Noticias del mercado

-

22:17

U.S. stocks closed

U.S. stocks advanced, after Chinese equities rebounded the most since 2009 and the Greek government faced a deadline for an economic plan to secure a new bailout.

The S&P 500 climbed as much as 1.4 percent today before giving up more than half its gains to trade near its average price during the past 200 days. Apple's 1.9 percent slide weighed on the major indexes.

The Greek government drafted a new proposal it hopes will convince creditors to let the country stay in the euro. The package of economic reforms and spending cuts is due to be submitted by midnight Brussels time. The proposals are set to be discussed by European Union leaders Sunday to determine whether the country will get a new bailout, or be forced to leave the single currency.

In China, stocks halted a rout to post the biggest gain since 2009 amid volatile trading. Regulators banned major stockholders from selling stakes, with more than half the country's listed companies suspended from trading.

Greece's financial crisis and China's equity market turmoil have diverted attention from U.S. economic data and the path of the Federal Reserve's monetary policy, as investors grow concerned about global growth. The S&P 500 is down 3.8 percent since its May record, and 0.4 percent for the year.

The International Monetary Fund today cut its forecast for global growth this year, citing a weaker first quarter in the U.S. and expressed confidence financial-market turbulence from China to Greece won't cause widespread damage.

Minutes of the Federal Reserve's June meeting, released Wednesday, signaled that officials saw improving economic conditions warranting tighter monetary policy, but expressed concerns on the overseas risks.

Investors will get further clues on the Fed's outlook when Chair Janet Yellen speaks on Friday. Fed officials in June forecast they would raise rates twice this year, signaling that September is the most likely month for liftoff, while lowering their outlook for subsequent increases.

Data today showed more Americans than forecast filed for unemployment benefits last week, representing a pause in the pace of labor-market improvement. Applications for benefits have been below 300,000 for 18 straight weeks, the longest stretch since 2000.

Quarterly earnings will become a more prominent focus for investors in the coming weeks, after Alcoa Inc. unofficially kicked off the reporting season yesterday. JPMorgan Chase & Co. and Wells Fargo & Co. are among S&P 500 firms reporting results next week. Analysts project earnings for companies on the gauge dropped 6.5 percent in the second-quarter.

-

21:01

S&P 500 2,053.12 +6.44 +0.3 %, NASDAQ 4,928.21 +18.45 +0.4 %, Dow 17,570.07 +54.65 +0.3 %

-

18:30

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday as trading returned to normal at the New York Stock Exchange and Beijing's efforts to halt a rout in Chinese stocks lifted markets around the world. U.S. stocks had fallen sharply on Wednesday as market turmoil in China, a rout in commodity prices, the Greek crisis and a major outage on the New York Stock Exchange spooked investors. While the NYSE resumed operations late in the trading day on Wednesday, all eyes were on the exchange to see if its systems would withstand heavy opening trade volumes.

Almost of Dow stocks in positive area (26 of 30). Top looser - Intel Corporation (INTC, -0.82%). Top gainer - The Travelers Companies, Inc. (TRV, +1.95).

Most of S&P index sectors in positive area. Top looser - Utilities (-0.3%). Top gainer - Healthcare (+1.2%).

At the moment:

Dow 17554.00 +112.00 +0.64%

S&P 500 2054.50 +15.25 +0.75%

Nasdaq 100 4378.25 +31.75 +0.73%

Oil 51.38 -0.95 -1.82%

Oil 52.98 +1.33 +2.58%

Gold 1160.30 -3.20 -0.28%

-

18:00

European stocks closed: FTSE 100 6,581.63 +90.93 +1.40 %, CAC 40 4,757.22 +118.20 +2.55 %, DAX 10,996.41 +249.11 +2.32 %

-

18:00

European stocks close: stocks closed higher on hopes for a deal between Athens and its lenders

Stock indices closed higher on hopes for a deal between Athens and its lenders. Greek Prime Minister Alexis Tsipras promised on Wednesday that Athens will provide credible reform proposals on Thursday.

An emergency summit of all 28 European Union members is scheduled to take place on Sunday.

