Noticias del mercado

-

21:00

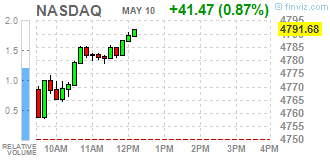

Dow +1.06% 17,893.59 +187.68 Nasdaq +1.04% 4,799.50 +49.29 S&P +1.07% 2,080.66 +21.97

-

20:19

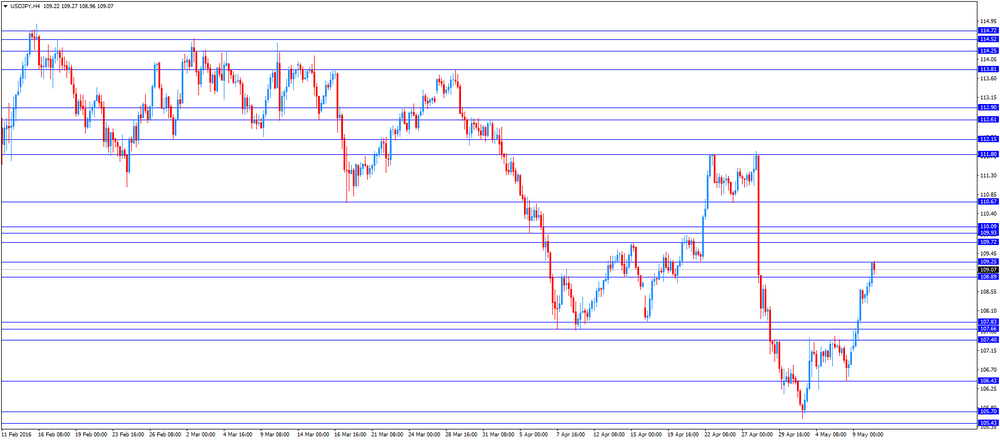

American focus: The US dollar strengthened against the Japanese currency

The yen continued to fall against the dollar, setting a new low in May. Since the beginning of the week, the yen fell nearly 2 percent against the background of strengthening risk appetite and rumors of a possible intervention by the Bank of Japan. On Monday, Japan's Finance Minister Taro Aso said that the Central Bank is ready to intervene in case of a sharp increase in the volatility of the national currency. Previously it was thought that Tokyo would not dare to intervene, given the US position, but Aso's words made market participants doubt it. Today, Aso reiterated his intention. "Certainly, we are ready to intervene if the yen continues to rise sharply," - said the Minister. According to Aso, the change rate of USD / JPY for two days at 5 yen can be called "somewhat excessive". Recall that in recent months, other officials of Japan have already made warning of the possibility of intervention designed to put an end to the strengthening of the yen. This strengthening leads to the fact that Japan is more difficult to achieve the acceleration of inflation and stimulate economic growth.

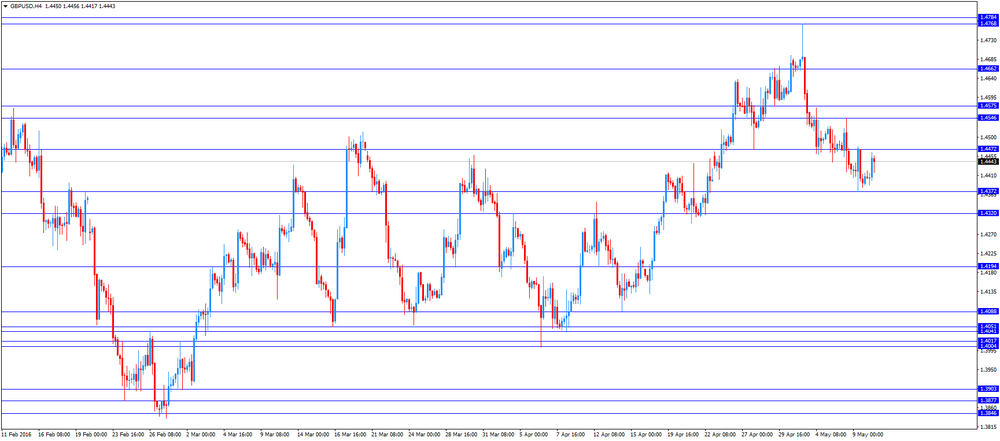

The British pound strengthened against the dollar, reaching yesterday's high but then went back to the opening level. Experts note the support provided pound increase in demand for high-risk currencies and expectations of the key events of the week. Tomorrow there will be the publication of reports on industrial production and production in the manufacturing industry, where they are likely to confirm the weakness of GDP in the 1st quarter. Meanwhile, on Thursday a meeting of the Bank of England. Economists will be closely watching those to preserve the unity of opinion among the leadership of the Bank of England after increasing downside risks to GDP growth. Over the weekend edition of the Guardian reported that at least one member of the Committee of Central Bank may act for the interest rate cut to stimulate the economy.

