Noticias del mercado

-

21:00

DJIA 18617.12 121.46 0.66%, NASDAQ 5228.15 23.57 0.45%, S&P 500 2185.73 10.24 0.47%

-

18:01

European stocks closed: FTSE 6914.71 48.29 0.70%, DAX 10742.84 91.95 0.86%, CAC 4503.95 51.94 1.17%

-

17:38

WSE: Session Results

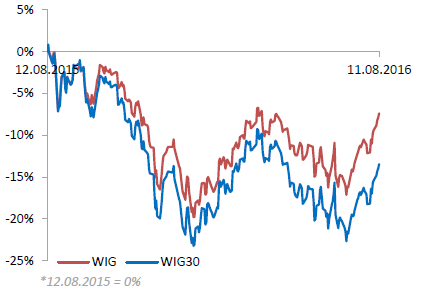

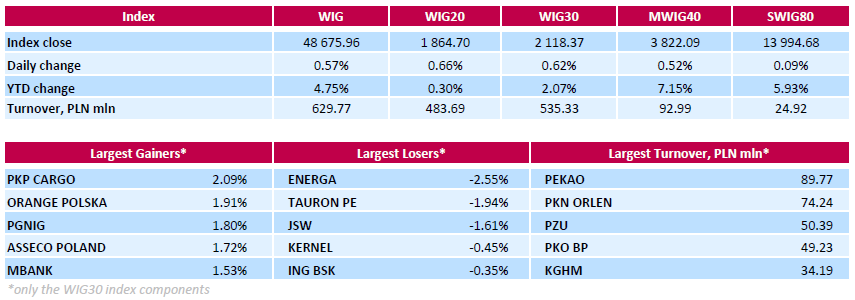

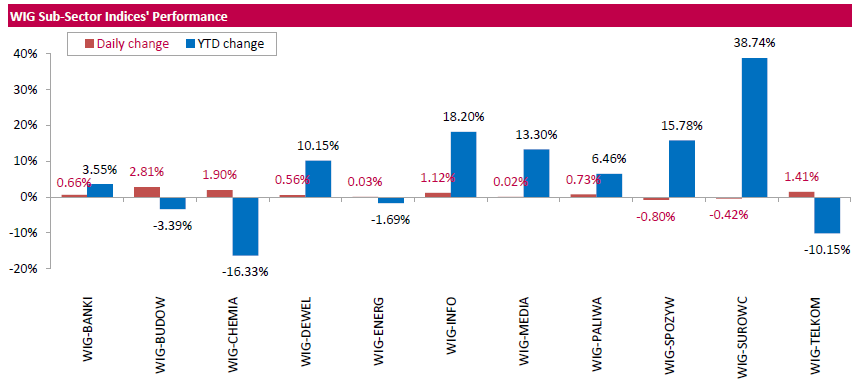

Polish equities advanced on Thursday. The broad market measure, the WIG Index, added 0.57%. Except for materials (-0.42%) and food (-0.80%), every sector in the WIG Index rose, with construction (+2.81%) outperforming.

The large-cap stocks' measure, the WIG30 Index, grew by 0.62%. In the index basket, railway freight transport operator PKP CARGO (WSE: PKP) led the gainers with a 2.09% advance, followed by telecommunication services provider ORANGE POLSKA (WSE: OPL), oil and gas producer PGNIG (WSE: PGN) and IT-company ASSECO POLAND (WSE: ACP), surging by 1.91%, 1.8% and 1.72% respectively. On the other side of the ledger, genco ENERGA (WSE: ENG) was the poorest performer, tumbling by 2.55% as the company posted bigger-than-expected Q2 net loss of PLN 127 mln ($33.29 mln) due to an asset value impairment. Analysts had expected ENERGA to report a net loss of PLN 19.9 mln, compared with a net profit of PLN 178 mln in the same period last year. Other major decliners were genco TAURON PE (WSE: TPE) and coking coal miner JSW (WSE: JSW), dropping by 1.94% and 1.61% respectively.

-

17:14

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday as strong labor market data and upbeat corporate results buoyed investor sentiment about U.S. economic growth. The number of Americans applying for unemployment benefits slipped by 3,000 last week to 266,000 from the week earlier, continuing a trend of being below the 300,000 mark for the 75th consecutive week. The data follows a set of robust labor market reports including last week's monthly payrolls numbers.

