Noticias del mercado

-

21:00

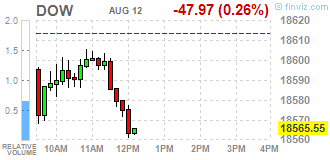

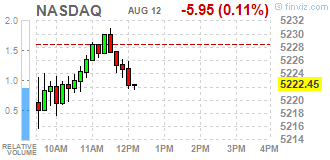

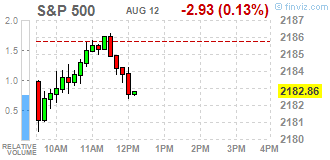

DJIA 18564.28 -49.24 -0.26%, NASDAQ 5227.29 -1.10 -0.02%, S&P 500 2182.15 -3.64 -0.17%

-

18:17

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes was little changed on Friday as a rise in oil prices offset the impact of weak economic data. U.S. retail sales were unexpectedly flat in July as people cut back on buying clothes and other goods, while another report showed that producers index fell 0,4% in July, the biggest drop in nearly a year. Cooling consumer spending and tame inflation suggest the Federal Reserve will probably not raise interest rates anytime soon despite a robust labor market.

Most of all Dow stocks in negative area (19 of 30). Top gainer - Exxon Mobil Corporation (XOM, +1.22%). Top gainer - Microsoft Corporation (MSFT, -1.00%).

S&P sectors mixed. Top gainer - Conglomerates (+1.4%). Top loser - Industrial goods (-0.3%).

At the moment:

Dow 18558.00 +106.00 +0.57%

S&P 500 2181.00 +8.25 +0.38%

Nasdaq 100 4797.50 +16.00 +0.33%

Oil 44.32 +0.83 +1.91%

Gold 1357.70 +7.70 +0.57%

U.S. 10yr 1.49 -0.08

-

18:00

European stocks closed: FTSE 6916.02 1.31 0.02%, DAX 10713.43 -29.41 -0.27%, CAC 4500.19 -3.76 -0.08%

-

17:59

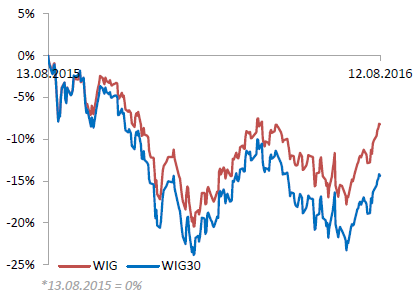

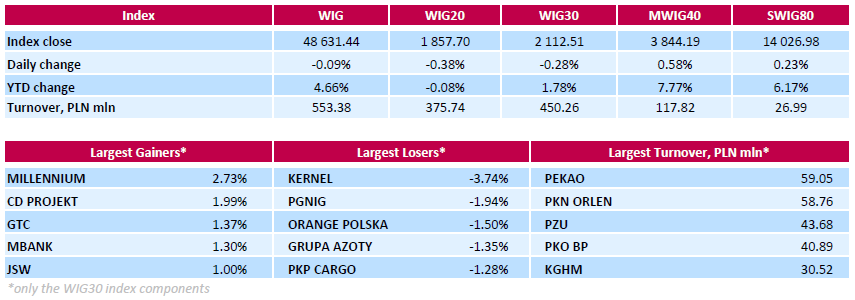

WSE: Session Results

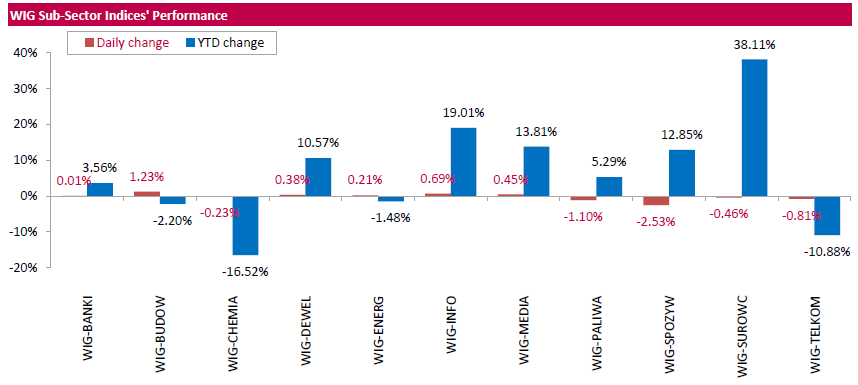

Polish equity market closed slightly lower on Friday. The broad market benchmark, the WIG Index, inched down 0.09%. Sector performance in the WIG Index was mixed. Food sector (-2.53%) recorded the biggest decline, while construction (+1.23%) fared the best.