Greece has submit a formal application for a three-year loan facility from the European Stability Mechanism (ESM) on Wednesday.

Meanwhile, the economic data from the Eurozone was better than expected. Germany's seasonally adjusted trade surplus increased to €22.8 billion in May from €21.5 billion in April, beating expectations for a decline to €21 billion. April's figure was revised down from a surplus of €22.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.7% in May, while imports rose 0.4%.

On an annual basis, exports were up 4.6% in May, while imports increased 3.0%.

Germany's current account surplus was at €11.6 billion in May.

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

The minutes of the meeting will be released on July 22.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,581.63 +90.93 +1.40 %

DAX 10,996.41 +249.11 +2.32 %

CAC 40 4,757.22 +118.20 +2.55 %

-

17:55

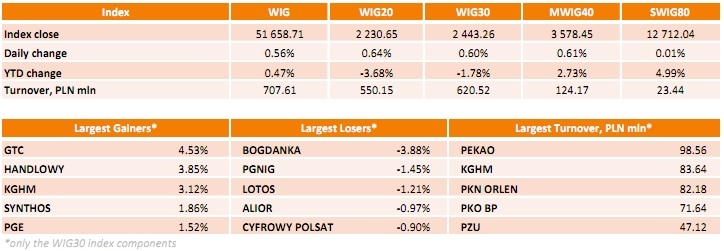

WSE: Session Results

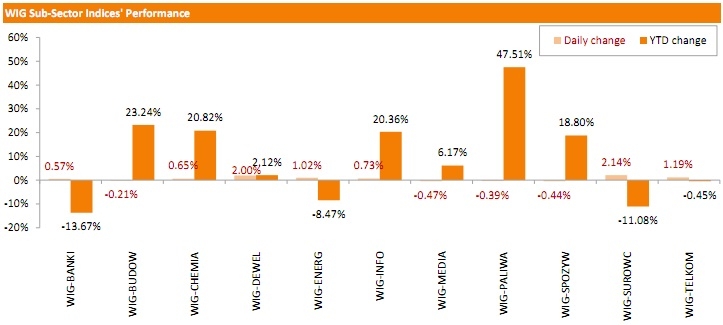

Polish equity market appreciated on Thursday. The broad measure, the WIG index, recorded a 0.56% uptick. Sector-wise, materials sector became the best performer, gaining 2.14%. On the contrary, media sector was the biggest laggard, losing 0.47%.

The large-cap stocks advanced 0.6%, as measured by the WIG30 Index. GTC (WSE: GTC) led the pack up, rising 4.53%. It was followed by HANDLOWY (WSE: BHW) and KGHM (WSE: KGH), gaining 3.85% and 3.12% respectively. On the other side of the ledger, BOGDANKA (WSE: LWB) posted the sharpest decline, sliding down 3.88 %. The other notable losers were PGNIG (WSE: PGN) and LOTOS (WSE: LTS), plunging 1.45% and 1.21% respectively.

-

17:17

International Monetary Fund Managing Director Christine Lagarde debt restructuring has to be part of new bailout programme to keep Greece in the Eurozone

International Monetary Fund Managing Director Christine Lagarde said on Wednesday that debt restructuring has to be part of new bailout programme to keep Greece in the Eurozone.

"One leg is about significant reforms and fiscal consolidation ... And the other leg is debt restructuring, which we believe is needed in the particular case of Greece for it to have debt sustainability," she said.

-

17:08

European Council President Donald Tusk hopes the Greek reform plans would be concrete and realistic

European Council President Donald Tusk said on Thursday that he hoped the Greek reform plans would be concrete and realistic.

"The realistic proposal from Greece will have to be matched by an equally realistic proposal on debt sustainability from the creditors. Only then will we have a win-win situation. Otherwise, we will continue the lethargic dance we have been dancing for the past five months," he said.

-

17:03

European Central Bank Governing Council Member Ardo Hansson: the central bank is ready to implement policy measures if Greece leaves the Eurozone

European Central Bank (ECB) Governing Council Member Ardo Hansson said on Thursday that the central bank is ready to implement policy measures if Greece leaves the Eurozone.

