Noticias del mercado

-

21:02

S&P 500 2,053.11 -28.23 -1.36%, NASDAQ 4,917.83 -79.63 -1.59%, Dow 17,553.41 -223.50 -1.26%

-

19:40

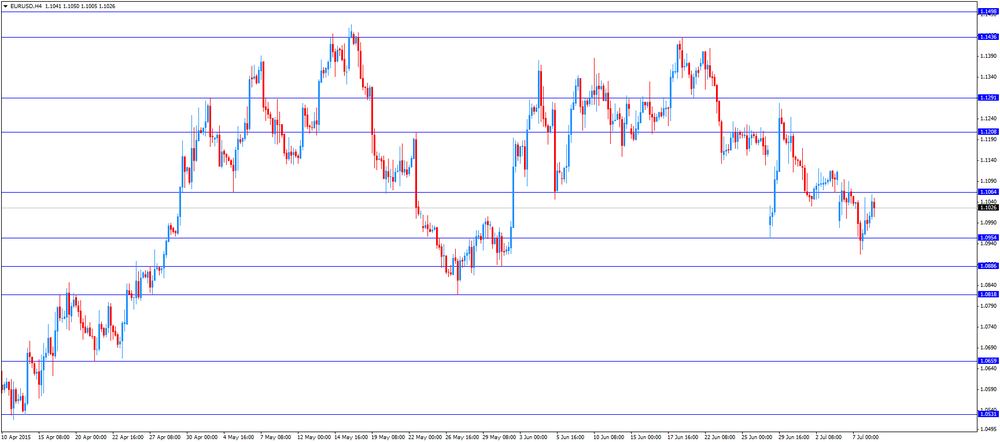

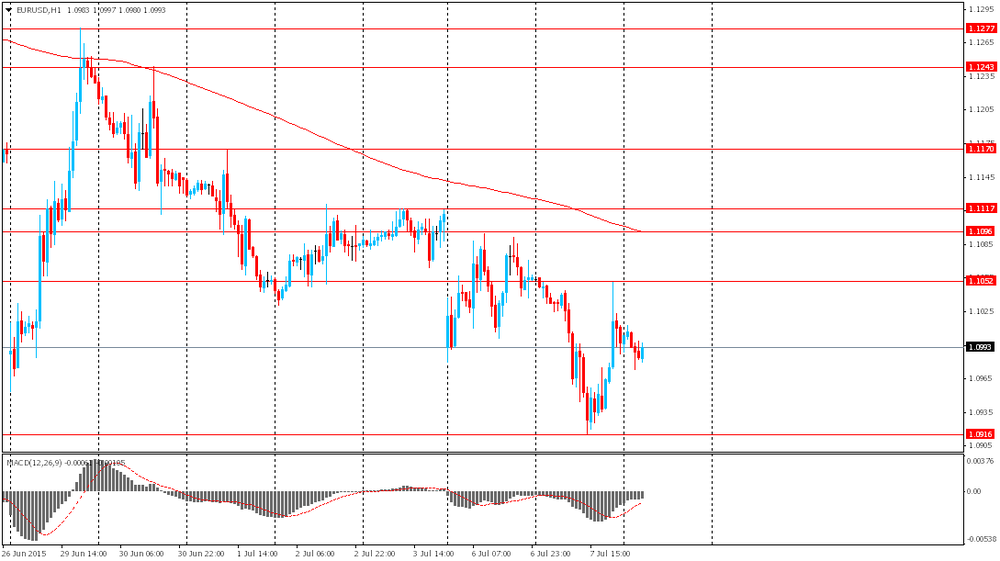

American focus: the euro rose

The euro rose against the dollar rebounded from one-month low, reached on Tuesday. The single currency was supported amid renewed hopes for a new Greek plan to help avoid bankruptcy and exit from the euro zone countries, after European leaders yesterday gave Athens a period of five days to sign a new agreement. At an emergency summit of euro zone on Tuesday, European leaders have put forward an ultimatum to Greece - it has five days to reach an agreement with its creditors from the eurozone, or waiting for the collapse of the financial system.

Meanwhile, Greece officially asked for a new three-year aid package to the European Stability Mechanism, the permanent euro zone bailout fund. If agreement is not reached in time, EU leaders will hold an emergency summit in Brussels on Sunday, during which discussed measures to minimize the consequences of a Greek exit from the eurozone.

The pressure on the euro was reported that a conference of the Eurogroup on Greece, scheduled for today, was canceled for unspecified reasons. The head of the Eurogroup Deysselblum said that contrary to the plans, a conference call will take place. Earlier, representatives of the Eurogroup Working Group has scheduled the meeting to discuss the latest proposals of Athens.

Investors are also awaiting the publication of minutes of the June meeting of the Fed on Wednesday for guidance on the timing of the primary rate hike in the United States.

