Noticias del mercado

-

21:00

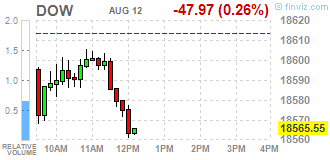

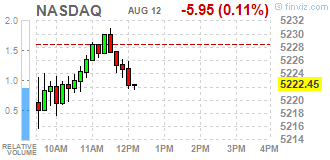

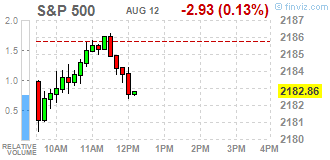

DJIA 18564.28 -49.24 -0.26%, NASDAQ 5227.29 -1.10 -0.02%, S&P 500 2182.15 -3.64 -0.17%

-

18:17

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes was little changed on Friday as a rise in oil prices offset the impact of weak economic data. U.S. retail sales were unexpectedly flat in July as people cut back on buying clothes and other goods, while another report showed that producers index fell 0,4% in July, the biggest drop in nearly a year. Cooling consumer spending and tame inflation suggest the Federal Reserve will probably not raise interest rates anytime soon despite a robust labor market.

Most of all Dow stocks in negative area (19 of 30). Top gainer - Exxon Mobil Corporation (XOM, +1.22%). Top gainer - Microsoft Corporation (MSFT, -1.00%).

S&P sectors mixed. Top gainer - Conglomerates (+1.4%). Top loser - Industrial goods (-0.3%).

At the moment:

Dow 18558.00 +106.00 +0.57%

S&P 500 2181.00 +8.25 +0.38%

Nasdaq 100 4797.50 +16.00 +0.33%

Oil 44.32 +0.83 +1.91%

Gold 1357.70 +7.70 +0.57%

U.S. 10yr 1.49 -0.08

-

18:00

European stocks closed: FTSE 6916.02 1.31 0.02%, DAX 10713.43 -29.41 -0.27%, CAC 4500.19 -3.76 -0.08%

-

17:59

WSE: Session Results

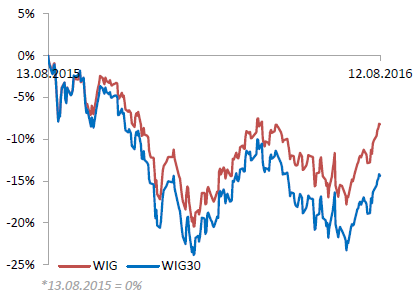

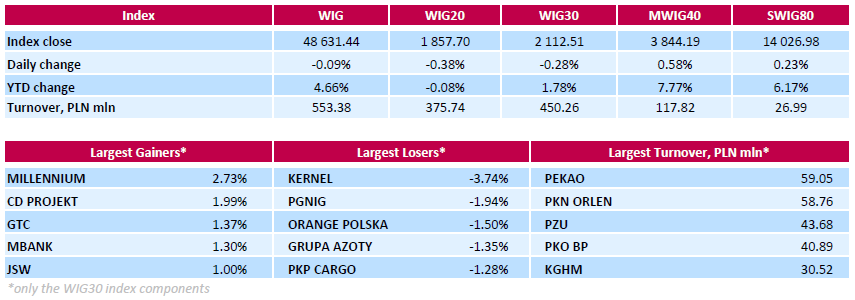

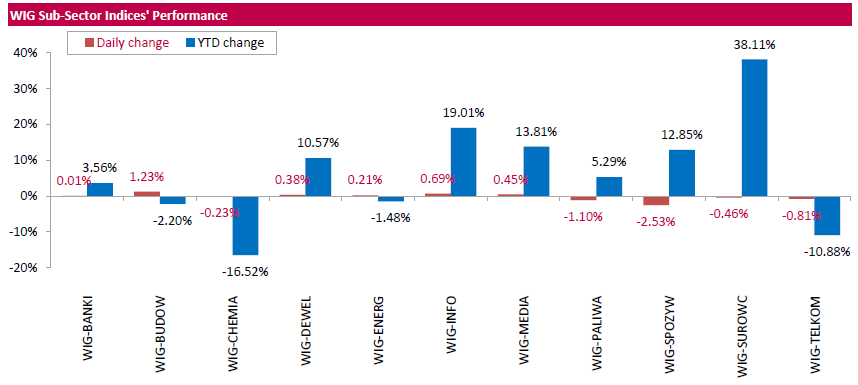

Polish equity market closed slightly lower on Friday. The broad market benchmark, the WIG Index, inched down 0.09%. Sector performance in the WIG Index was mixed. Food sector (-2.53%) recorded the biggest decline, while construction (+1.23%) fared the best.

The large-cap stocks' measure, the WIG30 Index, lost 0.28%. In the index basket, agricultural producer KERNEL (WSE: KER) tumbled the most, down 3.74%. It was followed by oil and gas producer PGNIG (WSE: PGN), dropping by 1.94%. The company reported a PLN 115 mln net loss for the second quarter of 2016 (versus profit of PLN 621 mln in corresponding period of the previous year) and restated its dividend policy of paying PLN 0.20 per share. Other major decliners were telecommunication services provider ORANGE POLSKA (WSE: OPL), chemical producer GRUPA AZOTY (WSE: ATT) and railway freight transport operator PKP CARGO (WSE: PKP), falling by 1.5%, 1.35% and 1.28% respectively. On the other side of the ledger, bank MILLENNIUM (WSE: MIL) led the gainers with a 2.73% advance, followed by videogame developer CD PROJEKT (WSE: CDR), property developer GTC (WSE: GTC) and bank MBANK (WSE: MBK), surging by 1.99%, 1.37% and 1.3% respectively.

The Warsaw Stock Exchange will be closed on Monday, August 15, due to the Feast of Assumption of the Blessed Mary.

-

17:46

Falling dollar support oil prices

Oil prices have risen due to the weakening US dollar, which keeps the prices close to the previous day's high.

The dollar began to lose ground after the release of data on US retail sales, which showed a flat trend in July, contrary to the expectations.

Quotes of oil holds near 3-week intraday high after the day intentions of Saudi Arabia to cooperate with other oil-producing countries to stabilize prices was made public.

Saudi Minister of Energy Khaled Al-Falih said Thursday that, together with other members of OPEC and oil-producing countries that are not members of the cartel, "will take any steps to help" the oil market. His statements were perceived by some as a sign of readiness to support the coordinated production limitation.

However, many traders and analysts are skeptical about the willingness of Saudi Arabia to restrict production, as the volume of oil production in the country in July has reached record levels.

"It does not look like the action of a country that is going to stop the fight for market share".

OPEC said that next month will hold a meeting in Algeria. In April this year a meeting of oil-producing countries to discuss the possibility of production constraints, failed.

Analysts at RBC Capital Markets believe that OPEC countries are unlikely to make any real steps. "The action plan is likely to be purely symbolic and aimed rather at changing market sentiment than any real action".

On Thursday, the International Energy Agency reported that abundant world oil reserves may be reduced in the second half of the year, as production has not kept pace with demand.

