Noticias del mercado

-

21:00

Dow -1.14% 17,724.06 -204.29 Nasdaq -0.85% 4,769.15 -40.73 S&P -0.84% 2,066.95 -17.44

-

20:21

American focus: the US dollar depreciated significantly against the euro and the Canadian dollar

The euro has appreciated strongly against the dollar, updating the maximum of 9 May, which was due to profit-taking after a six-day growth of the US currency. Little influenced by the statements of Bundesbank board member Dombreta. He noted that the loose monetary policy of the European Central Bank is justified by depressed prospects for economic growth in the euro zone. "Currently, expansionary monetary policy is justified subdued inflation outlook and fragile growth. Although, of course, there are side effects that increase with time, and may have a negative impact on banks' profitability." - Said a board member of the Bundesbank Andreas Dombret. His words were similar to the latest comments from the head of the Bundesbank, Weidmann, who also defended the ECB policy after criticism German Finance Minister Wolfgang Schaeuble.

Also today, the Organization for Economic Cooperation and Development reported that the economic downturn in emerging economies shows signs of easing, data showed that the leading economic indicator covering all OECD countries fell to 99.6 in March from 99.7 in February. China's index remained at 98.3, while the index for the US fell to 98.8 from 98.9. The figure for the UK remained at around 99.1, while the indicator for Germany was 99.7, as in February. Indicator for the euro area fell to 100.4, the indicator for France stabilized at 100.9, while the index for Italy fell to 100.7 from 100.8.

The pound rose moderately against the US dollar, rebounding after falling in the first half of the session, which was caused by the publication of weak data on Britain. As it became known, the total volume of industrial production in the UK fell in March by 0.2% per annum, leveling the February increase of 0.1%. Output in the manufacturing sector decreased by 1.9%, accelerating compared with February, when production fell by 1.6%. However, the latest update in line with expectations. In monthly terms, the total volume of industrial production increased by 0.3% after falling 0.2% in February. Analysts had expected an increase of 0.5%. In manufacturing, output grew by 0.1% in the fall of 0.9% the previous month and the forecast of + 0.3%.

In the course of trading is also affected by the expectations of the meeting of the Central Bank of England, which is scheduled for tomorrow. Economists will be closely watching those to preserve the unity of opinion among the leadership of the Bank of England after increasing downside risks to GDP growth. Over the weekend edition of the Guardian reported that at least one member of the Committee of Central Bank may act for the interest rate cut to stimulate the economy.

The Canadian dollar rose strongly against the dollar, reaching a peak on 6 May. Support currency had a sharp rise in oil prices following the publication of statistics on US petroleum inventories. US Department of Energy reported that in the week of April 30 - May 6 crude oil inventories fell by 3.4 million barrels to 540 million barrels. Analysts on average had expected an increase of 0.5 mln. Barrels. Oil reserves in Cushing terminal rose by 1.5 million barrels to 67.8 million barrels. Gasoline inventories fell by 1.2 million barrels to 240.6 million barrels. Analysts had expected stocks will decline by only 0.6 million. Barrels. Meanwhile, distillate inventories decreased by 1.6 million barrels to 155.3 million barrels. Analysts expected distillate stocks to decrease by 0.8 million. Barrels. The utilization of refining capacity fell 0.6% to 89.1%. Analysts expected an increase of 0.5%. It was also reported that oil production in the US in the week from 30 April to 6 decreased to 8.802 million. Barrels per day versus 8.825 million barrels per day in the previous week.

-

20:00

U.S.: Federal budget , April 106 (forecast -112)

-

18:39

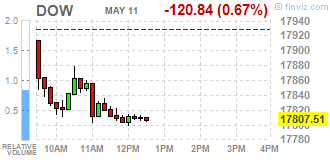

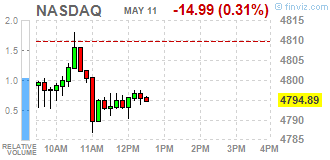

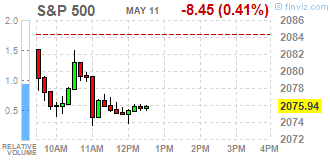

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Wednesday as weak earnings reports from Walt Disney, Macy's and Fossil reverberated across the consumer sector. Disney (DIS) shares were down 4,5% at $101,82 after the company posted a rare earnings miss. The stock was the biggest drag on the Dow, accounting for about 33 points of the index's 80 points fall.

Most of Dow stocks in negative area (21 of 30). Top looser - The Walt Disney Company (DIS, -4,43). Top gainer - Caterpillar Inc. (CAT, +1,28%).

Most of S&P sectors also in negative area. Top looser - Services (-1,1%). Top gainer - Basic Materials (+0,7%).

At the moment:

Dow 17764.00 -89.00 -0.50%

S&P 500 2071.50 -6.00 -0.29%

Nasdaq 100 4384.50 -7.50 -0.17%

Oil 45.98 +1.32 +2.96%

Gold 1273.50 +8.70 +0.69%

U.S. 10yr 1.74 -0.02

-

18:01

European stocks close: stocks traded mixed on higher oil prices

Market participants also eyed economic data from Germany. Destatis released its manufacturing turnover data for Germany on Wednesday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.1% in March, after a 0.2% fall in February. February's figure was revised down up a 0.5% decrease.

Domestic turnover decreased by 1.3% in March, while the business with foreign customers dropped 0.8%.

Sales to euro area countries fell 0.5% in March, while sales to other countries were down 1.1%.

On a yearly basis, real manufacturing turnover in Germany was up on adjusted for working days basis by 0.7% in March, after a 1.8% rise in February.

European Central Bank (ECB) Governing Council member Ewald Nowotny said in a speech on Wednesday that the exchange rate of the euro was not the target of the central bank's stimulus measures. He also said that helicopter money could not be implemented in the Europe, adding that was little more than a "fantasy discussion" in the Eurozone.

