Noticias del mercado

-

21:00

Dow +0.29% 17,762.89 +51.77 Nasdaq -0.14% 4,753.94 -6.75 S&P +0.22% 2,069.00 +4.54

-

18:01

European stocks closed: FTSE 100 6,104.19 -58.30 -0.95% CAC 40 4,293.27 -23.40 -0.54% DAX 9,862.12 -113.20 -1.13%

-

18:00

European stocks close: stocks traded lower on falling oil prices

Stock closed lower on a drop in oil prices. Oil prices fell on concerns over the global oil oversupply.

Market participants also eyed the economic data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Thursday. Industrial production in the Eurozone fell 0.8% in March, missing expectations for a flat reading, after a 1.2% drop in February. February's figure was revised down from a 0.8% decrease.

Non-durable consumer goods output dropped 1.9% in March, capital goods output decreased 1.1%, while energy output increased 2.0%.

Intermediate goods output fell 0.8% in March, while durable consumer goods declined 0.4%.

On a yearly basis, Eurozone's industrial production rise 0.2% in March, missing expectations for a 1.1% rise, after a 0.8% increase in February.

Durable consumer goods climbed by 1.1% in March from a year ago, capital goods rose by 1.6%, non-durable consumer goods slid by 3.0%, while intermediate goods output increased by 1.1%.

Energy output declined by 0.7% in March from a year ago.

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected. All members voted to keep the central bank's monetary policy unchanged.

The central bank downgraded its growth forecasts. The economy is expected to expand 2.0% in 2016, down from its previous forecast of a 2.2% rise, and 2.3% in 2017, down from its previous forecast of a 2.4% gain. The BoE said that uncertainty around Britain's membership in the European Union weighed on the economic growth.

The BoE Governor Mark Carney said at a press conference on Thursday that Britain's exit from the European Union could lead to a "technical recession," adding that the central bank would do everything to cushion a shock. He pointed out that it would need time to offset the effect of shock.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,104.19 -58.30 -0.95 %

DAX 9,862.12 -113.20 -1.13 %

CAC 40 4,293.27 -23.40 -0.54 %

-

17:52

Cleveland Fed President Loretta Mester: inflation in the U.S. picks up this year

Cleveland Fed President Loretta Mester said in a speech on Thursday that price stability was the Holy Grail for central banks, adding that price stability and monetary policy were intimately linked.

She also said that inflation in the U.S. rose this year.

"The headline and underlying measures of inflation have moved higher," Cleveland Fed president noted.

"As of the first quarter of this year, the year-over-year change in the headline PCE price index has risen to 1 percent from 0.2 percent in the first quarter of last year. Core PCE inflation was 1.7 percent in the first quarter, compared to 1.3 percent a year ago, and core CPI inflation was 2.3 percent compared with 1.7 percent a year ago," Mester added.

