Noticias del mercado

-

20:20

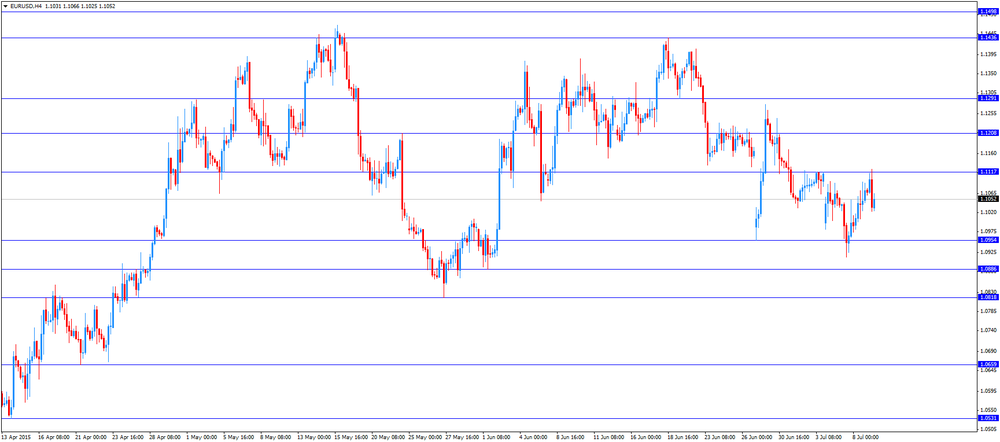

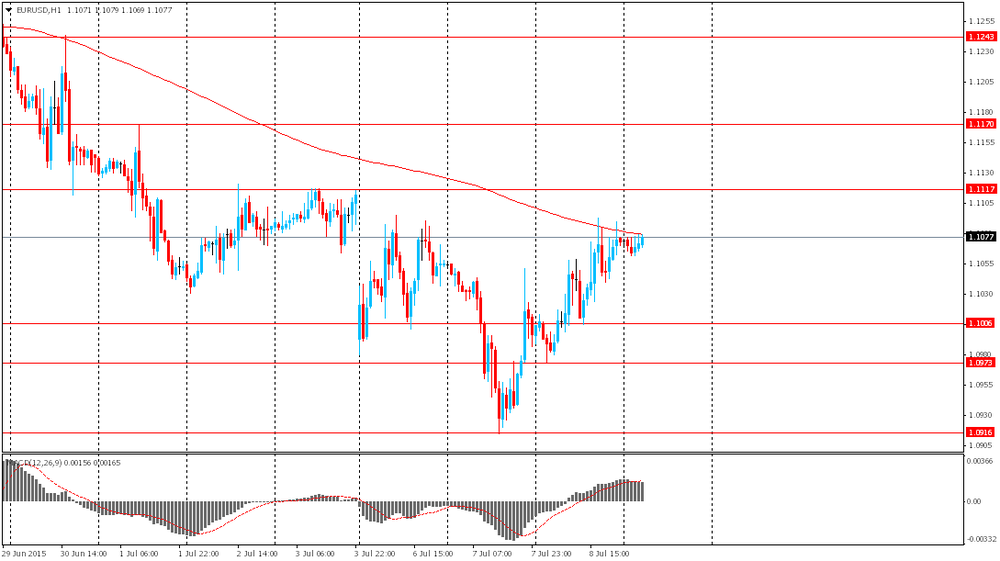

American focus: the euro weakened

The euro fell sharply against the dollar, approaching yesterday's lows. Markets continue to monitor news from Greece. Today, Prime Minister Tsipras was to submit new proposals to be considered by the authorities of the EU, and then can be finally agreed at the EU summit on Sunday. A little influenced by data for Germany. Statupravleniya Destatis said that German exports unexpectedly rose in May, accelerating at the same rate of increase compared with the previous months. The report said that exports rose in May by 1.7 percent, despite the expectations of the experts on the 0.8 percent decline. Last growth rate was the highest since the beginning of the year. Recall, according to the results of April, exports increased by 1.6 percent. At the same time, imports jumped in May by 0.4 percent, compared with a fall of 0.8 percent in April. Economists had expected that imports will grow by only 0.1 percent. As a result, the trade surplus increased to a seasonally adjusted 22.8 billion. Euros from 21.5 billion. Euros in April. In annual terms, growth in exports slowed in May to 4.6 percent from 7.6 percent the previous month. Imports, meanwhile, grew by 3 percent compared to 3.3 percent in April. In unadjusted basis, the trade surplus amounted to 19.5 billion. Euros, which was more than in the same period last year (17.5 billion. Euros), but lower than the forecasts of experts at the level of 20.5 billion. Euro. We also learned that the current account surplus amounted to 11.1 billion. Euros compared to 11.9 billion. Euros in May 2014. Economists had forecast that the surplus of 16 bn. Euros.

