Noticias del mercado

-

21:00

DJIA 18474.43 -58.62 -0.32%, NASDAQ 5199.92 -25.56 -0.49%, S&P 500 2172.83 -8.91 -0.41%

-

19:44

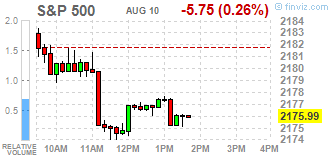

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes retreated from record levels as a drop in oil prices pressured energy stocks. Oil prices fell 1.7% in choppy trading after the U.S. government reported a surprise crude stockpile build.

Most of Dow stocks in negative area (22 of 30). Top gainer - The Walt Disney Company (DIS, +1.33%). Top loser - Exxon Mobil Corporation (XOM, -2.24%).

Most of S&P sectors in negative area, Top gainer - Conglomerates(+0.3%). Top loser - Healthcare (-0.8%),

At the moment:

Dow 18450.00 -16.00 -0.09%

S&P 500 2172.25 -5.25 -0.24%

Nasdaq 100 4780.00 -11.75 -0.25%

Oil 42.04 -0.73 -1.71%

Gold 1351.70 +5.00 +0.37%

U.S. 10yr 1.51 -0.03

-

18:01

European stocks closed: FTSE 6857.44 6.14 0.09%, DAX 10658.55 -34.35 -0.32%, CAC 4451.36 -16.71 -0.37%

-

17:37

WSE: Session Results

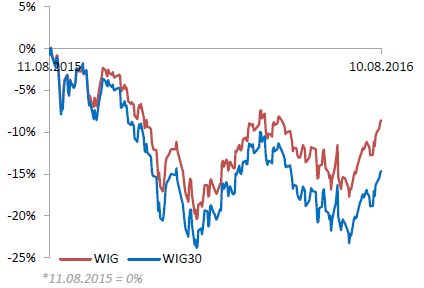

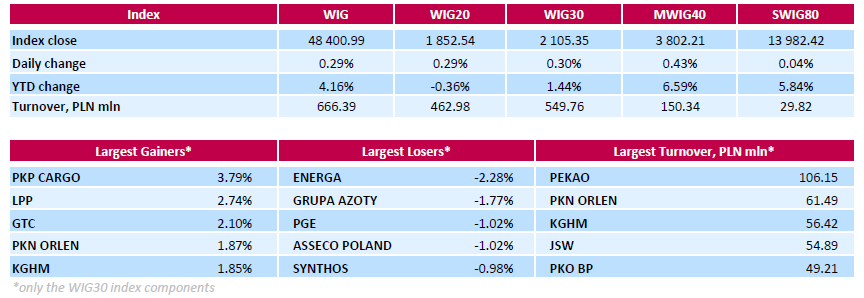

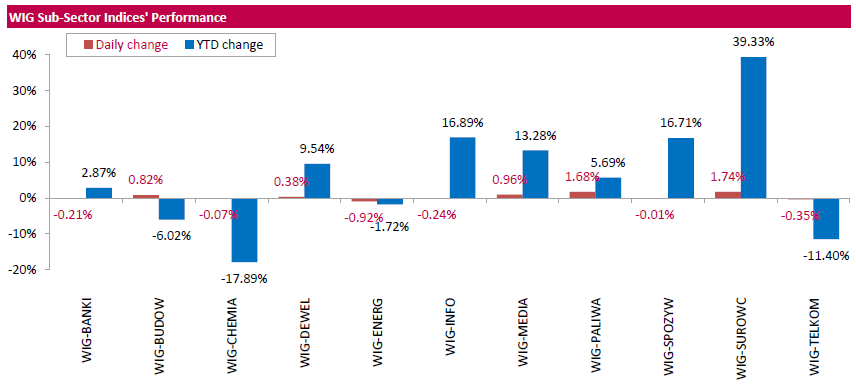

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, gained 0.29%. Sector performance within the WIG Index was mixed. Materials (+1.74%) outperformed, while utilities (-0.92%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, added 0.3%. Within the index components, railway freight transport operator PKP CARGO (WSE: PKP) led the gainers with a 3.79% surge. Other major advancers were clothing retailer LPP (WSE: LPP), property developer GTC (WSE: GTC), oil refiner PKN ORLEN (WSE: PKN) and copper producer KGHM (WSE: KGH), boosting by 1.85%-2.74%. On the other side of the ledger, genco ENERGA (WSE: ENG) suffered the steepest drop, plunging 2.28%. It was followed by chemical producer GRUPA AZOTY (WSE: ATT), IT-company ASSECO POLAND (WSE: ACP) and genco PGE (WSE: PGE), which recorded declines between 1.02% and 1.77%.

-

16:05

WSE: After start on Wall Street

The third day in a row the US market opened flat and does not bring new content to trade in Europe. In fact, the S&P500 drifting around the level from yesterday's close. Thus there is no reasons for the WIG20 index to change the existing behavior. Given that the counter of turnover shows little more than PLN 300 million, the last hour of trading seems to be a weak period for the attack on the zone of resistance 1,853-1,850 points. With such low activity possible technical signals will require confirmation at the next session.

