Noticias del mercado

-

23:00

New Zealand: RBNZ Interest Rate Decision, 2% (forecast 2%)

-

21:00

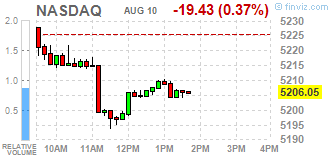

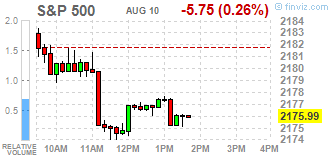

DJIA 18474.43 -58.62 -0.32%, NASDAQ 5199.92 -25.56 -0.49%, S&P 500 2172.83 -8.91 -0.41%

-

20:00

U.S.: Federal budget , July -113 (forecast -113)

-

19:44

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes retreated from record levels as a drop in oil prices pressured energy stocks. Oil prices fell 1.7% in choppy trading after the U.S. government reported a surprise crude stockpile build.

Most of Dow stocks in negative area (22 of 30). Top gainer - The Walt Disney Company (DIS, +1.33%). Top loser - Exxon Mobil Corporation (XOM, -2.24%).

Most of S&P sectors in negative area, Top gainer - Conglomerates(+0.3%). Top loser - Healthcare (-0.8%),

At the moment:

Dow 18450.00 -16.00 -0.09%

S&P 500 2172.25 -5.25 -0.24%

Nasdaq 100 4780.00 -11.75 -0.25%

Oil 42.04 -0.73 -1.71%

Gold 1351.70 +5.00 +0.37%

U.S. 10yr 1.51 -0.03

-

18:01

European stocks closed: FTSE 6857.44 6.14 0.09%, DAX 10658.55 -34.35 -0.32%, CAC 4451.36 -16.71 -0.37%

-

17:52

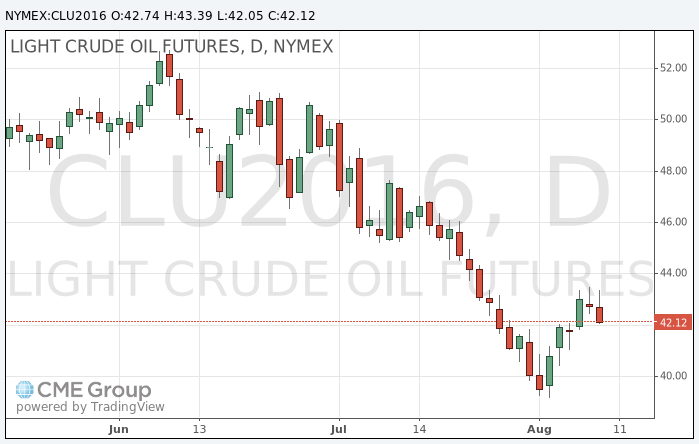

Oil fell after US inventories data

Oil prices fell after the US Department of Energy data showed an unexpected increase in oil inventories.

Energy Information Administration reported an increase of reserves by 1.06 million barrels, while markets expected a decline of 800,000 barrels. World oil reserves remain above average levels after several years of very high production in the US and other countries.

EIA raised the forecast for oil production in the US this year. However, as reported by the department, the production will be below 2015 levels.

OPEC reported that July production rose by 45,000 barrels per day versus 33.11 million barrels per day in June. Saudi Arabia told OPEC that its production in July reached a historical maximum of 10.67 million barrels per day.

On Monday it was reported that OPEC may undergo an informal meeting on which the restriction of production will be discussed. However, markets are skeptical that the cartel would take serious action against low oil prices. Investors point out that the OPEC members could not agree on a freezing of oil production in the past. Even if an agreement is reached on the freeze, the impact on prices will be limited, since most of the oil-producing countries are already using almost all the available production capacity, said Capital Economics economist Thomas Pugh.

The cost of the September futures on WTI fell to 42.05 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 44.11 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:37

