Noticias del mercado

-

22:06

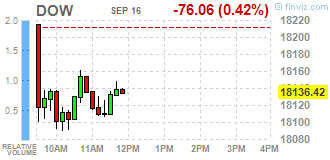

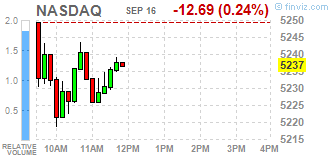

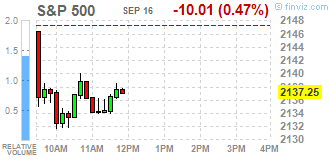

Major US stock indices ended the session down

Major stock Wall Street indices closed in the red zone against the backdrop of falling shares of Oracle (ORCL), which led to a decrease in the technology sector. The focus of investors were shares of Deutsche Bank (DB), which have fallen by more than 9% on news that the US Department of Justice required by the lender to pay $ 14 billion. As a settlement in the case of fraudulent mortgage loans in the period from 2005 to 2007.

In addition, as shown by the preliminary results of the studies submitted by Thomson-Reuters and Institute of Michigan, showed in September the US consumers feel at the same level in relation to the economy, as in the past month. According to the data, in September consumer sentiment index was at 89.8 points. It was predicted that the index was 90.8 points.

Oil prices fell to multi-week lows, as the increase in Iranian exports and the resumption of oil supplies from Libya and Nigeria heightened investors' fears that the global glut will persist. The cost of oil futures for Brent and WTI fell by 9-10% within one week, underscoring the volatility of the oil market. "We've seen a lot of bearish news this week The weak fundamental factors are putting pressure on the market.", - Said Frank Klumpp, an oil analyst at LBBW.

Most DOW components of the index closed in negative territory (23 of 30). Most remaining shares rose Intel Corporation (INTC, + 3.21%). Outsider were shares of United Technologies Corporation (UTX, -2.44%).

Almost all of the S & P registered a decline. The leader turned conglomerates sector (+ 1.7%). financial sector (-0.9%) fell the most.

At the close:

Dow -0.49% 18,123.80 -88.68

Nasdaq -0.10% 5,244.57 -5.12

S & P -0.38% 2,139.16 -8.10

-

22:01

U.S.: Net Long-term TIC Flows , July 103.9 (forecast 30.2)

-

22:00

U.S.: Total Net TIC Flows, July 140.6

-

21:00

Dow -0.54% 18,114.28 -98.20 Nasdaq -0.27% 5,235.52 -14.17 S&P -0.53% 2,135.98 -11.28

-

18:00

European stocks closed: FTSE 100 -20.02 6710.28 -0.30% DAX -155.03 10276.17 -1.49% CAC 40 -40.77 4332.45 -0.93%

-

17:53

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes near session lows on Friday as Oracle led a decline in tech stocks and financials came under pressure in the wake of Deutsche Bank's $14 billion fine. The far bigger-than-expected penalty was levied by the U.S. Department of Justice to settle claims that the German bank missold mortgage-backed securities. Deutsche Bank's U.S.-listed shares (DB) were down 9,3%.

Most of Dow stocks in negative area (27 of 30). Top gainer - Intel Corporation (INTC, +2.27%). Top loser - Cisco Systems, Inc. (CSCO, -1.88%).

Most of all S&P sectors also in negative area. Top gainer - Conglomerates (+0.4%). Top loser - Financial (-1.0%).

At the moment:

Dow 18047.00 -68.00 -0.38%

S&P 500 2128.75 -9.25 -0.43%

Nasdaq 100 4804.50 -9.25 -0.19%

Oil 43.87 -0.65 -1.46%

Gold 1312.60 -5.40 -0.41%

U.S. 10yr 1.70 -0.01

-

17:46

Oil falls through important support but recovers

Oil prices fell to multi-week lows as the increase in Iranian exports and the resumption of oil supplies from Libya and Nigeria heightened investors' fears that the global glut will persist.