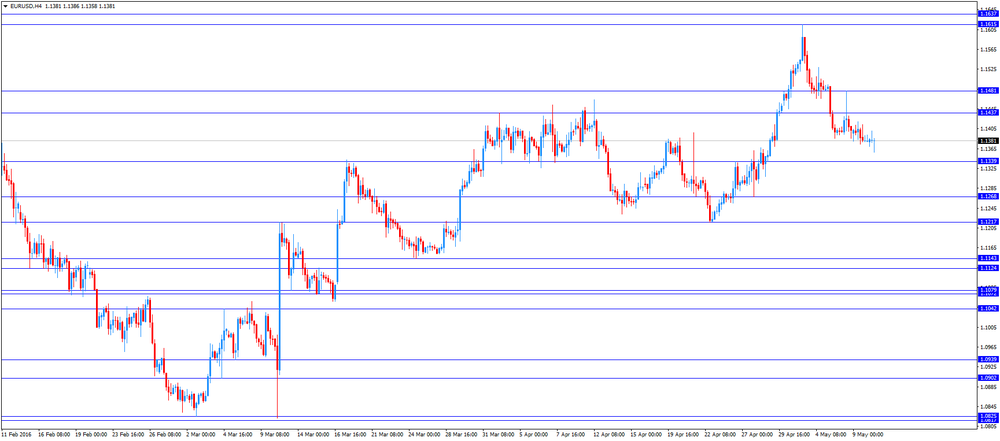

The euro traded mixed against the dollar, while remaining near the level of opening of the session. Against the background of the lack of new catalyst and the important economic data trading dynamics dictate change risk appetite. Little influenced by minor US reports. The Commerce Department reported that seasonally adjusted inventories in the warehouses of wholesale trade increased in March by 0.1%, reaching $ 583.6 billion. Last change coincided with forecasts. Meanwhile, the index for February was revised to -0.6% from -0.5%. Compared with March 2015 stocks increased by 0.3%. Wholesale sales of $ 430.7 billion., An increase of 0.7% compared with February. In annual terms, sales decreased by 2.0%. Also, the Ministry of Commerce said that the ratio of stocks to sales ratio was 1.36 months in March as February. Recall that in March 2015 the ratio was at 1.32 months.

Meanwhile, the review of vacancies and labor turnover (Jolts), published by the US Bureau of Labor Statistics showed that the number of vacancies in March increased to 5.757 million. Compared with 5.608 million. In February (revised from 5.445 million.). Analysts had expected a decline to 5.412 million.

-

18:13

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Tuesday, tracking global equities, as investors' appetite for risk increased and as oil prices rose, boosting energy shares. Oil was up about 2%, driven by supply disruptions in Canada and elsewhere that have knocked out 2.5 million barrels of daily production and overshadowed fears of oversupply. World stock markets also rose, helped by solid corporate earnings in Europe, progress on Greek debt talks, and a new pledge by Japan that it was prepared to weaken its currency.

Almost all of Dow stocks in positive area (28 of 30). Top looser - Pfizer Inc. (PFE, -0,68). Top gainer - The Goldman Sachs Group, Inc. (GS, +2,23%).

Almost all of S&P sectors also in positive area. Top looser - Conglomerates (-2,4%). Top gainer - Basic Materials (+1,5%).

At the moment:

Dow 17826.00 +180.00 +1.02%

S&P 500 2073.25 +19.00 +0.92%

Nasdaq 100 4380.25 +44.50 +1.03%

Oil 44.39 +0.95 +2.19%

Gold 1260.40 -6.20 -0.49%

U.S. 10yr 1.76 +0.00

-

18:00

European stocks closed: FTSE 100 6,156.65 +41.84 +0.68% CAC 40 4,338.21 +15.40 +0.36% DAX 10,045.4 +64.95 +0.65%

-

18:00

European stocks close: stocks traded higher on a rise in oil prices

Stock indices closed higher as oil prices increased. Oil prices remained supported by the wildfire in Canada.

Market participants also eyed the economic data from the Eurozone. Destatis released its industrial production data for Germany on Tuesday. German industrial production fell 1.3% in March, missing expectations for a 0.3% drop, after a 0.7% decline in February. It was the biggest drop since August 2014.

German industrial production excluding energy and construction fell by 1.2% in March.

According to Destatis, Germany's trade surplus increased to €26.0 billion in March from 20.2 in February. February's figure was revised down from a surplus of €20.3 billion.

Exports climbed 1.9% in March, while imports were down 2.3%.

On a yearly basis, German exports decreased 0.5% in March, while imports slid by 4.3%.

Germany's current account surplus was €30.4 billion in March, up from €21.1 billion in February. February's figure was revised up from a surplus of €20.0 billion.

The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France slid 0.3% in March, missing expectations for a 0.3% increase, after a 1.3% drop in February. February's figure was revised down from a 1.0% fall. Manufacturing output dropped 0.9% in March, while construction output jumped 1.2%.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £11.2 billion in March from £11.4 billion in February.

The decline in deficit was driven by a rise in exports, which increased by £0.4 billion in March.

The total trade deficit for goods and services widened to £13.3 billion in the first quarter from £12.2 billion in the fourth quarter of 2015. It was the biggest gap since the first quarter of 2008.

The total trade deficit, including services, narrowed to £3.83 billion in March from £4.3 billion in February. February's figure was revised down from a deficit of £4.84 billion.

The National Institute of Economic and Social Research (NIESR) lowered its GDP growth forecast for the U.K. on Tuesday. If Britain remains in the European Union (EU), the U.K. GDP will be expected to grow 2.0% in 2016, down from the previous estimate of 2.3%. The NIESR expects the U.K. economy to expand at 2.7% in 2017, unchanged from the previous estimate. The NIESR said that uncertainty around the referendum on Britain's membership in the EU weighed on the economy.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,156.65 +41.84 +0.68 %

DAX 10,045.44 +64.95 +0.65 %

CAC 40 4,338.21 +15.40 +0.36 %

-

17:45

BRC and KPMG sales monitor: U.K. retail sales declined by an annual rate of 0.9% on a like-for-like basis in April

According to the British Retail Consortium (BRC) and KPMG sales monitor, the U.K. retail sales decreased by an annual rate of 0.9% on a like-for-like basis in April, after a 0.7% fall in March.

On a total basis, retail sales were flat year-on-year in April.

"April saw the second month of flat sales for UK retailers with positive food sales offset by record declines in fashion. As a result, the 12-month average growth for non-food sales slowed to 2.5 per cent while for food sales it nudged back into positive territory at 0.1 per cent," BRC Chief Executive, Helen Dickinson, said.

-

17:42

Oil demonstrates positive dynamics

Oil prices rose by about 3 percent, partially recovering from yesterday's fall as supply disruptions in Canada and other countries offset growing concerns about record-high US inventories of crude oil.