WSE: Session Results

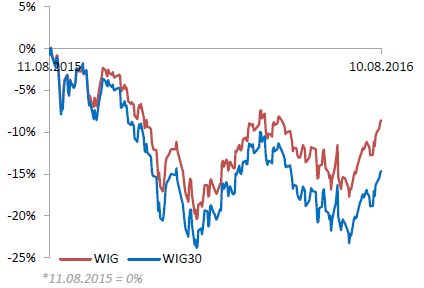

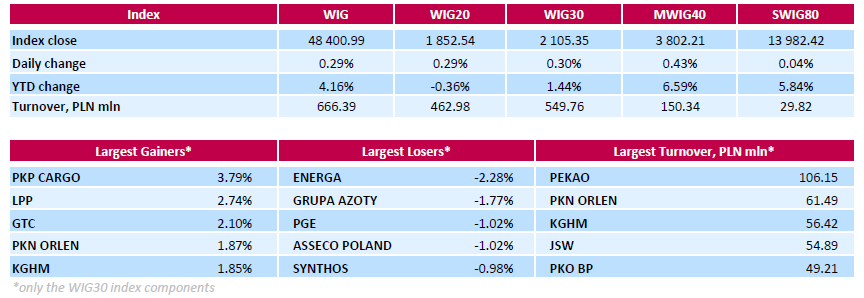

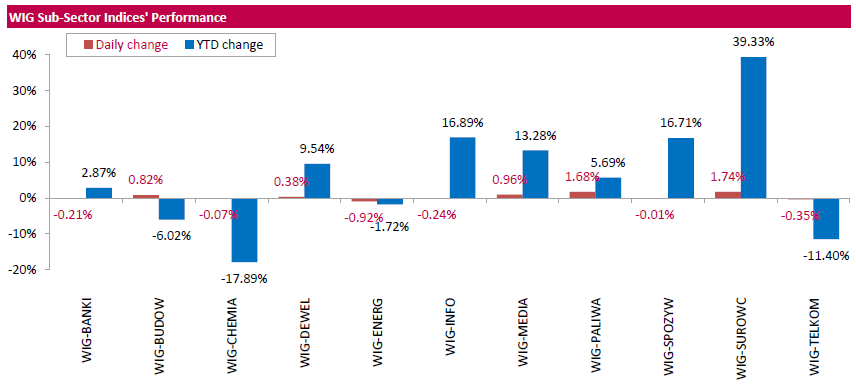

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, gained 0.29%. Sector performance within the WIG Index was mixed. Materials (+1.74%) outperformed, while utilities (-0.92%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, added 0.3%. Within the index components, railway freight transport operator PKP CARGO (WSE: PKP) led the gainers with a 3.79% surge. Other major advancers were clothing retailer LPP (WSE: LPP), property developer GTC (WSE: GTC), oil refiner PKN ORLEN (WSE: PKN) and copper producer KGHM (WSE: KGH), boosting by 1.85%-2.74%. On the other side of the ledger, genco ENERGA (WSE: ENG) suffered the steepest drop, plunging 2.28%. It was followed by chemical producer GRUPA AZOTY (WSE: ATT), IT-company ASSECO POLAND (WSE: ACP) and genco PGE (WSE: PGE), which recorded declines between 1.02% and 1.77%.

-

17:31

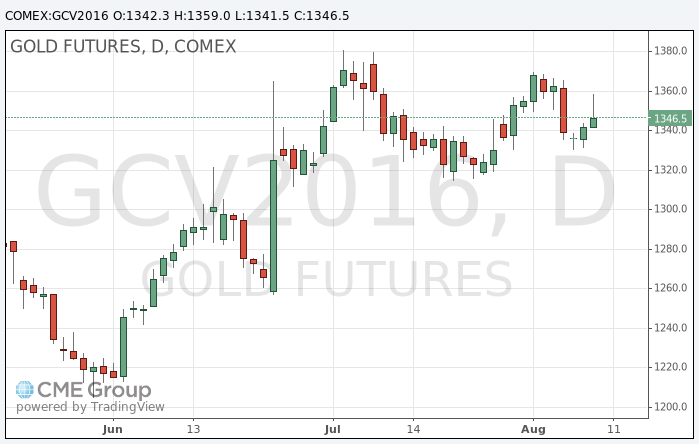

Gold price rose than reversals

Gold prices rose sharply during the European trade, with continued growth in the previous session as investors reconsidered the likelihood that the Federal Reserve will raise interest rates this year.

Later, during the US session, gold prices retreated from highs against the dollar strength.

A day earlier, gold rose $ 5.40, or 0.4%, after disappointing US economic data forced market participants to revise the expectations of the next increase in interest rates in the US, putting pressure on the dollar.

For the year gold has risen in price by almost 26% to date, helped by concerns about global economic growth and expectations of monetary stimulus.

Stocks of the world's largest gold exchange-traded fund SPDR Gold Shares on Tuesday fell by 0.12 percent to 972.62 tons.

The cost of the October gold futures on COMEX rose to $ 1,359.00 an ounce.

-

16:38

US crude oil inventories up 1.1 mln barrels last week

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending August 5, 2016, 255,000 barrels per day less than the previous week's average. Refineries operated at 92.2% of their operable capacity last week. Gasoline production increased last week, averaging 10.1 million barrels per day. Distillate fuel production decreased last week, averaging over 4.7 million barrels per day.

U.S. crude oil imports averaged 8.4 million barrels per day last week, down by 334,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 8.4 million barrels per day, 11.5% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 930,000 barrels per day. Distillate fuel imports averaged 184,000 barrels per day last week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.1 million barrels from the previous week. At 523.6 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories decreased by 2.8 million barrels last week, but are well above the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories decreased by 2.0 million barrels last week but are near the upper limit of the average range for this time of year. Propane/propylene inventories rose 2.0 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories increased by 2.5 million barrels last week.

-

16:30

U.S.: Crude Oil Inventories, August 1.055 (forecast -0.95)

-

16:05

WSE: After start on Wall Street

The third day in a row the US market opened flat and does not bring new content to trade in Europe. In fact, the S&P500 drifting around the level from yesterday's close. Thus there is no reasons for the WIG20 index to change the existing behavior. Given that the counter of turnover shows little more than PLN 300 million, the last hour of trading seems to be a weak period for the attack on the zone of resistance 1,853-1,850 points. With such low activity possible technical signals will require confirmation at the next session.

-

16:05

US: the number of job openings was little changed at 5.6 million

The number of job openings was little changed at 5.6 million on the last business day of June, the U.S Bureau of Labor Statistics reported today. Hires and separations were little changed at 5.1 million and 4.9 million, respectively. Within separations, the quits rate was 2.0 percent and the layoffs and

discharges rate was 1.1 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions.

In June, there were 5.6 million job openings, little changed from May. The job openings rate in June

was 3.8 percent. The number of job openings was essentially unchanged for total nonfarm, total private, and government. Job openings increased in durable goods manufacturing (+37,000) and decreased in federal government (-15,000). In the regions, job openings increased in the South.The number of hires was 5.1 million in June, essentially the same as May. The hires rate was 3.6 percent in June. The number of hires was little changed for total private and for government. Hires was also little changed in all industries. The number of hires increased in the Northeast region.