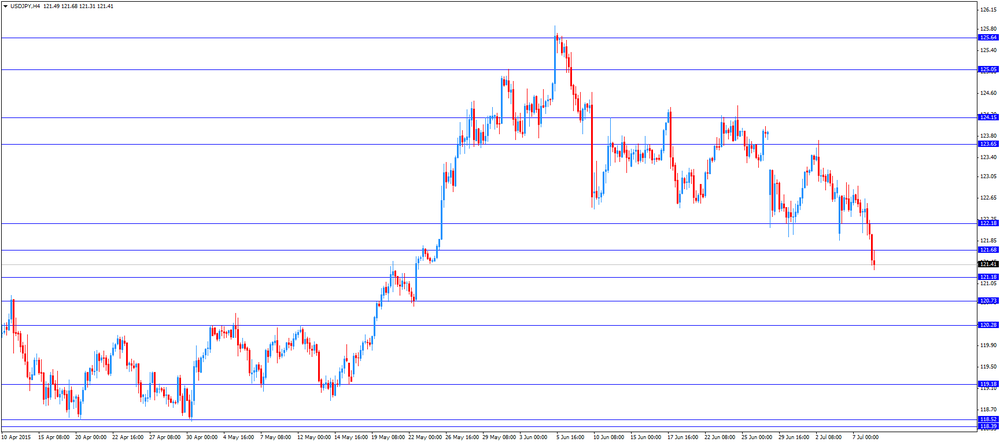

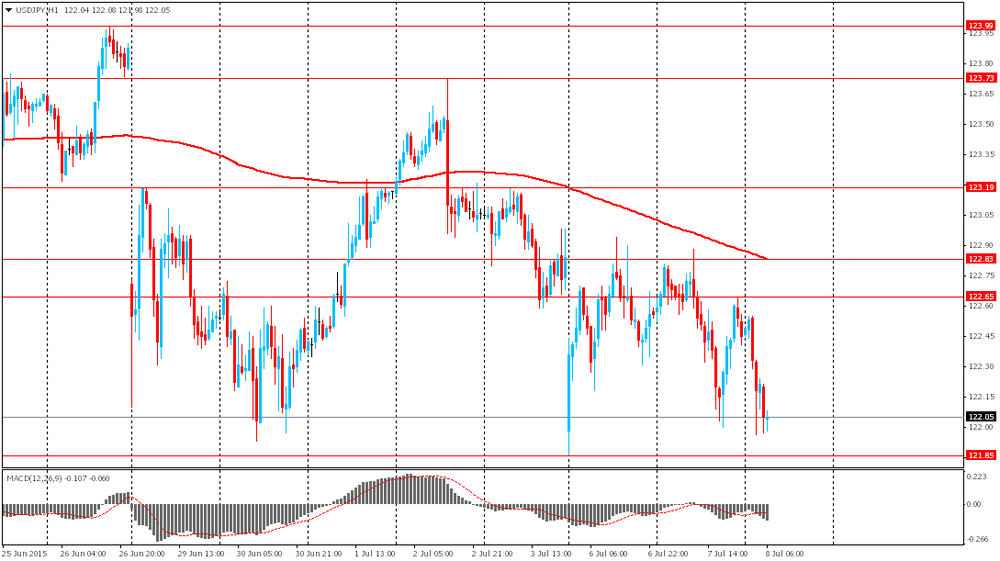

The US dollar fell to a six-week low against the yen strengthens, losing more than 1%, as the collapsed Chinese stock market increased investor demand for safe Japanese currency. The Chinese stock market fell sharply on Wednesday, continuing to sell, despite the new government measures that restore investor confidence. Sales were provoked by fears of slowing second-largest economy in the world and exacerbated concerns about the risks of financial stability because of the crisis in the market.

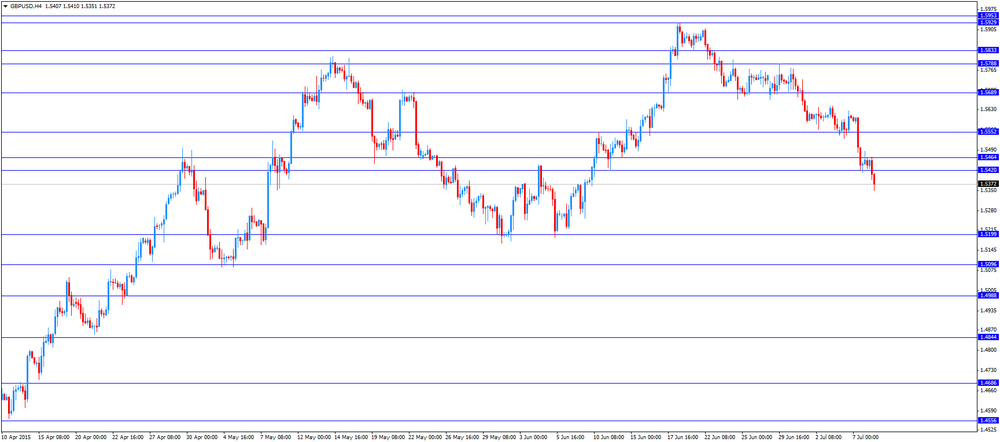

The pound continued to fall in price against the US dollar, breaking the mark of $ 1.5400 and refreshed at least June 10 on concern the market as to what additional fiscal consolidation may delay a rate hike of the Bank of England. It is expected that the British government will introduce additional measures. Escape from the market risk was also triggered fears of a Greek exit from the euro zone and the decline in commodity prices due to panic in the Chinese markets. Little impact on the currency had data from mortgage lender Halifax. As it became known, housing prices jumped in June by 1.7 percent, compared with growth of 0.3 percent in May. In the period from April to June, the growth in housing prices accelerated to 9.6 per cent per annum against 8.6 percent in the previous three months. Martin Ellis, economist at Halifax, said the housing stock available for sale were at a record low. "This shortcoming has been a key factor in sustaining growth in housing prices at a steady pace since the beginning of 2015 - said Ellis. - Economic growth, increased employment, accelerating growth of real wages and very low mortgage rates - all of these factors support the demand for housing" . It is worth mentioning, the latest data from the Halifax report contrasted with the mortgage lender Nationwide, which last week reported that house prices fell by 0.2 percent in June compared to May, while the annual growth rate slowed down to 3.3 per cent (minimum pace for two years).