Estimates Energy Aspects, forest fires in Canada affected the production of about 1.6 million barrels per day, which is more than 1% of the global supply. Canada is a major exporter of oil to the US and Canadian production decline may reduce the amount of oil in the US stores, which will be a positive factor for the oil market. Also today, the media reported a series of attacks on oil infrastructure in Nigeria. Against the background of this production the largest producer of oil in Africa, close to 22-year low.

However, experts say that the world's oil reserves are near record highs, and some supply disruptions little that this will change, as the decline in production in some OPEC countries offset by growth of exports from Iran and nearly a record oil production in Saudi Arabia and Russia .

Supply disruptions overshadowed concerns about crude oil reserves in the US, which is expected to have grown by the end of the fifth week, and reached a record high above 543 million. Barrels. Genscape Yesterday the company reported an increase in stocks at Cushing terminal by 1.4 million barrels last week. If this information is confirmed, when the US Department of Energy will publish its data on stocks, it will exacerbate the problem of oversupply in the oil market.

"I think we are still in a bull market, but I also think that the" headwinds "strengthened" - said Scott Shelton, an energy broker ICAP.

WTI for delivery in June rose to $44.38 a barrel. Brent for June rose to $45.28 a barrel.

-

17:42

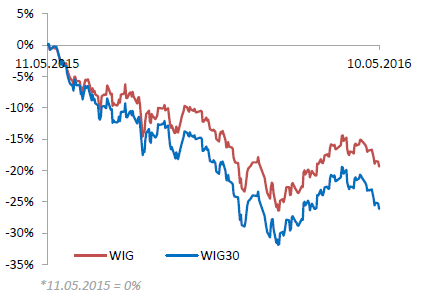

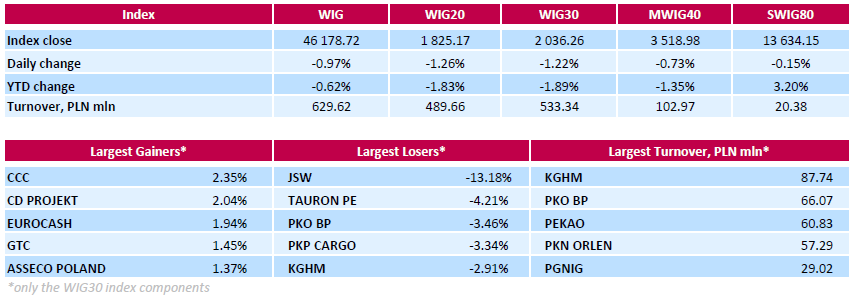

WSE: Session Results

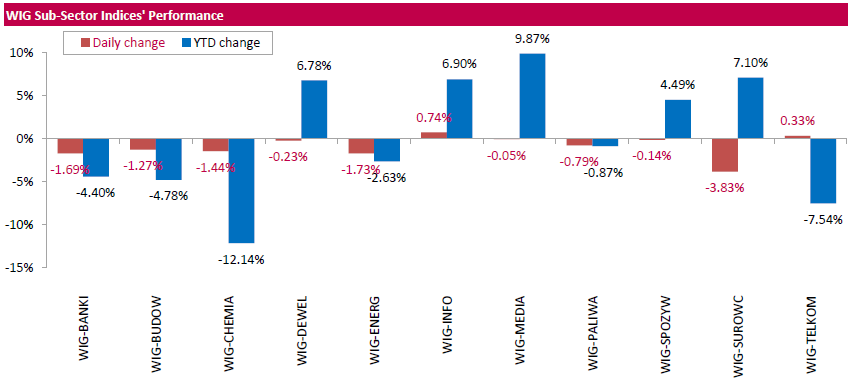

Polish equity market closed lower on Tuesday. The broad market benchmark, the WIG Index, lost 0.97%. Except for information technology (+0.74%) and telecommunication services (+0.33%), every sector in the WIG Index declined, with materials (-3.83%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.22%. Within the WIG30 Index components, coking coal producer JSW (WSE: JSW) was hit the hardest, retreating by 13.18% after a month-long growth, which took the stock up 60%. Other major laggards included genco TAURON PE (WSE: TPE), bank PKO BP (WSE: PKO) and railway freight transport operator PKP CARGO (WSE: PKP), plunging by 4.21%, 3.46% and 3.34% respectively. On the other side of the ledger, footwear retailer CCC (WSE: CCC) recorded the biggest gain, up 2.35%. It was followed by videogame developer CD PROJEKT (WSE: CDR) and FMCG-wholesaler EUROCASH (WSE: EUR), advancing 2.04 % and 1.94% respectively.

-

17:41

Koichi Hamada, a key economic adviser to Japanese Prime Minister Shinzo Abe: the Bank of Japan would intervene in the foreign exchange market if the yen rises against the U.S. dollar to Y90-95

Koichi Hamada, a key economic adviser to Japanese Prime Minister Shinzo Abe, said in an interview with Reuters on Tuesday that the Bank of Japan (BoJ) would intervene in the foreign exchange market if the yen rises against the U.S. dollar to Y90-95.

"In case the yen happens to be so firm that it becomes between 90-95 yen per dollar, then Japan would have to intervene even if it angers the United States," he said.

Hamada also said that there was no need for further stimulus measures at the moment.

-

17:34

NIESR: Britain’s exit from the European Union would be a shock for the country’s economy

The National Institute of Economic and Social Research (NIESR) said on Tuesday that Britain's exit from the European Union (EU) would be a shock for the country's economy. The economy would expand 1.9% next year, lower than 2.7% growth if Britain remains in the EU.

The pound would depreciate in the longer-term, declining to close to parity with the euro by 2030.