Meanwhile, investors took a wait after Greece requested on Wednesday a new three-year lending program and promised some economic reforms.

Satisfied with the European leaders of Greece's request for an extension of emergency lending crisis summit on Sunday, will depend, to decide whether Prime Minister Alexis Tsipras pension cuts, tax increases and other austerity measures after five months of negotiations.

German Finance Minister Wolfgang Schaeuble said that "immediate consideration will begin only after will be a complete package of reforms."

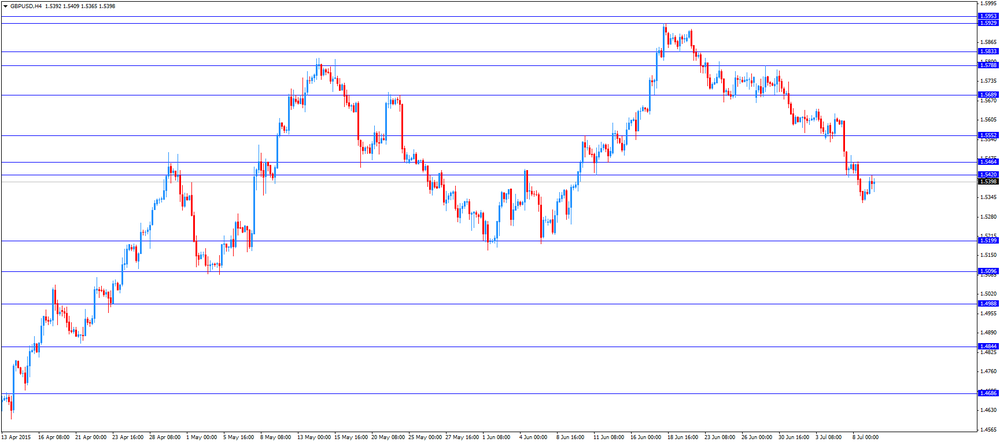

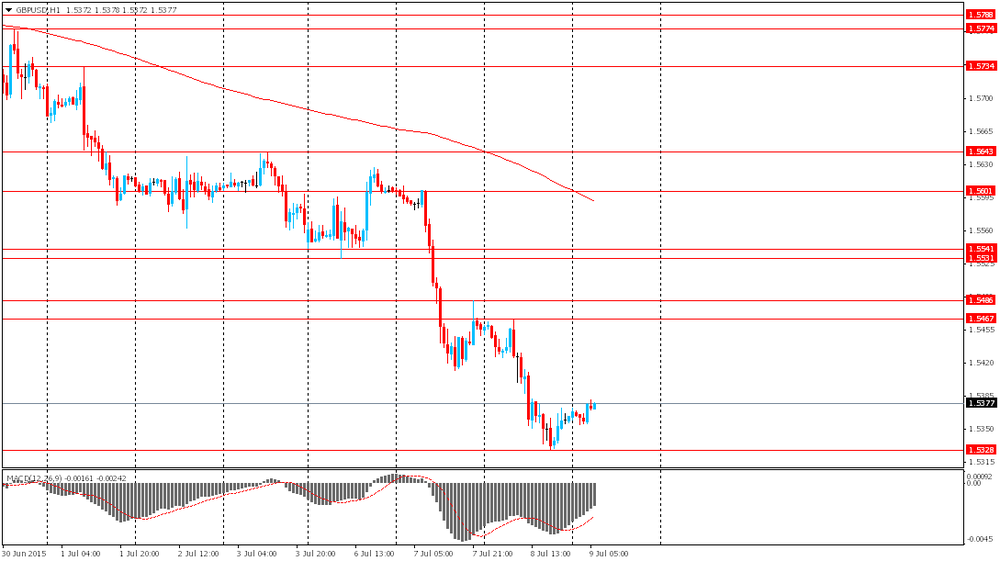

The pound fell against the dollar, little impact on the bidding had a decision on monetary policy the Bank of England. As expected, it left rates unchanged (at 0.5%) and a program of asset purchases (375 billion. Lbs). Traders also drew attention to the results of the survey of the Royal Institution of Chartered Surveyors (RICS), which showed that UK house prices rose in June, the fastest pace in the last eleven months. According to the report, the monthly house price balance rose to 40 in June to 34 in May. Experts expect that figure to grow only up to June 36. The growth rate was the highest since July 2014.