The cost of oil futures for Brent and WTI fell by 9-10 percent in one week, stressing the volatility in the oil market. "We've seen a lot of bearish news this week. The weak fundamental factors are putting pressure on the market.", - Said Frank Klumpp, oil analyst at LBBW.

Strengthening of the dollar against the backdrop of positive US data also important for oil trading. The US Dollar Index, showing the US dollar against a basket of six major currencies, rose 0.7%. As oil prices are tied to the dollar, a stronger dollar makes oil more expensive for holders of foreign currencies.

Up to August, Iran, the third largest producer of OPEC exports increased by more than 2 million barrels per day. Most of the additional Iran's exports went to Asia and Europe. Daily crude oil imports from Iran and India rose in August to the highest level in at least 15 years. At the same time, Austria's OMV said it has taken delivery of Iranian oil in the port of Italy. It was the first cargo from Iran since 2012.

There are also signs of the resumption of oil supplies from Nigeria and Libya. Earlier, crude oil exports by these countries has been hampered by conflict and unrest. This week, the State Oil Corporation of Libya has removed restrictions on the supply of oil from a number of ports with total capacity of 300 thousand barrels per day. Meanwhile, Exxon Mobil and Royal Dutch Shell said that are ready to resume the supply of Nigerian grade Qua Iboe. According to estimates, Libya and Nigeria may return the market about 800 thousand barrels per day.

The cost of the October futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 43.28 dollars per barrel on the New York Mercantile Exchange.

October futures price for North Sea petroleum mix of mark Brent fell to 46.12 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:38

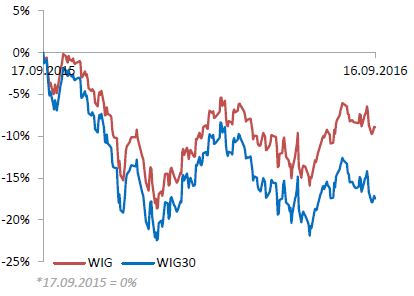

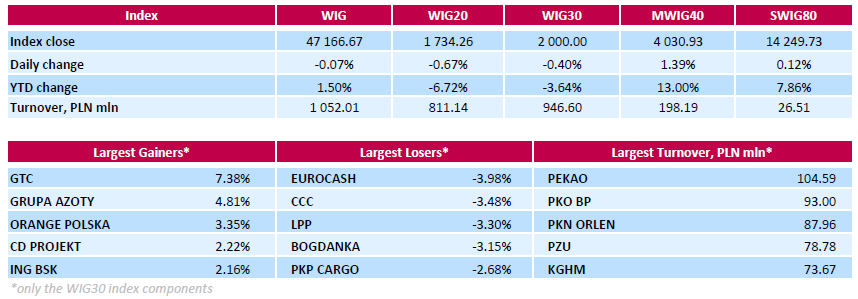

WSE: Session Results

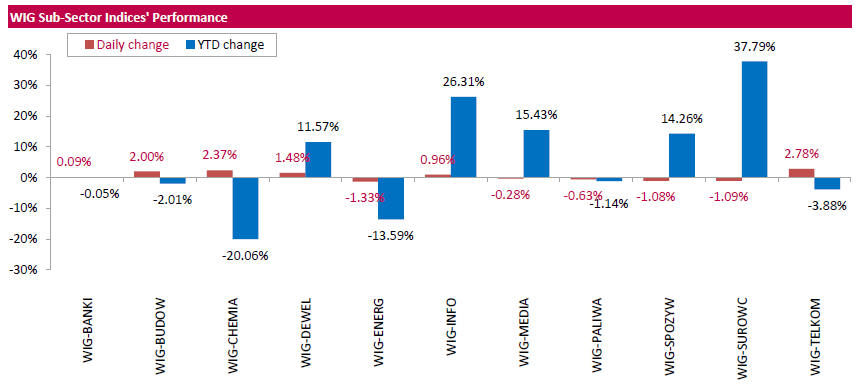

Polish equity market closed little changed on Friday. The broad market measure, the WIG Index, edged down 0.07%. Sector performance within the WIG Index was mixed. Utilities (-1.33%) sank the most, while telecoms (+2.78%) outperformed.

