, tumbling by 2.55% as the company posted bigger-than-expected Q2 net loss of PLN 127 mln ($33.29 mln) due to an asset value impairment. Analysts had expected ENERGA to report a net loss of PLN 19.9 mln, compared with a net profit of PLN 178 mln in the same period last year. Other major decliners were genco TAURON PE (WSE: TPE) and coking coal miner JSW (WSE: JSW), dropping by 1.94% and 1.61% respectively.

-

17:24

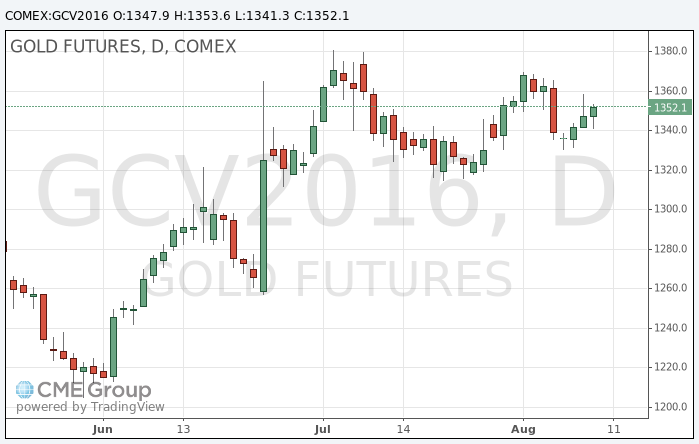

Gold price show a moderate increase

Gold prices rose moderately against the background of uncertainty regarding US monetary policy outlook, although the recovery of the dollar prompted some buyers to fix the recent gains in early trading.

Investors expect that the Fed will raise rates again in December, supported by positive economic data, but other countries are increasingly seeking to enhance the stimulation of the economy. The Reserve Bank of New Zealand cut rates today.

World stock indices hovered near one-year highs on Thursday as oil prices fell for the third consecutive day, as investors are not particularly responded to the decline in interest rates in New Zealand.

A day earlier, gold has risen in price by $ 5.20, or 0.39%.

According to Fed Watch CME, traders estimate the probability of a FED hike in December to 40%. Earlier this week, the probability was about 50%. The chances of a hike in September is now about 9% compared with 20% a few days ago.

The precious metal rose earlier this month above $ 1370, as the disappointing US economic data led market participants to revise the expectations of the next US rate increase.

For the year gold has risen in price by almost 26% to date, helped by concerns about global economic growth and expectations of monetary stimulus.

Investment demand for gold reached a record high for the first half of the level in January-June this year, revealed on Thursday a report of the World Gold Council, linking interest in the metal with a sharp rise in popularity in exchange-traded funds (ETF.

The cost of the October gold futures on COMEX rose to $ 1,353.60 an ounce.

-

17:14

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday as strong labor market data and upbeat corporate results buoyed investor sentiment about U.S. economic growth. The number of Americans applying for unemployment benefits slipped by 3,000 last week to 266,000 from the week earlier, continuing a trend of being below the 300,000 mark for the 75th consecutive week. The data follows a set of robust labor market reports including last week's monthly payrolls numbers.

Almost all of Dow stocks in positive area (28 of 30). Top gainer - NIKE, Inc. (NKE, +1.69%). Top loser - E. I. du Pont de Nemours and Company (DD, -0.26%).

All S&P sectors in positive area, Top gainer - Basic Materials (+1.2%).

At the moment:

Dow 18558.00 +106.00 +0.57%

S&P 500 2181.00 +8.25 +0.38%

Nasdaq 100 4797.50 +16.00 +0.33%

Oil 42.95 +1.24 +2.97%

Gold 1357.30 +5.40 +0.40%

U.S. 10yr 1.52 +0.02

-

16:45

Bloomberg: the level of consumer confidence in the US fell sharply at the end of last week

The research results published by Bloomberg have shown that the index of US consumer confidence fell sharply last week.

According to data for the week ending 7 August, the index of consumer comfort fell to three-month low, and reached 41.8 points compared with 43.0 points the previous week (31 July). The average value of the index amounted to 43 since the beginning of 2016.

With regard to the components of the index, the decline was recorded on all indicators. Personal finance sensor has fallen by 3.1 points to 53.4 points, reaching a nine-month low, and recorded the largest weekly decline in more than two years. The average value of this index since the beginning of the year amounted to 56.5 points. As for the consumer climate, which shows if now is the time to purchase goods and services, declined from 37.5 points to 37.4 points, the lowest level since mid-December 2015. The average value since the beginning of 2016 amounted to 39.5 points. Meanwhile, the index that assesses views on the economy as a whole fell to 34.7 points from 35.0 the previous week, but remained above the average of the year (34.3 points).

-

16:05

Russian Federation trade balance surplus decreased by 41.4% in June to $ 8.114 billion - CB

The surplus of the trade balance in June 2016 amounted to 8.114 billion dollars according to data published on the CBR website.

Compared with the same period of 2015 (13.85 billion dollars), the trade surplus fell by 41.4% in June 2016.

Exports in June totaled 24.11 billion dollars (a decrease of 19.8% compared to June 2015), while imports were equal to 15.99 billion dollars (a decrease of 1.4% compared to June 2015).

-

15:54

WSE: After start on Wall Street

The beginning of trading on Wall Street took place on light pros. Today's increase goes further to defend the level of the narrow consolidation, although you may see that from the beginning of the week the volatility is low and de facto there is lack of idea what to do with the market. The market in the US likes to have arguments up in its sleeve for bigger changes, and these may come not earlier than tomorrow. In the afternoon, we met a series of data from the US (the number of new applications for unemployment benefits and prices data of import and export) that were not particularly important however indicate inflationary pressures in the US economy. It must be remembered that the more mentioned pressure will be evident, the more difficult it will be the Federal Reserve to justify the lack of rate hikes.