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 0.3% in March, missing forecasts of a 0.5% increase, after a 0.2% fall in February. February's figure was revised up from a 0.3% decline.

The increase was mainly driven by a rise in electricity, gas, steam & air conditioning output, which climbed by 3.3% in March.

On a yearly basis, industrial production in the U.K. decreased 0.2% in March, beating expectations for a 0.4% drop, after a 0.1% increase in February. February's figure was revised up from a 0.5% fall.

The decline was driven by a drop in manufacturing, which slid 1.9% year-on-year in March.

Manufacturing production in the U.K. was up 0.1% in March, missing expectations for a 0.3% gain, after a 0.9% decline in February. February's figure was revised up from a 1.1% decrease.

The rise was mainly driven by an increase in manufacture of transport equipment, which rose by 2.7% in March.

On a yearly basis, manufacturing production in the U.K. decreased 1.9% in March, in line with forecasts, after a 1.6% drop in February. It was the largest decrease since May 2013.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.3% in three months to April, after a 0.4% growth in three months to March. The previous figure was revised up from a 0.3% growth.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,162.49 +5.84 +0.09 %

DAX 9,975.32 -70.12 -0.70 %

CAC 40 4,316.67 -21.54 -0.50 %

-

18:00

European stocks closed: FTSE 100 6,162.49 +5.84 +0.09% CAC 40 4,316.67 -21.54 -0.50% DAX 9,975.32 -70.12 -0.70%

-

17:43

Oil demonstrates positive dynamics

The cost of oil futures rose sharply, again returned to positive territory, helped by data from the US Department of Energy, who reported an unexpected decline in crude oil inventories.

US Department of Energy report showed that in the week of April 30 - May 6 crude oil inventories fell by 3.4 million barrels to 540 million barrels. Analysts on average had expected an increase of 0.5 mln. Barrels. Oil reserves in Cushing terminal rose by 1.5 million barrels to 67.8 million barrels. Gasoline inventories fell by 1.2 million barrels to 240.6 million barrels. Analysts had expected stocks will decline by only 0.6 million. Barrels. Meanwhile, distillate inventories decreased by 1.6 million barrels to 155.3 million barrels. Analysts expected distillate stocks to decrease by 0.8 million. Barrels. The utilization of refining capacity fell 0.6% to 89.1%. Analysts expected an increase of 0.5%. It was also reported that oil production in the US in the week from 30 April to 6 decreased to 8.802 million. Barrels per day versus 8.825 million barrels per day in the previous week.

Recall yesterday's data from the American Petroleum Institute pointed to the opposite situation with petroleum products. According to the report, for the week US crude stocks rose 3.45 million. Barrels. The gain was the largest for 5 weeks. Meanwhile, stocks in the Cushing terminal rose by 1.46 million barrels. Distillate stocks in the US for the week fell by 1.4 million barrels, while gasoline stocks rose 0.3 million barrels.

Support prices also have reports of disruption of oil supplies from Nigeria. Today, Shell Petroleum Development Division announced the event of force majeure related to the export of Bonny Light crude oil. Against this background, oil production in the country could fall to a more than 20-year low. Meanwhile, the Libyan National Oil said it would be forced to suspend production at the fields, providing the bulk of the country's oil exports for a month, if the insurgents will not remove the blockade of the port.

However, experts say that the world's oil reserves are near record highs, and some supply disruptions little that this will change, as the decline in production in some OPEC countries offset by growth of exports from Iran and nearly a record oil production in Saudi Arabia and Russia .

WTI for delivery in June rose to $45.94 a barrel. Brent for June rose to $47.09 a barrel.

-

17:39

WSE: Session Results

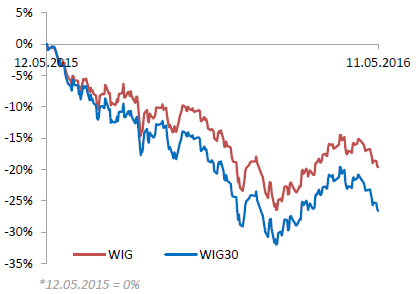

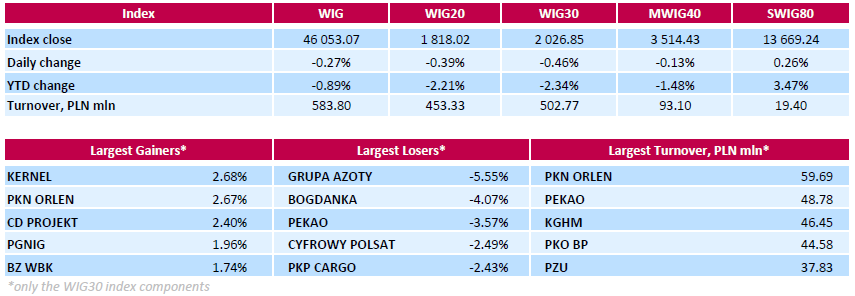

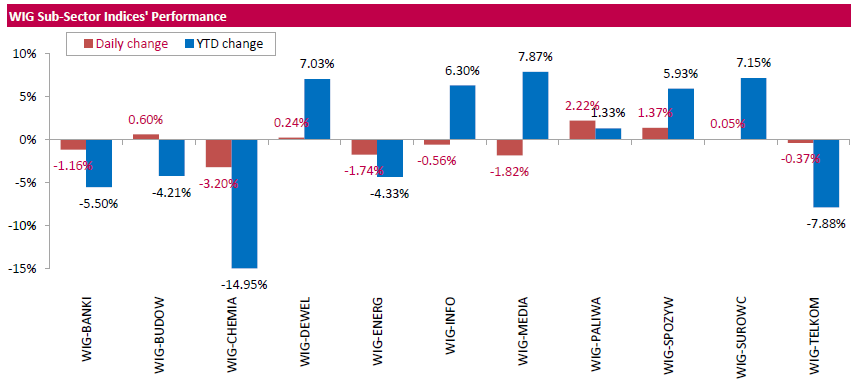

Polish equity market closed lower on Wednesday. The broad market benchmark, the WIG Index, fell by 0.27%. Sector performance in the WIG Index was mixed. Chemicals (-3.20%) recorded the biggest decline, while oil and gas sector (+2.22%) fared the best.

