Noticias del mercado

-

21:00

Dow -0.55% 17,726.90 -97.39 Nasdag -0.33% 4,728.89 -15.51 S&P -0.41% 2,047.14 -8.33

-

18:00

European stocks closed: FTSE 100 6,837.15 -16.29 -0.24% CAC 40 4,651.08 -39.95 -0.85% DAX 10,663.51 -182.88 -1.69%

-

18:00

European stocks close: stocks closed lower as concerns over Greece weighed on markets

Stock indices traded lower as concerns over Greece weighed on markets. Greek Prime Minister Alexis Tsipras said on Sunday that the government will renegotiate austerity measures and a bailout programme.

Standard and Poor's has downgraded Greece's rating late Friday.

The Sentix investor confidence index for the Eurozone rose to 12.4 in February from 0.9 in January, exceeding expectations for an increase to 3.4.That was the highest level since February 2006.

The index benefited from a weaker euro and lower oil prices.

Germany's trade surplus widened to €21.8 billion in December from €17.9 billion in November, exceeding expectations for a rise to €18.2 billion. November's figure was revised up from a surplus of €17.7 billion.

The Bank of England Governor Mark Carney said in Istanbul on Monday that wage growth just started in the U.K.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,837.15 -16.29 -0.24%

DAX 10,663.51 -182.88 -1.69%

CAC 40 4,651.08 -39.95 -0.85%

-

17:40

Oil: A review of the market situation

Oil has risen slightly during today's trading, registering with the third-session increase in a row, which was due to statements by OPEC.

Representatives of the Organization of Petroleum Exporting Countries (OPEC) reported that demand for oil cartel will grow this year against the background of reduction in the rate of production growth in the US, which proves the correctness of the chosen company policy to reduce prices for the suppression of competition and a recovery in demand for oil. In November, OPEC supply in Saudi Arabia, the largest oil cartel decided to keep in force the previous limit of production, since the protection of the organization's market share has become a higher priority compared to the maintenance of oil prices. According to the monthly report of the OPEC cartel's oil demand in 2015 will grow by about 110,000 barrels per day to 29.2 million barrels a day. Previously, the forecast was adjusted in the direction of growth in demand for 400,000 barrels per day. Before that OPEC had expected a decline in demand for oil cartel about 300,000 barrels a day this year.

Also, market participants drew attention to US data. As we learned from the report oilfield services company Baker Hughes, the number of drilling rigs operating in the US last week fell by 83 percent to 1,140 units, which is the lowest since December 2011.

"Reducing the number of drilling rigs in itself is a factor that plays into the hands of the" bulls "- said a senior analyst at the commodity market in the SEB AB Bjarne Shildrop. - Maybe wait for the rally of oil prices is somewhat premature."

"OPEC forecast data and Baker Hughes enhance investors' optimism - said a senior analyst at Tradition Energy Gene MakDzhillian. - I do still not sure whether we are seeing a short-term correction of quotations or the bottom has been reached."

Meanwhile, in the course of trade affected by reports that Saudi Chevron division reduced oil production in Kuwait Wafra field with 225 thousand. B / c last October to 180 thousand. B / c because regulators countries have stopped issuing new permits and renew old to work for the company's employees.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) rose to 53.33 dollars per barrel on the New York Mercantile Exchange.

March futures price for North Sea petroleum mix of Brent rose $ 0.13 to $ 58.27 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:34

Foreign exchange market. American session: the Canadian dollar rose against the U.S. dollar after the better-than-expected Canadian housing starts data

The U.S. dollar traded lower against the most major currencies. The greenback remained supported by Friday's labour market data. The U.S. economy added 257,000 jobs in January, exceeding expectations for a rise of 231,000 jobs, after a gain of 329,000 jobs in December. December's figure was revised up from a rise of 252,000 jobs.

The U.S. unemployment rate rose to 5.7% in January from 5.6% in December as the number of job seekers grew. Analysts had expected the unemployment rate to remain unchanged at 5.6%.

The euro traded against the U.S. dollar as concerns over Greece's further bailout policy eased. Greek Prime Minister Alexis Tsipras said on Sunday that the government will renegotiate austerity measures and a bailout programme.

Standard and Poor's has downgraded Greece's rating late Friday.

The Sentix investor confidence index for the Eurozone rose to 12.4 in February from 0.9 in January, exceeding expectations for an increase to 3.4.That was the highest level since February 2006.

The index benefited from a weaker euro and lower oil prices.

Germany's trade surplus widened to €21.8 billion in December from €17.9 billion in November, exceeding expectations for a rise to €18.2 billion. November's figure was revised up from a surplus of €17.7 billion.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England Governor Mark Carney said in Istanbul on Monday that wage growth just started in the U.K.

