Noticias del mercado

-

21:00

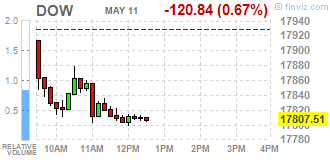

Dow -1.14% 17,724.06 -204.29 Nasdaq -0.85% 4,769.15 -40.73 S&P -0.84% 2,066.95 -17.44

-

18:39

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Wednesday as weak earnings reports from Walt Disney, Macy's and Fossil reverberated across the consumer sector. Disney (DIS) shares were down 4,5% at $101,82 after the company posted a rare earnings miss. The stock was the biggest drag on the Dow, accounting for about 33 points of the index's 80 points fall.

Most of Dow stocks in negative area (21 of 30). Top looser - The Walt Disney Company (DIS, -4,43). Top gainer - Caterpillar Inc. (CAT, +1,28%).

Most of S&P sectors also in negative area. Top looser - Services (-1,1%). Top gainer - Basic Materials (+0,7%).

At the moment:

Dow 17764.00 -89.00 -0.50%

S&P 500 2071.50 -6.00 -0.29%

Nasdaq 100 4384.50 -7.50 -0.17%

Oil 45.98 +1.32 +2.96%

Gold 1273.50 +8.70 +0.69%

U.S. 10yr 1.74 -0.02

-

18:01

European stocks close: stocks traded mixed on higher oil prices

Market participants also eyed economic data from Germany. Destatis released its manufacturing turnover data for Germany on Wednesday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.1% in March, after a 0.2% fall in February. February's figure was revised down up a 0.5% decrease.

Domestic turnover decreased by 1.3% in March, while the business with foreign customers dropped 0.8%.

Sales to euro area countries fell 0.5% in March, while sales to other countries were down 1.1%.

On a yearly basis, real manufacturing turnover in Germany was up on adjusted for working days basis by 0.7% in March, after a 1.8% rise in February.

European Central Bank (ECB) Governing Council member Ewald Nowotny said in a speech on Wednesday that the exchange rate of the euro was not the target of the central bank's stimulus measures. He also said that helicopter money could not be implemented in the Europe, adding that was little more than a "fantasy discussion" in the Eurozone.

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 0.3% in March, missing forecasts of a 0.5% increase, after a 0.2% fall in February. February's figure was revised up from a 0.3% decline.

The increase was mainly driven by a rise in electricity, gas, steam & air conditioning output, which climbed by 3.3% in March.

On a yearly basis, industrial production in the U.K. decreased 0.2% in March, beating expectations for a 0.4% drop, after a 0.1% increase in February. February's figure was revised up from a 0.5% fall.

The decline was driven by a drop in manufacturing, which slid 1.9% year-on-year in March.

Manufacturing production in the U.K. was up 0.1% in March, missing expectations for a 0.3% gain, after a 0.9% decline in February. February's figure was revised up from a 1.1% decrease.

The rise was mainly driven by an increase in manufacture of transport equipment, which rose by 2.7% in March.

On a yearly basis, manufacturing production in the U.K. decreased 1.9% in March, in line with forecasts, after a 1.6% drop in February. It was the largest decrease since May 2013.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.3% in three months to April, after a 0.4% growth in three months to March. The previous figure was revised up from a 0.3% growth.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,162.49 +5.84 +0.09 %

DAX 9,975.32 -70.12 -0.70 %

CAC 40 4,316.67 -21.54 -0.50 %

-

18:00

European stocks closed: FTSE 100 6,162.49 +5.84 +0.09% CAC 40 4,316.67 -21.54 -0.50% DAX 9,975.32 -70.12 -0.70%