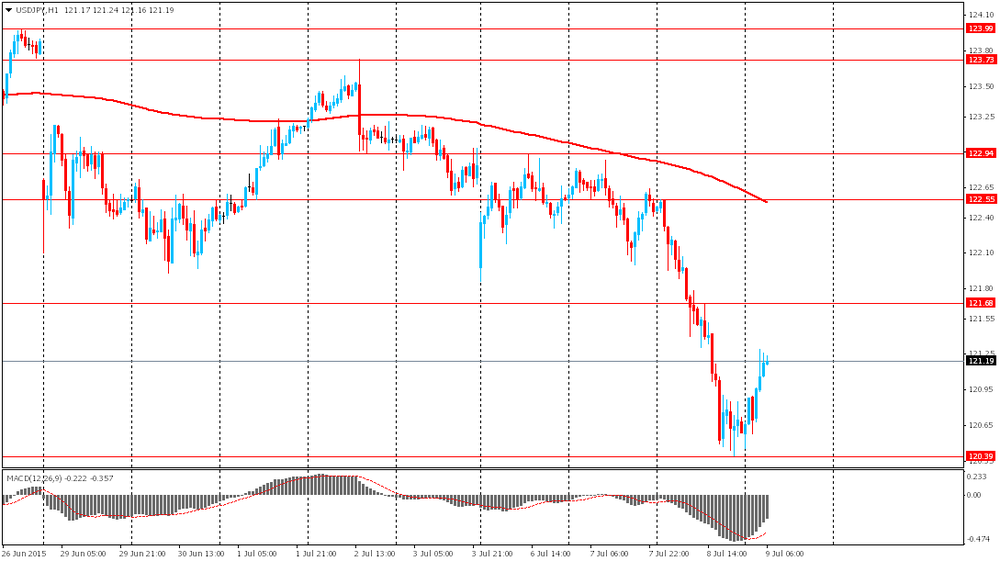

The US dollar rose against the yen, rising to a six-week low of the previous session, as the Chinese stock markets rose sharply on Thursday morning, weakening demand for safe-haven assets.

The Chinese stock market fell on Wednesday, despite the fresh government measures to stabilize the market to strengthen investor confidence.

Sales increased on concerns about a slowdown in the second largest in the world economy and concerns about risks to the financial stability of the turmoil in the market.

On Thursday, the US Labor Department reported that the number of initial applications for unemployment benefits in the week ending 4 July increased by 15,000 to 297,000 from 282,000 the previous week. Analysts had expected last week, the number of appeals will be reduced by 7,000 to 275,000.

The dollar weakened slightly after the minutes of the June meeting of the Federal Reserve, released on Wednesday, showed that members of the committee want to see more signs of US economic recovery before you start lifting interest rates.

The minutes also indicate concern about the financial crisis in Greece, noting that in the case of a chain reaction in the global market crisis could disrupt plans for the Fed to raise rates.

-

17:17

International Monetary Fund Managing Director Christine Lagarde debt restructuring has to be part of new bailout programme to keep Greece in the Eurozone

International Monetary Fund Managing Director Christine Lagarde said on Wednesday that debt restructuring has to be part of new bailout programme to keep Greece in the Eurozone.

"One leg is about significant reforms and fiscal consolidation ... And the other leg is debt restructuring, which we believe is needed in the particular case of Greece for it to have debt sustainability," she said.

-

17:08

European Council President Donald Tusk hopes the Greek reform plans would be concrete and realistic

European Council President Donald Tusk said on Thursday that he hoped the Greek reform plans would be concrete and realistic.

"The realistic proposal from Greece will have to be matched by an equally realistic proposal on debt sustainability from the creditors. Only then will we have a win-win situation. Otherwise, we will continue the lethargic dance we have been dancing for the past five months," he said.

-

17:03

European Central Bank Governing Council Member Ardo Hansson: the central bank is ready to implement policy measures if Greece leaves the Eurozone

European Central Bank (ECB) Governing Council Member Ardo Hansson said on Thursday that the central bank is ready to implement policy measures if Greece leaves the Eurozone.

