Noticias del mercado

-

16:25

Conference Board: The index of US employment improves again in July

The report from the Conference Board, showed that US employment trends index, representing a set of labor market indicators continued to improve in the last month.

According to the data, the July employment trends index increased to 128.28 compared to 127.89 in June. In annual terms, the index rose by 1.6 percent.

The index includes eight US labor market indicators. In particular, these indicators include the number of applications for unemployment benefits and the number of new jobs announced, reported by the US Bureau of Labor Statistics, and industrial production figures, calculated by the Federal Reserve. The index is designed to filter out confounding factors and volatility of monthly labor market indicators in order to demonstrate more clearly the trend. In July, five of the eight components of the index recorded an increase.

"Employment trends index still suggests that job growth will slow in the coming months, despite the strong performance on employment in June and July. It is surprising that hiring was so strong, given the current slow economic growth. It is possible that the rate of economic growth were in fact stronger than the anemic GDP increasing by 1.2 percent over the past four quarters, "- said Gad Levanon, economist at Conference Board.

-

16:01

U.S.: Labor Market Conditions Index, July 1

-

15:45

Option expiries for today's 10:00 ET NY cut

GBPUSD 1.3000 (698m), 1.3050 1.31, 1.3150 1.3250 1.3350

EURUSD 1.0900 (696m) 1.1000 (572m), 1.1050 1.1100 (1.26bn), 1.1145/50 (682m) 1.1200, 1.1260/65/70/75 (614m) 1.1300, 1.1350

USDJPY 100.00, 100.50/56, 100.75 101.50 102.00 (1.13bn) 103.00 104.00 105.00

AUDUSD 0.7550, 0.7560 0.7600, 0.7650, 0.7660, 0.7675

NZDUSD 0.6960 0.7220

USDCAD 1.3000 1.3100/05 1.3200 (1.1bn), 1.3245/50

USDCHF 0.9605 0.9745, 0.9755 0.9875 0.9920

-

15:34

Italian banks may be faced with an increase in finance cost

Italian banks face the prospect of higher financing costs after the rating agency DBRS has put the country's credit rating "A" for review citing uncertainty about the referendum, scheduled for the autumn.

"It was decided to revise the rating of Italy, as the political uncertainty surrounding the forthcoming constitutional referendum, and the pressure on Italian banks pose to the rating risks. Concerns also cause weak growth in the third largest European economy and its high level of public debt to GDP.", - noted DBRS.

-

14:35

Canadian building permits index much lower in June

Municipalities issued building permits worth $6.4 billion in June, down 5.5% from the previous month. Lower construction intentions for multi-family dwellings and institutional buildings were mostly responsible for the decline.

In the residential sector, the value of building permits fell 5.0% to $4.1 billion. This was the third consecutive monthly decline. The decrease in the value of multi-family dwelling permits more than offset the gain posted by single-family homes. Five provinces recorded declines, led by British Columbia and Ontario.

The value of non-residential permits was down 6.2% to $2.3 billion in June, led by lower construction intentions for institutional buildings. Decreases were registered in seven provinces. Ontario and the Northwest Territories posted the most notable declines.

The value of permits for multi-family dwellings was down 15.8% to $1.7 billion in June. Declines were recorded in seven provinces, led by Ontario and British Columbia

The value of institutional building permits was down 20.6% to $664 million in June, following notable gains the two previous months. Lower construction intentions for hospitals were largely responsible for the drop. Declines were posted in six provinces. The most notable decreases were registered in Ontario and the Northwest Territories, both of which recorded large increases the previous month. Saskatchewan reported the largest advance for institutional building intentions.

-

14:30

Canada: Building Permits (MoM) , June -5.5%

-

14:27

European session review: US dollar rose slightly against the euro

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Industrial Production (m / m) June -1.3% 0.7% 0.8%

7:15 Switzerland Consumer Price Index m / m in July 0.1% 0.5% -0.4%

7:15 Switzerland Consumer Price Index y / y in July -0.4% -0.3% -0.2%

8:30 Eurozone indicator of investor confidence from Sentix August 1.7 4.2

The euro fell slightly against the dollar, returning to the opening level. In general, the USD is consolidating after Friday's rally, which was caused by the publication of US labor market data. Recent statistics has been very supportive, which convinced investors in the stability of the economy and forced them to reconsider the forecasts regarding the timing of rate hikes. Today futures on interest rates suggest that the market takes into account a 15% probability of a rate hike in September and 43% in December.