The large-cap stocks' measure, the WIG30 Index, lost 0.46%. Within the WIG30 Index components, chemical producer GRUPA AZOTY (WSE: ATT) was hit the hardest, down 5.55%, after the company reported a 1.4% fall in its Q1 net profit to PLN 272.4 mln or $70.1 mln (versus analysts' consensus estimate of PLN 307.6 mln), as falling fertilizer prices outweighed lower gas costs. In addition, the company's deputy chief executive stated the management sees worse prospects for 2016 compared to 2015. Other major laggards were thermal coal miner BOGDANKA (WSE: LWB) and PEKAO (WSE: PEO, plunging by 4.07% and 3.57% respectively. On the other side of the ledger, agricultural producer KERNEL (WSE: KER), oil refiner PKN ORLEN (WSE: PKN) and videogame developer CD PROJEKT (WSE: CDR) were the best performers, advancing 2.68%, 2.67% and 2.4% respectively.

-

17:32

China's vice premier Zhang Gaoli: China will reach its economic growth target this year

China's vice premier Zhang Gaoli said on Wednesday that the country would reach its economic growth target this year. China expects its economy to expand 6.5%-7.0% in 2016, after a 6.9% growth in 2015.

Zhang noted that China's economy remained resilient.

-

17:22

European Central Bank Governing Council member Vitas Vasiliauskas: there is no need in further stimulus measures at the moment

European Central Bank (ECB) Governing Council member Vitas Vasiliauskas said on Wednesday that there was no need in further stimulus measures as the recent stimulus measures were working. He added that the ECB had tools to act if needed.

-

17:22

Gold prices rose today

Gold has risen in price moderate, departing from two-week low as the dollar rally stalled and European stocks fell, which increased investors' appetite for safe assets. Support prices have also hopes that the Fed will not raise interest rates at the June meeting.

According to analysts, in the near future, the level of $ 1,300 will act as a strong barrier. It is worth emphasizing, since the beginning of the year the precious metal quotes have increased by almost 20 percent against the background of large-scale gold inflows to funds and reduce the likelihood of Fed rate increase in the near future. Recall increase in rates is usually a negative impact on gold prices as the precious metal can not compete with the assets, income, when borrowing costs rise.

"The increase in gold prices will be limited, as the Fed little chance to surprise the markets" in a bad way ", and the space for the weakening of the dollar also has its limits", - experts said Goldman Sachs. However, Goldman Sachs increased its forecasts for gold prices in the coming months, citing the strong net speculative positioning. According to the new estimates, the price of gold will be $ 1,200 in three months, $ 1180 in six months and $ 1,150 in 12 months. Previously, prices were projected at $ 1,100, $ 1,050 and $ 1,000, respectively. Also, Goldman Sachs analysts expect that the Fed will raise rates in September, but also do not exclude such a possibility at the July meeting, if the US economy will show steady growth. Meanwhile, according to the quotations of futures on a bet the Fed, traders estimate the probability of a July rate increase of 21%.

The cost of the June gold futures on the COMEX rose to $ 1275.7 per ounce.

-

17:16

European Central Bank Governing Council member Ewald Nowotny: the exchange rate of the euro is not the target of the ECB’S stimulus measures

European Central Bank (ECB) Governing Council member Ewald Nowotny said in a speech on Wednesday that the exchange rate of the euro was not the target of the central bank's stimulus measures. He also said that helicopter money could not be implemented in the Europe, adding that was little more than a "fantasy discussion" in the Eurozone.

-

16:53

NIESR’s gross domestic product rises by 0.3% in three months to April

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.3% in three months to April, after a 0.4% growth in three months to March. The previous figure was revised up from a 0.3% growth.

"UK economic growth continues to be subdued compared with the rates we saw at the end of last year. Some of this slowdown is undoubtedly a result of heightened uncertainty around the impending EU referendum, and so is likely to be temporary should the UK decide to remain in the EU after June 23rd," Jack Meaning, NIESR Research Fellow, said.

The NIESR yesterday lowered its GDP growth forecast for the U.K. If Britain remains in the European Union (EU), the U.K. GDP will be expected to grow 2.0% in 2016, down from the previous estimate of 2.3%. The NIESR expects the U.K. economy to expand at 2.7% in 2017, unchanged from the previous estimate.

-

16:47

U.S. crude inventories decline by 3.4 million barrels to 540.0 million in the week to May 06

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 3.4 million barrels to 540.0 million in the week to May 06.

Analysts had expected U.S. crude oil inventories to rise by 0.5 million barrels.

Gasoline inventories decreased by 1.23 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 1.52 million barrels.

U.S. crude oil imports fell by 5,000 barrels per day.

Refineries in the U.S. were running at 89.1% of capacity, down from 89.7% the previous week.

Oil production fell by 0.3% last week to 8.802 million barrels a day from 8.825 million barrels a day in the previous week.

-

16:30

U.S.: Crude Oil Inventories, May -3.41 (forecast 0.5)

-

16:00

United Kingdom: NIESR GDP Estimate, April 0.3%

-

15:54

Ifo World Economic Climate index increases to 90.5 in the second quarter

German Ifo Institute released its Ifo World Economic Climate figures on Wednesday. The Ifo World Economic Climate index increased to 90.5 in the second quarter from 87.8 in the first quarter. The increase was driven by rises of economic climate indexes in North America and Europe. The index for Asia declined slightly in the second quarter.