Traders also await weekly data from Baker Hughes oilfield on the number of rigs operating in the USA. This index has shown growth for several consecutive weeks, giving rise to concerns about the fact that oil prices are already high enough to lead to production growth in the United States and preserve the excess supply in the market. Energy Information Administration recently raised its forecast for oil production in the country for the current and next year.

The cost of the September futures on US light crude oil WTI rose to 44.17 dollars per barrel.

September futures price for North Sea petroleum mix of Brent crude rose to 46.66 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:32

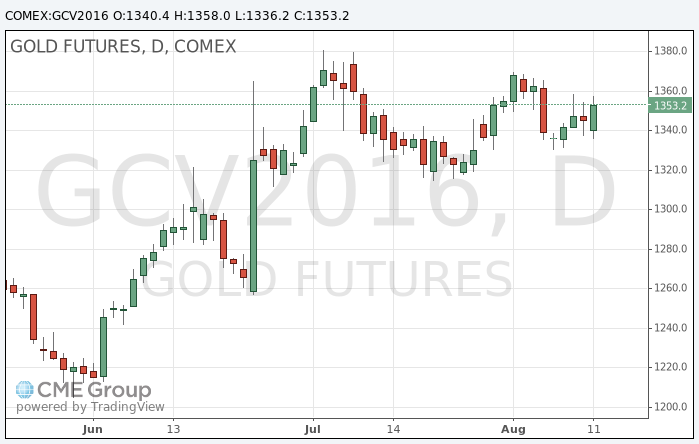

Gold price rose

Gold prices rose as investors believe the Fed will not rush to raise interest rates in coming months after weak data on retail sales.

According to the US Department of Commerce, retail sales in the US were unchanged in July. The seasonally adjusted volume of retail sales remained at the same level and amounted to $ 4.5773 trillion. Meanwhile, the index for June was revised upward to + 0.8% from + 0.6%. Analysts had expected sales to increase by 0.4%. Excluding cars, retail sales fell by 0.3%, almost leveling 0.4 percent increase in June. It was predicted that sales in this category will rise by 0.2%. Meanwhile, excluding autos and gasoline, sales were down 0.1%. In annual terms, total retail sales rose in July by 2.3%, slowing down the pace compared to the previous month, when an increase of 2.7% was recorded.

Expectations of continued low interest rates usually support gold. "The US economy does not feel very strong," - said Peter Hug from Kitco Metals. "It does not appear that the Fed will raise interest rates soon," - he added.

According to the futures market, the likelihood of a Fed hike in September is 12% down from 18% a month ago.

The cost of the October gold futures on COMEX rose to $ 1,358.00 an ounce.

-

16:46

Will Home Depot beat analysts' expectations in the second quarter?

Adjusted earnings and Home Depot sales (HD) exceeded the consensus forecast of analysts in the last eight of the nine quarters. The largest increase in adjusted EPS (earnings per share) was 24.1% to $ 1.44, recorded in the first quarter of 2016. Home Depot plans to announce its quarterly results on 16 August.

Growth in the first quarter was due to the impressive increase in sales and effective cost management measures.

Home Depot's profit in the first quarter also favorably influenced by "buy backs". Home Depot bought back 9.5 million shares for approximately $ 1.3.

Adjusted EPS growth was better than the competition. Profits of Bed Bath & Beyond (BBBY) decreased by 14% compared to the same period of last year, to $ 0.80 per share, mainly against the background of weak sales. Adjusted earnings of Williams-Sonoma jumped by 10.4% in the previous quarter, to $ 0.53. Lowe's Inc. (LOW) profit increased by 24.3% to $ 0.87 per share, on the back of improved sales and profitability.

After the impressive results of the first quarter, Home Depot raised its forecast for revenue. The company expects earnings per share to grow by 14.8%, to $ 6.27. This estimate is based on the expectation of 6.3% sales growth, or by 4.9% in 2016 fiscal year.

Analysts expect second-quarter adjusted earnings per share to grow by 15.2%, to $ 1.97.

Currently, shares of The Home Depot, Inc. (HD) trading at $ 136.22 (-0.60%)

-

16:21

Credit Suisse selling GBP/USD, Levels & Targets

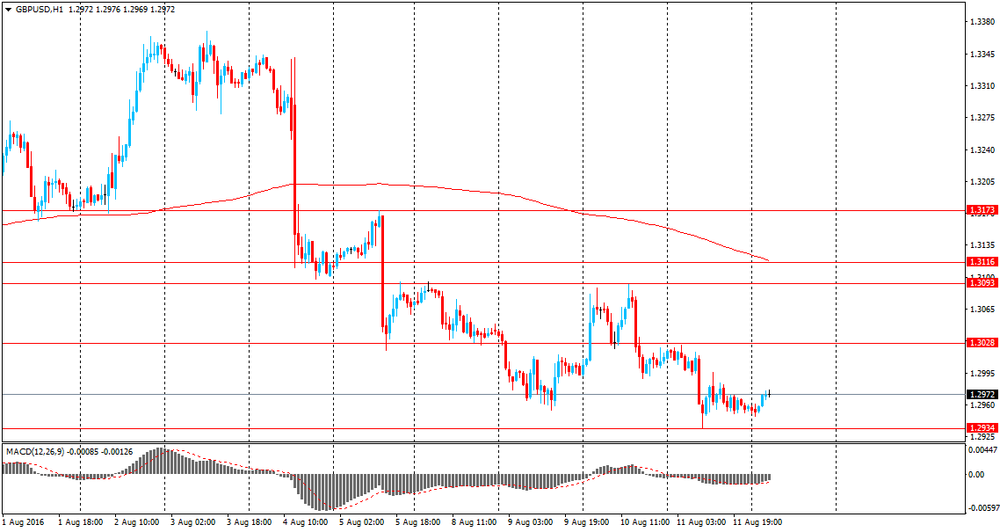

"GBPUSD has completed a bearish "pennant" formation on last week's break below former trendline/range support now at 1.3200.

We look for a test of the July 2016 low at 1.2798 next. However, bigger picture we look for an eventual break below here to then test our next target at the 78.6% retracement of the 1985/2007 rise at 1.2752. We would expect this to hold initially, but below it can target pattern objectives at 1.2433 then 1.2000, with scope for 1.1855

Resistance shows at 1.3155/85 initially then 1.3373. Above 1.3413/82 is needed for a base.

*CS maintains a limit order to sell GBP/USD at 1.3155 targeting 1.2752.

GBPJPY remains under heavy pressure and given that we also remain bullish JPY (c.f. JPY remain in a core bull trend 5th Aug 2016) we expect to see further weakness to retest this year's low at 128.81. Capitulation beneath here can see the core downtrend resume for 118.80 initially, with the major 2011 low at 116.84 expected to provide a floor.

Resistance moves to 136.26 then 139.93/140.15 with a bigger barrier seen at 1422.22/143.93. Selling is expected at the latter level and above it is needed to set a base again and open up strength to 146.36.

EURGBP has extended its rally from support at .8252/43 and we remain bullish for a break above the July 2016 high at .8640 to test the 61.8% retracement of the 2008/15 fall at .8706, potentially .8816. We would expect a cap at the latter level.

