Noticias del mercado

-

22:15

Major US stock indexes finished trading in positive territory

Major US stock indices grew moderately on Monday, while DJIA and S & P finished the session at record highs, helped by the appreciation of shares in the technology and energy sectors.

The focus was also on the United States. As the survey of vacancies and labor turnover (JOLTS), published by the Bureau of Labor Statistics showed, in October the number of vacancies dropped to 5.996 million. Meanwhile, the indicator for September was revised upwards to 6.177 million from 6.093 million. Analysts had expected that the number of vacancies will decrease to 6,030 million. The vacancy level was 3,9%, decreasing by 0,1% relative to September. The number of vacancies declined in the private sector, and little has changed in the government segment. In October, hiring amounted to 5.552 million against 5.32 million in September. The level of hiring in October increased by 0.2%, and amounted to 3.8%.

Oil prices rose after the explosion in New York reoriented the market to geopolitical risk. On Monday morning, an explosion occurred near the Port Authority of New York and New Jersey, one of the city's busiest suburban hubs. "The explosion caused an increase in oil quotations," said Olivier Jacob, Managing Director of PetroMatrix, "However, prices are still within the recent range."

Most components of the DOW index finished trading in positive territory (19 out of 30). The leader of growth was the shares of The Walt Disney Company (DIS, + 2.37%). Outsider were shares of The Boeing Company (BA, -1.05%).

Most sectors of the S & P index recorded an increase. The raw materials sector grew most (+ 0.8%). The sector of industrial goods showed the greatest decrease (-0.4%).

At closing:

DJIA + 0.23% 24,386.03 +56.87

Nasdaq + 0.51% 6,875.08 +35.00

S & P + 0.32% 2,659.99 +8.49

-

21:01

DJIA +0.14% 24,363.11 +33.95 Nasdaq +0.44% 6,870.10 +30.02 S&P +0.23% 2,657.67 +6.17

-

18:00

European stocks closed: FTSE 100 +59.52 7453.48 +0.80% DAX -30.05 13123.65 -0.23% CAC 40 -12.26 5386.83 -0.23%

-

16:16

U.S job openings were little changed at 6.0 million in October

The number of job openings was little changed at 6.0 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month, hires increased to 5.6 million and separations were little changed at 5.2 million. Within separations, the quits rate and the layoffs and

discharges rate were little changed at 2.2 percent and 1.1 percent, respectively. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions. -

16:00

U.S.: JOLTs Job Openings, October 5996 (forecast 6030)

-

15:32

U.S. Stocks open: Dow +0.08% Nasdaq +0.16%, S&P +0.07%

-

15:27

Before the bell: S&P futures +0.08%, NASDAQ futures +0.11%

U.S. stock-index futures were marginally higher on Wednesday, weighed down by reports of an explosion in New York's busy Port Authority commuter hub.

Global Stocks:

Nikkei 22,938.73 +127.65 +0.56%

Hang Seng 28,965.29 +325.44 +1.14%

Shanghai 3,322.24 +32.25 +0.98%

S&P/ASX 5,998.30 +3.90+0.07%

FTSE 7,429.00 +35.04 +0.47%

CAC 5,396.21 -2.88 -0.05%

DAX 13,154.94 +1.24 +0.01%

Crude $57.46 (+0.17%)

Gold $1,249.10 (+0.06%)

-

15:16

U.S. stock index futures pare some gains after reports of New York authorities responding to reports of explosion in Manhattan

-

A few injuries reported in incident at New York's port authority - WABC news citing police sources

-

-

15:13

Russia's Putin says any steps pre-empting agreement between Israel and Palestine are counter productive

-

14:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

238.83

0.70(0.29%)

130

ALTRIA GROUP INC.

MO

71.64

0.10(0.14%)

654

Amazon.com Inc., NASDAQ

AMZN

1,164.88

2.88(0.25%)

14549

Apple Inc.

AAPL

169.55

0.18(0.11%)

58837

AT&T Inc

T

36.7

-0.03(-0.08%)

4431

Barrick Gold Corporation, NYSE

ABX

13.67

0.02(0.15%)

7700

Boeing Co

BA

286.99

1.09(0.38%)

5158

Caterpillar Inc

CAT

144.1

0.24(0.17%)

1867

Cisco Systems Inc

CSCO

37.5

-0.11(-0.29%)

11107

Exxon Mobil Corp

XOM

82.6

-0.06(-0.07%)

1827

Facebook, Inc.

FB

179.35

0.35(0.20%)

33901

Ford Motor Co.

F

12.62

0.01(0.08%)

2952

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.03

0.06(0.40%)

19257

General Electric Co

GE

17.74

0.03(0.17%)

46718

General Motors Company, NYSE

GM

42.13

0.11(0.26%)

2756

Goldman Sachs

GS

250.03

-0.32(-0.13%)

3085

Google Inc.

GOOG

1,038.37

1.32(0.13%)

1510

Hewlett-Packard Co.

HPQ

20.95

-0.12(-0.57%)

1202

Intel Corp

INTC

43.41

0.06(0.14%)

7460

International Business Machines Co...