-

17:39

WSE: Session Results

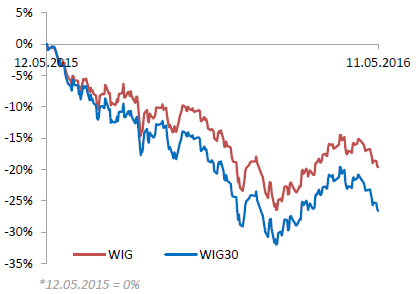

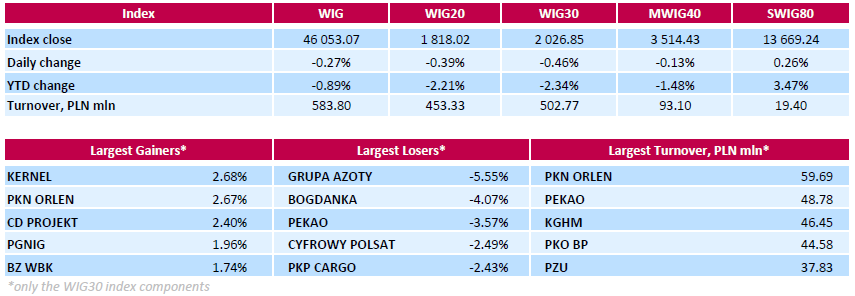

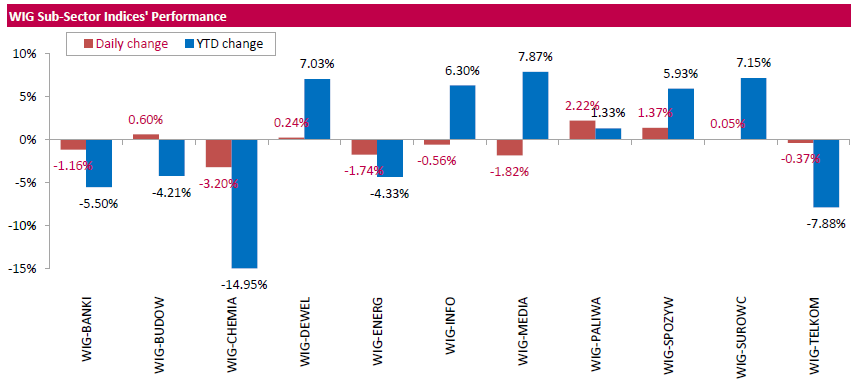

Polish equity market closed lower on Wednesday. The broad market benchmark, the WIG Index, fell by 0.27%. Sector performance in the WIG Index was mixed. Chemicals (-3.20%) recorded the biggest decline, while oil and gas sector (+2.22%) fared the best.

The large-cap stocks' measure, the WIG30 Index, lost 0.46%. Within the WIG30 Index components, chemical producer GRUPA AZOTY (WSE: ATT) was hit the hardest, down 5.55%, after the company reported a 1.4% fall in its Q1 net profit to PLN 272.4 mln or $70.1 mln (versus analysts' consensus estimate of PLN 307.6 mln), as falling fertilizer prices outweighed lower gas costs. In addition, the company's deputy chief executive stated the management sees worse prospects for 2016 compared to 2015. Other major laggards were thermal coal miner BOGDANKA (WSE: LWB) and PEKAO (WSE: PEO, plunging by 4.07% and 3.57% respectively. On the other side of the ledger, agricultural producer KERNEL (WSE: KER), oil refiner PKN ORLEN (WSE: PKN) and videogame developer CD PROJEKT (WSE: CDR) were the best performers, advancing 2.68%, 2.67% and 2.4% respectively.

-

17:32

China's vice premier Zhang Gaoli: China will reach its economic growth target this year

China's vice premier Zhang Gaoli said on Wednesday that the country would reach its economic growth target this year. China expects its economy to expand 6.5%-7.0% in 2016, after a 6.9% growth in 2015.

Zhang noted that China's economy remained resilient.

-

17:22

European Central Bank Governing Council member Vitas Vasiliauskas: there is no need in further stimulus measures at the moment

European Central Bank (ECB) Governing Council member Vitas Vasiliauskas said on Wednesday that there was no need in further stimulus measures as the recent stimulus measures were working. He added that the ECB had tools to act if needed.

-

17:16

European Central Bank Governing Council member Ewald Nowotny: the exchange rate of the euro is not the target of the ECB’S stimulus measures

European Central Bank (ECB) Governing Council member Ewald Nowotny said in a speech on Wednesday that the exchange rate of the euro was not the target of the central bank's stimulus measures. He also said that helicopter money could not be implemented in the Europe, adding that was little more than a "fantasy discussion" in the Eurozone.

