Noticias del mercado

-

16:57

Greek industrial production declines 4.9% in May

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Tuesday. On a seasonally adjusted basis, Greek industrial production declined 4.9% in May.

On a yearly basis, industrial production in Greece plunged at an adjusted rate of 4.0% in May, after a 1.0% gain in April. April's figure was revised up from a 0.4% increase.

Production in the manufacturing sector fell at an annual rate of 2.7% in May, output in the mining sector slid 15.0%, while electricity production plunged by 7.5%.

-

16:45

Industrial production in Italy rises 0.9% in May

The Italian statistical office Istat released its industrial production data on Friday. Industrial production in Italy climbed at a seasonally-adjusted rate of 0.9% in May, after a 0.3% decline in April.

Output in the energy sector jumped 1.7% in May, while production in the capital goods sector was up 2.3%.

On a yearly basis, industrial production in Italy rose at a seasonally-adjusted rate of 0.3% in May, after a 0.1% increase in April.

-

16:31

Wholesale inventories in the U.S. rises 0.8% in May

The U.S. Commerce Department released wholesale inventories on Friday. Wholesale inventories in the U.S. rose 0.8% in May, beating expectations for a 0.3% gain, after a 0.4% increase in April.

The increase was partly driven by a rise inventories of non-durable goods. Inventories of non-durable goods increased 1.2% in May, while inventories of durable goods gained 0.6%.

Wholesale sales climbed by 0.3% in May, after a 1.7% rise in April.

-

16:07

Overview of some Greek reform proposals

Athens sent new reform proposals to its lenders two hours before the deadline on Thursday. These are some reform proposals:

- Tax increases for shipping and railways companies;

- €300 million defence spending cuts by 2016;

- The raising of the retirement age to 67 by 2022;

- Unifying VAT rates at 23%, including restaurants and catering, scrapping tax breaks for the Greek islands;

- Phasing out solidarity grants for pensioners by 2019;

- The privatisation of ports and regional airports.

- Tax increases for shipping and railways companies;

-

16:00

U.S.: Wholesale Inventories, May 0.8% (forecast 0.3%)

-

15:47

U.S. Treasury Secretary Jacob Lew: a deal between Athens and its lenders is getting closer

U.S. Treasury Secretary Jacob Lew in New York on Friday that a deal between Athens and its lenders is getting closer. He added that it would be better for the world economy if a deal is reached.

"It would be a better thing for the global economy if this thing gets resolved," Lew said.

He pointed that Athens should reduce its budget deficit and make its economy more efficient. Greece's creditors should restructure Greece's debt, Lew added.

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0920-25(E2.0bn), $1.0940(747mn), $1.1000(E806mn), $1.1050(E300mn)

USD/JPY: Y120.00($1.4bn), Y121.90-122.00($515mn), Y123.00($1.5bn)

EUR/JPY: Y132.00(E550mn), Y133.00(E300mn), Y135.00(E501mn), Y135.25(E300mn), Y136.30(E704mn)

GBP/USD: $1.5690(Gbp253mn)

EUR/GBP: Gbp0.7300(E650mn)

AUD/USD: $0.7300(A$418mn), $0.7450(A$344mn), $0.7500(A$1.1bn)

USD/CAD: C$1.2600($455mn), C$1.2700($661mn)

-

15:28

Head of the Eurogroup Jeroen Dijsselbloem said in Friday that Greek reform proposals were "extensive"

The head of the Eurogroup Jeroen Dijsselbloem said in Friday that Greek reform proposals were "extensive". He did not comment on Greek proposal, adding that the decision will be made tomorrow.

Whichever way we go, we have to take a very far-reaching decision tomorrow, so let's do it carefully," Dijsselbloem said.

-

15:14

French Economy Minister Emmanuel Macron: Greek reform proposals could meet expectation of Greece’s creditors

French Economy Minister Emmanuel Macron said in Madrid on Friday that Greek reform proposals could meet expectation of Greece's creditors.

"There have been several significant changes that have been proposed by the Greek government that allow us to think that the level of reforms are of a nature that could meet expectations," he said.