The large-cap stocks' measure, the WIG30 index, went down 0.4%. In the index basket, FMCG-wholesaler EUROCASH (WSE: EUR) led the decliners with a 3.98% drop, followed by thermal coal miner BOGDANKA (WSE: LWB) and two apparel retailers CCC (WSE: CCC) and LPP (WSE: LPP), retreating by 3.15%-3.48%. Elsewhere, Poland's state-controlled utilities PGE (WSE: PGE), ENERGA (WSE: ENG) and ENEA (WSE: ENA) as well as oil and gas producer PGNIG (WSE: PGN) recorded losses between 0.93% and 2.36%, weighted down by the announcement the companies jointly submitted a preliminary, nonbinding offer for purchase of Polish assets of France's power group EDF. On the country, property developer GTC (WSE: GTC), chemical producer GRUPA AZOTY (WSE: ATT) and telecommunication services provider ORANGE POLSKA (WSE: OPL) were the biggest advancers, gaining 7.38%, 4.81% and 3.35% respectively.

-

17:30

Gold declines for the second day in a row

Gold fell markedly reaching a two-week low move caused by the publication of inflation data from the US, which increased the likelihood of a hike by Federal Reserve later this year.

US Labor Department said that consumer prices rose more than expected in August as rising rents and health care costs offset a drop in gasoline prices, pointing to a steady build-up of inflation. According to the report, the consumer price index rose 0.2 percent last month after being unchanged in July. In the 12 months to August, the consumer price index increased 1.1 percent after rising 0.8 percent in July. Economists had forecast that the CPI will rise by 0.1 percent for the month and 1.0 percent per annum. The core CPI price which excludes food and energy, rose 0.3 percent, the biggest increase since February, after rising 0.1 percent in July. Core CPI rose by 2.3 percent in the 12 months to August, after rising 2.2 percent in July.

The surge in inflation is likely to be welcomed by representatives of the Federal Reserve when they meet next Tuesday and Wednesday to discuss monetary policy. According to the futures market, the likelihood of tighter monetary policy in September is 15% against 12% the previous day and at the December meeting a hike is estimated at 56.5% compared with 47.4% of the previous day.

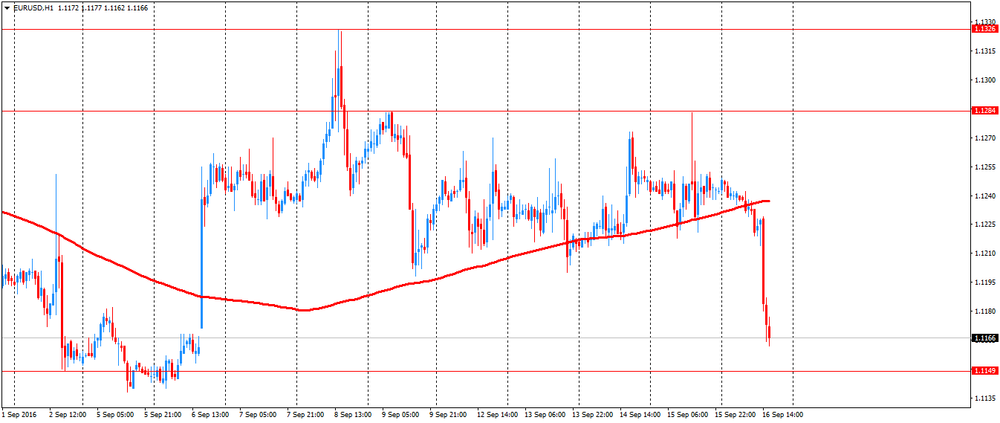

"The inflation data were positive for the US dollar, and this put pressure on the gold price - ThinkMarkets, Naeem Aslam -. The precious metal is now trading close enough to the level of technical support $ 1,300, and if we overcome this level, it will be a bearish signal for gold" . The US Dollar Index, showing the US dollar against a basket of six major currencies, rose 0.7%. Since gold prices are tied to the dollar, a stronger dollar makes the precious metal more expensive for holders of foreign currencies.