The Canadian dollar rose against the U.S. dollar after the better-than-expected Canadian housing starts data. Housing starts in Canada increased to a seasonally adjusted annualized rate of 187,276 units in January from a revised reading of 179,637 units in December. December's figure revised down from 180,560 units. Analysts had expected an increase to 184,000 units.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi increased against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback. Job advertisements in Australia increased 1.3% in January, after a 1.8% rise in December.

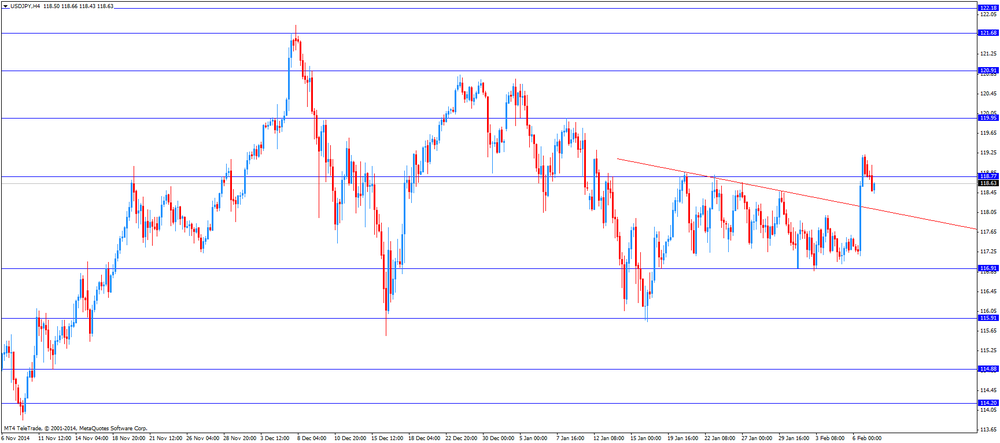

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback. Japan's consumer confidence index increased to 39.1 in January from 38.8 in December, missing expectations for a rise to 39.4.

Japan's economy watchers' current conditions index rose to 45.6 in January from 45.2 in December, missing expectations for an increase to 45.7.

Japan's economy watchers' future conditions index climbed to 50.0 in January from 46.7 in December.

-

17:20

Gold: A review of the market situation

Gold prices rose moderately, departing from the three-week low, due to the decline in European stock markets and the uncertainty associated with Greece. Experts point out that the focus of markets continues to be Greece and the related political uncertainty, as Greek Prime Tsipras continues to seek a review of the debt agreements. On Wednesday, the euro zone finance ministries will discuss the situation of Greece, and markets will be hard to expect the results of this meeting.

"Three months before the FOMC meeting gold acted as a safe haven because of concerns about Greece, but now the emphasis has shifted again to the United States, namely, the timing of the Fed raising interest rates - said Citi analyst David Wilson, referring to the meeting of FOMC, which took place last month. - it is expected that gold prices will continue to decline as the market is not very concerned about the influence of Greece to the rest of Europe at the moment. "

The course of today's trading also influenced the data for China, showing that trade surplus in January rose to $ 60.03 billion, compared with $ 49.61 billion a month earlier. Analysts had forecast a surplus of $ 49.0 billion. The record surplus in the balance of foreign trade in the last month was recorded on a background of a maximum of more than five years, the fall in imports. The volume of imports fell by 19.7% compared with January 2014 due to lower commodity prices and weak domestic demand. Oil imports decreased by 41.8%, iron ore - by 50.3%, coal - by 50.3%. China reduced imports from all regions, which are its major trading partners, including the European Union and the United States

As for the situation in the physical market, the margins in China rose to $ 05.04 per ounce from less than $ 4 on Friday, as the drop in prices last week attracted new buyers. Chinese consumers are buying gold on the eve of the New Year according to the lunar calendar, but just before the holiday demand falls, traders said. "As the Chinese New Year is already there (celebrated on February 19-20), purchase substantially completed, and you should not expect seasonal support from the Chinese market," - said an analyst at Phillip Futures Howie Lee.

March futures price of gold on the COMEX today rose to 1240.40 dollars per ounce.

-

17:03

China’s imports plunged by 19.9% in January

China's Customs Administration released its trade data on Sunday. China's exports declined 3.3% in January from a year earlier, while imports dropped by 19.9%.

These figures indicate a slowdown of Chinese economy.

-

16:55

OPEC expects oil demand to increase this year

The Organization of the Petroleum Exporting Countries (OPEC) said on Monday that oil demand will be 29.2 million barrels a day this year, a rise of about 100,000 barrels a day compared with last year.

OPEC lowered its estimate for non-OPEC supply growth in 2015 by about 400,000 barrels a day.

Falling oil prices have forced international oil companies to cut their expenditure.

Oil price has rebounded in the past two weeks.

OPEC expects that global oil demand will rise by 1.17 million barrels a day in 2015 to 92.32 million barrels a day.