-

15:32

U.S. Stocks open: Dow +0.02%, Nasdaq +0.01%, S&P +0.04%

-

15:26

Before the bell: S&P futures +0.16%, NASDAQ futures +0.15%

U.S. stock-index futures edged up.

Global Stocks:

Nikkei 16,735.12 -29.85 -0.18%

Hang Seng 22,492.43 +26.82 +0.12%

Shanghai 3,019.29 -6.3928 -0.21%

FTSE 6,847.12 -4.18 -0.06%

CAC 4,457.95 -10.120 -0.23%

DAX 10,660.44 -32.46 -0.30%

Crude $42.64 (-0.30%)

Gold $1362.20 (+1.15%)

-

15:03

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.38

0.03(0.2899%)

1150

ALTRIA GROUP INC.

MO

66.88

0.26(0.3903%)

2519

Amazon.com Inc., NASDAQ

AMZN

769.45

1.14(0.1484%)

5806

Apple Inc.

AAPL

108.82

0.01(0.0092%)

59781

AT&T Inc

T

43.08

0.00(0.00%)

2245

Barrick Gold Corporation, NYSE

ABX

22.1

0.61(2.8385%)

82893

Boeing Co

BA

132

0.47(0.3573%)

700

Caterpillar Inc

CAT

82.81

-0.02(-0.0241%)

700

Chevron Corp

CVX

101.29

-0.03(-0.0296%)

1070

Cisco Systems Inc

CSCO

30.92

-0.02(-0.0646%)

1226

Citigroup Inc., NYSE

C

45.75

-0.15(-0.3268%)

2000

Exxon Mobil Corp

XOM

87.95

-0.00(-0.00%)

1874

Facebook, Inc.

FB

125.02

-0.04(-0.032%)

37742

Ford Motor Co.

F

12.32

0.01(0.0812%)

5810

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.43

0.34(2.8122%)

325247

General Electric Co

GE

31.3

-0.00(-0.00%)

2280

Intel Corp

INTC

35.08

0.16(0.4582%)

165

International Business Machines Co...

IBM

162.41

0.64(0.3956%)

792

Johnson & Johnson

JNJ

123.55

0.12(0.0972%)

1000

JPMorgan Chase and Co

JPM

65.87

0.00(0.00%)

760

Merck & Co Inc

MRK

62.25

-0.24(-0.3841%)

966

Microsoft Corp

MSFT

58.35

0.15(0.2577%)

4697

Nike

NKE

55.77

0.00(0.00%)

2030

Pfizer Inc

PFE

35.18

0.10(0.2851%)

8044

Starbucks Corporation, NASDAQ

SBUX

55.25

0.05(0.0906%)

19898

Tesla Motors, Inc., NASDAQ

TSLA

228.97

-0.11(-0.048%)

8974

The Coca-Cola Co

KO

43.55

0.08(0.184%)

1315

Twitter, Inc., NYSE

TWTR

18.72

0.04(0.2141%)

64730

Verizon Communications Inc

VZ

53.68

0.02(0.0373%)

266

Wal-Mart Stores Inc

WMT

73.3

0.26(0.356%)

2512

Walt Disney Co

DIS

95.35

-1.32(-1.3655%)

220685

Yahoo! Inc., NASDAQ

YHOO

39.39

0.15(0.3823%)

10520

-

15:00

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) upgraded to Outperform from Neutral at Macquarie

Downgrades:

Other:

Walt Disney (DIS) target lowered to $118 from $122 at Pivotal Research Group

-

13:10

WSE: Mid session comment

Today's trading on the Warsaw market may be described in one word: stabilization. With the neutral behavior of Euroland, and thus maintaining yesterday's achievements, drifting at current levels is the optimal solution for the market. The only thing that may worry is a low turnover. Low turnover on the decline is a good news for the market, but low volume has its other side in the form of low reliability from the technical point of view.

In the middle of today's session the WIG20 index was at the level of 1,843 points (-0.19%) and with the turnover of PLN 185 million.

-

12:47

Major stock indices in Europe moderately lower

European stocks traded in the red zone, but remain near the seven-week high. The pressure on the indices was put by a decrease in shares of utility companies and energy producers, as well as the negative dynamics of oil market.

Oil dropped by about the percentage in response to data on the petroleum products from the American Petroleum Institute (API). Recall, this week crude oil inventories rose by 2.09 million barrels of crude oil.

Investors' attention is also focused on corporate reporting. In Europe, 59% of companies from the Stoxx Europe 600 Index recorded a better-than-expected profit. However, the average earnings per share fell by 9% (7% excluding oil and gas company). 51% of European companies have exceeded forecasts of revenue, which on average has decreased by 3% (and not changed, excluding utilities).

Euro Stoxx 600 fell 0.2 percent. The volume ois about a third lower than the average for the last 30 days.

Shares of Prudential Plc - a British insurance company - rose by 1.5 percent after reports that first-half profit exceeded analysts' expectations.