-

17:22

Gold prices fell slightly today

Quotes of gold fell today, approaching to almost two-week low. The pressure on the precious metal has a stronger dollar and increased risk appetite.

It is worth emphasizing, gold prices declined for five of the last six sessions, however, they are still 19 percent higher than at the beginning of the year, as expectations the US Federal Reserve to increase interest rates weakened. Low interest rates support the price of gold, which does not bring interest income to investors. The increase in rates, in turn, would contribute to the growth of the dollar and have reduced the demand for gold.

"Drivers who have raised the price of gold continues to remain largely unchanged, including fluctuating Fed forecasts on terms of the rate increase and decrease of the US dollar", - said Nitesh Shah, an analyst at ETF Securities.

Analysts at the same time note that the limiting factor for the growth of gold prices are expectations of Fed rate at the next meeting, which will lead to the strengthening of the US currency. According to the quotations of futures on a bet the Fed, traders estimate the probability of a June rate hike to 4%.

A slight effect on the gold had data for China. National Bureau of Statistics of China reported that the results of April the consumer price index rose by 2.3% per annum, as well as in March. The experts predicted an increase of 2.4%. The index is still below the inflation target of 3% this year, and the central bank have further room for easing monetary policy against the backdrop of the ongoing economic slowdown. Compared with the previous month, the consumer price index fell by 0.2% after falling in March to 0.4% in April. In addition, it was announced that the producer price index in April fell by 3.4% per year, after declining by 4.3% in March. The fall of the index observed over four years. Economists had forecast the index decline 3.8%.

The cost of the June gold futures on the COMEX fell to $ 1262.5 per ounce.

-

17:01

NIESR cuts its GDP growth forecast for the U.K.

The National Institute of Economic and Social Research (NIESR) lowered its GDP growth forecast for the U.K. on Tuesday. If Britain remains in the European Union (EU), the U.K. GDP will be expected to grow 2.0% in 2016, down from the previous estimate of 2.3%. The NIESR expects the U.K. economy to expand at 2.7% in 2017, unchanged from the previous estimate.

The NIESR said that uncertainty around the referendum on Britain's membership in the EU weighed on the economy.

The unemployment rate is expected to decline to rise to 5.2% this year from 5.1% last year.

The Bank of England (BoE) is expected to start hiking its interest rates in November, according to NIESR.

The inflation is expected to be an average 0.3% this year and 0.9% next year.

-

16:36

Wholesale inventories in the U.S. increase 0.1% in March

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. increased 0.1% in March, in line with expectations, after a 0.6% fall in January. February's figure was revised down from a 0.5% decline.

The increase was mainly driven by a rise in inventories of non-durable goods. Inventories of non-durable goods increased 0.5% in March, while inventories of durable goods fell 0.1%.

Wholesale sales rose 0.7% in March, after a 0.2% fall in February.

-

16:25

Job openings climb to 5.757 million in March

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings jumped to 5.757 million in March from 5.608 million in February, beating expectations for a fall to 5.412. February's figure was revised up from 5.445 million.

The number of job openings rose for total private (5.251 million) and for government (506,000) in March from February.

The hires rate was 3.7% in March.

Total separations decreased to 5.045 million in March from 5.159 million in February.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:16

Greek industrial production decreases 0.8% in March

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Tuesday. Greek industrial production decreased 0.8% in March, after a 4.5% fall in February.

On a yearly basis, industrial production in Greece slid at an adjusted rate of 4.0% in March, after a 2.5% decrease in February. February's figure was revised up from a 3.0% drop.

Production in the manufacturing sector decreased at an annual rate of 2.5% in March, output in the mining and quarrying sector dropped 23.8%, while electricity production slid by 5.1%.

-

16:02

U.S.: JOLTs Job Openings, March 5.757 (forecast 5.412)

-

16:00

U.S.: Wholesale Inventories, March 0.1% (forecast 0.1%)

-

15:56

Greek consumer prices increase 0.7% in April

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Tuesday Greek consumer prices increased 0.7% in April, after a 1.3% rise in March.

On a yearly basis, the Greek consumer price index declined 1.3% in April, after a 1.5 fall in March. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 4.8% in April, transport costs dropped by 4.5%, clothing and footwear prices were down 2.2%, while household equipment prices decreased 1.4%.

Prices of food and non-alcoholic beverages fell at an annual rate of 1.0% in April, while alcoholic beverages and tobacco prices increased by 1.4%.

-

15:50

WSE: After start on Wall Street

U.S. Stocks open: Dow +0.47%, Nasdaq +0.34%, S&P +0.41%

The beginning of trading on Wall Street is an increase of more than 0.3% and the increase in attacks on the exponential average of 21 sessions. The movement bears the marks of continuing defense of Friday.

On the WSE we have different problem. The combination of concerns about Friday Moody's rating with a negative impulse for the banking sector after its non-preferred for the holder of a mortgage in CHF court judgment, set the sentiment on the Warsaw Stock Exchange clearly down. Hence start of trading on the market in the US is not very interesting for our investors.

-

15:39

National Federation of Independent Business’s small-business optimism index for the U.S. rises to 93.6 in April

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index rose to 93.6 in April from 92.6 in March.

5 of 10 sub-indexes increased last month, 1 sub-index fell, while 4 were unchanged.

"The Federal Reserve continues to send out a message of economic weakness, indicating that the economy is too weak to be able to handle a 25 basis point increase in the Federal Funds rate. This reinforces the uncertainty felt on Main Street and supports the reluctance to spend and hire reflected in the NFIB measures," NFIB Chief Economist Bill Dunkelberg said.

