Noticias del mercado

-

21:01

U.S.: Consumer Credit , September 28.92 (forecast 17.5)

-

21:00

Dow -0.00% 17,863.17 -0.26 Nasdaq +0.11% 5,133.50 +5.76 S&P +6.20% 2,093.66 +122.26

-

18:35

WSE: Session Results

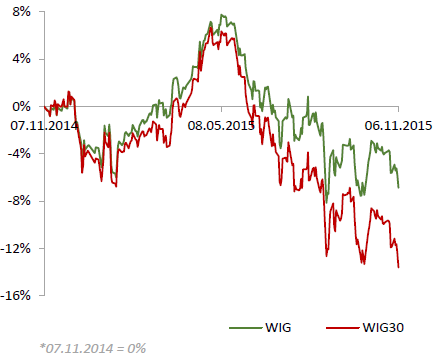

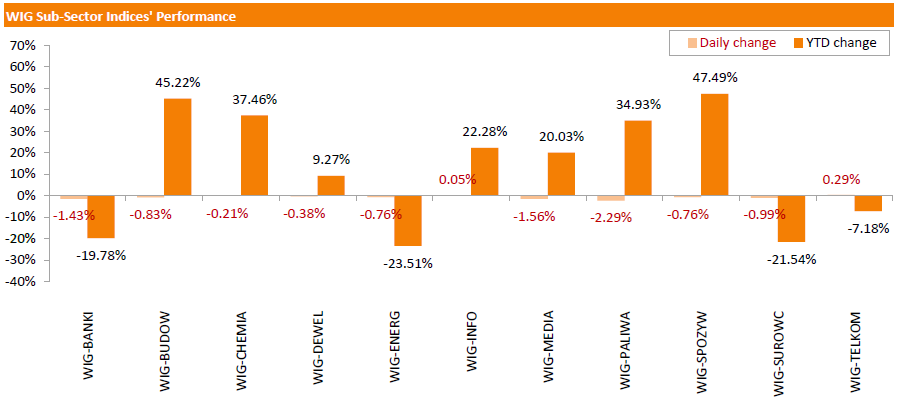

Polish equities declined on Friday. The broad market benchmark, the WIG Index, lost 1.05%. Most sectors fell, with oil and gas sector stocks (-2.29%) posting the sharpest drop.

The large-cap stocks plunged by 1.26%, as measured by the WIG30 Index. Within the index components, CCC (WSE: CCC) and PGNIG (WSE: PGN) were the biggest laggards, plunging by 7.14% and 6.56% respectively after publishing quarterly reports. The former reported Q3 net income of PLN 33.8 mln, beating consensus of PLN 31.1 mln.; the company, however, lowered its full year 2015 expectations. The latter posted Q3 profit of PLN 291 mln versus consensus of PLN 512.7 mln. All banking sector names, but for PKO BP (WSE: PKO; +0.32%) also suffered steep losses, tumbling by 1.09%-4.84% as stronger USD is seen unfavorable for them. At the same time, BOGDANKA (WSE: LWB) and PKP CARGO (WSE: PKP) led a handful of gainers, advancing by 2.58% and 2.11% respectively.

-

18:00

European stocks closed: FTSE 100 6,353.83 -11.07 -0.17% CAC 40 4,984.15 +4.11 +0.08% DAX 10,988.03 +100.29 +0.92%

-

17:18

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes near zero level on Friday after a stronger-than-expected October jobs report boost prospects that the Federal Reserve will raise interest rates next month.

The Labor Department's report showed nonfarm payrolls increased by 271,000 in October, beating the 180,000 expected. Data for August and September were revised to show 12,000 more jobs on average were created than previously reported. The unemployment rate fell to 5.0%, the lowest since April 2008, from 5.1% in September. The jobless rate is now at a level many Fed officials view as consistent with full employment.

Most of Dow stocks in negative area (20 of 30). Top looser - Chevron Corporation (CVX, -2.24%). Top gainer - The Goldman Sachs Group, Inc. (GS, +3.21%).

Most of S&P index sectors in negative area. Top gainer - Conglomerates (+3,2%). Top looser - Utilities (-3.6%).

