Noticias del mercado

-

21:00

Dow -49.61 17,377.48 -0.28% Nasdaq -49.64 4,589.68 -1.07% S&P -10.9 2,000.37 -0.54%

-

18:17

NY Fed Empire State manufacturing index climbed to 9.5 in January

The New York Federal Reserve released its survey on Thursday. The NY Fed Empire State manufacturing index climbed to 9.5 in January from -1.23 in December, exceeding expectations for a rise to 5.3. December's figure was revised up from -3.6.

The decline was driven by a fall in orders and shipments.

The new orders index climbed to 6.09 in January from a revised reading of 0.39 in December.

The index for the number of employees increased to 13.68 in January from 8.33 last month.

"Indexes for the six-month outlook pointed to widespread optimism about future conditions", the report said.

-

18:00

European stocks closed: FTSE 100 6,498.78 +110.32 +1.73% CAC 40 4,323.2 +99.96 +2.37% DAX 10,032.61 +215.53 +2.20%

-

18:00

European stocks close: stocks closed higher on speculation the ECB will add further stimulus measures

Stock indices closed higher on speculation the ECB will add further stimulus measures as the Swiss National Bank (SNB) announced today that it will discontinue the 1.20 per euro exchange rate floor.

The Swiss National Bank (SNB) President Thomas Jordan said at a press conference on Thursday that the SNB will intervene in the foreign exchange markets if required.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

Eurozone's trade surplus widened to €20.0 billion in November from €19.6 billion in October, missing expectations for a rise to €21.3 billion. October's figure was revised up from a surplus of €19.4 billion.

The increase was driven by a weaker euro and falling oil prices.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,498.78 +110.32 +1.73%

DAX 10,032.61 +215.53 +2.20%

CAC 40 4,323.2 +99.96 +2.37%

-

17:41

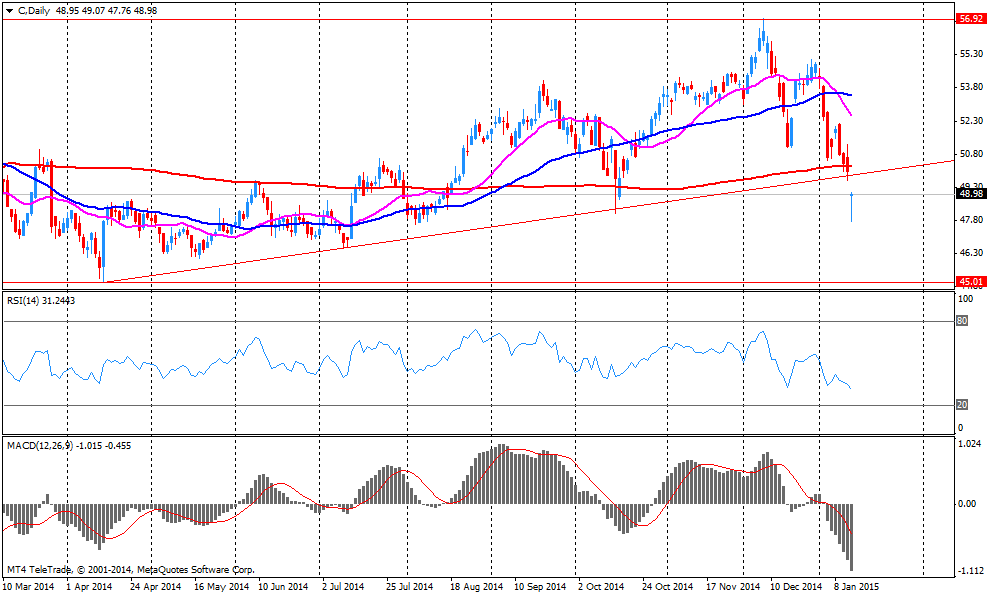

Oil: a review of the market situation

Oil prices continued to fall after yesterday's rally, which is associated with an increase in demand on the world market, as well as new forecasts from the Bank of America Merrill Lynch.

As it became known, experts today BOAML lowered its forecast for the price of Brent crude oil at the end of the first quarter of 2015 to $ 31 per barrel

Recall concerns about weakening global demand, coupled with forecasts that the Organization of Petroleum Exporting Countries will not cut production to support oil market, putting pressure on prices in recent months.

The course of trade also influenced the report from OPEC, which lowered the forecast demand for oil cartel in 2015 to 100 thousand. / Sec - to 28.8 million b / d. The main factor in reducing the demand for oil has become the price of oil, which was below expectations, the report said. In December, OPEC has reduced the forecast of demand for crude oil delivered by the cartel, 2015 to 300 thousand. Barrels per day compared to the previously expected index, to 28.9 million b / d. This figure is the lowest since 2003, OPEC believed that global demand next year will grow by 1.2% - up to 92.26 million b / d, an increase of 70 thousand. B / d lower than the previous forecast. In addition, the report of the organization said that the total oil reserves in the developed economies in October amounted to 2.7 billion barrels, or 15 million barrels higher than the average for the past 5 years.