"We are forced to deal with this possibility more and more because the probability of such a scenario has, unfortunately, increased over time. We can use a wide range of non-standard monetary policy measures and close cooperation with other central banks. We are prepared to implement these capabilities if needed," he said.

-

16:52

European Central Bank Governing Council Member Jens Weidmann: the ECB should not expand emergency funding (ELA) if there is no baoilout programme

European Central Bank (ECB) Governing Council Member Jens Weidmann said on Thursday that the ECB should not expand emergency funding (ELA) if there is no baoilout programme.

"The Eurosystem should not increase the liquidity provision, and capital controls need to stay in force until an appropriate support package has been agreed by all parties and the solvency of both the Greek government and the Greek banking system has been ensured. ELA is no longer being used to finance capital flight. This certainly represents a step forward, and shifts the responsibility to where it belongs: with the governments and parliaments," he said.

Weidmann added that fiscal policy makers are responsible for providing any short-term assistance to Greece.

-

16:38

German Chancellor Angela Merkel rejects any debt cut for Greece

German Chancellor Angela Merkel rejected any debt cut for Greece on Thursday.

"A classic haircut is out of the question for me. That hasn't changed between the day before yesterday and today," she said.

-

16:18

European Central Bank President Mario Draghi expressed concerns the Greek debt crisis can be resolved

European Central Bank President Mario Draghi expressed concerns on Wednesday that the Greek debt crisis can be resolved. He also said that he did not believe that Russia will provide financial help for Greece.

-

16:05

International Monetary Fund’s World Economic Outlook: the lender cuts its global growth forecast for 2015 to 3.3% in 2015

The International Monetary Fund (IMF) released its World Economic Outlook on Thursday. The IMF lowered its global economic growth forecasts due to a weaker first quarter in the U.S.

The global economy will expand by 3.3% in 2015, down from the previous forecast of 3.5%, according to the IMF.

The IMF cut its growth forecasts in advanced economies to 2.1% in 2015, down from 2.4%, while emerging markets expected to expand 4.2%, down from 4.3%.

The lender kept unchanged its growth forecast for the Eurozone for 2015 at 1.5%, saying that "developments in Greece have, so far, not resulted in any significant contagion".

The U.S. economic growth forecast for 2015 was cut to 2.5% from 3.1%, noting that the U.S. economic slowdown spilled over to Canada and Mexico.

The IMF urged economies to implement structural reforms.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.05bn), $1.1050(E500mn), $1.1100(E1.35bn)

USD/JPY: Y121.00($1.54bn), Y122.00($680mn)

EUR/JPY: Y136.00(E450mn)

GBP/USD: $1.5370(Gbp250mn)

AUD/USD: $0.7380(A$200mn), $0.7500(A$394mn)

USD/CAD: C$1.2550($650mn)

-

15:43

Greek unemployment rate declines to 25.6% in April, the lowest level since August 2012

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 25.6% in April from 25.8% in March.

It was the lowest level since August 2012.

The number of unemployed fell to 1.216 million in April from 1.295 million a year ago.

The youth unemployment rate was 53.2% in April.

-

15:24

Bank of England keeps its interest rate on hold at 0.5% in July

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

The minutes of the meeting will be released on July 22.

All members voted in June to keep the central bank's monetary policy unchanged, according to MPC's meeting minutes.

-

15:03

Canada’s new housing price index climbs 0.2% in May

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.2% in May, exceeding expectations of a 0.1% gain, after a 0.1% rise in April.

The increase was driven by gains in Toronto.

On a yearly basis, new housing price index in Canada climbed 1.2% in May.

-

14:45

Initial jobless claims climb by 15,000 to 297,000 in the week ending July 04

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending July 04 in the U.S. increased by 15,000 to 297,000 from 282,000 in the previous week. The previous week's reading was revised down from 271,000.

Analysts had expected the number of initial jobless claims to be 275,000.

Jobless claims remained below 300,000 the 18th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims rose by 69,000 to 2,334,000 in the week ended June 27.

-

14:30

Canada: New Housing Price Index, MoM, May 0.2% (forecast 0.1%)

-

14:30

U.S.: Initial Jobless Claims, July 297 (forecast 275)

-

14:30

U.S.: Continuing Jobless Claims, June 2334 (forecast 2248)

-

14:28

Housing starts in Canada declines to a seasonally adjusted annualized rate of 202,818 units in June

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Thursday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 202,818 units in June from a revised reading of 196,981 units in May. May's figure was revised down from 201,705 units.