Below .8252/43 can see a retreat back to 8120/18, potentially .8000/.7995, but with a floor expected here.

*CS booked profit today on its long EUR/GBP from 0.8380 at 0.8620".

Copyright © 2016 Credit Suisse, eFXnews™

-

16:11

US: The Index of Consumer Sentiment hit 90.4 in August

A key measure of consumers' attitudes is slightly higher so far this month, but didn't rise as much as expected, according to preliminary data released Friday. The Index of Consumer Sentiment hit 90.4 in August, the University of Michigan said. Economists expected the consumer sentiment index to hit 91.5, versus 90 in July's final reading, according to a Thomson Reuters consensus estimate. The monthly survey of 500 consumers measures attitudes toward topics like personal finances, inflation, unemployment, government policies and interest rates - CNBC.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, August 90.4 (forecast 91.5)

-

16:00

U.S.: Business inventories , June 0.2% (forecast 0.1%)

-

15:51

Conference Board Leading Index down 0.3% in June

The research results published by Conference Board showed that at the end of June the leading economic index for the UK fell by 0.3 per cent, to a level of 113.7 points (2010 = 100), after falling 0.2 percent in May and -0.1 per cent in April. Within six months (from December 2015 to June 2016) the index decreased by 0.1 percent compared with a growth of 0.6 percent in the previous six-month.

The leading economic index is a weighted average, which is calculated based on a number of macroeconomic indicators. The index characterizes the development of the economy over the next 6 months. There is also a rule of thumb that the output value of the indicator in the negative area for three months in succession is an indication of slowing down of the economy.

-

15:51

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1100 (EUR 513m)

USDJPY 102.00 (USD 615m) 102.50 (USD 1.79bln)

AUDNZD 1.0900 (AUD 1.48bln)

-

15:34

WSE: After start on Wall Street

Today's data from the US economy, a zero increase in sales with forecast of 0.4 percent growth and a decline excluding cars was supplemented by the low readings of PPI. These figures stand in clear contradiction with the data from the labor market.

In short, these are not the data that allow the Fed to raise interest rates at the September FOMC meeting. It was hardest reflected in quotations of the dollar and boost of the weakening of the US dollar appeared on most pairs associated with the USD. The stock market went up to the report calmer. At the beginning of trading on Wall Street the S&P500 index lost 0,20 percent.

-

15:32

U.S. Stocks open: Dow -0.20%, Nasdaq -0.24%, S&P -0.22%

-

15:14

Before the bell: S&P futures -0.13%, NASDAQ futures -0.07%

U.S. stock-index futures fluctuated amid lackluster data.

Global Stocks:

Nikkei 16,919.92 +184.80 +1.10%

Hang Seng 22,766.91 +186.36 +0.83%

Shanghai 3,051.02 +48.38 +1.61%

FTSE 6,900.35 -14.36 -0.21%

CAC 4,491.65 -12.30 -0.27%

DAX 10,693.85 -48.99 -0.46%

Crude $43.72 (+0.53%)

Gold $1355.00 (+0.37%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.35

-0.07(-0.6718%)

9350

Amazon.com Inc., NASDAQ

AMZN

770.4

-0.84(-0.1089%)

5770

Apple Inc.

AAPL

108.19

0.26(0.2409%)

87411

AT&T Inc

T

43.4

0.01(0.0231%)

2335

Barrick Gold Corporation, NYSE

ABX

22.24

0.50(2.2999%)

102121

Cisco Systems Inc

CSCO

30.98

0.03(0.0969%)

1503

Citigroup Inc., NYSE

C

45.25

-0.48(-1.0496%)

12810

Exxon Mobil Corp

XOM

86.87

0.15(0.173%)

2040

Facebook, Inc.

FB

124.86

-0.04(-0.032%)

34357

Ford Motor Co.

F

12.31

0.00(0.00%)

11491

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.01

-0.10(-0.8258%)

184810

General Electric Co

GE

31.2

-0.09(-0.2876%)

15346

General Motors Company, NYSE

GM

31.76

0.01(0.0315%)

400

Goldman Sachs

GS

162.72

-1.14(-0.6957%)

2874

Google Inc.

GOOG

784.48

-0.37(-0.0471%)

1374

Home Depot Inc

HD

136

-1.04(-0.7589%)

14980

International Business Machines Co...

IBM

163.53

-0.00(-0.00%)

1042

Johnson & Johnson

JNJ

123.77

-0.00(-0.00%)

500

JPMorgan Chase and Co

JPM

64.95

-0.51(-0.7791%)

9017

Merck & Co Inc

MRK

63.31

-0.32(-0.5029%)

563

Microsoft Corp

MSFT

58.21

-0.09(-0.1544%)

1256

Nike

NKE

56.75

0.02(0.0353%)

4266

Pfizer Inc

PFE

35.2

0.05(0.1422%)

1128

Procter & Gamble Co

PG

86.95

0.22(0.2537%)

3970

Starbucks Corporation, NASDAQ

SBUX

55.45

-0.02(-0.0361%)

580

Tesla Motors, Inc., NASDAQ

TSLA

225

0.09(0.04%)

4894

The Coca-Cola Co

KO

43.85

0.10(0.2286%)

13042

Twitter, Inc., NYSE

TWTR

19.75

-0.03(-0.1517%)

123381

Visa

V

80

-0.12(-0.1498%)

259

Wal-Mart Stores Inc

WMT

73.87

0.07(0.0949%)

2500

Walt Disney Co

DIS

97.55

-0.22(-0.225%)

2810

Yahoo! Inc., NASDAQ

YHOO

41.47

0.20(0.4846%)

68229

Yandex N.V., NASDAQ

YNDX

23.18

-0.06(-0.2582%)

400

-

14:41

US retail sales lower than forecasts - Bloomberg

According to Bloomberg, sales at U.S. retailers were little changed in July as Americans flocked to auto dealers at the expense of other merchants.

"After three upside surprises, we see some downside risk," Jim O'Sullivan, chief U.S. economist at High Frequency Economics Ltd in Valhalla, New York, said in a research note before the report. At the same time, "most important is the improving labor market, including what is probably just the start of a pickup in wage gains."

Estimates in the Bloomberg survey ranged from no change to a 0.9 percent gain. June's reading was revised from an initially reported 0.6 percent increase.

Gasoline service station receipts dropped 2.7 percent, while sales weakened at sporting goods and hobby outlets, department stores, clothing merchants and restaurants.

-

14:35

-

14:33

US: The Producer Price Index decreased 0.4 percent in July

The Producer Price Index for final demand decreased 0.4 percent in July, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.5 percent in June and 0.4 percent in May. On an unadjusted basis, the final demand index moved down 0.2 percent for

the 12 months ended in July.

In July, the decline in the final demand index was led by prices for final demand services, which fell 0.3 percent. The index for final demand goods decreased 0.4 percent.

