Noticias del mercado

-

17:38

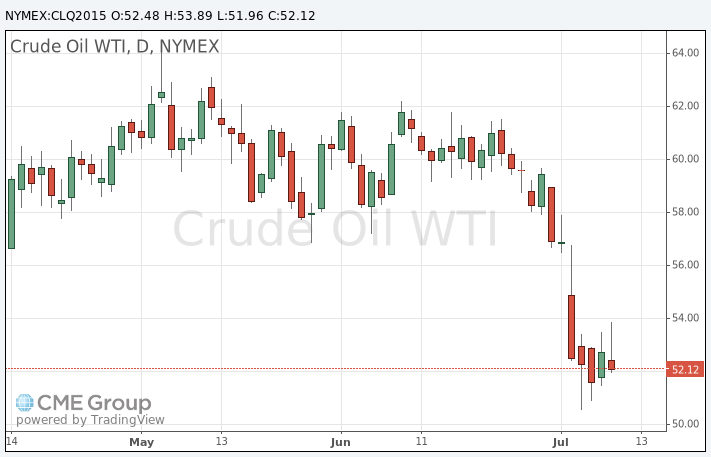

WTI crude oil price declines after the release of the International Energy Agency’s report

WTI crude oil price declined after the release of the International Energy Agency's (IEA) report. The IEA said in its report that oil prices will fall further due to a massive oversupply. Global oil supply climbed by 550,000 barrels a day in June to 96.6 million barrels a day, up 3.1 million barrels a day in June last year.

The IEA expects the global oil demand to slow down in 2016. The agency forecasts the global oil demand in 2016 to decline to 1.2 million barrels per day from an average 1.4 million this year.

OPEC will release its monthly report on Monday.

Iran deal seems possible. Top adviser to Iran's Supreme Leader Ayatollah Ali Khamenei, Ali Akbar Velayati, said that his country had no intention to abandon talks on the nuclear program. A deal could lead to a higher oil supply.

WTI crude oil for August delivery decreased to $51.96 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $58.61 a barrel on ICE Futures Europe.

-

17:18

Gold traded higher as stock markets in Europe, Asia and the U.S. traded higher

Gold traded higher as stock markets in Europe, Asia and the U.S. traded higher. The indexes were supported by hopes for a deal between Greece and its lenders and by rebound in the Chinese stock market.

The Chinese stock index Shanghai Composite rose 4.5% on Friday as Chinese regulators implemented measures to control the selloff on exchanges. The China Securities Regulatory Commission said on late Wednesday that it had ordered investors holding more than 5% of a company's shares not to sell any of their holdings for the next six months.

Athens sent new reform proposals to its lenders two hours before the deadline on Thursday. New proposals includes VAT reforms, other tax policies, pension and public sector reforms, higher corporate tax and the privatization of the port and the railway companies.

Greece's creditors will make a decision on Greek reform proposals tomorrow.

Investors are awaiting a speech by the Fed Chair Janet Yellen which is scheduled to be at 16:30 GMT.

August futures for gold on the COMEX today rose to 1163.00 dollars per ounce.

-

10:33

The international rig count declines to 1,146 in June

Oil driller Baker Hughes said on Wednesday that the international rig count for June 2015 fell to 1,146 from 1,158 May 2015.

The average U.S. rig number for June 2015 declined to 861 in June 2015 from the 889 in May 2015.

The worldwide rig count for June 2015 decreased to 2,136 from the 2,127 in May 2015.

-

09:00

Oil advanced amid gains in Chinese stocks

West Texas Intermediate futures for August delivery advanced to $53.37 (+1.12%); Brent crude climbed to $59.27 (+1.13%) after Chinese stocks advanced amid the government's steps to support equity markets.

Tonight Iran missed another deadline in its negotiations with global powers. However officials said that they were ready to work more. Talks have already extended beyond initial deadline on June 30. The Friday morning deadline was supposed to meet the start of a 30-day review period by the U.S. Congress. But now U.S. lawmakers will take 60 days to study any document once a deal is outlined. This will delay the lifting of sanctions.

-

08:57

Gold traded in a narrow range

Gold is currently at $1,160.60 (+0.12%) an ounce. The metal slightly climbed from a four-month low amid a stronger euro; however it's still headed for a week of declines. The euro rose against the dollar on news about new proposals by Greece's government to its creditors. A stronger euro made this dollar-denominated precious metal cheaper.

Bullion has also received some support from IMF's global growth forecast revision. The fund cut its forecast for this year to 3.3% from 3.5% based on recent weakness in the U.S. economy.

Physical demand in key consumers (China and India) remained weak.

-

00:36

Commodities. Daily history for Jul 9’2015:

(raw materials / closing price /% change)

Oil 52.59 -0.36%

Gold 1,158.80 -0.03%

-