-

17:40

WSE: Session Results

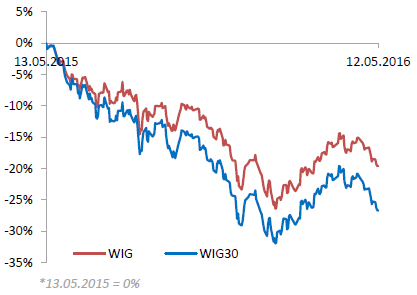

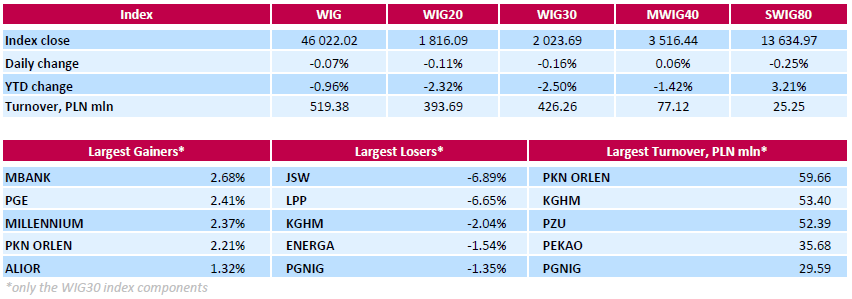

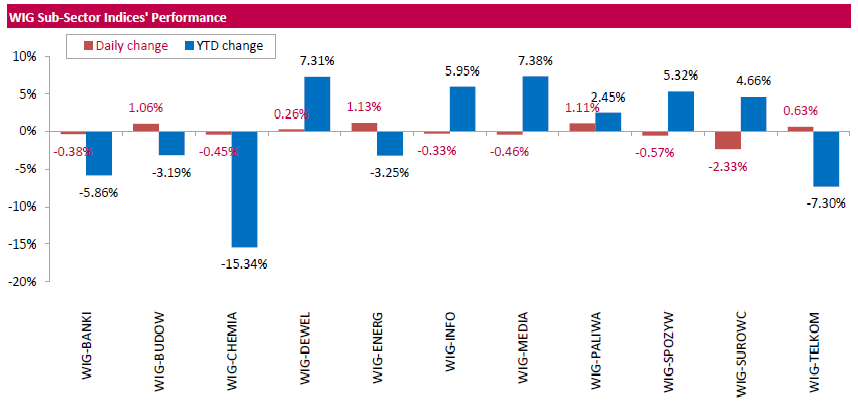

Polish equity market closed slightly lower on Thursday. The broad market measure, the WIG index, inched down 0.07%. Sector performance within the WIG Index was mixed. Materials stocks (-2.33%) tumbled the most, while utilities names (+1.13%) fared the best.

The large-cap stocks' benchmark, the WIG30 Index, plunged by 0.16%. In the index basket, coking coal miner JSW (WSE: JSW) topped the list of decliners with a 6.89% drop. It was followed by clothing retailer LPP (WSE: LPP), which fell by 6.65% after the company reported Q1 net loss of PLN 65.6 mln, nearly twice deeper than the expected loss of PLN 35.9 mln. Other major laggards were copper producer KGHM (WSE: KGH), genco ENERGA (WSE: ENG) and oil and gas producer PGNIG (WSE: PGN), losing 2.04%, 1.54% and 1.35% respectively. On the other side of the ledger, MBANK (WSE: MBK) led the gainers with a 2.68% advance, followed by genco PGE (WSE: PGE), bank MILLENNIUM (WSE: MIL) and oil refiner PKN ORLEN (WSE: PKN), growing by 2.41%, 2.37% and 2.21% respectively.

-

17:19

MI consumer inflation expectations in Australia decline to 3.2% in May

The Melbourne Institute (MI) released its inflation expectations for Australia on Thursday. The MI consumer inflation expectations in Australia declined to 3.2% in May from 3.4% in April.

68.3% respondents expected inflation to decline within the 0‐5% range in May, down from 69.3% in April.

-

16:28

Bank lending in Japan increases 2.2% year-on-year in April

The Bank of Japan released its bank lending data on late Wednesday evening. Bank lending in Japan increased 2.2% year-on-year in April, after a 2.0% rise in March.

Lending excluding trusts climbed 2.2% year-on-year in April, lending from trusts rose 2.2%, while lending from foreign banks was up 1.4%.

-

16:13

Japan’s Eco Watchers' current conditions index falls to 43.5 in April

Japan's Cabinet Office released Eco Watchers' Index figures on Thursday. Japan's economy watchers' current conditions index fell to 43.5 in April from 45.4 in March, missing expectations for a decline to 44.9.

Japan's economy watchers' future conditions index decreased to 45.5 in April from 46.7 in March.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

16:10

Bank of England Governor Mark Carney: Britain’s exit from the European Union could lead to a “technical recession”

The Bank of England (BoE) Governor Mark Carney said at a press conference on Thursday that Britain's exit from the European Union could lead to a "technical recession," adding that the central bank would do everything to cushion a shock. He pointed out that it would need time to offset the effect of shock.