-

16:18

Bank of England Governor Mark Carney: there is a lot of job creation in the U.K., not a lot of productivity

The Bank of England Governor Mark Carney said in Istanbul on Monday that wage growth just started in the U.K. He noted that there is a lot of job creation in the U.K., not a lot of productivity.

-

15:57

Germany's trade surplus widened to €21.8 billion in December

Destatis released German trade data on Monday. Germany's trade surplus widened to €21.8 billion in December from €17.9 billion in November, exceeding expectations for a rise to €18.2 billion. November's figure was revised up from a surplus of €17.7 billion.

Exports rose 3.4% in December, while imports fell 0.8%.

For 2014 as whole, Germany's trade surplus increased to an annual total of €217 billion, the largest ever trade surplus.

Exports increased 3.7%in 2014, while imports rose 2%.

-

15:37

U.S. Stocks open: Dow -0.42%, Nasdaq -0.28%, S&P -0.22%

-

15:29

Before the bell: S&P futures -0.62%, Nasdaq futures -0.56%

U.S. stock-index futures fell after Greece's prime minister reiterated pledges opposing the nation's bailout.

Global markets:

Nikkei 17,711.93 +63.43 +0.36%

Hang Seng 24,521 -158.39 -0.64%

Shanghai Composite 3,095.12 +19.22 +0.62%

FTSE 6,787.21 -66.23 -0.97%

CAC 4,618.52 -72.51 -1.55%

DAX 10,635.2 -211.19 -1.95%

Crude oil $52.43 (+1.43%)

Gold $1240.10 (+0.45%)

-

15:06

Stocks before the bell

(company / ticker / price / change, % / volume)

Chevron Corp

CVX

109.65

+0.04%

2.2K

ALTRIA GROUP INC.

MO

53.41

+0.15%

1.4K

Starbucks Corporation, NASDAQ

SBUX

89.30

+0.34%

3.8K

Caterpillar Inc

CAT

83.52

+0.37%

0.2K

Barrick Gold Corporation, NYSE

ABX

12.45

+1.06%

41.1K

Yandex N.V., NASDAQ

YNDX

16.45

+2.05%

28.0K

Johnson & Johnson

JNJ

101.00

-0.10%

1.8K

Procter & Gamble Co

PG

85.52

-0.11%

2.7K

Hewlett-Packard Co.

HPQ

37.90

-0.13%

0.9K

Wal-Mart Stores Inc

WMT

87.18

-0.17%

0.1K

Apple Inc.

AAPL

118.70

-0.19%

132.6K

Pfizer Inc

PFE

33.10

-0.21%

10.1K

Google Inc.

GOOG

529.65

-0.25%

0.7K

Merck & Co Inc

MRK

58.60

-0.32%

1.0K

AT&T Inc

T

34.75

-0.34%

6.6K

Microsoft Corp

MSFT

42.26

-0.35%

70.9K

Ford Motor Co.

F

15.80

-0.38%

2.2K

American Express Co

AXP

84.68

-0.39%

7.2K

Exxon Mobil Corp

XOM

91.13

-0.40%

16.9K

Yahoo! Inc., NASDAQ

YHOO

42.76

-0.42%

6.1K

General Electric Co

GE

24.41

-0.45%

12.0K

Verizon Communications Inc

VZ

49.10

-0.47%

1.4K

Cisco Systems Inc

CSCO

27.10

-0.51%

0.6K

Walt Disney Co

DIS

101.50

-0.51%

1.6K

International Business Machines Co...

IBM

155.90

-0.52%

1.6K

Visa

V

266.00

-0.53%

4.6K

Intel Corp

INTC

33.10

-0.59%

9.2K

JPMorgan Chase and Co

JPM

57.54

-0.60%

4.1K

The Coca-Cola Co

KO

41.20

-0.60%

472.3K

3M Co

MMM

164.99

-0.65%

1.3K

Amazon.com Inc., NASDAQ

AMZN

371.72

-0.68%

2.1K

General Motors Company, NYSE

GM

35.75

-0.69%

17.0K

Facebook, Inc.

FB

73.83

-0.86%

20.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.68

-0.90%

3.0K

McDonald's Corp

MCD

93.10

-0.95%

0.1K

Citigroup Inc., NYSE

C

48.67

-0.96%

7.1K

Tesla Motors, Inc., NASDAQ

TSLA

214.78

-1.19%

5.1K

ALCOA INC.

AA

16.19

-2.29%

51.9K

Twitter, Inc., NYSE

TWTR

46.72

-2.69%

54.7K

-

14:58

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Exxon Mobil (XOM) downgraded to Hold from Buy at Argus

Alcoa (AA) downgraded from Overweight to Neutral at JP Morgan, target lowered from $20 to $18.50

Other:

Apple (AAPL) target raised to $145 from $135 at Canaccord Genuit

Twitter (TWTR) target raised to $50 from $45 at Wunderlich

Freeport-McMoRan (FCX) target lowered from $42 to $25 at Argus

-

14:51

Housing starts in Canada increased to a seasonally adjusted annualized rate of 187,276 units in January

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 187,276 units in January from a revised reading of 179,637 units in December. December's figure revised down from 180,560 units.

