Noticias del mercado

-

21:00

Dow +109.7 17,430.41 +0.63% Nasdaq +37.48 4,608.30 +0.82% S&P +16.50 2,009.17 +0.83%

-

18:17

European Central Bank Executive Board member Benoit Coeure: the bond-buying programme must be big to be efficient

The European Central Bank Executive Board member Benoit Coeure said on Friday in a newspaper interview that the bond-buying programme must be big to be efficient.

He also said that the European Central Bank (ECB) is studying the experiences of the U.S. and Britain with quantitative easing to decide what volume of bond-buying programme it may have.

-

18:07

European stocks close: stocks closed higher on signs the ECB will add further stimulus measures

Stock indices closed higher on signs the ECB will add further stimulus. European stocks reached their highest level since 2008. European Central Bank Executive Board member Benoit Coeure said on Friday in a newspaper interview that the bond-buying programme must be big to be efficient.

Eurozone's consumer price index dropped 0.1% in December, beating expectations for a 0.2% decline, after a 0.2% decrease in November.

On a yearly basis, Eurozone's consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.7% in December from 0.8% in November. Analysts had expected inflation to remain unchanged.

Germany's final consumer price index was flat in December, in line with expectations.

On a yearly basis, German final consumer price index remained at 0.2% in December, in line with expectations.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,550.27 +51.49 +0.79%

DAX 10,167.77 +135.16 +1.35%

CAC 40 4,379.62 +56.42 +1.31%

-

18:00

European stocks closed: FTSE 100 6,550.27 +51.49 +0.79% CAC 40 4,379.62 +56.42 +1.31% DAX 10,167.77 +135.16 +1.35%

-

17:40

Oil: A review of the market situation

Oil prices rose more than $ 1, departing multi-year lows, which was due to new forecasts from the International Energy Agency. Today, in its monthly report the IEA said that this year the prices may recover. The agency downgraded the outlook for production from countries outside OPEC. "Where will the market bottom is anyone's guess. But the sale does not go unnoticed - said IEA. - Recovery of prices - in the absence of any major failures - can and is not inevitable, but growing signs that it is still going to happen" . "Rebalancing may begin in the second half of the year" - said the agency that advises the major industrialized countries in the field of energy policies.

However, while traders consider any recovery as temporary. Oil prices fell by nearly 60 percent over the past six months, and both the key brand of oil is currently trading below $ 50 a barrel as the supply of high quality light crude oil from the United States and Canada exceeded demand in a period of low global economic growth.

Recall, on the eve of the OPEC once again cut its forecast for demand for its oil in 2015 - from 28.9 to 28.8 million barrels a day, the lowest level in 12 years. This is 300 thousand. Barrels per day lower than the rate in 2014. Earlier in the week the largest banks Goldman Sachs and Societe Generale sharply worsened its oil price forecasts for the current year, and the US Department of Energy reported an increase in production in the country last week to the highest level since 1983.

"In the oil market is a big game and lose the one who blinks first. OPEC decades determined the direction of the market within the cartel, but it is obvious that this situation came to an end," - says chief strategist at CMC Markets Michael McCarthy.

Also add that the oil market has the situation on the currency market, where the euro yesterday showed the strongest in the history of the fall of the Swiss franc and reached a 11-year low against the dollar after the Bank of Switzerland to lift restrictions on the franc to the euro.

The cost of the February futures on US light crude oil WTI (Light Sweet Crude Oil) rose to 47.07 dollars per barrel on the New York Mercantile Exchange.

February futures price for North Sea Brent crude oil mix increased by $ 0.7 to $ 49.10 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:34

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the U.S. better-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index

The U.S. dollar traded mixed against the most major currencies after the U.S. better-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index. The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 98.2 in January from a final reading of 93.6 in December, exceeding expectations for an increase to 94.2. That was the highest level since January 2004.

The increase was driven by falling gasoline prices and a strengthening labour market.

The U.S. consumer price inflation fell 0.4% in December, missing expectations for a 0.3% decrease, after a 0.3% decline in November. That was largest decline since December 2008.

The declines was driven by lower gasoline prices.

On a yearly basis, the U.S. consumer price index fell to 0.8% in December from 1.3% in November, missing forecasts of a decline to 1.0%.

The U.S. consumer price inflation excluding food and energy was flat in December, missing expectations for a 0.1% gain, after a 0.1% rise in November.

On a yearly basis, the U.S. consumer price index excluding food and energy decreased to 1.6% in December from a 1.7% gain in November. Analysts had expected consumer inflation to remain unchanged at 1.7%.

The U.S. industrial production decreased 0.1% in December, missing expectations for a 0.1% rise, after a 1.3% gain in November.

The decline was driven by lower output of utilities.

