Noticias del mercado

-

17:41

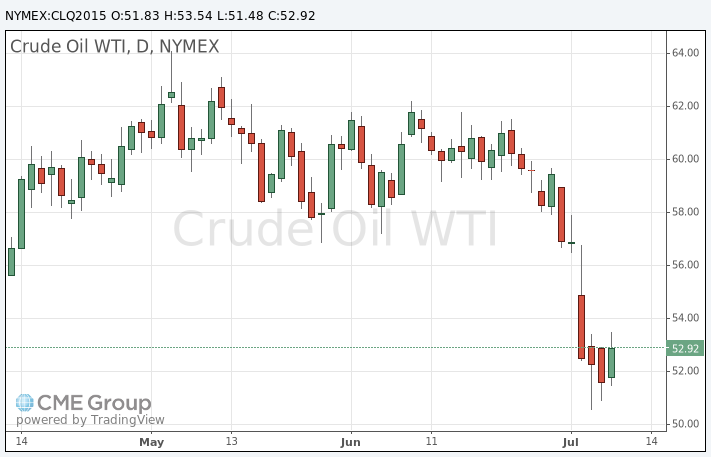

Oil price climb as the Chinese stock index Shanghai Composite rebounded

Oil price rose as the Chinese stock index Shanghai Composite rebounded due to measures taken by the Chinese government.

Stalled talks on the Iranian nuclear program also supported oil prices. Talks will continue until July 10. A deal could lead to a higher oil supply.

The Greek debt crisis remains in focus. Greek Prime Minister Alexis Tsipras promised on Wednesday that Athens will provide credible reform proposals on Thursday.

An emergency summit of all 28 European Union members is scheduled to take place on Sunday.

WTI crude oil for August delivery increased to $53.54 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $57.56 a barrel on ICE Futures Europe.

-

17:24

Gold traded higher on the weaker-than-expected U.S. economic data

Gold traded higher on the weaker-than-expected U.S. economic data. The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending July 04 in the U.S. increased by 15,000 to 297,000 from 282,000 in the previous week. The previous week's reading was revised down from 271,000.

Analysts had expected the number of initial jobless claims to be 275,000.

Jobless claims remained below 300,000 the 18th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims rose by 69,000 to 2,334,000 in the week ended June 27.

The Fed's minutes also supported gold. It is likely that the Fed will not raise its interest rates in September.

The Greek debt crisis and a drop in the Chinese stock market also remained in focus.

Greek Prime Minister Alexis Tsipras promised on Wednesday that Athens will provide credible reform proposals on Thursday.

An emergency summit of all 28 European Union members is scheduled to take place on Sunday.

August futures for gold on the COMEX today rose to 1166.90 dollars per ounce.

-

10:28

Chinese consumer price index rises at annual rate of 1.4% in June

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 1.4% in June, exceeding expectations for a 1.3% increase, after a 1.2% gain in May.

The increase was driven by rises in food and non-food prices. Food prices rose at an annual rate of 1.9% in June, while non-food prices increased 1.2%.

On a monthly basis, consumer price inflation was flat in June.

The Chinese producer price index (PPI) dropped 4.8% in June, missing forecasts of a 4.5% fall, after a 4.6% decline in May.

-

08:54

Oil: prices rebounded

West Texas Intermediate futures for August delivery rebounded to $52.52 (+1.68%); Brent crude advanced to $57.82 (+1.35%) after an Iranian diplomat hinted that investors might had been too sure of a deal. He said that Tehran would not be flexible regarding its "red lines".

Both crudes managed to advance despite Wednesday's data from the Energy Information Administration, which showed that crude inventories unexpectedly rose last week in the U.S.

Crude inventories rose by 384,000 barrels, compared with analysts' expectations for a decrease of 700,000 barrels. Crude stocks at the Cushing, Oklahoma, rose by 299,000 barrels. Gasoline stocks rose by 1.2 million barrels, compared with expectations for a 254,000 barrels drop. Distillate stockpiles, which include diesel and heating oil, rose by 1.6 million barrels, vs expectations for a 860,000 barrels gain. U.S. crude imports fell by 197,000 barrels per day.

-

08:52

Gold stayed near a four-month low

Gold is currently at $1,160.40 (-0.27%) an ounce. The metal failed to strengthen even after minutes of the latest FOMC meeting showed that policymakers need more signs of progress in the U.S. economy to justify the beginning of normalization of interest rates. At the same time the minutes indicated that policymakers still intend to raise rates this year.

Greece's crisis continues to play little part in bullion dynamics, although normally investors turn to gold at times of economic uncertainties.

-

00:33

Commodities. Daily history for Jul 8’2015:

(raw materials / closing price /% change)

Oil 51.80 +0.29%

Gold 1,157.50 -0.52%

-