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0920-25 (EUR 773m) 1.0940-50 (913m) 1.1050 (334m) 1.1100 (574m) 1.1130-35 (522m) 1.1190-1.1200 (1.045bln)

USDJPY 100.00 (USD 410m) 101.00 (781m) 102.00 (270m) 102.25 (300m) 102.45-55 (500m) 103.00 (1.52bln) 103.50 (1.27bln) 104.00 (590m)

GBPUSD 1.2995-1.3000 (GBP 473m) 1.3180 (210m)

AUDUSD 0.7420 (AUD 288m) 0.7600 (376m)

USDCAD 1.2975 (USD 260m) 1.3000 (345m) 1.3025 (316m) 1.3115-20 (450m)

NZDUSD 0.7075 (NZD 200m) 0.7200 (287m)

AUDNZD 1.0700 (AUD 318m) 1.0750 (AUD 636m)

-

15:32

U.S. Stocks open: Dow +0.36%, Nasdaq +0.43%, S&P +0.34%

-

15:23

Before the bell: S&P futures +0.23%, NASDAQ futures +0.26%

U.S. stock-index futures rose.

Global Stocks:

Nikkei Closed.

Hang Seng 22,580.55 +88.12 +0.39%

Shanghai 3,002.67 -16.0714 -0.53%

FTSE 6,852.24 -14.18 -0.21%

CAC 4,481.77 +29.76 +0.67%

DAX 10,701.68 +50.79 +0.48%

Crude $41.68 (-0.07%)

Gold $1352.20 (+0.02%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.37

0.04(0.3872%)

15620

ALTRIA GROUP INC.

MO

66.84

-0.00(-0.00%)

36082

Amazon.com Inc., NASDAQ

AMZN

770.5

1.94(0.2524%)

7680

American Express Co

AXP

64.76

0.02(0.0309%)

207

Apple Inc.

AAPL

108.39

0.39(0.3611%)

96126

AT&T Inc

T

43.3

0.10(0.2315%)

1007

Barrick Gold Corporation, NYSE

ABX

21.75

-0.02(-0.0919%)

46930

Chevron Corp

CVX

100.59

0.45(0.4494%)

1120

Cisco Systems Inc

CSCO

30.9

0.05(0.1621%)

3242

Citigroup Inc., NYSE

C

45.63

0.18(0.396%)

9626

E. I. du Pont de Nemours and Co

DD

69.15

0.45(0.655%)

300

Exxon Mobil Corp

XOM

86.77

0.36(0.4166%)

4915

Facebook, Inc.

FB

125.15

0.27(0.2162%)

59180

Ford Motor Co.

F

12.28

0.03(0.2449%)

17494

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.11

0.09(0.7487%)

62733

General Electric Co

GE

31.32

0.05(0.1599%)

3350

Google Inc.

GOOG

787

2.32(0.2957%)

842

Home Depot Inc

HD

135.75

0.15(0.1106%)

2982

Intel Corp

INTC

34.53

-0.00(-0.00%)

1083

International Business Machines Co...

IBM

162.13

0.05(0.0309%)

305

International Paper Company

IP

46.79

0.44(0.9493%)

117

Johnson & Johnson

JNJ

123.49

0.13(0.1054%)

212

JPMorgan Chase and Co

JPM

65.4

0.12(0.1838%)

570

Microsoft Corp

MSFT

58.09

0.07(0.1206%)

29042

Nike

NKE

55.8

0.67(1.2153%)

6265

Pfizer Inc

PFE

35.23

0.10(0.2847%)

1620

Procter & Gamble Co

PG

86.31

-0.00(-0.00%)

53057

Starbucks Corporation, NASDAQ

SBUX

55.75

0.13(0.2337%)

1957

Tesla Motors, Inc., NASDAQ

TSLA

226.45

0.80(0.3545%)

3647

The Coca-Cola Co

KO

43.61

0.00(0.00%)

78469

Twitter, Inc., NYSE

TWTR

19.2

0.16(0.8403%)

113606

Wal-Mart Stores Inc

WMT

73.95

-0.00(-0.00%)

38277

Walt Disney Co

DIS

98.15

0.29(0.2963%)

10182

Yahoo! Inc., NASDAQ

YHOO

41.7

1.77(4.4328%)

626364

Yandex N.V., NASDAQ

YNDX

22.31

-0.05(-0.2236%)

200

-

14:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $117 at RBC Capital Mkts

-

14:46

Canadian New Housing Price Index rose 0.1% in June driven mainly by new housing prices in Toronto, Oshawa and Vancouver

The New Housing Price Index (NHPI) rose 0.1% in June, following a 0.7% increase in May. The advance, driven mainly by new housing prices in Toronto and Oshawa and Vancouver, was moderated by decreases in Calgary and Edmonton.

The combined region of Toronto and Oshawa (+0.5%) was the top contributor to the national gain among the census metropolitan areas covered by the survey. Builders reported higher labour costs, market conditions and new list prices as the reasons for the increase. New house prices in Vancouver advanced 0.4%, reflecting market conditions.

The largest monthly price gains in June were observed in St. Catharines-Niagara (+1.2%) and Windsor (+0.9%). Builders in St. Catharines-Niagara cited market conditions as the main reason for the rise, the eighth consecutive monthly increase. Builders in Windsor reported higher material costs and land development fees.

Prices were unchanged in 8 of the 21 metropolitan areas surveyed.

-

14:44

US import and export prices higher in July

Prices for U.S. imports advanced 0.1 percent in July, the U.S. Bureau of Labor Statistics reported today, following a 0.6-percent rise the previous month. In July, increasing nonfuel prices more than offset a downturn in fuel prices. The price index for U.S. exports rose 0.2 percent in July, after advancing 0.8 percent in June.