-

16:53

NIESR’s gross domestic product rises by 0.3% in three months to April

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.3% in three months to April, after a 0.4% growth in three months to March. The previous figure was revised up from a 0.3% growth.

"UK economic growth continues to be subdued compared with the rates we saw at the end of last year. Some of this slowdown is undoubtedly a result of heightened uncertainty around the impending EU referendum, and so is likely to be temporary should the UK decide to remain in the EU after June 23rd," Jack Meaning, NIESR Research Fellow, said.

The NIESR yesterday lowered its GDP growth forecast for the U.K. If Britain remains in the European Union (EU), the U.K. GDP will be expected to grow 2.0% in 2016, down from the previous estimate of 2.3%. The NIESR expects the U.K. economy to expand at 2.7% in 2017, unchanged from the previous estimate.

-

15:54

Ifo World Economic Climate index increases to 90.5 in the second quarter

German Ifo Institute released its Ifo World Economic Climate figures on Wednesday. The Ifo World Economic Climate index increased to 90.5 in the second quarter from 87.8 in the first quarter. The increase was driven by rises of economic climate indexes in North America and Europe. The index for Asia declined slightly in the second quarter.

The current economic situation index for the global economy dropped to 86.0 in the second quarter from 87.9 in the first quarter, while the economic expectations index jumped to 94.7 from 87.7.

Ifo expects the global economy to expand 2.0% this year, while the recovery remained moderate.

-

15:48

WSE: After start on Wall Street

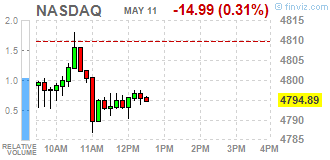

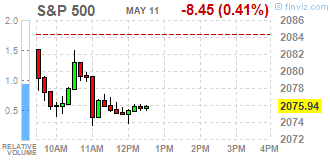

U.S. Stocks open: Dow -0.37%, Nasdaq -0.25%, S&P -0.21%

Wall Street started the session in the context of declining oil prices, so the downward beginning directly corresponds to the raw material market. There is no surprise - yesterday's growth was built on good performance of oil prices. Europe had the opportunity to prepare for such a scenario, but locally more important turned out strengthening of the euro, which does not allow for the DAX to correct day's weakness.

For frozen in the consolidation the WIG20 opening in the US is less important. Barely PLN 290 mln of turnover on the index indicates that the WSE is waiting for a movement that will stand out from today suspension. In less than an hour we will will be data on stocks of fuel in the USA.

-

15:38

Westpac’s consumer confidence index for Australia climbs 8.5% in May

Westpac Bank released its consumer confidence index for Australia on Wednesday. The index climbed 8.5% in May, after a 0.4% decline in April.

The index was driven by rises in all sub-indexes.

"Our analysis indicates that the dominant driver of the boost to confidence has been the rate cut," Westpac Chief Economist Bill Evans said.

"The Reserve Bank board next meets on June 7. We expect the Board to keep rates on hold at that meeting although we are expecting a further rate cut at the August meeting," he added.

-

15:33

U.S. Stocks open: Dow -0.37%, Nasdaq -0.25%, S&P -0.21%

-

15:04

Before the bell: S&P futures -0.12%, NASDAQ futures -0.07%

U.S. stock-index futures slipped.

Nikkei 16,579.01 +13.82 +0.08%

Hang Seng 20,055.29 -187.39 -0.93%

Shanghai Composite 2,837.63 +5.04 +0.18%

FTSE 6,147.13 -9.52 -0.15%

CAC 4,309.73 -28.48 -0.66%

DAX 9,980.67 -64.77 -0.64%

Crude $44.90 (+0.54%)

Gold $1279.50 (+1.16%)

-

14:46

OECD’s leading composite leading indicator declines to 99.6 in March

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator decreased to 99.6 in March from 99.7 in February.

It signalled stable growth in Canada, the Eurozone as a whole, Germany and France.

The index for Japan showed signs of growth stabilisation.

There were signs of firming growth momentum in India.

The index for the U.S., the U.K., and Italy pointed to an easing in growth momentum.

The index for China signalled stable growth.