Capacity utilisation rate declined to 79.7% in December from 80.0% in November. November's figure was revised up from 80.1%. Analysts had expected a capacity utilisation rate of 80.2%.

The euro traded lower against the U.S. dollar. Eurozone's consumer price index dropped 0.1% in December, beating expectations for a 0.2% decline, after a 0.2% decrease in November.

On a yearly basis, Eurozone's consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.7% in December from 0.8% in November. Analysts had expected inflation to remain unchanged.

Germany's final consumer price index was flat in December, in line with expectations.

On a yearly basis, German final consumer price index remained at 0.2% in December, in line with expectations.

The British pound fell against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. Retail sales in Switzerland decreased at an annual rate of 1.2% in November, missing expectations for a 1.1% rise, after a 0.3% gain in October.

The Swiss Franc plunged against the greenback yesterday as the Swiss National Bank announced today that it will discontinue the 1.20 per euro exchange rate floor. But the SNB added that will remain active in the foreign exchange market.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded higher against the greenback.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia. In the overnight trading session, the Aussie rose against the greenback.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

-

17:20

Gold: a review of the market situation

Gold prices rose sharply today, reaching a four-month high, and went to his largest weekly gain in the last 17 months (+ 4.5%). Investors sought safe "haven" of volatility after yesterday's unexpected decision to the Central Bank of Switzerland.

Recall SNB yesterday refused to support the objectives of the franc above 1.20 per euro, franc why in a short time rose by 30 percent. According to market participants, the central bank made this decision knowing about the intention of the European Central Bank to announce the beginning of buying up government bonds on January 22.

Meanwhile, today a member of the Board of the European Central Bank Benoit Ker said that to a possible program of quantitative easing, the ECB has worked, it has to be big. Ker also decided to repay poshedshie again talk of a Greek exit from the eurozone. "Any talk of a Greek exit from the eurozone unreasonable and unrealistic, - he said. - Its output is not discussed, and no one in Europe over this output does not work. So it is not discussed."

Precious metal more expensive despite the significant strengthening of the US dollar, which usually causes a backlash.

Had little impact as US data. Preliminary results presented Thomson-Reuters and the Institute of Michigan, showed that in January, US consumers are feeling more optimistic about the economy than last month.

According to published data, in January preliminary consumer sentiment index was 98.2 points compared with a final reading in December at the level of 93.6 points. It is worth noting that, according to the average expert estimates, the index should make 94.2 points. Also presented in the report the results of studies showed that the index of 5-year inflation expectations + 2.8% and the 12-month inflation expectations + 2.4%, preliminary expectations index 91.6, preliminary index of current conditions 108.3

It also became known that the stocks of the world's largest gold ETF-secured fund SPDR Gold Trust on Thursday rose 1.35 percent to 717.15 tons. At the same time, the demand for physical markets is reduced: the margin on the Shanghai Gold Exchange fell to $ 02.01 an ounce at $ 04.03 on Thursday.

The cost of the February gold futures on the COMEX today rose to 1273.50 dollars per ounce.

-

16:55

Thomson Reuters/University of Michigan preliminary consumer sentiment index jumped to its highest level since January 2004

The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 98.2 in January from a final reading of 93.6 in December, exceeding expectations for an increase to 94.2. That was the highest level since January 2004.

The increase was driven by falling gasoline prices and a strengthening labour market.

A gauge of consumers' current expectations climbed to 108.3 in January from 104.8 in December.

-

16:09

U.S. industrial production declines 0.1% in December

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production decreased 0.1% in December, missing expectations for a 0.1% rise, after a 1.3% gain in November.

The decline was driven by lower output of utilities. The output of utilities dropped 7.3% in December "as warmer-than-usual temperatures reduced demand for heating".

Capacity utilisation rate declined to 79.7% in December from 80.0% in November. November's figure was revised up from 80.1%.

Analysts had expected a capacity utilisation rate of 80.2%.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, January 98.2 (forecast 94.2)

-

15:41

U.S. consumer price inflation fell 0.4% in December

The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation fell 0.4% in December, missing expectations for a 0.3% decrease, after a 0.3% decline in November. That was largest decline since December 2008.

The declines was driven by lower gasoline prices.

On a yearly basis, the U.S. consumer price index fell to 0.8% in December from 1.3% in November, missing forecasts of a decline to 1.0%.

The U.S. consumer price inflation excluding food and energy was flat in December, missing expectations for a 0.1% gain, after a 0.1% rise in November.

On a yearly basis, the U.S. consumer price index excluding food and energy decreased to 1.6% in December from a 1.7% gain in November. Analysts had expected consumer inflation to remain unchanged at 1.7%.

Energy costs dropped 4.7% in December, the largest drop in six years.