-

16:03

U.S.: JOLTs Job Openings, June 5.62 (forecast 5.57)

-

15:46

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1085 (EUR 223m) 1.1100 (306m) 1.1200 (648m)

USDJPY 100.25 (USD 700m) 100.75 (230m) 101.00 (250m) 101.85 (447m) 102.70 (275m)

GBPUSD 1.2800 (GBP 260m) 1.3000 (170m)

USDCHF 0.9960 (USD 555m)

AUDUSD 0.7450 (AUD 895m) 0.7480 (255m) 0.7530 (466m) 0.7550 (595m) 0.7600 (541m) 0.7650 (494m)

USDCAD 1.3065-75 (USD 550m) 1.3175 (216m)

-

15:32

U.S. Stocks open: Dow +0.02%, Nasdaq +0.01%, S&P +0.04%

-

15:26

Before the bell: S&P futures +0.16%, NASDAQ futures +0.15%

U.S. stock-index futures edged up.

Global Stocks:

Nikkei 16,735.12 -29.85 -0.18%

Hang Seng 22,492.43 +26.82 +0.12%

Shanghai 3,019.29 -6.3928 -0.21%

FTSE 6,847.12 -4.18 -0.06%

CAC 4,457.95 -10.120 -0.23%

DAX 10,660.44 -32.46 -0.30%

Crude $42.64 (-0.30%)

Gold $1362.20 (+1.15%)

-

15:03

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.38

0.03(0.2899%)

1150

ALTRIA GROUP INC.

MO

66.88

0.26(0.3903%)

2519

Amazon.com Inc., NASDAQ

AMZN

769.45

1.14(0.1484%)

5806

Apple Inc.

AAPL

108.82

0.01(0.0092%)

59781

AT&T Inc

T

43.08

0.00(0.00%)

2245

Barrick Gold Corporation, NYSE

ABX

22.1

0.61(2.8385%)

82893

Boeing Co

BA

132

0.47(0.3573%)

700

Caterpillar Inc

CAT

82.81

-0.02(-0.0241%)

700

Chevron Corp

CVX

101.29

-0.03(-0.0296%)

1070

Cisco Systems Inc

CSCO

30.92

-0.02(-0.0646%)

1226

Citigroup Inc., NYSE

C

45.75

-0.15(-0.3268%)

2000

Exxon Mobil Corp

XOM

87.95

-0.00(-0.00%)

1874

Facebook, Inc.

FB

125.02

-0.04(-0.032%)

37742

Ford Motor Co.

F

12.32

0.01(0.0812%)

5810

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.43

0.34(2.8122%)

325247

General Electric Co

GE

31.3

-0.00(-0.00%)

2280

Intel Corp

INTC

35.08

0.16(0.4582%)

165

International Business Machines Co...

IBM

162.41

0.64(0.3956%)

792

Johnson & Johnson

JNJ

123.55

0.12(0.0972%)

1000

JPMorgan Chase and Co

JPM

65.87

0.00(0.00%)

760

Merck & Co Inc

MRK

62.25

-0.24(-0.3841%)

966

Microsoft Corp

MSFT

58.35

0.15(0.2577%)

4697

Nike

NKE

55.77

0.00(0.00%)

2030

Pfizer Inc

PFE

35.18

0.10(0.2851%)

8044

Starbucks Corporation, NASDAQ

SBUX

55.25

0.05(0.0906%)

19898

Tesla Motors, Inc., NASDAQ

TSLA

228.97

-0.11(-0.048%)

8974

The Coca-Cola Co

KO

43.55

0.08(0.184%)

1315

Twitter, Inc., NYSE

TWTR

18.72

0.04(0.2141%)

64730

Verizon Communications Inc

VZ

53.68

0.02(0.0373%)

266

Wal-Mart Stores Inc

WMT

73.3

0.26(0.356%)

2512

Walt Disney Co

DIS

95.35

-1.32(-1.3655%)

220685

Yahoo! Inc., NASDAQ

YHOO

39.39

0.15(0.3823%)

10520

-

15:00

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) upgraded to Outperform from Neutral at Macquarie

Downgrades:

Other:

Walt Disney (DIS) target lowered to $118 from $122 at Pivotal Research Group

-

14:54

European session review: the US dollar depreciated significantly

The following data was published:

(Time / country / index / period / previous value / forecast)

6:45 France Industrial Production m / m in June -0.5% 0.2% -0.8%

The euro has appreciated considerably against the US dollar, updating August highs. Experts point out that the US currency depreciates against the background of low markey activity associated with the period of the summer holidays. In addition, pressure on the dollar still have yesterday's disappointing data on labor productivity in the US. Today futures on interest rates suggest that the market priced in a 15% probability of a rate hike in September and a 40% probability in December.

Gradually, investors' attention shifted to the American statistics on the level of vacancies and labor turnover in the United States. Recall, a significant reduction was recorded in May, which coincided with a weak NFP. It is expected that in June JOTLS job openings rose to 5.57 million after an increase of 5.5 mln. In May.

The pound resumed growth against the dollar after a small correction. However, analysts say that taking into account the previous active sales of the British currency a few weeks of downside risk will remain.