At the moment:

Dow 17769.00 -33.00 -0.19%

S&P 500 2085.25 -8.75 -0.42%

Nasdaq 100 4693.25 -2.00 -0.04%

Oil 44.58 -0.62 -1.37%

Gold 1086.70 -17.50 -1.58%

U.S. 10yr 2.34 +0.09

-

16:00

United Kingdom: NIESR GDP Estimate, October 0.6% (forecast 0.6%)

-

15:34

U.S. Stocks open: Dow +0.17%, Nasdaq -0.01%, S&P -0.03%

-

15:28

Before the bell: S&P futures -0.29%, NASDAQ futures -0.21%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 19,265.6 +149.19 +0.78%

Hang Seng 22,867.33 -183.71 -0.80%

Shanghai Composite 3,589.76 +66.94 +1.90%

FTSE 6,355.48 -9.42 -0.15%

CAC 4,951.92 -28.12 -0.56%

DAX 10,923.2 +35.46 +0.33%

Crude oil $45.29 (+0.20%)

Gold $1093.60 (-0.96%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

JPMorgan Chase and Co

JPM

68.00

2.35%

62.7K

Citigroup Inc., NYSE

C

55.30

2.12%

1.2K

Goldman Sachs

GS

195.40

1.76%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

62.84

1.35%

1.1K

International Business Machines Co...

IBM

139.49

0.65%

0.3K

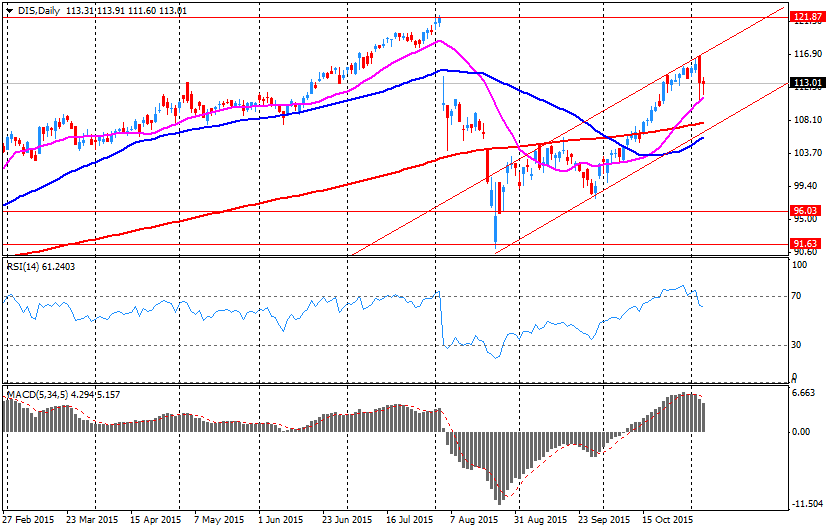

Walt Disney Co

DIS

113.65

0.58%

31.5K

Travelers Companies Inc

TRV

114.54

0.50%

1K

Apple Inc.

AAPL

121.48

0.46%

120.3K

American Express Co

AXP

74.10

0.23%

1.4K

Facebook, Inc.

FB

109.00

0.22%

10.5K

Nike

NKE

132.04

0.14%

2.3K

Twitter, Inc., NYSE

TWTR

28.70

0.14%

12.7K

Wal-Mart Stores Inc

WMT

58.68

0.12%

0.5K

Visa

V

79.30

0.05%

0.1K

Amazon.com Inc., NASDAQ

AMZN

656.00

0.05%

13.5K

Cisco Systems Inc

CSCO

28.44

0.04%

0.5K

Microsoft Corp

MSFT

54.40

0.04%

1.1K

3M Co

MMM

158.99

0.00%

37.0K

Pfizer Inc

PFE

34.15

0.00%

0.1K

ALCOA INC.

AA

9.20

0.00%

3.9K

Starbucks Corporation, NASDAQ

SBUX

62.28

0.00%

3.3K

E. I. du Pont de Nemours and Co

DD

64.79

-0.03%

0.2K

Chevron Corp

CVX

94.50

-0.05%

6.9K

Ford Motor Co.

F

14.56

-0.07%

4.4K

Procter & Gamble Co

PG

76.33

-0.08%

2.2K

Caterpillar Inc

CAT

74.15

-0.09%

0.2K

Verizon Communications Inc

VZ

46.15

-0.11%

0.1K

AT&T Inc

T

33.30

-0.12%

2.8K

Home Depot Inc

HD

125.57

-0.12%

0.1K

McDonald's Corp

MCD

112.72

-0.12%

8.1K

Boeing Co

BA

147.78

-0.13%

0.2K

General Electric Co

GE

29.59

-0.17%

12.3K

Exxon Mobil Corp

XOM

84.62

-0.22%

6.5K

Merck & Co Inc

MRK

54.90

-0.27%

7.2K

Intel Corp

INTC

33.90

-0.29%

2.0K

UnitedHealth Group Inc

UNH

115.89

-0.29%

0.8K

Google Inc.