The increase was driven by higher multiple starts.

"The trend in housing starts increased this month as multiple starts trended upward, offsetting a downward trend in single-detached home starts. The rise in the trend of multiple starts reflects a 53% increase in seasonally adjusted multiple starts from February to June 2015. Seasonally adjusted multiple starts are at their highest level since September 2012, but are expected to moderate over the coming months," the CMHC's Chief Economist Bob Dugan said.

-

14:14

Canada: Housing Starts, June 202.8 (forecast 190)

-

14:13

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the release of the Bank of England’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Changing the number of employed June 39.9 Revised From 42 -5 7.3

01:30 Australia Unemployment rate June 5.9% Revised From 6.0% 6.1% 6.0%

01:30 China PPI y/y June -4.6% -4.5% -4.8%

01:30 China CPI y/y June 1.2% 1.3% 1.4%

06:00 Germany Current Account May 19.6 11.1

06:00 Germany Trade Balance May 22.1 21 22.8

06:00 Japan Prelim Machine Tool Orders, y/y June 15% 6.6%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

The U.S. dollar traded mixed against the most major currencies ahead of the release of the number of U.S. initial jobless claims. The number of initial jobless claims in the U.S. is expected to decrease by 6,000 to 275,000 last week.

Yesterday's release of the Fed's minutes weighed on the greenback. Most members noted that the conditions for tightening monetary policy had not yet been achieved. They noted that they need more information indicating that economic growth was strengthening, that labour market conditions were continuing to improve, and that inflation was moving back toward the Committee's objective".

Members expressed worries that a failure to reach a deal between Greece and its creditors "could result in disruptions in financial markets in the euro area, with possible spillover effects on the United States," the minutes said.

The euro traded lower against the U.S. dollar on the uncertainty over the Greek debt talks. Speaking in in the European Parliament, Greek Prime Minister Alexis Tsipras promised on Wednesday that Athens will provide credible reform proposals on Thursday.

An emergency summit of all 28 European Union members is scheduled to take place on Sunday.

Greece has submit a formal application for a three-year loan facility from the European Stability Mechanism (ESM) on Wednesday.

"The Loan will be used to meet Greece's debt obligations and to ensure stability of the financial system," Greek Finance Minister Euclid Tsakalotos said in the letter.

He did not mention the exact amount of the financial aid.

Meanwhile, the economic data from the Eurozone was better than expected. Germany's seasonally adjusted trade surplus increased to €22.8 billion in May from €21.5 billion in April, beating expectations for a decline to €21 billion. April's figure was revised down from a surplus of €22.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.7% in May, while imports rose 0.4%.

On an annual basis, exports were up 4.6% in May, while imports increased 3.0%.

Germany's current account surplus was at €11.6 billion in May.

The British pound traded mixed against the U.S. dollar after the release of the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian housing market data. Canada's new housing price index is expected to rise 0.1% in May, after a 0.1% gain in April.

EUR/USD: the currency pair fell to $1.1023

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y121.57

The most important news that are expected (GMT0):

12:15 Canada Housing Starts June 201.7 190

12:30 Canada New Housing Price Index, MoM May 0.1% 0.1%

12:30 U.S. Initial Jobless Claims July 281 275

12:30 U.S. Continuing Jobless Claims June 2264 2248

-

13:45

Orders

EUR/USD

Offers 1.1120 1.1145-50 1.1180 1.1200 1.1220-25 1.1245

Bids 1.1000 1.0980 1.0960 1.0940 1.0925 1.0900 1.0880 1.0850 1.0825 1.0800

GBP/USD

Offers 1.5430 1.5460 1.5485 1.5500 1.5520 1.5550 1.5585 1.5600

Bids 1.5350 1.5330 1.5300 1.5285

EUR/GBP

Offers 0.7200 0.7225 0.7240 0.7260 0.7285 0.7300

Bids 0.7160-65 0.7135 0.7120 0.7100 0.7085 0.7055-60 0.7040 0.7020 0.7000

EUR/JPY

Offers 134.40 134.60 134.85 135.00 135.30 135.50 135.80 136.00

Bids 133.50-60 133.25 133.00 132.80 132.50 132.00

USD/JPY

Offers 121.50-55 121.80 122.00 122.20 122.40 122.85 123.00

Bids 121.20-25 121.00 120.75-80 120.50 120.25 120.00

AUD/USD

Offers 0.7485-90 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7440 0.7400 0.7380 0.7350 0.7330 0.7300 0.7285 0.7250

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

13:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

11:42

Germany's seasonally adjusted trade surplus increases to €22.8 billion in May

Destatis released its trade data for Germany on Thursday. Germany's seasonally adjusted trade surplus increased to €22.8 billion in May from €21.5 billion in April. April's figure was revised down from a surplus of €22.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.7% in May, while imports rose 0.4%.