The large-cap stocks' measure, the WIG30 Index, lost 0.28%. In the index basket, agricultural producer KERNEL (WSE: KER) tumbled the most, down 3.74%. It was followed by oil and gas producer PGNIG (WSE: PGN), dropping by 1.94%. The company reported a PLN 115 mln net loss for the second quarter of 2016 (versus profit of PLN 621 mln in corresponding period of the previous year) and restated its dividend policy of paying PLN 0.20 per share. Other major decliners were telecommunication services provider ORANGE POLSKA (WSE: OPL), chemical producer GRUPA AZOTY (WSE: ATT) and railway freight transport operator PKP CARGO (WSE: PKP), falling by 1.5%, 1.35% and 1.28% respectively. On the other side of the ledger, bank MILLENNIUM (WSE: MIL) led the gainers with a 2.73% advance, followed by videogame developer CD PROJEKT (WSE: CDR), property developer GTC (WSE: GTC) and bank MBANK (WSE: MBK), surging by 1.99%, 1.37% and 1.3% respectively.

The Warsaw Stock Exchange will be closed on Monday, August 15, due to the Feast of Assumption of the Blessed Mary.

-

16:46

Will Home Depot beat analysts' expectations in the second quarter?

Adjusted earnings and Home Depot sales (HD) exceeded the consensus forecast of analysts in the last eight of the nine quarters. The largest increase in adjusted EPS (earnings per share) was 24.1% to $ 1.44, recorded in the first quarter of 2016. Home Depot plans to announce its quarterly results on 16 August.

Growth in the first quarter was due to the impressive increase in sales and effective cost management measures.

Home Depot's profit in the first quarter also favorably influenced by "buy backs". Home Depot bought back 9.5 million shares for approximately $ 1.3.

Adjusted EPS growth was better than the competition. Profits of Bed Bath & Beyond (BBBY) decreased by 14% compared to the same period of last year, to $ 0.80 per share, mainly against the background of weak sales. Adjusted earnings of Williams-Sonoma jumped by 10.4% in the previous quarter, to $ 0.53. Lowe's Inc. (LOW) profit increased by 24.3% to $ 0.87 per share, on the back of improved sales and profitability.

After the impressive results of the first quarter, Home Depot raised its forecast for revenue. The company expects earnings per share to grow by 14.8%, to $ 6.27. This estimate is based on the expectation of 6.3% sales growth, or by 4.9% in 2016 fiscal year.

Analysts expect second-quarter adjusted earnings per share to grow by 15.2%, to $ 1.97.

Currently, shares of The Home Depot, Inc. (HD) trading at $ 136.22 (-0.60%)

-

15:34

WSE: After start on Wall Street

Today's data from the US economy, a zero increase in sales with forecast of 0.4 percent growth and a decline excluding cars was supplemented by the low readings of PPI. These figures stand in clear contradiction with the data from the labor market.

In short, these are not the data that allow the Fed to raise interest rates at the September FOMC meeting. It was hardest reflected in quotations of the dollar and boost of the weakening of the US dollar appeared on most pairs associated with the USD. The stock market went up to the report calmer. At the beginning of trading on Wall Street the S&P500 index lost 0,20 percent.

-

15:32

U.S. Stocks open: Dow -0.20%, Nasdaq -0.24%, S&P -0.22%

-

15:14

Before the bell: S&P futures -0.13%, NASDAQ futures -0.07%

U.S. stock-index futures fluctuated amid lackluster data.