The further decline of the euro hampered by returning risk appetite, as well as today's data for Germany and the euro zone. Ministry of Economy of Germany said that the seasonally adjusted industrial production in June increased by 0.8% compared with the previous month. Ministry of Economy of Germany said that the seasonally adjusted industrial production in June increased by 0.8% compared with the previous month. Economists had expected an increase of 0.7%. Manufacturing output increased by 1.5%, whereas in construction it fell by 0,5%. The data also showed that in the 2nd quarter, the industrial sector recorded a decline of 1% compared to the 1st quarter. " Overall, today's data weakened fears of a hard landing of the German economy in the 2nd quarter" said ING economist Carsten Brzeski

A survey presented by Sentix research group, showed that investor sentiment in the euro area improved significantly in August, as markets have examined the initial shock of the UK decision to leave the European Union. According to the data, investors confidence indicator rose in August to 4.2 points compared with 1.7 points in July. Analysts had expected the index to rise only 3.0 points. The sub-index of expectations rose in August to 4.8 points versus -2.0 points in July. However, the sub-index assessing the current conditions in the euro area deteriorated to 3.8 points from 5.5 points, reaching its lowest level since February last year. Investors more positively assess the prospects of Germany - the expectations index rose to 7.0 from 2.7 in July.

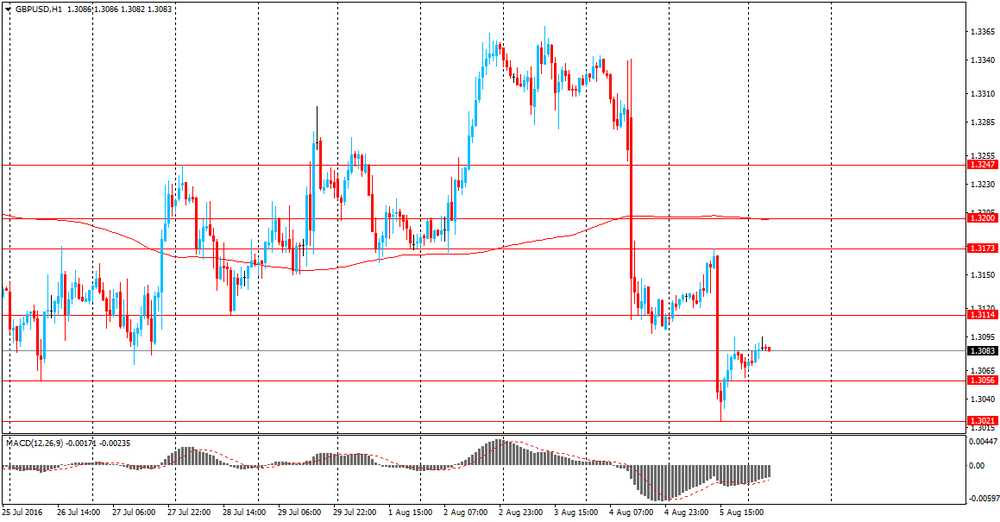

The pound has fallen sharply against the dollar, but then recovered in response to the resumption of risk appetite. However, Friday's data on US labor market and the Bank of England's readiness for aggressive policy easing continues to put pressure on the pound. Recall, last week the Bank of England lowered its rate to a record low and increased the volume of bond purchases to soften the negative impact of Brexit. Central Bank officials also signaled that they could even reduce the rate more. In general, the last stimulus program indicates a strong concern of officials about the economic outlook.

The course of trading was also affected by the expectations of tomorrow's statistics on industrial production in the UK. It is expected that by the end of June, industrial production increased by 0.2% in monthly terms and by 1.6% y/y. Meanwhile, production in the manufacturing sector is likely to contract by 0.2% in the month and increased by 1.3% y/y.

