Noticias del mercado

-

21:00

DJIA 18521.51 -7.78 -0.04%, NASDAQ 5224.51 11.37 0.22%, S&P 500 2180.38 -0.51 -0.02%

-

18:00

European stocks closed: FTSE 6851.30 42.17 0.62%, DAX 10692.90 260.54 2.50%, CAC 4468.07 52.61 1.19%

-

17:38

WSE: Session Results

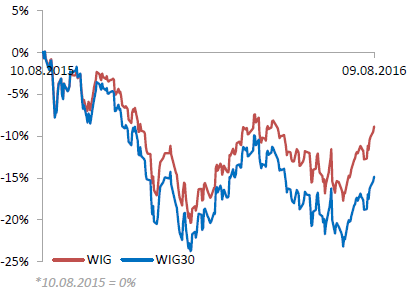

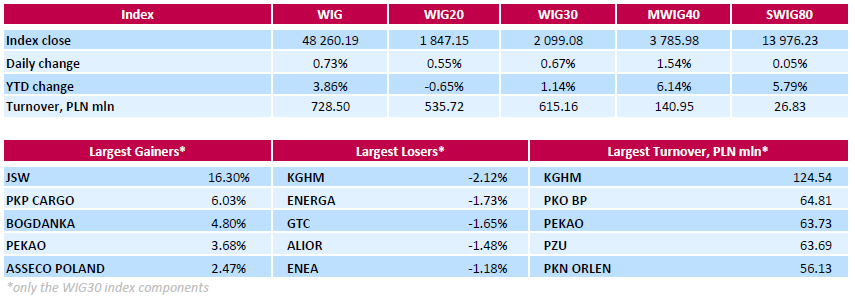

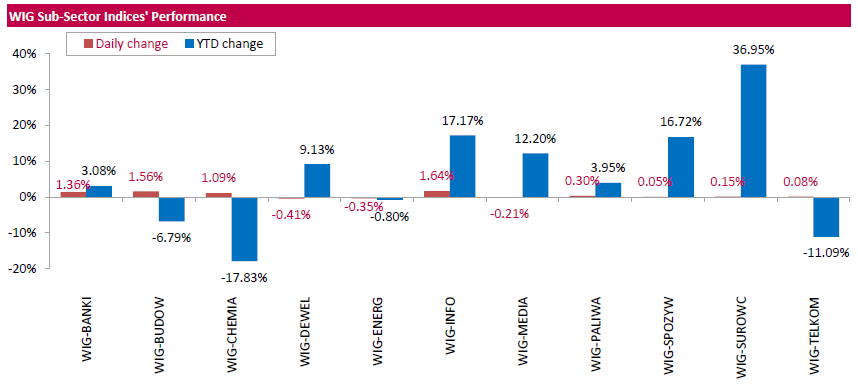

Polish equity market closed higher on Tuesday. The broad market measure, the WIG index, added 0.73%. Sector-wise, information technology stocks (+1.64%) fared the best, while developing sector names (-0.41%) fell the most.

The large-cap benchmark, the WIG30 Index, surged by 0.67%. Within the index components, coking coal miner JSW (WSE: JSW) led the gainers, skyrocketing by 16.3%, supported by the announcement the company agreed to transfer its Krupiński coal mine to the state-funded restructuring company by the end of January 2017. The transfer is within the frames of JSW's ongoing corporate restructuring and is expected to allow the company to reduce capex and labor costs. Other major advancers were railway freight transport operator PKP CARGO (WSE: PKP), thermal coal miner BOGDANKA (WSE: LWB) and bank PEKAO (WSE: PEO), climbing 6.03%, 4.8% and 3.68% respectively. On the other side of the ledger, copper producer KGHM (WSE: KGH), genco ENERGA (WSE: ENG) and property developer GTC (WSE: GTC) topped the list of the underperformers, dropping by 2.12%, 1.73% and 1.65% respectively.

-

17:18

Wall Street. Major U.S. stock-indexes slightly rose

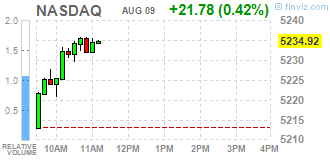

Major U.S. stock-indexes traded near record highs on Tuesday morning as a rise in technology stocks added to the lift from steadying oil prices. Oil edged further above $45 on estimates of a drop in U.S. inventories and speculation of producer action to freeze output.