Almost all of Dow stocks in positive area (28 of 30). Top gainer - NIKE, Inc. (NKE, +1.69%). Top loser - E. I. du Pont de Nemours and Company (DD, -0.26%).

All S&P sectors in positive area, Top gainer - Basic Materials (+1.2%).

At the moment:

Dow 18558.00 +106.00 +0.57%

S&P 500 2181.00 +8.25 +0.38%

Nasdaq 100 4797.50 +16.00 +0.33%

Oil 42.95 +1.24 +2.97%

Gold 1357.30 +5.40 +0.40%

U.S. 10yr 1.52 +0.02

-

15:54

WSE: After start on Wall Street

The beginning of trading on Wall Street took place on light pros. Today's increase goes further to defend the level of the narrow consolidation, although you may see that from the beginning of the week the volatility is low and de facto there is lack of idea what to do with the market. The market in the US likes to have arguments up in its sleeve for bigger changes, and these may come not earlier than tomorrow. In the afternoon, we met a series of data from the US (the number of new applications for unemployment benefits and prices data of import and export) that were not particularly important however indicate inflationary pressures in the US economy. It must be remembered that the more mentioned pressure will be evident, the more difficult it will be the Federal Reserve to justify the lack of rate hikes.

-

15:32

U.S. Stocks open: Dow +0.36%, Nasdaq +0.43%, S&P +0.34%

-

15:23

Before the bell: S&P futures +0.23%, NASDAQ futures +0.26%

U.S. stock-index futures rose.

Global Stocks:

Nikkei Closed.

Hang Seng 22,580.55 +88.12 +0.39%

Shanghai 3,002.67 -16.0714 -0.53%

FTSE 6,852.24 -14.18 -0.21%

CAC 4,481.77 +29.76 +0.67%

DAX 10,701.68 +50.79 +0.48%

Crude $41.68 (-0.07%)

Gold $1352.20 (+0.02%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.37

0.04(0.3872%)

15620

ALTRIA GROUP INC.

MO

66.84

-0.00(-0.00%)

36082

Amazon.com Inc., NASDAQ

AMZN

770.5

1.94(0.2524%)

7680

American Express Co

AXP

64.76

0.02(0.0309%)

207

Apple Inc.

AAPL

108.39

0.39(0.3611%)

96126

AT&T Inc

T

43.3

0.10(0.2315%)

1007

Barrick Gold Corporation, NYSE

ABX

21.75

-0.02(-0.0919%)

46930

Chevron Corp

CVX

100.59

0.45(0.4494%)

1120

Cisco Systems Inc

CSCO

30.9

0.05(0.1621%)

3242

Citigroup Inc., NYSE

C

45.63

0.18(0.396%)

9626

E. I. du Pont de Nemours and Co

DD

69.15

0.45(0.655%)

300

Exxon Mobil Corp

XOM

86.77

0.36(0.4166%)

4915

Facebook, Inc.

FB

125.15

0.27(0.2162%)

59180

Ford Motor Co.

F

12.28

0.03(0.2449%)

17494

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.11

0.09(0.7487%)

62733

General Electric Co

GE

31.32

0.05(0.1599%)

3350

Google Inc.

GOOG

787

2.32(0.2957%)

842

Home Depot Inc

HD

135.75

0.15(0.1106%)

2982

Intel Corp

INTC

34.53

-0.00(-0.00%)

1083

International Business Machines Co...

IBM

162.13

0.05(0.0309%)

305

International Paper Company

IP

46.79

0.44(0.9493%)

117

Johnson & Johnson

JNJ

123.49

0.13(0.1054%)

212

JPMorgan Chase and Co

JPM

65.4

0.12(0.1838%)

570

Microsoft Corp

MSFT

58.09

0.07(0.1206%)

29042

Nike

NKE

55.8

0.67(1.2153%)

6265

Pfizer Inc

PFE

35.23

0.10(0.2847%)

1620

Procter & Gamble Co

PG

86.31

-0.00(-0.00%)

53057

Starbucks Corporation, NASDAQ

SBUX

55.75

0.13(0.2337%)

1957

Tesla Motors, Inc., NASDAQ

TSLA

226.45

0.80(0.3545%)

3647

The Coca-Cola Co

KO

43.61

0.00(0.00%)

78469

Twitter, Inc., NYSE

TWTR

19.2

0.16(0.8403%)

