Noticias del mercado

-

23:59

Schedule for today, Thursday, Jul 16’2015:

(time / country / index / period / previous value / forecast)

00:00 China New Loans June 900.8 1050

1:00 Australia Consumer Inflation Expectation July 3%

04:00 Japan BoJ monthly economic report

07:15 Switzerland Retail Sales Y/Y May 1.6%

07:16 Switzerland Retail Sales (MoM) May 2.1%

09:00 Eurozone Trade balance unadjusted May 24.9

09:00 Eurozone Harmonized CPI June 0.2% 0%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) June 0.3% 0.2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) June 0.9% 0.8%

11:45 Eurozone ECB Interest Rate Decision 0.05%

12:30 Eurozone ECB Press Conference

12:30 Canada Foreign Securities Purchases May 12.94

12:30 U.S. Continuing Jobless Claims 2334 2295

12:30 U.S. Initial Jobless Claims July 297 285

14:00 U.S. NAHB Housing Market Index July 59 59

14:00 U.S. Philadelphia Fed Manufacturing Survey July 15.2 12.0

14:00 U.S. Fed Chairman Janet Yellen Speaks

18:00 United Kingdom BOE Gov Mark Carney Speaks

20:00 U.S. Total Net TIC Flows May 106.6

20:00 U.S. Net Long-term TIC Flows May 53.9

-

22:08

Major US stock indexes finished trading almost unchanged

US stocks declined slightly, ending a series of five-day increase. In the course of trading influence the statements of the Federal Reserve Janet Yellen that turmoil abroad are unlikely to affect the US economy and the Fed is on track to raise interest rates this year. Yellen said she expects a stable growth of the economy until the end of the year, and it allows the Fed to raise rates, but did not give a direct hint at the time of promotion.

In addition, as it became known today, US industrial production rose slightly in June, held back decline in production of vehicles. Last month, production, except for the production of cars increased by 0.3%, after declining by 0.1%, the report showed the Federal Reserve on Wednesday. Total industrial production, which also includes mining and utilities rose 0.3% after a 0.2% decline.

At the same time, US companies increased prices for goods and services in June, a sign that inflation is slowly rising from historically weak levels. The Producer Price Index, which measures prices at which companies sell goods and services rose to a seasonally adjusted 0.4% in June, after rising 0.5% in May. This was stated by the Ministry of Labour.

Also had little impact Beige Book report, which showed that the US economy has continued from mid-May to late June. The largest expansion was recorded in three counties: New York, Philadelphia and Kansas City. Moderate growth was recorded in Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Dallas and San Francisco. "Improvements in consumer spending vary among counties. Some counties have shown that low energy prices helped to increase spending, while the number of border districts noted a weakness related to the growth of the dollar", - the report says. Rising wages and employment recorded in all districts. The highest growth was recorded in salaries of industries such as human resources, construction and information technology.

Most components of the index DOW closed in negative territory (19 of 30). Outsider shares were Chevron Corporation (CVX, -1.35%). Most remaining shares of Apple Inc. rose (AAPL, + 0.89%).

Sector S & P index finished trading mixed. Most of the basic materials sector fell (-1.5%). The largest growth sector proved conglomerates (+ 0.1%).

At the close:

Dow -0.02% 18,050.17 -3.41

Nasdaq -0.12% 5,098.94 -5.95

S & P -0.07% 2,107.42 -1.54

-

21:00

Dow -0.20% 18,017.16 -36.42 Nasdaq -0.29% 5,089.95 -14.94 S&P -0.27% 2,103.23 -5.72

-

20:01

American focus: the dollar strengthened significantly against most major currencies

The dollar strengthened sharply against the euro, approaching to a maximum of 7 July, which was related to statements of Fed Yellen and publication of data on the United States. Today, Fed Chairman Yellen reiterated that the Central Bank may raise interest rates this year if the economy will maintain its current rate of growth. "If the economy develops as we expect it, then most likely, the economic conditions at some point in the current year will be appropriate to increase the interest rates on federal credit funds", - said Yellen. She also expressed the view that the pace of US economic growth will increase in the second half of the year, while the unemployment rate will continue to decline gradually. She added that the situation in the labor market has improved significantly, but the FOMC does not consider it appropriate criteria of maximum employment. Yellen also noted tentative signs of recovery in the growth rate of wages, although it is recognized that they still remain relatively low, supporting other signs of a sagging economy. The head of the Federal Reserve suggested that the debt crisis in Greece and the situation on the stock market in China may carry risks for the United States. However, it noted the likelihood that global economic growth will be stronger than the average expected by experts that will provide additional support for economic activity in the United States.

With regard to statistics, the Fed reported that manufacturing in the last month, with the exception of car production increased by 0.3 percent after falling 0.1 percent. Total industrial production, which also includes mining and utilities rose 0.3 percent after a 0.2 percent decline. Production of utilities increased 1.5 percent after rising 1.2 percent the previous month. Production in mining, which includes oil drilling, increased by 1 percent after falling 2.1 percent. Drilling of oil and gas wells fell by 3.7 percent after falling 8.7 percent. The median forecast of economists called for an increase of 0.2 percent in industrial production. Fed report also showed that capacity utilization rose to 78.4 percent compared with 78.2 percent a month ago.

The Canadian dollar depreciated significantly against the US dollar, reaching its lowest level since March 2009, which was caused by the unexpected decision of the Bank of Canada rate. Recall, the Bank of Canada announced reduction of rates by 0.25% to 0.50%., Citing a significant effect on the reduction in price of oil and the deterioration of the export of goods, not including the energy sector. It is worth emphasizing, expectations for rates before the meeting split exactly in half. In an accompanying statement, the regulator has also revised forecasts for GDP for the 2nd quarter, as well as 2015-2016 downward. Central Bank reported that the forecasts for economic growth in Canada in 2015 were substantially reduced from the April estimates, and also referred to the slowing global economy, particularly the US and China. However, the Bank expects renewed growth in the 3rd quarter. Central Bank considered that at this point, additional monetary stimulus to help the economy confidently embark on growth and inflation to return to target levels that are projected to happen in the 1st half of 2017. Meanwhile, the head of the Bank of Canada Poloz said that QE is included in the arsenal of tools that may, if necessary to involve the Central Bank. However, he added, the Central Bank expects that the use of other monetary policy instruments will be required.

The Swiss franc declined against the US currency, updating a minimum of 27 of May. In the course of trading influenced the widespread strengthening of the US dollar and weak data on Switzerland. As previously reported, in July 2015 the index of investor expectations in Switzerland ZEW-CS decreased. The indicator dropped by 5.5 points and now stands at minus 5.4 points value. This reading indicates that slightly larger share of financial experts expect the Swiss economy is getting worse, compared with the current situation. ZEW-CS indicator reflects the expectations of surveyed financial market experts regarding the economic development in Switzerland on a six-month period. It is calculated monthly by the Centre for European Economic Research (ZEW) in Mannheim in cooperation with Credit Suisse (CS), Zurich. Estimates of the current economic situation in Switzerland are slightly more positive in July compared with the previous month. The corresponding indicator increased by 1.4 points. Nevertheless, the indicator "balance of performance" is clearly in the negative area with a -21.6 reading.

