Noticias del mercado

-

23:00

New Zealand: RBNZ Interest Rate Decision, 2% (forecast 2%)

-

20:00

U.S.: Federal budget , July -113 (forecast -113)

-

16:30

U.S.: Crude Oil Inventories, August 1.055 (forecast -0.95)

-

16:05

US: the number of job openings was little changed at 5.6 million

The number of job openings was little changed at 5.6 million on the last business day of June, the U.S Bureau of Labor Statistics reported today. Hires and separations were little changed at 5.1 million and 4.9 million, respectively. Within separations, the quits rate was 2.0 percent and the layoffs and

discharges rate was 1.1 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions.

In June, there were 5.6 million job openings, little changed from May. The job openings rate in June

was 3.8 percent. The number of job openings was essentially unchanged for total nonfarm, total private, and government. Job openings increased in durable goods manufacturing (+37,000) and decreased in federal government (-15,000). In the regions, job openings increased in the South.The number of hires was 5.1 million in June, essentially the same as May. The hires rate was 3.6 percent in June. The number of hires was little changed for total private and for government. Hires was also little changed in all industries. The number of hires increased in the Northeast region.

-

16:03

U.S.: JOLTs Job Openings, June 5.62 (forecast 5.57)

-

15:46

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1085 (EUR 223m) 1.1100 (306m) 1.1200 (648m)

USDJPY 100.25 (USD 700m) 100.75 (230m) 101.00 (250m) 101.85 (447m) 102.70 (275m)

GBPUSD 1.2800 (GBP 260m) 1.3000 (170m)

USDCHF 0.9960 (USD 555m)

AUDUSD 0.7450 (AUD 895m) 0.7480 (255m) 0.7530 (466m) 0.7550 (595m) 0.7600 (541m) 0.7650 (494m)

USDCAD 1.3065-75 (USD 550m) 1.3175 (216m)

-

14:54

European session review: the US dollar depreciated significantly

The following data was published:

(Time / country / index / period / previous value / forecast)

6:45 France Industrial Production m / m in June -0.5% 0.2% -0.8%

The euro has appreciated considerably against the US dollar, updating August highs. Experts point out that the US currency depreciates against the background of low markey activity associated with the period of the summer holidays. In addition, pressure on the dollar still have yesterday's disappointing data on labor productivity in the US. Today futures on interest rates suggest that the market priced in a 15% probability of a rate hike in September and a 40% probability in December.

Gradually, investors' attention shifted to the American statistics on the level of vacancies and labor turnover in the United States. Recall, a significant reduction was recorded in May, which coincided with a weak NFP. It is expected that in June JOTLS job openings rose to 5.57 million after an increase of 5.5 mln. In May.

The pound resumed growth against the dollar after a small correction. However, analysts say that taking into account the previous active sales of the British currency a few weeks of downside risk will remain.

Investors also drew attention to the Bank of England study, which reported that the recent results of the referendum have a negative impact on capital spending, hiring and turnover within the next year. "The data showed that consumer spending growth continued to decelerate. Consumer caution has increased before and after the referendum, and the turnover in the business services sector has continued to decrease. In addition, service providers activity is revised to the downside, referring to the increase in uncertainty. Plans for employment in the business services sector were also reduced and total labor costs increased slightly in the production sector, but little has changed as a whole ", -. the bank said. It is worth emphasizing that this survey was conducted among 270 enterprises in the period from late June to late July.