-

19:29

WSE: Session Results

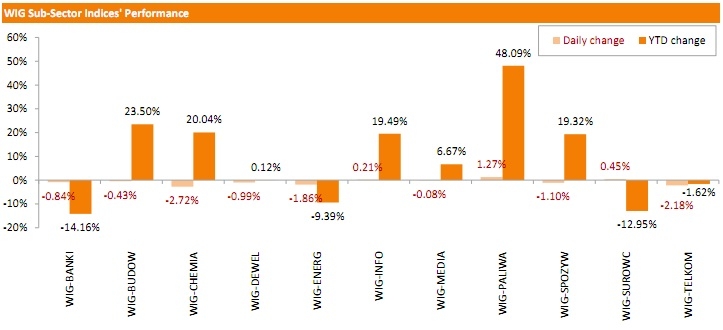

Wednesday preserved a downward tendency in Polish equity market. The broad market measure, the WIG Index, lost 0.42%. Sector-wise, oil and gas sector (+1.27%), materials (+0.45%) and technologies (+0.21%) were the only sectors, which posted positive results. At the same time, chemicals names fared the worst (-2.72%), followed by telecommunications (-2.18%) and utilities (-1.86%) stocks. In addition, it should be noted, that the Polish banking stocks sub-index WIG-BANKI hit a nearly 2-year low, dragged down by a new plan of the ruling Civic Platform party to force banks to pay half of the cost of converting Swiss franc loans into zlotys.

The large-cap stocks fell by 0.29%, as measured by the WIG30 Index. Within the indicator's components, chemicals name GRUPA AZOTY (WSE: ATT) was the sharpest decliner, plunging 4.77%. It was followed by utilities names ENEA (WSE: ENA) and Tauron PE (WSE: TPE) as well as banking stocks BZ WBK (WSE: BZW) and HANDLOWY (WSE: BHW), posting losses in the range between 2.46% and 3.17%. On the other side of the ledger, clothing retailer LPP (WSE: LPP) recorded the biggest climb, advancing 2.97%. Oil and gas sector names PGNIG (WSE: PGN) and PKN ORLEN (WSE: PKN) added 2.07% and 1.11% respectively. Elsewhere, PKO BP (WSE: PKO) corrected upwards by 0.91% after recent down-surge.

-

18:47

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes extended their losses, but in low volumes, with the S&P 500 hitting a session low and the Dow Jones Industrial Average and Nasdaq both falling more than 1 percent. Trading in all securities were halted on the New York Stock Exchange on Wednesday following earlier reports of technical difficulties, although NYSE-listed issues was still trading on other exchanges. U.S. markets were in the red even before the halt, as the slide in Chinese markets spurred concerns over its impact on global economic growth. Beijing unveiled yet another battery of measures to arrest the sell-off in shares and the securities regulator warned of "panic sentiment" gripping investors in the world's second-largest economy. Chinese shares have fallen more than 30 percent in the last three weeks, and some investors fear China's turmoil is now a bigger risk than the crisis in Greece.

Almost of Dow stocks in negative area (29 of 30). Top looser - General Electric Company (GE, -2.00%). Top gainer - Microsoft Corporation (MSFT, +0.29).

S&P index sectors mixed. Top looser - Basic mterials (-1,9%).

At the moment:

Dow 17478.00 -202.00 -1.14%

S&P 500 2046.50 -27.25 -1.31%

Nasdaq 100 4357.00 -65.25 -1.48%

Oil 51.38 -0.95 -1.82%

Gold 1160.70 +8.10 +0.70%

10-year yield 2.23% -0.00

-

18:05

European stocks close: stocks closed higher on new Greek deadline

Stock indices closed higher on new Greek deadline. Greece has submit a formal application for a three-year loan facility from the European Stability Mechanism (ESM) on Wednesday.

"The Loan will be used to meet Greece's debt obligations and to ensure stability of the financial system," Greek Finance Minister Euclid Tsakalotos said in the letter.

He did not mention the exact amount of the financial aid.

European Council President Donald Tusk said on Tuesday that just five days left for Greece to reach a deal with its creditors to save it from bankruptcy.

European Commission President Jean-Claude Juncker said on Tuesday that authorities are prepared for all outcomes of the negotiations with Greece about its debt crisis, including a scenario of the Greek exit from the Eurozone.

European Central Bank Governing Council Member Christian Noyer said on Wednesday that Greek banks would not receive any emergency lending if the Greek government fails to reach a deal with its creditors.

The Bank of France released its business sentiment index for France on Wednesday. The index fell to 98 in June from 99 in May.

The central bank expects the French economy to expand 0.2% in the second quarter of 2015.

UK's Finance Minister George Osborne presented the annual budget today. The government plans to achieve a surplus in the 2019/20 financial year, one year later than previously predicted.

The Office for Budget Responsibility projects the U.K. economy to grow 2.4% in 2015, 2.3% in 2016, and 2.4% for the rest of the decade.

The government plans to cut corporation tax from 20% to 19% in 2017 and to 18% by 2020.

Osborne said that a new 8% surcharge on bank profits will be introduced from January next year.

Halifax released its house prices data for the U.K. on Wednesday. House prices in the U.K. increased 1.7% in June, after a 0.3% rise in May. May's figure was revised up from a 0.1% decline.

On a yearly basis, house prices climbed 9.6% in three months to June, after a 8.6% increase in three months to May. It was the fastest pace since September 2014.