-

18:35

WSE: Session Results

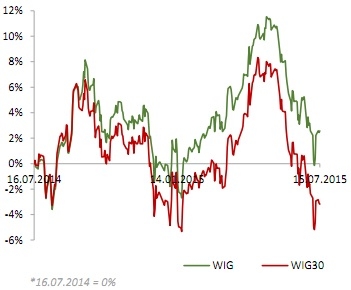

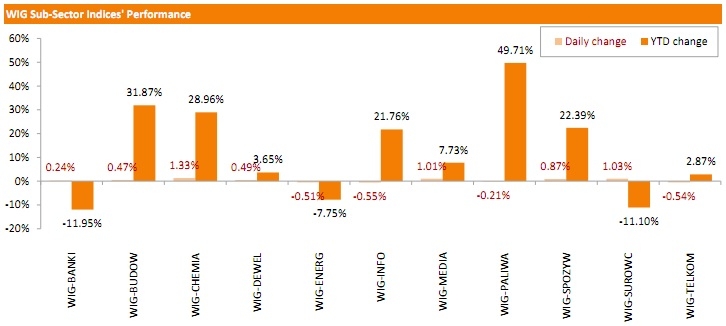

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index edged up 0.12%. Sector-wise, informational technologies (-0.55%) and telecommunication sector (-0.54%) fared the worst. On the contrary, the best-performing sectors were chemicals (+1.33%) and materials (+1.03%).

The large-cap stocks' measure, the WIG30 Index underperformed the broad market, posting a 0.1% drop. ALIOR (WSE: ALR) was the worst performer within the indicator's components, losing 3.13%. It was followed by TAURON PE (WSE: TPE) and ASSECO POLAND (WSE: ACP), slumping 2.18% and 1.68% respectively. On the other side of the ledger, SYNTHOS (WSE: SNS) and CYFROWY POLSAT (WSE: CPS) were the biggest advancers, gaining 2.26% and 1.99% respectively. LOTOS (WSE: LTS) also produced solid gains (+1.95%), following the news the company plans to float its railway subsidiary Lotos Kolej on the Warsaw Stock Exchange.

-

18:02

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes were modestly higher on Wednesday, set for a fifth straight day of gains, after Federal Reserve Chair Janet Yellen said the turmoil abroad was unlikely to affect the U.S. economy and that the Fed was on track to raise interest rates this year. Yellen said she expects the economy to grow steadily for the rest of the year, allowing the Fed to hike rates, but gave no direct hint on the timing or pace of a hike.

Most of Dow stocks in positive area (18 of 30). Top looser - Chevron Corporation (CVX, -0.81%). Top gainer - Johnson & Johnson (JNJ, +1.11).

S&P index sectors mixed. Top looser - Healthcare (-0.7%). Top gainer - Basic Materials (+0.4%).

At the moment:

Dow 17980.00 +19.00 +0.11%

S&P 500 2104.25 +2.25 +0.11%

Nasdaq 100 4531.00 +13.50 +0.30%

10-year yield 2.38% -0.02

Oil 52.16 -0.88 -1.66%

Gold 1144.90 -8.60 -0.75%

-

18:00

European stocks closed: FTSE 100 6.754,70 +0,95 +0,01% CAC 5,047.24 +14.77 +0.29% DAX 11,539.66 +22.76 +0.20%

-

18:00

European stocks close: stocks closed slightly higher ahead of the results of the Greek parliament's vote

Stock indices closed slightly higher ahead of the results of the Greek parliament's vote. The Greek government should pass a series of reforms in the Greek parliament to start talks about the third bailout programme.

Reuters reported on Tuesday that Greece will need far bigger debt relief that was considered by the Eurozone governments, according to a confidential study by the International Monetary Fund (IMF).

"The dramatic deterioration in debt sustainability points to the need for debt relief on a scale that would need to go well beyond what has been under consideration to date - and what has been proposed by the European Stability Mechanism (ESM)," the IMF said.

The French consumer price inflation fell 0.1% in June, after a 0.2% increase in May.

On a yearly basis, the consumer price index climbed 0.3% in June, after a 0.3% rise in May.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate rose 5.6% in the March to May quarter from 5.5% in three months to February. It was the first increase in two years.

Analysts had expected the unemployment rate to remain unchanged at 5.5%.

The claimant count increased by 7,000 people in June, missing expectations for a drop by 8,800, after a decrease of 1,100 people in May. May's figure was revised down from a decline of 6,500.

Average weekly earnings, excluding bonuses, climbed by 2.8% in the March to May quarter, missing expectations for a rise by 3.0%, after a 2.7% gain in the December to February quarter. It was the highest gain in more than six years.

The previous three months' figure was revised up from a 2.2% increase.

Average weekly earnings, including bonuses, rose by 3.2% in the March to May quarter, missing expectations for a gain of 3.3%, after a 2.7% increase in the December to February quarter. It was the highest rise since June to April 2010.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,753.75 0.00 0.00%

DAX 11,539.66 +22.76 +0.20 %

CAC 40 5,047.24 +14.77 +0.29 %

-

17:41

Oil prices decline despite a drop in U.S. crude oil inventories

Oil prices declined despite a drop in U.S. crude oil inventories. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.346 million barrels to 461.4 million in the week to July 10.

Analysts had expected U.S. crude oil inventories to decline by 2.1 million barrels.

Gasoline inventories climbed by 58,000 barrels to 218 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 438,000 barrels to 57.1 million barrels.

U.S. crude oil imports increased by 38,000 barrels per day.

Refineries in the U.S. were running at 95.3% of capacity, up from 94.7% the previous week.

A deal with Iran on its nuclear programme still weighs on oil prices. Iran will be able to sell more crude oil on the global market. The global oil market is already oversupplied. More crude oil will lead to falling oil prices.

It is not clear how long it would take for the sanctions to be lifted. Analysts expect Iran to boost its crude oil exports by the end of the year or at the beginning of the next year.

WTI crude oil for August delivery decreased to $52.28 a barrel on the New York Mercantile Exchange.

Brent crude oil for August declined to $57.70 a barrel on ICE Futures Europe.

-

17:22

Gold hits 4-month low as the U.S. dollar rose on comments by the Fed Chair Janet Yellen

Gold hits 4-month low as the U.S. dollar rose on comments by the Fed Chair Janet Yellen. She said that she expects the U.S. economy to strengthen in the rest of the year, and that the Fed could raise its interest rate "at some point this year".