Macron added that there is a need of discussions about restructuring Greece's sovereign debt.

-

15:04

Germany does not want to judged Greek reform proposals before the examination

Chancellor Angela Merkel's spokesman Steffen Seibert did not want to comment Greek reform proposals on Friday.

"We cannot comment on their content yet. We will wait until the institutions examine them and express their opinion," he said.

-

14:52

French President Francois Hollande said on Friday that Greece's reform proposals were "serious and credible"

French President Francois Hollande said on Friday that Greece's reform proposals were "serious and credible".

"The Greeks have just shown their determination to remain in the euro zone, since the programme they are putting forward is serious and credible," he said.

-

14:38

Canada’s economy loses 6,400 jobs in June

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 6.8% in June. Analysts had expected the unemployment rate to rise to 6.9%.

Employment rose by 33,000 in the second quarter, after an increase by 63,000 in the first quarter.

The number of employed people fell by 6,400 jobs in June, beating expectations for a fall of 10,000 jobs, after a 58,900 rise in May.

The decline was driven by a drop in part-time employment. Part-time employment in May fell by 71,000 jobs, while full-time work climbed by 65,000.

The labour participation rate decreased to 65.7% in June from 65.9 in May.

The Bank of Canada monitors closely the labour participation rate.

-

14:30

Canada: Unemployment rate, June 6.8% (forecast 6.9%)

-

14:30

Canada: Employment , June -6.4 (forecast -10)

-

14:14

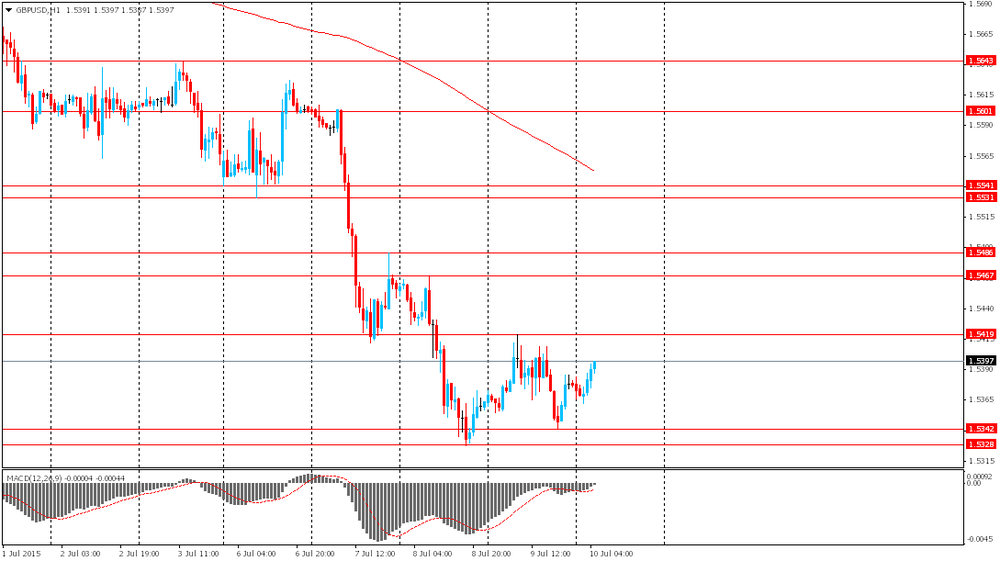

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the better-than-expected U.K. trade data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans May 0.7% Revised From 1.0% -3.5% -6.1%

05:00 Japan Consumer Confidence June 41.4 41.7

06:45 France Industrial Production, y/y May 1.1% 1.6%

06:45 France Industrial Production, m/m May -0.8% Revised From -0.9% 0.4% 0.4%

08:30 United Kingdom Total Trade Balance May -1.834 Revised From -1.202 -0.393

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. wholesale inventories data and ahead of a speech by the Fed Chair Janet Yellen. Wholesale inventories in the U.S. are expected to rise 0.3% in May, after a 0.4% gain in April.