Also, market participants continue to analyze yesterday's Beige Book report. It noted that the decline in energy prices hit the US oil and gas producers, forcing some companies to lay off workers, while others can not get loans.

Many regulators, investors and economists believe that cheap oil and petroleum products in general are beneficial for the US economy, allowing households to spend more money on other products.

In the "beige book" The Fed's monthly report on business activity in the country, according to the testimony of some of the economic recovery. Companies report the Fed - the central bank of the country - that low gasoline prices increased sales of goods in the Chicago area during the holidays and gave people the opportunity to buy cars in the larger district of Atlanta. But the Fed also has a long list of problems caused by more than 50 percent collapse in oil prices since mid-June.

The cost of the February futures on US light crude oil WTI (Light Sweet Crude Oil) dropped to 47.11 dollars per barrel on the New York Mercantile Exchange.

February futures price for North Sea Brent crude oil mix fell $ 0.33 to $ 48.30 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:34

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data. The he Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to 6.3 in January from 24.5 in December. That was the lowest level since February 2014. Analysts had expected the index to decline to 20.3.

The U.S. producer price index dropped 0.3% in December, in line with expectations, after a 0.2% decrease in November. That was the biggest decline since October 2011.

On a yearly basis, the producer price index increased 1.1% in December, missing expectations for a 1.2% gain, after a 1.4% rise in November.

The decline was driven by a decline in oil prices.

The producer price index excluding food and energy gained 0.3% in December, beating forecasts of a 0.1% increase, after a flat reading in November.

On a yearly basis, the producer price index excluding food and energy climbed 2.1% in December, exceeding expectations for a 2.0% increase, after a 1.8% gain in November.

The number of initial jobless claims in the week ending January 09 in the U.S. rose by 19,000 to 316,000 from 297,000 in the previous week. The previous week's figure was revised down from 294,000. Analysts had expected the number of initial jobless claims to increase to 299,000.

The NY Fed Empire State manufacturing index climbed to 9.5 in January from a revised reading of -1.23 in December, exceeding expectations for a rise to 5.3.

The euro dropped against the U.S. dollar as the Swiss National Bank (SNB) announced today that it will discontinue the 1.20 per euro exchange rate floor.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

Eurozone's trade surplus widened to €20.0 billion in November from €19.6 billion in October, missing expectations for a rise to €21.3 billion. October's figure was revised up from a surplus of €19.4 billion.

The increase was driven by a weaker euro and falling oil prices.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar, after dropping in the morning trading session as the Swiss National Bank announced today that it will discontinue the 1.20 per euro exchange rate floor. But the SNB added that will remain active in the foreign exchange market.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded higher against the greenback.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie rose against the greenback after the better-than-expected labour market data. Australia's unemployment rate fell to 6.1% in December from 6.2% in November, beating expectations for a rise to 6.3%. November's figure was revised up from 6.3%.

The number of employed people in Australia rose by 37,400 in December, exceeding expectations for an increase by 5,300, after a gain by 44,900 in November. November's figure was revised up from an increase by 42,700.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

-

17:20

Gold: a review of the market situation

Gold prices rose today by more than two percent, reaching at this 4-month high, which was associated with an unexpected decision by the Swiss Central Bank to abandon the peg franc. In addition, the SNB lowered the rate on demand deposits to 0.75%.

Gold prices rose nearly 6 percent this month, after declining for two consecutive years, but the forecast for the current year remains uncertain.

"Gold demand in the background of the situation, because no one expected that the Swiss central bank to abandon the peg. This caused a noticeable fluctuations in the market, and obviously led to a flight to safe assets," - said the expert Saxo Bank Ole Hansen.

It is worth emphasizing, lower interest rates positive effect on gold, because it lowers the relative cost containment metal that guarantees investors a profit.

Meanwhile, the weakness of the dollar is also supporting gold, as it boosts the metal's appeal as an alternative asset and decreases in the value of dollar-denominated commodities for holders of other currencies.