Yellen noted that there is "still some slack" in the U.S. labour market.

She also said that the situation in Greece and China could "pose some risk" to the U.S. economy.

The better-than-expected U.S. economic data also weighed on gold price. The U.S. producer price index increased 0.4% in June, exceeding expectations for a 0.2% gain, after a 0.5% rise in May.

On a yearly basis, the producer price index decreased 0.7% in June, beating forecasts of a 0.9% decline, after a 1.1% fall in May.

The rise was driven by higher food and gasoline prices. Gasoline prices jumped 4.3% in June. Food prices climbed by 0.6%, driven by a shortage of eggs, and as wholesale egg prices soared a 84.5% in June.

The producer price index excluding food and energy climbed 0.3% in June, exceeding expectations for a 0.1% gain, after a 0.1% increase in May.

On a yearly basis, the producer price index excluding food and energy climbed 0.8% in June, beating forecasts of a 0.7% increase, after a 0.6% rise in May.

The U.S. industrial production rose 0.3% in June, exceeding expectations for a 0.2% increase, after a 0.2% decline in May. It was the biggest increase since November 2013.

The increase was driven by higher mining and utilities output. Mining output climbed by 1.0% in June, while utility output rose by 1.5%.

The U.S. manufacturing production flat in June.

Capacity utilisation rate increased to 78.4% in June from 78.2% in May. May's figure was revised up 78.2%. Analysts had expected a capacity utilisation rate of 78.1%.

Market participants are awaiting the results of the Greek parliament's vote. The Greek government should pass a series of reforms in the Greek parliament to start talks about the third bailout programme.

August futures for gold on the COMEX today declined to 1144.30 dollars per ounce.

-

17:02

U.S. crude inventories decline by 4.346 million barrels to 461.4 million in the week to July 10

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.346 million barrels to 461.4 million in the week to July 10.

Analysts had expected U.S. crude oil inventories to decline by 2.1 million barrels.

Gasoline inventories climbed by 58,000 barrels to 218 million barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 438,000 barrels to 57.1 million barrels.

U.S. crude oil imports increased by 38,000 barrels per day.

Refineries in the U.S. were running at 95.3% of capacity, up from 94.7% the previous week.

-

16:38

Fed Chair Janet Yellen expects the U.S. economy to strengthen in the rest of the year and interest rate hike “at some point this year”

The Fed Chair Janet Yellen testified before the Senate Banking Committee on Wednesday. She said that she expects the U.S. economy to strengthen in the rest of the year. Yellen pointed out that the Fed could raise its interest rate "at some point this year".

"Looking forward, prospects are favourable for further improvement in the U.S. labour market and the economy more broadly," she said.

The Fed chairwoman pointed out that the U.S. dollar could expand faster than expected in the second half of the year due to lower gasoline prices and as a negative impact on the U.S. exports due to a stronger U.S. dollar begins to fade.

She noted that there is "still some slack" in the U.S. labour market.

Yellen also said that the situation in Greece and China could "pose some risk" to the U.S. economy.

-

16:30

U.S.: Crude Oil Inventories, July -4.346 (forecast -2.1)

-

16:17

Bank of Canada lowers its interest rate to 0.50%

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank lowered its interest rate to 0.50% from 0.75%. It was the second interest rate cut this year.

This decision was not expected by analysts.

"Additional monetary stimulus is required at this time to help return the economy to full capacity and inflation sustainably to target," the bank said in its statement.

A weak global economic growth, low inflation in Canada and low oil prices lead to this decision.

The central bank said that the real GDP in Canada contracted in the first half of the year.

Canada's real GDP is expected to expand by just over 1% in 2015 and about 2.5% in 2016 and 2017. The central bank expect the economy to return to full capacity and inflation to 2% on a sustained basis in the first half of 2017.

The BoC said that inflation in Canada was about 1% in the recent months due to lower energy prices, while core inflation was about 2%.

"The lower outlook for Canadian growth has increased the downside risks to inflation," the central bank said.

-

16:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.75%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E588mn), $1.1050(E225mn), $1.1100(E400mn), $1.1200(E334mn)

USD/JPY: Y122.00($654mn), Y123.25($380mn), Y123.50($645mn), Y125.00($992mn)

EUR/JPY: Y134.75(E320mn)

EUR/GBP: Gbp0.7000(E525mn), Gbp0.7080(E420mn), Gbp0.7100(E349mn), Gbp0.7120(E320mn)

USD/CAD: C$1.2700($973mn)

-

15:43

U.S. industrial production rises 0.3% in June

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production rose 0.3% in June, exceeding expectations for a 0.2% increase, after a 0.2% decline in May. It was the biggest increase since November 2013.

The increase was driven by higher mining and utilities output. Mining output climbed by 1.0% in June, while utility output rose by 1.5%.

The U.S. manufacturing production flat in June.

Capacity utilisation rate increased to 78.4% in June from 78.2% in May. May's figure was revised up 78.2%. Analysts had expected a capacity utilisation rate of 78.1%.

-

15:33

U.S. Stocks open: Dow -0.06%, Nasdaq +0.09%, S&P -0.02%

-

15:29

Before the bell: S&P futures +0.02%, NASDAQ futures +0.16%

U.S. stock-index futures were little changed after Federal Reserve Chair Janet Yellen said prospects are good for further improvement in the labor market, keeping the central bank on track for an interest-rate increase in 2015.

Nikkei 20,463.33 +78.00 +0.38%

Hang Seng 25,055.76 -65.15 -0.26%

Shanghai Composite 3,805.81 -118.68 -3.02%

FTSE 6,760.41 +6.66 +0.10%

CAC 5,045.19 +12.72 +0.25%

DAX 11,531.78 +14.88 +0.13%

Crude oil $52.57 (-0.89%)

Gold $1150.70 (-0.25%)

-

15:15

U.S.: Capacity Utilization, June 78.4% (forecast 78.1%)

-

15:15

U.S.: Industrial Production (MoM), June 0.3% (forecast 0.2%)

-

15:15

U.S.: Industrial Production YoY , June 1.5%

-

15:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Caterpillar Inc

CAT

84.50

+0.05%

2.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

17.12

+0.06%

13.1K

Cisco Systems Inc

CSCO

28.05

+0.07%

1.0K

Travelers Companies Inc

TRV

102.47

+0.09%

3.5K

Verizon Communications Inc

VZ

47.46

+0.11%

0.3K

Starbucks Corporation, NASDAQ

SBUX

55.85

+0.18%

15.3K

ALCOA INC.

AA

10.79

+0.19%

3.5K

Boeing Co

BA

148.05

+0.20%

0.7K

Microsoft Corp

MSFT

45.74

+0.26%

1.5K

Apple Inc.