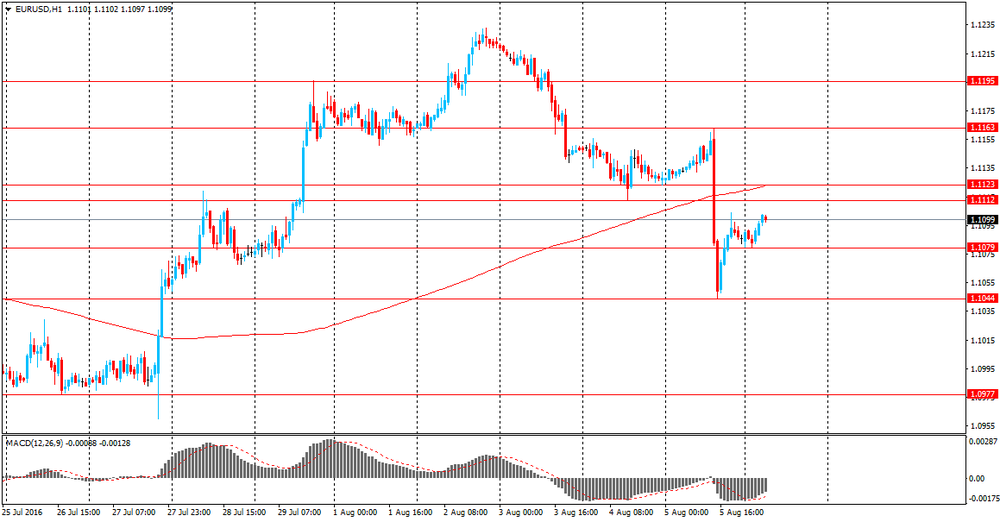

EUR / USD: during the European session, the pair has dropped from $ 1.1104 to $ 1.1079

GBP / USD: during the European session, the pair fell to $ 1.3031, but then partially recovered