A speech by the Fed Chair Janet Yellen is scheduled to be at 16:30 GMT.

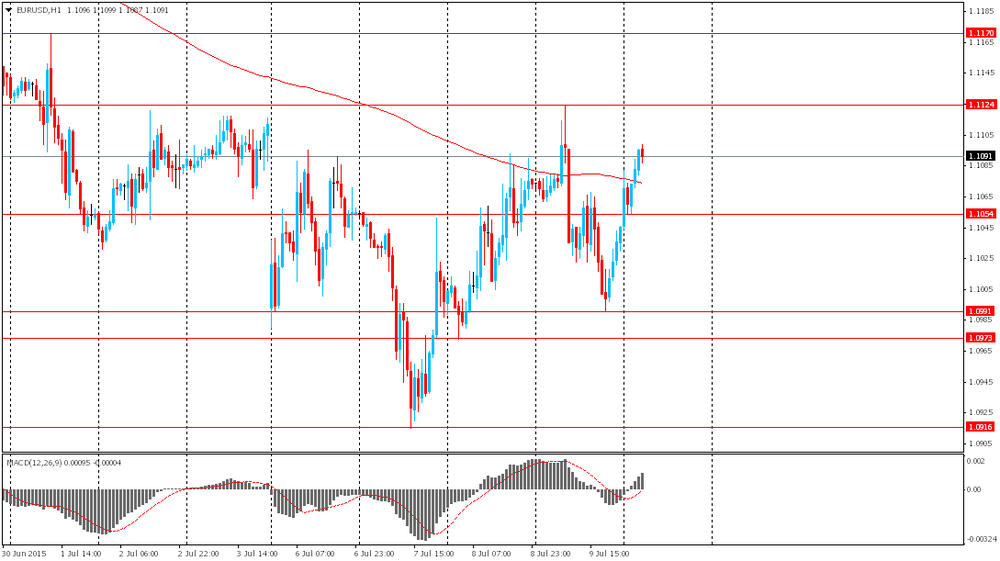

The euro traded higher against the U.S. dollar on hopes for a deal between Athens and its lenders. Athens sent new reform proposals to its lenders two hours before the deadline on Thursday. New proposals includes VAT reforms, other tax policies, pension and public sector reforms, higher corporate tax and the privatization of the port and the railway companies.

Greece's creditors will likely make a decision on Greek reform proposals today.

Meanwhile, the economic data from the Eurozone was mixed. German wholesale prices declined 0.2% in June, after a 0.5% increase in May.

On a yearly basis, wholesale prices in Germany fell 0.5% in June, after a 0.4% drop in May.

The fall was largely driven by a 10.5% decline in the wholesale prices of solid fuels and related products.

Industrial production in France rose 0.4% in May, in line with expectations, after a 0.7% decline in April.

The increase was driven by a rise in in output in the transport and automobile sector, which climbed 2.3% in May.

France's current account surplus decreased to €0.3 billion in May from €0.4 billion in April.

The decline in current account surplus was driven by a higher goods deficit.

The British pound traded higher against the U.S. dollar after the better-than-expected U.K. trade data. The U.K. trade deficit in goods narrowed to £8.0 billion in May from £9.8 billion in April. It was the lowest level since June 2013.

April's figure was revised down from a deficit of £8.56 billion.

The decline in the trade deficit was driven by a drop in imports. Imports dropped by 5.5% in May, while exports of goods rose 0.1%.

The total trade deficit, including services, narrowed to £393 million in May from £1.834 billion in April. It was the lowest total trade deficit since June 2013.

April's figure was revised down from a deficit of £1.202 billion.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian labour market data. The unemployment rate in Canada is expected to rise to 6.9% in June from 6.8% in May.

Canada's economy is expected to lose 10,000 jobs in June.