AAPL

125.94

+0.26%

67.5K

Yandex N.V., NASDAQ

YNDX

15.51

+0.26%

0.1K

Hewlett-Packard Co.

HPQ

30.60

+0.29%

0.1K

Wal-Mart Stores Inc

WMT

74.01

+0.30%

0.6K

Twitter, Inc., NYSE

TWTR

36.83

+0.30%

50.2K

Visa

V

70.32

+0.31%

0.4K

Facebook, Inc.

FB

90.08

+0.45%

56.9K

JPMorgan Chase and Co

JPM

69.36

+0.46%

19.8K

Walt Disney Co

DIS

118.40

+0.46%

5.2K

AMERICAN INTERNATIONAL GROUP

AIG

63.86

+0.46%

0.2K

Ford Motor Co.

F

14.88

+0.47%

30.5K

E. I. du Pont de Nemours and Co

DD

59.72

+0.49%

0.2K

Tesla Motors, Inc., NASDAQ

TSLA

266.95

+0.49%

5.6K

Home Depot Inc

HD

116.00

+0.55%

10.1K

Goldman Sachs

GS

213.72

+0.74%

4.3K

Citigroup Inc., NYSE

C

56.35

+0.79%

30.7K

ALTRIA GROUP INC.

MO

51.35

0.00%

0.3K

Nike

NKE

112.33

-0.01%

0.1K

United Technologies Corp

UTX

111.50

-0.01%

0.2K

The Coca-Cola Co

KO

41.15

-0.05%

2.4K

Pfizer Inc

PFE

35.05

-0.09%

0.1K

Chevron Corp

CVX

95.45

-0.10%

0.8K

Exxon Mobil Corp

XOM

83.00

-0.13%

0.2K

Intel Corp

INTC

29.60

-0.17%

2.0K

General Electric Co

GE

26.61

-0.19%

1.0K

Google Inc.

GOOG

560.00

-0.20%

0.6K

Amazon.com Inc., NASDAQ

AMZN

464.50

-0.23%

9.7K

AT&T Inc

T

35.02

-0.28%

1K

Johnson & Johnson

JNJ

99.49

-0.29%

1.7K

Barrick Gold Corporation, NYSE

ABX

09.85

-0.40%

22.1K

UnitedHealth Group Inc

UNH

124.25

-0.60%

0.1K

Yahoo! Inc., NASDAQ

YHOO

38.40

-0.60%

7.2K

-

15:12

U.S. producer price index rises 0.4% in May

The U.S. Commerce Department released the producer price index figures on Wednesday. The U.S. producer price index increased 0.4% in June, exceeding expectations for a 0.2% gain, after a 0.5% rise in May.

On a yearly basis, the producer price index decreased 0.7% in June, beating forecasts of a 0.9% decline, after a 1.1% fall in May.

The rise was driven by higher food and gasoline prices. Gasoline prices jumped 4.3% in June. Food prices climbed by 0.6%, driven by a shortage of eggs, and as wholesale egg prices soared a 84.5% in June.

The producer price index excluding food and energy climbed 0.3% in June, exceeding expectations for a 0.1% gain, after a 0.1% increase in May.

On a yearly basis, the producer price index excluding food and energy climbed 0.8% in June, beating forecasts of a 0.7% increase, after a 0.6% rise in May.

The figures added to speculation on that the Fed will start raising its interest rate this year.

-

15:07

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Amazon (AMZN) target raised to $500 from $490 at Nomura

Google (GOOGL) target raised to $710 from $614 at B. Riley & Co

Intel (INTC) target lowered to $35 from $45 at Jefferies

Yahoo! (YHOO) target lowered to $50 from $59 at Sun Trust Rbsn Humphrey

-

14:57

NY Fed Empire State manufacturing index climbs to 3.86 in July

The New York Federal Reserve released its survey on Wednesday. The NY Fed Empire State manufacturing index climbed to 3.86 in July from -1.98 in June, exceeding expectations for an increase to 3.0.

The increase was driven by a rise in the general business conditions expectations index. The general business conditions expectations index for the next six months rose to 27.04 in July from 25.84 in June.

The new orders index dropped to -3.50 in July from 2.12 in June.

The price-paid index decreased to 7.45 in July from 9.62 in June.

The index for the number of employees fell to 3.19 in July from 8.65 last month. It was the lowest level since December 2013.

-

14:45

Canadian manufacturing shipments are up 0.1% in May

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments rose 0.1% in May, missing forecasts of a 0.4% increase, after a 2.2% drop in April. April's figure was revised down from a 2.1% decline.

The rise was driven by higher sales of aerospace products and parts, and petroleum and coal products. Production in aerospace products and parts jumped 22.2% in June, while sales of petroleum and coal products climbed 5.6%

Sales increased in 6 of 21 categories.

-

14:38

Bank of Japan Governor Haruhiko Kuroda: inflation in Japan will reach 2% target by next year

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at the press conference on Wednesday that inflation in Japan will reach 2% target by next year. He noted that it is unlikely the economy in Japan will continue to slow down this quarter.

"Prices will likely pick up at a significant pace some time during the end of this fiscal year," he said.

Kuroda reiterated that the central bank will adjust its quantitative easing if needed.

-

14:35

-

14:30

U.S.: PPI excluding food and energy, m/m, June 0.3% (forecast 0.1%)

-

14:30

U.S.: PPI excluding food and energy, Y/Y, June 0.8% (forecast 0.7%)

-

14:30

U.S.: PPI, m/m, June 0.4% (forecast 0.2%)

-

14:30

Canada: Manufacturing Shipments (MoM), May 0.1% (forecast 0.4%)

-

14:30

U.S.: PPI, y/y, June -0.7% (forecast -0.9%)

-

14:30

U.S.: NY Fed Empire State manufacturing index , July 3.86 (forecast 3)

-

14:17

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar on the weaker-than-expected U.K. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence July -6.9% -3.2%

01:30 Australia New Motor Vehicle Sales (YoY) June 1.0% Revised From 0.8% 4.0%

01:30 Australia New Motor Vehicle Sales (MoM) June -0.8% Revised From -1.3% 3.8%

02:00 China Retail Sales y/y May 10.1% 10.2% 10.6%

02:00 China Industrial Production y/y May 6.1% 6.0% 6.8%

02:00 China Fixed Asset Investment May 11.4% 11.2% 11.4%

02:00 China GDP y/y Quarter II 7.0% 6.9% 7.0%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

06:45 France CPI, m/m June 0.2% -0.1%

06:45 France CPI, y/y June 0.3% 0.3%

08:30 United Kingdom Average Earnings, 3m/y May 2.7% 3.3% 3.2%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May 2.7% 3% 2.8%

08:30 United Kingdom ILO Unemployment Rate May 5.5% 5.5% 5.6%

08:30 United Kingdom Claimant count June -1.1 Revised From -6.5 -8.8 7

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 0.1 -5.4

The U.S. dollar traded mixed to higher against the most major currencies ahead the release of the U.S. economic data. The U.S. PPI is expected to increase 0.2% in June, after a 0.5% rise in May.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in June, after a 0.1 gain in May.