Prices for final demand less foods, energy, and trade services were unchanged in July after rising 0.3 percent in June. For the 12 months ended in July, the index for final demand less foods, energy, and trade services increased 0.8 percent. -

14:31

U.S.: Retail Sales YoY, July 2.3%

-

14:30

U.S.: Retail sales, July 0% (forecast 0.4%)

-

14:30

U.S.: PPI excluding food and energy, m/m, July -0.3% (forecast 0.2%)

-

14:30

U.S.: PPI, m/m, July -0.4% (forecast 0.1%)

-

14:30

U.S.: Retail sales excluding auto, August -0.3% (forecast 0.2%)

-

14:30

U.S.: PPI excluding food and energy, Y/Y, July 0.7% (forecast 1.2%)

-

14:30

U.S.: PPI, y/y, July -0.2% (forecast 0.2%)

-

14:18

Monday 15.08.2016 - WSE will be closed

We would like to remind that there will be no trading session (the Exchange will be closed) on Monday, August 15, 2016.

-

14:00

Orders

EUR/USD

Offers 1.1160 1.1175-80 1.1200 1.1230 1.1250 1.1280 1.1300

Bids 1.1130 1.1115 1.1100 1.1070 1.1050-55 1.1020-25 1.1000-05

GBP/USD

Offers 1.2980 1.3000 1.3020-25 1.3065 1.3080 1.3095-05 1.3130 1.3150

Bids 1.2930 1.2900 1.2880 1.2850 1.2830 1.2800 1.2780 1.2750

EUR/GBP

Offers 0.8625-30 0.8655-60 0.8685 0.8700

Bids 0.8585 0.8570 0.8550 0.8535 0.8520 0.8500 0.8475-80 0.8450

EUR/JPY

Offers 114.00 114.50 114.80 115.00 115.30 115.50

Bids 113.50 113.00 112.80-85 112.50 112.00-10 111.85 111.50

USD/JPY

Offers 102.20-25 102.50 102.80-85 103.00 103.50

Bids 102.00 101.80 101.60 101.30 101.10 101.00 100.70-75 100.50

AUD/USD

Offers 0.7700 0.7720 0.7750-55 0.7785 0.7800 0.7835 0.7850 0.7900

Bids 0.7680 0.7660 0.7620 0.7600 0.7585 0.7565 0.7570 0.7550

-

13:19

WSE: Mid session comment

The preliminary reading of GDP for Poland do not live up to the forecast, but it is difficult to talk about some serious passing with market expectations. GDP figures for Europe were in line with expectations, and the data on industrial production were slightly better than expected. It is hard to expect that the data close enough to forecast aroused excitement in the market during the holidays. Everything seems to indicate that only the US readings can bring some new content.

The Warsaw market shows the next day of weak activity. In this context, there is no surprise too modest percentage change and low volatility. Stability in the region of yesterday's close strengthens by flat trade in Europe and a symmetrical distribution of companies on the losing and gaining in value. If the part of Wall Street will not come with any new impulses to the sleepy afternoon, the market will be looking forward to the final day and enjoy a long weekend. In the mid-session the WIG20 index reached the level of 1,863 points (-0.07%) and the turnover of slightly over PLN 160 million.

-

12:42

Major stock indices in Europe trading mixed in ultra low volume

European stocks traded in different directions, but with a slight change. The focus is on corporate profits and the latest statistical data for the euro area.

The revised data released by the Statistical Office, Eurostat, showed that economic growth in the eurozone maintained the pace in the second quarter, confirming at the same time the preliminary estimates provided in late July. According to the report, the gross domestic product of 19 countries in the currency bloc in the second quarter increased by 0.3 percent compared to the previous three-month period and increased by 1.6 percent year on year. Last change coincided with the forecasts. Recall that in the first quarter Eurozone GDP grew by 0.6 percent in quarterly terms and by 1.7 percent on an annual basis

A separate report from the Eurostat showed that the seasonally adjusted volume of industrial production in the eurozone rose in June by 0.6% after contracting 1.2% in the previous month. The experts predicted an increase of 0.5%. Meanwhile, among the EU countries, industrial production rose by 0.5% after falling 1.1% the previous month. On an annual basis, industrial production increased by 0.4% in the euro area and by 0.5% in the EU. It was expected that production in the euro zone will grow by 0.7% after rising 0.3% in May.

Some support also has a rise in oil prices against the background of recent statements by the Minister of Petroleum of Saudi Arabia. He noted that at the informal meeting of OPEC members and countries outside the cartel, which will be held in Algiers in September, could be discussed measures to stabilize the oil market. In addition, he added that the balance of the fundamental factors in the oil market is recovering.

The composite index of Europe's largest enterprises Stoxx Europe 600 fell less than 0.1. The trading volume today is about 41 percent lower than the average of 30 days. "Despite the positive background, there are still some lingering concerns over the banking sector and low inflation - said Nicolas Lopez, head of MG Valores Research -. But pessimism, which intensified immediately after Brexit gradually fades away, and we should continue to see upward movement. "

Shares of mining companies shows the worst result among the 19 industry. Quotes of Rio Tinto Group and Randgold Resources Ltd. decreased by at least 2.1 percent.

Shares of A.P. Moeller Maersk A / S rose 3.6 percent after the largest company in Denmark said that earnings before interest and taxes exceeded projections.

Capitalization of Tullow Oil Plc increased 3.9 percent, as Bank of America Merrill Lynch upgraded the company's stock rating to "buy" from "neutral."

At the moment:

FTSE 100 +5.50 6920.21 + 0.08%

DAX -27.72 10715.12 -0.26%

CAC 40 -4.51 4499.44 -0.10%

-

12:11

The International Monetary Fund reached a three-year funding deal with Egypt

The International Monetary Fund reached a three-year funding deal with Egypt on Thursday, which is set to support the government's economic reform program and improve the functioning of the foreign exchange markets.

The $12 billion agreement is subject to approval by the IMF's Executive Board.

Egypt is a strong country with great potential but it has some problems that need to be fixed urgently, the lender said.

The IMF said the program aims to improve the functioning of the forex markets and bring down the budget deficit and government debt.

It will also raise growth and create jobs, especially for women and young people and strengthen the social safety net to protect the vulnerable during the process of adjustment, the lender said.

Financial sector policies will be geared toward safeguarding the strength and stability of the banking system, Chris Jarvis, who led an IMF mission to Cairo said - RTT.

-

11:17

Industrial production in Euro Zone up 0.6% due to capital goods and durable goods

In June 2016 compared with May 2016, seasonally adjusted industrial production rose by 0.6% in the euro area (EA19) and by 0.5% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In May 2016 industrial production fell by 1.2% and 1.1% respectively. In June 2016 compared with June 2015, industrial production increased by 0.4% in the euro area and by 0.5% in the EU28.

The increase of 0.6% in industrial production in the euro area in June 2016, compared with May 2016, is due to production of capital goods rising by 1.3%, durable consumer goods by 1.0% and non-durable consumer goods by 0.7%, while production of intermediate goods fell by 0.2% and energy by 0.6%. In the EU28, the increase of 0.5% is due to production of capital goods rising by 1.3%, durable consumer goods by 0.9% and non-durable consumer goods by 0.1%, while production of intermediate goods fell by 0.1% and energy by 0.5%. Among Member States for which data are available, the highest increases in industrial production were registered in Ireland (+7.1%), Bulgaria (+3.9%) and Greece (+3.8%), and the largest decreases in Estonia (-3.1%), Hungary (-2.3%) and Malta (-1.6%).