The current economic situation index for the global economy dropped to 86.0 in the second quarter from 87.9 in the first quarter, while the economic expectations index jumped to 94.7 from 87.7.

Ifo expects the global economy to expand 2.0% this year, while the recovery remained moderate.

-

15:48

WSE: After start on Wall Street

U.S. Stocks open: Dow -0.37%, Nasdaq -0.25%, S&P -0.21%

Wall Street started the session in the context of declining oil prices, so the downward beginning directly corresponds to the raw material market. There is no surprise - yesterday's growth was built on good performance of oil prices. Europe had the opportunity to prepare for such a scenario, but locally more important turned out strengthening of the euro, which does not allow for the DAX to correct day's weakness.

For frozen in the consolidation the WIG20 opening in the US is less important. Barely PLN 290 mln of turnover on the index indicates that the WSE is waiting for a movement that will stand out from today suspension. In less than an hour we will will be data on stocks of fuel in the USA.

-

15:40

Option expiries for today's 10:00 ET NY cut

USDJPY 107.50 (USD 406m) 107.85 (308m) 108.95 (330m) 109.06 (420m)

EURUSD: 1.1280 (EUR 249m) 1.1350 (454m) 1.1400-05 (355m) 1.1450 (525m) 1.1500 (270m)

AUDUSD 0.7400 (AUD 201m) 0.7500 (663m)

USDCAD 1.2500 (USD 365m) 1.2895 (240m)

NZDUSD 0.6795-0.6807 (NZD 686m) 0.6800 (238m) 0.6905 (202m)

AUDNZD 1.0750 (AUD 700m) 1.1050 (600m) 1.1215 (1.14bln)

-

15:38

Westpac’s consumer confidence index for Australia climbs 8.5% in May

Westpac Bank released its consumer confidence index for Australia on Wednesday. The index climbed 8.5% in May, after a 0.4% decline in April.

The index was driven by rises in all sub-indexes.

"Our analysis indicates that the dominant driver of the boost to confidence has been the rate cut," Westpac Chief Economist Bill Evans said.

"The Reserve Bank board next meets on June 7. We expect the Board to keep rates on hold at that meeting although we are expecting a further rate cut at the August meeting," he added.

-

15:33

U.S. Stocks open: Dow -0.37%, Nasdaq -0.25%, S&P -0.21%

-

15:04

Before the bell: S&P futures -0.12%, NASDAQ futures -0.07%

U.S. stock-index futures slipped.

Nikkei 16,579.01 +13.82 +0.08%

Hang Seng 20,055.29 -187.39 -0.93%

Shanghai Composite 2,837.63 +5.04 +0.18%

FTSE 6,147.13 -9.52 -0.15%

CAC 4,309.73 -28.48 -0.66%

DAX 9,980.67 -64.77 -0.64%

Crude $44.90 (+0.54%)

Gold $1279.50 (+1.16%)

-

14:46

OECD’s leading composite leading indicator declines to 99.6 in March

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator decreased to 99.6 in March from 99.7 in February.

It signalled stable growth in Canada, the Eurozone as a whole, Germany and France.

The index for Japan showed signs of growth stabilisation.

There were signs of firming growth momentum in India.

The index for the U.S., the U.K., and Italy pointed to an easing in growth momentum.

The index for China signalled stable growth.

The index for Russia showed signs of positive change in growth momentum.

-

14:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.67

0.00(0.00%)

23385

ALTRIA GROUP INC.

MO

64.34

-0.26(-0.4025%)

820

Amazon.com Inc., NASDAQ

AMZN

703.89

0.82(0.1166%)

22381

Apple Inc.

AAPL

93.23

-0.19(-0.2034%)

27087

AT&T Inc

T

39.16

-0.15(-0.3816%)

700

Barrick Gold Corporation, NYSE

ABX

18.44

0.51(2.8444%)

94328

Caterpillar Inc

CAT

72.5

-0.01(-0.0138%)

5805

Chevron Corp

CVX

101.17

-0.10(-0.0987%)

4004

Cisco Systems Inc

CSCO

27.05

0.02(0.074%)

580

Citigroup Inc., NYSE

C

44.7

-0.14(-0.3122%)

14619

Exxon Mobil Corp

XOM

89.24

-0.00(-0.00%)

9601

Facebook, Inc.

FB

120.34

-0.16(-0.1328%)

53005

Ford Motor Co.

F

13.42

-0.07(-0.5189%)

515

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.12

0.26(2.3941%)

185928

General Electric Co

GE

30.43

-0.05(-0.164%)

4663

General Motors Company, NYSE

GM

31.3

-0.05(-0.1595%)

408

Goldman Sachs

GS

160.98

-0.44(-0.2726%)

735

Google Inc.

GOOG

721.09

-2.09(-0.289%)

983

Hewlett-Packard Co.

HPQ

11.64

0.03(0.2584%)

11433

Home Depot Inc

HD

137.51

-0.00(-0.00%)

426

Intel Corp

INTC

30.05

-0.09(-0.2986%)

12498

Johnson & Johnson

JNJ

114.65

-0.02(-0.0174%)

410

JPMorgan Chase and Co

JPM

61.95

-0.09(-0.1451%)

2262

McDonald's Corp

MCD

132

0.40(0.304%)

500

Microsoft Corp

MSFT

50.86

-0.16(-0.3136%)

1101

Nike

NKE

58.85

-0.35(-0.5912%)

2197

Pfizer Inc

PFE

33.45

-0.05(-0.1493%)

2874

Starbucks Corporation, NASDAQ

SBUX

57.49

0.00(0.00%)

755

Tesla Motors, Inc., NASDAQ

TSLA

207.25

-1.44(-0.69%)

10306

Twitter, Inc., NYSE

TWTR

14.67

0.04(0.2734%)