-

15:39

Option expiries for today's 10:00 ET NY cut

USDJPY 108.50 (USD 884m) 108.75 (505m) 109.50 (842m) 110.80 (300m)

EURUSD: 1.1235-40 (EUR 408m) 1.1390 (200m) 1.1400 (281m) 1.1450 (407m) 1.1600 (771m)

GBPUSD 1.4450 (GBP 252m) 1.4600 (201m)

AUDUSD 0.7300 (AUD 203m) 0.7375 (200m) 0.7550-55 (326m) 0.7500 (355m) 0.7545 (652m)

USDCAD 1.3250 (USD 485m)

NZDUSD 0.6650 (NZD 482m) 0.6800 (238m) 0.6905 (202m)

EURJPY 123.50 (201m) 125.00 (386m)

-

15:33

U.S. Stocks open: Dow +0.47%, Nasdaq +0.34%, S&P +0.41%

-

15:12

Before the bell: S&P futures +0.34%, NASDAQ futures +0.21%

U.S. stock-index futures rose.

Nikkei 16,565.19 +349.16 +2.15%

Hang Seng 20,242.68 +85.87 +0.43%

Shanghai Composite 2,833.18 +1.07 +0.04%

FTSE 6,131.81 +17.00 +0.28%

CAC 4,337.04 +14.23 +0.33%

DAX 10,027.36 +46.87 +0.47%

Crude $43.47 (+0.07%)

Gold $1266.00 (-0.05%)

-

15:00

Industrial production in Italy is flat in March

The Italian statistical office Istat released its industrial production data on Tuesday. Industrial production in Italy was flat in March, after a 0.7% decline in February. February's figure was revised down from a 0.6% decrease.

An increase in production of energy products offset drops in production of output of consumer goods, investment goods and intermediate products.

On a yearly basis, industrial production in Italy climbed at a seasonally-adjusted rate of 0.5% in March, after a 1.1% increase in February. February's figure was revised down from 1.2% gain.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

169.21

0.69(0.4095%)

745

ALCOA INC.

AA

9.56

0.10(1.0571%)

47272

ALTRIA GROUP INC.

MO

63.87

0.21(0.3299%)

200

Amazon.com Inc., NASDAQ

AMZN

692

12.25(1.8021%)

80599

Apple Inc.

AAPL

93.15

0.36(0.388%)

88711

AT&T Inc

T

38.89

0.03(0.0772%)

1763

Barrick Gold Corporation, NYSE

ABX

17.45

0.06(0.345%)

106417

Boeing Co

BA

132.3

0.20(0.1514%)

191

Caterpillar Inc

CAT

71.02

0.24(0.3391%)

550

Chevron Corp

CVX

100.6

0.25(0.2491%)

2125

Cisco Systems Inc

CSCO

26.54

0.03(0.1132%)

10544

Citigroup Inc., NYSE

C

44.18

0.29(0.6607%)

9969

Exxon Mobil Corp

XOM

88.81

0.24(0.271%)

12168

Facebook, Inc.

FB

119.64

0.40(0.3355%)

121853

Ford Motor Co.

F

13.36

0.04(0.3003%)

20788

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.8001

0.2801(2.6626%)

178290

General Electric Co

GE

29.95

0.08(0.2678%)

3728

General Motors Company, NYSE

GM

30.9

0.12(0.3899%)

2100

Goldman Sachs

GS

158.5

0.99(0.6285%)

2400

Google Inc.

GOOG

715.9

3.00(0.4208%)

4788

Home Depot Inc

HD

136.8

0.56(0.411%)

254

Intel Corp

INTC

29.86

0.06(0.2013%)

4527

International Business Machines Co...

IBM

148

0.66(0.4479%)

1971

McDonald's Corp

MCD

131.45

0.62(0.4739%)

1217

Microsoft Corp

MSFT

50.17

0.10(0.1997%)

3540

Nike

NKE

58.92

0.20(0.3406%)

2188

Pfizer Inc

PFE

33.9

0.08(0.2366%)

21249

Procter & Gamble Co

PG

82.2

0.08(0.0974%)

2458

Tesla Motors, Inc., NASDAQ

TSLA

209.5

0.58(0.2776%)

18410

The Coca-Cola Co

KO

45.49

0.25(0.5526%)

201

Twitter, Inc., NYSE

TWTR

14.25

0.05(0.3521%)

25713

United Technologies Corp

UTX

100.55

0.46(0.4596%)

2314

Verizon Communications Inc

VZ

51.23

0.15(0.2937%)

920

Wal-Mart Stores Inc

WMT

69

0.05(0.0725%)

1310

Walt Disney Co

DIS

105.8

0.46(0.4367%)

16737

Yahoo! Inc., NASDAQ

YHOO

37.2

0.02(0.0538%)

101

Yandex N.V., NASDAQ

YNDX

19.15

-0.09(-0.4678%)

2798

-

14:44

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 China PPI y/y April -4.3% -3.8% -3.4%

01:30 China CPI y/y April 2.3% 2.4% 2.3%

05:45 Switzerland Unemployment Rate (non s.a.) April 3.6% 3.5% 3.5%

06:00 Germany Current Account March 21.1 Revised From 20.0 30.4

06:00 Germany Industrial Production s.a. (MoM) March -0.7% Revised From -0.5% -0.3% -1.3%

06:00 Germany Trade Balance (non s.a.), bln March 20.2 Revised From 20.3 26.0

06:45 France Industrial Production, m/m March -1.3% Revised From -1.0% 0.3% -0.3%

06:45 France Industrial Production, y/y March 0.6% 0.5%

08:30 United Kingdom Total Trade Balance March -4.3 Revised From -4.84 -3.83

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data. Job openings are expected to decline to 5.412 million in March from 5.445 million in February.

Wholesale inventories in the U.S. are expected to rise 0.1% in March, after a 0.5% decrease in February.

The euro traded mixed against the U.S. dollar on the mixed economic data from the Eurozone. Destatis released its industrial production data for Germany on Tuesday. German industrial production fell 1.3% in March, missing expectations for a 0.3% drop, after a 0.7% decline in February. It was the biggest drop since August 2014.