"Economic growth, higher employment, increasing real earnings growth and very low mortgage rates are all supporting housing demand," Halifax's housing economist Martin Ellis said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,490.7 +58.49 +0.91%

DAX 10,747.3 +70.52 +0.66%

CAC 40 4,639.02 +34.38 +0.75%

-

18:00

European stocks closed: FTSE 100 6,490.7 +58.49 +0.91 %, CAC 40 4,639.02 +34.38 +0.75 %, DAX 10,747.3 +70.52 +0.66 %

-

17:41

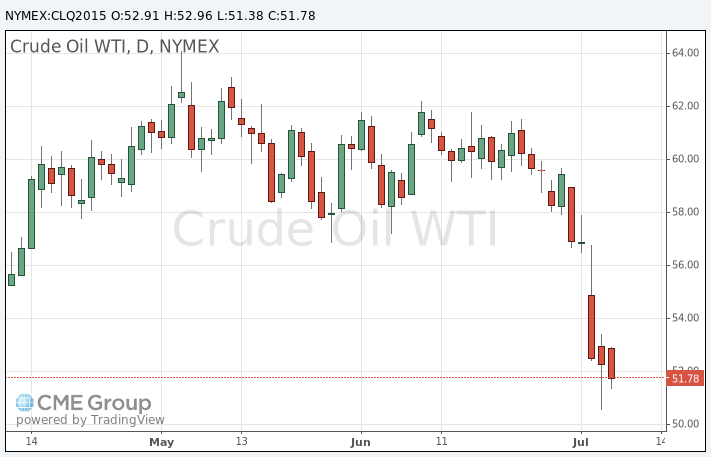

WTI crude oil price declines on the increase in U.S. crude oil inventories

WTI crude oil price declined on the increase in U.S. crude oil inventories. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 384,000 barrels to 465.8 million in the week to July 03.

Analysts had expected U.S. crude oil inventories to decline by 1 million barrels.

Gasoline inventories climbed by 1.2 million barrels to 218 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 299,000 barrels to 56.7 million barrels.

U.S. crude oil imports declined by 197,000 barrels per day.

Refineries in the U.S. were running at 94.7% of capacity, down from 95.0% the previous week.

The collapse in China's stock prices and the uncertainty over the Greek debt problem also weighed on oil prices.

Traders expect the results of talks on the Iranian nuclear program. Talks will continue until July 10. A deal could lead to a higher oil supply.

WTI crude oil for August delivery decreased to $51.38 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $57.17 a barrel on ICE Futures Europe.

-

17:20

Gold traded higher as investors focussed on the release of minutes of the Fed’s last monetary policy meeting

Gold traded higher as investors focussed on the release of minutes of the Fed's last monetary policy meeting. Market participants hope to find some signals when the Fed will start raising its interest rates.

The Greek debt crisis and a drop in the Chinese stock market also remained in focus.

Greece has submit a formal application for a three-year loan facility from the European Stability Mechanism (ESM) on Wednesday.

"The Loan will be used to meet Greece's debt obligations and to ensure stability of the financial system," Greek Finance Minister Euclid Tsakalotos said in the letter.

He did not mention the exact amount of the financial aid.

European Council President Donald Tusk said on Tuesday that just five days left for Greece to reach a deal with its creditors to save it from bankruptcy.

European Commission President Jean-Claude Juncker said on Tuesday that authorities are prepared for all outcomes of the negotiations with Greece about its debt crisis, including a scenario of the Greek exit from the Eurozone.

August futures for gold on the COMEX today rose to 1163.70 dollars per ounce.

-

17:10

French Prime Minister Manuel Valls: a deal between Greece and its creditors was "within grasp"

French Prime Minister Manuel Valls said on Wednesday that a deal between Greece and its creditors was "within grasp".

He also said that to keep Athens in the Eurozone is a geopolitical target.

"Keeping Greece in the euro and therefore in the heart of Europe and the EU is something of the utmost geostrategic and geopolitical importance," Valls said.

He noted that Europe allows Greece to leave the Eurozone, it will be "an admission of impotence". Valls added that France refuses that.

-

16:58

U.S. crude inventories rise by 384,000 barrels to 465.8 million in the week to July 03

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 384,000 barrels to 465.8 million in the week to July 03.

Analysts had expected U.S. crude oil inventories to decline by 1 million barrels.

Gasoline inventories climbed by 1.2 million barrels to 218 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 299,000 barrels to 56.7 million barrels.

U.S. crude oil imports declined by 197,000 barrels per day.

Refineries in the U.S. were running at 94.7% of capacity, down from 95.0% the previous week.

-

16:30

U.S.: Crude Oil Inventories, July 0.384 (forecast -1)

-

16:09

Greece submits a formal application for a three-year loan facility from the European Stability Mechanism (ESM) on Wednesday

Greece has submit a formal application for a three-year loan facility from the European Stability Mechanism (ESM) on Wednesday.

"The Loan will be used to meet Greece's debt obligations and to ensure stability of the financial system," Greek Finance Minister Euclid Tsakalotos said in the letter.

He did not mention the exact amount of the financial aid.

-

15:54

UK's Finance Minister George Osborne: the government plans to achieve a surplus in the 2019/20 financial year

UK's Finance Minister George Osborne presented the annual budget today. The government plans to achieve a surplus in the 2019/20 financial year, one year later than previously predicted.

"Britain still spends too much, borrows too much, and our weak productivity shows we don't train enough or build enough or invest enough. This will be a Budget for working people. A Budget that sets out a plan for Britain for the next five years to keep moving us from a low-wage, high-tax, high-welfare economy; to the higher-wage, lower-tax, lower-welfare country we intend to create," Osborne said.

The Office for Budget Responsibility projects the U.K. economy to grow 2.4% in 2015, 2.3% in 2016, and 2.4% for the rest of the decade.

The government plans to cut corporation tax from 20% to 19% in 2017 and to 18% by 2020.

Osborne said that a new 8% surcharge on bank profits will be introduced from January next year.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0880(E514mn), $1.1050(E509mn)

USD/JPY: Y122.00($411mn), Y123.50($320mn)

EUR/JPY: Y134.40(E206mn)

GBP/USD: $1.5550(Gbp308mn)

EUR/GBP: Gbp0.7000(E487mn)

AUD/USD: $0.7400(A$368mn), $0.7445-50(A$387mn)

USD/CAD: C$1.2500($915mn)

-

15:32

U.S. Stocks open: Dow -0.72%, Nasdaq -0.82%, S&P -0.62%

-

15:29

Before the bell: S&P futures -0.77%, NASDAQ futures -0.73%

U.S. stock-index futures dropped as a selloff in Asian equities threatened to spread across regions.