"Monetary policy cannot immediately offset all the effects of a shock," he said.

-

15:57

Bank of England's Monetary Policy Committee May minutes: the referendum on Britain’s membership in the European Union is the main risk to the outlook

The Bank of England's Monetary Policy Committee (MPC) released its February meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged.

The consumer price inflation in the U.K. was 0.5% in March, below the central bank's 2% target. The BoE noted that inflation was driven by a drop in energy and food prices, adding that this effect would dissipate over the next year and inflation would reach the 2 % target by mid-2018.

The central bank said that Britain's economy slowed in the first quarter and was expected to decelerate in the second quarter as uncertainty around Britain's membership in the European Union (EU) weighed on the economy.

The BoE noted that the domestic private sector remained resilient, while consumer confidence was robust.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles".

The BoE also said that the referendum was the main risk to the outlook.

"A vote to leave the EU could materially alter the outlook for output and inflation, and therefore the appropriate setting of monetary policy. Households could defer consumption and firms delay investment, lowering labour demand and causing unemployment to rise. At the same time, supply growth is likely to be lower over the forecast period, reflecting slower capital accumulation and the need to reallocate resources. Sterling is also likely to depreciate further, perhaps sharply," the central bank noted.

-

15:48

Bank of England’s quarterly inflation report: the central bank downgrades its growth forecasts

The Bank of England (BoE) released its quarterly inflation report on Thursday. The central bank downgraded its growth forecasts. The economy is expected to expand 2.0% in 2016, down from its previous forecast of a 2.2% rise, and 2.3% in 2017, down from its previous forecast of a 2.4% gain.

The central bank said that uncertainty around Britain's membership in the European Union weighed on the economic growth.

The BoE expects inflation in the U.K. to be 0.4% this year, 1.5% next year and 2.1% in 2018.

-

15:46

WSE: After start on Wall Street

This afternoon, we learned the weekly number of applications for unemployment benefits in the US. The third week in a row this number is growing, and today significantly. The main value approached the psychological level of 300 thousand and is the highest since February last year. This is not a positive signal, because in conjunction with the worst monthly report may signal weaker performance of the labor market. Investors reacted immediately. The dollar is weaker (less chance of a rate hike), and stock indices went down.

U.S. Stocks open: Dow +0.30%, Nasdaq +0.38%, S&P +0.34%

-

15:36

Bank of England keeps its interest rate on hold at 0.5% in May

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

15:32

U.S. Stocks open: Dow +0.30%, Nasdaq +0.38%, S&P +0.34%

-

15:21

Before the bell: S&P futures +0.56%, NASDAQ futures +0.48%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,646.34 +67.33 +0.41%

Hang Seng 19,915.46 -139.83 -0.70%

Shanghai Composite 2,836.74 -0.30 -0.01%

FTSE 6,180.48 +17.99 +0.29%

CAC 4,354.92 +38.25 +0.89%

DAX 10,014.96 +39.64 +0.40%

Crude $46.66 (+0.93%)

-

15:02

Canada’s new housing price index climbs 0.2% in March

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.2% in March, exceeding expectations of a 0.1% gain, after a 0.2% rise in February.

The increase was mainly driven by higher prices in Toronto and Vancouver. New home prices in Toronto and Oshawa region rose 0.4% in March, while prices in Vancouver climbed 0.4%.

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.6

0.06(0.6289%)

26749

Amazon.com Inc., NASDAQ

AMZN

717.11

3.88(0.544%)

50068

Apple Inc.