A little pressure on gold have data on the United States. As shown by Philadelphia Fed report, in January PMI deteriorated markedly, reaching at this level 6.3 points compared to 24.5 points in December. It is worth noting that many economists expected a decline of this indicator only to the level of 20.3. All sub-indices fell in January: the index terms of delivery in January fell to -11.0 vs. -0.2 in December, the shipments index to -6.9 from 15.1, the new orders index to 8.5 from 13.6 in December, the index of inventories to 0.7 from 7.3, the employment index to -2.0 from 8.4 in December, the index of wholesale prices in January -0.2 against 9.8 in December, and the index purchase prices up 9.8 against 14.4 in December

We also add that previously reported showed that the number of Americans who first applied for unemployment benefits rose to its highest level in four months last week, noting a slight decline in the labor market, which has just published its strongest year for more than ten years. Initial claims for unemployment benefits rose by 19,000 and amounted to a seasonally adjusted 316,000 in the week ended January 10th. Economists had expected 299,000 new claims.

The cost of the February gold futures on the COMEX today rose to 1262.20 dollars per ounce.

-

16:42

Philadelphia Federal Reserve Bank’s manufacturing index dropped to 6.3 in January

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to 6.3 in January from 24.5 in December. That was the lowest level since February 2014.

Analysts had expected the index to decline to 20.3.

A reading above zero indicates expansion.

The survey said that general activity and new orders are expected to grow moderately.

"Price pressures were reduced and that lower energy prices are having net beneficial effects", the survey said.

The survey's respondents expect weaker labour market conditions in January.

"Firms remain optimistic about increases in overall business and employment over the next six months", the survey showed.

-

16:07

Swiss National Bank President Thomas Jordan: the exit strategy of the exchange rate floor has required surprise

The Swiss National Bank (SNB) President Thomas Jordan said at a press conference on Thursday that the CHF1.20 exchange rate floor has been discontinued because it was unsustainable.

"The euro has depreciated substantially against the US dollar and this, in turn, has caused the Swiss franc to weaken against the US dollar. In these circumstances, the SNB has concluded that enforcing and maintaining the minimum exchange rate for the Swiss franc against the euro is no longer justified", Jordan said.

He added that surprise was necessary.

Jordan pointed out that the overvaluation of the Swiss franc has declined since the introduction of the exchange rate floor but the currency remains high.

The SNB president noted that the SNB will intervene in the foreign exchange markets if required.

Switzerland's central bank will lower the interest rate for sight deposit accounts to -0.75% from 22 January. The target range for the 3-month Libor is being cut by 0.5% to between -1.25% and -0.25%.

The SNB capped the franc at 1.20 per euro in September 2011. It had intervened heavily in 2012 to defend the cap. The Swiss National Bank's foreign exchange reserves increased in December. That indicates that the Swiss National Bank's (SNB) has intervened in currency markets last month.

Jordan also said that inflation in Switzerland is expected to -0.1% in 2015 due to falling oil prices. He added that lower oil prices will stimulate the global economy.

-

16:00

U.S.: Philadelphia Fed Manufacturing Survey, January 6.3 (forecast 20.3)

-

15:35

U.S Stocks open: Dow +0.25%, Nasdaq +0.37%, S&P +0.29%

-

15:32

U.S. producer price index dropped 0.3% in December

The U.S. Commerce Department released the producer price index figures on Thursday. The U.S. producer price index dropped 0.3% in December, in line with expectations, after a 0.2% decrease in November. That was the biggest decline since October 2011.

On a yearly basis, the producer price index increased 1.1% in December, missing expectations for a 1.2% gain, after a 1.4% rise in November.

The decline was driven by a decline in oil prices. Gasoline prices dropped 14.5%, while food prices fell 0.4%.

The producer price index excluding food and energy gained 0.3% in December, beating forecasts of a 0.1% increase, after a flat reading in November.

On a yearly basis, the producer price index excluding food and energy climbed 2.1% in December, exceeding expectations for a 2.0% increase, after a 1.8% gain in November.

-

15:27

Before the bell: S&P futures +0.30%, Nasdaq futures +0.08%

U.S. stock-index futures rose as data showed wholesale prices fell and New York-area manufacturing expanded. Futures fluctuated earlier after Switzerland's central bank unexpectedly gave up its minimum exchange rate.

Global markets:

Nikkei 17,108.7 +312.74 +1.86%

Hang Seng 24,350.91 +238.31 +0.99%

Shanghai Composite 3,335.88 +113.44 +3.52%

FTSE 6,457.9 +69.44 +1.09%

CAC 4,294.21 +70.97 +1.68%

DAX 9,956.74 +139.66 +1.42%

Crude oil $50.27 (+3.75%)

Gold $1255.20 (+1.67%)

-

15:07

DOW components before the bell

(company / ticker / price / change, % / volume)