German industrial production excluding energy and construction fell by 1.2% in March.

According to Destatis, Germany's trade surplus increased to €26.0 billion in March from 20.2 in February. February's figure was revised down from a surplus of €20.3 billion.

Exports climbed 1.9% in March, while imports were down 2.3%.

On a yearly basis, German exports decreased 0.5% in March, while imports slid by 4.3%.

Germany's current account surplus was €30.4 billion in March, up from €21.1 billion in February. February's figure was revised up from a surplus of €20.0 billion.

The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France slid 0.3% in March, missing expectations for a 0.3% increase, after a 1.3% drop in February. February's figure was revised down from a 1.0% fall. Manufacturing output dropped 0.9% in March, while construction output jumped 1.2%.

The British pound traded mixed against the U.S. dollar on the U.K. trade data. The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £11.2 billion in March from £11.4 billion in February.

The decline in deficit was driven by a rise in exports, which increased by £0.4 billion in March.

The total trade deficit for goods and services widened to £13.3 billion in the first quarter from £12.2 billion in the fourth quarter of 2015. It was the biggest gap since the first quarter of 2008.

The total trade deficit, including services, narrowed to £3.83 billion in March from £4.3 billion in February. February's figure was revised down from a deficit of £4.84 billion.

The Swiss franc traded lower against the U.S. dollar. The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate increased to a seasonally adjusted 3.5% in April from 3.4% in March. March's figure was revised down from 3.5%.

On a seasonally unadjusted basis, the unemployment rate in Switzerland decreased to 3.5% in April from 3.6% in March, in line with expectations.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y109.27

The most important news that are expected (GMT0):

14:00 U.S. Wholesale Inventories March -0.5% 0.1%

14:00 U.S. JOLTs Job Openings March 5.445 5.412

21:00 New Zealand RBNZ Financial Stability Report

23:00 New Zealand RBNZ Press Conference

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

NIKE (NKE) downgraded to Market Perform from Outperform at Wells Fargo

Other:

American International Group (AIG) target lowered to $53 from $56 at FBR Capital

Pfizer (PFE) removed from US 1 List at BofA/Merrill

-

13:05

WSE: Mid session comment

After the first half of the session the picture of market remains unchanged. With relatively low activity the Warsaw Stock Exchange collapses under its own weight, essentially blurring the conclusions from Friday's tip. Unfortunately it happens at the pretty optimism presented by the West of Europe. Also a weaker performance show others emerging markets, which are our point of reference. We may also see that bigger capital can abstain with decisions to next Friday, when we will know the decision of Moody's vs. Polish rating.

In the mid-session the WIG20 index reached the level of 1830 points (-0,97%) with turnover of PLN 223 mln.

-

12:00

European stock markets mid session: stocks traded higher on the mixed economic data from the Eurozone

Stock indices traded higher on the mixed economic data from the Eurozone. Destatis released its industrial production data for Germany on Tuesday. German industrial production fell 1.3% in March, missing expectations for a 0.3% drop, after a 0.7% decline in February. It was the biggest drop since August 2014.

German industrial production excluding energy and construction fell by 1.2% in March.

According to Destatis, Germany's trade surplus increased to €26.0 billion in March from 20.2 in February. February's figure was revised down from a surplus of €20.3 billion.

Exports climbed 1.9% in March, while imports were down 2.3%.

On a yearly basis, German exports decreased 0.5% in March, while imports slid by 4.3%.

Germany's current account surplus was €30.4 billion in March, up from €21.1 billion in February. February's figure was revised up from a surplus of €20.0 billion.

The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France slid 0.3% in March, missing expectations for a 0.3% increase, after a 1.3% drop in February. February's figure was revised down from a 1.0% fall. Manufacturing output dropped 0.9% in March, while construction output jumped 1.2%.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £11.2 billion in March from £11.4 billion in February.

The decline in deficit was driven by a rise in exports, which increased by £0.4 billion in March.

The total trade deficit for goods and services widened to £13.3 billion in the first quarter from £12.2 billion in the fourth quarter of 2015. It was the biggest gap since the first quarter of 2008.

The total trade deficit, including services, narrowed to £3.83 billion in March from £4.3 billion in February. February's figure was revised down from a deficit of £4.84 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,166.23 +51.42 +0.84 %

DAX 10,088.46 +107.97 +1.08 %

CAC 40 4,368.69 +45.88 +1.06 %

-

11:46

Bank of France expects the country’s economy to expand at 0.3% in the second quarter

The Bank of France released its gross domestic product (GDP) forecasts for France on Tuesday. French economy is expected to expand at 0.3% in the second quarter, after a 0.5% growth in the first quarter.

The manufacturing business confidence index remained unchanged at 99 in April. Companies expect a growth in activity to accelerate in May.

The services business sentiment index remained unchanged at 96 in April. But services companies expect a rise in activity in May.

The construction business sentiment index increased to 97 in April from 96 in March. Companies expect an increase in activity in May.

-

11:42

U.K. trade deficit in goods narrows to £11.2 billion in March

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £11.2 billion in March from £11.4 billion in February.

The decline in deficit was driven by a rise in exports, which increased by £0.4 billion in March.

The total trade deficit for goods and services widened to £13.3 billion in the first quarter from £12.2 billion in the fourth quarter of 2015. It was the biggest gap since the first quarter of 2008.

The total trade deficit, including services, narrowed to £3.83 billion in March from £4.3 billion in February. February's figure was revised down from a deficit of £4.84 billion.

-

11:31

French industrial production slides 0.3% in March

The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France slid 0.3% in March, missing expectations for a 0.3% increase, after a 1.3% drop in February. February's figure was revised down from a 1.0% fall.

Manufacturing output dropped 0.9% in March, while construction output jumped 1.2%.