Global Stocks:

Nikkei 16,919.92 +184.80 +1.10%

Hang Seng 22,766.91 +186.36 +0.83%

Shanghai 3,051.02 +48.38 +1.61%

FTSE 6,900.35 -14.36 -0.21%

CAC 4,491.65 -12.30 -0.27%

DAX 10,693.85 -48.99 -0.46%

Crude $43.72 (+0.53%)

Gold $1355.00 (+0.37%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.35

-0.07(-0.6718%)

9350

Amazon.com Inc., NASDAQ

AMZN

770.4

-0.84(-0.1089%)

5770

Apple Inc.

AAPL

108.19

0.26(0.2409%)

87411

AT&T Inc

T

43.4

0.01(0.0231%)

2335

Barrick Gold Corporation, NYSE

ABX

22.24

0.50(2.2999%)

102121

Cisco Systems Inc

CSCO

30.98

0.03(0.0969%)

1503

Citigroup Inc., NYSE

C

45.25

-0.48(-1.0496%)

12810

Exxon Mobil Corp

XOM

86.87

0.15(0.173%)

2040

Facebook, Inc.

FB

124.86

-0.04(-0.032%)

34357

Ford Motor Co.

F

12.31

0.00(0.00%)

11491

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.01

-0.10(-0.8258%)

184810

General Electric Co

GE

31.2

-0.09(-0.2876%)

15346

General Motors Company, NYSE

GM

31.76

0.01(0.0315%)

400

Goldman Sachs

GS

162.72

-1.14(-0.6957%)

2874

Google Inc.

GOOG

784.48

-0.37(-0.0471%)

1374

Home Depot Inc

HD

136

-1.04(-0.7589%)

14980

International Business Machines Co...

IBM

163.53

-0.00(-0.00%)

1042

Johnson & Johnson

JNJ

123.77

-0.00(-0.00%)

500

JPMorgan Chase and Co

JPM

64.95

-0.51(-0.7791%)

9017

Merck & Co Inc

MRK

63.31

-0.32(-0.5029%)

563

Microsoft Corp

MSFT

58.21

-0.09(-0.1544%)

1256

Nike

NKE

56.75

0.02(0.0353%)

4266

Pfizer Inc

PFE

35.2

0.05(0.1422%)

1128

Procter & Gamble Co

PG

86.95

0.22(0.2537%)

3970

Starbucks Corporation, NASDAQ

SBUX

55.45

-0.02(-0.0361%)

580

Tesla Motors, Inc., NASDAQ

TSLA

225

0.09(0.04%)

4894

The Coca-Cola Co

KO

43.85

0.10(0.2286%)

13042

Twitter, Inc., NYSE

TWTR

19.75

-0.03(-0.1517%)

123381

Visa

V

80

-0.12(-0.1498%)

259

Wal-Mart Stores Inc

WMT

73.87

0.07(0.0949%)

2500

Walt Disney Co

DIS

97.55

-0.22(-0.225%)

2810

Yahoo! Inc., NASDAQ

YHOO

41.47

0.20(0.4846%)

68229

Yandex N.V., NASDAQ

YNDX

23.18

-0.06(-0.2582%)

400

-

14:18

Monday 15.08.2016 - WSE will be closed

We would like to remind that there will be no trading session (the Exchange will be closed) on Monday, August 15, 2016.

-

13:19

WSE: Mid session comment

The preliminary reading of GDP for Poland do not live up to the forecast, but it is difficult to talk about some serious passing with market expectations. GDP figures for Europe were in line with expectations, and the data on industrial production were slightly better than expected. It is hard to expect that the data close enough to forecast aroused excitement in the market during the holidays. Everything seems to indicate that only the US readings can bring some new content.

The Warsaw market shows the next day of weak activity. In this context, there is no surprise too modest percentage change and low volatility. Stability in the region of yesterday's close strengthens by flat trade in Europe and a symmetrical distribution of companies on the losing and gaining in value. If the part of Wall Street will not come with any new impulses to the sleepy afternoon, the market will be looking forward to the final day and enjoy a long weekend. In the mid-session the WIG20 index reached the level of 1,863 points (-0.07%) and the turnover of slightly over PLN 160 million.