Caterpillar Inc

CAT

86.14

+0.08%

52.1K

Home Depot Inc

HD

102.79

+0.15%

0.8K

Goldman Sachs

GS

180.72

+0.27%

2.8K

Cisco Systems Inc

CSCO

28.00

+0.29%

2.6K

Nike

NKE

94.00

+0.31%

5.3K

McDonald's Corp

MCD

91.82

+0.31%

0.3K

Verizon Communications Inc

VZ

47.13

+0.34%

11.7K

AT&T Inc

T

33.45

+0.36%

3.1K

American Express Co

AXP

87.50

+0.49%

0.2K

JPMorgan Chase and Co

JPM

57.10

+0.51%

8.5K

Visa

V

257.00

+0.56%

0.1K

General Electric Co

GE

23.93

+0.63%

15.8K

Intel Corp

INTC

36.60

+0.69%

10.3K

Walt Disney Co

DIS

94.88

+0.69%

0.3K

Boeing Co

BA

131.34

+0.74%

4.8K

Wal-Mart Stores Inc

WMT

87.44

+0.96%

0.2K

Chevron Corp

CVX

105.51

+1.55%

7.4K

Exxon Mobil Corp

XOM

91.17

+1.59%

44.6K

Pfizer Inc

PFE

32.48

0.00%

4.2K

Microsoft Corp

MSFT

45.95

-0.01%

8.0K

Travelers Companies Inc

TRV

103.76

-0.01%

1.3K

International Business Machines Co...

IBM

155.65

-0.10%

2.2K

The Coca-Cola Co

KO

42.39

-0.40%

0.5K

Merck & Co Inc

MRK

62.24

-0.64%

0.2K

Johnson & Johnson

JNJ

103.30

-0.67%

48.0K

-

15:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Apple (AAPL) downgrade to Neutral from Buy at Mizuho, target $115

Johnson&Johnson (JNJ) downgraded to Sell from Neutral at Goldman

Other:

Hewlett-Packard (HPQ) removed from Short-Term Buy List at Deutsche Bank

JPMorgan Chase (JPM) target lowered to $65 from $68 at Jefferies

-

14:47

Company News: Bank of America (BAC) reported weaker than expected fourth quarter profits

Bank of America (BAC) earned $0.32 per share in the fourth quarter, missing analysts' estimate of $0.31. Revenue in the fourth quarter dropped 12.7% year-over-year to $20.15 billion, missing analysts' estimate of $21.01 billion.

Bank of America (BAC) shares decreased to $15.54 (-3.12%) prior to the opening bell.

-

14:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1770-80(E570mn), $1.1900(E470mn), $1.2000(E1.0bn)

USD/JPY: Y114.80($500mn), Y115.00($550mn), Y116.75($400mn), Y117.50($610mn), Y118.00($592mn)

GBP/USD: $1.5225(stg150mn), $1.5250(stg180mn)

AUD/USD: $0.8200(A$200mn)

NZD/USD: $0.7750($242mn)

USD/CAD: C$1.1750($761mn), C$1.2000($865mn), C$1.2040($429mn)

-

14:40

German economy grew 1.5% in 2014

The German Federal Statistics Office released preliminary gross domestic product (GDP) data on Thursday. The German economy grew 1.5% in 2014, the best performance in three years.

The increase was driven by higher private consumption as employment and wages were higher and inflation was moderate.

Germany's exports increased 3.7% in 2014 versus 1.6% in the previous year, while imports rose 3.3% versus 3.1% gain in the previous year.

-

14:38

-

14:31

U.S.: PPI, y/y, December +1.1% (forecast +1.2%)

-

14:31

U.S.: PPI excluding food and energy, Y/Y, December +2.1% (forecast +2.0%)

-

14:31

U.S.: NY Fed Empire State manufacturing index , December 9.95 (forecast 5.3)

-

14:30

U.S.: Initial Jobless Claims, January 316 (forecast 299)

-

14:30

U.S.: PPI, m/m, December -0.3% (forecast -0.3%)

-

14:30

U.S.: PPI excluding food and energy, m/m, December +0.3% (forecast +0.1%)

-

14:08

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as the Swiss National Bank (SNB) announced today that it will discontinue the 1.20 per euro exchange rate floor

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom RICS House Price Balance December 13% 11% 11%

00:30 Australia Unemployment rate December 6.2% Revised From 6.3% 6.3% 6.1%

00:30 Australia Changing the number of employed December +44.9 +5.3 +37.4

10:00 Eurozone Trade Balance s.a. November 19.6 Revised From 19.4 21.3 20.0

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. economic data. The U.S. PPI is expected to decline 0.3% in December, after a 0.2% decrease in November.

The number of initial jobless claims in the U.S. is expected to increase by 5,000 to 299,000.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to drop to 20.3 in January from 24.5 in December.

The euro traded lower against the U.S. dollar as the Swiss National Bank (SNB) announced today that it will discontinue the 1.20 per euro exchange rate floor.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

Eurozone's trade surplus widened to €20.0 billion in November from €19.6 billion in October, missing expectations for a rise to €21.3 billion. October's figure was revised up from a surplus of €19.4 billion.