The U.S. industrial production is expected to climb 0.2% in June, after a 0.2% drop in May.

The Fed Chair Janet Yellen will testify before the Senate Banking Committee at 14:00 GMT.

The euro traded mixed against the U.S. dollar as investors are cautious if the Greek government will be able to pass a series of reforms in the Greek parliament.

The deal also needs to be approved by national parliaments before talks about a bailout programme can start.

The French consumer price inflation fell 0.1% in June, after a 0.2% increase in May.

On a yearly basis, the consumer price index climbed 0.3% in June, after a 0.3% rise in May.

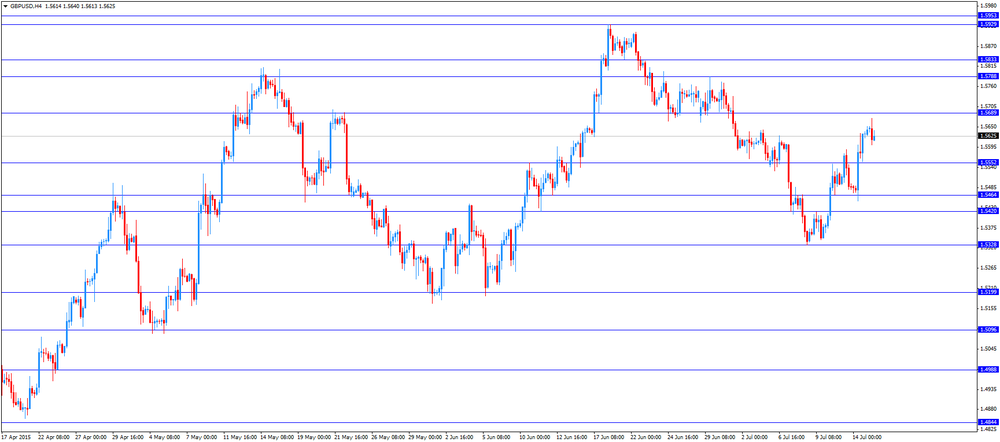

The British pound traded lower against the U.S. dollar on the weaker-than-expected U.K. labour market data. The U.K. unemployment rate rose 5.6% in the March to May quarter from 5.5% in three months to February. It was the first increase in two years.

Analysts had expected the unemployment rate to remain unchanged at 5.5%.

The claimant count increased by 7,000 people in June, missing expectations for a drop by 8,800, after a decrease of 1,100 people in May. May's figure was revised down from a decline of 6,500.

Average weekly earnings, excluding bonuses, climbed by 2.8% in the March to May quarter, missing expectations for a rise by 3.0%, after a 2.7% gain in the December to February quarter. It was the highest gain in more than six years.

The previous three months' figure was revised up from a 2.2% increase.

Average weekly earnings, including bonuses, rose by 3.2% in the March to May quarter, missing expectations for a gain of 3.3%, after a 2.7% increase in the December to February quarter. It was the highest rise since June to April 2010.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Bank of Canada's (BoC) interest rate decision. Analysts expect the central bank to keep its monetary policy unchanged.

Canada's manufacturing shipments are expected to increase 0.4% in May, after a 2.1% drop in April.

The Swiss franc traded lower against the U.S. dollar. A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index dropped to -5.4 points in July from 0.1 points in June as Swiss economic expectations worsened.