113606

Wal-Mart Stores Inc

WMT

73.95

-0.00(-0.00%)

38277

Walt Disney Co

DIS

98.15

0.29(0.2963%)

10182

Yahoo! Inc., NASDAQ

YHOO

41.7

1.77(4.4328%)

626364

Yandex N.V., NASDAQ

YNDX

22.31

-0.05(-0.2236%)

200

-

14:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $117 at RBC Capital Mkts

-

13:13

WSE: Mid session comment

The next day an empty macro calendar and a lack of important reports is used to develop a consistent upward trend in Europe. Today in particular stands out Paris, in turn, the German DAX remains comfortably at field won on Tuesday.

This demand pressure has encouraged our market to another attempt to strike at today's highs. Unfortunately the solid drawback remains turnover, which at the halfway point of the session among the 20 largest companies was amounted to PLN 180 million, which does not indicate a session of a breakthrough. The WIG20 index in the same time reached the level of 1,852 points (+ 0.00%).

-

12:48

Major stock indices in Europe show moderate activity

European stocks traded mostly in positive territory, near a seven-week high, as investors analyze corporate reports and monitor the situation on the oil market.

Oil prices are rising slightly, slowly recovering after yesterday's crash. However, concern about the increase in US oil inventories and record levels of production in Saudi Arabia may not allow oil to continue its upward movement.

A slight effect on the indices have data from Britain and France. The report of the Royal Institute of Chartered Surveyors (RICS) reported that the cost of housing in Britain rose in July at the slowest rate in the past three years. Demand decreased significantly, and the houses offered for sale turned out to be at a record low. So far, housing prices are rising slightly, but it is expected that in the next year will begin to decline. The pressure on the cost of housing have had changes in the tax laws of the country. "Now the housing market adjusts to conflicting economic data and the Bank of England recently adopted stimulus measures - said the chief economist at RICS Simon Rabinson".

At the same time, the National Bureau of Statistics Insee said that the inflation rate in France fell by 0.4% in July from the previous month. However, the consumer price index rose by 0.2% y/y. Changes in line with the forecasts of most economists. Lower inflation occurred against the background of falling prices for products and manufacturing. Their value fell by 2.9% compared with the previous month. Clothing and footwear fell by 14%. Energy prices fell by 1.3%. The harmonized index of consumer prices in the second economy of Europe rose 0.4% compared with the same period last year, after rising 0.3% in June.

The composite index of Europe's largest companies Stoxx 600 added 0.3 percent. Trading volume today about a third lower than the average for the last 30 days. Yesterday, the shares intrerupted a five-day increase, which was supported by optimism that central banks will encourage growth as well as better than expected US labor market data. "We had a good rally, and investors have realized that it can not go on forever, - said Peter Dixon, Commerzbank AG economist -.. Macro and corporate news are not able to give the markets a big push, however, uncertainty about Brexit and Fed futre hikes inhibit the increase of shares. "

Quotes of Zurich Insurance Group AG rose 4 percent after the insurance company announced a smaller-than-expected decline in revenue.

Shares of Belgian lender KBC Group NV rose by 4.7 per cent, since the sum of earnings and revenue topped analysts' estimates.

The capitalization of ThyssenKrupp AG fell 1.3 percent after the largest steel producer in Germany reported a decline in quarterly profit.

At the moment:

FTSE 100 6848.32 -18.10 -0.26%

DAX +60.25 10711.14 + 0.57%

CAC 40 +29.88 4481.89 + 0.67%

-

09:52

Major stock exchanges trading higher: FTSE -0.3%, DAX + 0.4%, CAC40 + 0.5%, FTMIB + 0.4%, IBEX + 0.5%

-

09:13

WSE: After opening

WIG20 index opened at 1850.84 points (-0.09%)*

WIG 48445.06 0.09%

WIG30 2106.22 0.04%

mWIG40 3807.40 0.14%

*/ - change to previous close

The futures market began the trading with a rise of 0.16% to 1,858 points. The contract on the DAX presents quite surprisingly better posture with the approach of over 0.6%.

The cash market (the WIG20 index) at the opening drop of 0.09% to 1,850 points. At the same time, the German DAX rose approx. 0.5%. The turnover is concentrated on the medium size companies such as JSW and wanting to make its debut in Frankfurt - Ciech (WSE: CIE).