Most of Dow stocks in positive area (19 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +0.82%). Top loser - American Express Company (AXP, -0.29%).

All S&P sectors, but for Industrial Goods (-0.11%), in positive area. Top gainer - Conglomerates(+0.73%).

At the moment:

Dow 18512.00 +52.00 +0.28%

S&P 500 2182.00 +6.50 +0.30%

Nasdaq 100 4803.00 +23.75 +0.50%

Oil 43.04 +0.02 +0.05%

Gold 1347.40 +6.10 +0.45%

U.S. 10yr 1.56 -0.02

-

15:50

WSE: After start on Wall Street

The beginning of trading on Wall Street is slightly upward, although the last days we may see a weaker performance of Wall Street compare to shining triumphs of emerging markets or even the German DAX. After a quiet yesterday's session, today's trade promises to have a similar style, which fits in neutral opening and cosmetic increases of contracts. For the bulls it is important that goof mood is still maintained.

On the Warsaw market afternoon trading phase is quite successful, which, like yesterday, may be associated with the activity of foreign funds managed from the United States.

-

15:31

U.S. Stocks open: Dow +0.06%, Nasdaq +0.04%, S&P +0.03%

-

15:19

Before the bell: S&P futures +0.08%, NASDAQ futures +0.14%

U.S. stock-index futures were little changed as investors assessed recent gains.

Global Stocks:

Nikkei 16,764.97 +114.40 +0.69%

Hang Seng 22,465.61 -29.15 -0.13%

Shanghai 3,025.91 +21.63 +0.72%

FTSE 6,833.69 +24.56 +0.36%

CAC 4,439.17 +23.71 +0.54%

DAX 10,526.11 +93.75 +0.90%

Crude $42.95 (-0.16%)

Gold $1,338.50 (-0.21%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.45

-0.00(-0.00%)

2130

ALTRIA GROUP INC.

MO

66.6

0.11(0.1654%)

416

Amazon.com Inc., NASDAQ

AMZN

767

0.44(0.0574%)

16267

Apple Inc.

AAPL

108.11

-0.26(-0.2399%)

143998

Barrick Gold Corporation, NYSE

ABX

21.51

0.09(0.4202%)

79576

Boeing Co

BA

133

0.81(0.6128%)

772

Chevron Corp

CVX

101.5

0.30(0.2964%)

6085

Cisco Systems Inc

CSCO

31.1

0.09(0.2902%)

1421

Citigroup Inc., NYSE

C

45.99

0.03(0.0653%)

3153

Exxon Mobil Corp

XOM

88.69

0.10(0.1129%)

5146

Facebook, Inc.

FB

125.39

0.13(0.1038%)

30198

Ford Motor Co.

F

12.22

0.04(0.3284%)

44514

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.2

-0.09(-0.7323%)

47730

General Electric Co

GE

31.25

-0.02(-0.064%)

4300

General Motors Company, NYSE

GM

31.06

0.18(0.5829%)

2800

Google Inc.

GOOG

781.02

-0.74(-0.0947%)

259

Intel Corp

INTC

35.04

0.00(0.00%)

4934

International Business Machines Co...

IBM

162.14

0.10(0.0617%)

549

Merck & Co Inc

MRK

62.61

-0.25(-0.3977%)

4650

Microsoft Corp

MSFT

58.12

0.06(0.1033%)

484

Nike

NKE

56

0.02(0.0357%)

880

Pfizer Inc

PFE

34.95

0.02(0.0573%)

1878

Tesla Motors, Inc., NASDAQ

TSLA

226.69

0.53(0.2343%)

7426

Twitter, Inc., NYSE

TWTR

18.19

-0.01(-0.0549%)

17113

Verizon Communications Inc

VZ

53.7

0.11(0.2053%)

460

Wal-Mart Stores Inc

WMT

73.45

0.11(0.15%)

1118

Walt Disney Co

DIS

96.03

0.28(0.2924%)

2344

Yahoo! Inc., NASDAQ

YHOO

39.47

0.23(0.5861%)

178081

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Overweight from Neutral at Piper Jaffray; target raised to $117

Downgrades:

Other:

Volkswagen AG (VOW3) initiated with an Underperform at Jefferies

General Motors (GM) initiated with a Hold at Jefferies; target $33

General Motors (GM) initiated with Buy ratings at Seaport Global Securities

Ford Motor (F) initiated with a Underperform at Jefferies; target $10

Barrick Gold (ABX) initiated with an Equal Weight at Morgan Stanley

-

13:07

WSE: Mid session comment

Today's session, as yesterday, runs very quietly and is devoid of significant new impulses to trade. In Europe, a slightly falling prices of commodity companies, other industries are on small pros. Further good behave banking sector. The German market is located at the previous highs, and in close proximity to a maximum of April. Exceeding these resistances will be a medium-term buy signal, which should improve the climate for a long time in Europe, which recently lost a little in the eyes of global investors.