Output in mining and quarrying, energy, water supply and waste management climbed 3.7% in March.

On a yearly basis, the French industrial production climbed 0.5% in March, after a 0.6% gain in February.

-

11:12

Germany's trade surplus increases to €26.0 billion in March

Destatis released its trade data for Germany on Tuesday. Germany's trade surplus increased to €26.0 billion in March from 20.2 in February. February's figure was revised down from a surplus of €20.3 billion.

Exports climbed 1.9% in March, while imports were down 2.3%.

On a yearly basis, German exports decreased 0.5% in March, while imports slid by 4.3%.

Germany's current account surplus was €30.4 billion in March, up from €21.1 billion in February. February's figure was revised up from a surplus of €20.0 billion.

-

11:06

German industrial production falls 1.3% in March

Destatis released its industrial production data for Germany on Tuesday. German industrial production fell 1.3% in March, missing expectations for a 0.3% drop, after a 0.7% decline in February. It was the biggest drop since August 2014.

February's figure was revised down from a 0.5% decrease.

The output of capital goods decreased 1.4% in March, energy output rose 0.3%, and the production in the construction sector was down 3.2%, while the production of intermediate goods fell 1.3%.

The output of consumer goods declined 0.2% in March.

German industrial production excluding energy and construction fell by 1.2% in March.

-

10:46

Swiss unemployment rate rises to a seasonally adjusted 3.5% in April

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate increased to a seasonally adjusted 3.5% in April from 3.4% in March. March's figure was revised down from 3.5%.

On a seasonally unadjusted basis, the unemployment rate in Switzerland decreased to 3.5% in April from 3.6% in March, in line with expectations.

The number of unemployed people in Switzerland fell by 5,784 to 149,540 in April from the previous month.

The youth unemployment rate was down to 3.2% in April from 3.4% in March.

-

10:36

Japanese Finance Minister Taro Aso: Japan is ready to intervene in the foreign exchange market

Japanese Finance Minister Taro Aso repeated on Tuesday that the government was ready to intervene in the foreign exchange market if the yen would raise further and if it would hurt the country's economy.

"It will be natural for us to undertake intervention if that kind of one-sided situation continues," he said.

-

10:30

United Kingdom: Total Trade Balance, March -3.83

-

10:24

Chinese consumer price index rises at annual rate of 2.3% in April

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 2.3% in April, missing expectations for a 2.4% increase, after a 2.3% gain in March.

Food prices rose at an annual rate of 7.4% in April, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation decreased 0.2% in April, after a 0.4% fall in March.

The Chinese producer price index (PPI) dropped 3.4% in April, beating expectations for a 3.8% fall, after a 4.3% decline in March.

-

10:12

Minneapolis Fed Bank President Neel Kashkari: an interest rate hike in June is possible

Minneapolis Fed Bank President Neel Kashkari said on Monday that the Fed's cautious approach was "right", adding that an interest rate hike in June was possible.

He noted that he expected the U.S. economy to expand about 2% this year.

-

10:09

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.50 (USD 884m) 108.75 (505m) 109.50 (842m) 110.80 (300m)

EUR/USD 1.1235-40 (EUR 408m) 1.1390 (200m) 1.1400 (281m) 1.1450 (407m) 1.1600 (771m)

GBP/USD 1.4450 (GBP 252m) 1.4600 (201m)

AUD/USD 0.7300 (AUD 203m) 0.7375 (200m) 0.7550-55 (326m) 0.7500 (355m) 0.7545 (652m)

USD/CAD 1.3250 (USD 485m)

NZD/USD 0.6650 (NZD 482m) 0.6800 (238m) 0.6905 (202m)

EUR/JPY 123.50 (201m) 125.00 (386m)

-

09:12

WSE: After opening

WIG20 index opened at 1845.54 points (-0.16%)*

WIG 46649.26 0.04%

WIG30 2061.36 0.00%

mWIG40 3552.53 0.22%

*/ - change to previous close

The cash market opened with a drop of 0.16% at modest turnover. Unfortunately, activity is similar to the value indicating the session that does not have too much potential for a breakthrough. The market revolves around the level of 1850 points and its behavior remains weaker than the environment, where the DAX gained 0.6%.

-

09:01

France: Industrial Production, y/y, March 0.5%

-

09:01

France: Industrial Production, m/m, March -0.3% (forecast 0.3%)

-

08:35

Options levels on tuesday, May 10, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1562 (4261)

$1.1502 (4428)

$1.1459 (2127)

Price at time of writing this review: $1.1389

Support levels (open interest**, contracts):

$1.1338 (1704)

$1.1297 (3741)

$1.1240 (5140)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 63948 contracts, with the maximum number of contracts with strike price $1,1600 (5214);

- Overall open interest on the PUT options with the expiration date June, 3 is 86300 contracts, with the maximum number of contracts with strike price $1,1200 (8391);

- The ratio of PUT/CALL was 1.35 versus 1.33 from the previous trading day according to data from May, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.4705 (1834)

$1.4608 (2086)

$1.4512 (2131)

Price at time of writing this review: $1.4414

Support levels (open interest**, contracts):

$1.4289 (2114)

$1.4192 (2696)

$1.4095 (1340)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 29009 contracts, with the maximum number of contracts with strike price $1,4500 (2131);

- Overall open interest on the PUT options with the expiration date June, 3 is 31424 contracts, with the maximum number of contracts with strike price $1,4200 (2696);

- The ratio of PUT/CALL was 1.08 versus 1.10 from the previous trading day according to data from May, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

WSE: Before opening

Yesterday's session was a bit disappointing, but mostly when comparing the behavior of the WSE with the environment, where demand attempts were grander. Anyway, the final amendments yesterday were in Europe decreased relative to the highs of the day and, for example, the DAX not gained nearly 2%, but slightly more than 1%. The increase on the CAC40 shrank more than twice from more than 1% to barely 0.5%. In the US session finally ended relatively neutral, and the behavior of contracts before today's session is slightly positive. It can result from a quite good behavior of the Nikkei, which gained more than 2% after yesterday weakening of the yen. Changes in other Asian parquets are more balanced and mostly slightly deviating from the neutral level. This also applies to the parquet of the Chinese, which quite calmly accepted the information on domestic inflation, which turned out to be more or less consistent with those expected.