Investors also drew attention to the Bank of England study, which reported that the recent results of the referendum have a negative impact on capital spending, hiring and turnover within the next year. "The data showed that consumer spending growth continued to decelerate. Consumer caution has increased before and after the referendum, and the turnover in the business services sector has continued to decrease. In addition, service providers activity is revised to the downside, referring to the increase in uncertainty. Plans for employment in the business services sector were also reduced and total labor costs increased slightly in the production sector, but little has changed as a whole ", -. the bank said. It is worth emphasizing that this survey was conducted among 270 enterprises in the period from late June to late July.

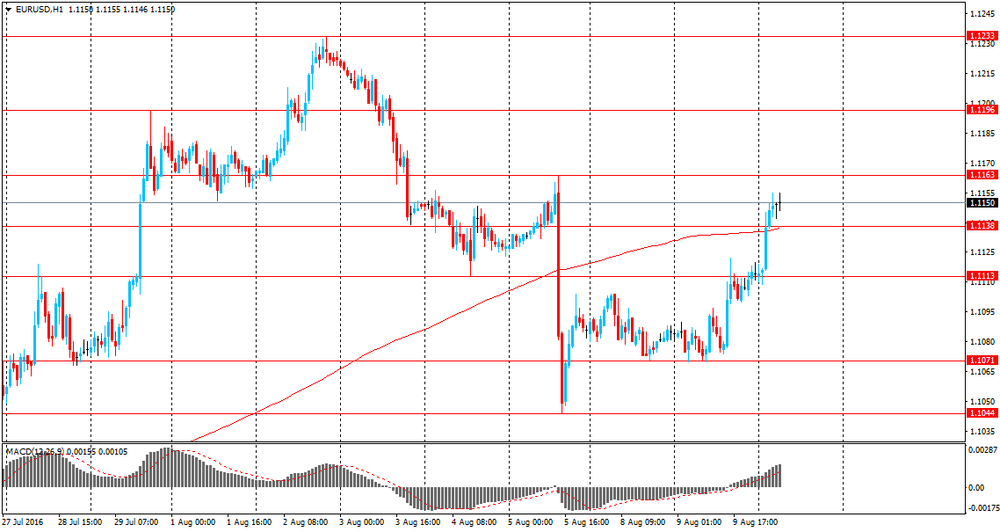

EUR / USD: during the European session, the pair rose to $ 1.1190

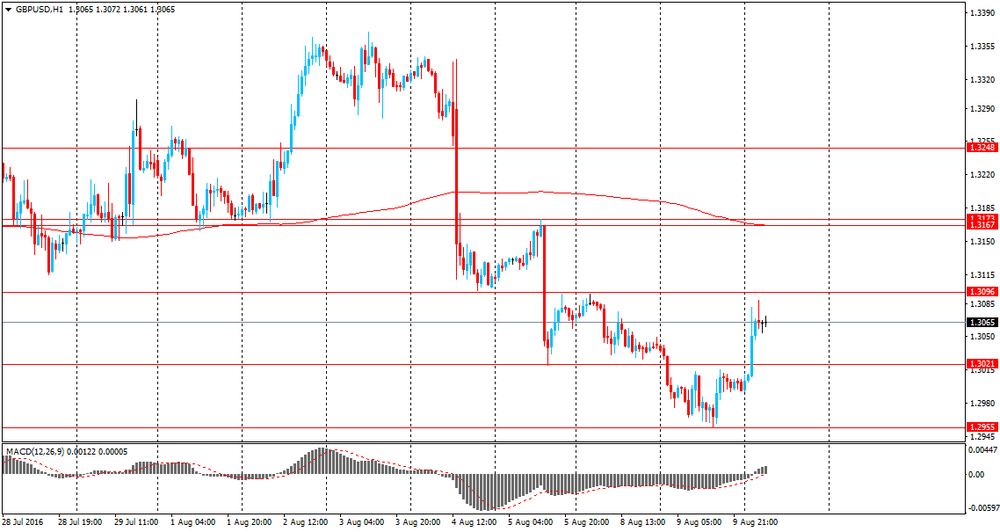

GBP / USD: during the European session, the pair has risen to $ 1.3092

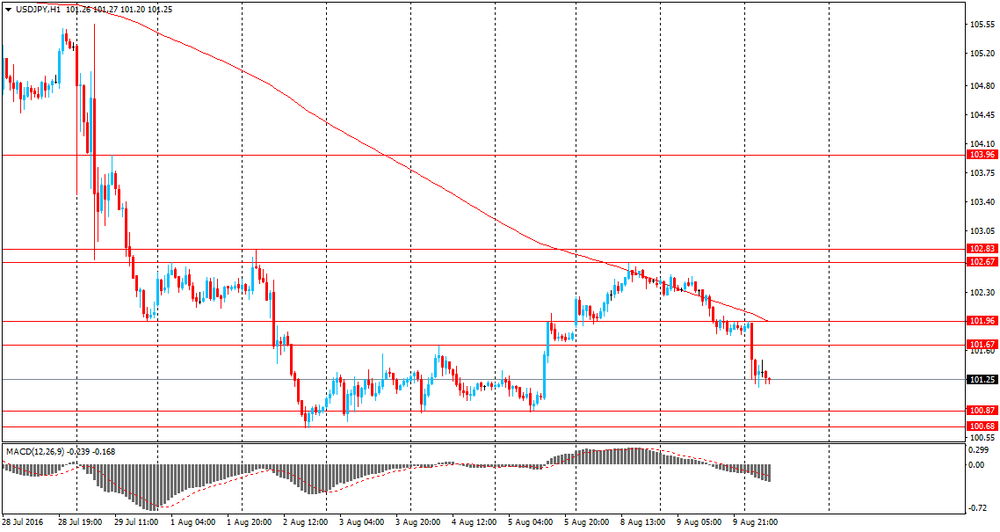

USD / JPY: during the European session, the pair fell to Y101.00

-

14:07

OPEC: Expects higher oil consumption in coming months which will help ease supply overhang