On the Warsaw market rather unexpected drop in the morning in the southern phase of trade has been neutralized and the WIG20 index has returned to the levels of today's opening. Activity remains small, and quotes differ a little from the area of yesterday's many hours of consolidation. At the halfway point of the session the WIG20 index was at 1,836 points (-0,04%) and with turnover of approx. PLN 235 million.

-

12:42

Major stock indices in Europe show moderate gains

European stocks traded with a moderate increase, helped by positive corporate reporting of a number of companies and recovery of oil prices.

Certain influence on the dynamics of trade had statistics on Britain. The Office for National Statistics said that industrial output rose by 0.1 percent compared to May, confirming the forecasts of economists. At the end of May the production declined by 0.6 percent (revised from -0.5 percent). Output in the manufacturing sector decreased by 0.3 percent, which was slower than the fall of 0.6 percent in May. Experts predicted a decrease of 0.2 percent. Annual industrial production growth accelerated to 1.6 percent, in line with expectations, compared with 1.4 per cent. Manufacturing output increased by 0.9% y/y, after rising 1.5 percent in May. Analysts had expected an increase of 1.3 percent. For the three-month period to June, the volume of industrial production increased by 2.1 percent. This was the highest growth since the third quarter of 1999.

A separate report showed that the deficit in trade in goods widened in June to 12,4 billion in May (revised from 9,880 billion). Last change reflects an increase in exports by 1.0 billion pounds to 24.6 billion., as well as increased imports of 1.8 billion pounds to 37.0 billion. The surplus on trade in services remained unchanged at 7.3 billion pounds. As a result, the overall trade deficit amounted to 5.1 billion.

In focus were also statements by the Bank of England and member of the Monetary Policy Committee Ian McCafferty, who pointed to the possibility of expanding monetary stimulus measures if the state of the British economy deteriorates. Recall, last week the Bank of England lowered the benchmark interest rate to a record low level and increased the volume of bond purchases to soften the negative impact of Brexit. In general, the last stimulus program indicates a strong concern for the Bank of England officials about the economic outlook.

The composite index of Europe's largest companies Stoxx 600 added 0.2 percent. Over the last four sessions the index rose by 1.8 percent. The trading volume today is 39 percent lower than the monthly average.

Altice cost rose 12 percent amid reports of increasing profits. The company said that the increase was due to the good performance in Portugal and the USA.

Voestalpine AG Shares fell 3.2 percent, putting pressure on the shares of mining companies. Today, the company reported a 64 percent decline in profits.

Quotes of Amec Foster Wheeler Plc surged 13 percent as revenue and profit of the company exceeded the forecasts of experts.

Share of SFR Group SA rose 12 percent after Altice said it plans to cut 5,000 jobs in the French company.

Cost of Legal & General Group Plc fell 6.5 percent, as the profit margin was lower than analysts' estimates.

At the moment:

FTSE 100 +22.27 6831.40 + 0.33%

DAX +51.54 10483.90 + 0.49%

CAC 40 +21.14 4436.60 + 0.48%

-

09:27

Positive start for major stock exchanges: FTSE 100 6,811.22 + 17.75 + 0.26%, DAX 10,438.97 + 6.61 + 0.06%

-

09:15

WSE: After opening

WIG20 index opened at 1836.65 points (-0.02%)*

WIG 47919.88 0.02%

WIG30 2085.05 0.00%

mWIG40 3729.62 0.03%

*/- change to previous close

The cash market opened up with a modest fall of 0.02% to 1,836 points, what is the answer to the lack of major changes in global markets after the end of yesterday's session on the Warsaw Stock Exchange.

Prices of PKO BP (WSE: PKO) shares go down and the negative reaction we see in the case of values of Getin Noble Bank (WSE: GNB) which incidentally collect the second turnover on the market. The German DAX remains stable, and the local market is doing quite well with a worse behavior of KGHM and PKO BP.