Analysts had expected an increase to 184,000 units.

The CMHC's Chief Economist Bob Dugan that "the trend in total housing starts has been moderating since September 2014, reflecting lower trends in both multiple and single-detached starts". He added that economic and demographic factors still support housing demand.

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1230-40(E1.0bn), $1.1280(E456mn), $1.1300(E445mn), $1.1400(E1.57bn), $1.1500(E1.4bn)

USD/JPY: Y118.00($638mn), Y118.20($280mn), Y118.25($545mn), Y118.50($370mn), Y118.75($370mn), Y118.85($205mn), Y119.40($443mn), Y119.45($410mn), Y120.00($1.0bn)

AUD/USD: $0.7780(A$212mn)

AUD/JPY: Y92.55(A$205mn)

-

14:15

Canada: Housing Starts, January 187 (forecast 184)

-

14:00

Foreign exchange market. European session: the euro declined against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:15 Australia RBA's Governor Glenn Stevens Speech

00:30 Australia ANZ Job Advertisements (MoM) January +1.8% 1.3%

05:00 Japan Consumer Confidence January 38.8 39.4 39.1

06:00 Japan Eco Watchers Survey: Current January 45.2 45.7 45.6

06:00 Japan Eco Watchers Survey: Outlook January 46.7 50.0

07:00 Germany Trade Balance December 17.9 Revised From 17.7 18.2 21.8

07:00 Germany Current Account December 18.9 Revised From 18.6 25.3

08:00 G20 G20 Meetings

09:30 Eurozone Sentix Investor Confidence February 0.9 3.4 12.4

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by Friday's labour market data. The U.S. economy added 257,000 jobs in January, exceeding expectations for a rise of 231,000 jobs, after a gain of 329,000 jobs in December. December's figure was revised up from a rise of 252,000 jobs.

The U.S. unemployment rate rose to 5.7% in January from 5.6% in December as the number of job seekers grew. Analysts had expected the unemployment rate to remain unchanged at 5.6%.

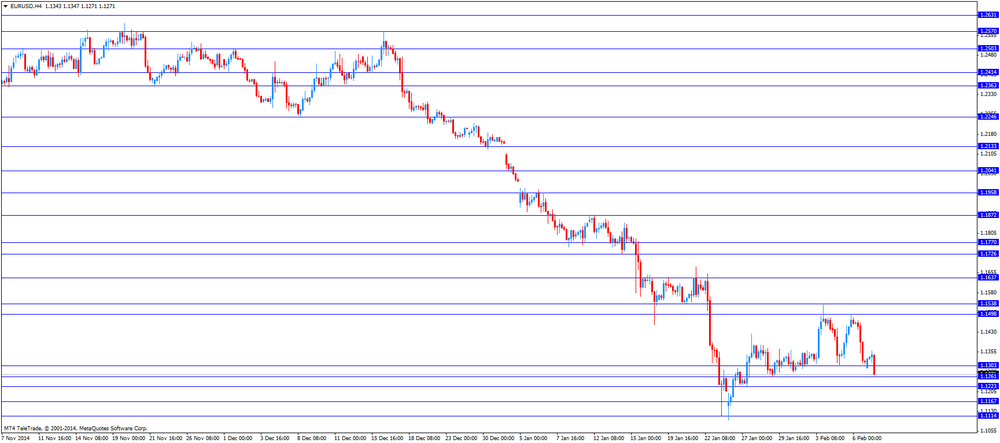

The euro declined against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro.

Standard and Poor's has downgraded Greece's rating late Friday.

The Sentix investor confidence index for the Eurozone rose to 12.4 in February from 0.9 in January, exceeding expectations for an increase to 3.4.That was the highest level since February 2006.

The index benefited from a weaker euro and lower oil prices.

Germany's trade surplus widened to €21.8 billion in December from €17.9 billion in November, exceeding expectations for a rise to €18.2 billion. November's figure was revised up from a surplus of €17.7 billion.