-

12:42

Major stock indices in Europe trading mixed in ultra low volume

European stocks traded in different directions, but with a slight change. The focus is on corporate profits and the latest statistical data for the euro area.

The revised data released by the Statistical Office, Eurostat, showed that economic growth in the eurozone maintained the pace in the second quarter, confirming at the same time the preliminary estimates provided in late July. According to the report, the gross domestic product of 19 countries in the currency bloc in the second quarter increased by 0.3 percent compared to the previous three-month period and increased by 1.6 percent year on year. Last change coincided with the forecasts. Recall that in the first quarter Eurozone GDP grew by 0.6 percent in quarterly terms and by 1.7 percent on an annual basis

A separate report from the Eurostat showed that the seasonally adjusted volume of industrial production in the eurozone rose in June by 0.6% after contracting 1.2% in the previous month. The experts predicted an increase of 0.5%. Meanwhile, among the EU countries, industrial production rose by 0.5% after falling 1.1% the previous month. On an annual basis, industrial production increased by 0.4% in the euro area and by 0.5% in the EU. It was expected that production in the euro zone will grow by 0.7% after rising 0.3% in May.

Some support also has a rise in oil prices against the background of recent statements by the Minister of Petroleum of Saudi Arabia. He noted that at the informal meeting of OPEC members and countries outside the cartel, which will be held in Algiers in September, could be discussed measures to stabilize the oil market. In addition, he added that the balance of the fundamental factors in the oil market is recovering.

The composite index of Europe's largest enterprises Stoxx Europe 600 fell less than 0.1. The trading volume today is about 41 percent lower than the average of 30 days. "Despite the positive background, there are still some lingering concerns over the banking sector and low inflation - said Nicolas Lopez, head of MG Valores Research -. But pessimism, which intensified immediately after Brexit gradually fades away, and we should continue to see upward movement. "

Shares of mining companies shows the worst result among the 19 industry. Quotes of Rio Tinto Group and Randgold Resources Ltd. decreased by at least 2.1 percent.

Shares of A.P. Moeller Maersk A / S rose 3.6 percent after the largest company in Denmark said that earnings before interest and taxes exceeded projections.

Capitalization of Tullow Oil Plc increased 3.9 percent, as Bank of America Merrill Lynch upgraded the company's stock rating to "buy" from "neutral."

At the moment:

FTSE 100 +5.50 6920.21 + 0.08%

DAX -27.72 10715.12 -0.26%

CAC 40 -4.51 4499.44 -0.10%

-

09:37

Major stock markets were traded slightly lower: FTSE: -0.1%, DAX -0.2%, CAC40 -0.1%, FTMIB flat, IBEX -0.1%

-

09:25

WSE: After opening

WIG20 index opened at 1863.79 points (-0.05%)*

WIG 48660.74 -0.03%

WIG30 2115.64 -0.13%

mWIG40 3831.37 0.24%

*/ - change to previous close

Better than expected data from Germany did not bring more excitement and Europe began a day from modest changes on the red side, but soon there were attempts to stabilize. In this context, the WSE may come in the last session before the extended weekend - on Monday there is no session - duplicating the behavior of core markets. After the first trades the WIG20 reached the area of 1,867 points growing by 0.1 percent.

Traditionally, like the last sessions, the market is not presented attractively in terms of activity. Technicians will see a door to a new wave of growth peaks and add a few points to the margin of safety. Taking into account the fact that on Monday there is no session today's task for bulls is to keep the WIG20 over the broken resistance.

-

08:30

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.2%, FTSE + 0.3%

-

08:25

WSE: Before opening

Yesterday's trading in the US resulted in increases in the major indexes, what brought new records. It was result of the good attitude of the oil market and the good performance of companies related to retail. Currently the contract for S&P500 is traded around the neutral level. Still we may see increases in the price of oil.

Therefore it may be concluded that the beginning of the European markets will be held at levels close to yesterday's closing. Before the session will appear readings about German GDP.