Gold reserves in the largest investment fund SPDR Gold Trust fell yesterday by 3.3 tons. Meanwhile, the demand for gold in India remained weak which prevented higher prices for precious metals.

The cost of the October futures for gold on the COMEX fell to $ 1310.1 per ounce.

-

16:31

-

16:09

US consumer sentiment little changed in September. The dollar continue to rise

Confidence was unchanged in early September from the August final and barely different from the July reading. Small and offsetting changes have taken place in the third quarter 2016 surveys: modest gains in the outlook for the national economy have been offset by small declines in income prospects as well as buying plans.

While income gains expected during the year ahead have edged upward, declines in inflation expectations were the main reasons future financial prospects improved, as both near and long term inflation expectations fell to near record lows. Nonetheless, buying plans suffered from the perception that no additional price discounts would be offered.

Even the more optimistic outlook for the economy had little if any impact on the expected growth rate in new jobs. Importantly, all of these changes were relatively minor. Overall, consumers remain reasonably optimistic about their economic prospects. Real personal consumption expenditures can be expected to grow by 2.6% through mid 2017.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, September 89.8 (forecast 90.8)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 1.11bln) 1.1200 (526m) 1.1230-35 (1.75bln) 1.1275-80 (382m)1.1300 (473m) 1.1320 (660m)

USD/JPY: 100.00-05 (1.06bln) 101.00 (464m) 101.50 (310m) 102.00 (291m) 102.50 (410m) 102.70-75 (910m) 103.00 (407m) 103.50 (246m) 104.00 (1.53bln)

GBP/USD 1.3250 (756m) 1.3350 (565m) 1.3450 (245m)

AUD/USD: 0.7345-50 (AUD 256m) 0.7600 (553m)0.7530 (250m) 0.7650 (485m)

USD/CAD: 1.2800 (280m) 1.2855 (280m) 1.2870 (280m) 1.3000 (916m) 1.3100 (336m)1.3400 (220m)

AUD/JPY 75.00 (AUD 249m)) 76.25 (250m) 77.25 (228m)

AUD/NZD 1.0440 (AUD 280m)

-

15:38

WSE: After start on Wall Street

Today's readings of CPI inflation in the United States provide arguments for the September increase in the cost of credit. CPI and CPI-Core were in August higher than expected and the market reaction is adequate to the data. Strengthening of the dollar sheds EURUSD pair into daily lows. Retreating also contracts on the S&P500 and the German DAX. The Warsaw Stock Exchange should follow the environment, but slowly approaching the time for determining the settlement price of contracts on the WIG20 and we think that this is the most important topic of today's session.

-

15:33

U.S. Stocks open: Dow -0.46%, Nasdaq -0.24%, S&P -0.41%

-

15:28

Before the bell: S&P futures -0.19%, NASDAQ futures -0.14%

U.S. stock-index futures slipped as investors awaited next week's Federal Reserve meeting, with economic indicators pointing to uneven growth in the world's largest economy.

Global Stocks:

Nikkei 16,519.29 +114.28 +0.70%

Hang Seng Closed

Shanghai Closed

FTSE 6,713.84 -16.46 -0.24%

CAC 4,339.82 -33.40 -0.76%

DAX 10,316.55 -114.65 -1.10%

Crude $43.12 (-1.80%)

Gold $1313.90 (-0.31%)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.38

-0.09(-0.9504%)

6650

Amazon.com Inc., NASDAQ

AMZN

772

2.31(0.3001%)

28712

Apple Inc.

