Noticias del mercado

-

17:48

Oil fell 1.5%

Oil prices fell moderately, losing previously earned positions. Pressure on the quotes had a widespread appreciation of the US dollar against the background of positive data on employment.

The dollar index rose 0.6 percent after data showed that by the end of July the number of employees in the US increased much more than expected. A stronger dollar makes oil and other commodities denominated in US currency, less affordable for holders of other currencies, which tend to reduce demand for such raw materials. At the same time, experts say, if the situation in the US labor market continues to improve, it will support the demand for oil. Lower unemployment also generally positive for gasoline consumption.

Another reason for the fall in oil prices is a concern about excess supply in the market, which intensified after the report on oil stocks. On Wednesday, the US Department of Energy announced that from 23 July to 29 July oil inventories rose 1.4 million barrels to 522.5 million barrels. Analysts had expected a decline in stocks by 2 million. Barrels. Meanwhile, gasoline stocks fell by 3.3 million barrels to 238.2 million barrels. Analysts had expected a reduction of only 300,000 barrels. US domestic oil production decreased to 8.460 million barrels per day versus 8.515 million barrels a day the previous week.

Early next week, investors will get new guidance on the oil market demand, which will help data on oil imports to China in July.

The cost of the September futures on WTI (Light Sweet Crude Oil) fell to 41.21 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 43.72 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

16:32

-

15:02

OPEC members may revive production freeze talks in September - Bloomberg

-

10:18

Oil fell in early trading

This morning, New York crude oil futures for WTI fell by -0.45% to $ 41.77 and Brent oil futures were down -0.54% to $ 44.06 per barrel. Thus, the black gold is trading lower due to fears of exacerbated oversupply of raw materials on the market, while analysts forecast a likely decrease in imports from China. According to traders, the markets experienced new pressures due to excess production of oil and petroleum products.

-

00:43

Commodities. Daily history for Aug 04’2016:

(raw materials / closing price /% change)

Oil 41.81 -0.29%

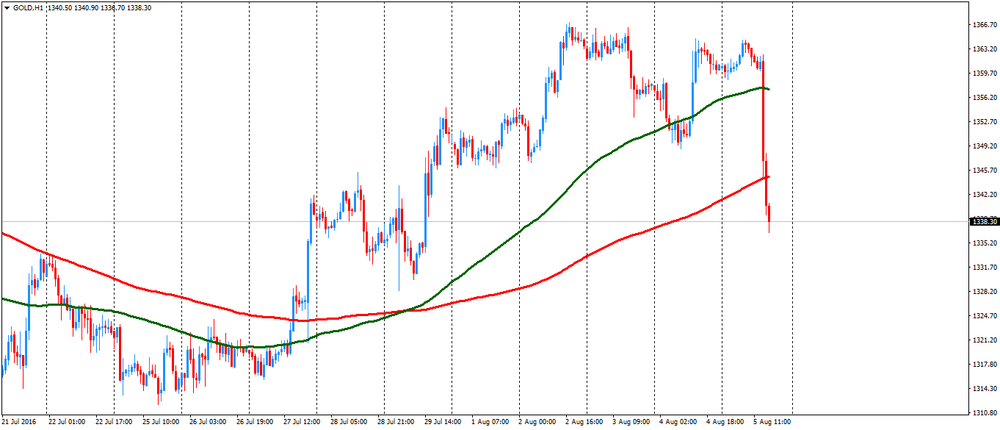

Gold 1,367.30 +0.01%

-