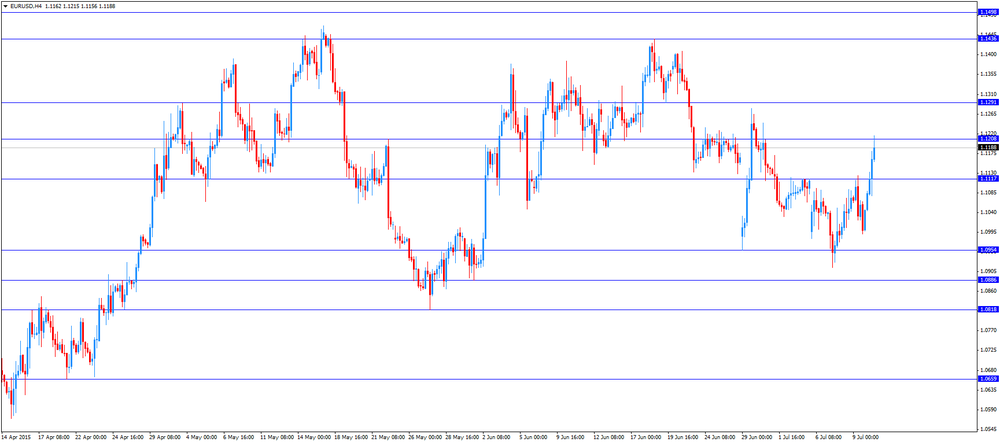

EUR/USD: the currency pair rose to $1.1215

GBP/USD: the currency pair increased to $1.5550

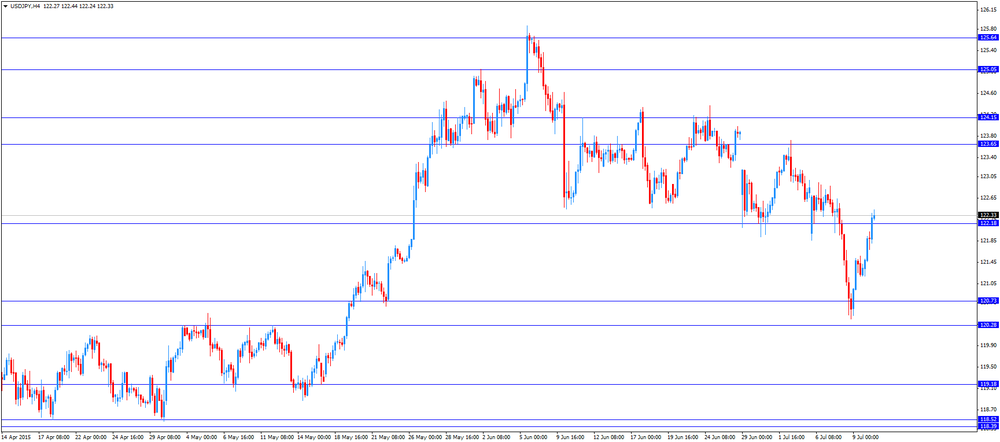

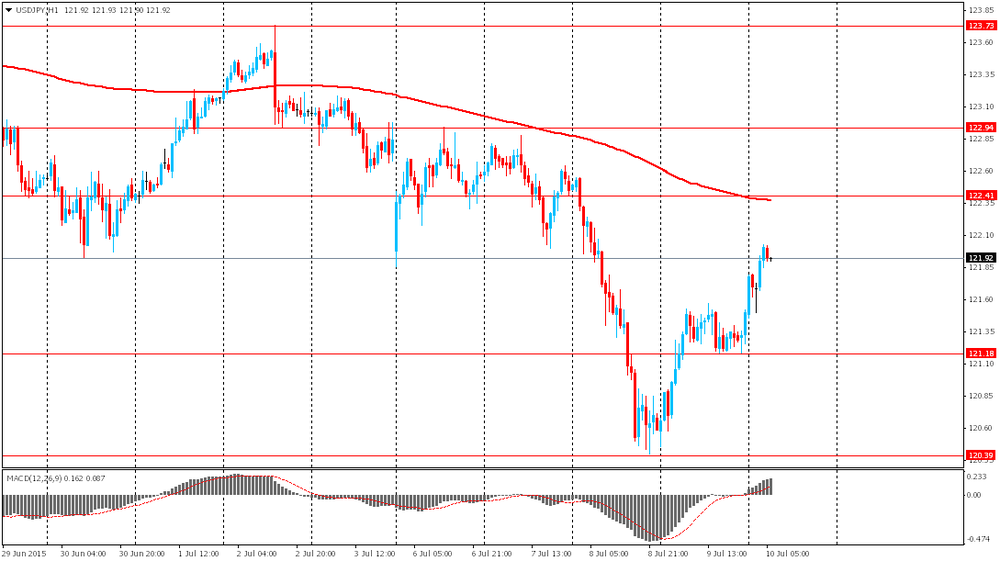

USD/JPY: the currency pair climbed to Y122.44

The most important news that are expected (GMT0):

12:30 Canada Unemployment rate June 6.8% 6.9%

12:30 Canada Employment June 58.9 -10

14:00 U.S. Wholesale Inventories May 0.4% 0.3%

16:30 U.S. Fed Chairman Janet Yellen Speaks

-

14:00

Orders

EUR/USD

Offers 1.1130-35 1.1150 1.1165 1.1180 1.1200 1.1220-25 1.1245 1.1280 1.1300 1.1330

Bids 1.1100 1.1085 1.1050-60 1.1030 1.1000 1.0980 1.0960 1.0940 1.0925 1.0900 1.0880 1.0850 1.0825 1.0800

GBP/USD

Offers 1.5450-60 1.5485 1.5500 1.5520 1.5550 1.5585 1.5600 1.5625 1.5650

Bids 1.5400 1.5375-80 1.5365 1.5350 1.5330 1.5300 1.5285 1.5265 1.5250

EUR/GBP

Offers 0.7225-30 0.7240 0.7260 0.7285 0.7300 0.7330 0.7350

Bids 0.7180-85 0.7160 0.7135 0.7120 0.7100 0.7085 0.7055-60 0.7040 0.7020 0.7000

EUR/JPY

Offers 135.80 136.00 136.30 136.50 136.75 137.00 137.50

Bids 134.50 134.30 134.00 133.80 133.50 133.25 133.00

USD/JPY

Offers 122.20 122.40 122.85 123.00 123.25 123.50 123.80 124.00

Bids 121.85 121.60 121.40 121.20-25 121.00 120.75 120.50 120.25 120.00

AUD/USD

Offers 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7450 0.7425-30 0.7400 0.7380 0.7350 0.7330 0.7300

-

11:48

France’s current account surplus falls to €0.3 billion in May

The Bank of France released its current account data on Friday. France's current account surplus decreased to €0.3 billion in May from €0.4 billion in April.

The decline in current account surplus was driven by a higher goods deficit.