The index for Russia showed signs of positive change in growth momentum.

-

14:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.67

0.00(0.00%)

23385

ALTRIA GROUP INC.

MO

64.34

-0.26(-0.4025%)

820

Amazon.com Inc., NASDAQ

AMZN

703.89

0.82(0.1166%)

22381

Apple Inc.

AAPL

93.23

-0.19(-0.2034%)

27087

AT&T Inc

T

39.16

-0.15(-0.3816%)

700

Barrick Gold Corporation, NYSE

ABX

18.44

0.51(2.8444%)

94328

Caterpillar Inc

CAT

72.5

-0.01(-0.0138%)

5805

Chevron Corp

CVX

101.17

-0.10(-0.0987%)

4004

Cisco Systems Inc

CSCO

27.05

0.02(0.074%)

580

Citigroup Inc., NYSE

C

44.7

-0.14(-0.3122%)

14619

Exxon Mobil Corp

XOM

89.24

-0.00(-0.00%)

9601

Facebook, Inc.

FB

120.34

-0.16(-0.1328%)

53005

Ford Motor Co.

F

13.42

-0.07(-0.5189%)

515

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.12

0.26(2.3941%)

185928

General Electric Co

GE

30.43

-0.05(-0.164%)

4663

General Motors Company, NYSE

GM

31.3

-0.05(-0.1595%)

408

Goldman Sachs

GS

160.98

-0.44(-0.2726%)

735

Google Inc.

GOOG

721.09

-2.09(-0.289%)

983

Hewlett-Packard Co.

HPQ

11.64

0.03(0.2584%)

11433

Home Depot Inc

HD

137.51

-0.00(-0.00%)

426

Intel Corp

INTC

30.05

-0.09(-0.2986%)

12498

Johnson & Johnson

JNJ

114.65

-0.02(-0.0174%)

410

JPMorgan Chase and Co

JPM

61.95

-0.09(-0.1451%)

2262

McDonald's Corp

MCD

132

0.40(0.304%)

500

Microsoft Corp

MSFT

50.86

-0.16(-0.3136%)

1101

Nike

NKE

58.85

-0.35(-0.5912%)

2197

Pfizer Inc

PFE

33.45

-0.05(-0.1493%)

2874

Starbucks Corporation, NASDAQ

SBUX

57.49

0.00(0.00%)

755

Tesla Motors, Inc., NASDAQ

TSLA

207.25

-1.44(-0.69%)

10306

Twitter, Inc., NYSE

TWTR

14.67

0.04(0.2734%)

24601

Wal-Mart Stores Inc

WMT

67.5

-0.79(-1.1568%)

11713

Walt Disney Co

DIS

101.4

-5.20(-4.878%)

431886

Yandex N.V., NASDAQ

YNDX

19.9

0.31(1.5824%)

3500

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Walt Disney (DIS) target lowered to $129 from $130 at Topeka Capital Markets

Apple (AAPL) target lowered to $115 from $120 at UBS

-

13:09

WSE: Mid session comment

The first half of the session indicates that in the area of 1,815 points market has found a new equilibrium. Two attempts of descent below 1,815 points ended with reversals. It seems that the potential for further price reductions without any correction, and especially the drop under 1,800 points, is not substantial.

In the context of low activity market stabilized waiting for the new impetus. The environment, however, favored bearish sentiment. The DAX has lost more than 0.7 percent, and the CAC more than 1 percent. PLN rates held reasonably well, but the consensus is that any attempts to capitalize on the strengthening of the Polish currency before Friday will have slim chances of success. Turnover on the blue chips at halfway point was barely over PLN 160 mln and the WIG20 index was at 1,823 points (-0.07%).

-

12:00

European stock markets mid session: stocks traded lower on a decline in oil prices

Stock indices traded lower as oil prices declined. Oil prices fell on concerns over the global oil oversupply.

Market participants also eyed economic data from Germany. Destatis released its manufacturing turnover data for Germany on Wednesday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.1% in March, after a 0.2% fall in February. February's figure was revised down up a 0.5% decrease.

Domestic turnover decreased by 1.3% in March, while the business with foreign customers dropped 0.8%.