U.S. import prices continued to advance in July, ticking up 0.1 percent. Prices for imports have not recorded a monthly decrease over the past 5 months and increased 3.0 percent since last declining in February. Prior to July, the increases were driven by rising fuel prices. In contrast, in July, nonfuel prices led the advance and fuel prices recorded a decrease. Despite the recent increases, import prices remain down on an over-the-year basis, falling 3.7 percent over the past 12 months. Import prices have not recorded a 12-month advance since 2 years ago when the index rose 0.9 percent between July 2013 and July 2014.

Prices for U.S. exports increased 0.2 percent in July, after rising 2.4 percent over the 3 previous months. In July, higher nonagricultural prices more than offset a decrease in agricultural prices.

The price index for exports last recorded a 1-month decline when the index edged down 0.1 percent in March. Even accounting for the recent advances, export prices declined 3.0 percent over the past 12 months and have not increased on an over-the-year basis since the index advanced 0.4 percent in August 2014. -

14:41

US: 75 consecutive weeks of initial claims below 300,000

In the week ending August 6, the advance figure for seasonally adjusted initial claims was 266,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 269,000 to 267,000. The 4-week moving average was 262,750, an increase of 3,000 from the previous week's revised average. The previous week's average was revised down by 500 from 260,250 to 259,750.

There were no special factors impacting this week's initial claims. This marks 75 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:30

Canada: New Housing Price Index, MoM, June 0.1% (forecast 0.3%)

-

14:30

U.S.: Initial Jobless Claims, 266 (forecast 265)

-

14:30

U.S.: Import Price Index, July 0.1% (forecast -0.3%)

-

14:30

U.S.: Continuing Jobless Claims, 2155 (forecast 2140)