"We are forced to deal with this possibility more and more because the probability of such a scenario has, unfortunately, increased over time. We can use a wide range of non-standard monetary policy measures and close cooperation with other central banks. We are prepared to implement these capabilities if needed," he said.

-

16:52

European Central Bank Governing Council Member Jens Weidmann: the ECB should not expand emergency funding (ELA) if there is no baoilout programme

European Central Bank (ECB) Governing Council Member Jens Weidmann said on Thursday that the ECB should not expand emergency funding (ELA) if there is no baoilout programme.

"The Eurosystem should not increase the liquidity provision, and capital controls need to stay in force until an appropriate support package has been agreed by all parties and the solvency of both the Greek government and the Greek banking system has been ensured. ELA is no longer being used to finance capital flight. This certainly represents a step forward, and shifts the responsibility to where it belongs: with the governments and parliaments," he said.

Weidmann added that fiscal policy makers are responsible for providing any short-term assistance to Greece.

-

16:38

German Chancellor Angela Merkel rejects any debt cut for Greece

German Chancellor Angela Merkel rejected any debt cut for Greece on Thursday.

"A classic haircut is out of the question for me. That hasn't changed between the day before yesterday and today," she said.

-

16:18

European Central Bank President Mario Draghi expressed concerns the Greek debt crisis can be resolved

European Central Bank President Mario Draghi expressed concerns on Wednesday that the Greek debt crisis can be resolved. He also said that he did not believe that Russia will provide financial help for Greece.

-

16:05

International Monetary Fund’s World Economic Outlook: the lender cuts its global growth forecast for 2015 to 3.3% in 2015

The International Monetary Fund (IMF) released its World Economic Outlook on Thursday. The IMF lowered its global economic growth forecasts due to a weaker first quarter in the U.S.

The global economy will expand by 3.3% in 2015, down from the previous forecast of 3.5%, according to the IMF.

The IMF cut its growth forecasts in advanced economies to 2.1% in 2015, down from 2.4%, while emerging markets expected to expand 4.2%, down from 4.3%.

The lender kept unchanged its growth forecast for the Eurozone for 2015 at 1.5%, saying that "developments in Greece have, so far, not resulted in any significant contagion".

The U.S. economic growth forecast for 2015 was cut to 2.5% from 3.1%, noting that the U.S. economic slowdown spilled over to Canada and Mexico.

The IMF urged economies to implement structural reforms.

-

15:43

Greek unemployment rate declines to 25.6% in April, the lowest level since August 2012

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 25.6% in April from 25.8% in March.

It was the lowest level since August 2012.

The number of unemployed fell to 1.216 million in April from 1.295 million a year ago.

The youth unemployment rate was 53.2% in April.

-

15:36

U.S. Stocks open: Dow +1.34%, Nasdaq +1.46%, S&P +1.33%

-

15:29

Before the bell: S&P futures +1.14%, NASDAQ futures +1.16%

U.S. stock-index futures rose as Chinese stocks staged their biggest rebound since 2009, easing at least for the moment concern that the world's second-largest economy is headed for a slump that not even policy makers can prevent.

Nikkei 19,855.5 +117.86 +0.60%

Hang Seng 24,392.79 +876.23 +3.73%

Shanghai Composite 3,710.27 +203.07 +5.79%

FTSE 6,584.5 +93.80 +1.45%

CAC 4,755.12 +116.10 +2.50%

DAX 10,987.26 +239.96 +2.23%

Crude oil $53.29 (+3.16%)

Gold $1164.20 (+0.06%)

-

15:24

Bank of England keeps its interest rate on hold at 0.5% in July

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

The minutes of the meeting will be released on July 22.

All members voted in June to keep the central bank's monetary policy unchanged, according to MPC's meeting minutes.

-

15:03

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

HONEYWELL INTERNATIONAL INC.

HON

101.36

+0.39%

0.1K

ALCOA INC.