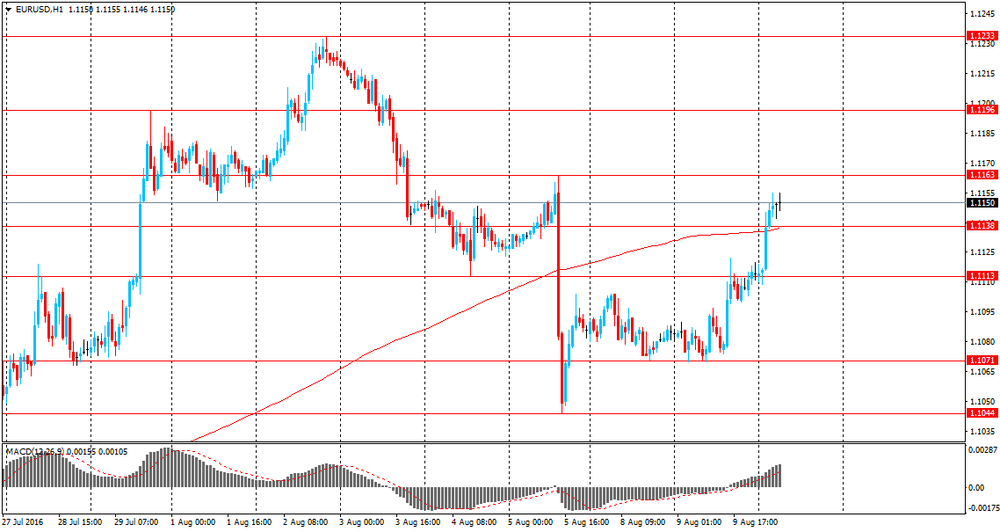

EUR / USD: during the European session, the pair rose to $ 1.1190

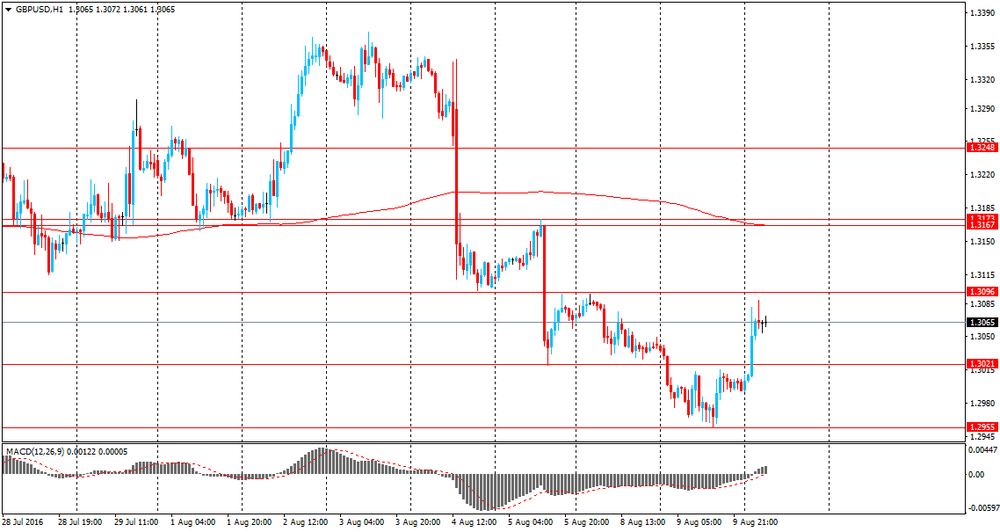

GBP / USD: during the European session, the pair has risen to $ 1.3092

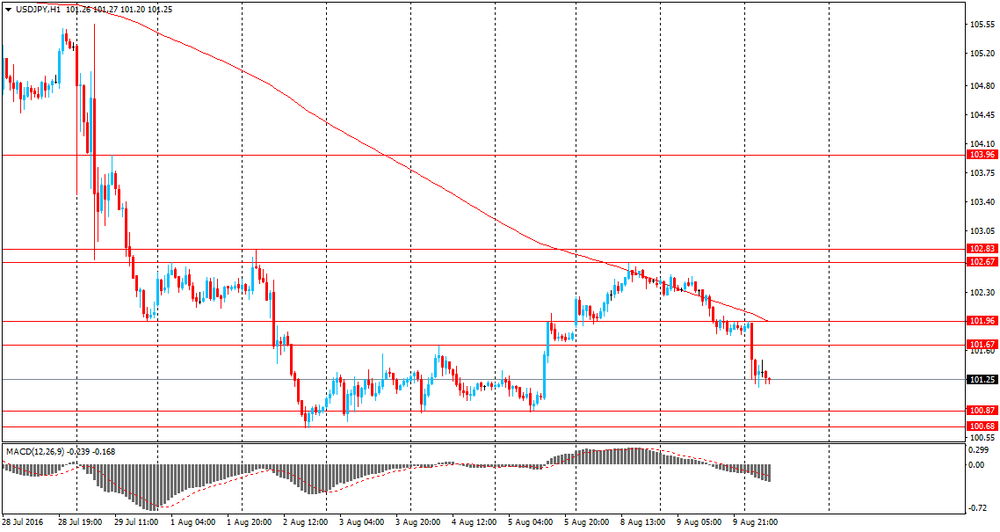

USD / JPY: during the European session, the pair fell to Y101.00

-

14:07

OPEC: Expects higher oil consumption in coming months which will help ease supply overhang

-

2017 OPEC demand forecast at 33.01mbpd vs 32.98mbpd prior

-

2017 world oil demand growth forecast unchanged at 1.17mbpd

-

Expects 2017 non-OPEC supply to fall by 150kbpd vs 110k prior

-

Expects higher oil consumption in coming months which will help ease supply overhang and will contribute to expected rebalancing of market

-

Report implies that global oil market will see 100kbpd average surplus in 201, compared to small deficit in prior report

-

Secondary sources says OPEC output rose to 33.11mbpd

-

Saudi's say they raised output to record 10.67mbpd in July

*via forexlive -

-

13:47

Orders

EUR/USD

Offers 1.1160 1.1180 1.1200 1.1230 1.1250 1.1280 1.1300

Bids 1.1130 1.1115 1.1100 1.1070 1.1050-55 1.1020-25 1.1000-05

GBP/USD

Offers 1.3065 1.3080 1.3195-05 1.3130 1.3150 1.3185 1.3200

Bids 1.3020 1.3000 1.2985 1.2965 1.2950 1.2930 1.2900

EUR/GBP

Offers 0.8565 0.8580 0.8600 0.8630 0.8650

Bids 0.8535 0.8520 0.8500 0.8475-80 0.8450

EUR/JPY

Offers 113.35 113.50 113.85 114.00 114.50 114.80 115.00