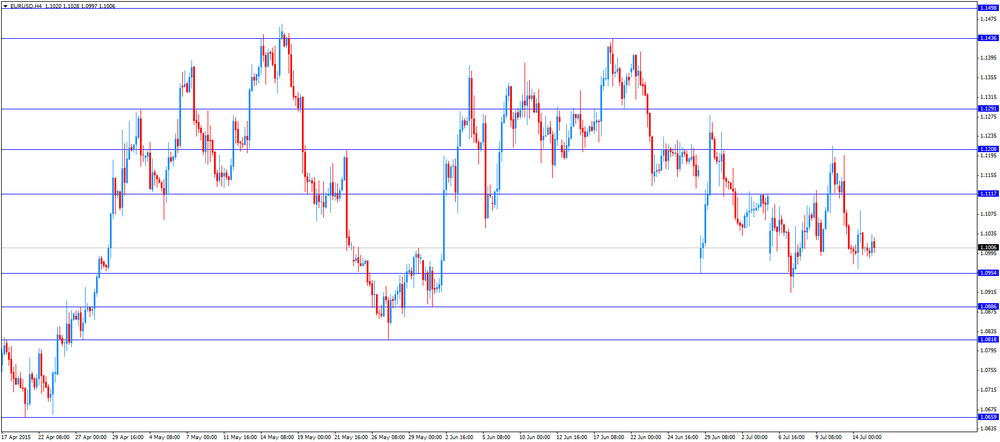

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5601

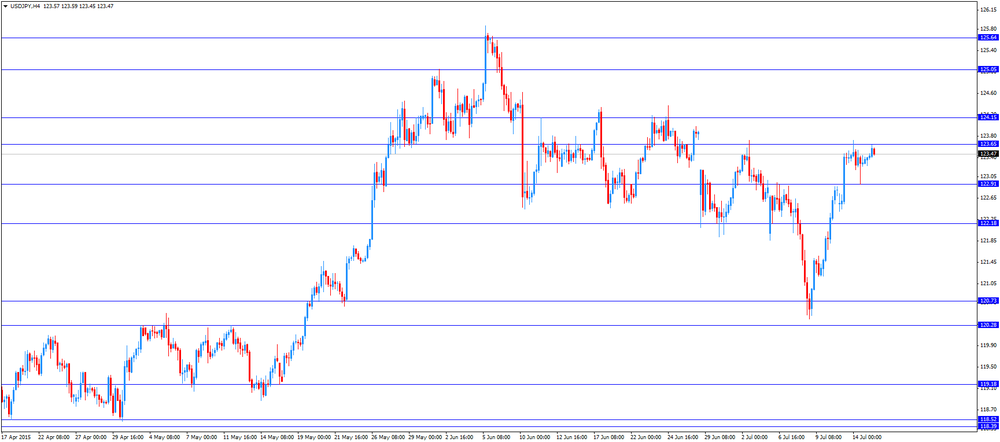

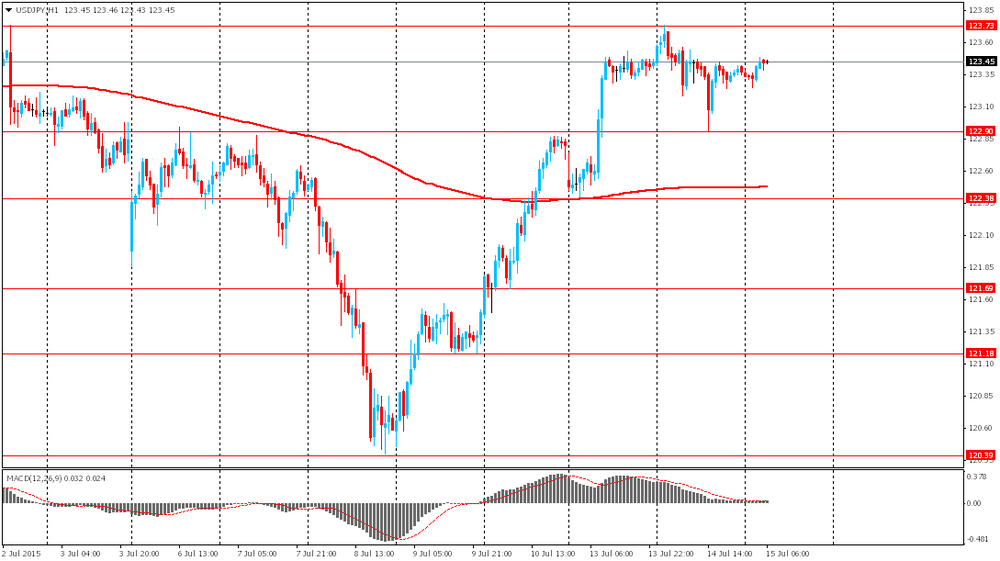

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) May -2.1% 0.4%

12:30 U.S. PPI, m/m June 0.5% 0.2%

12:30 U.S. PPI, y/y June -1.1% -0.9%

12:30 U.S. PPI excluding food and energy, m/m June 0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y June 0.6% 0.7%

12:30 U.S. NY Fed Empire State manufacturing index July -1.98 3

13:15 U.S. Industrial Production (MoM) June -0.2% 0.2%

13:15 U.S. Industrial Production YoY June 1.4%

13:15 U.S. Capacity Utilization June 78.1% 78.1%

14:00 Canada Bank of Canada Rate 0.75% 0.75%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Fed Chairman Janet Yellen Speaks

16:25 U.S. FOMC Member Mester Speaks

18:00 U.S. Fed's Beige Book

19:00 U.S. FOMC Member Williams Speaks

22:45 New Zealand CPI, q/q Quarter II -0.3% 0.6%

22:45 New Zealand CPI, y/y Quarter II 0.1% 0.4%

-

14:00

Orders

EUR/USD

Offers 1.1050 1.1080 1.1100 1.1125 1.1140 1.1165 1.1180 1.1200 1.1220-25 1.1245

Bids 1.0985 1.0960-65 1.0940 1.0925 1.0900 1.0880 1.0850 1.0825 1.0800

GBP/USD

Offers 1.5680 1.5700-10 1.5725-30 1.5750 1.5780 1.5800

Bids 1.5625-30 1.5600 1.5580 1.5550 1.5530 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7050-55 0.7085 0.7100 0.7120-25 0.7150 0.7170 0.7185 0.7200

Bids 0.7020-25 0.7000 0.6980 0.6950 0.6925-30 0.6900

EUR/JPY

Offers 136.50 136.75 137.00 137.50 137.80 138.00

Bids 135.85 135.60 135.20 135.00 134.80 134.50 134.30 134.000

USD/JPY

Offers 123.80 124.00 124.30 124.50 124.75 125.00

Bids 123.20-25 123.00 122.80 122.50-60 121.85 121.60 121.40 121.00

AUD/USD

Offers 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7425-30 0.7400 0.7380 0.7350 0.7330 0.7300

-

12:05

European stock markets mid session: stocks traded little changed as investors are cautious if the Greek government will be able to pass a series of reforms in the Greek parliament

Stock indices traded little changed as investors are cautious if the Greek government will be able to pass a series of reforms in the Greek parliament.

The deal also needs to be approved by national parliaments before talks about a bailout programme can start.

The French consumer price inflation fell 0.1% in June, after a 0.2% increase in May.

On a yearly basis, the consumer price index climbed 0.3% in June, after a 0.3% rise in May.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate rose 5.6% in the March to May quarter from 5.5% in three months to February. It was the first increase in two years.

Analysts had expected the unemployment rate to remain unchanged at 5.5%.

The claimant count increased by 7,000 people in June, missing expectations for a drop by 8,800, after a decrease of 1,100 people in May. May's figure was revised down from a decline of 6,500.

Average weekly earnings, excluding bonuses, climbed by 2.8% in the March to May quarter, missing expectations for a rise by 3.0%, after a 2.7% gain in the December to February quarter. It was the highest gain in more than six years.

The previous three months' figure was revised up from a 2.2% increase.

Average weekly earnings, including bonuses, rose by 3.2% in the March to May quarter, missing expectations for a gain of 3.3%, after a 2.7% increase in the December to February quarter. It was the highest rise since June to April 2010.

Current figures:

Name Price Change Change %

FTSE 100 6,754.81 +1.06 +0.02 %

DAX 11,516.27 -0.63 -0.01 %

CAC 40 5,029.25 -3.22 -0.06 %

-

11:47

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs drops to -5.4 points in July

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index dropped to -5.4 points in July from 0.1 points in June as Swiss economic expectations worsened.

The current conditions index by 1.4 points to -21.6 points in July from -23.0 points in June.

"The economic outlook for Switzerland has dimmed again, and while analysts expect to see the strongest economic momentum in the Eurozone over the next six months, the present state of the Eurozone economy is still rated as poor," Credit Suisse said.

-

11:39

French consumer price inflation falls 0.1% in June

The French statistical office Insee released its consumer price inflation for France on Wednesday. The French consumer price inflation fell 0.1% in June, after a 0.2% increase in May.

On a yearly basis, the consumer price index climbed 0.3% in June, after a 0.3% rise in May.

Fresh food prices rose 5.2% year-on-year in June, while petroleum products prices dropped by 7.3%.

-

11:27

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E588mn), $1.1050(E225mn), $1.1100(E400mn), $1.1200(E334mn)

USD/JPY: Y122.00($654mn), Y123.25($380mn), Y123.50($645mn), Y125.00($992mn)

EUR/JPY: Y134.75(E320mn)

EUR/GBP: Gbp0.7000(E525mn), Gbp0.7080(E420mn), Gbp0.7100(E349mn), Gbp0.7120(E320mn)

USD/CAD: C$1.2700($973mn)

-

11:17

U.K. unemployment rate increases to 5.6% in the March to May quarter, the first increase in two years

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate rose 5.6% in the March to May quarter from 5.5% in three months to February. It was the first increase in two years.