AAPL

115.13

-0.44(-0.3807%)

504951

Barrick Gold Corporation, NYSE

ABX

17.53

-0.12(-0.6799%)

38051

Caterpillar Inc

CAT

81.5

-0.53(-0.6461%)

732

Citigroup Inc., NYSE

C

46.56

-0.52(-1.1045%)

43781

Exxon Mobil Corp

XOM

83.9

-1.18(-1.3869%)

52406

Facebook, Inc.

FB

128.01

-0.34(-0.2649%)

25814

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.64

-0.14(-1.4315%)

49255

General Electric Co

GE

29.69

-0.06(-0.2017%)

12322

General Motors Company, NYSE

GM

31.34

0.22(0.7069%)

150

Goldman Sachs

GS

167

-1.08(-0.6426%)

400

Google Inc.

GOOG

769.5

-2.26(-0.2928%)

1861

Intel Corp

INTC

36.48

-0.08(-0.2188%)

6932

JPMorgan Chase and Co

JPM

66.3

-0.34(-0.5102%)

11332

Microsoft Corp

MSFT

57.03

-0.16(-0.2798%)

3050

Nike

NKE

55.41

-0.06(-0.1082%)

101

Procter & Gamble Co

PG

87.5

-0.56(-0.6359%)

584

Starbucks Corporation, NASDAQ

SBUX

53.98

-0.13(-0.2403%)

3298

Tesla Motors, Inc., NASDAQ

TSLA

200

-0.42(-0.2096%)

2476

Twitter, Inc., NYSE

TWTR

18.89

0.59(3.224%)

541951

Verizon Communications Inc

VZ

51.8

-0.18(-0.3463%)

153

Visa

V

82.2

0.19(0.2317%)

2000

Wal-Mart Stores Inc

WMT

72.46

0.06(0.0829%)

849

Walt Disney Co

DIS

93.81

1.31(1.4162%)

140

Yahoo! Inc., NASDAQ

YHOO

43.89

-0.10(-0.2273%)

301

Yandex N.V., NASDAQ

YNDX

20.46

-0.04(-0.1951%)

200

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Citigroup (C) downgraded to Neutral from Buy at Goldman

Other:

Coca-Cola (KO) initiated with a Neutral at Credit Suisse; target $44

Wal-Mart (WMT) resumed/upgraded with a Outperform at Credit Suisse

Amazon (AMZN) target raised to $1000 from $840 at RBC Capital Mkts

Apple (AAPL) target raised to $140 from $120 at Canaccord Genuity

-

14:41

Foreign investment in Canadian securities slowed for a fourth straight month

Foreign investment in Canadian securities slowed for a fourth straight month to $5.2 billion in July. At the same time, Canadian investors continued to invest in foreign securities by adding $4.6 billion to their holdings.

Foreign investment in Canadian securities slowed for a fourth straight month to $5.2 billion in July. Non-resident investors resumed their acquisitions of Canadian debt securities, but purchased equities at a much slower pace. Despite the lower activity in July, foreign investment in Canadian securities from January to July was strong, totalling $85.7 billion, compared with $65.9 billion for the same period in 2015.

Foreign investors acquired $6.2 billion of Canadian bonds in July, mainly secondary market purchases of government instruments denominated in Canadian dollars. Foreign investment was led by a $4.8 billion acquisition of federal government bonds, following a divestment of $8.1 billion in June. On the other hand, non-resident investors reduced their exposure to private corporate bonds for the first time since October 2015, as retirements exceeded new issues. In July, Canadian long-term interest rates were down by five basis points and the Canadian dollar depreciated by 0.8 US cent against its US counterpart.

-

14:39

Canadian manufacturing sales edged up 0.1% in July

Manufacturing sales edged up 0.1% in July to $50.7 billion. Higher sales in the food, petroleum and coal products, and primary metals industries were largely offset by a decrease in the production of aerospace product and parts, and by lower machinery sales.

Overall, sales were up in 9 of 21 industries, representing about 54% of the manufacturing sector. Non-durable goods rose 1.0% to $23.6 billion, while durable goods decreased 0.7% to $27.0 billion.