GOOG

729.14

-0.29%

8.2K

General Motors Company, NYSE

GM

35.33

-0.31%

1.8K

Johnson & Johnson

JNJ

102.00

-0.32%

0.1K

Yandex N.V., NASDAQ

YNDX

15.69

-0.32%

0.5K

Tesla Motors, Inc., NASDAQ

TSLA

231.00

-0.33%

1.6K

Yahoo! Inc., NASDAQ

YHOO

35.00

-0.34%

16.2K

The Coca-Cola Co

KO

42.12

-0.50%

1.1K

ALTRIA GROUP INC.

MO

57.70

-0.60%

1.8K

United Technologies Corp

UTX

100.02

-0.77%

0.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.35

-1.13%

0.5K

Barrick Gold Corporation, NYSE

ABX

7.05

-4.21%

3.1K

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Facebook (FB) target raised to $130 from $115 at Argus

HP Inc. (HPQ) initiated with a Buy at Brean Capital

-

14:30

U.S.: Unemployment Rate, October 5% (forecast 5.1%)

-

14:30

Canada: Unemployment rate, October 7.0% (forecast 7.1%)

-

14:30

U.S.: Nonfarm Payrolls, October 271 (forecast 180)

-

14:30

Canada: Employment , October 44.4 (forecast 10)

-

14:30

Canada: Building Permits (MoM) , September -6.7% (forecast 1.3%)

-

14:30

U.S.: Average hourly earnings , October 0.4% (forecast 0.2%)

-

14:30

U.S.: Average workweek, October 34.5 (forecast 34.5)

-

14:03

-

13:59

Orders

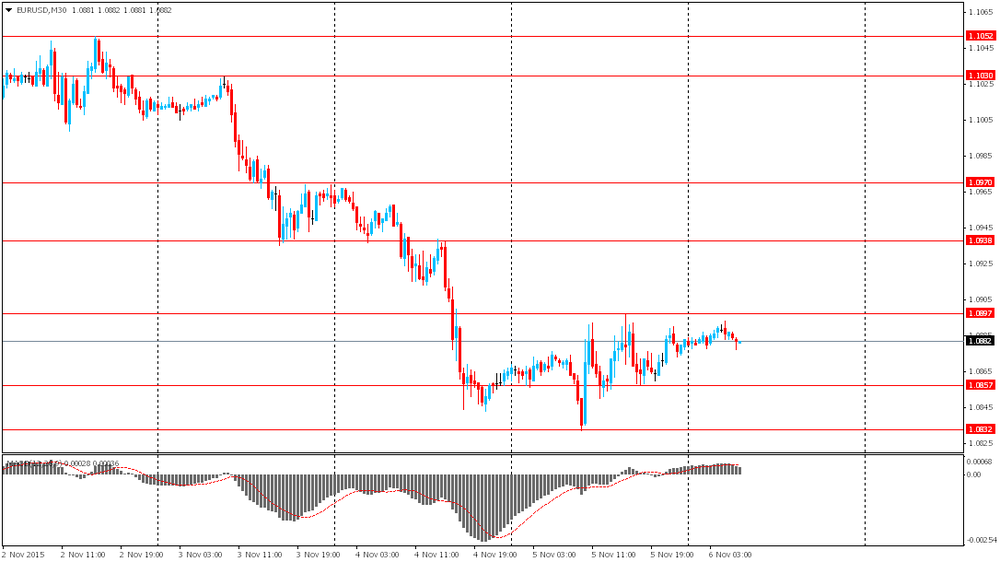

EUR/USD

Offers 1.0885 1.0900 1.0925-30 1.0960 1.0980 1.1000 1.1020-25 1.1050

Bids 1.0850-60 1.0830 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.5200 1.5220 1.5245-50 1.5265 1.5280 1.5300 1.5325-30 1.5350 1.5370 1.5380-85 1.5400