Gasoline prices declined 9.4% in December, while food prices rose 0.3%, the largest rise since September 2014.

-

15:36

U.S. Stocks open: Dow +0.04%, Nasdaq +0.23%, S&P +0.18%

-

15:24

Before the bell: S&P futures -0.23%, Nasdaq futures -0.39%

U.S. stock-index futures pared losses as data showed the cost of living declined by the most in six years amid a plunge in energy costs, increasing speculation the Federal Reserve will remain patient in its plans to raise interest rates.

Global markets:

Nikkei 16,864.16 -244.54 -1.43%

Hang Seng 24,103.52 -247.39 -1.02%

Shanghai Composite 3,377.43 +40.98 +1.23%

FTSE 6,503.25 +4.47 +0.07%

CAC 4,326.73 +3.53 +0.08%

DAX 10,026.43 -6.18 -0.06%

Crude oil $47.00 (+1.26%)

Gold $1265.60 (+0.06%)

-

15:15

U.S.: Industrial Production (MoM), December -0.1% (forecast +0.1%)

-

15:15

U.S.: Capacity Utilization, December 79.7% (forecast 80.2%)

-

15:10

Stocks before the bell

(company / ticker / price / change, % / volume)

JPMorgan Chase and Co

JPM

55.00

+0.02%

1.3K

Verizon Communications Inc

VZ

47.15

+0.11%

3.3K

AT&T Inc

T

33.30

+0.12%

8.3K

Yahoo! Inc., NASDAQ

YHOO

46.32

+0.19%

8.3K

Ford Motor Co.

F

14.89

+0.20%

13.0K

The Coca-Cola Co

KO

42.47

+0.21%

0.6K

Intel Corp

INTC

36.27

+0.22%

1.1M

Apple Inc.

AAPL

107.05

+0.22%

177.5K

Facebook, Inc.

FB

74.30

+0.34%

43.2K

Merck & Co Inc

MRK

62.11

+0.37%

0.7K

Pfizer Inc

PFE

32.55

+0.46%

4.9K

General Electric Co

GE

23.69

+0.47%

4.6K

Chevron Corp

CVX

103.20

+0.52%

1.8K

Twitter, Inc., NYSE

TWTR

37.16

+0.62%

51.8K

Yandex N.V., NASDAQ

YNDX

17.84

+0.68%

0.8K

Barrick Gold Corporation, NYSE

ABX

11.45

+0.70%

53.7K

Exxon Mobil Corp

XOM

89.60

+0.72%

11.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.50

+0.93%

3.6K

Visa

V

253.13

0.00%

1.6K

Home Depot Inc

HD

101.00

-0.01%

1.1K

American Express Co

AXP

85.85

-0.03%

1.7K

Boeing Co

BA

130.10

-0.03%

7.5K

Caterpillar Inc

CAT

84.20

-0.14%

1.6K

Amazon.com Inc., NASDAQ

AMZN

286.56

-0.14%

2.6K

Starbucks Corporation, NASDAQ

SBUX

79.46

-0.15%

3.7K

Walt Disney Co

DIS

94.19

-0.17%

1.2K

Google Inc.

GOOG

500.96

-0.17%

0.5K

ALTRIA GROUP INC.

MO

52.38

-0.17%

0.2K

International Business Machines Co...

IBM

154.29

-0.18%

0.4K

Microsoft Corp

MSFT

45.40

-0.18%

2.9K

ALCOA INC.

AA

14.94

-0.20%

20.9K

Citigroup Inc., NYSE

C

47.12

-0.23%

14.7K

Johnson & Johnson

JNJ

102.22

-0.26%

0.6K

Hewlett-Packard Co.

HPQ

38.09

-0.26%

4.1K

Cisco Systems Inc

CSCO

27.32

-0.33%

24.8K

General Motors Company, NYSE

GM

33.30

-0.39%

9.0K

Tesla Motors, Inc., NASDAQ

TSLA

191.05

-0.43%

10.0K

Goldman Sachs

GS

175.10

-1.90%

14.9K

-

15:01

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Intel (INTC) downgrade from Buy to Mkt Perform at Charter Equity

Other:

Walt Disney (DIS) target raised to $110 from $96 at Stifel

Intel (INTC) target raised from $39 to $41 at Stifel

Apple (AAPL) target raised from $120 to $123 at RBC Capital Mkts

Intel (INTC) target lowered from $38 to $36 at Cowen

-

14:49

Company News: Goldman Sachs (GS) reported better than expected fourth quarter earnings, but revenue drops

Goldman Sachs (GS) earned $4.38 per share in the fourth quarter, beating analysts' estimate of $4.32. Revenue in the fourth quarter dropped 8.3% year-over-year to $7.69 billion, beating analysts' estimate of $7.64 billion.