-

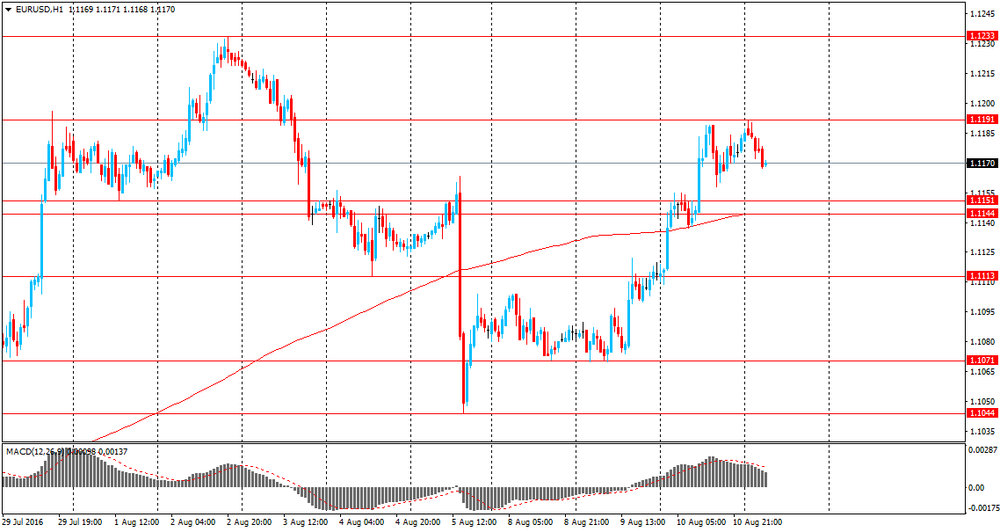

13:50

Orders

EUR/USD

Offers 1.1165 1.1175-80 1.1200 1.1230 1.1250 1.1280 1.1300

Bids 1.1130 1.1115 1.1100 1.1070 1.1050-55 1.1020-25 1.1000-05

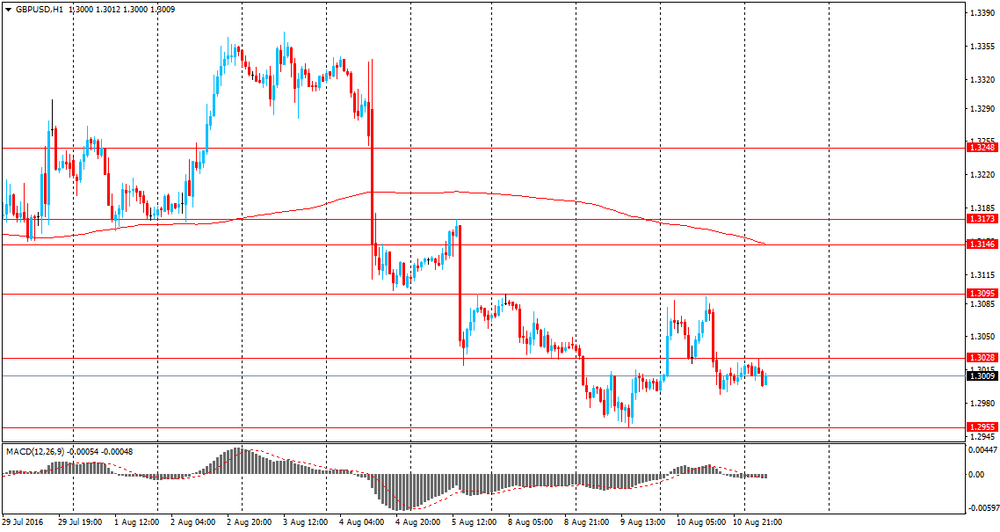

GBP/USD

Offers 1.3000 1.3020-25 1.3065 1.3080 1.3095-05 1.3130 1.3150

Bids 1.2970 1.2950 1.2930 1.2900 1.2880 1.2850

EUR/GBP

Offers 0.8600 0.8625-30 0.8655-60 0.8685 0.8700

Bids 0.8570 0.8550 0.8535 0.8520 0.8500 0.8475-80 0.8450

EUR/JPY

Offers 113.30-35 113.50 113.85 114.00 114.50 114.80 115.00

Bids 112.80-85 112.50 112.00-10 111.85 111.50 111.00

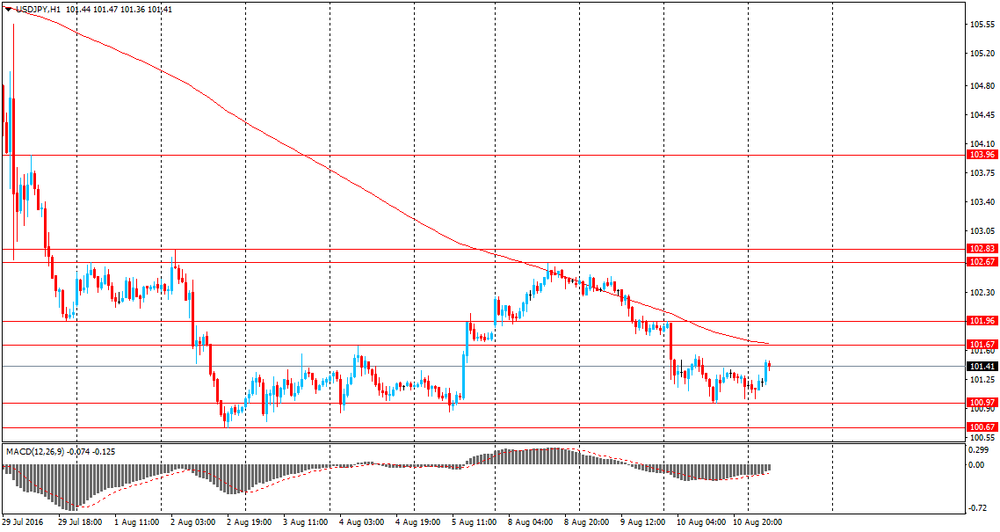

USD/JPY

Offers 101.50 101.80 102.00 102.25-30 102.60 102.80-85 103.00

Bids 101.10 101.00 100.70-75 100.50 100.25 100.00

AUD/USD

Offers 0.7720 0.7750-55 0.7785 0.7800 0.7835 0.7850 0.7900

Bids 0.7680-85 0.76650 0.7650 0.7620 0.7600 0.7585 0.7565 0.7570 0.7550

-

13:19

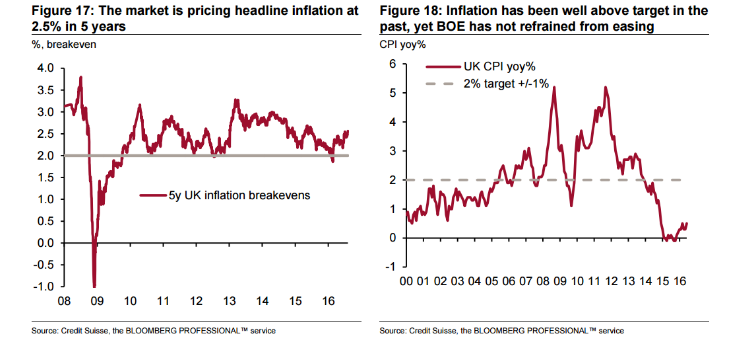

GBP: 10 Reason Why Negative Rates Could Happen In The UK - Credit Suisse

"We identify 10 reasons why negative rates could end up happening in the UK:

1. The UK economy has simply become much less predictable now to rule any option out: Most economists see a quick, shallow recession - yet Carney himself admitted last week that there is no perfect way to 'model' the UK economy post-Brexit. Even McCafferty said he "prefers to learn as we go, providing some stimulus while using our available ammunition cautiously."

2. 'Never' is a temporary concept for central banks. What is deemed appropriate and effective in 'exceptional' policy has fluctuated as conditions surprise in an 'exceptional' way too. In 2010 ECB QE/corporate bond buying was unfeasible. In 2015 the MPC was adamant the next UK rate move would be higher; not an ultra-dovish cut with QE. Kuroda shunned negative rates in Japan just days before BOJ cut negative.

3. The MPC may be trying to rein in expectations at the moment. The MPC knows many central banks that provided too honest a forward guidance recently have suffered from disappointing markets later (e.g. ECB in December 2015, BOJ in January and Riksbank in February). We believe part of the reason why a shrewd Bank of England may want to appear so shut to even discussing negative rates may just be to avoid fueling market expectations - especially before Brexit effects become clear.

4. Negative rates can be 'designed' to be less painful. NIRP is not 'one size fits all'. Theoretically, schemes can be tailored to disproportionately attribute effects among agents, depending upon desired and undesired side effects. The SNB's negative sight deposit rate only applies to entities that hold deposits over a high exemption threshold.

5. Rate cuts seem to be a 'powerful' tool in the UK: Some structural factors about the UK economy suggest to us that interest rates have a faster and cleaner transmission to households than in other places.

6. QE may reach problems sooner than expected: As detailed in the macro section earlier, market size and operational limits of UK QE are already becoming apparent just two days into purchases.

7. High headline inflation need not exclude further rate cuts: Negative rates may be seen as a useful tool for such a 'deflation' setup (e.g., by Riksbank, ECB, BOJ).

8. Can fiscal easing 'permanently fill the slack' in the longer term? November's UK Autumn Statement is widely expected to mark a shift from current austerity. ...If fiscal policy no longer takes the pinch, BOE may have little option but to eventually fill the gap. PM Theresa May has so far welcomed higher spending, but we question the true political appetite of creating a legacy defined by deep budget deficits.