-

2017 OPEC demand forecast at 33.01mbpd vs 32.98mbpd prior

-

2017 world oil demand growth forecast unchanged at 1.17mbpd

-

Expects 2017 non-OPEC supply to fall by 150kbpd vs 110k prior

-

Expects higher oil consumption in coming months which will help ease supply overhang and will contribute to expected rebalancing of market

-

Report implies that global oil market will see 100kbpd average surplus in 201, compared to small deficit in prior report

-

Secondary sources says OPEC output rose to 33.11mbpd

-

Saudi's say they raised output to record 10.67mbpd in July

*via forexlive -

-

13:47

Orders

EUR/USD

Offers 1.1160 1.1180 1.1200 1.1230 1.1250 1.1280 1.1300

Bids 1.1130 1.1115 1.1100 1.1070 1.1050-55 1.1020-25 1.1000-05

GBP/USD

Offers 1.3065 1.3080 1.3195-05 1.3130 1.3150 1.3185 1.3200

Bids 1.3020 1.3000 1.2985 1.2965 1.2950 1.2930 1.2900

EUR/GBP

Offers 0.8565 0.8580 0.8600 0.8630 0.8650

Bids 0.8535 0.8520 0.8500 0.8475-80 0.8450

EUR/JPY

Offers 113.35 113.50 113.85 114.00 114.50 114.80 115.00

Bids 113.00 112.80 112.50 112.00-10 111.50 111.00

USD/JPY

Offers 101.60 101.80 102.00 102.25-30 102.60 102.80-85 103.00

Bids 101.15-20 101.00 100.70-75 100.50 100.25 100.00

AUD/USD

Offers 0.7720 0.7750 0.7765 0.7785 0.7800 0.7835 0.7850 0.7900

Bids 0.7680 0.76650 0.7650 0.7620 0.7600 0.7585 0.7565 0.7570 0.7550

-

13:10

WSE: Mid session comment

Today's trading on the Warsaw market may be described in one word: stabilization. With the neutral behavior of Euroland, and thus maintaining yesterday's achievements, drifting at current levels is the optimal solution for the market. The only thing that may worry is a low turnover. Low turnover on the decline is a good news for the market, but low volume has its other side in the form of low reliability from the technical point of view.

In the middle of today's session the WIG20 index was at the level of 1,843 points (-0.19%) and with the turnover of PLN 185 million.

-

12:47

Major stock indices in Europe moderately lower

European stocks traded in the red zone, but remain near the seven-week high. The pressure on the indices was put by a decrease in shares of utility companies and energy producers, as well as the negative dynamics of oil market.

Oil dropped by about the percentage in response to data on the petroleum products from the American Petroleum Institute (API). Recall, this week crude oil inventories rose by 2.09 million barrels of crude oil.

Investors' attention is also focused on corporate reporting. In Europe, 59% of companies from the Stoxx Europe 600 Index recorded a better-than-expected profit. However, the average earnings per share fell by 9% (7% excluding oil and gas company). 51% of European companies have exceeded forecasts of revenue, which on average has decreased by 3% (and not changed, excluding utilities).

Euro Stoxx 600 fell 0.2 percent. The volume ois about a third lower than the average for the last 30 days.

Shares of Prudential Plc - a British insurance company - rose by 1.5 percent after reports that first-half profit exceeded analysts' expectations.

Quotes of Belgian Ageas SA climbed 3.9 percent as profits were more than forecast.

G4S Plc rose 15 percent after the statements on increasing revenues and maintaining its dividend.

EON SE shares fell 5.7 per cent against the background of a net loss in the 1st half of the year. The loss has been associated with the depreciation of the assets associated with the production and storage of gas.

Capitalization of Novozymes A / S fell 8.5 percent as the profit was below estimates. In addition, the company worsened its forecast for sales.

Shares of Entertainment One Ltd. rose 5.2 percent after the company rejected a takeover bid.

At the moment:

FTSE 100 6837.02 -14.28 -0.21%

DAX -49.70 10643.20 -0.46%

CAC 40 4453.66 -14.41 -0.32%

-

11:47

-

11:38

Bank of America Merrill Lynch selling EUR / AUD

Bank of America Merrill Lynch announced its willingness to sell the pair EUR / AUD. Bank's analysts expect the break of the 200-week moving averagage at 1.4436. After that, the investment bank expect a decline to $ 1.4087, $ 1.3740 and $ 1.35. They sold at $ 1.4470 with the target at $ 1.3740 and a protective stop at $ 1.4802.

Comments from Bank of America Merrill Lynch via Dow Jones Newswires.

-

11:20

Bank of England Brexit update: survey of companies indicated the result of the EU referendum would have a negative effect overall

This Update generally covers intelligence gathered from business contacts between late June 2016 and late July 2016.

• A survey of companies indicated the result of the EU referendum would have a negative effect, overall, on capital spending, hiring and turnover over the coming year (previously published in the August Inflation Report). Consistent with those results, Agents' scores for employment and investment intentions had weakened in absolute terms, pointing to expectations of little change in staff numbers and capital spending over the coming six to twelve months.