24601

Wal-Mart Stores Inc

WMT

67.5

-0.79(-1.1568%)

11713

Walt Disney Co

DIS

101.4

-5.20(-4.878%)

431886

Yandex N.V., NASDAQ

YNDX

19.9

0.31(1.5824%)

3500

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Walt Disney (DIS) target lowered to $129 from $130 at Topeka Capital Markets

Apple (AAPL) target lowered to $115 from $120 at UBS

-

14:10

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar on the U.K. industrial production data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence May -4.0% 8.5%

01:30 Australia Home Loans March 0.9% Revised From 1.5% -1.5% -0.9%

05:00 Japan Coincident Index (Preliminary) March 110.7 111.2

05:00 Japan Leading Economic Index (Preliminary) March 98.9 Revised From 96.8 96.4 98.4

08:30 United Kingdom Industrial Production (MoM) March -0.2% Revised From -0.3% 0.5% 0.3%

08:30 United Kingdom Industrial Production (YoY) March 0.1% Revised From -0.5% -0.4% -0.2%

08:30 United Kingdom Manufacturing Production (MoM) March -0.9% Revised From -1.1% 0.3% 0.1%

08:30 United Kingdom Manufacturing Production (YoY) March -1.6% Revised From -1.8% -1.9% -1.9%

11:00 U.S. MBA Mortgage Applications May -3.4% 0.4%

The U.S. dollar traded mixed to lower against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Destatis released its manufacturing turnover data for Germany on Wednesday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.1% in March, after a 0.2% fall in February. February's figure was revised down up a 0.5% decrease.

Domestic turnover decreased by 1.3% in March, while the business with foreign customers dropped 0.8%.

Sales to euro area countries fell 0.5% in March, while sales to other countries were down 1.1%.

On a yearly basis, real manufacturing turnover in Germany was up on adjusted for working days basis by 0.7% in March, after a 1.8% rise in February.

The British pound traded mixed against the U.S. dollar on the U.K. industrial production data. The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 0.3% in March, missing forecasts of a 0.5% increase, after a 0.2% fall in February. February's figure was revised up from a 0.3% decline.

The increase was mainly driven by a rise in electricity, gas, steam & air conditioning output, which climbed by 3.3% in March.

On a yearly basis, industrial production in the U.K. decreased 0.2% in March, beating expectations for a 0.4% drop, after a 0.1% increase in February. February's figure was revised up from a 0.5% fall.

The decline was driven by a drop in manufacturing, which slid 1.9% year-on-year in March.

Manufacturing production in the U.K. was up 0.1% in March, missing expectations for a 0.3% gain, after a 0.9% decline in February. February's figure was revised up from a 1.1% decrease.

The rise was mainly driven by an increase in manufacture of transport equipment, which rose by 2.7% in March.

On a yearly basis, manufacturing production in the U.K. decreased 1.9% in March, in line with forecasts, after a 1.6% drop in February. It was the largest decrease since May 2013.

