Noticias del mercado

-

17:41

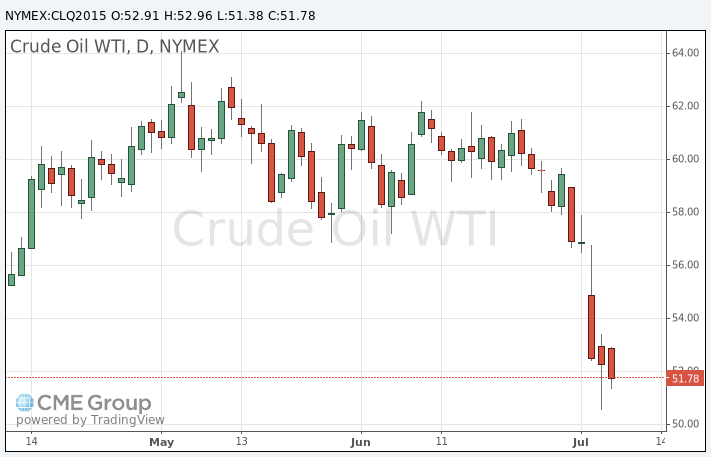

WTI crude oil price declines on the increase in U.S. crude oil inventories

WTI crude oil price declined on the increase in U.S. crude oil inventories. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 384,000 barrels to 465.8 million in the week to July 03.

Analysts had expected U.S. crude oil inventories to decline by 1 million barrels.

Gasoline inventories climbed by 1.2 million barrels to 218 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 299,000 barrels to 56.7 million barrels.

U.S. crude oil imports declined by 197,000 barrels per day.

Refineries in the U.S. were running at 94.7% of capacity, down from 95.0% the previous week.

The collapse in China's stock prices and the uncertainty over the Greek debt problem also weighed on oil prices.

Traders expect the results of talks on the Iranian nuclear program. Talks will continue until July 10. A deal could lead to a higher oil supply.

WTI crude oil for August delivery decreased to $51.38 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $57.17 a barrel on ICE Futures Europe.

-

17:20

Gold traded higher as investors focussed on the release of minutes of the Fed’s last monetary policy meeting

Gold traded higher as investors focussed on the release of minutes of the Fed's last monetary policy meeting. Market participants hope to find some signals when the Fed will start raising its interest rates.

The Greek debt crisis and a drop in the Chinese stock market also remained in focus.

Greece has submit a formal application for a three-year loan facility from the European Stability Mechanism (ESM) on Wednesday.

"The Loan will be used to meet Greece's debt obligations and to ensure stability of the financial system," Greek Finance Minister Euclid Tsakalotos said in the letter.

He did not mention the exact amount of the financial aid.

European Council President Donald Tusk said on Tuesday that just five days left for Greece to reach a deal with its creditors to save it from bankruptcy.

European Commission President Jean-Claude Juncker said on Tuesday that authorities are prepared for all outcomes of the negotiations with Greece about its debt crisis, including a scenario of the Greek exit from the Eurozone.

August futures for gold on the COMEX today rose to 1163.70 dollars per ounce.

-

16:58

U.S. crude inventories rise by 384,000 barrels to 465.8 million in the week to July 03

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 384,000 barrels to 465.8 million in the week to July 03.

Analysts had expected U.S. crude oil inventories to decline by 1 million barrels.

Gasoline inventories climbed by 1.2 million barrels to 218 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 299,000 barrels to 56.7 million barrels.

U.S. crude oil imports declined by 197,000 barrels per day.

Refineries in the U.S. were running at 94.7% of capacity, down from 95.0% the previous week.

-

09:07

Oil: prices remain under pressure

West Texas Intermediate futures for August delivery fell to $51.70 (-1.20%); Brent crude declined to $56.23 (-1.09%) as concerns over Greece and selloff in Chinese stocks outweighed expectations for a further drop in U.S. crude oil inventories. The American Petroleum Institute (API) estimated an almost 960,000-barrel drop. Government data will be published this afternoon.

Meanwhile the U.S. Energy Information Administration reported Tuesday that U.S. production fell from a 44-year high in May and is expected to keep declining through February 2016. Despite declines in U.S. output the agency expects global supplies to exceed consumption in 2015 and 2016.

The deadline for a deal between Iran and global powers was extended to July 10. Expectations for more supplies from OPEC's fifth-largest producer weigh on crude prices.

-

09:04

Gold continued declining

Gold dropped to $1,150.10 (-0.22%) an ounce. The metal does not receive much support from Greece's situation despite that it's a traditional safe-haven asset at times of economic uncertainty. However it seems that this time investors favored sovereign debt. Strong dollar and possibility of a rate hike in the U.S. by the end of the year push bullion down. Minutes of the latest FOMC meeting will be published on Wednesday afternoon. Traders are waiting for it to find clues on the timing of the liftoff in Fed interest rates. Higher U.S. rates later this year would put additional pressure on non-interest-paying bullion.

Barclays analysts said that gold prices might experience their worst dynamics in the third quarter of 2015 as experts expect rates to be raised in September.

-

00:32

Commodities. Daily history for Jul 7’2015:

(raw materials / closing price /% change)

Oil 52.95 +1.18%

Gold 1,154.50 +0.16%

-