-

11:15

GDP rose by 0.3% in the euro area

Seasonally adjusted GDP rose by 0.3% in the euro area (EA19) and by 0.4% in the EU28 during the second quarter of 2016, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. In the first quarter of 2016, GDP grew by 0.6% and 0.5% respectively.

Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.6% in the euro area and by 1.8% in the EU28 in the second quarter of 2016, after +1.7% and +1.8% respectively in the previous quarter.

During the second quarter of 2016, GDP in the United States increased by 0.3% compared with the previous quarter (after +0.2% in the first quarter of 2016). Compared with the same quarter of the previous year, GDP grew by 1.2% (after +1.6% in the previous quarter).

-

11:00

Eurozone: GDP (QoQ), Quarter II 0.3% (forecast 0.3%)

-

11:00

Eurozone: GDP (YoY), Quarter II 1.6% (forecast 1.6%)

-

11:00

Eurozone: Industrial Production (YoY), June 0.4% (forecast 0.7%)

-

11:00

Eurozone: Industrial production, (MoM), June 0.6% (forecast 0.5%)

-

10:36

UK: the output in the construction industry was estimated to have decreased by 0.7% q/q

The reporting period for this release covers the second quarter of 2016 plus the calendar month of June 2016, and therefore includes data for a short period after the EU referendum. There is very little anecdotal evidence at present to suggest that the referendum has had an impact on output.

In Quarter 2 (Apr to June) 2016, output in the construction industry was estimated to have decreased by 0.7% compared with Quarter 1 (Jan to Mar) 2016.

Downward pressure on the quarter came from all new work, which decreased by 0.8%, and repair and maintenance (R and M), which decreased by 0.5%.

Between Quarter 2 2016 and Quarter 2 2015, output was estimated to have decreased by 1.4%.

In June 2016, construction output decreased by 0.9% compared with May 2016.

-

10:22

Car sales in China up 26%

The volume of cars sold in China has increased in July by 26% compared to the previous year.

According to data released today by the China Association of Automobile Manufacturers, the volume of cars sold in China has increased by 26% compared to the same month last year. Chinese and foreign automakers sold 1.6 million passenger cars vs 1.27 million vehicles in July last year, demonstrating the fastest growth rate since 2013. Experts point out that the tax measures have contributed to this. After the fall of auto sales in October, the government in Beijing halved the purchase tax on small cars to 5%.

-

10:20

Italian GDP unchanged in Q2

In the second quarter of 2016 the seasonally and calendar adjusted, chained volume measure of Gross Domestic Product (GDP) resulted unchanged with respect to the first quarter of 2016 and increased by 0.7 per cent in comparison with the second quarter of 2015.

-

10:15

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0920-25 (EUR 773m) 1.0940-50 (913m) 1.1050 (334m) 1.1100 (574m) 1.1130-35 (522m) 1.1190-1.1200 (1.045bln)

USD/JPY 100.00 (USD 410m) 101.00 (781m) 102.00 (270m) 102.25 (300m) 102.45-55 (500m) 103.00 (1.52bln) 103.50 (1.27bln) 104.00 (590m)

GBP/USD 1.2995-1.3000 (GBP 473m) 1.3180 (210m)

AUD/USD 0.7420 (AUD 288m) 0.7600 (376m)

USD/CAD 1.2975 (USD 260m) 1.3000 (345m) 1.3025 (316m) 1.3115-20 (450m)

NZD/USD 0.7075 (NZD 200m) 0.7200 (287m)

AUD/NZD 1.0700 (AUD 318m) 1.0750 (AUD 636m)

-

09:39

Oil is gaining in early trading

This morning, the New York futures for WTI rose 0.71% to $ 43.80 and crude oil futures for Brent rose by + 0.46% to $ 46.25 per barrel. Thus, the black gold is trading in the plus on the background of statements by Saudi Arabia and the International Energy Agency. The IEA said Thursday that expects the reduction of world oil reserves in the coming months. This increase in demand for oil from the refinery will stimulate further recovery in the market balance. Minister of Energy of Saudi Arabia Khalid al-Falih said that his country could take part in a coordinated action of OPEC and the major exporting countries, to help balance the market. He said that the meeting of the International Energy Forum in September in Algeria is an opportunity for this.

-

09:37

Major stock markets were traded slightly lower: FTSE: -0.1%, DAX -0.2%, CAC40 -0.1%, FTMIB flat, IBEX -0.1%

-

09:25

WSE: After opening

WIG20 index opened at 1863.79 points (-0.05%)*

WIG 48660.74 -0.03%

WIG30 2115.64 -0.13%

mWIG40 3831.37 0.24%

*/ - change to previous close

Better than expected data from Germany did not bring more excitement and Europe began a day from modest changes on the red side, but soon there were attempts to stabilize. In this context, the WSE may come in the last session before the extended weekend - on Monday there is no session - duplicating the behavior of core markets. After the first trades the WIG20 reached the area of 1,867 points growing by 0.1 percent.

Traditionally, like the last sessions, the market is not presented attractively in terms of activity. Technicians will see a door to a new wave of growth peaks and add a few points to the margin of safety. Taking into account the fact that on Monday there is no session today's task for bulls is to keep the WIG20 over the broken resistance.

-

08:50

France: In Q2 2016 payroll employment increased once again (flash estimate)

In Q2 2016, payroll employment continued to increase in non-farm market sectors (+0.2%). With 24,100 jobs created, it increased slightly less than in the previous quarter (+37,300 jobs). Year-on-year, it rose by +0.9% (+143,300 jobs).

Employment continued to drop in industry in Q2 2016 (-0.3%, i.e -9,700 jobs). In construction, job losses resumed (-0.3%, i.e. -3,500 jobs after +0.1% in the previous quarter). Year-on-year, industry shed more jobs (-33,900) than construction (-13,400).

-

08:48

Asian session review: Australian and New Zealand dollar fell

The following data was published:

2:00 China Investment in fixed assets in July 9.0% 8.8% 8.1%

2:00 China Retail sales, y / y in July 10.6% 10.5% 10.2%

2:00 China Industrial Production y / y in July 6.2% 6.1% 6.0%

6:00 Germany Consumer Price Index m / m (final data) July 0.1% 0.3% 0.3%

6:00 Germany CPI, y / y CPI, y / y

(Final data) July 0.3% 0.4% 0.4%

6:00 Germany GDP q / q (preliminary data) II quarter 0.7% 0.2% 0.4%

6:00 Germany GDP y / y (preliminary data) II quarter 1.3% 1.5% 3.1%

Australian and New Zealand dollars fell from the beginning of the session on weaker-than-expected macroeconomic data from China. As reported today by the National Bureau of Statistics of China, industrial production in the period from January to July increased by 6% compared to the same period of the previous year (+6.2%). Economists had expected an increase of 6.1%. Compared with the previous month, industrial production increased by 0.52% after rising 0.47% in June.