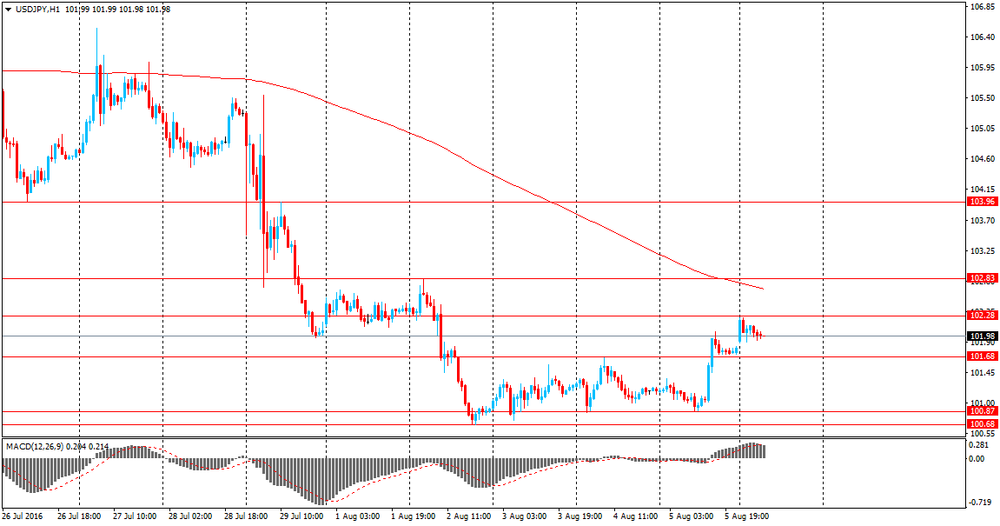

USD / JPY: during the European session, the pair rose to Y102.45

-

14:00

Orders

EUR/USD

Offers 1.1120 1.1130 1.1150 1.1180 1.1200 1.1220 1.1240 1.1250

Bids 1.1080 1.1060 1.1050 1.1035/40 1.1020 1.1000 1.0980

GBP/USD

Offers 1.3080 1.3100 1.3120 1.3145/50 1.3170 1.3180 1.3200

Bids 1.3040 1.3020/25 1.3010 1.3000 1.2980 1.2970 1.2950

EUR/GBP

Offers 0.8500 0.8520 0.8540 0.8550 0.8580 0.8600

Bids 0.8480 0.8460 0.8450 0.8430/35 0.8420 0.8400/10

EUR/JPY

Offers 113.40/50 113.80 114.00 114.50 115.00

Bids 113.20 113.00 112.80 112.50 112.00 111.50 111.00

USD/JPY

Offers 102.20/25 102.35/40 102.50 102.80 103.00 103.15/20 103.40

Bids 101.80 101.60/70 101.50 101.25 101.00/10 100.80 100.50

AUD/USD

Offers 0.7625/30 0.7640 0.7660 0.7680 0.7700 0.7730 0.7750

Bids 0.7600/05 0.7590 0.7575/80 0.7550 0.7530 0.7500 0.7480

-

13:17

French GDP likely to increase by 0.3% in the 3rd quarter

The monthly report published by the Bank of France showed that the economy is likely to grow somewhat more rapidly in the third quarter.

Gross domestic product is expected to increase by 0.3 percent in the third quarter. Recall in the second quarter economic growth of France was flat.

In addition, data showed that the index of business confidence in the manufacturing sector rose slightly in July - up to 98 points against 97 points in June. Business leaders noted that industrial production is likely to remain stable in August. Meanwhile, the index of sentiment in the services sector registered 96 points compared with 97 points a month earlier. Representatives of the services sector said that the forecast indicates moderate growth of activity in August.

Business sentiment indicator for the construction segment remained unchanged in July - at the level of 97 points. Meanwhile, business leaders forecast a very slight fall in activity at the end of August.

-

12:45

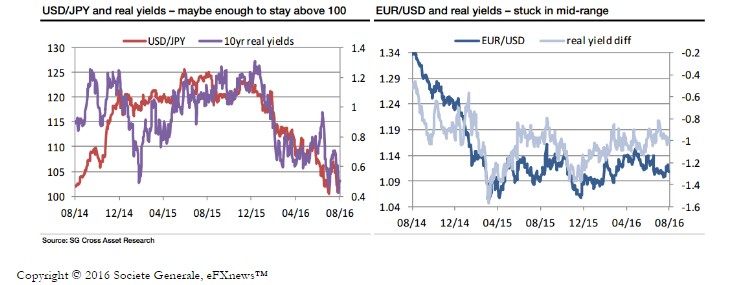

What the bonds say about EUR/USD and USD/JPY - Societe Generale

"The US/Japanese real 10year yield spread moved back out to 50bp after the payroll data, but just eye-balling the yield spread and USD/JPY suggests we'd need a 20bp move up in US real yields to have any chance of seeing USD/JPY 110. My hopes of that happening haven't revived on these figures, and as for the 50bp move in relative yields that would point the way to USD/JPY120... that's going to take better US data and a massive change of heart by the BOJ. Maybe a risk-friendly set of US numbers is enough to keep USD/JPY from breaking 100 for now, but the most we can hope for is that a 100-105 range is enough to give the Nikkei a bid...

The EUR/USD chart isn't any more encouraging. The 10-year real yield differential, at 1.02%, is exactly at the average of 2016, and did I mention that the EUR/USD average this year is 1.1150? ½% below that is probably a fair discount for the Eurozone's proximity to the UK. I'd rather get my duration kick in the Eurozone than the US (or the UK for that matter, though that's not exactly working out at the moment)".

-

12:14

Japanese Prime Minister Abe: supplementary budget will be submitted in autumn

Japanese Prime Minister Shinzo Abe said today that the government will make an additional budget plan and submit it to Parliament in the autumn.

Recall Abe's cabinet approved the program of fiscal measures last week amounting to 13.5 trillion yen to help revive the economy, whose growth has slowed significantly after the increase in the sales tax in 2014. The package includes 7.5 trillion. yen spending by national and local authorities, some of which are expected to be financed by the supplementary budget for the current fiscal year. Nevertheless, the impact of the approved package is likely to be quite moderate. According to some economists, such measures will increase GDP growth by only 0.1-0.2 percentage points.