Goldman Sachs (GS) shares decreased to $175.50 (-1.68%) prior to the opening bell.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1700(E1.0bn), $1.1725(E417mn), $1.1750(E2.6bn), $1.1800(E809mn), $1.1850(E350mn), $1.1900(E470mn), $1.1890-1.1910(E2.3bn)

USD/JPY: Y114.00($1.65bn), Y116.00($1.6bn), Y116.50($576mn), Y117.00($848mn), Y117.65-75($600mn), Y118.00($560mn), Y118.25($630mn), Y119.00($582mn), Y119.50($1.0bn)

GBP/USD: $1.5100(stg418mn), $1.5300(stg530mn)

AUD/USD: $0.7950(A$1.0bn), $0.8125(A$221mn), $0.8150(A$422mn), $0.8165(A$282mn), $0.8205(A$1.57bn)

NZD/USD: $0.7800(NZ$766mn)

-

14:41

Company News: Intel (INTC) reported better than expected fourth quarter profits

Intel (INTC) earned $0.74 per share in the fourth quarter, beating analysts' estimate of $0.66. Revenue in the fourth quarter increased 6.4% year-over-year to $14.72 billion, beating analysts' estimate of $14.71 billion.

Revenue per business segment:

PC Client Group: $8.9 billion (+3% y/y);

Data Center Group: $4.1 billion (+25%);

Internet of Things Group: $591 million (+10% y/y);

Software and services operating segments: $557 million (-6% y/y).

The company forecast first-quarter revenue of $13.2-$14.2 billion (analysts' estimate: $13.77 billion). Intel (INTC) expect that its revenue will increase 5% (analysts' estimate: +4%) in the full fiscal year 2015.

Intel (INTC) shares decreased to $36.20 (-0.11%) prior to the opening bell.

-

14:30

U.S.: CPI, m/m , December -0.4% (forecast -0.3%)

-

14:30

U.S.: CPI excluding food and energy, m/m, December 0.0% (forecast +0.1%)

-

14:30

U.S.: CPI, Y/Y, December +0.8% (forecast +1.0%)

-

14:30

U.S.: CPI excluding food and energy, Y/Y, December +1.6% (forecast +1.7%)

-

14:07

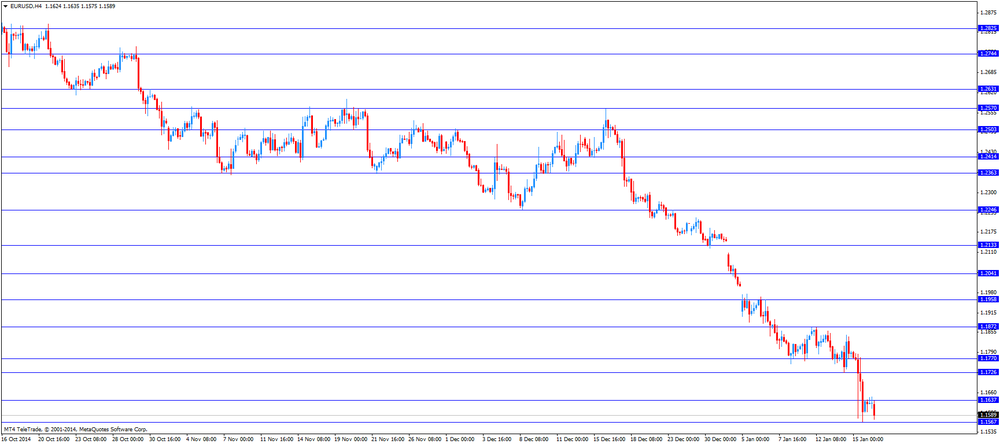

Foreign exchange market. European session: the euro fell against the U.S. dollar after consumer price inflation from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany CPI, m/m (Finally) December 0.0% 0.0% 0.0%

07:00 Germany CPI, y/y (Finally) December +0.2% +0.2% +0.2%

08:15 Switzerland Retail Sales Y/Y November +0.3% +1.1% -1.2%

10:00 Eurozone Harmonized CPI (Finally) December -0.2% -0.2% -0.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December -0.2% -0.2% -0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December +0.8% +0.8% +0.7%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. economic data. The U.S. consumer price inflation is expected to decline 0.3% in December, after a 0.3% drop in November.

The U.S. consumer price index excluding food and energy is expected to rise 0.1% in December, after a 0.1% gain in November.

The U.S. industrial production is expected to rise 0.1% in December, after a 1.3% increase in November.

The euro fell against the U.S. dollar after consumer price inflation from the Eurozone. Eurozone's consumer price index dropped 0.1% in December, beating expectations for a 0.2% decline, after a 0.2% decrease in November.