The increase was driven by a weaker euro and falling oil prices.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc plunged against the U.S. dollar as the Swiss National Bank announced today that it will discontinue the 1.20 per euro exchange rate floor. But the SNB added that will remain active in the foreign exchange market.

EUR/USD: the currency pair declined to $1.1779

GBP/USD: the currency pair increased to $1.5262

USD/JPY: the currency pair fell to $116.23

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims January 294 299

13:30 U.S. PPI, m/m December -0.2% -0.3%

13:30 U.S. PPI, y/y December +1.4% +1.2%

13:30 U.S. PPI excluding food and energy, m/m December 0.0% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December +1.8% +2.0%

15:00 U.S. Philadelphia Fed Manufacturing Survey January 24.5 20.3

-

13:50

Orders

EUR/USD

Offers $1.1900, $1.1850-60, $1.1800/03

Bids $1.1625/20

GBP/USD

Offers $1.5400/05

Bids $1.5145/40, $1.5105/00, $1.5055/50

AUD/USD

Offers $0.8300, $0.8250, $0.8200

Bids $0.8150, $0.8110/00, $0.8060/50, $0.8020

EUR/JPY

Offers Y138.00, Y137.50, Y136.80/00

Bids Y135.50, Y135.00, Y134.50

USD/JPY

Offers Y118.00, Y117.50, Y117.15/20

Bids Y116.50, Y116.00, Y115.50

EUR/GBP

Offers stg0.7850/55

Bids stg0.7720, stg0.7700, stg0.7680

-

13:27

Eurozone's trade surplus widened to €20.0 billion in November

Eurostat released trade data for the Eurozone on Thursday. Eurozone's trade surplus widened to €20.0 billion in November from €19.6 billion in October, missing expectations for a rise to €21.3 billion. October's figure was revised up from a surplus of €19.4 billion.

The increase was driven by a weaker euro and falling oil prices.

Exports climbed by 0.2% in November, while imports remained flat.

-

13:00

European stock markets mid-session: SNB sends European indices south in volatile trading after early gains

European indices sharply declined after the SNB decided to discontinue the minimum exchange rate of 1.20 per euro and lowered interest rates more into negative territory to -0.75. The surprise move erased early gains driven by a recovery in commodities. The Swiss franc rallied against its major peers and Swiss stocks plunged.

Earlier in the session markets were driven by expectations that the ECB will implement quantitative easing after its policy meeting on January 22nd after the interim ruling by the European Court of Justice. Yesterday Advocate General Pedro Cruz Villalon of the EU Court of justice in Luxembourg said the ECB's Outright Monetary Transactions program is "in principle" in line with European law and advised the judges to approve the measures.

Investors are looking forward to the European Central Bank policy meeting taking place on January 22nd and the Greek elections on January 25th where the anti-austerity party Syriza, that wants to renegotiate debt, is leading polls. According to Moody the "Grexit" seems a relatively unlikely scenario, even if the anti-austerity party Syriza will win in the upcoming Greek elections.

Eurozone's Trade Balance rose less-than-expected in the last quarter. Analysts forecasted the balance to rise to 21.3 billion, 1.3 billion more than the actual reading reported by Eurostat. In the previous quarter the Trade Balance had a reading of 19.4 billion.

In today's session the FTSE 100 index lost declining -0.61% quoted at 6,349.27. France's CAC 40 lost -0.66% trading at 4,195.46. Germany's DAX 30 is currently trading -0.30% at 9,787.87.

-

12:20

Oil: Prices extend fall on record output

Brent crude and West Texas Intermediate extended losses on Thursday being negative for the last straight seven weeks. Brent Crude lost -2.44%, currently trading at USD47.50 a barrel. West Texas Intermediate declined by -1.40% currently quoted at USD47.80 as Iraq announced to further boost its exports to a record level.

The global glut continues in 2015 and a low global demand weighs amid record output from U.S. shale drillers - U.S. crude production increased by 60,000 barrels a day last week according to the EIA and stockpiles expanded. Both major brands lost more than 50% of their value since mid-2014 but the OPEC, responsible for 40% of worldwide oil-production, decided to leave output-rates unchanged around 30 million barrels a day and repeatedly reaffirmed not to change policy in the fight for market share. Record Russian output not seen since the end of the Soviet Union further adds to the downward pressure on oil prices.