Quotes of Belgian Ageas SA climbed 3.9 percent as profits were more than forecast.

G4S Plc rose 15 percent after the statements on increasing revenues and maintaining its dividend.

EON SE shares fell 5.7 per cent against the background of a net loss in the 1st half of the year. The loss has been associated with the depreciation of the assets associated with the production and storage of gas.

Capitalization of Novozymes A / S fell 8.5 percent as the profit was below estimates. In addition, the company worsened its forecast for sales.

Shares of Entertainment One Ltd. rose 5.2 percent after the company rejected a takeover bid.

At the moment:

FTSE 100 6837.02 -14.28 -0.21%

DAX -49.70 10643.20 -0.46%

CAC 40 4453.66 -14.41 -0.32%

-

09:37

Major stock exchanges began trading mixed: the FTSE 100 6,827.21 + 18.08 + 0.27%, DAX 10,681.29-11.61-0.11%

-

09:20

WSE: After opening

WIG20 index opened at 1845.78 points (-0.07%)*

WIG 48218.19 -0.09%

WIG30 2096.77 -0.11%

mWIG40 3789.70 0.10%

*/ - change to previous close

Today's session on the Warsaw market started with small declines. With the same situation we are dealing on European markets. London, Paris and Frankfurt record solidarity revocation, of which a relatively smallest decline recorded German DAX. The WIG20 index fit in with the surroundings and decrease of largest companies by 0.3 percent undergo pressure from core markets. Withdrawal is so small that it is difficult to talk about the attack of supply. Trading on the WIG20 component is not large and after the first quarter is less than PLN 10 mln.

-

08:21

WSE: Before opening

Tuesday's session on Wall Street ended with a modest changes in the major indexes. The S&P500 finished the day rising by 0.04 percent and Wall Street has had another day of consolidation at levels reached at the last Friday session.

It should be noted quite a difference between the flat end in the US and a strong rise in the German DAX, which rose yesterday by 2.5 percent, mainly on a wave of good quarterly results of companies. Parting of markets on this scale may end up with back of the DAX to the line.

Today's macro calendar day plan contains no reports worthy of attention.

The Warsaw market is influenced by two variables - good posture of emerging markets basket and rebound of bear market in shares of banks. There is also important, of course, behavior of developed markets, which glide on annual maximums. If all these variables will be further arranged in the positive growth factors, the WIG20 index will have a chance to cover "after-brexit" gap on the chart and go over 1,850 points.

-

08:20

Expected negative start of trading on the major stock exchanges in Europe: DAX-0.2%, CAC40 -0.1%, FTSE -0.1%

-

07:25

Global Stocks

European stocks rose Tuesday, with the benchmark index rallying to a post-Brexit high and German's DAX 30 entering bull-market territory, after a round of upbeat earnings lifted sentiment.

The Stoxx Europe 600 SXXP, +0.92% picked up 0.9% to end at 344.67, its highest close since June 23. A gain on Tuesday marked the gauge's fifth in a row, the longest string of gains since early July.

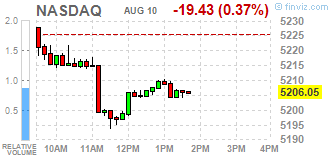

The Nasdaq Composite narrowly logged its second record close of 2016 on Tuesday, as losses in oil prices and weak productivity data all but erased gains for the broad benchmarks.

The S&P 500 index SPX, +0.04% SPX, +0.04% ended up less than a point at 2,181.74, after setting a record high of 2,187.69 earlier in the day. Gains in health-care and consumer-staples stocks were offset by losses in energy and materials sectors, weighed down by the drop in oil prices.

The Dow Jones Industrial Average DJIA, +0.02% closed up 3.76 points.

The Nasdaq Composite Index COMP, +0.24% gained 12.34 points, or 0.2%, to 5,225.48-an all-time closing high.

Asian shares hit a one-year high on Wednesday while the dollar and Treasury yields slid on weak U.S. productivity data and sterling recovered from a one-month low.

MSCI's broadest index of Asia-Pacific shares excluding Japan .MIAPJ0000PUS rose 0.35 percent to the highest level since August 2015. Japan's Nikkei .N225 fell 0.3 percent, pulled down by a stronger yen.

Hong Kong's Hang Seng index .HSI rose 0.6 percent, hovering close to its highest level since November. China's CSI 300 index .CSI300 and the Shanghai Composite .SSEC were little changed.

-

00:35

Stocks. Daily history for Aug 09’2016:

(index / closing price / change items /% change)

Nikkei 225 16,764.97 +114.40 +0.69%

Shanghai Composite 3,025.91 +21.63 +0.72%

S&P/ASX 200 5,552.55 +14.71 +0.27%

FTSE 100 6,851.3 +42.17 +0.62%

CAC 40 4,468.07 +52.61 +1.19%

Xetra DAX 10,692.9 +260.54 +2.50%

S&P 500 2,181.74 +0.85 +0.04%

Dow Jones Industrial Average 18,533.05 +3.76 +0.02%

S&P/TSX Composite 14,801.23 +45.61 +0.31%

-