-

11:40

German wholesale prices decline 0.2% in June

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices declined 0.2% in June, after a 0.5% increase in May.

On a yearly basis, wholesale prices in Germany fell 0.5% in June, after a 0.4% drop in May. Wholesale prices have been declining since July 2013.

The fall was largely driven by a 10.5% decline in the wholesale prices of solid fuels and related products.

-

11:33

French industrial production rises 0.4% in May

The French statistical office Insee its industrial production figures on Friday. Industrial production in France rose 0.4% in May, in line with expectations, after a 0.7% decline in April.

The increase was driven by a rise in in output in the transport and automobile sector, which climbed 2.3% in May.

Manufacturing output was up 0.6% in May, while construction output increased 1.0%.

On a yearly basis, the French industrial production rose 1.6% in May, after a 1.1% gain in April.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0920-25(E2.0bn), $1.0940(747mn), $1.1000(E806mn), $1.1050(E300mn)

USD/JPY: Y120.00($1.4bn), Y121.90-122.00($515mn), Y123.00($1.5bn)

EUR/JPY: Y132.00(E550mn), Y133.00(E300mn), Y135.00(E501mn), Y135.25(E300mn), Y136.30(E704mn)

GBP/USD: $1.5690(Gbp253mn)

EUR/GBP: Gbp0.7300(E650mn)

AUD/USD: $0.7300(A$418mn), $0.7450(A$344mn), $0.7500(A$1.1bn)

USD/CAD: C$1.2600($455mn), C$1.2700($661mn)

-

11:15

U.K. trade deficit in goods narrows to £8.0 billion in May, the lowest level since June 2013

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £8.0 billion in May from £9.8 billion in April. It was the lowest level since June 2013.