Bids 113.00 112.80 112.50 112.00-10 111.50 111.00

USD/JPY

Offers 101.60 101.80 102.00 102.25-30 102.60 102.80-85 103.00

Bids 101.15-20 101.00 100.70-75 100.50 100.25 100.00

AUD/USD

Offers 0.7720 0.7750 0.7765 0.7785 0.7800 0.7835 0.7850 0.7900

Bids 0.7680 0.76650 0.7650 0.7620 0.7600 0.7585 0.7565 0.7570 0.7550

-

11:47

-

11:38

Bank of America Merrill Lynch selling EUR / AUD

Bank of America Merrill Lynch announced its willingness to sell the pair EUR / AUD. Bank's analysts expect the break of the 200-week moving averagage at 1.4436. After that, the investment bank expect a decline to $ 1.4087, $ 1.3740 and $ 1.35. They sold at $ 1.4470 with the target at $ 1.3740 and a protective stop at $ 1.4802.

Comments from Bank of America Merrill Lynch via Dow Jones Newswires.

-

11:20

Bank of England Brexit update: survey of companies indicated the result of the EU referendum would have a negative effect overall

This Update generally covers intelligence gathered from business contacts between late June 2016 and late July 2016.

• A survey of companies indicated the result of the EU referendum would have a negative effect, overall, on capital spending, hiring and turnover over the coming year (previously published in the August Inflation Report). Consistent with those results, Agents' scores for employment and investment intentions had weakened in absolute terms, pointing to expectations of little change in staff numbers and capital spending over the coming six to twelve months.