9. Negative rates may just accelerate the UK's rebalancing: Negative rates in Switzerland/Japan were intended to prevent currency appreciation due to excessive capital inflows. This context differs from the UK - where the natural trend for GBP is already skewed to depreciation, and where there is the reverse problem of attracting inflows to fund the still large, sticky current account deficit. .

10. If all other options seem exhausted, the BOE may need to send a dovish signal: If the UK's recession is deeper and longer than expected, the BOE may simply have few options but to open the door to further easing. It is unclear what would be more damaging for investor confidence- refraining from negative rates due to bank profitability concerns, or signaling that the central bank has run out of options. Negative rates may even be less awkward than other measures - e.g., FX interventions are frowned upon by the US Treasury.

Conclusion: We believe the arguments we make above for negative rates are still outweighed by the ample and well-understood reasons against negative rates in the UK. But the debate is certainly not as straightforward or binary as the BOE has made it to sound this week. The situation is simply too fluid for never saying never".

Copyright © 2016 Credit Suisse, eFXnews™

-

13:13

WSE: Mid session comment

The next day an empty macro calendar and a lack of important reports is used to develop a consistent upward trend in Europe. Today in particular stands out Paris, in turn, the German DAX remains comfortably at field won on Tuesday.

This demand pressure has encouraged our market to another attempt to strike at today's highs. Unfortunately the solid drawback remains turnover, which at the halfway point of the session among the 20 largest companies was amounted to PLN 180 million, which does not indicate a session of a breakthrough. The WIG20 index in the same time reached the level of 1,852 points (+ 0.00%).

-

12:48

Major stock indices in Europe show moderate activity

European stocks traded mostly in positive territory, near a seven-week high, as investors analyze corporate reports and monitor the situation on the oil market.

Oil prices are rising slightly, slowly recovering after yesterday's crash. However, concern about the increase in US oil inventories and record levels of production in Saudi Arabia may not allow oil to continue its upward movement.

A slight effect on the indices have data from Britain and France. The report of the Royal Institute of Chartered Surveyors (RICS) reported that the cost of housing in Britain rose in July at the slowest rate in the past three years. Demand decreased significantly, and the houses offered for sale turned out to be at a record low. So far, housing prices are rising slightly, but it is expected that in the next year will begin to decline. The pressure on the cost of housing have had changes in the tax laws of the country. "Now the housing market adjusts to conflicting economic data and the Bank of England recently adopted stimulus measures - said the chief economist at RICS Simon Rabinson".

At the same time, the National Bureau of Statistics Insee said that the inflation rate in France fell by 0.4% in July from the previous month. However, the consumer price index rose by 0.2% y/y. Changes in line with the forecasts of most economists. Lower inflation occurred against the background of falling prices for products and manufacturing. Their value fell by 2.9% compared with the previous month. Clothing and footwear fell by 14%. Energy prices fell by 1.3%. The harmonized index of consumer prices in the second economy of Europe rose 0.4% compared with the same period last year, after rising 0.3% in June.

The composite index of Europe's largest companies Stoxx 600 added 0.3 percent. Trading volume today about a third lower than the average for the last 30 days. Yesterday, the shares intrerupted a five-day increase, which was supported by optimism that central banks will encourage growth as well as better than expected US labor market data. "We had a good rally, and investors have realized that it can not go on forever, - said Peter Dixon, Commerzbank AG economist -.. Macro and corporate news are not able to give the markets a big push, however, uncertainty about Brexit and Fed futre hikes inhibit the increase of shares. "

Quotes of Zurich Insurance Group AG rose 4 percent after the insurance company announced a smaller-than-expected decline in revenue.

Shares of Belgian lender KBC Group NV rose by 4.7 per cent, since the sum of earnings and revenue topped analysts' estimates.

The capitalization of ThyssenKrupp AG fell 1.3 percent after the largest steel producer in Germany reported a decline in quarterly profit.

At the moment:

FTSE 100 6848.32 -18.10 -0.26%

DAX +60.25 10711.14 + 0.57%

CAC 40 +29.88 4481.89 + 0.67%

-

12:06

Italian trade balance decreased in June

In June 2016 seasonally-adjusted data, compared to May 2016, decreased by 0.4% for outgoing flows and are stationary for incoming flows. Exports grew by 0.3% for non EU countries and fell by 0.9% for EU countries. Imports increased by 0.4% for EU countries and decreased by 0.5% for non EU countries. During the second quarter 2016, seasonally-adjusted data, in comparison with the previous quarter, increased by 2.4% for exports and by 1.8% for imports.

In June 2016, compared with the same month of the previous year, exports decreased by 0.5% and imports by 6.1%. Outgoing flows increased by 1.3% for EU countries while decreased by 2.8% for non EU countries. Incoming flows fell by 1.1 for EU area and by 13.0% for non EU area. The trade balance in June amounted to +4,7 billion Euros (+1,2 billion Euros for EU area and +3,5 billion Euros for non EU countries).

-

11:04

IEA cuts 2017 oil demand growth forecast by 100k bpd to 1.2mln bpd

- forecast reduced on dimmer economic outlook following Brexit vote.

- raises 2017 non-OPEC oil output growth forecast by 200k bpd to 300m bpd.

- our balances show essentially no oversupply during H2 2016. Hefty draw from stocks in Q3.

- stock draw will increase refiners' appetite for oil asnd help pave the way to a sustained tightening of crude balance.

*via forexlive.

-

11:02

Italy's consumer prices decreased as initially estimated in July

Italy's consumer prices decreased as initially estimated in July, final figures from the statistical office Istat showed Thursday.