-

10:33

Chinese glimmers of hope according to Sentix

-

The outcome of the Brexit referendum in the UK has no further impact on the sentix Economic expectations. The headline index for the euro zone rebounds to +4.2 points.

-

The Chinese economy gains momentum and leads global recovery. Current situation and expectation values both increase.

-

The remaining world regions post improvements in the current situation values as well. The US economy remains pleasantly robust as the current situation value strengthens. The economy in Latin America and Eastern Europe continue to stabilise.

Economic expectations are no longer negatively affected by the Brexit fallout. The sentix Economic Index improves moderately to +4.2 points. Positive growth impulses of the Chinese economy are accountable for the latest upswing, however. The European economy merely contributes to the confidence built up. The index for Asia ex. Japan jumps from +8.2 to +14.1 points. The latest round of yuan depreciation against the US Dollar and the Japanese Yen seems to act as a stimulant.

-

-

10:02

Option expiries for today's 10:00 ET NY cut

GBP/USD 1.3000 (698m), 1.3050,1.31, 1.3150,1.3250,1.3350

EUR/USD 1.0900 (696m),1.1000 (572m), 1.1050,1.1100 (1.26bn),1.1145/50 (682m),1.1200, 1.1260/65/70/75 (614m),1.1300,1.1350

USD/JPY 100.00, 100.50/56, 100.75,101.50,102.00 (1.13bn),103.00,104.00,105.00

AUD/USD 0.7550, 0.7560,0.7600, 0.7650, 0.7660, 0.7675

NZD/USD 0.6960,0.7220

USD/CAD 1.3000,1.3100/05,1.3200 (1.1bn), 1.3245/50

USD/CHF 0.9605,0.9745, 0.9755,0.9875,0.9920

-

09:28

Swiss CPI inflation down 0.4% in July

The Swiss Consumer Price Index (CPI) fell by 0.4% in July 2016 compared with the previous month, reaching 100.3 points (December 2015=100). Inflation was -0.2% in comparison with the same month in the previous year. These are the findings of the Federal Statistical Office (FSO).

-

09:15

Switzerland: Consumer Price Index (YoY), July -0.2% (forecast -0.3%)

-

09:15

Switzerland: Consumer Price Index (MoM) , July -0.4% (forecast 0.5%)

-

09:10

Today’s events:

At 15:30 GMT the United States will hold an auction of 3- and 6-month bills.

Also today, Spain will hold an auction of 10-year government bonds.

-

08:58

Asian session review: the dollar consolidates

The US dollar weakened slightly against the euro, but still receives support from positive data on the US labor market, which were published on Friday. As reported by the US Department of Labor, the number of new jobs increased in July 255,000 after rising 292,000 in June. The unemployment rate remained at around 4.9%. It was expected that the number of employees will increase to 180 000 in July and the unemployment rate to fall to 4.8%. The last increase in hiring was enough to increase the share of economically active population to 62.8% from 62.7% in June. The average hourly earnings in the private sector increased by 8 cents compared with June, to 35.69 dollars. The annualized figure rose by 2.6%, exceeding the rate of inflation. Strong job growth should strengthen the Fed's confidence in the labor market, which officials see as at or near full employment. Fed Chair Yellen stated that the economy needs to create a little less than 100 000 jobs a month to keep up with population growth. Second consecutive month of growth for payrolls is a stimulus to the economy after the average annual economic growth reflected an increase of 1.0% over the past three quarters. Most economists expect that against the background of improved economic situation, the Fed may soon hike. Currently, futures on the Fed rate indicate that the market is pricing in a 18% probability of a rate hike in September and a 47% in December.

The Australian dollar fell slightly from the beginning of the trading session, after negative data on the index of the number of vacancies in Australia. As reported today by the Banking Group Australia and New Zealand Banking Group Limited (ANZ), the number of vacancies index fell 0.8% in Jully, after an increase by 0.4% in June. The previous value was revised downward to 0.5%. According to ANZ, in July, the number of vacancies index fell due to uncertainty in the world against the background of Brexit

However, a further decrease in the Australian was stoped by China's trade surplus, which in July was higher than analysts' expectations. The surplus of China's foreign trade in July was $ 52.31 billion, which is higher than the forecast of $ 47.60 billion. The previous value was $ 48.10 billion.