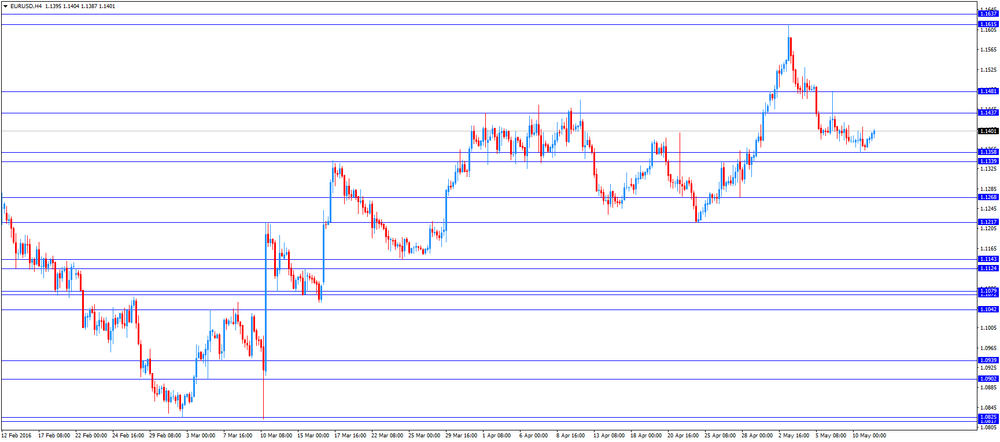

EUR/USD: the currency pair rose to $1.1404

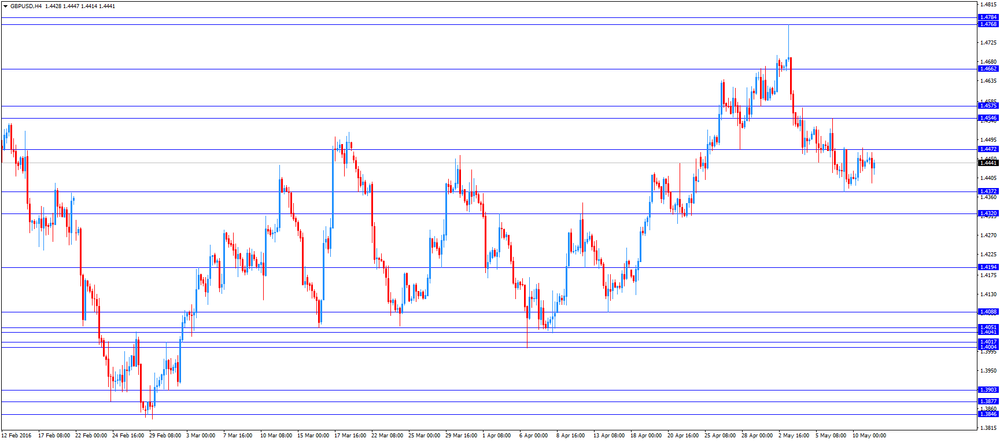

GBP/USD: the currency pair traded mixed

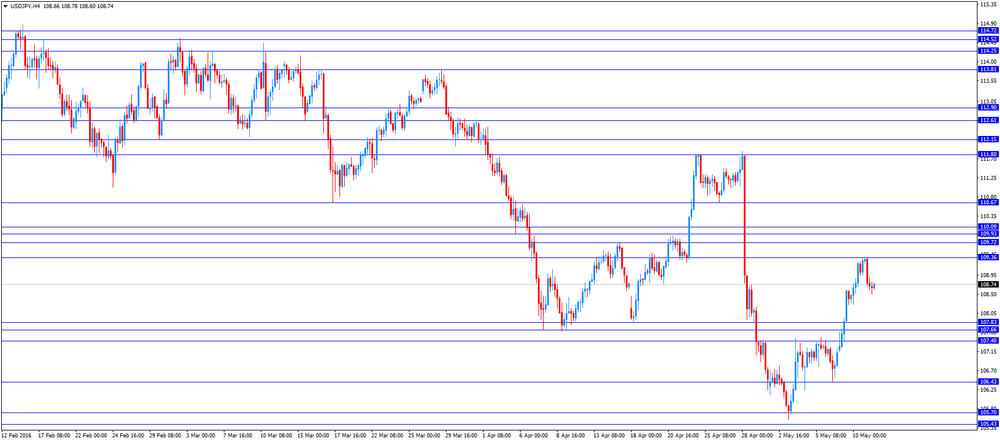

USD/JPY: the currency pair climbed to Y109.27

The most important news that are expected (GMT0):

12:45 Canada Gov Council Member Wilkins Speaks

14:00 United Kingdom NIESR GDP Estimate April 0.3%

14:30 U.S. Crude Oil Inventories May 2.784 0.5

18:00 U.S. Federal budget April -108 -112

22:30 New Zealand Business NZ PMI April 54.7

23:50 Japan Current Account, bln March 2435 3005

-

13:09

WSE: Mid session comment

The first half of the session indicates that in the area of 1,815 points market has found a new equilibrium. Two attempts of descent below 1,815 points ended with reversals. It seems that the potential for further price reductions without any correction, and especially the drop under 1,800 points, is not substantial.

In the context of low activity market stabilized waiting for the new impetus. The environment, however, favored bearish sentiment. The DAX has lost more than 0.7 percent, and the CAC more than 1 percent. PLN rates held reasonably well, but the consensus is that any attempts to capitalize on the strengthening of the Polish currency before Friday will have slim chances of success. Turnover on the blue chips at halfway point was barely over PLN 160 mln and the WIG20 index was at 1,823 points (-0.07%).

-

13:00

U.S.: MBA Mortgage Applications, May 0.4%

-

12:00

European stock markets mid session: stocks traded lower on a decline in oil prices

Stock indices traded lower as oil prices declined. Oil prices fell on concerns over the global oil oversupply.

Market participants also eyed economic data from Germany. Destatis released its manufacturing turnover data for Germany on Wednesday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.1% in March, after a 0.2% fall in February. February's figure was revised down up a 0.5% decrease.

Domestic turnover decreased by 1.3% in March, while the business with foreign customers dropped 0.8%.

Sales to euro area countries fell 0.5% in March, while sales to other countries were down 1.1%.

On a yearly basis, real manufacturing turnover in Germany was up on adjusted for working days basis by 0.7% in March, after a 1.8% rise in February.

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 0.3% in March, missing forecasts of a 0.5% increase, after a 0.2% fall in February. February's figure was revised up from a 0.3% decline.

The increase was mainly driven by a rise in electricity, gas, steam & air conditioning output, which climbed by 3.3% in March.

On a yearly basis, industrial production in the U.K. decreased 0.2% in March, beating expectations for a 0.4% drop, after a 0.1% increase in February. February's figure was revised up from a 0.5% fall.

The decline was driven by a drop in manufacturing, which slid 1.9% year-on-year in March.

Manufacturing production in the U.K. was up 0.1% in March, missing expectations for a 0.3% gain, after a 0.9% decline in February. February's figure was revised up from a 1.1% decrease.

The rise was mainly driven by an increase in manufacture of transport equipment, which rose by 2.7% in March.

On a yearly basis, manufacturing production in the U.K. decreased 1.9% in March, in line with forecasts, after a 1.6% drop in February. It was the largest decrease since May 2013.

Current figures:

Name Price Change Change %

FTSE 100 6,143.67 -12.98 -0.21 %

DAX 9,980.65 -64.79 -0.64 %

CAC 40 4,296.03 -42.18 -0.97 %

-

11:35

Japan's leading index declines to 98.4 in March

Japan's Cabinet Office released its preliminary leading index data on Wednesday. The leading index decreased to 98.4 in March from 98.9 in February, beating expectations for a decline to 96.4. It was the lowest level since November 2012.

February's figure was revised up from 96.8.

Japan's coincident index climbed to 111.2 in March from 110.7 in February.

-

11:25

Germany’s manufacturing turnover declines by 1.1% in March

Destatis released its manufacturing turnover data for Germany on Wednesday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.1% in March, after a 0.2% fall in February. February's figure was revised down up a 0.5% decrease.

Domestic turnover decreased by 1.3% in March, while the business with foreign customers dropped 0.8%.

Sales to euro area countries fell 0.5% in March, while sales to other countries were down 1.1%.

On a yearly basis, real manufacturing turnover in Germany was up on adjusted for working days basis by 0.7% in March, after a 1.8% rise in February.

-

11:08

U.K. industrial production rises 0.3% in March

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 0.3% in March, missing forecasts of a 0.5% increase, after a 0.2% fall in February. February's figure was revised up from a 0.3% decline.