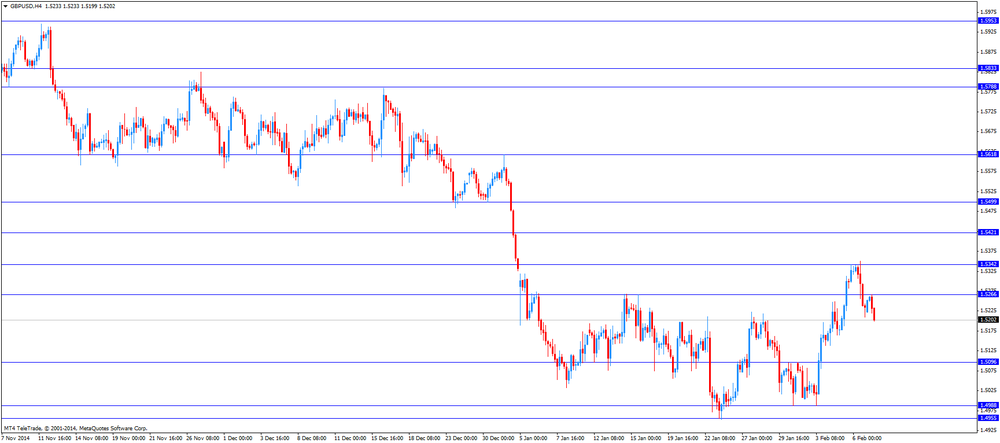

The British pound fell against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England Governor Mark Carney said in Istanbul on Monday that wage growth just started in the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian housing starts data. Housing starts in Canada are expected to rise to 184,000 units in January from 180,000 units in December.

EUR/USD: the currency pair fell to $1.1269

GBP/USD: the currency pair decreased to $1.5199

USD/JPY: the currency pair declined to Y118.43

The most important news that are expected (GMT0):

13:15 Canada Housing Starts January 180 Revised From 181 184

21:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Tertiary Industry Index December +0.2% +0.1%

-

13:46

Orders

EUR/USD

Offers $1.1410-20, $1.1400, $1.1370

Bids $1.1270-65, $1.1260-50, $1.1200/01

GBP/USD

Offers $1.5380, $1.5350-55, $1.5295/305

Bids $1.5200, $1.5155-450, $1.5105/00, $1.5085/80

AUD/USD

Offers $0.7950, $0.7900, $0.7845/50

Bids $0.7700, $0.7655/50, $0.7600

EUR/JPY

Offers Y135.50, Y135.00

Bids Y134.00, Y133.50, Y133.00

USD/JPY

Offers Y120.00, Y119.40/60, Y119.00

Bids Y118.10/00, Y117.50

EUR/GBP

Offers stg0.7495/500

Bids stg0.7400

-

13:33

Sentix investor confidence index for the Eurozone reaches the highest level since February 2006

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 12.4 in February from 0.9 in January, exceeding expectations for an increase to 3.4.

That was the highest level since February 2006.

A reading above 0.0 indicates optimism, below indicates pessimism.

The index benefited from a weaker euro and lower oil prices.

The investor confidence index for Switzerland dropped in February as the decision by the Swiss National Bank (SNB) to discontinue the CHF1.20 exchange rate floor weighed on the confidence.

-

13:18

OECD’s leading indicator increased to 100.5 in December

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator increased to 100.5 in December from 100.4 in November. It signalled stable growth in the United States, Canada, Japan, China and Brazil.

The index for the U.K. pointed to an easing in growth momentum.

Economic growth prospects have improved in the Eurozone.

The indicator for India indicates firming growth, while the index for Russia continues to point to a loss in growth momentum.

Germany's indicator rose to 99.7 in December from 99.6 in November. Italy's indicator climbed to 101.0 from 100.9.

The U.S. indicator remained unchanged at 100.4. China's reading increased to 99.3 from 99.1, while India's reading rose to 99.4 from 99.3.

Russia's indicator declined to 99.4 from 100.0, while UK's indicator decreased to 100.2 from 100.3.

-

13:00

European stock markets mid-session: indices recover slightly from early slump

European stocks recover slightly after they slumped sharply in early trading tracking losses on Wall Street and Asia on concerns over economic growth in China and worries that Greece heads for a showdown with the European Union.

Yesterday data showed that China's trade performance slumped far more than analysts expected. Chinese exports fell 3.3% and imports decreased by 19.9%.

Over the weekend Greek Prime Minister Alexis Tsirpas ruled out any extension of the international bailout and reaffirmed that he will stick to his plan to roll back austerity measures. On late Friday Standard and Poor's downgraded Greece from B- to B, only one notch higher than "default" and kept the outlook for Greece negative. S&P warned that time is running out for Greece to reach an agreement. Moody's is reviewing its rating.

Today data on German Trade Balance was published. Germany's surplus widened in December from revised 17.9 billion to 21.8 billion, more than the 18.2 billion predicted by economists.

Eurozone's Sentix Investor Confidence Index for February improved to the highest level in 9-months. The index improved from a previous reading of 0.9 to 12.4, beating estimates of an increase to 3.0.

The FTSE 100 index is currently trading -0.72% quoted at 6,804.22 points. Germany's DAX 30 lost -1.66% trading at 10,666.56. France's CAC 40 is currently trading at 4,637.49 points, -1.14%.