AA

10.56

+0.57%

162.6K

Deere & Company, NYSE

DE

95.50

+0.57%

2.0K

McDonald's Corp

MCD

96.47

+0.66%

0.2K

ALTRIA GROUP INC.

MO

51.41

+0.74%

0.8K

Intel Corp

INTC

29.74

+0.81%

6.4K

Wal-Mart Stores Inc

WMT

73.70

+0.88%

0.3K

AT&T Inc

T

35.10

+0.89%

11.9K

Nike

NKE

110.26

+0.91%

2.4K

Johnson & Johnson

JNJ

98.70

+0.95%

2.8K

Walt Disney Co

DIS

116.30

+0.96%

15.2K

General Electric Co

GE

26.14

+0.97%

19.0K

FedEx Corporation, NYSE

FDX

168.64

+0.99%

0.2K

Hewlett-Packard Co.

HPQ

30.75

+0.99%

0.3K

Exxon Mobil Corp

XOM

82.80

+1.01%

23.9K

Verizon Communications Inc

VZ

47.05

+1.01%

0.9K

Apple Inc.

AAPL

123.88

+1.07%

323.9K

Home Depot Inc

HD

112.20

+1.08%

1.9K

Google Inc.

GOOG

522.43

+1.08%

0.4K

Starbucks Corporation, NASDAQ

SBUX

53.97

+1.09%

9.5K

International Business Machines Co...

IBM

165.00

+1.13%

1.0K

Amazon.com Inc., NASDAQ

AMZN

434.54

+1.13%

0.5K

Facebook, Inc.

FB

86.66

+1.18%

93.1K

Caterpillar Inc

CAT

83.25

+1.19%

0.4K

Visa

V

67.55

+1.22%

4.0K

Chevron Corp

CVX

94.70

+1.22%

3.9K

Goldman Sachs

GS

206.66

+1.27%

14.5K

Ford Motor Co.

F

14.56

+1.32%

22.0K

The Coca-Cola Co

KO

40.40

+1.35%

12.8K

Travelers Companies Inc

TRV

100.10

+1.36%

1.2K

Citigroup Inc., NYSE

C

53.52

+1.36%

30.8K

Microsoft Corp

MSFT

44.85

+1.37%

27.3K

AMERICAN INTERNATIONAL GROUP

AIG

62.00

+1.37%

0.9K

JPMorgan Chase and Co

JPM

66.34

+1.39%

0.4K

Barrick Gold Corporation, NYSE

ABX

10.45

+1.46%

6.6K

Boeing Co

BA

144.00

+1.47%

2.5K

Cisco Systems Inc

CSCO

27.39

+1.48%

3.9K

General Motors Company, NYSE

GM

31.68

+1.57%

34.7K

Twitter, Inc., NYSE

TWTR

35.32

+1.61%

49.6K

E. I. du Pont de Nemours and Co

DD

59.18

+1.75%

0.8K

Procter & Gamble Co

PG

82.55

+1.93%

0.2K

Yahoo! Inc., NASDAQ

YHOO

38.19

+2.58%

47.1K

Tesla Motors, Inc., NASDAQ

TSLA

261.79

+2.68%

18.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

17.27

+4.67%

32.8K

-

15:03

Canada’s new housing price index climbs 0.2% in May

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.2% in May, exceeding expectations of a 0.1% gain, after a 0.1% rise in April.

The increase was driven by gains in Toronto.

On a yearly basis, new housing price index in Canada climbed 1.2% in May.

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Travelers (TRV) upgraded to Buy from Neutral at BofA/Merrill, target lowered to $110 from $112

Downgrades:

Other:

-

14:49

Company News: PepsiCo (PEP) reported better then expected EPS and revenue

Company reported Q2 profit of $1.32 per share versus $1.24 consensus. Revenues fell 5.7% year/year to $15.92 bln versus $15.84 bln consensus.

PEP rose to $98.00 (+2.50%) on the premarket.

-

14:45

Initial jobless claims climb by 15,000 to 297,000 in the week ending July 04

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending July 04 in the U.S. increased by 15,000 to 297,000 from 282,000 in the previous week. The previous week's reading was revised down from 271,000.