The consumer price index edged down 0.1 percent year-over-year in July, confirming the flash data, following a 0.4 percent drop in June. It was the sixth month of decline in a row.

Excluding energy and unprocessed food, core inflation accelerated to 0.6 percent in July from 0.5 percent in the previous month.

On a monthly basis, consumer prices rose 0.2 percent from June, when it increased by 0.1 percent.

That was in line with the flash report published on July 29. It was the third successive monthly climb.

The EU measure of inflation, or HICP, dropped 0.2 percent annually in July, revised from a 0.1 percent fall reported earlier. In June, the rate of decline was also 0.2 percent.

Month-on-month, the harmonized index of consumer prices dipped 1.9 percent in July, above the previous estimate of a 1.8 percent fall - RTTnews.

-

10:22

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0920-25 (EUR 773m) 1.0940-50 (913m) 1.1050 (334m) 1.1100 (574m) 1.1130-35 (522m) 1.1190-1.1200 (1.045bln)

USD/JPY 100.00 (USD 410m) 101.00 (781m) 102.00 (270m) 102.25 (300m) 102.45-55 (500m) 103.00 (1.52bln) 103.50 (1.27bln) 104.00 (590m)

GBP/USD 1.2995-1.3000 (GBP 473m) 1.3180 (210m)

AUD/USD 0.7420 (AUD 288m) 0.7600 (376m)

USD/CAD 1.2975 (USD 260m) 1.3000 (345m) 1.3025 (316m) 1.3115-20 (450m)

NZD/USD 0.7075 (NZD 200m) 0.7200 (287m)

AUD/NZD 1.0700 (AUD 318m) 1.0750 (AUD 636m)

-

09:55

Oil little changed in early trading

This morning, New York crude oil futures for WTI fell by -0.24% to $ 41.61 and Brent oil futures were down -0.20% to $ 43.96 per barrel. Thus, the black gold is traded slightly lower on the background of data on reserves of fossil fuels in the United States. According to data published by the US Department of Energy, the amount of oil reserves for the week ended July 29 rose by 1.06 million barrels - up to 523.6 million barrels. This is 37.7% above the average for this time of the year for the last five years. In addition, the pressure on the black gold had record volumes of oil production in Saudi Arabia which has announced an increase in production up to 10.67 million b / d in July.

-

09:52

Major stock exchanges trading higher: FTSE -0.3%, DAX + 0.4%, CAC40 + 0.5%, FTMIB + 0.4%, IBEX + 0.5%

-

09:22

French inflation lower in July - Insee

In July 2016, the Consumer Prices Index (CPI) declined by 0.4% over a month, after an increase by 0.1% in June. Seasonally adjusted, it was stable in July after an upturn by 0.1% in June. Year-on-year, the CPI rose by 0.2%, as in the previous month.

This month-on-month drop was mainly due to summer sales, underlying the seasonal fall in prices of manufactured products. Besides, energy prices fell back because of petroleum products. Conversely, prices of some services related to tourism expanded seasonally. Finally, food prices were very slightly up.

-

09:13

WSE: After opening

WIG20 index opened at 1850.84 points (-0.09%)*

WIG 48445.06 0.09%

WIG30 2106.22 0.04%

mWIG40 3807.40 0.14%

*/ - change to previous close

The futures market began the trading with a rise of 0.16% to 1,858 points. The contract on the DAX presents quite surprisingly better posture with the approach of over 0.6%.

The cash market (the WIG20 index) at the opening drop of 0.09% to 1,850 points. At the same time, the German DAX rose approx. 0.5%. The turnover is concentrated on the medium size companies such as JSW and wanting to make its debut in Frankfurt - Ciech (WSE: CIE).

-

08:37

Asian session review: RBNZ cuts as expected, New Zealand dollar rose

During the Asian session was observed on NZD/USD a "buy the rumors, sell the news" scenario after RBNZ cuts rates by 0.25%, as expected.

The Reserve Bank of New Zealand lowered its key interest rate by a quarter percentage point to a record low of 2.00%, and signaled the likelihood of further policy easing in order to accelerate inflation and curb the growth of the New Zealand currency.

The pound traded in a narrow range with a slight decline after the last Bank of England was unable to acquire sufficient amount of long-term government bonds as part of its quantitative easing program the size of 1.17 billion pounds, Bid to Cover: 0.96. The Bank of England announced its intention to include the missing 52 million pounds in the second half of the six-month program of asset purchases.

Also published today data on the index of housing prices in the UK. According to the Royal Institute of certified real estate appraisers (RICS), UK house price index increased by 5% in June, lower than the previous value of 16% and +6% expectations. According to the RICS report, house prices in the UK grew the slowest pace in three years. The Index decrease was due to the result of the referendum as well as changes in tax legislation.

The New Zealand dollar rose after the Reserve Bank of New Zealand lowered its key interest rate by 25 bps to a record low of 2.00% and signaled further easing of its monetary policy. Central bank's decision coincided with market expectations. RBNZ said in the July economic report that is likely to further easing policies to ensure the stabilization of inflation in the middle of 1-3% range. Currently, the annual inflation rate is only 0.4%, far below the target range. Reserve Bank of New Zealand Governor Graeme Wheeler said the annual inflation is expected to weaken in the third quarter, but to increase in the fourth quarter.

RBNZ also made it clear that the exchange rate remains a source for concern. Wheeler said that the trade-weighted index of the New Zealand dollar is considerably higher than anticipated in the June statement.