AAPL

92.64

0.13(0.1405%)

70927

AT&T Inc

T

39.3

0.12(0.3063%)

2867

Barrick Gold Corporation, NYSE

ABX

18.21

-0.23(-1.2473%)

57004

Caterpillar Inc

CAT

72.95

0.52(0.7179%)

805

Chevron Corp

CVX

101.92

0.78(0.7712%)

3400

Cisco Systems Inc

CSCO

26.89

0.19(0.7116%)

1900

Citigroup Inc., NYSE

C

45

0.53(1.1918%)

12911

Exxon Mobil Corp

XOM

89.69

0.88(0.9909%)

22163

Facebook, Inc.

FB

119.92

0.40(0.3347%)

83665

FedEx Corporation, NYSE

FDX

161.49

0.20(0.124%)

200

Ford Motor Co.

F

13.39

0.07(0.5255%)

40135

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.82

0.21(1.8088%)

315523

General Electric Co

GE

29.97

-0.37(-1.2195%)

340435

Goldman Sachs

GS

160.06

0.64(0.4015%)

400

Google Inc.

GOOG

718.75

3.46(0.4837%)

5638

Intel Corp

INTC

30.16

0.10(0.3327%)

6432

Johnson & Johnson

JNJ

114.61

0.24(0.2098%)

437

McDonald's Corp

MCD

129.66

0.52(0.4027%)

1940

Merck & Co Inc

MRK

54.4

0.09(0.1657%)

100

Microsoft Corp

MSFT

51.27

0.22(0.431%)

27993

Nike

NKE

57.7

0.69(1.2103%)

14179

Pfizer Inc

PFE

33.25

0.09(0.2714%)

900

Starbucks Corporation, NASDAQ

SBUX

56.7

0.47(0.8359%)

4150

Tesla Motors, Inc., NASDAQ

TSLA

211.6

2.64(1.2634%)

18474

Twitter, Inc., NYSE

TWTR

14.66

0.07(0.4798%)

10425

Verizon Communications Inc

VZ

51.35

0.20(0.391%)

223

Visa

V

77.82

0.52(0.6727%)

238

Wal-Mart Stores Inc

WMT

66.16

-0.25(-0.3764%)

18386

Walt Disney Co

DIS

102.3

0.01(0.0098%)

5856

Yahoo! Inc., NASDAQ

YHOO

37.45

0.08(0.2141%)

3571

Yandex N.V., NASDAQ

YNDX

19.77

0.08(0.4063%)

5560

-

14:48

U.S. import price index increases by 0.3% in April

The U.S. Labor Department released its import and export prices data on Thursday. The U.S. import price index increased by 0.3% in April, missing expectations for a 0.5% rise, after a 0.3% gain in March. March's figure was revised up from a 0.2% increase.

The rise was mainly driven by higher prices for fuel imports, which climbed 3.3% in April.

U.S. export prices climbed by 0.5% in April, after a flat reading in March.

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Pfizer (PFE) initiated with a Hold at Berenberg; target $38

General Electric (GE) resumed with a Underweight at JP Morgan

-

14:43

Initial jobless claims rise to 294,000 in the week ending May 07

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending May 07 in the U.S. increased by 20,000 to 294,000 from 274,000 in the previous week. Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 62nd straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 37,000 to 2,161,000 in the week ended April 30.

-

13:23

WSE: Mid session comment

Behind us the first half of the session with a turnover of PLN 168 mln in the first line of companies (the WIG20). As per session with a reflection of the recent decline it looks rather to withdraw from the game a fair representation of the supply side, which is not particularly good news for the bulls.

It is important that we establish the nature of the trade to keep up with the European parquets.

-

11:59

European stock markets mid session: stocks traded mixed on the negative economic data from the Eurozone

Stock indices traded mixed on the negative economic data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Thursday. Industrial production in the Eurozone fell 0.8% in March, missing expectations for a flat reading, after a 1.2% drop in February. February's figure was revised down from a 0.8% decrease.

Non-durable consumer goods output dropped 1.9% in March, capital goods output decreased 1.1%, while energy output increased 2.0%.