-

12:20

Oil: Prices recover after Chinese data weighed

Oil prices added in today's trading. Brent Crude rose by +0.38%, currently trading at USD58.02 a barrel almost flat. On January 13th Crude hit a low at USD45.19 and began to rise on reports on declining rig numbers in the U.S. and capital expenditure cuts. Brent rose more than 9% last week, its biggest rise in a week since 2011. West Texas Intermediate rose by +1.22% currently quoted at USD52.32. Oil prices dipped on disappointing data Chinese trade data fuelling concerns over an economic slowdown.

Worldwide supply still exceeds demand in a period of low global economic growth and the OPEC refusing to cut output rates to stabilize prices. Smaller OPEC members want to cut production but the organisation, responsible for 40% of worldwide production focuses on its fight for market share. Rising U.S. stockpiles are contributing to a global glut that drove prices almost 50 percent lower last year. Supply will exceed demand by 2 million barrels a day in the first half of 2015, said Iranian Oil Minister Bijan Namdar Zanganeh.

-

12:00

Gold prices rise after Friday’s slump on U.S. jobs data

Gold pauses Friday's slump to three-week lows and is trading higher today as the hefty decline spurred physical demand. Physical purchases were also driven by the upcoming Lunar New Year in China. On Friday the better-than-expected jobs data fuelled expectations that the FED is going to hike interest rates rather sooner than later, weighing on the price of the precious metal as higher interest rates make gold less attractive as the metal is not yield-bearing. A stronger greenback recently weighed on the dollar-denominated precious metal as it makes it more expensive for holders of other currencies.

Today the precious metal was sought after as safe-haven asset on renewed concerns over the developments in Greece. Over the weekend Greek Prime Minister Alexis Tsirpas ruled out any extension of the international bailout and reaffirmed that he will stick to his plan to roll back austerity measures. On late Friday Standard and Poor's downgraded Greece from B- to B, only one notch higher than "default" and kept the outlook for Greece negative. S&P warned that time is running out for Greece to reach an agreement.

The precious metal is currently quoted at USD1,240.90, +0,52% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1230-40(E1.0bn), $1.1280(E456mn), $1.1300(E445mn), $1.1400(E1.57bn), $1.1500(E1.4bn)

USD/JPY: Y118.00($638mn), Y118.20($280mn), Y118.25($545mn), Y118.50($370mn), Y118.75($370mn), Y118.85($205mn), Y119.40($443mn), Y119.45($410mn), Y120.00($1.0bn)

AUD/USD: $0.7780(A$212mn)

AUD/JPY: Y92.55(A$205mn)

-

10:30

Eurozone: Sentix Investor Confidence, February 12.4 (forecast 3.4)

-

10:20

Press Review: Greece Reaffirms Rejection of Bailout Before Emergency EU Meeting

BLOOMBERG

Greece Reaffirms Rejection of Bailout Before Emergency EU Meeting

(Bloomberg) -- Prime Minister Alexis Tsipras reaffirmed his government's rejection of Greece's international bailout program before Wednesday's emergency meeting of the euro area's finance ministers to discuss the country's financing needs.

"We need an honest negotiation with our partners that does not condemn the Greek economy and society to unending recession," Tsipras, 40, said in an address to parliament on Sunday, marking the start of a three-day debate on his government's policy platform.

The leader of Greece's anti-bailout governing coalition vowed to increase the minimum wage, restore the income tax-free threshold, halt infrastructure privatizations, and ask for World War II reparations from Germany, in a speech that sets him on a collision course with the country's creditors.

Source: http://www.bloomberg.com/news/articles/2015-02-08/tsipras-plans

REUTERS

Oil dips after weak Chinese trade data(Reuters) - Brent crude oil prices slipped on Monday as a slump in Chinese imports pointed to lower fuel demand in the world's biggest energy consumer, outweighing news of falling U.S. oil rig counts and healthy U.S. economic growth.

Global benchmark Brent crude oil for March was down 10 cents at $57.70 a barrel by 0748 GMT (2.48 a.m. EST) after rising as high as $59.06 earlier in the session. U.S. crude was at $51.87 a barrel, having hit a session high of $53.40.

Prices dipped as China's trade performance slumped in January, with exports falling 3.3 percent from year-ago levels while imports tumbled 19.9 percent, far worse than analysts had expected and highlighting a deepening slowdown.

Source: http://www.reuters.com/article/2015/02/09/us-markets-oil-idUSKBN0LD01P20150209

REUTERS

BoE's Carney says worried about financial reform fatigue globally(Reuters) - Bank of England Governor Mark Carney said on Monday he was worried about financial reform fatigue globally, ahead of a meeting of G20 finance ministers and central bankers.

"I worry about reform fatigue, not surprisingly, both at the FSB (Financial Stability Board) and more generally," Carney said at an Institute of International Finance meeting.

"Many of the toughest reforms are micro reforms that can have big political coalitions against them and have payoff very far into the future," he said.