• Business services growth had softened further, partly reflecting weakness in commercial property investment and corporate transactions. Consumer spending growth had also slowed, although that appeared to have partly reflected the effects of unusually wet weather. A decline in manufacturing export volumes had been arrested, aided by the depreciation of sterling.

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1085 (EUR 223m) 1.1100 (306m) 1.1200 (648m)

USD/JPY 100.25 (USD 700m) 100.75 (230m) 101.00 (250m) 101.85 (447m) 102.70 (275m)

GBP/USD 1.2800 (GBP 260m) 1.3000 (170m)

USD/CHF 0.9960 (USD 555m)

AUD/USD 0.7450 (AUD 895m) 0.7480 (255m) 0.7530 (466m) 0.7550 (595m) 0.7600 (541m) 0.7650 (494m)

USD/CAD 1.3065-75 (USD 550m) 1.3175 (216m)

-

09:39

Today’s events:

At 09:30 GMT Germany will hold an auction of 10-year bonds

At 17:01 GMT the United States will hold an auction of 10-year bonds

At 18:00 GMT the US monthly budget report

At 21:00 GMT RBNZ decision on the basic interest rate and RBNZ Monetary Policy

At 22:00 GMT the RBNZ Press Conference

-

09:06

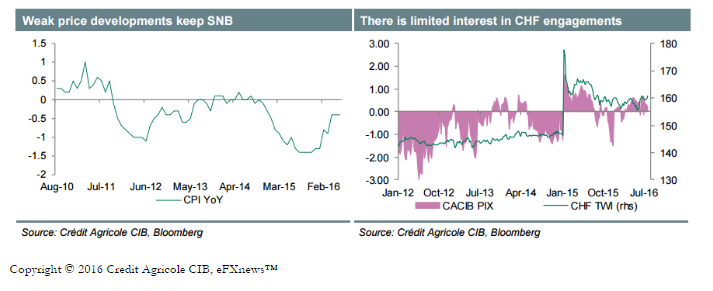

CHF: A Sell Vs USD, GBP; We Stay Short - Credit Agricole

"The franc has been relatively well supported for most of the last few weeks, party on the back of the view that the SNB's aggressive stance with respect to currency intervention drove the central bank's balance sheet closer to unsustainable levels.

However, with inflation remaining extraordinarily low and as the overvalued currency remains the key factor in keeping monetary conditions too tight there seems little scope of price developments stabilising more considerably anytime soon.

Looking ahead we expect the franc to remain a sell on rallies, in particular against the USD and the GBP. We remain long GBP/CHF".

-

08:58

French industrial production down 0.8% in June

Over the second quarter of 2016, output decreased slightly in the manufacturing industry (-0.2% q-o-q). It was virtually stable in the overall industry (-0.1% q-o-q).

Output decreased sharply in the manufacture of food products and beverages (-2.3%), and tumbled in the manufacture of coke and refined petroleum products (-11.7%). It was stable in "other manufacturing". Conversely, output rose in the manufacture of transport equipment (+1.7%) and to a lesser extent in the manufacture of machinery and equipment goods (+0.5%) and in mining and quarrying; energy; water supply (+0.3%).

Over a year, manufacturing output soared in the manufacture of transport equipment (+7.6%) and rose more moderately in "other manufacturing" (+0.5%) and in mining and quarrying; energy; water supply (+0.9%). On the contrary, it shrank markedly in the manufacture of food products and beverages (-3.0%) and in the manufacture of machinery and equipment goods (-2.4%), and plummeted in the manufacture of coke and refined petroleum products (-13.2%).