On an annual basis, exports were up 4.6% in May, while imports increased 3.0%.

Germany's current account surplus was at €11.6 billion in May.

-

11:29

FOMC’s June minutes: most Fed officials noted that the conditions for tightening monetary policy had not yet been achieved

The Federal Reserve released its June monetary policy meeting minutes on Wednesday. Most members noted that the conditions for tightening monetary policy had not yet been achieved. They noted that they need more information indicating that economic growth was strengthening, that labour market conditions were continuing to improve, and that inflation was moving back toward the Committee's objective".

Members expressed worries that a failure to reach a deal between Greece and its creditors "could result in disruptions in financial markets in the euro area, with possible spillover effects on the United States," the minutes said.

-

11:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.05bn), $1.1050(E500mn), $1.1100(E1.35bn)

USD/JPY: Y121.00($1.54bn), Y122.00($680mn)

EUR/JPY: Y136.00(E450mn)

GBP/USD: $1.5370(Gbp250mn)

AUD/USD: $0.7380(A$200mn), $0.7500(A$394mn)

USD/CAD: C$1.2550($650mn)

-

11:14

European Central Bank decides not to raise the amount of emergency funding (ELA) on Wednesday

The European Central Bank (ECB) decided not to raise the amount of emergency funding (ELA) on Wednesday. The amount the Greek central bank can lend its banks totals around €88.6 billion.

The ECB wants to await the outcome this weekend's talks on Greece. The central bank will discuss emergency liquidity assistance (ELA) to Greek banks on Monday.

It is likely that Greek banks remain closed.

-

11:03

France could lose €65 billion in case of a Greek default

The Senate's finance commission said on Wednesday that France could lose €65 billion in case of a Greek default.

"Our country's total exposure to a possible Greek default represents around 65 billion euros, well above the 40 billion euros usually cited," Senator Alberic de Montgolfier said in a statement.

-

10:54

OECD’s composite leading indicator declines to 100.0 in May

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Wednesday. The composite leading indicator fell to 100.0 in May from 100.1 in April.

It signalled stable growth in Germany, Japan and India.

There were signs of positive growth momentum in the Eurozone, especially in France and Italy.

The index for the U.S., the U.K. and China pointed to an easing in growth momentum.

The index for Russia showed signs of positive change in growth momentum.

-

10:43

Australia's unemployment rate is up to 6.0% in June

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.0% in June from 5.9% in May, beating expectations for an increase to 6.1%. May's figure was revised down from 6.0%.

The number of employed people in Australia climbed by 7,300 in June, beating forecast of a decline by 5,000, after a gain by 39,900 in May. May's figure was revised down from a rise by 42,000.

Full-time employment rose by 24,500, while part-time employment declined by 17,200.

The participation rate was 64.8%.

-

10:28

Chinese consumer price index rises at annual rate of 1.4% in June

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 1.4% in June, exceeding expectations for a 1.3% increase, after a 1.2% gain in May.

The increase was driven by rises in food and non-food prices. Food prices rose at an annual rate of 1.9% in June, while non-food prices increased 1.2%.

On a monthly basis, consumer price inflation was flat in June.

The Chinese producer price index (PPI) dropped 4.8% in June, missing forecasts of a 4.5% fall, after a 4.6% decline in May.

-

10:14

Consumer credit in the U.S. climbs by $16.1 billion in May

The Fed released its consumer credits figures on Wednesday. Consumer credit in the U.S. rose by $16.1 billion in May, after a $21.4 billion gain April.

April's figure was revised down from a $20.54 billion rise.

The increase was driven by a gain in non-revolving credit. Revolving credit climbed by $14.5 billion in May, while non-revolving credit rose by $1.6 billion.