Prices of raw materials are gaining slightly in the morning, but after a fatal behavior yesterday, where oil grew cheaper by as much as 4%.

On our market in the morning we had the results of two banks: Pekao (WSE: PEO) and ING (WSE: ING). Both surprised slightly positive and in this respect continues the trend set by other financial companies. So the mood before the session are relatively neutral, with the possibility of slight positive surprise.

-

08:19

Asian session: The yen nursed broad losses on Tuesday

The yen nursed broad losses on Tuesday, beaten back from recent peaks following warnings by Japan that it was prepared to step in and weaken the currency.

In the wake of the yen's surge, Finance Minister Taro Aso on Monday said Tokyo is ready to intervene to weaken the currency if moves are volatile enough to hurt the country's trade and economy. Aso reiterated the message on Tuesday.

The firmer dollar, coupled with weaker commodity prices, saw the Australian, New Zealand and Canadian currencies all come under pressure. Prices for iron ore, oil, copper fell on Monday.

EUR/USD: during the Asian session the pair traded in the range of $1.1365-90

GBP/USD: during the Asian session the pair traded in the range of $1.4390-20

USD/JPY: during the Asian session the pair rose to Y108.85

Based on Reuters materials

-

08:01

Germany: Trade Balance (non s.a.), bln, March 23.6

-

08:01

Germany: Current Account , March 30.4

-

08:00

Germany: Industrial Production s.a. (MoM), March -1.3% (forecast -0.3%)

-

07:45

Switzerland: Unemployment Rate (non s.a.), April 3.5% (forecast 3.5%)

-

06:25

Global Stocks

European stock markets gained on Monday, but closed off their best levels after oil prices turned negative. Hopes that the U.S. Federal Reserve will keep rates on hold in June and a mostly positive session in Asia offset renewed concerns over a slowdown in China following weak trade data there.

The S&P 500 and Nasdaq Composite closed in positive territory Monday on the back of a rally in health-care stocks, while the Dow Jones Industrial Average retreated as uncertainties in the oil weighed on Wall Street. Volatility in stocks emerged after the weekend dismissal of Saudi Arabia's powerful energy minister, Ali al-Naimi, sowed uncertainty about the country's energy policy, said Paul Nolte, portfolio manager at Kingsview Asset Management. Al-Naimi will be succeeded by Khalid al-Falih, the chairman of the country's state oil company, Saudi Aramco.

Shares in Asia were choppy Tuesday, largely due to falling commodities prices, though Japanese stocks surged after officials warned that the government could intervene against a sharp rise in the yen. Commodities continued their selloff, with rebar futures falling more than 6% and iron ore futures down about 5%.

Based on MarketWatch materials

-

04:28

Nikkei 225 16,459.92 +243.89 +1.50 %, Hang Seng 20,081.66 -75.15 -0.37 %, Shanghai Composite 2,824.09 -8.02 -0.28 %

-

03:31

China: PPI y/y, April -3.4% (forecast -3.8%)

-

03:31

China: CPI y/y, April 2.3% (forecast 2.4%)

-

00:32

Commodities. Daily history for May 9’2016:

(raw materials / closing price /% change)

Oil 43.24 -0.46%

Gold 1,265.40 -0.09%

-

00:31

Stocks. Daily history for Sep Apr May 9’2016:

(index / closing price / change items /% change)

Nikkei 225 16,216.03 +109.31 +0.68 %

Hang Seng 20,156.81 +46.94 +0.23 %

S&P/ASX 200 5,320.7 +28.65 +0.54 %

Shanghai Composite 2,832.91 -80.34 -2.76 %

FTSE 100 6,114.81 -10.89 -0.18 %

CAC 40 4,322.81 +21.57 +0.50 %

Xetra DAX 9,980.49 +110.54 +1.12 %

S&P 500 2,058.69 +1.55 +0.08 %

NASDAQ Composite 4,750.21 +14.05 +0.30 %

Dow Jones 17,705.91 -34.72 -0.20 %

-

00:30

Currencies. Daily history for May 9’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1381 -0,18%

GBP/USD $1,4407 -0,12%

USD/CHF Chf0,9712 -0,13%

USD/JPY Y108,47 +1,24%

EUR/JPY Y123,46 +1,02%

GBP/JPY Y156,26 +1,13%

AUD/USD $0,7313 -0,71%

NZD/USD $0,6764 -1,08%

USD/CAD C$1,2958 +0,37%

-

00:02

Schedule for today, Tuesday, May 10’2016:

(time / country / index / period / previous value / forecast)

01:30 China PPI y/y April -4.3% -3.8%

01:30 China CPI y/y April 2.3% 2.4%

05:45 Switzerland Unemployment Rate (non s.a.) April 3.6%

06:00 Germany Current Account March 20.0

06:00 Germany Industrial Production s.a. (MoM) March -0.5% -0.3%

06:00 Germany Trade Balance (non s.a.), bln March 20.3

06:45 France Industrial Production, m/m March -1.0% 0.5%

06:45 France Industrial Production, y/y March 0.6%

08:30 United Kingdom Total Trade Balance March -4.84

14:00 U.S. Wholesale Inventories March -0.5% 0.2%

14:00 U.S. JOLTs Job Openings March 5.445 5.412

21:00 New Zealand RBNZ Financial Stability Report

23:00 New Zealand RBNZ Press Conference

-