Analysts had expected the number of initial jobless claims to be 275,000.

Jobless claims remained below 300,000 the 18th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims rose by 69,000 to 2,334,000 in the week ended June 27.

-

14:28

Housing starts in Canada declines to a seasonally adjusted annualized rate of 202,818 units in June

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Thursday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 202,818 units in June from a revised reading of 196,981 units in May. May's figure was revised down from 201,705 units.

The increase was driven by higher multiple starts.

"The trend in housing starts increased this month as multiple starts trended upward, offsetting a downward trend in single-detached home starts. The rise in the trend of multiple starts reflects a 53% increase in seasonally adjusted multiple starts from February to June 2015. Seasonally adjusted multiple starts are at their highest level since September 2012, but are expected to moderate over the coming months," the CMHC's Chief Economist Bob Dugan said.

-

12:00

European stock markets mid session: stocks traded higher on hopes for a deal between Athens and its lenders

Stock indices traded higher on hopes for a deal between Athens and its lenders. Speaking in in the European Parliament, Greek Prime Minister Alexis Tsipras promised on Wednesday that Athens will provide credible reform proposals on Thursday.

An emergency summit of all 28 European Union members is scheduled to take place on Sunday.

Greece has submit a formal application for a three-year loan facility from the European Stability Mechanism (ESM) on Wednesday.

"The Loan will be used to meet Greece's debt obligations and to ensure stability of the financial system," Greek Finance Minister Euclid Tsakalotos said in the letter.

He did not mention the exact amount of the financial aid.

Meanwhile, the economic data from the Eurozone was better than expected. Germany's seasonally adjusted trade surplus increased to €22.8 billion in May from €21.5 billion in April, beating expectations for a decline to €21 billion. April's figure was revised down from a surplus of €22.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.7% in May, while imports rose 0.4%.

On an annual basis, exports were up 4.6% in May, while imports increased 3.0%.

Germany's current account surplus was at €11.6 billion in May.

Current figures:

Name Price Change Change %

FTSE 100 6,551.21 +60.51 +0.93 %

DAX 10,926.56 +179.26 +1.67 %

CAC 40 4,724.4 +85.38 +1.84 %

-

11:42

Germany's seasonally adjusted trade surplus increases to €22.8 billion in May

Destatis released its trade data for Germany on Thursday. Germany's seasonally adjusted trade surplus increased to €22.8 billion in May from €21.5 billion in April. April's figure was revised down from a surplus of €22.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.7% in May, while imports rose 0.4%.

On an annual basis, exports were up 4.6% in May, while imports increased 3.0%.

Germany's current account surplus was at €11.6 billion in May.

-

11:29

FOMC’s June minutes: most Fed officials noted that the conditions for tightening monetary policy had not yet been achieved

The Federal Reserve released its June monetary policy meeting minutes on Wednesday. Most members noted that the conditions for tightening monetary policy had not yet been achieved. They noted that they need more information indicating that economic growth was strengthening, that labour market conditions were continuing to improve, and that inflation was moving back toward the Committee's objective".

Members expressed worries that a failure to reach a deal between Greece and its creditors "could result in disruptions in financial markets in the euro area, with possible spillover effects on the United States," the minutes said.

-

11:14

European Central Bank decides not to raise the amount of emergency funding (ELA) on Wednesday

The European Central Bank (ECB) decided not to raise the amount of emergency funding (ELA) on Wednesday. The amount the Greek central bank can lend its banks totals around €88.6 billion.

The ECB wants to await the outcome this weekend's talks on Greece. The central bank will discuss emergency liquidity assistance (ELA) to Greek banks on Monday.

It is likely that Greek banks remain closed.

-

11:03

France could lose €65 billion in case of a Greek default

The Senate's finance commission said on Wednesday that France could lose €65 billion in case of a Greek default.

"Our country's total exposure to a possible Greek default represents around 65 billion euros, well above the 40 billion euros usually cited," Senator Alberic de Montgolfier said in a statement.