On a yearly basis, Eurozone's consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.7% in December from 0.8% in November. Analysts had expected inflation to remain unchanged.

Germany's final consumer price index was flat in December, in line with expectations.

On a yearly basis, German final consumer price index remained at 0.2% in December, in line with expectations.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded mixed against the U.S. dollar. Retail sales in Switzerland decreased at an annual rate of 1.2% in November, missing expectations for a 1.1% rise, after a 0.3% gain in October.

The Swiss Franc plunged against the greenback yesterday as the Swiss National Bank announced today that it will discontinue the 1.20 per euro exchange rate floor. But the SNB added that will remain active in the foreign exchange market.

EUR/USD: the currency pair declined to $1.1575

GBP/USD: the currency pair traded mixed

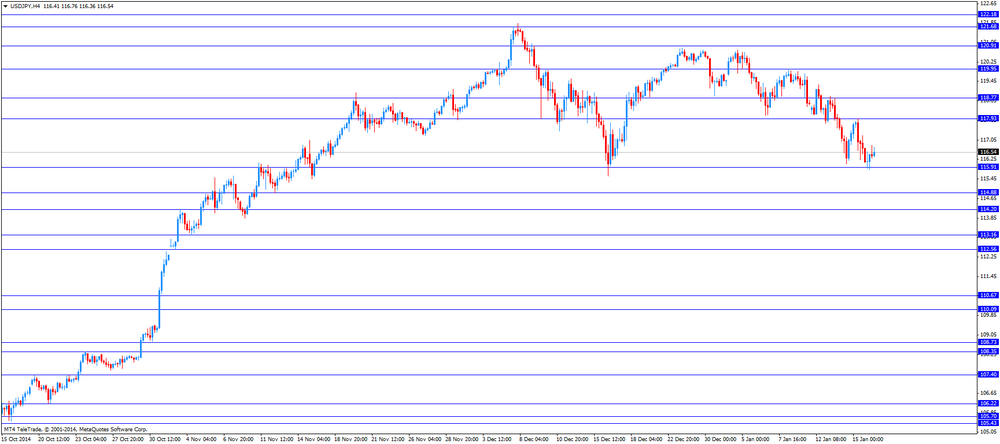

USD/JPY: the currency pair rose to $116.76

The most important news that are expected (GMT0):

13:30 U.S. CPI, m/m December -0.3% -0.3%

13:30 U.S. CPI, Y/Y December +1.3% +1.0%

13:30 U.S. CPI excluding food and energy, m/m December +0.1% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y December +1.7% +1.7%

14:15 U.S. Industrial Production (MoM) December +1.3% +0.1%

14:15 U.S. Capacity Utilization December 80.1% 80.2%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) January 93.6 94.2

-

13:00

European stock markets mid-session: Indices add gains after yesterday’s turmoil

Yesterday European indices sharply declined after the SNB decided to discontinue the minimum exchange rate of 1.20 per euro and lowered interest rates more into negative territory to -0.75. The surprise move erased early gains driven by a recovery in commodities. The Swiss franc rallied against its major peers and Swiss stocks plunged. Later in the day markets recovered and posted solid gains in volatile trading.

In today's session the FTSE 100 index is trading flat at+0.10% quoted at 6,498.88. France's CAC 40 added +0.55% trading at 4,347.09. Germany's DAX 30 is currently trading +0.22% above the psychologically important level of 10,000 at 10,054.54. Energy shares offset the continuous slump on the Swiss market amid rising oil prices. Indices were further supported from ongoing speculation that the ECB will announce to start QE on the next policy meeting taking place on January 22nd.

A report form Eurostat said that harmonized Consumer Price Inflation on a yearly basis remained unchanged and in line with estimates at -0.2%. Harmonized CPI ex EFAT, excluding the volatile energy and food items costs, was 0.1% below expectations at +0.7%. CPI for December was at -0.1%. Analysts expected data to show a reading of -0.2%.

-

12:20

Oil: Prices rise on International Energy Agency forecast: ‘tide will turn’

Brent crude and West Texas Intermediate extended gains. Brent Crude added +2.80%, currently trading at USD49.62 a barrel. West Texas Intermediate rose by +2.18% currently quoted at USD47.26 as the International Energy Agency cut forecasts for supplies outside the OPEC by 350,000 barrels a day, the first cut since July and stated that prices could rise as the slow-down in output will rebalance prices. The Agency added that prices may fall further before they recover but a reversal in the trend is possible this year.

The global glut continues in 2015 and a low global demand weighs amid record output from U.S. shale drillers - U.S. crude production increased by 60,000 barrels a day last week according to the EIA and stockpiles expanded. Both major brands lost more than 50% of their value since mid-2014 but the OPEC, responsible for 40% of worldwide oil-production, decided to leave output-rates unchanged around 30 million barrels a day and repeatedly reaffirmed not to change policy in the fight for market share. Record Russian output not seen since the end of the Soviet Union further adds to the downward pressure on oil prices.