-

08:49

Asian session review: US dollar continues to decline

During the Asian session, the US dollar continued to decline against other major currencies, as yesterday's preliminary data showed that labor productivity in the United States continued to decline this spring to record third quarterly drop in a row, which could jeopardize the acceleration of wage growth and the economy as a whole in the coming years. This was stated by the Ministry of Labour.

The data showed that the level of labor productivity in the agricultural sector - the gauge of production of goods and services for one hour- decreased in the 2nd quarter by 0.5% compared to the first quarter. The reason for this change has been a more rapid growth in hours worked than in output. Recall that in the first quarter productivity fell by 0.6%.

Also today positive data on orders for engineering products, and the index of activity in the Japanese service.

Orders for Japanese machine building products increased by 8.3% in June, higher than economists' forecast of 3.1%. In May the decline was -1.4%.

The index of activity in the service sector, published by the Ministry of Economy, Trade and Industry of Japan, increased by 0.8%, higher than analysts' expectations of +0.3% in June. The index of activity in the services sector reflects the state of Japan's domestic service sector, including information and communications, electricity, gas heating and water supply, services, transport, wholesale and retail trade, finance and insurance, and social security. Typically, a high value of the index is a positive factor for the Japanese currency.

The Australian dollar rose against the weakening of the US currency, as well as positive data on the index of consumer confidence. The consumer confidence index in Australia published by the Faculty of Economics and Commerce at the University of Melbourne, grew by 2% in August, after a decline of 3% in July. This indicator reflects the level of public confidence in the economy by means of ratings respondents into categories such as personal financial situation in the past year and the outlook for next year, expectations about the economic situation in the 1 and 5 year term, as well as the current consumer climate in terms of households readiness to commit large purchases. In general, high levels are considered to be a positive factor for the Australian currency. Westpac survey was conducted during the first four days of August.

Also Today the head of the RBA Glenn Stevens said the central bank's inflation target is flexible, and inflation may remain below target for some time.

Stevens also said that the leadership of the central bank, whose task is to balance the risks in the economy, discussed the risks associated with the preservation of very low interest rates.

"Given the low interest rates around the world, it would be strange to think that Australia will not follow the example of other central banks," - said Stevens and added - "You can not rely solely on interest rates in an effort to accelerate economic growth"

Also the head of the RBA stated the need to increase the efforts to accelerate the growth of the country's GDP.

Earlier, the number of mortgage loans in Australia increased by 1.2% in June, below economists' forecast of 2.3%. The value from May was revised from -1% to -0.8%

Report on mortgages, published by the Australian Bureau of Statistics shows the number of approved housing loans. It also traces the development trend in the housing market in Australia, and the level of consumer confidence, as large loans to purchase real estate are not taken into account. The high value of the index is a positive factor for the Australian currency.

Also, the Australian Bureau of Statistics reported that the volume of approved home loans linked to investments, increased by 3.2% compared to May, when the growth was recorded at 3.9%.

The Australian Bureau of Statistics report shows that the growth of investment loans remained stable at the level of 0.3-0.4% per month, so a bit limited, but not slowing further.

Today's data suggest that financing flows in the housing market continues.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1110-45 range

GBP / USD: during the Asian session, the pair is trading in the $ 1.2990-1.3050 range

USD / JPY: during the Asian session, the pair was trading in the Y101.10-101.40 range

-

08:46

France: Industrial Production, m/m, June -0.8% (forecast 0.2%)

-

08:37

Mortgage loans in Australia below expectations in June

The number of mortgage loans in Australia increased by 1.2% in June, below economists' forecast of 2.3%. The value from May was revised from -1% to -0.8%

Report on mortgages, published by the Australian Bureau of Statistics shows the number of approved housing loans. It also traces the development trend in the housing market in Australia, and the level of consumer confidence, as large loans to purchase real estate are not taken into account. The high value of the index is a positive factor for the Australian currency.

Also, the Australian Bureau of Statistics reported that the volume of approved home loans linked to investments, increased by 3.2% compared to May, when the growth was recorded at 3.9%.