The increase was mainly driven by a rise in electricity, gas, steam & air conditioning output, which climbed by 3.3% in March.

On a yearly basis, industrial production in the U.K. decreased 0.2% in March, beating expectations for a 0.4% drop, after a 0.1% increase in February. February's figure was revised up from a 0.5% fall.

The decline was driven by a drop in manufacturing, which slid 1.9% year-on-year in March.

Manufacturing production in the U.K. was up 0.1% in March, missing expectations for a 0.3% gain, after a 0.9% decline in February. February's figure was revised up from a 1.1% decrease.

The rise was mainly driven by an increase in manufacture of transport equipment, which rose by 2.7% in March.

On a yearly basis, manufacturing production in the U.K. decreased 1.9% in March, in line with forecasts, after a 1.6% drop in February. It was the largest decrease since May 2013.

February's figure was revised up from a 1.8% decline.

-

10:51

Home loans in Australia fall 0.9% in March

The Australian Bureau of Statistics released its home loans data on Wednesday. Home loans in Australia fell 0.9% in March, beating expectations for a 1.5% drop, after 0.9% increase in February. February's figure was revised down from a 1.5% rise.

The value of owner occupied loans decreased at a seasonally adjusted 1.2% in March, investment lending climbed 1.5%, while the number of loans for the construction of dwellings slid 2.0%.

-

10:34

Head of research at state-owned oil company Kuwait Petroleum Corp., Abdulaziz Al Attar: Kuwait plans to almost double its oil output by 2020

Head of research at state-owned oil company Kuwait Petroleum Corp., Abdulaziz Al Attar, said on Tuesday that Kuwait planned to almost double its oil output by 2020 reaching 4 million a barrels a day. The country's oil production totalled 2.77 million barrels a day in March.

Al Attar noted that Kuwait planned to expand its domestic refining capacity to 1.4 million barrels a day and boost international cooperation.

-

10:31

United Kingdom: Manufacturing Production (YoY), March -1.9% (forecast -1.9%)

-

10:30

United Kingdom: Industrial Production (MoM), March 0.3% (forecast 0.5%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , March 0.1% (forecast 0.3%)

-

10:30

United Kingdom: Industrial Production (YoY), March -0.2% (forecast -0.4%)

-

10:20

San Francisco Fed President John Williams: it is unlikely that the Fed would cut its interest rates into negative territory

San Francisco Fed President John Williams said on Monday that it was unlikely that the Fed would cut its interest rates into negative territory. He also said that the U.S. banking system was safer than before the financial crisis, due to higher reserve requirements and stress testing.

Williams noted that the U.S. economy was in a good shape.

-

10:09

Reserve Bank of New Zealand Graeme Wheeler: risks to the financial stability have increased

The Reserve Bank of New Zealand (RBNZ) released its Financial Stability Report on Tuesday. The RBNZ Graeme Wheeler said that risks to the financial stability have increased further in the past six months.

"Although New Zealand's economic growth remains solid, the outlook for the global economy has deteriorated. Despite highly accommodative monetary policies and low oil prices, growth is slowing in a number of trading partner economies," he said.

"Dairy prices remain low with global dairy supply continuing to increase. Many farmers now face a third season of negative cash flow with heavy demand for working capital," the RBNZ governor added.

Wheeler expressed concerns about a rise in prices in the Auckland housing market, adding that the imbalance between housing demand and supply in Auckland should be reduced.

-

10:03

Option expiries for today's 10:00 ET NY cut

USD/JPY 107.50 (USD 406m) 107.85 (308m) 108.95 (330m) 109.06 (420m)

EUR/USD: 1.1280 (EUR 249m) 1.1350 (454m) 1.1400-05 (355m) 1.1450 (525m) 1.1500 (270m)

AUD/USD 0.7400 (AUD 201m) 0.7500 (663m)

USD/CAD 1.2500 (USD 365m) 1.2895 (240m)

NZD/USD 0.6795-0.6807 (NZD 686m) 0.6800 (238m) 0.6905 (202m)

AUD/NZD 1.0750 (AUD 700m) 1.1050 (600m) 1.1215 (1.14bln)

-

09:09

WSE: After opening

WIG20 index opened at 1823.50 points (-0.09%)*

WIG 46157.22 -0.05%

WIG30 2034.39 -0.09%

mWIG40 3519.11 0.00%

*/ - change to previous close

Low turnover at the session opening at the WSE is gradually becoming a pattern. The Polish market effectively ignores external reinforcement of the US trade and begins around the closing level. More than half of the WIG20 companies open in red.

-

08:31

Options levels on wednesday, May 11, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1550 (4212)

$1.1488 (4505)

$1.1443 (2129)

Price at time of writing this review: $1.1387

Support levels (open interest**, contracts):

$1.1331 (1683)

$1.1292 (3710)

$1.1237 (5494)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 63954 contracts, with the maximum number of contracts with strike price $1,1600 (5212);

- Overall open interest on the PUT options with the expiration date June, 3 is 86691 contracts, with the maximum number of contracts with strike price $1,1200 (8154);

- The ratio of PUT/CALL was 1.35 versus 1.35 from the previous trading day according to data from May, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.4705 (1871)

$1.4608 (2170)

$1.4512 (2163)

Price at time of writing this review: $1.4455

Support levels (open interest**, contracts):

$1.4387 (1209)

$1.4290 (2307)

$1.4193 (2800)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 29156 contracts, with the maximum number of contracts with strike price $1,4600 (2170);

- Overall open interest on the PUT options with the expiration date June, 3 is 32056 contracts, with the maximum number of contracts with strike price $1,4200 (2800);

- The ratio of PUT/CALL was 1.10 versus 1.08 from the previous trading day according to data from May, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:29

WSE: Before opening

Tuesday's session on the New York stock markets brought the strongest for two months increases of the major indexes, which gained approximately 1.25 percent. The growth driver was the nearly 3% increase in crude prices. Optimistic mood in the US is somewhat tempered by night revocation of contracts on the S&P500, but while current sentiment is maintained, the opening in Europe should be positive.