-

12:02

Gold at new 12-week high after SNB decision to lower interest rates and discontinue minimum exchange rate

Gold prices rose sharply close to highs from October 21st 2014 at USD1,254.90 after SNB decided to discontinue the minimum exchange rate of 1.20 per euro and lowered interest rates more into negative territory to -0.75. Yesterday the precious metal already hit a new high at USD1,244.10 intraday but lost afterwards. The precious metal is currently quoted at USD1,248.20, +1,49% a troy ounce.

After gold posted an drop last year for the first time since 2000 HSBC Securities (USA) Inc. sees prices raise in 2015 as Asian consumption rises and investors return to exchange traded products physically backed by the metal. Still, a strong U.S. dollar backed by solid economic growth in the U.S. weighs on the dollar-nominated metal as it becomes more expensive for holders of other currencies.

GOLD currently trading at USD1,248.20

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1770-80(E570mn), $1.1900(E470mn), $1.2000(E1.0bn)

USD/JPY: Y114.80($500mn), Y115.00($550mn), Y116.75($400mn), Y117.50($610mn), Y118.00($592mn)

GBP/USD: $1.5225(stg150mn), $1.5250(stg180mn)

AUD/USD: $0.8200(A$200mn)

NZD/USD: $0.7750($242mn)

USD/CAD: C$1.1750($761mn), C$1.2000($865mn), C$1.2040($429mn)

-

11:01

Eurozone: Trade Balance s.a., November 20.0 (forecast 21.3)

-

10:55

SNB ends minimum of CHF1.20 per euro exchange rate

The Swiss National Bank announced today that it will discontinue the minimum exchange rate of 1.20 per euro and introduced a negative rate of -0.75% on account balances that exceed a given exemption threshold. The news led to a massive rally of the Swiss Franc versus the single currency. The greenback also slumped after the surprise move and hit new lows. The euro also hit new lows at USD1.1574 in highly volatile trading after the news.

-

10:20

Press Review: Wall Street Now Sees Oil Around $40

REUTERS

India makes surprise early rate cut, hints at more

(Reuters) - The Reserve Bank of India surprised markets with a 25 basis point reduction in interest rates on Thursday and signaled it could cut further, amid signs of cooling inflation and what it said was a government commitment to contain the fiscal deficit.

While the early move was unexpected, aggressive reductions in rates have been seen as likely over the course of the coming year to help India's economy out of a rut, with growth rates struggling to recover from their weakest levels since the 1980s.

Source: http://www.reuters.com/article/2015/01/15/us-india-cenbank-idUSKBN0KO0DJ20150115

BLOOMBERG

Wall Street Now Sees Oil Around $40

Brace for $40-a-barrel oil.

The U.S. benchmark crude price, down more than $60 since June to below $45 yesterday, is on the way to this next threshold, said Societe Generale SA and Bank of America Corp. And Goldman Sachs Group Inc. says that West TexasIntermediate needs to remain near $40 during the first half to deter investment in new supplies that would add to the glut.

"The markets are continuing to price in huge oversupply in the first half of 2015," Mike Wittner, head of research at Societe Generale SA in New York, said by phone on Jan. 12. "We're going to go below $40."

Source: http://www.bloomberg.com/news/2015-01-14/oil-at-40-and-below-gaining-traction-on-wall-street.html

BLOOMBERG

What, Us Worry? Economists Stay Upbeat as Markets See Trouble

The U.S. consumer, that dynamo of the global economy, just took a step back.

Relax. It's not that bad, economists say.

News Wednesday that U.S. retail sales unexpectedly declined in December reverberated through financial markets, but few economists read the report as a sign of trouble for the nation's economy.

In fact, many economists say the U.S. economy is doing just fine.

So why did the markets react the way they did? The answer, in part, is that the report added to a wall of worry confronting investors. Topping the 2015 angst-list are the plunge in oil and other commodities, as well as slowdowns in China and Europe.

-

10:00

European Stocks. First hour: Indices recover after yesterday’s commodity rout and World Bank outlook on growth

European indices rebound from yesterday's drop tracking gains in commodities with mining and energy stocks adding the most as copper rose from 5-year lows and oil recovered. Yesterday commodities fell as the World Bank cut its forecast for 2015 despite continuously falling oil prices. The bank cited disappointing growth prospects in the Eurozone and Japan as main reasons. Strong company quarterly results further lend support.

Markets were also driven by expectations that the ECB will implement quantitative easing at its policy meeting on January 22nd after the interim ruling by the European Court of Justice. Yesterday Advocate General Pedro Cruz Villalon of the EU Court of justice in Luxembourg said the ECB's Outright Monetary Transactions program is "in principle" in line with European law and advised the judges to approve the measures.

The FTSE 100 index, the most commodity-and energy heavy index out of the three, is currently trading +1.14% quoted at 6,461.19 points, Germany's DAX 30 added +1.24% trading at 9,938.53. France's CAC 40 rose +1.31%, currently trading at 4,278.64 points.