Carney said that although the financial system was less likely to amplify initial shocks than in 2008, there was no room for complacency about its resilience.

Source: http://www.reuters.com/article/2015/02/09/us-g20-carney-idUSKBN0LD0KH20150209

-

10:00

European Stocks. First hour: Indices open sharply lower on disappointing Chinese Trade data and Greece concerns

European stocks slumped sharply in early trading tracking losses on Wall Street and Asia on concerns over economic growth in China and worries about developments in Greece. Yesterday data showed that China's trade performance slumped far more than analysts expected. Over the weekend Greek Prime Minister Alexis Tsirpas ruled out any extension of the international bailout and reaffirmed that he will stick to his plan to roll back austerity measures. On late Friday Standard and Poor's downgraded Greece from B- to B, only one notch higher than "default" and kept the outlook for Greece negative. S&P warned that time is running out for Greece to reach an agreement.

Today data on German Trade Balance was published. Germany's surplus widened in December from revised 17.9 billion to 21.8 billion, more than the 18.2 billion predicted by economists.

The FTSE 100 index is currently trading -0.92% quoted at 6,790.65 points. Germany's DAX 30 dropped -1.74% trading at 10,657.73. France's CAC 40 slumped -1.32%, currently trading at 4,629.08 points.

-

09:00

Global Stocks: Wall Street declines on renewed worries over Greece and strong job data

U.S. markets declined on Friday on solid jobs data that fuelled speculations on a mid-year rate-hike. The U.S. economy added 257,000 jobs in January, exceeding expectations for a rise of 231,000 jobs, after a gain of 329,000 jobs in December. December's figure was revised up from a rise of 252,000 jobs. The U.S. unemployment rate rose to 5.7% in January from 5.6% in December as the number of job seekers grew. Analysts had expected the unemployment rate to remain unchanged at 5.6%. Average hourly earnings increased 0.5% in January, beating forecasts of a 0.2% gain, after a 0.2% drop in December.

Renewed worries over Greek debt negotiations weighed on the markets. On late Friday S&P downgraded Greece from B- to B, only one notch higher than "default" and kept the outlook for Greece negative.

The DOW JONES index lost -0.34% closing at 17,824.29 points. The S&P 500 declined by -0.34% with a final quote of 2,055.47 points. Still both indices registered strong gains for the week. The Dow Jones rose the most in one week since January 2013.

Chinese stocks were mixed on Monday after data on Chinese trade published on Sunday was far worse than analysts expected. Hong Kong's Hang Seng is trading -0.41% at 24,578.52 points. China's Shanghai Composite closed at 3,095.12 points +0.62%. Market participants bet on further monetary easing by the People's Bank of China as the economic slowdown further aggravates.

Japan's Nikkei added gains on Monday, closing +0.36% with a final quote of 17,711.93 points fuelled by strong U.S. jobs data but gains were limited by weak Chinese trade data.

-

08:30

Foreign exchange market. Asian session: U.S. dollar mixed against the most major currencies

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:15Australia RBA's Governor Glenn Stevens Speech

00:30 Australia ANZ Job Advertisements (MoM) January +1.8% 1.3%

05:00 Japan Consumer Confidence January 38.8 39.4 39.1

06:00 Japan Eco Watchers Survey: Current January 45.2 45.7 45.6

06:00 Japan Eco Watchers Survey: Outlook January 46.7 50

07:00 Germany Trade Balance December 17.7 18.2 21.8

07:00 Germany Current Account December 18.6 25.3

The U.S. dollar traded mixed against most major currencies after data on the U.S. economy on Friday that reinforced speculations on a mid-year rate-hike. The U.S. economy added 257,000 jobs in January, exceeding expectations for a rise of 231,000 jobs, after a gain of 329,000 jobs in December. December's figure was revised up from a rise of 252,000 jobs. The U.S. unemployment rate rose to 5.7% in January from 5.6% in December as the number of job seekers grew. Analysts had expected the unemployment rate to remain unchanged at 5.6%. Average hourly earnings increased 0.5% in January, beating forecasts of a 0.2% gain, after a 0.2% drop in December.

The euro paused its decline after worries over Greek debt negotiations weighed on the single currency on Friday. On late Friday S&P downgraded Greece from B- to B, only one notch higher than "default" and kept the outlook for Greece negative.

The Australian dollar declined versus the greenback close to lows hit a week ago when the RBA eased monetary policy. Data on China's Trade Balance released on Sunday fuelled worries about the economic growth of Australia's major trading partner. The ANZ Job Advertisements for January rose less at a pace of +1.3% in January compared to +1.8% in December. Reserve Bank of Australia Governor Glenn Stevens said Australian businesses must prepared for an increase in use of the Chinese yuan for trade as Chinese companies will more and more wish to settle trades in RMB.