Sales to euro area countries fell 0.5% in March, while sales to other countries were down 1.1%.

On a yearly basis, real manufacturing turnover in Germany was up on adjusted for working days basis by 0.7% in March, after a 1.8% rise in February.

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 0.3% in March, missing forecasts of a 0.5% increase, after a 0.2% fall in February. February's figure was revised up from a 0.3% decline.

The increase was mainly driven by a rise in electricity, gas, steam & air conditioning output, which climbed by 3.3% in March.

On a yearly basis, industrial production in the U.K. decreased 0.2% in March, beating expectations for a 0.4% drop, after a 0.1% increase in February. February's figure was revised up from a 0.5% fall.

The decline was driven by a drop in manufacturing, which slid 1.9% year-on-year in March.

Manufacturing production in the U.K. was up 0.1% in March, missing expectations for a 0.3% gain, after a 0.9% decline in February. February's figure was revised up from a 1.1% decrease.

The rise was mainly driven by an increase in manufacture of transport equipment, which rose by 2.7% in March.

On a yearly basis, manufacturing production in the U.K. decreased 1.9% in March, in line with forecasts, after a 1.6% drop in February. It was the largest decrease since May 2013.

Current figures:

Name Price Change Change %

FTSE 100 6,143.67 -12.98 -0.21 %

DAX 9,980.65 -64.79 -0.64 %

CAC 40 4,296.03 -42.18 -0.97 %

-

11:35

Japan's leading index declines to 98.4 in March

Japan's Cabinet Office released its preliminary leading index data on Wednesday. The leading index decreased to 98.4 in March from 98.9 in February, beating expectations for a decline to 96.4. It was the lowest level since November 2012.

February's figure was revised up from 96.8.

Japan's coincident index climbed to 111.2 in March from 110.7 in February.

-

11:25

Germany’s manufacturing turnover declines by 1.1% in March

Destatis released its manufacturing turnover data for Germany on Wednesday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.1% in March, after a 0.2% fall in February. February's figure was revised down up a 0.5% decrease.

Domestic turnover decreased by 1.3% in March, while the business with foreign customers dropped 0.8%.

Sales to euro area countries fell 0.5% in March, while sales to other countries were down 1.1%.

On a yearly basis, real manufacturing turnover in Germany was up on adjusted for working days basis by 0.7% in March, after a 1.8% rise in February.

-

11:08

U.K. industrial production rises 0.3% in March

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 0.3% in March, missing forecasts of a 0.5% increase, after a 0.2% fall in February. February's figure was revised up from a 0.3% decline.

The increase was mainly driven by a rise in electricity, gas, steam & air conditioning output, which climbed by 3.3% in March.

On a yearly basis, industrial production in the U.K. decreased 0.2% in March, beating expectations for a 0.4% drop, after a 0.1% increase in February. February's figure was revised up from a 0.5% fall.

The decline was driven by a drop in manufacturing, which slid 1.9% year-on-year in March.

Manufacturing production in the U.K. was up 0.1% in March, missing expectations for a 0.3% gain, after a 0.9% decline in February. February's figure was revised up from a 1.1% decrease.

The rise was mainly driven by an increase in manufacture of transport equipment, which rose by 2.7% in March.

On a yearly basis, manufacturing production in the U.K. decreased 1.9% in March, in line with forecasts, after a 1.6% drop in February. It was the largest decrease since May 2013.

February's figure was revised up from a 1.8% decline.

-

10:51

Home loans in Australia fall 0.9% in March

The Australian Bureau of Statistics released its home loans data on Wednesday. Home loans in Australia fell 0.9% in March, beating expectations for a 1.5% drop, after 0.9% increase in February. February's figure was revised down from a 1.5% rise.

The value of owner occupied loans decreased at a seasonally adjusted 1.2% in March, investment lending climbed 1.5%, while the number of loans for the construction of dwellings slid 2.0%.

-

10:20

San Francisco Fed President John Williams: it is unlikely that the Fed would cut its interest rates into negative territory

San Francisco Fed President John Williams said on Monday that it was unlikely that the Fed would cut its interest rates into negative territory. He also said that the U.S. banking system was safer than before the financial crisis, due to higher reserve requirements and stress testing.