Bids 1.5180 1.5165 1.5150 1.5125-30 1.5100 1.5085 1.5050-60 1.5030 1.5000

EUR/GBP

Offers 0.7185 0.7200 0.7225-30 0.7250 0.7275 0.7300

Bids 0.7145-50 0.7125 0.7100 0.7085 0.7050 0.7030-35 0.7000

EUR/JPY

Offers 132.80 133.00 133.20 133.50-60 133.75-80 134.00 134.30 134.50

Bids 132.25-30 132.00 131.80 131.50 131.30 131.00 130.85 130.50

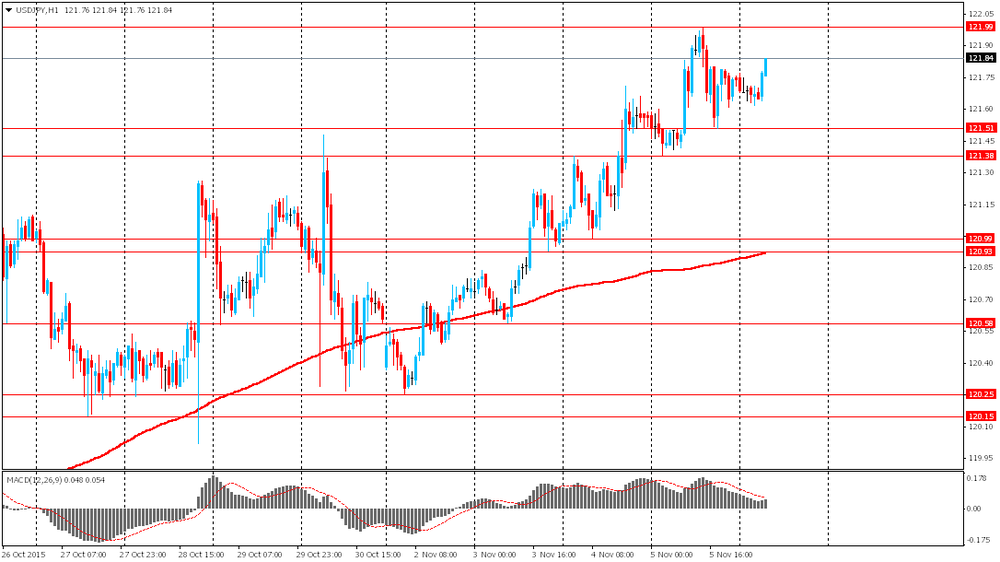

USD/JPY

Offers 122.00 122.25-30 122.50 122.75 123.00 123.20 123.50

Bids 121.50-60 121.25-30 121.00 120.75-80 120.50 120.20-25 120.00

AUD/USD

Offers 0.7180-85 0.7200 0.7220 0.7250 0.7265 0.7280-85 0.7300

Bids 0.7125-30 0.7100-05 0.7080 0.7065 0.7050 0.7030 0.7000

-

11:23

Option expiries for today's 10:00 ET NY cut

USD/JPY 121.50 (USD 380m) 122.00 (1.7bln) 122.50 (859m)

EUR/USD 1.0800 (EUR 1.2bln) 1.0850 (864m) 1.0900 (1bln)

GBP/USD 1.5305 (GBP 195m)

USD/CHF 0.9900 (500m) 1.1000 (1.8bln)

USD/CAD 1.3145-55 (1.25bln) 1.3170 (301m)

AUD/USD 0.7000 (875m) 0.7200 (250m)

-

10:30

United Kingdom: Manufacturing Production (MoM) , September 0.8% (forecast 0.4%)

-

10:30

United Kingdom: Industrial Production (YoY), September 1.1% (forecast 1.3%)

-

10:30

United Kingdom: Industrial Production (MoM), September -0.2% (forecast -0.1%)

-

10:30

United Kingdom: Manufacturing Production (YoY), September -0.6% (forecast -0.9%)

-

10:30

United Kingdom: Total Trade Balance, September -1.353

-

08:45

France: Trade Balance, bln, September -3.38 (forecast -3.1)

-

08:32

Options levels on friday, November 6, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1059 (3522)

$1.0980 (2055)

$1.0926 (378)

Price at time of writing this review: $1.0873

Support levels (open interest**, contracts):

$1.0815 (2240)

$1.0782 (4319)

$1.0742 (1619)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 62430 contracts, with the maximum number of contracts with strike price $1,1200 (4741);

- Overall open interest on the PUT options with the expiration date November, 6 is 57889 contracts, with the maximum number of contracts with strike price $1,0900 (5200);

- The ratio of PUT/CALL was 0.93 versus 0.99 from the previous trading day according to data from November, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5500 (3234)