Today's calendar will bring macro estimates of GDP in the euro zone, Polish CPI and the most important data of the day - the dynamics of retail sales in the US, where investors may find clues about the condition of the American consumer and the health of the US economy. So we may expect that the Warsaw market will look for inspiration in the behavior of core markets.

From a technical point of view, to overcome the resistance in the region of 1,853-1,860 points favors looking into the area of 2,000 points. The problem is the low activity and also may appear a willingness to profit taking. Important will also be, visible earlier, sensitivity to equal levels and it is worth to get a respectful approach to the upcoming meeting with the region of 1,900 points on the WIG20 index.

-

07:02

Global Stocks

European stocks ended firmly higher on Thursday as oil prices shook off losses and investors cheered a round of upbeat earnings reports.

The Stoxx Europe 600 SXXP, +0.78% gained 0.8% to close at 346.66, after trading as low as 343.16 earlier in the day.

The pan-European equities gauge on Wednesday edged down 0.2%, the first decline after five consecutive advances, as energy shares pulled lower.

Shares of oil companies rose on Thursday after mostly trading in the red earlier in the day when oil prices CLU6, +0.94% LCOV6, +0.65% had dropped more than 1%. Losses for oil prices had accelerated after the International Energy Agency said oil demand world-wide will be lower than previously expected, and warned that a "massive" stock overhang is keeping a lid on crude oil prices. Oil prices, however, reversed in the afternoon to trade sharply higher after Saudi Arabia hinted at a plan to freeze production.

The three main stock-market indexes rang up record highs Thursday as better-than-expected economic data and a rebound in oil prices boosted Wall Street sentiment.

The S&P 500 index SPX, +0.47% rose 10.30 points, or 0.5%, to close at 2,185.79, topping the previous all-time closing high of 2,182.87 set Aug. 5. Energy shares led the gains with a 1.3% jump, while consumer-discretionary stocks advanced 1%, thanks in part to a big jump in shares of Macy's Inc. M, +17.09% and Kohl's Corp. KSS, +16.17% following earnings.

The Dow Jones Industrial Average DJIA, +0.64% rallied 117.86 points, or 0.7%, to close at 18,613.52, topping its previous closing record of 18,595.03 set July 20. The average was led by a 2.9% jump in Nike Inc. NKE, +2.90% shares.

The Nasdaq Composite Index COMP, +0.46% gained 23.81 points, or 0.5%, to finish at 5,228.40, surpassing its previous record of 5,225.48 set on Tuesday.

It was the first day the three major stock-market indexes finished at records on the same day since Dec. 31 1999, according to Dow Jones data.

Asian stocks inched up on Friday, after a surge in oil prices helped propel Wall Street to record highs overnight, while Chinese economic indicators that missed expectations did not dent gains in mainland shares.

Both China's CSI300 index .CSI300 and the Shanghai Composite .SSEC rose about 0.5 percent after fixed asset investment, retail sales and industrial output all rose but were below expectations. Both indexes were headed for gains of about 1.4 percent for the week.

Fixed asset investment from January to July increased by 8.1 percent from a year earlier, the slowest rate in more than 16 years, compared with expectations for 8.8 percent.

July retail sales increased 10.2 percent, versus 10.6 percent the previous month and a forecast 10.5 percent. Industrial output rose 6.0 percent from a year earlier, slowing from June's 6.2 percent and just missing forecasts of 6.1 percent.

Japan's Nikkei .N225 rose 0.7 percent on a slightly weaker yen, and is poised to end the week 3.7 percent higher.

-

01:00

Stocks. Daily history for Aug 11’2016:

(index / closing price / change items /% change)

Nikkei 225 16,735.12 -29.85 -0.18%

Shanghai Composite 3,002.67 -16.07 -0.53%

S&P/ASX 200 5,508.01 -35.70 -0.64%

FTSE 100 6,914.71 +48.29 +0.70%

CAC 40 4,503.95 +51.94 +1.17%

Xetra DAX 10,742.84 +91.95 +0.86%

S&P 500 2,185.79 +10.30 +0.47%

Dow Jones Industrial Average 18,613.52 +117.86 +0.64%

S&P/TSX Composite 14,796.06 +21.02 +0.14%

-