• Business services growth had softened further, partly reflecting weakness in commercial property investment and corporate transactions. Consumer spending growth had also slowed, although that appeared to have partly reflected the effects of unusually wet weather. A decline in manufacturing export volumes had been arrested, aided by the depreciation of sterling.

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1085 (EUR 223m) 1.1100 (306m) 1.1200 (648m)

USD/JPY 100.25 (USD 700m) 100.75 (230m) 101.00 (250m) 101.85 (447m) 102.70 (275m)

GBP/USD 1.2800 (GBP 260m) 1.3000 (170m)

USD/CHF 0.9960 (USD 555m)

AUD/USD 0.7450 (AUD 895m) 0.7480 (255m) 0.7530 (466m) 0.7550 (595m) 0.7600 (541m) 0.7650 (494m)

USD/CAD 1.3065-75 (USD 550m) 1.3175 (216m)

-

09:58

Oil trading lower

This morning, New York crude oil futures for WTI fell by -0.96% to $ 42.34 and Brent oil futures were down -0.80% to $ 44.53 per barrel. Thus, the black gold is traded lower on the background of data from the Energy Information Administration (EIA). EIA lowered its forecast for the average oil price in 2016 to 41.6 dollars per barrel, as well as increased forecast for production of hydrocarbons in 2017 to 8.31 million barrels per day. Also, according to experts, a continuing excess of oil and oil products putting preasure on prices, while the alleged meeting of manufacturers is unlikely to announce a significantly supply reduction.

-

09:39

Today’s events:

At 09:30 GMT Germany will hold an auction of 10-year bonds

At 17:01 GMT the United States will hold an auction of 10-year bonds

At 18:00 GMT the US monthly budget report

At 21:00 GMT RBNZ decision on the basic interest rate and RBNZ Monetary Policy

At 22:00 GMT the RBNZ Press Conference

-

09:37

Major stock exchanges began trading mixed: the FTSE 100 6,827.21 + 18.08 + 0.27%, DAX 10,681.29-11.61-0.11%

-

09:20

WSE: After opening

WIG20 index opened at 1845.78 points (-0.07%)*

WIG 48218.19 -0.09%

WIG30 2096.77 -0.11%

mWIG40 3789.70 0.10%

*/ - change to previous close

Today's session on the Warsaw market started with small declines. With the same situation we are dealing on European markets. London, Paris and Frankfurt record solidarity revocation, of which a relatively smallest decline recorded German DAX. The WIG20 index fit in with the surroundings and decrease of largest companies by 0.3 percent undergo pressure from core markets. Withdrawal is so small that it is difficult to talk about the attack of supply. Trading on the WIG20 component is not large and after the first quarter is less than PLN 10 mln.

-

09:06

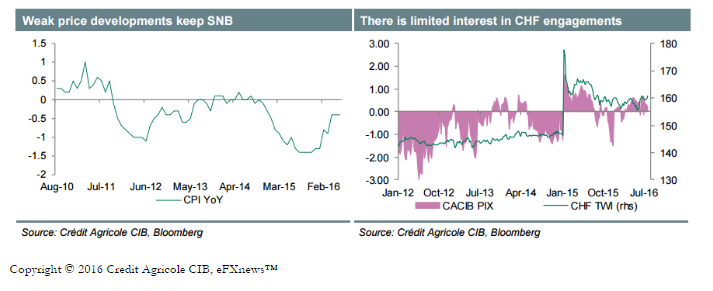

CHF: A Sell Vs USD, GBP; We Stay Short - Credit Agricole

"The franc has been relatively well supported for most of the last few weeks, party on the back of the view that the SNB's aggressive stance with respect to currency intervention drove the central bank's balance sheet closer to unsustainable levels.

However, with inflation remaining extraordinarily low and as the overvalued currency remains the key factor in keeping monetary conditions too tight there seems little scope of price developments stabilising more considerably anytime soon.

Looking ahead we expect the franc to remain a sell on rallies, in particular against the USD and the GBP. We remain long GBP/CHF".

-

08:58

French industrial production down 0.8% in June

Over the second quarter of 2016, output decreased slightly in the manufacturing industry (-0.2% q-o-q). It was virtually stable in the overall industry (-0.1% q-o-q).

Output decreased sharply in the manufacture of food products and beverages (-2.3%), and tumbled in the manufacture of coke and refined petroleum products (-11.7%). It was stable in "other manufacturing". Conversely, output rose in the manufacture of transport equipment (+1.7%) and to a lesser extent in the manufacture of machinery and equipment goods (+0.5%) and in mining and quarrying; energy; water supply (+0.3%).

Over a year, manufacturing output soared in the manufacture of transport equipment (+7.6%) and rose more moderately in "other manufacturing" (+0.5%) and in mining and quarrying; energy; water supply (+0.9%). On the contrary, it shrank markedly in the manufacture of food products and beverages (-3.0%) and in the manufacture of machinery and equipment goods (-2.4%), and plummeted in the manufacture of coke and refined petroleum products (-13.2%).

-

08:49

Asian session review: US dollar continues to decline

During the Asian session, the US dollar continued to decline against other major currencies, as yesterday's preliminary data showed that labor productivity in the United States continued to decline this spring to record third quarterly drop in a row, which could jeopardize the acceleration of wage growth and the economy as a whole in the coming years. This was stated by the Ministry of Labour.