$1.5400 (1776)

$1.5301 (1090)

Price at time of writing this review: $1.5192

Support levels (open interest**, contracts):

$1.5099 (1927)

$1.5000 (1725)

$1.4900 (700)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 22633 contracts, with the maximum number of contracts with strike price $1,5500 (3234);

- Overall open interest on the PUT options with the expiration date November, 6 is 22098 contracts, with the maximum number of contracts with strike price $1,5200 (3021);

- The ratio of PUT/CALL was 0.98 versus 0.99 from the previous trading day according to data from November, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:16

Germany: Industrial Production (YoY), September 0.2% (forecast 1.55%)

-

08:00

Germany: Industrial Production s.a. (MoM), September -1.1% (forecast 0.5%)

-

07:56

Foreign exchange market. Asian session: the dollar range-bound ahead of payrolls data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 Australia RBA Assist Gov Edey Speaks

04:00 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Leading Economic Index (Preliminary) September 103.5 102.1 101.4

05:00 Japan Coincident Index (Preliminary) September 112.2 111.9

The U.S. dollar little changed ahead of today's employment data release. A median forecast from economists surveyed by the Wall Street Journal suggests that the number of employed outside agricultural sector rose by 183,000 in October after a 142,000 increase in September. Analysts say that a strong report will intensify expectations for a rate hike in December.

The yen declined after Bank of Japan Governor Haruhiko Kuroda's speech. He said that he will study changes in the economy and make optimal decisions at every meeting. This means that Kuroda is ready to add more stimulus.

The Australian dollar was under pressure amid Australian GDP and inflation forecasts, which were released today. The Reserve Bank of Australia cut its 2015 GDP forecast to 2.25% from 2.5%. 2017 GDP forecast was lowered to 2.75%-3.75% from 3%-4%. The bank also cut its 2016 core inflation forecast to 1.5%-2.5% from 2%-3%. Inflation is expected to rise later on.

EUR/USD: the pair fluctuated within $1.0875-95 in Asian trade

USD/JPY: the pair rose to Y121.85

GBP/USD: the pair fell to $1.5200

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Industrial Production s.a. (MoM) September -1.2% 0.5%

07:00 Germany Industrial Production (YoY) September 2.3% 1.55%

07:45 France Trade Balance, bln September -2.98 -3.1

09:30 United Kingdom Industrial Production (MoM) September 1.0% -0.1%

09:30 United Kingdom Industrial Production (YoY) September 1.9% 1.3%

09:30 United Kingdom Manufacturing Production (MoM) September 0.5% 0.4%

09:30 United Kingdom Manufacturing Production (YoY) September -0.8% -0.9%

09:30 United Kingdom Total Trade Balance September -3.27

13:30 Canada Building Permits (MoM) September -3.7% 1.3%

13:30 Canada Unemployment rate October 7.1% 7.1%

13:30 Canada Employment October 12.1 10

13:30 U.S. Average workweek October 34.5 34.5

13:30 U.S. Average hourly earnings October 0% 0.2%

13:30 U.S. Nonfarm Payrolls October 142 180

13:30 U.S. Unemployment Rate October 5.1% 5.1%

15:00 United Kingdom NIESR GDP Estimate October 0.5% 0.6%

20:00 U.S. Consumer Credit September 16.02 17.5

21:15 U.S. FOMC Member Brainard Speaks

-

07:33

Oil prices rebounded slightly

West Texas Intermediate futures for December delivery climbed to $45.53 (+0.73%), while Brent crude rebounded to $48.31 (+0.69%) after falling on Thursday amid growing U.S. crude inventories. However oversupply keeps weighing on prices as well as a strong dollar, which makes this dollar-denominated commodity more expensive for users of other currencies. The dollar rose nearly 5% throughout October on expectations of an imminent interest rate hike.

-

07:14

Gold steady ahead of U.S. jobs data

Gold is currently at $1,108.00 (+0.34%) ahead of U.S. nonfarm payrolls report due later today. Market participants will eye these data to assess strength of the U.S. economy and the probability of a data-dependant rate hike next month. Strong job creation would raise expectations for higher rates in December and weigh on the non-interest-paying precious metal. Economists expect 180,000 new jobs in October compared to +142,000 in the previous month. HSBC economists said that average job gains of more than 150,000 a month this month and next month might be enough for most members of the Fed's federal open market committee to take the anticipated step at December meeting.