Market participants are looking forward to the publication of the Eurozone's Trade Balance and later in the day the NY Fed Empire State manufacturing index, Initial Jobless claims and the Producer Price Index as well as the Philadelphia Fed Manufacturing Survey in the U.S.

-

09:00

Global Stocks: U.S. indices decline, Nikkei, Hang Seng and Shanghai Composite add gains

U.S. markets closed lower on Wednesday after disappointing retail sales data showig the steepest drop in almost a year, with losses in the Basic Materials, Consumer Services and Financials losing the most. The DOW JONES index lost -1.06%, 186 points, closing at 17,427.09. The S&P 500 declined by -0.58% with a final quote of 2,011.27, dropping intraday below the level of 2,000 points.

Chinese stock markets rose on Thursday. Hong Kong's Hang Seng added +0.86% with a final quote of 24,319.17 points. China's Shanghai Composite closed at 3,335.88 points, adding 3.52%. China was reported to have broadened lending rules amid surging loan growth.

Japan's Nikkei advanced +1.86% posting the biggest gains in 4 weeks closing at 17,108.70 points after yesterday's sharp decline. A rebound in oil eased worries about global growth and lifted energy shares and a weaker Japanese yen helped exporters. Bank of Japan Governor Haruhiko Kuroda said that the bank will maintain stimulus measures until inflation is stable at 2 percent as monetary easing has its intended effects. Core Machinery Orders in November grew less-than expected +1.3%, analysts predicted +4.8%. Year on year Orders declined -14.6%, far more than the forecasted -5.8%.

-

09:00

Global Stocks: U.S. indices decline on disappointing results and mixed data

U.S. markets closed lower on Wednesday for a fifth day as bank results disappointed and energy shares extended losses on falling oil prices. According to Reuters expectations for U.S. fourth-quarter earnings have been scaled back sharply. The SNB's decision to scrap its cap to the franc further added to volatility. A mixed set of economic data added to the negative sentiment. The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to 6.3 in January from 24.5 in December. That was the lowest level since February 2014. Analysts had expected the index to decline to 20.3. The DOW JONES index lost -0.61%, declining by 106 points, closing at 17,320.71. The S&P 500 declined by -0.92% with a final quote of 1,992.67, falling below the level of 2,000 points for the first time in a month.

Chinese stock markets were mixed on Friday amid speculation the government will increase stimulus to boost economic growth. Hong Kong's Hang Seng trading -0.80% at 24,156.92 points. China's Shanghai Composite closed at 3,377.43 points, adding +1.23% extending its longest weekly winning streak in 8 years.

Japan's Nikkei fell to a 2-½ moth low during trade. The index closed -1.43 at 16,864.16 points falling for a third week. A strong yen as a result of flight to safety weighed Japanese stocks down. At markets close speculations on pension funds and the BOJ buying stocks trimmed losses and investors saw the sharp decline in prices as buying opportunity.

-

08:30

Foreign exchange market. Asian session: U.S. dollar trading stronger despite disappointing retail sales data

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom RICS House Price Balance December 13% 11% 11%

00:30 Australia Unemployment rate December 6.2% 6.3% 6.1%

00:30 Australia Changing the number of employed December +42.7 +5.3 +37.4

The U.S. dollar remained broadly stronger against its major peers, with exception of the Australian and New Zealand's dollar, despite disappointing retail sales data covering the holiday shopping season published yesterday. The euro was under further pressure after Advocate General Pedro Cruz Villalon of the EU Court of justice in Luxembourg said the ECB's Outright Monetary Transactions program is "in principle" in line with European law, backing Mario Draghi's plans for QE after the policy meeting on January 22nd.

Today investors look ahead to data on the NY Fed Empire State manufacturing index and Initial Jobless claims and the Producer Price Index.

The Australian dollar strengthened towards a one-month high on better-than expected job data after the currency was hit yesterday by a plunge of copper prices and dropped the most since January 2nd. According to official data the Unemployment Rate declined from revised 6.2% in November to 6.1% in December, beating forecasts of a rise to 6.3%. 37,400 new jobs were created in December, analyst expected a rise of 5,300.

New Zealand's dollar traded higher against the greenback. Data on New Zealand's Food Price Index for December had a reading of +0.3% compared to -0.5% in November. On a yearly basis Food Prices rose by 1.0%.

The Japanese yen declined versus the greenback. Bank of Japan Governor Haruhiko Kuroda said that the bank will maintain stimulus measures until inflation is stable at 2 percent as monetary easing has its intended effects. Core Machinery Orders in November grew less-than expected +1.3%, analysts predicted +4.8%. Year on year Orders declined -14.6%, far more than the forecasted -5.8%.