Intermediate goods output fell 0.8% in March, while durable consumer goods declined 0.4%.

On a yearly basis, Eurozone's industrial production rise 0.2% in March, missing expectations for a 1.1% rise, after a 0.8% increase in February.

Durable consumer goods climbed by 1.1% in March from a year ago, capital goods rose by 1.6%, non-durable consumer goods slid by 3.0%, while intermediate goods output increased by 1.1%.

Energy output declined by 0.7% in March from a year ago.

The Bank of England is scheduled to release its interest rate decision at 11:00 GMT. The central bank is expected to keep its monetary policy unchanged.

Current figures:

Name Price Change Change %

FTSE 100 6,157.28 -5.21 -0.08 %

DAX 10,015.05 +39.73 +0.40 %

CAC 40 4,334.63 +17.96 +0.42 %

-

11:50

Business NZ performance of manufacturing index for New Zealand climbs to 56.5 in April

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand climbed to 56.5 in April from 54.7 in March.

A reading above 50 indicates expansion in the manufacturing sector.

The increase was driven by rises in in production and new orders.

"The proportion of positive comments also remained above 60%, while comments centered on general market growth and increased orders, particularly from offshore. Overall, the April result represents another solid month for the sector," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

11:45

Greek unemployment rate declines to 24.2% in February

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.2% in February from 24.4% in January.

The number of unemployed decreased by 7,524 persons compared with January.

The youth unemployment rate was down to 51.4% in February from 51.8% compared with February 2015.

-

11:37

RICS house price balance for the U.K. drops to +41% in April

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance fell to +41% in April from +42% in March. It was the lowest level since June 2015.

The RICS noted that the decline was driven by the impact of Stamp Duty changes and uncertainty around the EU referendum.

-

11:22

French final consumer price inflation rises 0.1% in April

The French statistical office Insee released its final consumer price inflation for France on Thursday. The French consumer price inflation rose 0.1% in April, in line with the preliminary reading, after a 0.7% increase in March.

On a yearly basis, the consumer price index decreased 0.2% in April, in line with the preliminary reading, after a 0.1% decline in March.

Fresh food prices rose 0.4% year-on-year in April, services prices climbed by 1.0%, while petroleum products prices dropped by 12.1%.

-

11:17

German wholesale prices rise 0.3% in April

The German statistical office Destatis released its wholesale prices for Germany on Thursday. German wholesale prices rose 0.3% in April, after a 0.3% increase in March.

On a yearly basis, wholesale prices in Germany dropped 2.7% in April, after a 2.6% decline in March. It was the biggest drop since November 2009. Wholesale prices have been declining since July 2013.

The annual fall was mainly driven by a 16.7% drop in solid fuels and related products.

-

11:10

Eurozone’s industrial production falls 0.8% in March

Eurostat released its industrial production data for the Eurozone on Thursday. Industrial production in the Eurozone fell 0.8% in March, missing expectations for a flat reading, after a 1.2% drop in February. February's figure was revised down from a 0.8% decrease.

Non-durable consumer goods output dropped 1.9% in March, capital goods output decreased 1.1%, while energy output increased 2.0%.

Intermediate goods output fell 0.8% in March, while durable consumer goods declined 0.4%.

On a yearly basis, Eurozone's industrial production rise 0.2% in March, missing expectations for a 1.1% rise, after a 0.8% increase in February.

Durable consumer goods climbed by 1.1% in March from a year ago, capital goods rose by 1.6%, non-durable consumer goods slid by 3.0%, while intermediate goods output increased by 1.1%.

Energy output declined by 0.7% in March from a year ago.

-

10:52

Bank of Japan Governor Haruhiko Kuroda: the central bank’s stimulus measures need more time to take effect

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in an interview with German Boersen Zeitung on Wednesday that the central bank's stimulus measures needed more time to take effect.

"We have to wait a few months to see the effects in the real economy," he said.