Williams noted that the U.S. economy was in a good shape.

-

10:09

Reserve Bank of New Zealand Graeme Wheeler: risks to the financial stability have increased

The Reserve Bank of New Zealand (RBNZ) released its Financial Stability Report on Tuesday. The RBNZ Graeme Wheeler said that risks to the financial stability have increased further in the past six months.

"Although New Zealand's economic growth remains solid, the outlook for the global economy has deteriorated. Despite highly accommodative monetary policies and low oil prices, growth is slowing in a number of trading partner economies," he said.

"Dairy prices remain low with global dairy supply continuing to increase. Many farmers now face a third season of negative cash flow with heavy demand for working capital," the RBNZ governor added.

Wheeler expressed concerns about a rise in prices in the Auckland housing market, adding that the imbalance between housing demand and supply in Auckland should be reduced.

-

09:09

WSE: After opening

WIG20 index opened at 1823.50 points (-0.09%)*

WIG 46157.22 -0.05%

WIG30 2034.39 -0.09%

mWIG40 3519.11 0.00%

*/ - change to previous close

Low turnover at the session opening at the WSE is gradually becoming a pattern. The Polish market effectively ignores external reinforcement of the US trade and begins around the closing level. More than half of the WIG20 companies open in red.

-

08:29

WSE: Before opening

Tuesday's session on the New York stock markets brought the strongest for two months increases of the major indexes, which gained approximately 1.25 percent. The growth driver was the nearly 3% increase in crude prices. Optimistic mood in the US is somewhat tempered by night revocation of contracts on the S&P500, but while current sentiment is maintained, the opening in Europe should be positive.

Taking into account the fact that the news calendar does not have any other important item for today other than fuel inventories in the US, and yesterday's growth in the US was based on the oil price hike, the stock markets will rather be influenced by the markets of raw materials and any hints of today's US stock indices behavior. At the moment, both crude and the S&P500 contract show modest declines and confirm the sensitivity of the market price of the raw materials. The last two weeks also show the sensitivity of European markets to the relationship between the euro and the dollar. It is also worth to pay attention to a danger for the shares implied by correction on the chart of the USDJPY pair.

The Warsaw market is also sensitive to the currency rate fluctuations. The WIG20 shows a correlation with the condition of PLN, and the prospects of PLN are being reassessed in anticipation of ratings updates for the Polish debt. Till the end of the week the WSE may extend its "separation" from the core markets focusing more on the negative sentiment around Polish assets.

-

06:36

Global Stocks

European stocks moved up Tuesday as gains for Credit Suisse AG and Volkswagen AG shares and an important breakthrough on the Greek debt crisis allowed investors to set aside disappointing economic data.

The S&P 500 and Dow industrials steadily climbed to session highs Tuesday, to end with their best one-day percentage gains in two months as oil prices rallied.

Asian stocks rose, with the regional benchmark index heading for a second day of advance, as Japanese shares rallied amid a recovery in commodity prices. Evidence of firming inflation in China ignited gains in industrial metals Tuesday, fueling a 2 percent climb in Bloomberg's Commodity Index along with the gains in crude oil.

Based on MarketWatch materials

-

04:03

Nikkei 225 16,640.06 +74.87 +0.45 %, Hang Seng 20,202.13 -40.55 -0.20 %, Shanghai Composite 2,847.95 +15.36 +0.54 %

-

00:35

Stocks. Daily history for Sep Apr May 10’2016:

(index / closing price / change items /% change)

Nikkei 225 16,565.19 +349.16 +2.15 %

Hang Seng 20,242.68 +85.87 +0.43 %

S&P/ASX 200 5,342.79 +22.09 +0.42 %

Shanghai Composite 2,833.18 +1.07 +0.04 %

FTSE 100 6,156.65 +41.84 +0.68 %

CAC 40 4,338.21 +15.40 +0.36 %

Xetra DAX 10,045.44 +64.95 +0.65 %

FTSE 100 6,156.65 +41.84 +0.68 %

CAC 40 4,338.21 +15.40 +0.36 %

Xetra DAX 10,045.44 +64.95 +0.65 %

-