IBM

155.5

0.69(0.45%)

1038

JPMorgan Chase and Co

JPM

105.8

-0.13(-0.12%)

10836

Merck & Co Inc

MRK

55.6

0.03(0.05%)

1257

Microsoft Corp

MSFT

84.3

0.14(0.17%)

53245

Pfizer Inc

PFE

35.68

-0.06(-0.17%)

77544

Starbucks Corporation, NASDAQ

SBUX

58.46

-0.15(-0.26%)

1323

Tesla Motors, Inc., NASDAQ

TSLA

313.81

-1.32(-0.42%)

17495

The Coca-Cola Co

KO

45.3

-0.01(-0.02%)

86940

Visa

V

112.99

0.39(0.35%)

1093

Wal-Mart Stores Inc

WMT

96.65

0.10(0.10%)

31062

Walt Disney Co

DIS

104.6

0.37(0.36%)

29840

Yandex N.V., NASDAQ

YNDX

33.25

0.36(1.09%)

8000

-

14:40

Target price changes before the market open

Freeport-McMoRan (FCX) target raised to $16 at B. Riley FBR

-

13:38

Putin tells Assad he hopes that work of Syrian congress of national dialogue can be launched, will discuss matter with presidents of Egypt and Turkey

-

13:35

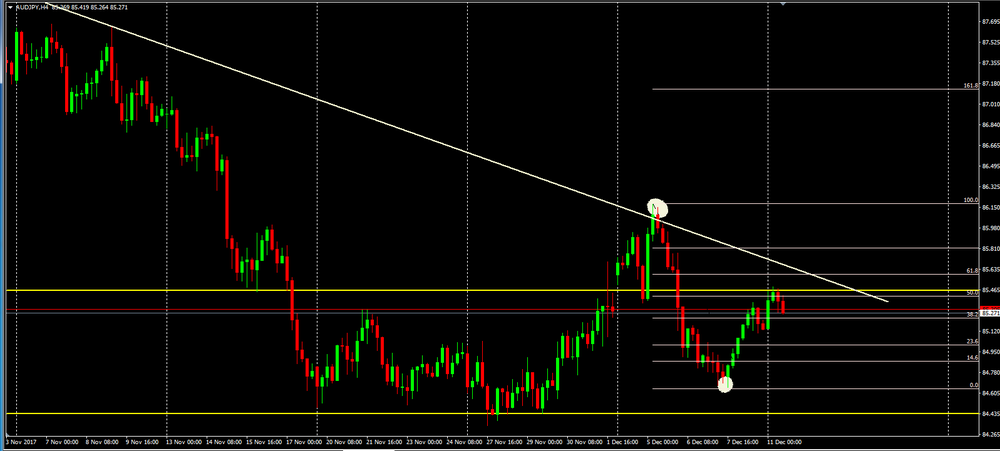

AUD/JPY 4-hour time frame chart

AUD/JPY 4-hour time frame chart

As we can see on 4-hour time frame chart, the price has been falling and respecting a downside trend line.

However, the price has been correcting its last bearish movement and now it seems that there is a potential new bearish movement soon.

We can see that the price is rejecting the resistance level and the fibonacci's levels, therefore, we can expect a further downside movement, at least to the previous low.

-

13:21

EU Commission says sees joint EU-UK brexit report as "a deal between gentlemen" fully endorsed by UK government

-

12:04

Austrian National Bank says Austrian banks should use the currently benign market environment to further improve structural efficiency and raise profitability while not taking on excessive risk, above all in real estate lending

-

A rising share of new housing loans to households shows relatively high loan-to-value, debt service-to-income and debt-to-income ratios

-

-

11:53

UK Brexit minister Davis says all sorts of possibilities for frictionless border with Ireland

-

11:52

-

11:51

Bitcoin reached $ 16,800 on the weekend. When you ask how much it could rise, think about how much gold ounce would be worth if the total supply was known

-

10:59

Russia's Lavrov says situation on Korean peninsula risks moving into "hot phase" - Ifax

-

Russia, India, China do not want tensions on Korean peninsula to be further escalated

-

-

10:31

Forex option contracts rolling off today at 14.00 GMT:

EUR/USD: 1.1640(518 m), 1.1700(980 m), 1.1800(1.02 b), 1.1900(606 m), 1.1950(372 m), 1.200(505 m)

USD/JPY: 111.95-112.00(881 m), 113.00-10(1.06 b), 113.20(371 m), 113.40(345 m)

USD/CHF: 0.9900(465 m), 0.9940(275 m), 1.0200(540 m)

AUD/USD: 0.7550(214 m), 0.7610-15(340 m), 0.7790(295 m)

NZD/USD: 0.6790(300 m), 0.6915(208 m), 0.6950-51(328 m)

USD/CAD: 1.2900(580 m)

EUR/JPY: 133.25(660 m)

EUR/GBP: 0.8820(280 млн)

AUD/NZD: 1.1000(252 млн)

-

10:30

Swiss total sight deposits at 575.873 bln CHF in week ending december 8 versus 576.78 bln CHF a week earlier

-

10:05

Italian retail sales down 1.0% in October

In October 2017, the retail trade decreased by 2.1% compared with October 2016, all store types showed decline as food retailing was down 1.7% and non-food retailing was down 2.4%.