Constant dollar sales increased 0.6%, indicating that a higher volume of goods was sold in July.

-

14:37

US CPI better than forecast up 1.1% y/y

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in August on a seasonally adjusted basis, the U.S. Bureau of Labor Statistic reported today. Over the last 12 months, the all items index rose 1.1 percent before seasonal adjustment.

The seasonally adjusted increase in the all items index was caused by a rise in the index for all items less food and energy. It increased 0.3 percent in August, as the indexes for shelter and medical care advanced.

The energy and food indexes were both unchanged in August. Major energy component indexes were mixed, with increases in the indexes for natural gas and electricity offsetting declines in the gasoline and fuel oil indexes. The food at home index declined for the fourth month in a row, offsetting an

increase in the index for food away from home.

The 0.3-percent increase in the index for all items less food and energy was the largest rise since February 2016. Along with shelter and medical care, the indexes for motor vehicle insurance, apparel, communication, and tobacco all increased. In contrast, the indexes for used cars and trucks, household furnishings and operations, recreation, and airline fares all declined in August. -

14:30

Canada: Manufacturing Shipments (MoM), July 0.1% (forecast 1%)

-

14:30

U.S.: CPI, Y/Y, August 1.1% (forecast 1%)

-

14:30

Canada: Foreign Securities Purchases, July 5.23 (forecast 10.12)

-

14:30

U.S.: CPI excluding food and energy, Y/Y, August 2.3% (forecast 2.2%)

-

14:30

U.S.: CPI, m/m , August 0.2% (forecast 0.1%)

-

14:30

U.S.: CPI excluding food and energy, m/m, August 0.3% (forecast 0.2%)

-

14:21

European session review: US dollar rose against major currencies

The following data was published:

(Time / country / index / period / previous value / forecast)

-----

The US dollar rose against other major currencies, but gains are limited as investors remain cautious ahead of today's US data and the Federal Reserve meeting next week.

The Commerce Department reported that retail sales in the US fell by 0.3% compared with the previous month, more than the projected decline of 0.1%. The decline was the first in five months.

Meanwhile, the Ministry of Labor said that the number of initial unemployment claims in the US rose last week, less than expected, indicating improvement in the labor market.

Labor Department also reported that the index of producer prices in the US remained unchanged in August.

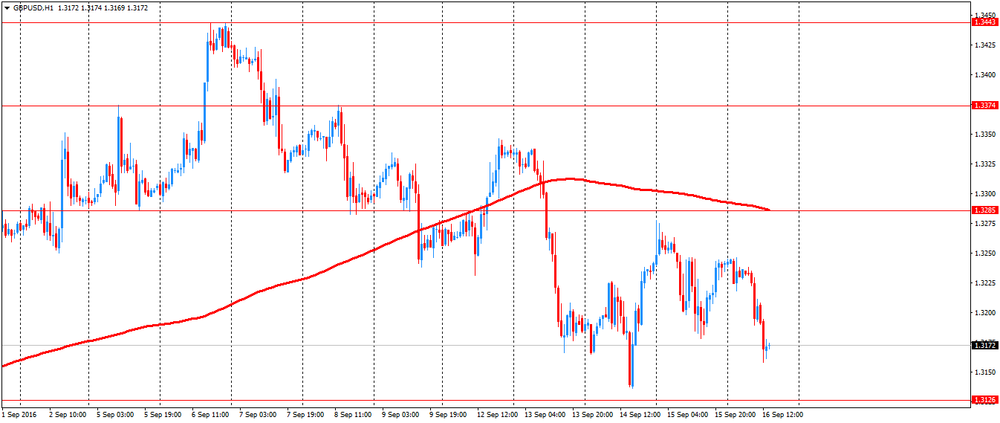

The pound fell against the dollar, while taking into account the fact that the British economic calendar for today is empty, investors will focus on the changes in risk appetite and US statistics. In addition, there may be some adjustment of positions before the weekend.