The official representative Sheng Layyun said that in July, due to flooding in a number of provinces, as well as high temperature and the low level of external demand growth has slowed a number of indicators. At the same time, he noted that in general the overall state of the Chinese economy is stable.

Chinese retail sales in July increased by 10.2% compared to the same period of the previous year, after rising 10.6% in June. The indicator was lower than the forecast, which anticipated an increase of 10.5%. Compared with June sales increased by 0.75% after rising 0.92% a month earlier.

The volume of investments in fixed assets in China, with the exception of agriculture, on an annualized basis, increased by 8.1%. Economists had expected agrowth rate of 8.8%, after rising by 9.0% a year earlier.

Investment in China's mining industry grew by 20.6%. In the industrial sector investment rose by 3.5%. In the service sector the inflow of investments in the first quarter of 2016 grew by 10.8%, more than in 2015.

In China, there is a slowdown in the growth of investment in fixed assets. According to the forecast of the Chinese government, this year the volume of investments in fixed assets, with the exception of agriculture, increase by 10.5%.

Also, retail sales in New Zealand in the second quarter increased by 2.3%, after rising 0.8% in the first quarter. Analysts had expected an increase of 1.0%. In annual terms, retail sales increased by 6%. Retail sales excluding auto sales rose 2.6%, higher than the forecast of 1.1%.

According to the report total retail sales growth was at a record high in dollar terms. Twelve of the 15 sectors were higher.

The index of business activity in the manufacturing sector of New Zealand, assessing conditions in the business environment of the country in July was 55.8 points, lower than the previous value, revised from 57.7 to 57.7 points. Manufacturing PMI is considered an important indicator of overall economic conditions. Despite the slight decline, the result above 50 indicates growth in activity and is a positive factor for the New Zealand currency.

The US dollar traded in a narrow range against the euro in the absence of new orientations regarding the future prospects of monetary policy the US. Disappointing data on the performance and growth of the US economy, published last week, triggered a weakening dollar.

Minutes of the July meeting of the Fed will be presented next week, and Fed Chairman Janet Yellen will speak at Jackson Hole later this month, which can also cause investors to reconsider expectations for a rate hike prospects.

The market saw a 12% chance of Fed raising rates in September and 39% probability in December, according to the CME Group.

The next test of strength for the dollar will be the publication of the report on retail sales. The indicator will be published today at 12:30 GMT. Retail sales rose 0.6% in June, after finishing a strong second quarter. It is expected that data for July will be strong, and with a monthly growth of 0.4%.

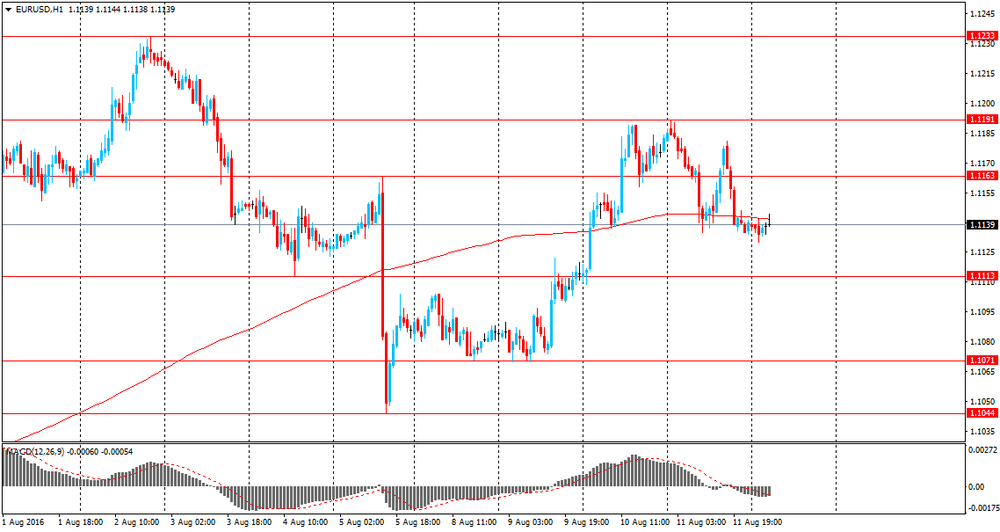

EUR / USD: during the Asian session, the pair was trading in the $ 1.1130-40 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.2945-60 range

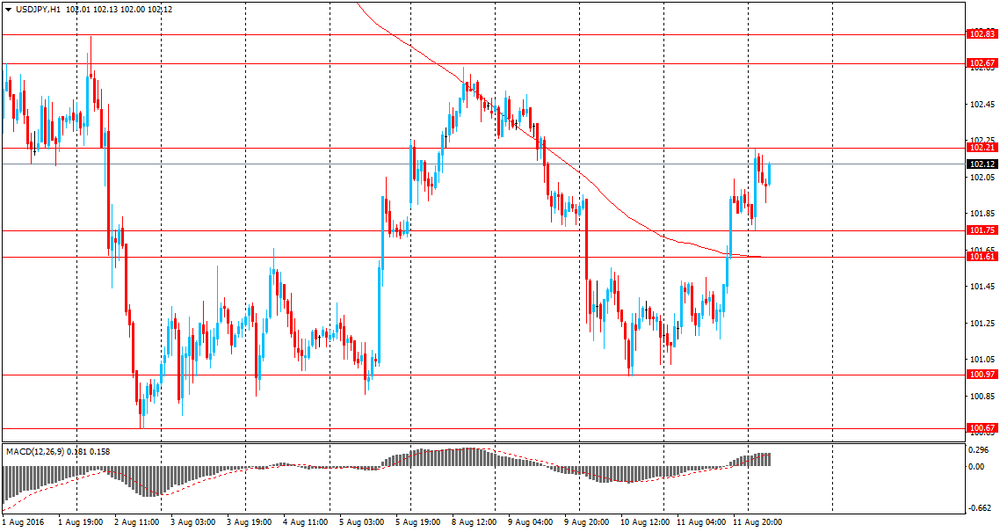

USD / JPY: during the Asian session, the pair was trading in Y101.75-102.10 range

-

08:45

France: Non-Farm Payrolls, Quarter II 0.2%

-

08:31

Turning Bullish AUD & Bearish CAD - Morgan Stanley

AUD: Bullish Following Rate Cut.

We have turned bullish AUD in the near term and believe it can continue to rally following the RBA's rate cut. AUD's reaction to the rate cut is telling, given it ended the day over 1% higher against USD despite the rate cut not being fully priced in. As the hunt for yield remains strong and the RBA's lack of an easing bias indicates no easing catalyst any time soon, we expect AUD to appreciate (particularly against USD). RBA Gov. Stevens' outgoing speech also gave no indication that further easing is imminent. Our long-term bearish view remains, but is contingent on the housing cycle turning and slowing growth in China forcing the RBA to cut 50bp further in 1H17.

CAD: Bearish Following Weak Data.