New Zealand's dollar added gains against the greenback in Asian trade. The RBNZ Governor Graeme Wheeler said on Wednesday last week that interest rates will remain on hold "for some time".

The Japanese yen traded higher against the greenback on Monday after Friday's slump despite disappointing current account data. Yesterday Japan reported the adjusted current account with a deficit of 187.2 billion Japanese yen. Today data on consumer confidence came in at 39.1 for January compared to a forecast of 39.4 points and a previous reading of 38.8. The Eco Watchers Survey (current) had a reading of 45.6, 0.1 points below forecasts. The Eco Watchers Survey (outlook) rose in January from 46.7 to 50 points.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar lost against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 G20 G20 Meetings

09:30 Eurozone Sentix Investor Confidence February 0.9 3.4

13:15 Canada Housing Starts January 180 Revised From 181 184

21:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Tertiary Industry Index December +0.2% +0.1%

-

08:01

Germany: Current Account , December 25.3

-

08:00

Germany: Trade Balance, December 21.8 (forecast 18.2)

-

07:15

Options levels on monday, February 9, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1513 (2066)

$1.1444 (366)

$1.1396 (236)

Price at time of writing this review: $1.1335

Support levels (open interest**, contracts):

$1.1230 (2220)

$1.1187 (2301)

$1.1129 (2025)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 97500 contracts, with the maximum number of contracts with strike price $1,1500 (4903);

- Overall open interest on the PUT options with the expiration date March, 6 is 97424 contracts, with the maximum number of contracts with strike price $1,1200 (4697);

- The ratio of PUT/CALL was 1.00 versus 0.88 from the previous trading day according to data from February, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.5505 (1670)

$1.5407 (512)

$1.5311 (1452)

Price at time of writing this review: $1.5263

Support levels (open interest**, contracts):

$1.5186 (540)

$1.5090 (667)

$1.4993 (1875)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 21514 contracts, with the maximum number of contracts with strike price $1,5500 (1670);

- Overall open interest on the PUT options with the expiration date March, 6 is 27168 contracts, with the maximum number of contracts with strike price $1,5000 (1875);

- The ratio of PUT/CALL was 1.26 versus 0.99 from the previous trading day according to data from February, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:01

Japan: Eco Watchers Survey: Outlook, January 50.0

-

07:00

Japan: Eco Watchers Survey: Current , January 45.6 (forecast 45.7)

-

03:27

Nikkei 225 17,699.72 +51.22 +0.29%, Hang Seng 24,456.87 -222.52 -0.90%, Shanghai Composite 3,064.39 -11.52 -0.37%

-

01:31

Australia: ANZ Job Advertisements (MoM), January 1.3%

-

01:05

Commodities. Daily history for Feb 6’2015:

(raw materials / closing price /% change)

Light Crude 51.69 +0.96%

Gold 1,234.60 +0.80%

-

01:02

Stocks. Daily history for Feb 6’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,820.17 +9.19 +0.16%

TOPIX 1,417.19 +7.08 +0.50%

SHANGHAI COMP 3,076.64 -59.89 -1.91%

HANG SENG 24,679.39 -86.10 -0.35%

FTSE 100 6,853.44-12.49 -0.18%

CAC 40 4,691.03-12.27 -0.26%

Xetra DAX 10,846.39 -59.02 -0.54%

S&P 500 2,055.47 -7.05 -0.34%

NASDAQ Composite 4,744.4 -20.70 -0.43%

Dow Jones 17,824.29 -60.59 -0.34%

-

01:00

Currencies. Daily history for Feb 6’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1319 -1,40%

GBP/USD $1,5235 -0,60%

USD/CHF Chf0,9252 -0,09%

USD/JPY Y118,83 +1,10%

EUR/JPY Y134,51 -0,26%

GBP/JPY Y181,04 +0,52%

AUD/USD $0,7798 +0,03%

NZD/USD $0,7354 -0,54%

USD/CAD C$1,2522 +0,71%

-

00:51

Japan: Current Account (adjusted), bln, December 187.2

-

00:00

Schedule for today, Monday, Feb 9’2015:

(time / country / index / period / previous value / forecast)

00:15Australia RBA's Governor Glenn Stevens Speech

00:30 Australia ANZ Job Advertisements (MoM) January +1.8% 1.3%

05:00 Japan Consumer Confidence January 38.8 39.4

06:00 Japan Eco Watchers Survey: Current January 45.2 45.7

06:00 Japan Eco Watchers Survey: Outlook January 46.7

07:00 Germany Trade Balance December 17.7 18.2

07:00 Germany Current Account December 18.6

08:00 G20 G20 Meetings

09:30 Eurozone Sentix Investor Confidence February 0.9 3.4

13:15 Canada Housing Starts January 180 Revised From 181 184

21:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Tertiary Industry Index December +0.2% +0.1%

-