Nikkei 19,737.64 -638.95 -3.14%

Hang Seng 23,516.56 -1,458.75 -5.84%

Shanghai Composite 3,506.78 -220.35 -5.91%

FTSE 6,496.75 +64.54 +1.00%

CAC 4,662.46 +57.82 +1.26%

DAX 10,792.15 +115.37 +1.08%

Crude oil $52.23 (-0.17%)

Gold $1153.60 (+0.09%)

-

15:17

European Central Bank Governing Council Member Christian Noyer: Greek banks would not receive any emergency lending if the Greek government fails to reach a deal with its creditors

European Central Bank Governing Council Member Christian Noyer said on Wednesday that Greeks banks would not receive any emergency lending if the Greek government fails to reach a deal with its creditors.

"Our rules oblige us to stop immediately at the point when there is no prospect of a political accord on a programme, or at the point when the Greek banking system crumbles - which would happen if it enters generalised default on all its debts," he said.

-

15:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Merck & Co Inc

MRK

58.00

+0.02%

2.5K

Twitter, Inc., NYSE

TWTR

35.43

-0.25%

290.7K

Hewlett-Packard Co.

HPQ

30.71

-0.29%

0.6K

AT&T Inc

T

35.18

-0.34%

51.8K

Procter & Gamble Co

PG

81.44

-0.34%

3.6K

UnitedHealth Group Inc

UNH

120.25

-0.37%

0.1K

Barrick Gold Corporation, NYSE

ABX

10.28

-0.39%

3.1K

International Business Machines Co...

IBM

164.29

-0.43%

0.7K

Johnson & Johnson

JNJ

98.48

-0.44%

2.2K

Walt Disney Co

DIS

116.50

-0.51%

5.8K

E. I. du Pont de Nemours and Co

DD

58.78

-0.54%

0.8K

Amazon.com Inc., NASDAQ

AMZN

434.22

-0.57%

0.4K

Google Inc.

GOOG

522.00

-0.58%

0.4K

ALTRIA GROUP INC.

MO

51.38

-0.58%

0.9K

The Coca-Cola Co

KO

40.00

-0.62%

0.8K

Microsoft Corp

MSFT

44.02

-0.63%

31.6K

Verizon Communications Inc

VZ

46.40

-0.64%

11.2K

Pfizer Inc

PFE

33.50

-0.68%

3.0K

Exxon Mobil Corp

XOM

82.24

-0.76%

2.0K

Cisco Systems Inc

CSCO

27.15

-0.77%

2.3K

Chevron Corp

CVX

94.52

-0.79%

0.9K

Nike

NKE

110.40

-0.80%

0.8K

Home Depot Inc

HD

111.50

-0.80%

0.8K

Apple Inc.

AAPL

124.65

-0.83%

163.8K

Starbucks Corporation, NASDAQ

SBUX

53.90

-0.87%

1.9K

Visa

V

67.15

-0.91%

1.4K

Boeing Co

BA

141.82

-0.93%

0.3K

Goldman Sachs

GS

206.20

-0.97%

10.4K

ALCOA INC.

AA

10.95

-0.99%

62.5K

Facebook, Inc.

FB

86.32

-1.03%

98.7K

JPMorgan Chase and Co

JPM

66.10

-1.05%

1.3K

Ford Motor Co.

F

14.69

-1.08%

7.0K

Caterpillar Inc

CAT

83.06

-1.11%

1.4K

General Electric Co

GE

26.17

-1.13%

63.0K

Deere & Company, NYSE

DE

95.12

-1.20%

0.7K

Intel Corp

INTC

29.52

-1.27%

30.1K

Citigroup Inc., NYSE

C

53.74

-1.39%

4.2K

General Motors Company, NYSE

GM

32.40

-1.40%

7.5K

Tesla Motors, Inc., NASDAQ

TSLA

263.07

-1.80%

40.9K

Yahoo! Inc., NASDAQ

YHOO

37.49

-1.94%

19.1K

Yandex N.V., NASDAQ

YNDX

14.51

-2.81%

3.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.71

-3.13%

19.7K

-

15:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Tesla (TSLA) downgraded to Sector Weight from Overweight at Pacific Crest

Other:

-

14:53

Greek Prime Minister Alexis Tsipras promised Athens will provide credible reform proposals on Thursday

Speaking in in the European Parliament, Greek Prime Minister Alexis Tsipras promised on Wednesday that Athens will provide credible reform proposals on Thursday.

An emergency summit of all 28 European Union members is scheduled to take place on Sunday.

Tsipras noted that Greece wants to reach a deal with its creditors but not at any price, accusing its lenders for transforming the country "into a laboratory for testing austerity over the past years".

"The money that was given to Greece never went to the people. The money was given to save Greek and European banks," the Greek prime minister said.

-

14:42

Building permits in Canada plunge 14.5% in May

Statistics Canada released housing market data on Wednesday. Building permits in Canada plunged 14.5% in May, missing expectations for a 5.0% decline, after a 12.1% gain in April.

April's figure was revised up from a 11.6% rise.

The drop was driven by declines in construction permits in the residential and non-residential sectors. Building permits for non-residential construction fell 16.0% in May, while permits in the residential sector slid 13.5%.