Market participants also continue to analyze the results of yesterday's meeting of the Bank of England. Recall, the Bank of England kept interest rates and quantitative easing unchanged at 0.25% and 425 billion pounds, respectively..

All nine members of the MPC voted unanimously for keeping the key rate. However, the statement was ambiguous, because the leaders of the Central Bank recognized that a number of short-term economic indicators in some ways turned out to be stronger than expected.

They also indicated that they expect at least a significant slowdown in economic growth in the second half of the year. At the same time, the Central Bank has signaled its readiness to lower the rate again if economic growth continues to slow in line with expectations.

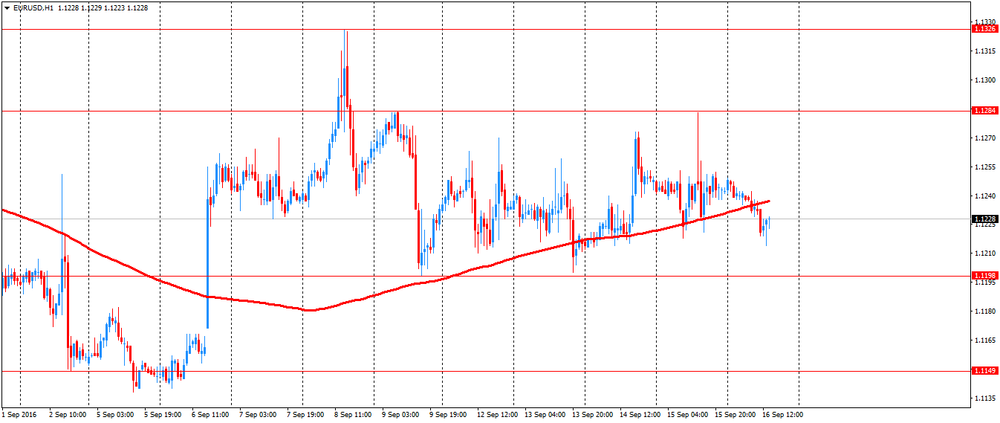

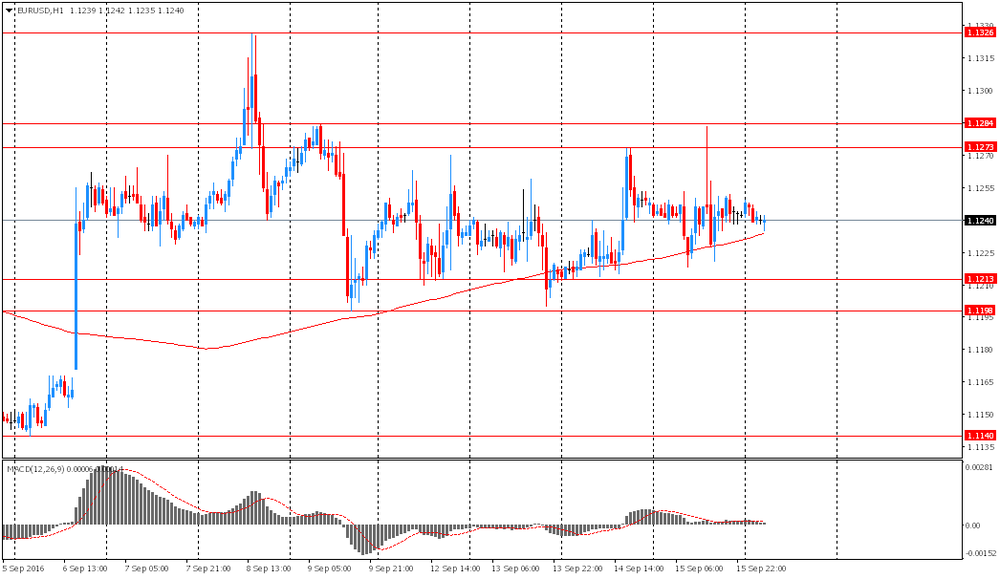

EUR / USD: during the European session, the pair fell to $ 1.1214

GBP / USD: during the European session, the pair fell to $ 1.3158

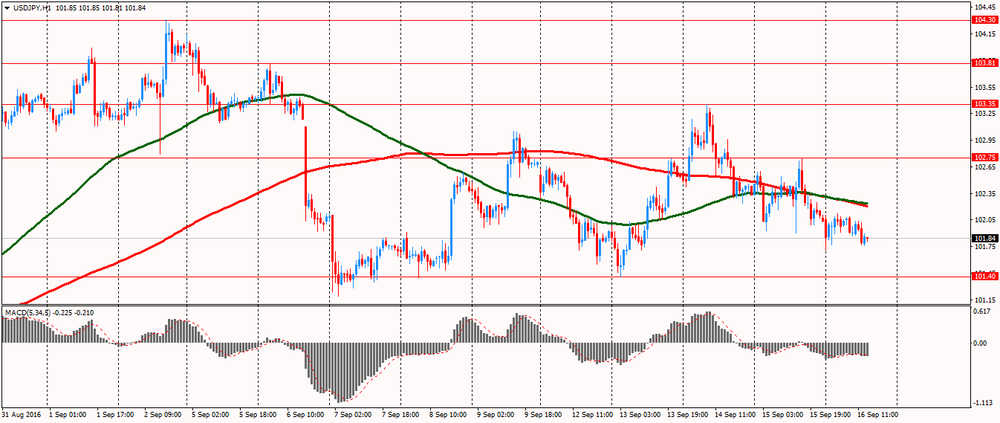

USD / JPY: during the European session, the pair is trading flat

-

13:01

WSE: Mid session comment

The first half of today's trading is part of the scenario usually played on settlement day of derivatives. Low activity accompanied by modest volatility. The market is shallow and the bulls failed to overcome the resistance level at 1,750 points. This quiet waiting for the final hour of the session was disrupted by changes in the key indices Euroland. The DAX went at daily minima daily losing more than 1 percent. That's exactly what we have in Paris. Our market did not react to this fact and still bravely holding up with a fall of the WIG20 index 0.56 percent.

-

12:50

USD/JPY: Preparing For Another Disappointing BoJ Meeting - Credit Suisse