China's exports fell by -4.4% in July, but the reduction was lower than July, when the index fell by -4.8%.Imports of goods and services in China declined in July and amounted to 12.5%, much lower than the previous value of -8.4% and -7.0% of analysts' expectations.

General Customs Administration of China also said that the pressure on exports is expected to fall early in the fourth quarter of this year.

The yen has weakened slightly since the beginning of the Asian session against the dollar amid rising probability of the Fed raising interest rates in September

EUR / USD: during the Asian session, the pair was trading in the $ 1.1080-95 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3065-80 range

USD / JPY: during the Asian session, the pair was trading in Y101.90-102.05 range

-

08:41

The pound falling again after last weeks BoE rate cut and better NFP. 250 pips to Brexit lows on GBP/USD

-

08:08

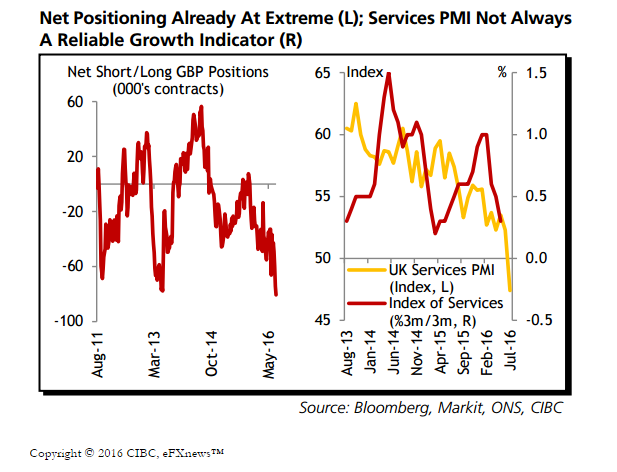

Whats next for GBP/USD ? - CIBC

"A rate cut was expected, and some other measures were previously hinted at, but the £60bn in government bond purchases, £10bn in corporate bond buying and new Term Funding Scheme (potentially worth another £100bn) went above and beyond what was expected.

So the fall in sterling by "just" 1.5% on the day to remain well above recent lows still is a little surprising.

That could partly be because positioning was already so skewed against the pound. It could also be because analysts are doubting whether the economy will behave quite as badly as the BoE expects, with outperformance potentially seeing a rethink down the road. Certainly a lot of emphasis is being placed on the services PMI, which doesn't always have a great correlation with GDP.

However, should the economy weaken we expect sterling to follow suit and dip to the mid-1.20's by year-end".

-

08:05

Fitch affirms AA+ rating of Australia

Fitch Ratings affirmed sovereign ratings of Austria at 'AA+' with stable outlooks late Friday.

The rating agency said the economic growth is expected to remain on a steady upward trend and average 1.6 percent in 2016-17 after four years of sluggish activity.

The underlying growth is forecast to pick up in 2017 as investment continues its steady recovery and net exports make a positive contribution to growth.

The fiscal deficit was better than expected in 2015 at 1.1 percent of GDP compared with a 1.9 percent target, Fitch said.

Further, the agency estimates Austria's fiscal policy to remain prudent, producing small primary general government surpluses during 2016-2018.

-

08:03

German industrial production up 0.8% in June

In June 2016,production in industry was up by 0.8% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In May 2016, the corrected figure shows a decrease of 0.9% (primary -1.3%) from April 2016.

In June 2016, production in industry excluding energy and construction was up by 1.5%. Within industry, the production of capital goods increased by 3.5% and the production of consumer goods by 1.2%. The production of intermediate goods decreased by 0.7%. Energy production was down by 2.7% in June 2016 and the production in construction decreased by 0.5%.

-

08:00

Germany: Industrial Production s.a. (MoM), June 0.8% (forecast 0.7%)

-

07:59

Chinese USD trade balance better than forecast

Exports declined 4.4 percent year-on-year in July from a year ago, after easing 4.8 percent in June, figures from the General Administration of Customs showed Monday. Shipments were expected to fall 3.5 percent.

At the same time, imports decreased 12.5 percent compared to an 8.4 percent drop in June. Economists had forecast only 7 percent drop for July.