EUR/USD: the euro traded weaker against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Trade Balance s.a. November 19.4 21.3

13:30 U.S. NY Fed Empire State manufacturing index December -3.6 5.3

13:30 U.S. Initial Jobless Claims January 294 299

13:30 U.S. PPI, m/m December -0.2% -0.3%

13:30 U.S. PPI, y/y December +1.4% +1.2%

13:30 U.S. PPI excluding food and energy, m/m December 0.0% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December +1.8% +2.0%

15:00 U.S. Philadelphia Fed Manufacturing Survey January 24.5 20.3

23:50 Japan Tertiary Industry Index November -0.2% +0.3%

-

07:28

Options levels on thursday, January 15, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1975 (1139)

$1.1918 (2663)

$1.1873 (710)

Price at time of writing this review: $ 1.1761

Support levels (open interest**, contracts):

$1.1707 (2097)

$1.1664 (3787)

$1.1609 (6696)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 50060 contracts, with the maximum number of contracts with strike price $1,2100 (4783);

- Overall open interest on the PUT options with the expiration date February, 6 is 56790 contracts, with the maximum number of contracts with strike price $1,1700 (6696);

- The ratio of PUT/CALL was 1.13 versus 1.14 from the previous trading day according to data from January, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.5403 (462)

$1.5304 (415)

$1.5307 (396)

Price at time of writing this review: $1.5224

Support levels (open interest**, contracts):

$1.5189 (537)

$1.5093 (1717)

$1.4995 (1166)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 15304 contracts, with the maximum number of contracts with strike price $1,5800 (1108);

- Overall open interest on the PUT options with the expiration date February, 6 is 17195 contracts, with the maximum number of contracts with strike price $1,5100 (1717);

- The ratio of PUT/CALL was 1.12 versus 1.12 from the previous trading day according to data from January, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

Nikkei 225 17,001.64 +205.68 +1.22%, Hang Seng 24,110.96 -1.64 -0.01%, Shanghai Composite 3,209.08 -13.36 -0.41%

-

01:31

Australia: Unemployment rate, December 6.1% (forecast 6.3%)

-

01:31

Australia: Changing the number of employed, December +37.4 (forecast +5.3)

-

01:02

United Kingdom: RICS House Price Balance, December 11% (forecast 11%)

-

00:51

Japan: Core Machinery Orders, y/y, November -14.6% (forecast -5.8%)

-

00:50

Japan: Core Machinery Orders, November +1.3% (forecast +4.8%)

-

00:32

Commodities. Daily history for Jan 14’2015:

(raw materials / closing price /% change)

Light Crude 48.62 +0.29%

Gold 1,229.10 -0.44%

-

00:31

Stocks. Daily history for Jan 14’2015:

(index / closing price / change items /% change)

Nikkei 225 16,795.96 -291.75 -1.71%

Hang Seng 24,112.6 -103.37 -0.43%

Shanghai Composite 3,223.25 -12.05 -0.37%

FTSE 100 6,388.46 -153.74 -2.35%

CAC 40 4,223.24 -67.04 -1.56%

Xetra DAX 9,817.08 -123.92 -1.25%

S&P 500 2,011.27 -11.76 -0.58%

NASDAQ Composite 4,639.32 -22.18 -0.48%

Dow Jones 17,427.09 -186.59 -1.06%

-

00:28

Currencies. Daily history for Jan 14’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1788 +0,14%

GBP/USD $1,5231 +0,47%

USD/CHF Chf1,0185 -0,14%

USD/JPY Y117,32 -0,51%

EUR/JPY Y138,31 -0,38%

GBP/JPY Y178,71 -0,07%

AUD/USD $0,8148 -0,20%

NZD/USD $0,7714 -0,29%

USD/CAD C$1,1950 -0,05%

-

00:00

Schedule for today, Thursday, Jan 15’2015:

(time / country / index / period / previous value / forecast)

00:01 United Kingdom RICS House Price Balance December 13% 11%

00:30 Australia Unemployment rate December 6.3% 6.3%

00:30 Australia Changing the number of employed December +42.7 +5.3

10:00 Eurozone Trade Balance s.a. November 19.4 21.3

13:30 U.S. NY Fed Empire State manufacturing index December -3.6 5.3

13:30 U.S. Initial Jobless Claims January 294 299

13:30 U.S. PPI, m/m December -0.2% -0.3%

13:30 U.S. PPI, y/y December +1.4% +1.2%

13:30 U.S. PPI excluding food and energy, m/m December 0.0% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December +1.8% +2.0%

15:00 U.S. Philadelphia Fed Manufacturing Survey January 24.5 20.3

23:50 Japan Tertiary Industry Index November -0.2% +0.3%

-