-

14:30

Canada: Building Permits (MoM) , May -14.5% (forecast -5.0%)

-

14:18

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on new Greek deadline

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Eco Watchers Survey: Current June 53.3 53.2 51.0

05:00 Japan Eco Watchers Survey: Outlook June 54.5 53.5

07:00 United Kingdom Halifax house price index June 0.3% Revised From -0.1% 1.7%

07:00 United Kingdom Halifax house price index 3m Y/Y June 8.6% 9.6%

09:00 Eurozone Eurogroup Meetings

11:00 U.S. MBA Mortgage Applications July -4.7% 4.6%

11:30 United Kingdom Annual Budget Release

The U.S. dollar traded mixed against the most major currencies ahead of the release of the Fed's last meeting minutes.

The euro traded lower against the U.S. dollar on new Greek deadline. European Council President Donald Tusk said on Tuesday that just five days left for Greece to reach a deal with its creditors to save it from bankruptcy.

"Until now I avoided talking about deadlines, but tonight I have to say it loud and clear - the final deadline ends this week. All of us are responsible for the crisis, and all of us have a responsibility to resolve it," he said.

European Commission President Jean-Claude Juncker said on Tuesday that authorities are prepared for all outcomes of the negotiations with Greece about its debt crisis, including a scenario of the Greek exit from the Eurozone.

He added that the commission has another plans in case if Athens needs humanitarian aid and his favourite plan how to keep Greece in the Eurozone.

European Central Bank Governing Council Member Christian Noyer said on Wednesday that Greek banks would not receive any emergency lending if the Greek government fails to reach a deal with its creditors.

The Greek government sent a formal application for a new bailout programme from the European Stability Mechanism.

The Bank of France released its business sentiment index for France on Wednesday. The index fell to 98 in June from 99 in May.

The central bank expects the French economy to expand 0.2% in the second quarter of 2015.

The British pound traded lower against the U.S. dollar after the release of the annual budget by UK's Finance Minister George Osborne. The government plans to achieve a surplus in the 2019/20 financial year, one year later than previously planned.

The Office for Budget Responsibility projects the U.K. economy to grow 2.4% in 2015, 2.3% in 2016, and 2.4% in 2017.

Halifax released its house prices data for the U.K. on Wednesday. House prices in the U.K. increased 1.7% in June, after a 0.3% rise in May. May's figure was revised up from a 0.1% decline.

On a yearly basis, house prices climbed 9.6% in three months to June, after a 8.6% increase in three months to May. It was the fastest pace since September 2014.

"Economic growth, higher employment, increasing real earnings growth and very low mortgage rates are all supporting housing demand," Halifax's housing economist Martin Ellis said.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian housing market data. The Canadian building permits are expected to decline 5.0% in May, after a 11.6% rise in April.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.5351

USD/JPY: the currency pair decreased to Y121.31

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) May 11.6% -5.0%

18:00 U.S. FOMC Member Williams Speaks

18:00 U.S. FOMC meeting minutes

23:50 Japan Core Machinery Orders, y/y May 3.0% 16.3%

23:50 Japan Core Machinery Orders May 3.8% -5%

-

14:00

Orders

EUR/USD

Offers 1.1030 1.1050 1.1085 1.1100 1.1120 1.1145-50 1.1180 1.1200 1.1220-25 1.1245

Bids 1.1000 1.0980 1.0960 1.0940 1.0925 1.0900 1.0880 1.0850 1.0825 1.0800

GBP/USD

Offers 1.5430 1.5460 1.5485 1.5500 1.5520 1.5550 1.5585 1.5600

Bids 1.5400 1.5380 1.5365 1.5350 1.5330 1.5300 1.5285

EUR/GBP

Offers 0.7170 0.7180-85 0.7200 0.7225 0.7240 0.7260 0.7285 0.7300

Bids 0.7135 0.7120 0.7100 0.7085 0.7055-60 0.7040 0.7020 0.7000 0.6985 0.6965

EUR/JPY

Offers 134.60 134.85 135.00 135.30 135.50 135.80 136.00 136.40 136.80 137.00

Bids 133.85 133.50 133.25 133.00 132.80 132.50

USD/JPY

Offers 121.80 122.00 122.20 122.40 122.85 123.00 123.20-25 123.50

Bids 121.25-30 121.00 120.75 120.50 120.25 120.00

AUD/USD

Offers 0.7400 0.7420 0.7440 0.7470 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7380 0.7350 0.7330 0.7300 0.7285 0.7250 0.7230 0.7200

-

13:00

U.S.: MBA Mortgage Applications, July 4.6%

-

12:01

European stock markets mid session: stocks traded higher on new Greek deadline

Stock indices traded higher on new Greek deadline. European Council President Donald Tusk said on Tuesday that just five days left for Greece to reach a deal with its creditors to save it from bankruptcy.

"Until now I avoided talking about deadlines, but tonight I have to say it loud and clear - the final deadline ends this week. All of us are responsible for the crisis, and all of us have a responsibility to resolve it," he said.

European Commission President Jean-Claude Juncker said on Tuesday that authorities are prepared for all outcomes of the negotiations with Greece about its debt crisis, including a scenario of the Greek exit from the Eurozone.

He added that the commission has another plans in case if Athens needs humanitarian aid and his favourite plan how to keep Greece in the Eurozone.

European Central Bank Governing Council Member Christian Noyer said on Wednesday that Greek banks would not receive any emergency lending if the Greek government fails to reach a deal with its creditors.

The Bank of France released its business sentiment index for France on Wednesday. The index fell to 98 in June from 99 in May.

The central bank expects the French economy to expand 0.2% in the second quarter of 2015.

Halifax released its house prices data for the U.K. on Wednesday. House prices in the U.K. increased 1.7% in June, after a 0.3% rise in May. May's figure was revised up from a 0.1% decline.

On a yearly basis, house prices climbed 9.6% in three months to June, after a 8.6% increase in three months to May. It was the fastest pace since September 2014.

"Economic growth, higher employment, increasing real earnings growth and very low mortgage rates are all supporting housing demand," Halifax's housing economist Martin Ellis said.