-

08:30

WSE: Before opening

Yesterday's closing of the S&P500 index by decline of 0.3% was largely driven by behavior of oil prices. Quotation of this raw material decelerated markedly yesterday's afternoon in response to the data on stocks. Yesterday, Europe was dominated by small declines, and it is difficult to say that the moods in the world are very optimistic. In Asia parquet in Japan is closed due to holidays.

Today's macro calendar is devoid of important publications, which will appear tomorrow. Therefore we are before the session without clear pulse in the global arena.

On the Warsaw market worse than expected results reported Energa (WSE: ENG). Also, Lotos (WSE: LTS) does not live up to earlier forecasts. Smaller derogation from the projections are visible in the case of Alior (WSE: ALR), though hard about the positive surprise here.

Financial Stability Committee issued an opinion on Wednesday about the identification of other systemically relevant institutions and the imposition of an additional capital buffer. It is a response to the request of the Polish Financial Supervision Authority, which proposes such as ING Bank (WSE: ING), PKO BP (WSE: PKO), Getin Noble (WSE: GNB) and Bank BGZ BNP Paribas (WSE: BGZ) to include to this group.

Yesterday, at the close of the session on the tape was tampered level of 1,850 points and today's session should give an answer whether it was justified or not. The key, as usual, will be the afternoon, which in recent days is as a rule under the sign of growth, probably due to the purchase of US funds.

-

08:16

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.2%, FTSE + 0.1%

-

07:07

Global Stocks

European stocks finished slightly lower Wednesday, with energy shares among those pulling the region's key benchmark away from its post-Brexit high.

The Stoxx Europe 600 SXXP, -0.20% slipped 0.2% to end at 343.98. The pan-European index suffered its first daily drop after five straight sessions of gains.

U.S. stocks closed slightly lower Wednesday, with the S&P 500 and Nasdaq retreating from record levels as the energy sector came under renewed pressure.

The main indexes, which opened with small gains, turned lower as crude-oil futures slumped following data on supply and production.

Oil futures fell 2.5% to a one-week low after the U.S. Energy Information Administration reported an increase crude supplies last week, while Saudi Arabia revealed record crude production in July.

The benchmark S&P 500 index SPX, -0.29% fell 6.25 points, or 0.4% to 2,175.49, a day after notching an all-time high. Energy shares, down 1.4%, led the losses, followed by financials, down 0.8%.

The Dow Jones Industrial Average DJIA, -0.20% fell 37.39 points, or 0.2%, to 18,495.66, with shares of Exxon Mobil Corp. XOM, -1.75% and Chevron Corp CVX, -1.16% leading losses.

Asian shares fell on Thursday, reversing recent gains following losses on Wall Street, though regional currencies rose after Beijing let the Chinese yuan strengthen to mark the one-year anniversary of a landmark devaluation.

Broad risk sentiment remains on the back foot as oil prices tumbled on news of a surprising jump in U.S. government stockpiles and as Singapore, the region's bellwether for trade, cut its economic forecast for the year.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.5 percent. It hit a one-year high on Wednesday and has broadly outperformed the MSCI world index .MIWO00000PUS since end-June.

Hong Kong .HSI and Indonesia .JKSE led regional gainers in trade. Japan's markets .N225 are closed for a holiday.

Singapore cut its economic growth forecast on concerns over Brexit and weakening global demand with official forecasts downgraded to an expansion of 1-2 percent this year from a previous forecast of 1-3 percent growth.

In Asia, yields on 10-year benchmark New Zealand bonds NZ10YT=RR fell to 2.18 percent after the Reserve Bank of New Zealand cut its official cash rate by 25 basis points to a record low of 2.0 percent as widely expected.

-

01:00

Stocks. Daily history for Aug 10’2016:

(index / closing price / change items /% change)

Nikkei 225 16,735.12 -29.85 -0.18%

Shanghai Composite 3,019.29 -6.3928 -0.21%

S&P/ASX 200 5,543.71 -8.837 -0.16%

FTSE 100 6,866.42 +15.12 +0.22%

CAC 40 4,452.01 -16.0600 -0.36%

Xetra DAX 10,650.89 -42.01 -0.39%

S&P 500 2,175.49 -6.25 -0.29%

Dow Jones Industrial Average 18,495.66 -37.39 -0.20%

S&P/TSX Composite 14,775.04 -26.19 -0.18%

-