Kuroda noted that inflation was picking up.

The BoJ governor pointed out the BoJ could ease its monetary policy further if needed.

-

10:38

European Central Bank Governing Council member Jens Weidmann: the ECB should not keep its low interest rates for a longer period

The European Central Bank (ECB) Governing Council member Jens Weidmann said on Wednesday that the central bank should not keep its low interest rates for a longer period.

"We must not over-extend the period of ultra-loose monetary policy because various risks and side-effects are part and parcel of the current policy stance," he said.

Weidmann noted that stimulus measures were right at the moment.

"An expansionary monetary policy stance is justified for now," he said.

-

10:22

Japan’s current account surplus climbs to ¥2,930.0 billion in March

Japan's Ministry of Finance released its current account data for Japan late Wednesday evening. Japan's current account surplus climbed to ¥2,930.0 billion in March from ¥2.435.0 billion in February, missing expectations for a surplus of ¥3,005.0 billion.

The trade surplus rose to ¥927.2 billion in March, up from a surplus of ¥425.2 billion in February.

Exports dropped at an annual rate of 11.4% in March, while imports plunged 16.6%.

-

10:10

U.S. budget surplus is $106.0 billion in April

The U.S. Treasury Department released its federal budget data on Wednesday. The budget surplus was $106.0 billion in April, missing expectations for a surplus of $112.0 billion, after a deficit of $108.0 billion in March.

The budget surplus was driven by annual tax payments.

In the seven months of the fiscal year 2016, which ends at September this year, the budget deficit totalled $355.0 billion, up 25.0% from a year ago.

-

09:21

WSE: After opening

WIG20 index opened at 1817.25 points (-0.04%)*

WIG 46090.27 0.08%

WIG30 2027.29 0.02%

mWIG40 3522.37 0.23%

*/ - change to previous close

The cash market opened at neutral level of 1,817 points with the turnover focused mostly on presented results companies, apart from the traditional KGHM. In the case of the German DAX losses reach 0.7%. The Warsaw market does not really want to drop and defends yesterday's lows, what in case of the weaker environment is encouraging.

-

08:17

WSE: Before opening

Yesterday's session on the WSE led to the stabilization of the clearly weaker beginning of this week. In the environment, however, the situation was quite different. The first days of the week were marked by increases, and yesterday could be the first signs of tiredness, which resulted in poor behavior of Wall Street. In practice, the US had a very weak session with clear declines in the majority of the shares. The S&P 500 finally dropped almost 1%. Thus, the previous successful session was leveled and confirmed the opinion that increases in an environment without the express basis of information were exaggerated. In Asia, the mood is not explicitly negative, but Europe will now have to adapt to yesterday's charge of bears on Wall Street, much of which took place after the close of the cash markets on the Old Continent. This will disturb the Warsaw Stock Exchange, which is struggling to maintain the level of 1800 points in the case of the WIG20 index.

-

04:03

Nikkei 225 16,485.28 -93.73 -0.57 %, Hang Seng 19,926.6 -128.69 -0.64 %, Shanghai Composite 2,803.4 -33.63 -1.19 %

-

01:02

Stocks. Daily history for Sep Apr May 11’2016:

(index / closing price / change items /% change)

Nikkei 225 16,579.01 +13.82 +0.08 %

Hang Seng 20,055.29 -187.39 -0.93 %

S&P/ASX 200 5,372.29 +29.51 +0.55 %

Shanghai Composite 2,837.63 +5.04 +0.18 %

FTSE 100 6,162.49 +5.84 +0.09 %

CAC 40 4,316.67 -21.54 -0.50 %

Xetra DAX 9,975.32 -70.12 -0.70 %

S&P 500 2,064.46 -19.93 -0.96 %

NASDAQ Composite 4,760.69 -49.19 -1.02 %

Dow Jones 17,711.12 -217.23 -1.21 %

-