The data showed that the level of labor productivity in the agricultural sector - the gauge of production of goods and services for one hour- decreased in the 2nd quarter by 0.5% compared to the first quarter. The reason for this change has been a more rapid growth in hours worked than in output. Recall that in the first quarter productivity fell by 0.6%.

Also today positive data on orders for engineering products, and the index of activity in the Japanese service.

Orders for Japanese machine building products increased by 8.3% in June, higher than economists' forecast of 3.1%. In May the decline was -1.4%.

The index of activity in the service sector, published by the Ministry of Economy, Trade and Industry of Japan, increased by 0.8%, higher than analysts' expectations of +0.3% in June. The index of activity in the services sector reflects the state of Japan's domestic service sector, including information and communications, electricity, gas heating and water supply, services, transport, wholesale and retail trade, finance and insurance, and social security. Typically, a high value of the index is a positive factor for the Japanese currency.

The Australian dollar rose against the weakening of the US currency, as well as positive data on the index of consumer confidence. The consumer confidence index in Australia published by the Faculty of Economics and Commerce at the University of Melbourne, grew by 2% in August, after a decline of 3% in July. This indicator reflects the level of public confidence in the economy by means of ratings respondents into categories such as personal financial situation in the past year and the outlook for next year, expectations about the economic situation in the 1 and 5 year term, as well as the current consumer climate in terms of households readiness to commit large purchases. In general, high levels are considered to be a positive factor for the Australian currency. Westpac survey was conducted during the first four days of August.

Also Today the head of the RBA Glenn Stevens said the central bank's inflation target is flexible, and inflation may remain below target for some time.

Stevens also said that the leadership of the central bank, whose task is to balance the risks in the economy, discussed the risks associated with the preservation of very low interest rates.

"Given the low interest rates around the world, it would be strange to think that Australia will not follow the example of other central banks," - said Stevens and added - "You can not rely solely on interest rates in an effort to accelerate economic growth"

Also the head of the RBA stated the need to increase the efforts to accelerate the growth of the country's GDP.

Earlier, the number of mortgage loans in Australia increased by 1.2% in June, below economists' forecast of 2.3%. The value from May was revised from -1% to -0.8%

Report on mortgages, published by the Australian Bureau of Statistics shows the number of approved housing loans. It also traces the development trend in the housing market in Australia, and the level of consumer confidence, as large loans to purchase real estate are not taken into account. The high value of the index is a positive factor for the Australian currency.

Also, the Australian Bureau of Statistics reported that the volume of approved home loans linked to investments, increased by 3.2% compared to May, when the growth was recorded at 3.9%.

The Australian Bureau of Statistics report shows that the growth of investment loans remained stable at the level of 0.3-0.4% per month, so a bit limited, but not slowing further.

Today's data suggest that financing flows in the housing market continues.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1110-45 range

GBP / USD: during the Asian session, the pair is trading in the $ 1.2990-1.3050 range

USD / JPY: during the Asian session, the pair was trading in the Y101.10-101.40 range

-

08:46

France: Industrial Production, m/m, June -0.8% (forecast 0.2%)

-

08:37

Mortgage loans in Australia below expectations in June

The number of mortgage loans in Australia increased by 1.2% in June, below economists' forecast of 2.3%. The value from May was revised from -1% to -0.8%

Report on mortgages, published by the Australian Bureau of Statistics shows the number of approved housing loans. It also traces the development trend in the housing market in Australia, and the level of consumer confidence, as large loans to purchase real estate are not taken into account. The high value of the index is a positive factor for the Australian currency.

Also, the Australian Bureau of Statistics reported that the volume of approved home loans linked to investments, increased by 3.2% compared to May, when the growth was recorded at 3.9%.

The Australian Bureau of Statistics report shows that the growth of investment loans remained stable at the level of 0.3-0.4% per month, so a bit limited, but not slowing further.

Today's data suggest that financing flows in the housing market continues.

-

08:31

The consumer confidence index from Australia rose in August

The consumer confidence index in Australia published by the Faculty of Economics and Commerce at the University of Melbourne, grew by 2% in August, after a decline of 3% in July. This indicator reflects the level of public confidence in the economy by means of ratings respondents into categories such as personal financial situation in the past year and the outlook for next year, expectations about the economic situation in the 1 and 5 year term, as well as the current consumer climate in terms of households readiness to commit large purchases. In general, high levels are considered to be a positive factor for the Australian currency.

Westpac survey was conducted during the first four days of August.

-

08:31

Options levels on wednesday, August 10, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1292 (4739)

$1.1259 (4342)

$1.1206 (1867)

Price at time of writing this review: $1.1147

Support levels (open interest**, contracts):

$1.1046 (3202)

$1.0989 (4504)

$1.0955 (4931)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 46399 contracts, with the maximum number of contracts with strike price $1,1250 (4739);

- Overall open interest on the PUT options with the expiration date September, 9 is 53550 contracts, with the maximum number of contracts with strike price $1,1100 (4931);

- The ratio of PUT/CALL was 1.15 versus 1.17 from the previous trading day according to data from August, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (2353)

$1.3206 (1918)

$1.3109 (1031)

Price at time of writing this review: $1.3051

Support levels (open interest**, contracts):

$1.2987 (2029)

$1.2891 (1781)

$1.2794 (2122)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 29276 contracts, with the maximum number of contracts with strike price $1,3300 (2353);

- Overall open interest on the PUT options with the expiration date September, 9 is 24107 contracts, with the maximum number of contracts with strike price $1,2800 (2122);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from August, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Reserve Bank of Australia Governor Glenn Stevens: Inflation targeting is flexible

Today the head of the RBA Glenn Stevens said the central bank's inflation target is flexible, and inflation may remain below target for some time.