-

12:00

Gold below four-month high after yesterday’s rally

Gold prices declined today from a four-month high hit yesterday as market participants take profits. The precious metal rose sharply yesterday as the SNB decided to discontinue the minimum exchange rate of 1.20 per euro and lowered interest rates more into negative territory to -0.75 in a surprise move. Although retreating from highs gold remains supported by mixed U.S. economic reports but a broadly strong dollar weighs as it makes gold more expensive for holders of other currencies.

Gold prices rose nearly 6 percent this month, after declining for two consecutive years, but the forecast for the current year remains uncertain.

Today investors look ahead to data on CPI, Industrial Production, Capacity Utilization and the Reuters/Michigan Consumer Sentiment Index to get a better picture on the economic outlook of the U.S. and when the FED will raise benchmark interest rates. It is worth emphasizing, lower interest rates positive effect on gold, because it lowers the relative cost containment metal that guarantees investors a profit.

The precious metal is currently quoted at USD1,257.70, -0,11% a troy ounce.

-

11:21

Eurozone’s Consumer Price Inflation remained unchanged in line with forecasts

A report form Eurostat said that harmonized Consumer Price Inflation on a yearly basis remained unchanged and in line with estimates at -0.2%. Harmonized CPI ex EFAT, excluding the volatile energy and food items costs, was 0.1% below expectations at +0.7%. CPI for December was at -0.1%. Analysts expected data to show a reading of -0.2%.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1700(E1.0bn), $1.1725(E417mn), $1.1750(E2.6bn), $1.1800(E809mn), $1.1850(E350mn), $1.1900(E470mn), $1.1890-1.1910(E2.3bn)

USD/JPY: Y114.00($1.65bn), Y116.00($1.6bn), Y116.50($576mn), Y117.00($848mn), Y117.65-75($600mn), Y118.00($560mn), Y118.25($630mn), Y119.00($582mn), Y119.50($1.0bn)

GBP/USD: $1.5100(stg418mn), $1.5300(stg530mn)

AUD/USD: $0.7950(A$1.0bn), $0.8125(A$221mn), $0.8150(A$422mn), $0.8165(A$282mn), $0.8205(A$1.57bn)

NZD/USD: $0.7800(NZ$766mn)

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, December +0.7% (forecast +0.8%)

-

11:00

Eurozone: Harmonized CPI, December -0.1% (forecast -0.2%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, December -0.2% (forecast -0.2%)

-

10:20

Press Review: SNB Officials Eating Words Risk Lasting Investor Aches

REUTERS

Brent crude oil holds above $48, few analysts see quick recovery

(Reuters) - Brent crude oil futures edged higher on Friday, holding above $48 a barrel as analysts said prices were well supported around current levels, although few expect a strong rebound anytime soon as global output continues to outweigh demand.

Benchmark Brent crude futures were trading at $48.38 per barrel at 0802 GMT, up 11 cents since their last settlement. U.S. crude was trading at $46.50 a barrel, up 25 cents.

"Our forecast seems to point towards a consolidation stage in the weeks to come," Phillip Futures said in a note. "Therefore, we expect crude prices to trade range bound between $44.75-$50.69 for WTI Mar'15 and $46.4-52.89 for Brent Mar'15."

Source: http://www.reuters.com/article/2015/01/16/us-markets-oil-idUSKBN0KP06L20150116

BLOOMBERG

SNB Officials Eating Words Risk Lasting Investor Aches

Brace for $40-a-barrel oil.

Switzerland's central bank officials have just eaten their words, risking lingering indigestion in financial markets.

Just three days after SNB Vice President Jean-Pierre Danthine called the franc cap a "pillar" of monetary policy, the SNB yesterday dropped the minimum exchange rate of 1.20 per euro.

The shock abandonment of the SNB's primary policy of the past three years may now leave investors warier of taking officials' words at face value, according to economists including Karsten Junius, chief economist at Bank J. Safra Sarasin AG in Zurich. By scrapping one tool, the franc cap, SNB President Thomas Jordan risks blunting the effects of another.

BLOOMBERG

Gold Heads for Second Weekly Advance as Swiss Shock Boosts SPDR

Gold traded near a four-month high, set for a second weekly gain, on haven demand after Switzerlands's unexpected currency move. Assets in the largest exchange-traded product expanded the most since 2011.