-

10:54

OECD’s composite leading indicator declines to 100.0 in May

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Wednesday. The composite leading indicator fell to 100.0 in May from 100.1 in April.

It signalled stable growth in Germany, Japan and India.

There were signs of positive growth momentum in the Eurozone, especially in France and Italy.

The index for the U.S., the U.K. and China pointed to an easing in growth momentum.

The index for Russia showed signs of positive change in growth momentum.

-

10:43

Australia's unemployment rate is up to 6.0% in June

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.0% in June from 5.9% in May, beating expectations for an increase to 6.1%. May's figure was revised down from 6.0%.

The number of employed people in Australia climbed by 7,300 in June, beating forecast of a decline by 5,000, after a gain by 39,900 in May. May's figure was revised down from a rise by 42,000.

Full-time employment rose by 24,500, while part-time employment declined by 17,200.

The participation rate was 64.8%.

-

10:28

Chinese consumer price index rises at annual rate of 1.4% in June

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 1.4% in June, exceeding expectations for a 1.3% increase, after a 1.2% gain in May.

The increase was driven by rises in food and non-food prices. Food prices rose at an annual rate of 1.9% in June, while non-food prices increased 1.2%.

On a monthly basis, consumer price inflation was flat in June.

The Chinese producer price index (PPI) dropped 4.8% in June, missing forecasts of a 4.5% fall, after a 4.6% decline in May.

-

10:14

Consumer credit in the U.S. climbs by $16.1 billion in May

The Fed released its consumer credits figures on Wednesday. Consumer credit in the U.S. rose by $16.1 billion in May, after a $21.4 billion gain April.

April's figure was revised down from a $20.54 billion rise.

The increase was driven by a gain in non-revolving credit. Revolving credit climbed by $14.5 billion in May, while non-revolving credit rose by $1.6 billion.

-

08:49

Global Stocks: Chinese stocks advanced

U.S. stocks ended lower on Wednesday amid continuous declines in Asian stocks and concerns over Greece. Stocks traded lower throughout the session, especially after trading on the New York Stock Exchange was suspended for three-and-a-half hours. Traders generally ignored the release of Fed meeting minutes.

The Dow Jones Industrial Average dropped 261.49 points, or 1.5%, to 17,515.42 (its lowest closing level since February). The S&P 500 fell 34.65 points, or 1.7%, to close at 2,046.69 (the lowest closing level since March). All 10 main sectors of the index finished lower. The Nasdaq Composite declined 87.70 points, or 1.8% to 4,909.76.

In Asia this morning Hong Kong Hang Seng gained 3.43%, or 805.67.97 points, to end 24,322.23. China Shanghai Composite Index rose 1.30%, or 45.58 points, to 3,552.78. Meanwhile the Nikkei lost 1.25%, or 247.65 points, to 19,489.99.

Chinese stocks rebounded. Late on Wednesday in an attempt to halt a plunge in stock prices the country's securities regulator ordered shareholders with stakes of more than 5% not to sell shares for the next six months. Investors' fears related to sharp declines in Chinese equities started to fade. Traders started buying stocks, which had lost much of their price, expecting recent steps by the government to help stabilize markets.

-

04:03

Nikkei 225 19,602.21 -135.43 -0.69%, Hang Seng 24,191.48 +674.92 +2.87%, Shanghai Composite 3,518.76 +11.57 +0.33%

-

00:33

Stocks. Daily history for Jul 8’2015:

(index / closing price / change items /% change)

Nikkei 225 19,737.64 -638.95 -3.14%

Hang Seng 23,516.56 -1,458.75 -5.84%

S&P/ASX 200 5,469.53 -111.89 -2.00%

Shanghai Composite 3,506.78 -220.35 -5.91%

FTSE 100 6,490.7 +58.49 +0.91%

CAC 40 4,639.02 +34.38 +0.75%

Xetra DAX 10,747.3 +70.52 +0.66%

S&P 500 2,046.68 -34.66 -1.67%

NASDAQ Composite 4,909.76 -87.70 -1.75%

Dow Jones 17,515.42 -261.49 -1.47%

-