Current figures:

Name Price Change Change %

FTSE 100 6,464.4 +32.19 +0.50%

DAX 10,689.38 +12.60 +0.12%

CAC 40 4,628.62 +23.98 +0.52%

-

11:44

French business sentiment index falls to 98 in June

The Bank of France released its business sentiment index for France on Wednesday. The index fell to 98 in June from 99 in May. Business leaders expect industrial output to increase in July.

The business sentiment index in services was up to 96 in June from 95 in May.

The construction sentiment index remained unchanged at 93 in June.

The central bank expects the French economy to expand 0.2% in the second quarter of 2015.

-

11:38

House prices in the U.K. rise 1.7% in June

Halifax released its house prices data for the U.K. on Wednesday. House prices in the U.K. increased 1.7% in June, after a 0.3% rise in May. May's figure was revised up from a 0.1% decline.

On a yearly basis, house prices climbed 9.6% in three months to June, after a 8.6% increase in three months to May. It was the fastest pace since September 2014.

"Economic growth, higher employment, increasing real earnings growth and very low mortgage rates are all supporting housing demand," Halifax's housing economist Martin Ellis said.

-

11:27

European Council President Donald Tusk: just five days left for Greece to reach a deal with its creditors

European Council President Donald Tusk said on Tuesday that just five days left for Greece to reach a deal with its creditors to save it from bankruptcy.

"Until now I avoided talking about deadlines, but tonight I have to say it loud and clear - the final deadline ends this week. All of us are responsible for the crisis, and all of us have a responsibility to resolve it," he said.

-

11:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0880(E514mn), $1.1050(E509mn)

USD/JPY: Y122.00($411mn), Y123.50($320mn)

EUR/JPY: Y134.40(E206mn)

GBP/USD: $1.5550(Gbp308mn)

EUR/GBP: Gbp0.7000(E487mn)

AUD/USD: $0.7400(A$368mn), $0.7445-50(A$387mn)

USD/CAD: C$1.2500($915mn)

-

11:04

European Commission President Jean-Claude Juncker: the commission prepared a plan in the event of a Grexit

European Commission President Jean-Claude Juncker said on Tuesday that authorities are prepared for all outcomes of the negotiations with Greece about its debt crisis, including a scenario of the Greek exit from the Eurozone.

"The commission is prepared for everything. We have a Grexit scenario, prepared in detail," he said.

He added that the commission has another plans in case if Athens needs humanitarian aid and his favourite plan how to keep Greece in the Eurozone.

-

10:51

Japan’s current account surplus climbs to ¥1,880.9 billion in May

Japan's Ministry of Finance released its current account data for Japan late Tuesday. Japan's current account surplus climbed to ¥1,880.9 billion in May from ¥1,326.4 billion in April, exceeding expectations for a surplus of ¥1,542 billion.

It was the fourth straight month that Japan posted an over ¥1 trillion surplus.

Japan benefits from a weaker yen.

Japan's trade balance deficit was ¥47.3 billion in May, after a deficit of ¥146.2 billion in the previous month. Exports fell at an annual rate of 0.1% in May, while imports dropped 10.3%.

-

10:37

International Monetary Fund: the U.S. economy could be hurt if Fed hikes its interest rates too early

The International Monetary Fund (IMF) said in its on Tuesday that the U.S. economy could be hurt if Fed hikes its interest rates too early. The IMF urged the Fed to delay its interest rate hike until 2016.

The Fed signalled that it is likely to start raising its interest rates in 2015.

"There is a strong case for waiting to raise rates until there are more tangible signs of wage or price inflation than are currently evident. Deferring rate increases and proceeding gradually thereafter would provide valuable insurance against the risks from disinflation, policy reversal, and ending back at a zero fed funds rate," the IMF noted.

-

10:17

Home prices in the U.S. increase 1.7% in May

According to the report from CoreLogic, home prices in the U.S. increased 1.7% in May. On a yearly basis, home prices jumped 6.3% in May.

"Mortgage rates on 30-year fixed-rate loans remained below 4% through May, helping to fuel home-purchase activity. Our homes-for-sale listing data shows that markets with high demand and limited supply, such as San Francisco, are recording double-digit appreciation rates over the past year," Chief Economist at CoreLogic Frank Nothaft said.

-

09:07

Oil: prices remain under pressure

West Texas Intermediate futures for August delivery fell to $51.70 (-1.20%); Brent crude declined to $56.23 (-1.09%) as concerns over Greece and selloff in Chinese stocks outweighed expectations for a further drop in U.S. crude oil inventories. The American Petroleum Institute (API) estimated an almost 960,000-barrel drop. Government data will be published this afternoon.

Meanwhile the U.S. Energy Information Administration reported Tuesday that U.S. production fell from a 44-year high in May and is expected to keep declining through February 2016. Despite declines in U.S. output the agency expects global supplies to exceed consumption in 2015 and 2016.

The deadline for a deal between Iran and global powers was extended to July 10. Expectations for more supplies from OPEC's fifth-largest producer weigh on crude prices.

-

09:04

Gold continued declining

Gold dropped to $1,150.10 (-0.22%) an ounce. The metal does not receive much support from Greece's situation despite that it's a traditional safe-haven asset at times of economic uncertainty. However it seems that this time investors favored sovereign debt. Strong dollar and possibility of a rate hike in the U.S. by the end of the year push bullion down. Minutes of the latest FOMC meeting will be published on Wednesday afternoon. Traders are waiting for it to find clues on the timing of the liftoff in Fed interest rates. Higher U.S. rates later this year would put additional pressure on non-interest-paying bullion.

Barclays analysts said that gold prices might experience their worst dynamics in the third quarter of 2015 as experts expect rates to be raised in September.