Bullion for immediate delivery was at $1,259.29 an ounce at 3:37 p.m. in Singapore from $1,262.75 a day earlier, when prices jumped 2.8 percent for the biggest increase this year, according to Bloomberg generic pricing. The metal rallied on Jan. 15 to $1,266.85, the highest since Sept. 8, as the SNB ended the franc's cap versus the euro. Gold traded at its most expensive relative to platinum since April 2013.

Gold rose 3 percent this week, extending a 2.9 percent increase a week earlier, as the Swiss bank's move roiled currency and equity markets. That spurred demand for the bullion as a haven as investors returned to ETPs, according to Australia & New Zealand Banking Group Ltd. The SNB's decision comes a week before European Central Bank policy makers meet on Jan. 22 to discuss introducing new stimulus amid concern Greece may exit the currency bloc after a Jan. 25 election.

-

09:16

Switzerland: Retail Sales Y/Y, November -1.2% (forecast +1.1%)

-

09:00

Global Stocks: U.S. indices decline on disappointing results and mixed data

U.S. markets closed lower on Wednesday for a fifth day as bank results disappointed and energy shares extended losses on falling oil prices. According to Reuters expectations for U.S. fourth-quarter earnings have been scaled back sharply. The SNB's decision to scrap its cap to the franc further added to volatility. A mixed set of economic data added to the negative sentiment. The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to 6.3 in January from 24.5 in December. That was the lowest level since February 2014. Analysts had expected the index to decline to 20.3. The DOW JONES index lost -0.61%, declining by 106 points, closing at 17,320.71. The S&P 500 declined by -0.92% with a final quote of 1,992.67, falling below the level of 2,000 points for the first time in a month.

Chinese stock markets were mixed on Friday amid speculation the government will increase stimulus to boost economic growth. Hong Kong's Hang Seng trading -0.80% at 24,156.92 points. China's Shanghai Composite closed at 3,377.43 points, adding +1.23% extending its longest weekly winning streak in 8 years.

Japan's Nikkei fell to a 2-½ moth low during trade. The index closed -1.43 at 16,864.16 points falling for a third week. A strong yen as a result of flight to safety weighed Japanese stocks down. At markets close speculations on pension funds and the BOJ buying stocks trimmed losses and investors saw the sharp decline in prices as buying opportunity.

-

09:00

European Stocks. First hour: Indices negative before inflation data – swiss selloff weighing on markets

European indices are negative after yesterday's rebound in very volatile markets following the selloff after the surprise decision of the SNB to scrap of the currency cap and further lower interest rates to minus 0.75%. The move indicates that the SNB sees a high chance that the ECB will implement quantitative easing after its policy meeting on January 22nd. The Swiss Market Index SMI extended losses today trading -3.88% following yesterday's biggest slump since 1989.

The FTSE 100 index is currently trading -0.43% quoted at 6,470.72 points, Germany's DAX 30 lost -0.27% trading at 10,005.11, back above the important level of 10,000 points. France's CAC 40 declined by -0.11%, currently trading at 4,318.57 points. German data on CPI for December was in line with expectations with 0.0% on a monthly, and +0.2% on a yearly basis with no changes to the previous data.

Market participants are looking forward to the publication of the Eurozone's harmonized CPI data on inflation. Later in the day market participants will closely watch data on U.S. CPI, Industrial Production, Capacity Utilization and the Reuters/Michigan Consumer Sentiment Index.

-

08:30

Foreign exchange market. Asian session: U.S. dollar trading mixed after volatile markets following the SNB decision

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

07:00 Germany CPI, m/m (Finally) December 0.0% 0.0% 0.0%

07:00 Germany CPI, y/y (Finally) December +0.2% +0.2% +0.2%

The U.S. dollar traded mixed against its major peers during the Asian session after mixed U.S. data published yesterday. Markets were highly volatile after the Swiss National Bank shocked market participants by scrapping its exchange rate cap against the single currency and cutting rates to minus 0.75%. The euro is heading for a fifth weekly decline against the greenback currently trading at USD1.1642 before ECB policy makers meet on January 22nd to decide on further stimulus.

Today investors look ahead to data on CPI, Industrial Production, Capacity Utilization and the Reuters/Michigan Consumer Sentiment Index.

The Australian dollar further strengthenedtowards a one-month in the absence of any major economic news.

New Zealand's dollar traded higher against the greenback after rising 1.4% yesterday with no major data on the cards.

The Japanese yen rose versus the greenback as investors bought the yen as safe-have asset. After the SNB news abandoning its three-year-old cap of 1.20 per euro on the franc the highly volatile markets led to risk-off trades. Japan's Tertiary industry Index for November rose by +0.2% missing expectations of n increase by +0.3% with a previous reading of -0.2% in October.