As a result, the trade surplus increased to $52.3 billion from $48.1 billion in June. The surplus was also above the expected level of $47.3 billion.

The country's export growth is likely to remain subdued for some time, Julian Evans-Pritchard at Capital Economics, said. While the worst is probably over for many emerging markets, global growth is likely to remain lackluster well into next year - RTT.

-

07:56

Gold reserves in China increased by 1.89% to $ 78.89 billion in July

China's foreign exchange reserves flat in July.

Today, the Administration of the People's Bank of China on currency transactions has published a report on foreign currency reserves, according to which, in July the volume of reserves reached $ 3.20 trillion from $ 3.21 trillion in June. The indicator contains data on the total amount of currency in the government accounts. It also takes into account the assets denominated in the currency and subject to conversion. Is an important indicator of the strength of the economy, as the reserves allow balanced international trade, and maintain the stability of the exchange rate.

The report also states that the amount of gold reserves in China last month increased by 1.89% to $ 78.89 billion.

Over the past decade, China's foreign exchange reserves have grown rapidly, with increased exports. However, in 2014 the volume of foreign exchange reserves began to decline as demand for Chinese goods fell against the backdrop of a slowdown in China's economy and the weakening of the global economic development.

-

07:04

Options levels on monday, August 8, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1259 (3469)

$1.1203 (1698)

$1.1165 (801)

Price at time of writing this review: $1.1104

Support levels (open interest**, contracts):

$1.1031 (3083)

$1.0977 (4103)

$1.0944 (4135)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 42924 contracts, with the maximum number of contracts with strike price $1,1250 (3920);

- Overall open interest on the PUT options with the expiration date September, 9 is 49470 contracts, with the maximum number of contracts with strike price $1,1000 (4135);

- The ratio of PUT/CALL was 1.15 versus 1.34 from the previous trading day according to data from August, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.3404 (1493)

$1.3306 (1709)

$1.3210 (1278)

Price at time of writing this review: $1.3083

Support levels (open interest**, contracts):

$1.2989 (1328)

$1.2892 (1094)

$1.2795 (1378)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 26129 contracts, with the maximum number of contracts with strike price $1,3500 (1866);

- Overall open interest on the PUT options with the expiration date September, 9 is 20892 contracts, with the maximum number of contracts with strike price $1,2800 (1378);

- The ratio of PUT/CALL was 0.80 versus 0.95 from the previous trading day according to data from August, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:01

Japan: Eco Watchers Survey: Current , July 45.1

-

07:01

Japan: Eco Watchers Survey: Outlook, July 47.1

-

05:09

China: Trade Balance, bln, July 52.3 (forecast 47.6)

-

03:30

Australia: ANZ Job Advertisements (MoM), July -0.8%

-

01:54

Japan: Current Account, bln, June 974.4 (forecast 1056.7)

-

00:33

Currencies. Daily history for Aug 05’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1086 -0,38%

GBP/USD $1,3078 -0,27%

USD/CHF Chf0,9805 +0,66%

USD/JPY Y101,80 +0,62%

EUR/JPY Y112,88 +0,27%

GBP/JPY Y133,03 +0,29%

AUD/USD $0,7617 -0,11%

NZD/USD $0,7141 -0,39%

USD/CAD C$1,3172 +1,16%

-

00:02

Schedule for today, Monday, Aug 05’2016

(time / country / index / period / previous value / forecast)

01:30 Australia ANZ Job Advertisements (MoM) July 0.5%

02:00 China Trade Balance, bln July 48.11 47.6

05:00 Japan Eco Watchers Survey: Outlook July 41.5

05:00 Japan Eco Watchers Survey: Current July 41.2

06:00 Germany Industrial Production s.a. (MoM) June -1.3% 0.7%

07:15 Switzerland Consumer Price Index (MoM) July 0.1% 0.5%

07:15 Switzerland Consumer Price Index (YoY) July -0.4% -0.3%

08:30 Eurozone Sentix Investor Confidence August 1.7

12:30 Canada Building Permits (MoM) June -1.9%

14:00 U.S. Labor Market Conditions Index July -1.9

-