-

08:26

WSE: Before opening

Yesterday's session on Wall Street ended with little drop, which was accompanied by one of the lowest this year turnover. In Asia, the inflation data from China was in line with expectations, which, like yesterday's information about the trade, went unnoticed.

The Asian stock markets quotations are calm, both the Nikkei index and the Shanghai market are in little gain. Contracts in the US are flat and show that since yesterday afternoon nothing special in the world had happened.

During today's session, the Central Statistic Office will give data regarding the average salary level in the second quarter in Poland. In addition, the markets attention should focus on indications from the UK (industrial production) and the US (data regarding the labor market), but it is hard to talk about the key macro readings.

The relevant information may be the fact that the PFSA wants to considered Getin Noble Bank (WSE: GNB) as an institution of systemic importance and impose additional buffer. It will be smaller than in the case of PKO BP (proposed 0.25% of the total exposure to the risks) but we know what's going on - on foreign currency loans and have to reckon with further messages regarding the banks involved in these products, what today may slightly reduce appetite for those shares.

-

07:09

Global Stocks

European stocks finished a bit higher Monday, with gains for bank shares helping the regional benchmark eke out a nearly two-week high.

The Stoxx Europe 600 SXXP, +0.04% closed up less than 0.1% at 341.53. The pan-European index marked its best close since July 27, FactSet data showed.

The Stoxx 600 has advanced for four trading days in a row. The benchmark on Friday jumped 1.1%, continuing to gain after the Bank of England ramped up its stimulus efforts.

U.S. stocks closed lower Monday after touching record highs as Wall Street caught its breath in the wake of last week's upbeat jobs data.

The S&P 500 index SPX, -0.09% pulled back from an intraday record of 2,185.44, reached shortly after the opening bell, to close with a loss of 1.98 points, or 0.1%, at 2,180.89. The index was dragged down by a sharp drop in health-care stocks, which outweighed a rise in energy shares that accompanied strong gains for crude-oil futures CLU6, -0.81%

The Dow Jones Industrial Average DJIA, -0.08% closed down 14.24 points, or 0.1%, at 18,529.29. A 1.6% drop in shares of Merck & Co. MRK, -1.57% and a 1.4% decline in Pfizer Inc. PFE, -1.44% shares dragged the blue-chip gauge down. Oil giant Exxon Mobil Corp. XOM, +1.18% was the average's best performer with a 1.2% gain, while Chevron Corp. CVX, +0.69% shares closed up 0.7%.

The Nasdaq Composite Index COMP, -0.15% fell 7.98 points, or 0.2%, to close at 5,213.14, after logging its first closing record in more than a year on Friday, following the employment report. Earlier in the session, the index carved out a new all-time intraday high of 5,228.40.

Asian shares stood atop one-year peaks on Tuesday as investors' desperate search for yield drove a record inflow into emerging market funds, while the pound slipped to one-month lows on speculation of further policy easing in the UK.

Analysts at Bank of America Merrill Lynch noted the search for yield had led to the largest 5-week inflow on record to emerging market debt funds and the longest inflow streak to equity funds in two years.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.1 percent, having already risen for three sessions in a row.

Japan's Nikkei .N225 was also attempting a fourth session of gains with a tentative rise of 0.2 percent, while Shanghai stocks .SSEC were flat.

The major data out in Asia was Chinese inflation for July and it caused few ripples by coming exactly as forecast at 1.8 percent ECONCN. The benign result merely confirmed there was plenty of scope for further policy easing if needed.

The need for stimulus was clear in Chinese trade flows which disappointed in July amid slack demand both at home and abroad.

-

00:29

Stocks. Daily history for Aug 08’2016:

(index / closing price / change items /% change)

Nikkei 225 16,650.57 +396.12 +2.44%

Shanghai Composite 3,004.72 +28.02 +0.94%

S&P/ASX 200 5,537.84 +40.43 +0.74%

FTSE 100 6,809.13 +15.66 +0.23%

CAC 40 4,415.46 +4.91 +0.11%

Xetra DAX 10,432.36 +65.15 +0.63%

S&P 500 2,180.89 -1.98 -0.09%

Dow Jones Industrial Average 18,529.29 -14.24 -0.08%

S&P/TSX Composite 14,755.62 +106.85 +0.73%

-