EUR/USD: the euro traded almost flat against the greenback

USD/JPY: the U.S. dollar traded weaker against the yen

GPB/USD: The British pound gained against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Retail Sales Y/Y November +0.3% +1.1%

10:00 Eurozone Harmonized CPI (Finally) December -0.2% -0.2%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December -0.2% -0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December +0.8% +0.8%

13:30 U.S. CPI, m/m December -0.3% -0.3%

13:30 U.S. CPI, Y/Y December +1.3% +1.0%

13:30 U.S. CPI excluding food and energy, m/m December +0.1% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y December +1.7% +1.7%

14:15 U.S. Industrial Production (MoM) December +1.3% +0.1%

14:15 U.S. Capacity Utilization December 80.1% 80.2%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) January 93.6 94.2

21:00 U.S. Net Long-term TIC Flows November -1.4 27.3

21:00 U.S. Total Net TIC Flows November 178.4

-

08:00

Germany: CPI, m/m, December 0.0% (forecast 0.0%)

-

08:00

Germany: CPI, y/y , December +0.2% (forecast +0.2%)

-

07:30

Options levels on friday, January 16, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1857 (613)

$1.1802 (619)

$1.1756 (103)

Price at time of writing this review: $ 1.1628

Support levels (open interest**, contracts):

$1.1549 (1650)

$1.1494 (6970)

$1.1444 (5755)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 53873 contracts, with the maximum number of contracts with strike price $1,2100 (4802);

- Overall open interest on the PUT options with the expiration date February, 6 is 63272 contracts, with the maximum number of contracts with strike price $1,1700 (6970);

- The ratio of PUT/CALL was 1.17 versus 1.13 from the previous trading day according to data from January, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.5404 (416)

$1.5307 (393)

$1.5212 (1001)

Price at time of writing this review: $1.5167

Support levels (open interest**, contracts):

$1.5090 (1687)

$1.4993 (1160)

$1.4895 (1506)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 15353 contracts, with the maximum number of contracts with strike price $1,5800 (1108);

- Overall open interest on the PUT options with the expiration date February, 6 is 17165 contracts, with the maximum number of contracts with strike price $1,5100 (1687);

- The ratio of PUT/CALL was 1.12 versus 1.12 from the previous trading day according to data from January, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

Nikkei 225 16,717.13 -391.57 -2.29%, Hang Seng 24,167.4 -183.51 -0.75%, Shanghai Composite 3,372.54 +36.08 +1.08%

-

00:51

Japan: Tertiary Industry Index , November +0.2% (forecast +0.3%)

-

00:38

Commodities. Daily history for Jan 15’2015:

(raw materials / closing price /% change)

Light Crude 46.09 -0.35%

Gold 1,263.70 -0.09%

-

00:36

Stocks. Daily history for Jan 15’2015:

(index / closing price / change items /% change)

Nikkei 225 17,108.7 +312.74 +1.86%

Hang Seng 24,350.91 +238.31 +0.99%

Shanghai Composite 3,336.45 +114.02 +3.54%

FTSE 100 6,498.78 +110.32 +1.73%

CAC 40 4,323.2 +99.96 +2.37%

Xetra DAX 10,032.61 +215.53 +2.20%

S&P 500 1,992.67 -18.60 -0.92%

NASDAQ Composite 4,570.82 -68.50 -1.48%

Dow Jones 17,320.71 -106.38 -0.61%

-

00:28

Currencies. Daily history for Jan 15’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1632 -1,34%

GBP/USD $1,5182 -0,32%

USD/CHF Chf0,8384 -21,48%

USD/JPY Y116,15 -1,01%

EUR/JPY Y135,10 -2,38%

GBP/JPY Y176,36 -1,33%

AUD/USD $0,8217 +0,84%

NZD/USD $0,7821 +1,37%

USD/CAD C$1,1960 +0,08%

-

00:00

Schedule for today, Friday, Jan 16’2015:

(time / country / index / period / previous value / forecast)

07:00 Germany CPI, m/m (Finally) December 0.0% 0.0%

07:00 Germany CPI, y/y (Finally) December +0.2% +0.2%

08:15 Switzerland Retail Sales Y/Y November +0.3% +1.1%

10:00 Eurozone Harmonized CPI (Finally) December -0.2% -0.2%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December -0.2% -0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December +0.8% +0.8%

13:30 U.S. CPI, m/m December -0.3% -0.3%

13:30 U.S. CPI, Y/Y December +1.3% +1.0%

13:30 U.S. CPI excluding food and energy, m/m December +0.1% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y December +1.7% +1.7%

14:15 U.S. Industrial Production (MoM) December +1.3% +0.1%

14:15 U.S. Capacity Utilization December 80.1% 80.2%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) January 93.6 94.2

21:00 U.S. Net Long-term TIC Flows November -1.4 27.3

21:00 U.S. Total Net TIC Flows November 178.4

-