We have turned bearish CAD last week following the week employment and trade data, expecting it to underperform other commodity currencies in coming weeks. On the trade side, the nominal deficit was the largest in history, at C$3.63b, with export volumes falling 1.4%. The details were also weak . Non-commodity export volumes fell once again (by 0.4%), bringing them nearly 9% below their January peak. The BoC lowered its forecasts for non-commodity export growth this year, but these figures are still disappointing and support our view that the BoC is too optimistic about an export-led recovery. These figures, along with the weak May retail sales volumes and GDP growth, mean the BoC's 2Q GDP forecast of -1% is probably too optimistic. Friday's employment data, which has been relatively resilient amidst Canada's tepid growth in recent years, was also disappointing. We may not get a shift in tone yet from the BoC but in an environment of commodity currencies receiving support (most with improving data), we think there is scope to price a higher probability of cuts in Canada curve.

Copyright © 2016 Morgan Stanley, eFXnews

-

08:30

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.2%, FTSE + 0.3%

-

08:29

Options levels on friday, August 12, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1303 (5052)

$1.1246 (3336)

$1.1208 (2202)

Price at time of writing this review: $1.1142

Support levels (open interest**, contracts):

$1.1087 (2157)

$1.1034 (3931)

$1.1001 (4569)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 48984 contracts, with the maximum number of contracts with strike price $1,1250 (5052);

- Overall open interest on the PUT options with the expiration date September, 9 is 54943 contracts, with the maximum number of contracts with strike price $1,1000 (5609);

- The ratio of PUT/CALL was 1.12 versus 1.13 from the previous trading day according to data from August, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.3205 (2147)

$1.3108 (1255)

$1.3012 (663)

Price at time of writing this review: $1.2960

Support levels (open interest**, contracts):

$1.2890 (2028)

$1.2794 (2284)

$1.2696 (1061)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 30747 contracts, with the maximum number of contracts with strike price $1,3300 (2478);

- Overall open interest on the PUT options with the expiration date September, 9 is 25065 contracts, with the maximum number of contracts with strike price $1,2800 (2284);

- The ratio of PUT/CALL was 0.82 versus 0.83 from the previous trading day according to data from August, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:28

China's economic activity weakened in July

China's economic activity weakened in July as industrial production, retail sales and investment all registered weak growth.

Industrial production grew 6 percent year-on-year in July, slower than the 6.2 percent increase seen in June. The annual growth was expected to remain unchanged at 6.2 percent.

On a monthly basis, industrial output gained 0.52 percent.

At the same time, retail sales climbed 10.2 percent on a yearly basis, following a 10.6 percent rise in June. Sales were forecast to grow 10.5 percent.

In the January to July period, fixed asset investment moved up 8.1 percent compared to a 9 percent expansion seen during January to June. Economists had forecast 8.9 percent growth.

Julian Evans-Pritchard at Capital Economics, said the downbeat investment figures raise questions over the efficacy of the recent policy easing - RTT.

-

08:25

WSE: Before opening

Yesterday's trading in the US resulted in increases in the major indexes, what brought new records. It was result of the good attitude of the oil market and the good performance of companies related to retail. Currently the contract for S&P500 is traded around the neutral level. Still we may see increases in the price of oil.

Therefore it may be concluded that the beginning of the European markets will be held at levels close to yesterday's closing. Before the session will appear readings about German GDP.

Today's calendar will bring macro estimates of GDP in the euro zone, Polish CPI and the most important data of the day - the dynamics of retail sales in the US, where investors may find clues about the condition of the American consumer and the health of the US economy. So we may expect that the Warsaw market will look for inspiration in the behavior of core markets.

From a technical point of view, to overcome the resistance in the region of 1,853-1,860 points favors looking into the area of 2,000 points. The problem is the low activity and also may appear a willingness to profit taking. Important will also be, visible earlier, sensitivity to equal levels and it is worth to get a respectful approach to the upcoming meeting with the region of 1,900 points on the WIG20 index.

-

08:21

Better Q2 retail sales in New Zeeland

Robust spending in most of the retail trade industries has boosted total sales for the June 2016 quarter, Statistics New Zealand said today. A strong increase this quarter follows a more subdued rise in the March 2016 quarter.

After adjusting for seasonal effects, the total volume of retail trade sales had a record rise in dollar terms for the June 2016 quarter. This quarter's sales volumes rose 2.3 percent - the largest percentage increase since the December 2006 quarter. This quarter's increase follows a 1.0 percent rise in the March 2016 quarter.

"Consumer spending is humming along, with DIY and trade staff customers boosting sales in the hardware and building supply trades. Strong vehicle sales also continued," business indicators senior manager Neil Kelly said.

"Twelve of the 15 industries had higher sales volumes this quarter, with some Auckland retailers in particular saying they had an extremely busy quarter," Mr Kelly added.

-

08:18

Germany: Selling prices in wholesale trade decreased by 1.4% in July

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade decreased by 1.4% in July 2016 from the corresponding month of the preceding year. In June and in May 2016 the annual rates of change were -1.5% and -2.3%, respectively. From June 2016 to July 2016 the index rose by 0.2%

-

08:16

German GDP growth exceed forecasts monthly and yearly

The German economy continues to grow. In the second quarter of 2016, the gross domestic product (GDP) rose 0.4% on the first quarter of the year after adjustment for price, seasonal and calendar variations. At the beginning of the year 2016, a strong GDP growth of 0.7% had been recorded.

The quarter-on-quarter comparison (upon adjustment for price, seasonal and calendar variations) shows that positive contributions came especially from the balance of exports and imports. According to provisional results, exports were up, while imports were slightly down compared with the first quarter of 2016. Both household final consumption expenditure and government final consumption expenditure supported growth, too. However, growth was slowed by weak gross capital formation. After a strong first quarter, a decline was recorded especially in gross fixed capital formation in machinery and equipment and in construction.

Economic growth accelerated year on year, too. The price-adjusted GDP rose 3.1% in the second quarter of 2016, which was the largest increase in five years. Adjusted for the exceptionally high calendar effect, the GDP growth was 1.8% after 1.9% (unadjusted 1.5%) in the first quarter of 2016.

The economic performance in the second quarter of 2016 was achieved by 43.5 million persons in employment in the domestic territory, which was an increase of 529,000 or 1.2% on a year earlier.

-

08:12

Consumer prices in Germany were 0.4% higher in July

Consumer prices in Germany were 0.4% higher in July 2016 compared with July 2015. The inflation rate as measured by the consumer price index increased slightly for the third consecutive month. This year, a somewhat higher rate than in July 2016 was measured in January (+0.5%). Compared with the previous month, the consumer price index rose by 0.3% in July 2016. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 28 July 2016.

The development of energy prices (-7.0%) had a marked downward effect on the overall rise in prices in July 2016, as had been the case in the preceding months. Compared with the last few months, the decrease of energy prices accelerated slightly year on year, in June 2016 it had stood at -6.4%. Consumers benefitted especially from the prices of mineral oil products, which were down in July 2016 on a year earlier (-12.8%, of which heating oil: -18.0%, and motor fuels: -11.5%). The prices of other energy products were also below the level of a year earlier (for example, charges for central and district heating: -8.9%; gas: -2.9%). Only electricity prices were up on a year earlier (+0.7%). Excluding energy prices, the inflation rate in July 2016 would have been +1.3%.