-

08:45

Foreign exchange market. Asian session: the pound advanced ahead of BOE meeting

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Changing the number of employed June 39.9 -5 7.3

01:30 Australia Unemployment rate June 5.9% 6.1% 6.0%

01:30 China PPI y/y June -4.6% -4.5% -4.8%

01:30 China CPI y/y June 1.2% 1.3% 1.4%

06:00 Germany Current Account May 19.6 11.1

06:00 Germany Trade Balance May 22.1 21 22.8

06:00 Japan Prelim Machine Tool Orders, y/y June 15% 6.6%

The sterling advanced slightly ahead of today's BOE monetary policy meeting. Some investors expect the central bank to start raising rates in the middle of 2016. Officials forecast policy tightening to be gradual. Earlier BOE's McCafferty said that the bank might raise rates at the end of the current year depending on wage growth and the economic situation on the whole.

The yen is falling against the dollar after yesterday's gains.

The Australian dollar advanced after June employment data came in better than expected. The unemployment rate rose to 6.0% in June compared to 5.9% in May (still below expectations for a 6.1% reading). Employment Change came in at +7,300, while economists expected a flat reading after a 40,000 gain reported previously.

EUR/USD: the pair traded around $1.1060-80 in Asian trade

USD/JPY: the pair rose to Y121.30

GBP/USD: the pair traded around $1.5355-80

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

12:15 Canada Housing Starts June 201.7 190

12:30 Canada New Housing Price Index, MoM May 0.1% 0.1%

12:30 U.S. Initial Jobless Claims July 281 275

12:30 U.S. Continuing Jobless Claims June 2264 2248

-

08:19

Options levels on thursday, July 9, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1259 (2037)

$1.1214 (906)

$1.1178 (442)

Price at time of writing this review: $1.1099

Support levels (open interest**, contracts):

$1.1018 (552)

$1.0992 (869)

$1.0957 (2473)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 42791 contracts, with the maximum number of contracts with strike price $1,1500 (2996);

- Overall open interest on the PUT options with the expiration date August, 7 is 57558 contracts, with the maximum number of contracts with strike price $1,0800 (6380);

- The ratio of PUT/CALL was 1.35 versus 1.36 from the previous trading day according to data from July, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (880)

$1.5605 (1652)

$1.5508 (299)

Price at time of writing this review: $1.5417

Support levels (open interest**, contracts):

$1.5288 (852)

$1.5191 (731)

$1.5094 (759)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 19211 contracts, with the maximum number of contracts with strike price $1,5750 (2900);

- Overall open interest on the PUT options with the expiration date August, 7 is 18482 contracts, with the maximum number of contracts with strike price $1,5250 (1853);

- The ratio of PUT/CALL was 0.96 versus 0.96 from the previous trading day according to data from July, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:05

Germany: Trade Balance, May 22.8 (forecast 21)

-

08:01

Japan: Prelim Machine Tool Orders, y/y , June 6.6%

-

03:31

Australia: Unemployment rate, June 6.0% (forecast 6.1%)

-

03:31

China: CPI y/y, June 1.4% (forecast 1.3%)

-

03:30

Australia: Changing the number of employed, June 7.3 (forecast -5)

-

03:30

China: PPI y/y, June -4.8% (forecast -4.5%)

-

00:29

Currencies. Daily history for Jul 8’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1073 +0,69%

GBP/USD $1,5364 -0,60%

USD/CHF Chf0,9454 -0,13%

USD/JPY Y120,59 -1,54%

EUR/JPY Y133,52 -0,85%

GBP/JPY Y185,27 -2,15%

AUD/USD $0,7425 -0,24%

NZD/USD $0,6724 +1,20%

USD/CAD C$1,2740 +0,22%

-

00:01

Schedule for today, Thursday, Jul 9’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Changing the number of employed June 42 -5

01:30 Australia Unemployment rate June 6.0% 6.1%

01:30 China PPI y/y June -4.6% -4.5%

01:30 China CPI y/y June 1.2% 1.3%

06:00 Germany Current Account May 19.6

06:00 Germany Trade Balance May 22.1 21

06:00 Japan Prelim Machine Tool Orders, y/y June 15%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

12:15 Canada Housing Starts June 201.7 190

12:30 Canada New Housing Price Index, MoM May 0.1% 0.1%

12:30 U.S. Initial Jobless Claims July 281 275

12:30 U.S. Continuing Jobless Claims June 2264 2248

-