-

09:01

Global Stocks: stocks fell across Asia

U.S. stocks ended higher on Monday reversing earlier losses amid positive changes in commodity prices and news that euro zone leaders studied new proposals to provide Greece with emergency financing. Now Greece is about to reach July 20 deadline to make a €3.5 billion ($3.9 billion) bond repayment to the European Central Bank. At the same time sources reported that Greece has until Friday morning to present detailed reform proposals to open green light for a bailout deal by a Sunday summit.

The Dow Jones industrial average climbed 93.33 points, or 0.5%, to 17,776.91. The Standard & Poor's 500 index rose 12.58 points, or 0.6%, to 2,081.34. The Nasdaq composite inched up 5.52 points, or 0.1%, to 4,997.46.

Despite these gains indices are still significantly below their record highs seen in May because of recent events in Greece. Investors favored the relative safety of government debt.

In Asia this morning Hong Kong Hang Seng fell 4.21%, or 1,051.97 points, to 23,923.34. China Shanghai Composite Index dropped 4.14%, or 154.16 points, to 3,572.96. Meanwhile the Nikkei lost 2.55%, or 518.75 points, to 19,857.84.

Stocks dropped across Asia amid the ongoing selloff in Chinese markets and Greece's debt crisis.

-

08:57

Foreign exchange market. Asian session: the Australian dollar and the sterling declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan Eco Watchers Survey: Current June 53.3 53.2 51.0

05:00 Japan Eco Watchers Survey: Outlook June 54.5 53.5

The Australian dollar fell and hit a six-year low against the U.S. dollar amid declines in Chinese stocks and iron ore prices.

The pound continued falling against the dollar amid unexpected declines in UK manufacturing production. In May the corresponding index fell by 0.6% compared to the previous month.

The yen advanced against the dollar due to demand for this safe-haven currency as investors prefer not to take risks because of declines in Asian equities. However the pace of gains slowed down after the release of current account data. The report showed that the country's unadjusted current account rose to Y1,880.9 billion in May compared to Y1,326.4 billion reported previously. Economists expected a reading of Y1542 billion.

EUR/USD: the pair traded around $1.0975-15 in Asian trade

USD/JPY: the pair fell to Y121.95

GBP/USD: the pair fell to $1.5425

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Halifax house price index June -0.1%

07:00 United Kingdom Halifax house price index 3m Y/Y June 8.6%

09:00 Eurozone Eurogroup Meetings

11:00 U.S. MBA Mortgage Applications July -4.7%

11:30 United Kingdom Annual Budget Release

12:30 Canada Building Permits (MoM) May 11.6% -5.0%

14:30 U.S. Crude Oil Inventories July 2.386 -1

18:00 U.S. FOMC Member Williams Speaks

18:00 U.S. FOMC meeting minutes

23:50 Japan Core Machinery Orders, y/y May 3.0% 16.3%

23:50 Japan Core Machinery Orders May 3.8% -5%

-

08:19

Options levels on wednesday, July 8, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1219 (1876)

$1.1166 (894)

$1.1122 (440)

Price at time of writing this review: $1.1010

Support levels (open interest**, contracts):

$1.0941 (722)

$1.0918 (1006)

$1.0887 (1223)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 41484 contracts, with the maximum number of contracts with strike price $1,1500 (2920);

- Overall open interest on the PUT options with the expiration date August, 7 is 556445 contracts, with the maximum number of contracts with strike price $1,0800 (6464);

- The ratio of PUT/CALL was 1.36 versus 1.23 from the previous trading day according to data from July, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.5705 (860)

$1.5608 (1625)

$1.5512 (283)

Price at time of writing this review: $1.5455

Support levels (open interest**, contracts):

$1.5387 (1071)

$1.5291 (843)

$1.5194 (735)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 18686 contracts, with the maximum number of contracts with strike price $1,5750 (2713);

- Overall open interest on the PUT options with the expiration date August, 7 is 17853 contracts, with the maximum number of contracts with strike price $1,5250 (1853);

- The ratio of PUT/CALL was 0.96 versus 0.94 from the previous trading day according to data from July, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:01

Japan: Eco Watchers Survey: Current , June 51.0 (forecast 53.2)

-

07:01

Japan: Eco Watchers Survey: Outlook, June 53.5

-

04:01

Nikkei 225 20,062.4 -314.19 -1.54%, Hang Seng 24,097.49 -877.82 -3.51%, Shanghai Composite 3,545.06 -182.07 -4.88%

-

01:54

Japan: Current Account, bln, May 1880.9 (forecast 1542)

-

00:32

Commodities. Daily history for Jul 7’2015:

(raw materials / closing price /% change)

Oil 52.95 +1.18%

Gold 1,154.50 +0.16%

-

00:32

Stocks. Daily history for Jul 7’2015:

(index / closing price / change items /% change)

Nikkei 225 20,376.59 +264.47 +1.31%

Hang Seng 24,975.31 -260.97 -1.03%

Shanghai Composite 3,728.19 -47.72 -1.26%

FTSE 100 6,432.21 -103.47 -1.58%

CAC 40 4,604.64 -106.90 -2.27%

Xetra DAX 10,676.78 -213.85 -1.96%

S&P 500 2,081.34 +12.58 +0.61%

NASDAQ Composite 4,997.46 +5.52 +0.11%

Dow Jones 17,776.91 +93.33 +0.53%

-

00:31

Currencies. Daily history for Jul 7’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0997 -0,53%

GBP/USD $1,5456 -0,94%

USD/CHF Chf0,9466 +0,44%

USD/JPY Y122,45 -0,09%

EUR/JPY Y134,66 -0,62%

GBP/JPY Y189,25 -1,04%

AUD/USD $0,7443 -0,73%

NZD/USD $0,6643 -0,41%

USD/CAD C$1,2712 +0,53%

-