Estimates of the value of retail sales fell month-on-month also: -1.0% compared with September 2017.

The underlying pattern, as measured by the 3 month on 3 month estimate, showed a contraction in October 2017, where the value of sales decreased by 0.1% and the volume of sales was down 0.2%.

The volume of retail trade dropped by 2.9% compared with October 2016 and decreased by 1.1% compared with September 2017.

-

09:44

Major European stock exchanges trading mostly in the green zone: FTSE 7429.73 +35.77 + 0.48%, DAX 13179.48 +25.78 + 0.20%, CAC 5407.74 +8.65 + 0.16%

-

08:27

Eurostoxx 50 futures up 0.17 pct, DAX futures up 0.21 pct, FTSE futures up 0.36 pct, CAC 40 futures up 0.34 pct

-

08:25

EU foreign policy chief Mogherini says EU continues respect international consensus on Jerusalem

-

Believes in Israel's interest to find sustainable mideast solution

-

Expresses full support to king of Jordan in peace process

-

Condemns all attacks on jews, including in Europe and on Israel

-

-

08:23

ECB's Nouy says we are going to see a number of mergers taking place within countries and across borders

-

Says implementation of NPL addendum to be delayed by a "few months":

-

-

08:19

10-year U.S. treasury yield at 2.383 percent, flat from U.S. close on friday

-

08:19

New Zealand government appoints Adrian Orr as Reserve Bank of NZ governor

-

New Zealand government says Orr will take up role on march 27

-

-

07:33

Global Stocks

European stocks rose Friday, scoring their highest close in a month, after the U.K. and the European Union came to terms on a Brexit divorce deal, opening the way to a key phase of talks. Bank stocks were in rally mode after news of the Brexit breakthrough and after global financial officials finally signed a deal Thursday to harmonize banking rules.

Stocks ended the week on an positive note Friday, with the S&P 500 and Dow Jones Industrial Average logging record closes, while the Nasdaq Composite also advanced. A stronger-than-expected November jobs report helped buoy stocks in early action.

Asia stocks were trading narrowly mixed in early Monday session, following an upbeat Wall Street last Friday after the release of a stronger-than-expected jobs report.

-

07:03

Options levels on monday, December 11, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1902 (2100)

$1.1884 (1029)

$1.1856 (208)

Price at time of writing this review: $1.1779

Support levels (open interest**, contracts):

$1.1713 (3199)

$1.1675 (3854)

$1.1634 (3017)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 87829 contracts (according to data from December, 8) with the maximum number of contracts with strike price $1,1800 (4810);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3595 (3607)

$1.3546 (1844)

$1.3510 (1430)

Price at time of writing this review: $1.3397

Support levels (open interest**, contracts):

$1.3302 (1563)

$1.3238 (1971)

$1.3161 (1827)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 27820 contracts, with the maximum number of contracts with strike price $1,3500 (3607);

- Overall open interest on the PUT options with the expiration date January, 5 is 27653 contracts, with the maximum number of contracts with strike price $1,2900 (2426);

- The ratio of PUT/CALL was 0.99 versus 0.88 from the previous trading day according to data from December, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:50

Japan: BSI Manufacturing Index, Quarter IV 9.7

-

00:26

Commodities. Daily history for Dec 08’2017:

(raw materials / closing price /% change)

Oil 57.73 -0.45%

Gold 1,295.00 +0.01%

-

00:25

Stocks. Daily history for Dec 08’2017:

(index / closing price / change items /% change)

Nikkei +313.05 22811.08 +1.39%

TOPIX +17.48 1803.73 +0.98%

Hang Seng +336.66 28639.85 +1.19%

CSI 300 +32.32 4003.38 +0.81%

Euro Stoxx 50 +18.32 3591.45 +0.51%

FTSE 100 +73.21 7393.96 +1.00%

DAX +108.55 13153.70 +0.83%

CAC 40 +15.23 5399.09 +0.28%

DJIA +117.68 24329.16 +0.49%

S&P 500 +14.52 2651.50 +0.55%

NASDAQ +27.24 6840.08 +0.40%

S&P/TSX +80.39 16096.07 +0.50%

-

00:25

Currencies. Daily history for Dec 08’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1764 -0,07%

GBP/USD $1,3389 -0,63%

USD/CHF Chf0,99288 -0,13%

USD/JPY Y113,46 +0,34%

EUR/JPY Y133,49 +0,13%

GBP/JPY Y151,921 -0,28%

AUD/USD $0,7504 -0,11%

NZD/USD $0,6840 +0,15%

USD/CAD C$1,28676 +0,11%

-

00:02

Schedule for today, Monday, Dec 11’2017 (GMT0)

06:00 Japan Prelim Machine Tool Orders, y/y November 49.9%

15:00 U.S. JOLTs Job Openings October 6.093 6.090

-