-

07:12

Global Stocks: U.S. stock indices edged lower ahead of payrolls data

U.S. stock indices edged lower on Thursday as investors were cautious ahead of a key jobs report, which could determine the Federal Reserve's decision at the next meeting.

The Dow Jones Industrial Average slid 4.15 points, or less than 0.1%, to 17,863.43. The S&P 500 lost 2.38 points, or 0.1%, to 2,099.93 (seven out of its 10 sectors fell with energy, utilities and materials leading declines). The Nasdaq Composite fell 14.74 points, or 0.3%, to 5,127.74.

According to the Labor Department the number of Americans who applied for unemployment benefits rose by 16,000 to 276,000 at the end of October marking the highest level in two months. Economists had expected 262,000 claims.

This morning in Asia Hong Kong Hang Seng fell 0.82%, or 189.84, to 22,861.2. China Shanghai Composite Index gained 0.52%, or 18.20, to 3.541.02. The Nikkei 225 rose 0.43%, or 81.53, to 19,197.94.

Asian indices are mixed. Japanese stocks rose due to a relatively weaker yen ahead of U.S. employment data. Recent comments by Fed officials intensified expectations for a rate hike in December pushing the dollar up against the yen.

-

06:16

Japan: Coincident Index, September 111.9

-

06:02

Japan: Leading Economic Index , September 101.4 (forecast 102.1)

-

03:00

Nikkei 225 19,208.85 +92.44 +0.48 %, Hang Seng 22,862.96 -188.08 -0.82 %, Shanghai Composite 3,514.44 -8.38 -0.24 %

-

00:32

Commodities. Daily history for Nov 5’2015:

(raw materials / closing price /% change)

Oil 45.37 +0.38%

Gold 1,103.00 -0.11%

-

00:31

Stocks. Daily history for Sep Nov 5’2015:

(index / closing price / change items /% change)

Nikkei 225 19,116.41 +189.50 +1.00 %

Hang Seng 23,051.04 -2.53 -0.01 %

Shanghai Composite 3,524.26 +64.62 +1.87 %

FTSE 100 6,364.9 -47.98 -0.75 %

CAC 40 4,980.04 +31.75 +0.64 %

Xetra DAX 10,887.74 +42.50 +0.39 %

S&P 500 2,099.93 -2.38 -0.11 %

NASDAQ Composite 5,127.74 -14.74 -0.29 %

Dow Jones 17,863.43 -4.15 -0.02 %

-

00:30

Currencies. Daily history for Nov 5’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0883 +0,17%

GBP/USD $1,5207 -1,16%

USD/CHF Chf0,995 +0,19%

USD/JPY Y121,74 +0,15%

EUR/JPY Y132,49 +0,32%

GBP/JPY Y185,11 -1,02%

AUD/USD $0,7141 -0,07%

NZD/USD $0,6610 +0,29%

USD/CAD C$1,3168 +0,15%

-

00:02

Schedule for today, Friday, Nov 6’2015:

(time / country / index / period / previous value / forecast)

01:00 Australia RBA Assist Gov Edey Speaks

04:00 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Leading Economic Index (Preliminary) September 103.5 102.1

05:00 Japan Coincident Index (Preliminary) September 112.2

07:00 Germany Industrial Production s.a. (MoM) September -1.2% 0.5%

07:00 Germany Industrial Production (YoY) September 2.3% 1.55%

07:45 France Trade Balance, bln September -2.98 -3.1

09:30 United Kingdom Industrial Production (MoM) September 1.0% -0.1%

09:30 United Kingdom Industrial Production (YoY) September 1.9% 1.3%

09:30 United Kingdom Manufacturing Production (MoM) September 0.5% 0.4%

09:30 United Kingdom Manufacturing Production (YoY) September -0.8% -0.9%

09:30 United Kingdom Total Trade Balance September -3.27

13:30 Canada Building Permits (MoM) September -3.7% 1.3%

13:30 Canada Unemployment rate October 7.1% 7.1%

13:30 Canada Employment October 12.1 10

13:30 U.S. Average workweek October 34.5 34.5

13:30 U.S. Average hourly earnings October 0% 0.2%

13:30 U.S. Nonfarm Payrolls October 142 180

13:30 U.S. Unemployment Rate October 5.1% 5.1%

15:00 United Kingdom NIESR GDP Estimate October 0.5% 0.6%

20:00 U.S. Consumer Credit September 16.02 17.5

21:15 U.S. FOMC Member Brainard Speaks

-