April's figure was revised down from a deficit of £8.56 billion.

The decline in the trade deficit was driven by a drop in imports. Imports dropped by 5.5% in May, while exports of goods rose 0.1%.

The total trade deficit, including services, narrowed to £393 million in May from £1.834 billion in April. It was the lowest total trade deficit since June 2013.

April's figure was revised down from a deficit of £1.202 billion.

-

11:04

Federal Reserve Bank of Kansas City President Esther George Thursday urges the Fed to raise its interest rate

Federal Reserve Bank of Kansas City President Esther George Thursday urged the Fed to raise its interest rate.

"We would be wise to act modestly but act now. Starting now to move rates up slowly and deliberately will allow the economy to adjust to a more normal and, in my view, appropriate stance of monetary policy," she said.

George noted that low interest rate could lead unstable markets and to a surge in inflation. But she acknowledged that low interest rate may be needed "for some time."

George is not a voting member of the Federal Open Market Committee this year.

-

10:57

International Monetary Fund Chief Economist Olivier Blanchard: Greece may need more debt relief

International Monetary Fund (IMF) Chief Economist Olivier Blanchard said on Thursday that Greece may need more debt relief and financing from its Eurozone creditors than estimated in IMF's report last week.

"We believe that current developments may well imply the need for even more financing, not least in support of the banks, and for even more debt relief," he said.

Blanchard warned that a Greek exit from the Eurozone would be "extremely costly" for Greece and its creditors.

-

10:51

OECD: long-term unemployment remains high

The Organization for Economic Cooperation and Development (OECD) released its unemployment report on Thursday. The OECD said that the number of unemployed declined to 42 million from 45 million in 2014, remaining well above its pre-crisis level.

According to the OECD's report, long-term unemployment remains "unacceptably high", especially in Europe. More than one in three jobseekers in the 34 OECD countries have been out of work for 12 months or more, the OECD said.

"Time is running out to prevent the scars of the crisis becoming permanent, with millions of workers trapped at the bottom of the economic ladder. If that happens, the long-run legacy of the crisis would be to ratchet inequality up yet another notch from levels that were already far too high," OECD secretary-general Angel Gurria said.

The OECD projects unemployment in its 34 OECD countries to fall to 6.6% in the last quarter of 2016 from 7.1% at the end of 2014.

Unemployment rate in both Greece and Spain is expected to remain above 20%.

-

10:43

Home loans in Australia drops 6.1% in May

The Australian Bureau of Statistics released its home loans data on Friday. Home loans in Australia dropped 6.1% in May, missing expectations for a 3.5% decline, after 0.7% rise in April. April's figure was revised down from 1.0% gain.

The value of home loans fell 5.3% in May, investment lending decreased 3.2%, while the value of total dwelling loans plunged 4.4%.

-

10:33

The international rig count declines to 1,146 in June

Oil driller Baker Hughes said on Wednesday that the international rig count for June 2015 fell to 1,146 from 1,158 May 2015.

The average U.S. rig number for June 2015 declined to 861 in June 2015 from the 889 in May 2015.

The worldwide rig count for June 2015 decreased to 2,136 from the 2,127 in May 2015.

-

10:30

United Kingdom: Total Trade Balance, May -0.393

-

10:14

Chicago Federal Reserve President Charles Evans wants the Fed to delay its interest rate hike until mid-2016

Chicago Federal Reserve President Charles Evans said on Thursday that he wants that the Fed delay its interest rate hike until mid-2016.

"There is value to delaying" given the risks from Europe, China and emerging markets," he said.

Evans expressed concerns about low inflation in the U.S.

Chicago Fed president is one of only two Fed officials who think the Fed should delay its first rate hike. Other officials think the Fed should raise its interest rate before the end of the year.