Wheeler also said that inflation in house prices remains high, but the planned macroprudential measures should reduce the risks to the financial system.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1160-70 range

GBP / USD: during the Asian session, the pair is trading in $ 1.2995-1.3010 range

USD / JPY: during the Asian session, the pair was trading in Y101.00-101.40 range

-

08:30

WSE: Before opening

Yesterday's closing of the S&P500 index by decline of 0.3% was largely driven by behavior of oil prices. Quotation of this raw material decelerated markedly yesterday's afternoon in response to the data on stocks. Yesterday, Europe was dominated by small declines, and it is difficult to say that the moods in the world are very optimistic. In Asia parquet in Japan is closed due to holidays.

Today's macro calendar is devoid of important publications, which will appear tomorrow. Therefore we are before the session without clear pulse in the global arena.

On the Warsaw market worse than expected results reported Energa (WSE: ENG). Also, Lotos (WSE: LTS) does not live up to earlier forecasts. Smaller derogation from the projections are visible in the case of Alior (WSE: ALR), though hard about the positive surprise here.

Financial Stability Committee issued an opinion on Wednesday about the identification of other systemically relevant institutions and the imposition of an additional capital buffer. It is a response to the request of the Polish Financial Supervision Authority, which proposes such as ING Bank (WSE: ING), PKO BP (WSE: PKO), Getin Noble (WSE: GNB) and Bank BGZ BNP Paribas (WSE: BGZ) to include to this group.

Yesterday, at the close of the session on the tape was tampered level of 1,850 points and today's session should give an answer whether it was justified or not. The key, as usual, will be the afternoon, which in recent days is as a rule under the sign of growth, probably due to the purchase of US funds.

-

08:28

Options levels on thursday, August 11, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1287 (4561)

$1.1263 (3389)

$1.1230 (2209)

Price at time of writing this review: $1.1165

Support levels (open interest**, contracts):

$1.1104 (2066)

$1.1047 (3868)

$1.0972 (5342)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 47772 contracts, with the maximum number of contracts with strike price $1,1250 (4818);

- Overall open interest on the PUT options with the expiration date September, 9 is 54084 contracts, with the maximum number of contracts with strike price $1,1000 (5342);

- The ratio of PUT/CALL was 1.13 versus 1.15 from the previous trading day according to data from August, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (2477)

$1.3206 (1913)

$1.3110 (1199)

Price at time of writing this review: $1.3008

Support levels (open interest**, contracts):

$1.2891 (2027)

$1.2794 (2263)

$1.2696 (1078)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 29978 contracts, with the maximum number of contracts with strike price $1,3300 (2477);

- Overall open interest on the PUT options with the expiration date September, 9 is 25023 contracts, with the maximum number of contracts with strike price $1,2800 (2263);

- The ratio of PUT/CALL was 0.83 versus 0.82 from the previous trading day according to data from August, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

USD/CAD Hgher, EUR/USD Lower Medium-Term - Bank of America Merrill

"Despite the very strong NFP report on Friday, this did not translate into USD buying either over the week in total or on Friday itself from hedge funds or real money clients. Indeed technicals do not yet signal a reason to broadly buy USD.

We remain medium-term bullish USD, and in the near-term still like USD/CAD higher

EUR was sold for the third consecutive week by hedge funds, and we note four weeks of EUR selling by real money clients following a period of EUR buying that has persisted since the end of last year. Strong and persistent corporate EUR selling has abated however.

We like EUR/USD lower in the medium term, but will need to see more priced in for Fed hikes this year to provide momentum".

Copyright © 2016 BofAML, eFXnews™

-

08:16

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.2%, FTSE + 0.1%

-

08:16

House prices in UK below expectations - RICS

UK house price index published by the Royal Institution of Chartered Surveyors increased by 5% in June, lower than the previous value of 16% and below +6% expectations. This report reflects the state of the housing market and the economy as a whole, since the real estate market is very sensitive to the business cycle. The decline is a negative factor for the British currency

According to the RICS report, house prices in July grew the slowest pace in three years due to the result of the referendum, as well as changes in tax legislation. There is not only a sharp drop in sales, but the reduction in the number of offers.

-

08:12

Inflation expectations declined 0.2% in Australia

The expected inflation rate (30‐per‐cent trimmed mean measure), reported in the Melbourne Institute Survey of Consumer Inflationary Expectations, fell in August, to 3.5 per cent from 3.7 per cent in July.

In August, the proportion of respondents (excluding respondents in the 'don't know' category) expecting the inflation rate to fall within the 0‐5 per cent range increased to 67.9 per cent from 67.0 per cent in July. This is attributable to the increases in the proportions of respondents expecting no price change and

those expecting prices to rise by 2 per cent or less. The weighted mean of responses within this range decreased to 2.2 per cent in August from 2.4 per cent in July, indicating that the distribution of response within the 0‐5 per cent range is shifting towards its lower end.

-

08:07

RBA Governor Stevens: monetary policy alone not enough

Reserve Bank of Australia Governor Glenn Stevens said monetary policy alone cannot dial up growth, but it should be accompanied by fiscal policy.

"I have serious reservations about the extent of reliance on monetary policy around the world," Stevens said in his final speech as governor on Wednesday.

"It isn't that the central banks were wrong to do what they could, it is that what they could do was not enough, and never could be enough, fully to restore demand after a period of recession associated with a very substantial debt build-up," Stevens said.

There needs to be realism about how much monetary policy can do, including pushing inflation up quickly.

Supporting inflation targeting, Stevens said that it has operated with requisite degree of flexibility. The framework bends with the circumstances, while retaining its essential integrity.

In the period of very low inflation, the bank may adjust monetary policy to lift inflation back to the target in short order, Stevens observed. However, this could create more problems than they solve - RTTnews.

-

08:05

The Reserve Bank of New Zeeland reduced the Official Cash Rate (OCR) by 25 basis points to 2.0 percent.