Taking into account the fact that the news calendar does not have any other important item for today other than fuel inventories in the US, and yesterday's growth in the US was based on the oil price hike, the stock markets will rather be influenced by the markets of raw materials and any hints of today's US stock indices behavior. At the moment, both crude and the S&P500 contract show modest declines and confirm the sensitivity of the market price of the raw materials. The last two weeks also show the sensitivity of European markets to the relationship between the euro and the dollar. It is also worth to pay attention to a danger for the shares implied by correction on the chart of the USDJPY pair.

The Warsaw market is also sensitive to the currency rate fluctuations. The WIG20 shows a correlation with the condition of PLN, and the prospects of PLN are being reassessed in anticipation of ratings updates for the Polish debt. Till the end of the week the WSE may extend its "separation" from the core markets focusing more on the negative sentiment around Polish assets.

-

08:25

Asian session: The dollar dipped

The dollar dipped on Wednesday as investors locked in gains following its steep rise against the yen after intervention warnings from Japanese officials. Both currencies had suffered losses in late April when the Bank of Japan held off from expanding monetary stimulus, touching off a rally in the yen that stoked investors' fears that Japan's Ministry of Finance would decide to intervene.

Still, many expect that Japan would be wary of conducting direct currency intervention before it hosts a G7 meeting later this month, as Tokyo is sensitive to criticism that it is trying to engineer a weaker yen.

Koichi Hamada, a key economic adviser to Prime Minister Shinzo Abe, was the latest to sound a currency market warning. Hamada said on Tuesday Japan will intervene in foreign exchange markets if the yen strengthens to 90-95 per dollar, even if that upsets the United States.

The New Zealand dollar stole some limelight, rising 0.6 percent to 68 U.S. cents NZD=D4, climbing well away from a recent low of $0.6717. Markets had sold the kiwi on Tuesday on speculation the Reserve Bank of New Zealand (RBNZ) would introduce new measures to curb Auckland's housing market. When the RBNZ held off from that course on Wednesday investors were quick to unwind those moves.

EUR/USD: during the Asian session the pair traded in the range of $1.1370-90

GBP/USD: during the Asian session the pair traded in the range of $1.4440-60

USD/JPY: during the Asian session the pair fell to Y108.60

Based on Reuters materials

-

07:17

Japan: Coincident Index, March 96.8

-

07:01

Japan: Leading Economic Index , March 98.4 (forecast 96.4)

-

06:36

Global Stocks

European stocks moved up Tuesday as gains for Credit Suisse AG and Volkswagen AG shares and an important breakthrough on the Greek debt crisis allowed investors to set aside disappointing economic data.

The S&P 500 and Dow industrials steadily climbed to session highs Tuesday, to end with their best one-day percentage gains in two months as oil prices rallied.

Asian stocks rose, with the regional benchmark index heading for a second day of advance, as Japanese shares rallied amid a recovery in commodity prices. Evidence of firming inflation in China ignited gains in industrial metals Tuesday, fueling a 2 percent climb in Bloomberg's Commodity Index along with the gains in crude oil.

Based on MarketWatch materials

-

04:03

Nikkei 225 16,640.06 +74.87 +0.45 %, Hang Seng 20,202.13 -40.55 -0.20 %, Shanghai Composite 2,847.95 +15.36 +0.54 %

-

03:30

Australia: Home Loans , March -0.9% (forecast -1.5%)

-

00:38

Commodities. Daily history for May 10’2016:

(raw materials / closing price /% change)

Oil 44.57 -0.20%

Gold 1,267.40 +0.21%

-

00:35

Stocks. Daily history for Sep Apr May 10’2016:

(index / closing price / change items /% change)

Nikkei 225 16,565.19 +349.16 +2.15 %

Hang Seng 20,242.68 +85.87 +0.43 %

S&P/ASX 200 5,342.79 +22.09 +0.42 %

Shanghai Composite 2,833.18 +1.07 +0.04 %

FTSE 100 6,156.65 +41.84 +0.68 %

CAC 40 4,338.21 +15.40 +0.36 %

Xetra DAX 10,045.44 +64.95 +0.65 %

FTSE 100 6,156.65 +41.84 +0.68 %

CAC 40 4,338.21 +15.40 +0.36 %

Xetra DAX 10,045.44 +64.95 +0.65 %

-

00:32

Currencies. Daily history for May 10’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1370 -0,10%

GBP/USD $1,4443 +0,25%

USD/CHF Chf0,9759 +0,48%

USD/JPY Y109,34 +0,80%

EUR/JPY Y124,31 +0,68%

GBP/JPY Y157,92 +1,05%

AUD/USD $0,7371 +0,79%

NZD/USD $0,6794 +0,44%

USD/CAD C$1,291 -0,37%

-

00:01

Schedule for today, Wednesday, May 11’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Home Loans March 1.5% -1.5%

05:00 Japan Coincident Index (Preliminary) March 110.7

06:00 Japan Leading Economic Index (Preliminary) March 96.8

08:30 United Kingdom Industrial Production (MoM) March -0.3% 0.5%

08:30 United Kingdom Industrial Production (YoY) March -0.5% -0.4%

08:30 United Kingdom Manufacturing Production (MoM) March -1.1% 0.3%

08:30 United Kingdom Manufacturing Production (YoY) March -1.8% -1.9%

11:00 U.S. MBA Mortgage Applications May -3.4%

14:00 United Kingdom NIESR GDP Estimate April 0.3%

14:30 U.S. Crude Oil Inventories May 2.784

18:00 U.S. Federal budget April -108 -100

22:30 New Zealand Business NZ PMI April 54.7

23:50 Japan Current Account, bln March 2435

-