-

08:01

Germany: GDP (YoY), Quarter II 3.1% (forecast 1.5%)

-

08:01

Germany: GDP (QoQ), Quarter II 0.4% (forecast 0.2%)

-

08:01

Germany: GDP (QoQ), Quarter II 0.4% (forecast 0.2%)

-

08:01

Germany: GDP (YoY), Quarter II 3.1% (forecast 1.5%)

-

08:00

Germany: CPI, y/y , July 0.4% (forecast 0.4%)

-

08:00

Germany: CPI, m/m, July 0.3% (forecast 0.3%)

-

07:02

Global Stocks

European stocks ended firmly higher on Thursday as oil prices shook off losses and investors cheered a round of upbeat earnings reports.

The Stoxx Europe 600 SXXP, +0.78% gained 0.8% to close at 346.66, after trading as low as 343.16 earlier in the day.

The pan-European equities gauge on Wednesday edged down 0.2%, the first decline after five consecutive advances, as energy shares pulled lower.

Shares of oil companies rose on Thursday after mostly trading in the red earlier in the day when oil prices CLU6, +0.94% LCOV6, +0.65% had dropped more than 1%. Losses for oil prices had accelerated after the International Energy Agency said oil demand world-wide will be lower than previously expected, and warned that a "massive" stock overhang is keeping a lid on crude oil prices. Oil prices, however, reversed in the afternoon to trade sharply higher after Saudi Arabia hinted at a plan to freeze production.

The three main stock-market indexes rang up record highs Thursday as better-than-expected economic data and a rebound in oil prices boosted Wall Street sentiment.

The S&P 500 index SPX, +0.47% rose 10.30 points, or 0.5%, to close at 2,185.79, topping the previous all-time closing high of 2,182.87 set Aug. 5. Energy shares led the gains with a 1.3% jump, while consumer-discretionary stocks advanced 1%, thanks in part to a big jump in shares of Macy's Inc. M, +17.09% and Kohl's Corp. KSS, +16.17% following earnings.

The Dow Jones Industrial Average DJIA, +0.64% rallied 117.86 points, or 0.7%, to close at 18,613.52, topping its previous closing record of 18,595.03 set July 20. The average was led by a 2.9% jump in Nike Inc. NKE, +2.90% shares.

The Nasdaq Composite Index COMP, +0.46% gained 23.81 points, or 0.5%, to finish at 5,228.40, surpassing its previous record of 5,225.48 set on Tuesday.

It was the first day the three major stock-market indexes finished at records on the same day since Dec. 31 1999, according to Dow Jones data.

Asian stocks inched up on Friday, after a surge in oil prices helped propel Wall Street to record highs overnight, while Chinese economic indicators that missed expectations did not dent gains in mainland shares.

Both China's CSI300 index .CSI300 and the Shanghai Composite .SSEC rose about 0.5 percent after fixed asset investment, retail sales and industrial output all rose but were below expectations. Both indexes were headed for gains of about 1.4 percent for the week.

Fixed asset investment from January to July increased by 8.1 percent from a year earlier, the slowest rate in more than 16 years, compared with expectations for 8.8 percent.

July retail sales increased 10.2 percent, versus 10.6 percent the previous month and a forecast 10.5 percent. Industrial output rose 6.0 percent from a year earlier, slowing from June's 6.2 percent and just missing forecasts of 6.1 percent.

Japan's Nikkei .N225 rose 0.7 percent on a slightly weaker yen, and is poised to end the week 3.7 percent higher.

-

04:00

China: Fixed Asset Investment, July 8.1% (forecast 8.8%)

-

04:00

China: Retail Sales y/y, July 10.2% (forecast 10.5%)

-

01:02

Commodities. Daily history for Aug 11’2016:

(raw materials / closing price /% change)

Oil 43.46 -0.07%

Gold 1,344.30 -0.42%

-

01:00

Stocks. Daily history for Aug 11’2016:

(index / closing price / change items /% change)

Nikkei 225 16,735.12 -29.85 -0.18%

Shanghai Composite 3,002.67 -16.07 -0.53%

S&P/ASX 200 5,508.01 -35.70 -0.64%

FTSE 100 6,914.71 +48.29 +0.70%

CAC 40 4,503.95 +51.94 +1.17%

Xetra DAX 10,742.84 +91.95 +0.86%

S&P 500 2,185.79 +10.30 +0.47%

Dow Jones Industrial Average 18,613.52 +117.86 +0.64%

S&P/TSX Composite 14,796.06 +21.02 +0.14%

-

00:59

Currencies. Daily history for Aug 11’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1140 -0,38%

GBP/USD $1,2958 -0,42%

USD/CHF Chf0,9753 +0,09%

USD/JPY Y101,91 +0,73%

EUR/JPY Y113,54 +0,35%

GBP/JPY Y131,06 -0,43%

AUD/USD $0,7697 -0,16%

NZD/USD $0,7207 -0,86%

USD/CAD C$1,2987 -0,69%

-

00:45

New Zealand: Retail Sales YoY, Quarter II 6%

-

00:45

New Zealand: Retail Sales, q/q, Quarter II 2.3% (forecast 1%)

-

00:30

New Zealand: Business NZ PMI, July 55.8

-

00:07

Schedule for today, Friday, Aug 12’2016

(time / country / index / period / previous value / forecast)

02:00 China Fixed Asset Investment July 9.0%

02:00 China Retail Sales y/y July 10.6% 10.5%

02:00 China Industrial Production y/y July 6.2% 6.1%

06:00 Germany CPI, m/m (Finally) July 0.1% 0.3%

06:00 Germany CPI, y/y (Finally) July 0.3% 0.4%

06:00 Germany GDP (QoQ) (Preliminary) Quarter II 0.7% 0.2%

06:00 Germany GDP (YoY) (Preliminary) Quarter II 1.3% 1.5%

06:45 France Non-Farm Payrolls (Preliminary) Quarter II 0.3%

09:00 Eurozone Industrial production, (MoM) June -1.2% 0.4%

09:00 Eurozone Industrial Production (YoY) June 0.5% 0.7%

09:00 Eurozone GDP (QoQ) (Revised) Quarter II 0.6% 0.3%

09:00 Eurozone GDP (YoY) (Revised) Quarter II 1.7% 1.6%

12:30 U.S. Retail sales July 0.6% 0.4%

12:30 U.S. Retail Sales YoY July 2.7%

12:30 U.S. Retail sales excluding auto August 0.7% 0.2%

12:30 U.S. PPI excluding food and energy, m/m July 0.4% 0.2%

12:30 U.S. PPI excluding food and energy, Y/Y July 1.3% 1.2%

12:30 U.S. PPI, m/m July 0.5% 0.1%

12:30 U.S. PPI, y/y July 0.3% 0.2%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) August 90 91.5

14:00 U.S. Business inventories June 0.2% 0.1%

-