Analysts had expected the unemployment rate to remain unchanged at 5.5%.

The claimant count increased by 7,000 people in June, missing expectations for a drop by 8,800, after a decrease of 1,100 people in May. May's figure was revised down from a decline of 6,500.

Average weekly earnings, excluding bonuses, climbed by 2.8% in the March to May quarter, missing expectations for a rise by 3.0%, after a 2.7% gain in the December to February quarter. It was the highest gain in more than six years.

The previous three months' figure was revised up from a 2.2% increase.

Average weekly earnings, including bonuses, rose by 3.2% in the March to May quarter, missing expectations for a gain of 3.3%, after a 2.7% increase in the December to February quarter. It was the highest rise since June to April 2010.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:04

Chinese economy expands 7.0% in the second quarter

Today's Chinese economic data was better than expected. Chinese economy expanded 7.0% in the second quarter, beating expectations for a 6.9% growth, after a 7.0% rise in the first quarter.

The weak housing market and industrial production in China weighs on the Chinese economic growth.

Industrial production in China increased 6.8% in May, exceeding expectations for a 6.0% rise, after a 6.1% gain in April.

Retail sales in China increased 10.6% in May, beating forecast of 10.2% gain, after a 10.1% rise in April.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), July -5.4

-

10:54

Bank of Japan keeps its monetary policy unchanged, but lowers its inflation forecasts

The Bank of Japan (BoJ) released its interest rate decision on Wednesday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The BoJ board member, Takahide Kiuchi, said again that the central bank should cut its asset purchases to 45 trillion yen annually.

The BoJ lowered its GDP growth forest for financial year 2015/16 to 1.7% from the previous estimate of 2.0%. Forecasts for financial years 2016/17 and 2017/18 remained unchanged.

The central bank cut its inflation for financial year 2015/16 to 0.7%, down from previous estimate of 0.8%, for financial year 2016/17 to 1.9%, down from previous estimate of 2.0%, and for financial year 2017/18 to 1.8%, down from previous estimate of 1.9%.

The BoJ noted that the country's economy continued to recover moderately.

-

10:43

IMF: Greece will need far bigger debt relief that was considered by the Eurozone governments

Reuters reported on Tuesday that Greece will need far bigger debt relief that was considered by the Eurozone governments, according to a confidential study by the International Monetary Fund (IMF).

"The dramatic deterioration in debt sustainability points to the need for debt relief on a scale that would need to go well beyond what has been under consideration to date - and what has been proposed by the European Stability Mechanism (ESM)," the IMF said.

A senior IMF official said on Tuesday that the debt relief would give Greece's economy a chance to recover.

-

10:34

European Central Bank Executive Board member Yves Mersch: the economy in the Eurozone is slowly but steadily improving

European Central Bank (ECB) Executive Board member Yves Mersch said on Tuesday that the economy in the Eurozone is slowly but steadily improving, supported by the ECB's accommodative monetary policy.

"I am confident that the economic recovery will continue," he said.

Mersch repeated that the Eurozone's inflation will hit 2% target in the medium terms.

He also said that the central bank will keep its bond-buying programme until September 2016.

-

10:30

United Kingdom: Average Earnings, 3m/y , May 3.2% (forecast 3.3%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, May 2.8% (forecast 3%)

-

10:30

United Kingdom: Claimant count , June 7 (forecast -8.8)

-

10:30

United Kingdom: ILO Unemployment Rate, May 5.6% (forecast 5.5%)

-

10:14

Cash levels rise to 5.5%

According to the latest Bank of America Merrill Lynch (BofAML) fund manager survey, which was conducted between July 2 and July 9, cash levels rose to 5.5% due to concerns over Greece, China and a possible interest rate hike by the Federal Reserve. It was the highest level since December 2008.

"When average cash balance rises above 4.5% a contrarian buy signal is generated for equities. When the cash balance falls below 3.5% a contrarian sell signal is generated," BofAML analysts said.

-

08:53

Oil price advanced as Iran needs time to boost exports

West Texas Intermediate futures for August delivery climbed to $53.13 (+0.17%); Brent crude advanced to $58.65 (+0.24%) after an initial fall caused by a deal between Iran and global powers (reached on Tuesday), which lifted sanctions in exchange for curbs on Iran's nuclear program.

Prices recovered after investors realized that it will take time for Iran to increase its oil exports. However markets are already oversupplied and the global glut limited price growth.

Goldman Sachs expects oil prices to decline further amid output growth in OPEC. The company's latest oil price forecast is for Brent to average $58 in 2015 and $62 in 2016, and for U.S. crude to average $52 and $57 this year and next, respectively.

-

08:50

Gold is steady ahead of Janet Yellen's speech

Gold is currently at $1,154.00 (+0.04%) an ounce. The metal is generally flat today as investors await Janet Yellen's testimony, which may help clarify the timing of an interest rate increase. Greece's deal reduced demand for safe-haven assets, such as bullion. "Gold was also burdened by the apparent lack of physical buyers and investors stepping forward. So while the selling pressure was not heavy, given the lack of buyers, it was sufficient to undermine prices," - HSBC said.

-

08:48

Global Stocks: U.S. stocks advanced at the beginning of Q2 earnings season

U.S. stocks advanced broadly at the beginning of a new earnings season, which started with J.P. Morgan Chase&Co (a Dow component), whose second-quarter profit rose 5.2% and shares climbed 1.4%. Earnings for S&P 500 companies are expected to fall 4.5% in the second quarter. That would mean the first fall since the third quarter of 2012. Analysts had also expected declines in the first quarter amid lower oil prices and a strong dollar. However, profits actually rose by 0.8%.

Analysts note that U.S. stocks are still sensitive to developments in Greece and prospects of Fed interest rates.

The Dow Jones industrial average gained 75.90 points, or 0.4%, to 18,053.58. The S&P 500 increased 9.35 points, or 0.5%, to 2,108.95. The Nasdaq Composite climbed 33.38 points, or 0.7%, to 5,104.89.

The U.S. Department of Commerce reported Tuesday that retail sales fell 0.3% in June, suggesting that consumer spending may weaken. Economists expected a 0.3% growth.

In Asia this morning Hong Kong Hang Seng slid 0.49%, or 122.48 points, to 24,998.43. China Shanghai Composite Index declined by 2.47%, or 96.84 points, to 3,827.65. Meanwhile the Nikkei rose 0.35%, or 70.75 points, to 20,456.08.

China's National Bureau of Statistics reported Wednesday that the country's gross domestic product expanded by 7% in the second quarter, compared to the same period last year. This growth rate is slightly faster than the 6.9% reading expected by economists and it's in line with the 7% growth target for the full year.