Stevens also said that the leadership of the central bank, whose task is to balance the risks in the economy, discussed the risks associated with the preservation of very low interest rates.

"Given the low interest rates around the world, it would be strange to think that Australia will not follow the example of other central banks," - said Stevens and added - "You can not rely solely on interest rates in an effort to accelerate economic growth"

Also the head of the RBA stated the need to increase the efforts to accelerate the growth of the country's GDP.

-

08:21

New Zealand's house sales declined notably in July

New Zealand's house sales declined notably in July from a year ago, while median house prices climbed further, the Real Estate Institute of New Zealand said Wednesday.

The total volume of home sales plunged 10.1 percent year-over-year in July, reversing a 6.0 percent climb in the previous month.

On a seasonally adjusted basis, the number of sales dropped 3.6 percent monthly in July.

At the same time, house prices grew 8.6 percent annually in July and rose 2.0 percent from the preceding month. The median price in Auckland alone surged 12.0 percent in July from a year ago - RTTnews.

-

08:21

WSE: Before opening

Tuesday's session on Wall Street ended with a modest changes in the major indexes. The S&P500 finished the day rising by 0.04 percent and Wall Street has had another day of consolidation at levels reached at the last Friday session.

It should be noted quite a difference between the flat end in the US and a strong rise in the German DAX, which rose yesterday by 2.5 percent, mainly on a wave of good quarterly results of companies. Parting of markets on this scale may end up with back of the DAX to the line.

Today's macro calendar day plan contains no reports worthy of attention.

The Warsaw market is influenced by two variables - good posture of emerging markets basket and rebound of bear market in shares of banks. There is also important, of course, behavior of developed markets, which glide on annual maximums. If all these variables will be further arranged in the positive growth factors, the WIG20 index will have a chance to cover "after-brexit" gap on the chart and go over 1,850 points.

-

08:20

Expected negative start of trading on the major stock exchanges in Europe: DAX-0.2%, CAC40 -0.1%, FTSE -0.1%

-

07:25

Global Stocks

European stocks rose Tuesday, with the benchmark index rallying to a post-Brexit high and German's DAX 30 entering bull-market territory, after a round of upbeat earnings lifted sentiment.

The Stoxx Europe 600 SXXP, +0.92% picked up 0.9% to end at 344.67, its highest close since June 23. A gain on Tuesday marked the gauge's fifth in a row, the longest string of gains since early July.

The Nasdaq Composite narrowly logged its second record close of 2016 on Tuesday, as losses in oil prices and weak productivity data all but erased gains for the broad benchmarks.

The S&P 500 index SPX, +0.04% SPX, +0.04% ended up less than a point at 2,181.74, after setting a record high of 2,187.69 earlier in the day. Gains in health-care and consumer-staples stocks were offset by losses in energy and materials sectors, weighed down by the drop in oil prices.

The Dow Jones Industrial Average DJIA, +0.02% closed up 3.76 points.

The Nasdaq Composite Index COMP, +0.24% gained 12.34 points, or 0.2%, to 5,225.48-an all-time closing high.

Asian shares hit a one-year high on Wednesday while the dollar and Treasury yields slid on weak U.S. productivity data and sterling recovered from a one-month low.

MSCI's broadest index of Asia-Pacific shares excluding Japan .MIAPJ0000PUS rose 0.35 percent to the highest level since August 2015. Japan's Nikkei .N225 fell 0.3 percent, pulled down by a stronger yen.

Hong Kong's Hang Seng index .HSI rose 0.6 percent, hovering close to its highest level since November. China's CSI 300 index .CSI300 and the Shanghai Composite .SSEC were little changed.

-

03:30

Australia: Home Loans , June 1.2% (forecast 2.4%)

-

02:32

Australia: Westpac Consumer Confidence, August 2%

-

01:50

Japan: Core Machinery Orders, y/y, June -0.9% (forecast -4.2%)

-

01:50

Japan: Core Machinery Orders, June 8.3% (forecast 3.1%)

-

00:36

Commodities. Daily history for Aug 09’2016:

(raw materials / closing price /% change)

Oil 42.75-0.05%

Gold 1,346.60-0.01%

-

00:35

Stocks. Daily history for Aug 09’2016:

(index / closing price / change items /% change)

Nikkei 225 16,764.97 +114.40 +0.69%

Shanghai Composite 3,025.91 +21.63 +0.72%

S&P/ASX 200 5,552.55 +14.71 +0.27%

FTSE 100 6,851.3 +42.17 +0.62%

CAC 40 4,468.07 +52.61 +1.19%

Xetra DAX 10,692.9 +260.54 +2.50%

S&P 500 2,181.74 +0.85 +0.04%

Dow Jones Industrial Average 18,533.05 +3.76 +0.02%

S&P/TSX Composite 14,801.23 +45.61 +0.31%

-

00:33

Currencies. Daily history for Aug 09’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1114 +0,26%

GBP/USD $1,2993 -0,37%

USD/CHF Chf0,9814 -0,12%

USD/JPY Y101,85 -0,54%

EUR/JPY Y113,19 -0,30%

GBP/JPY Y132,33 -0,93%

AUD/USD $0,7665 +0,14%

NZD/USD $0,7163 +0,20%

USD/CAD C$1,3119 -0,33%

-