Evans is a voting member of the Federal Open Market Committee this year.

-

08:51

Foreign exchange market. Asian session: the Australian dollar strengthened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Home Loans May 0.7% Revised From 1.0% -3.5% -6.1%

05:00 Japan Consumer Confidence June 41.4 41.7

06:45 France Industrial Production, y/y May 1.1% 1.6%

06:45 France Industrial Production, m/m May -0.9% 0.4% 0.4%

The Australian dollar rose as gains in Chinese stocks boosted demand for this commodity currency. The AUD gained despite weak home loans data. The Australian Bureau of Statistics reported that the home loans index came in at -6.1% in May vs -3.5% expected. April reading was revised to 0.7% from 1%.

The euro rose against the dollar after Greece presented new reform proposals indulging hopes for a deal. The new reforms package would bring the country additional €12 billion. The new package suggests raising income tax and VAT.

The yen declined against the dollar as demand for this safe-haven currency faded after Greece came up with a new reforms plan. Gains in Chinese stocks attracted investors to riskier assets and pushed on the yen.

EUR/USD: the pair rose to $1.1100 in Asian trade

USD/JPY: the pair rose to Y122.00

GBP/USD: the pair rose to $1.5400

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Total Trade Balance May -1.202

12:30 Canada Unemployment rate June 6.8% 6.9%

12:30 Canada Employment June 58.9 -10

14:00 U.S. Wholesale Inventories May 0.4% 0.3%

16:30 U.S. Fed Chairman Janet Yellen Speaks

-

08:47

France: Industrial Production, y/y, May 1.6%

-

08:45

France: Industrial Production, m/m, May 0.4% (forecast 0.4%)

-

08:12

Options levels on friday, July 10, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1292 (2402)

$1.1231 (2015)

$1.1181 (894)

Price at time of writing this review: $1.1123

Support levels (open interest**, contracts):

$1.0988 (120)

$1.0959 (871)

$1.0930 (2473)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 44725 contracts, with the maximum number of contracts with strike price $1,1400 (3309);

- Overall open interest on the PUT options with the expiration date August, 7 is 58071 contracts, with the maximum number of contracts with strike price $1,0800 (6397);

- The ratio of PUT/CALL was 1.30 versus 1.35 from the previous trading day according to data from July, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (907)

$1.5605 (1723)

$1.5508 (322)

Price at time of writing this review: $1.5404

Support levels (open interest**, contracts):

$1.5288 (850)

$1.5192 (776)

$1.5095 (790)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 18698 contracts, with the maximum number of contracts with strike price $1,5750 (2215);

- Overall open interest on the PUT options with the expiration date August, 7 is 19530 contracts, with the maximum number of contracts with strike price $1,5250 (1853);

- The ratio of PUT/CALL was 1.04 versus 0.96 from the previous trading day according to data from July, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:10

Japan: Consumer Confidence, June 41.7

-

03:31

Australia: Home Loans , May -6.1% (forecast -3.5%)

-

00:34

Currencies. Daily history for Jul 9’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1045 -0,25%

GBP/USD $1,5377 +0,08%

USD/CHF Chf0,9475 +0,22%

USD/JPY Y121,50 +0,75%

EUR/JPY Y134,20 +0,51%

GBP/JPY Y186,84 +0,84%

AUD/USD $0,7449 +0,32%

NZD/USD $0,6741 +0,25%

USD/CAD C$1,2702 -0,30%

-

00:01

Schedule for today, Friday, Jul 10’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Home Loans May 1.0% -3.5%

05:00 Japan Consumer Confidence June 41.4

06:45 France Industrial Production, y/y May 1.1%

06:45 France Industrial Production, m/m May -0.9% 0.5%

08:30 United Kingdom Total Trade Balance May -1.202

12:30 Canada Unemployment rate June 6.8% 6.9%

12:30 Canada Employment June 58.9 -10

14:00 U.S. Wholesale Inventories May 0.4% 0.3%

16:30 U.S. Fed Chairman Janet Yellen Speaks

-