RBNZ said: global growth is below trend despite being supported by unprecedented levels of monetary stimulus. Significant surplus capacity remains across many economies and, along with low commodity prices, is suppressing global inflation. Some central banks have eased policy further since the June Monetary Policy Statement, and long-term interest rates are at record lows. The prospects for global growth and commodity prices remain uncertain. Political risks are also heightened.

Weak global conditions and low interest rates relative to New Zealand are placing upward pressure on the New Zealand dollar exchange rate. The trade-weighted exchange rate is significantly higher than assumed in the June Statement. The high exchange rate is adding further pressure to the export and import-competing sectors and, together with low global inflation, is causing negative inflation in the tradables sector. This makes it difficult for the Bank to meet its inflation objective. A decline in the exchange rate is needed.

Domestic growth is expected to remain supported by strong inward migration, construction activity, tourism, and accommodative monetary policy. However, low dairy prices are depressing incomes in the dairy sector and reducing farm spending and investment. High net immigration is supporting strong growth in labour supply and limiting wage pressure.

House price inflation remains excessive and has become more broad-based across the regions, adding to concerns about financial stability. The Bank is consulting on stronger macro-prudential measures that should help to mitigate financial system risks arising from the rapid escalation in house prices.

Headline inflation is being held below the target band by continuing negative tradables inflation. Annual CPI inflation is expected to weaken in the September quarter, reflecting lower fuel prices and cuts in ACC levies. Annual inflation is expected to rise from the December quarter, reflecting the policy stimulus to date, the strength of the domestic economy, reduced drag from tradables inflation, and rising non-tradables inflation. Although long-term inflation expectations are well-anchored at 2 percent, the sustained weakness in headline inflation risks further declines in inflation expectations.

-

07:07

Global Stocks

European stocks finished slightly lower Wednesday, with energy shares among those pulling the region's key benchmark away from its post-Brexit high.

The Stoxx Europe 600 SXXP, -0.20% slipped 0.2% to end at 343.98. The pan-European index suffered its first daily drop after five straight sessions of gains.

U.S. stocks closed slightly lower Wednesday, with the S&P 500 and Nasdaq retreating from record levels as the energy sector came under renewed pressure.

The main indexes, which opened with small gains, turned lower as crude-oil futures slumped following data on supply and production.

Oil futures fell 2.5% to a one-week low after the U.S. Energy Information Administration reported an increase crude supplies last week, while Saudi Arabia revealed record crude production in July.

The benchmark S&P 500 index SPX, -0.29% fell 6.25 points, or 0.4% to 2,175.49, a day after notching an all-time high. Energy shares, down 1.4%, led the losses, followed by financials, down 0.8%.

The Dow Jones Industrial Average DJIA, -0.20% fell 37.39 points, or 0.2%, to 18,495.66, with shares of Exxon Mobil Corp. XOM, -1.75% and Chevron Corp CVX, -1.16% leading losses.

Asian shares fell on Thursday, reversing recent gains following losses on Wall Street, though regional currencies rose after Beijing let the Chinese yuan strengthen to mark the one-year anniversary of a landmark devaluation.

Broad risk sentiment remains on the back foot as oil prices tumbled on news of a surprising jump in U.S. government stockpiles and as Singapore, the region's bellwether for trade, cut its economic forecast for the year.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.5 percent. It hit a one-year high on Wednesday and has broadly outperformed the MSCI world index .MIWO00000PUS since end-June.

Hong Kong .HSI and Indonesia .JKSE led regional gainers in trade. Japan's markets .N225 are closed for a holiday.

Singapore cut its economic growth forecast on concerns over Brexit and weakening global demand with official forecasts downgraded to an expansion of 1-2 percent this year from a previous forecast of 1-3 percent growth.

In Asia, yields on 10-year benchmark New Zealand bonds NZ10YT=RR fell to 2.18 percent after the Reserve Bank of New Zealand cut its official cash rate by 25 basis points to a record low of 2.0 percent as widely expected.

-

01:01

Commodities. Daily history for Aug 10’2016:

(raw materials / closing price /% change)

Oil 41.49 -0.53%

Gold 1,352.30 +0.03%

-

01:00

Stocks. Daily history for Aug 10’2016:

(index / closing price / change items /% change)

Nikkei 225 16,735.12 -29.85 -0.18%

Shanghai Composite 3,019.29 -6.3928 -0.21%

S&P/ASX 200 5,543.71 -8.837 -0.16%

FTSE 100 6,866.42 +15.12 +0.22%

CAC 40 4,452.01 -16.0600 -0.36%

Xetra DAX 10,650.89 -42.01 -0.39%

S&P 500 2,175.49 -6.25 -0.29%

Dow Jones Industrial Average 18,495.66 -37.39 -0.20%

S&P/TSX Composite 14,775.04 -26.19 -0.18%

-

00:59

Currencies. Daily history for Aug 10’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1182 +0,61%

GBP/USD $1,3012 +0,15%

USD/CHF Chf0,9744 -0,72%

USD/JPY Y101,17 -0,67%

EUR/JPY Y113,14 -0,04%

GBP/JPY Y131,63 -0,53%

AUD/USD $0,7709 +0,57%

NZD/USD $0,7269 +1,46%

USD/CAD C$1,3076 -0,33%

-

00:00

Schedule for today, Thursday, Aug 11’2016

(time / country / index / period / previous value / forecast)

01:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

12:30 Canada New Housing Price Index, MoM June 0.7% 0.3%

12:30 U.S. Continuing Jobless Claims 2138 2140

12:30 U.S. Initial Jobless Claims 269 272

12:30 U.S. Import Price Index July 0.2% -0.3%

22:30 New Zealand Business NZ PMI July 57.7

22:45 New Zealand Retail Sales, q/q Quarter II 0.8% 1%

22:45 New Zealand Retail Sales YoY Quarter II 4.8%

-