The Australian Bureau of Statistics report shows that the growth of investment loans remained stable at the level of 0.3-0.4% per month, so a bit limited, but not slowing further.

Today's data suggest that financing flows in the housing market continues.

-

08:31

The consumer confidence index from Australia rose in August

The consumer confidence index in Australia published by the Faculty of Economics and Commerce at the University of Melbourne, grew by 2% in August, after a decline of 3% in July. This indicator reflects the level of public confidence in the economy by means of ratings respondents into categories such as personal financial situation in the past year and the outlook for next year, expectations about the economic situation in the 1 and 5 year term, as well as the current consumer climate in terms of households readiness to commit large purchases. In general, high levels are considered to be a positive factor for the Australian currency.

Westpac survey was conducted during the first four days of August.

-

08:31

Options levels on wednesday, August 10, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1292 (4739)

$1.1259 (4342)

$1.1206 (1867)

Price at time of writing this review: $1.1147

Support levels (open interest**, contracts):

$1.1046 (3202)

$1.0989 (4504)

$1.0955 (4931)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 46399 contracts, with the maximum number of contracts with strike price $1,1250 (4739);

- Overall open interest on the PUT options with the expiration date September, 9 is 53550 contracts, with the maximum number of contracts with strike price $1,1100 (4931);

- The ratio of PUT/CALL was 1.15 versus 1.17 from the previous trading day according to data from August, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (2353)

$1.3206 (1918)

$1.3109 (1031)

Price at time of writing this review: $1.3051

Support levels (open interest**, contracts):

$1.2987 (2029)

$1.2891 (1781)

$1.2794 (2122)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 29276 contracts, with the maximum number of contracts with strike price $1,3300 (2353);

- Overall open interest on the PUT options with the expiration date September, 9 is 24107 contracts, with the maximum number of contracts with strike price $1,2800 (2122);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from August, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Reserve Bank of Australia Governor Glenn Stevens: Inflation targeting is flexible

Today the head of the RBA Glenn Stevens said the central bank's inflation target is flexible, and inflation may remain below target for some time.

Stevens also said that the leadership of the central bank, whose task is to balance the risks in the economy, discussed the risks associated with the preservation of very low interest rates.

"Given the low interest rates around the world, it would be strange to think that Australia will not follow the example of other central banks," - said Stevens and added - "You can not rely solely on interest rates in an effort to accelerate economic growth"

Also the head of the RBA stated the need to increase the efforts to accelerate the growth of the country's GDP.

-

08:21

New Zealand's house sales declined notably in July

New Zealand's house sales declined notably in July from a year ago, while median house prices climbed further, the Real Estate Institute of New Zealand said Wednesday.

The total volume of home sales plunged 10.1 percent year-over-year in July, reversing a 6.0 percent climb in the previous month.

On a seasonally adjusted basis, the number of sales dropped 3.6 percent monthly in July.

At the same time, house prices grew 8.6 percent annually in July and rose 2.0 percent from the preceding month. The median price in Auckland alone surged 12.0 percent in July from a year ago - RTTnews.

-

03:30

Australia: Home Loans , June 1.2% (forecast 2.4%)

-

02:32

Australia: Westpac Consumer Confidence, August 2%

-

01:50

Japan: Core Machinery Orders, y/y, June -0.9% (forecast -4.2%)

-

01:50

Japan: Core Machinery Orders, June 8.3% (forecast 3.1%)

-

00:33

Currencies. Daily history for Aug 09’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1114 +0,26%

GBP/USD $1,2993 -0,37%

USD/CHF Chf0,9814 -0,12%

USD/JPY Y101,85 -0,54%

EUR/JPY Y113,19 -0,30%

GBP/JPY Y132,33 -0,93%

AUD/USD $0,7665 +0,14%

NZD/USD $0,7163 +0,20%

USD/CAD C$1,3119 -0,33%

-