China industrial production rose by 6.3% y/y in Q2 (0.1% below Q1 2015).

The Bank of Japan left its monetary policy unchanged and reiterated that the country's economy continued recovering at a moderate pace.

-

08:46

France: CPI, y/y, June 0.3%

-

08:45

France: CPI, m/m, June -0.1%

-

08:43

Foreign exchange market. Asian session: yen little changed amid BOJ decision

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Westpac Consumer Confidence July -6.9% -3.2%

01:30 Australia New Motor Vehicle Sales (YoY) June 0.8% 4.0%

01:30 Australia New Motor Vehicle Sales (MoM) June -1.3% 3.8%

02:00 China Retail Sales y/y May 10.1% 10.2% 10.6%

02:00 China Industrial Production y/y May 6.1% 6.0% 6.8%

02:00 China Fixed Asset Investment May 11.4% 11.2% 11.4%

02:00 China GDP y/y Quarter II 7.0% 6.9% 7.0%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

The sterling continued climbing on BOE Carney's comments, which suggest that a probability of a rate hike in the near future increases. Carney also noted that higher wages are the key factor of consumption growth. Today investors await employment data. Median forecast suggests a 3.3% growth in average earnings in the three months through May compared to a 2.7% growth reported previously.

The yen showed little reaction to BOJ decision to keep its monetary policy unchanged. The decision was made by 8-1 vote. The bank reiterated that Japan's economy continued to recover moderately.

The Australian dollar rose after data showed that new motor vehicle sales rose by 3.3% in June compared to the previous month. However the AUD was mostly influenced by China GDP data (the index advanced by 7.0% vs 6.9% expected).

EUR/USD: the pair declined to $1.0990 in Asian trade

USD/JPY: the pair traded around Y123.25-45

GBP/USD: the pair rose to $1.5650

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France CPI, m/m June 0.2%

06:45 France CPI, y/y June 0.3%

08:30 United Kingdom Average Earnings, 3m/y May 2.7% 3.3%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May 2.7% 3%

08:30 United Kingdom ILO Unemployment Rate May 5.5% 5.5%

08:30 United Kingdom Claimant count June -6.5 -8.8

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 0.1

12:30 Canada Manufacturing Shipments (MoM) May -2.1% 0.4%

12:30 U.S. PPI, m/m June 0.5% 0.2%

12:30 U.S. PPI, y/y June -1.1% -0.9%

12:30 U.S. PPI excluding food and energy, m/m June 0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y June 0.6% 0.7%

12:30 U.S. NY Fed Empire State manufacturing index July -1.98 3

13:15 U.S. Industrial Production (MoM) June -0.2% 0.2%

13:15 U.S. Industrial Production YoY June 1.4%

13:15 U.S. Capacity Utilization June 78.1% 78.1%

14:00 Canada Bank of Canada Rate 0.75% 0.75%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Fed Chairman Janet Yellen Speaks

14:30 U.S. Crude Oil Inventories July 0.384 -2.1

16:25 U.S. FOMC Member Mester Speaks

18:00 U.S. Fed's Beige Book

19:00 U.S. FOMC Member Williams Speaks

22:30 New Zealand Business NZ PMI June 51.5

22:45 New Zealand CPI, q/q Quarter II -0.3% 0.6%

22:45 New Zealand CPI, y/y Quarter II 0.1% 0.4%

-

08:24

Options levels on wednesday, July 15, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1147 (872)

$1.1107 (450)

$1.1078 (102)

Price at time of writing this review: $1.1001

Support levels (open interest**, contracts):

$1.0954 (2572)

$1.0919 (3130)

$1.0871 (4400)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 46290 contracts, with the maximum number of contracts with strike price $1,1400 (3426);

- Overall open interest on the PUT options with the expiration date August, 7 is 59751 contracts, with the maximum number of contracts with strike price $1,0800 (6264);

- The ratio of PUT/CALL was 1.29 versus 1.28 from the previous trading day according to data from July, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (1164)

$1.5806 (1715)

$1.5709 (949)

Price at time of writing this review: $1.5652

Support levels (open interest**, contracts):

$1.5588 (1669)

$1.5492 (1030)

$1.5395 (1148)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 20025 contracts, with the maximum number of contracts with strike price $1,5750 (2457);

- Overall open interest on the PUT options with the expiration date August, 7 is 21874 contracts, with the maximum number of contracts with strike price $1,5250 (2061);

- The ratio of PUT/CALL was 1.09 versus 1.09 from the previous trading day according to data from July, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:24

Japan: BoJ Interest Rate Decision, 0%

-

04:06

Nikkei 225 20,469.61 +84.28 +0.41 %, Hang Seng 25,023.31 -97.60 -0.39 %, Shanghai Composite 3,849.67 -74.82 -1.91 %

-

04:01

China: Industrial Production y/y, May 6.8% (forecast 6.0%)

-

04:01

China: Fixed Asset Investment, May 11.4% (forecast 11.2%)

-

04:00

China: GDP y/y, Quarter II 7.0% (forecast 6.9%)

-

04:00

China: Retail Sales y/y, May 10.6% (forecast 10.2%)

-

03:31

Australia: New Motor Vehicle Sales (MoM) , June 3.8%

-

03:31

Australia: New Motor Vehicle Sales (YoY) , June 4.0%

-

02:29

Australia: Westpac Consumer Confidence, July -6.8%

-

00:32

Commodities. Daily history for Jul 14’2015:

(raw materials / closing price /% change)

Oil 53.32 +0.53%

Gold 1,154.90 +0.12%

-

00:31

Stocks. Daily history for Jul 14’2015:

(index / closing price / change items /% change)

Nikkei 225 20,385.33 25,120.91 -103.10 -0.41 %

S&P/ASX 200 5,577.4 +104.23 +1.90 %

Shanghai Composite 3,926.03 -44.36 -1.12 %

FTSE 100 6,753.75 +15.80 +0.23 %

CAC 40 5,032.47 +34.37 +0.69 %

Xetra DAX 11,516.9 +32.52 +0.28 %

S&P 500 2,108.95 +9.35 +0.45 %

NASDAQ Composite 5,104.89 +33.38 +0.66 %

Dow Jones 18,053.58 +75.90 +0.42 %

-

00:29

Currencies. Daily history for Jul 14’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1007 +0,02%

GBP/USD $1,5631 +0,92%

USD/CHF Chf0,945 -0,49%

USD/JPY Y123,37 -0,06%

EUR/JPY Y135,80 -0,04%

GBP/JPY Y192,83 +0,86%

AUD/USD $0,7449 +0,64%

NZD/USD $0,6707 +0,28%

USD/CAD C$1,2731 -0,05%

-