"The BoJ meeting on 20-21 September appears to be attracting more market attention than the Fed meeting also taking place on 21 September. Option markets show a clear premium in USDJPY vol vs. the rest of G10 vol around the two-week tenor coinciding with the BoJ meeting

Indications of strong market interest in JPY abound across the vol space. The divergence in implied correlations, with JPY correlation drifting higher suggests markets are looking at the JPY as a potential driver for FX volatility (Figure 6). At the same time, the front-end tenor USDJPY risk reversal skew has moved close to zero over the course of the past few weeks, pricing USDJPY calls at a near flat premium to USDJPY puts

This sharp increase in demand for optionality around the BoJ meeting and the shift in relative pricing for USDJPY calls vs. puts to the highest point in almost a year suggests the market is approaching the upcoming BoJ meeting with high expectations for a dovish outcome, one that would likely drive spot USDJPY higher. We think these expectations will once again be disappointed.

Our economists are in fact expecting little to no change in policy from the BoJ at the upcoming meeting. Specifically, the spotlight next week is expected to be on the BoJ's "comprehensive assessment" of its NIRP+QQE policies. Our economics team believes this assessment will be broadly positive, pointing to improved borrowing and investment data as proof of its policies' success. In absence of a considerable change in how BoJ officials view their own policies, a significant change in said measures is unlikely.

If anything, our team believes there is a small possibility of a cut in the tier 3 IOER rate from -0.1% to -0.2%, or of a slight upgrade in JGB purchase targets from JPY80tn to JPY80-90tn.

In light of the large and rapid shift in expectations, we are not convinced that such changes are likely to be viewed as satisfactory relative to market pricing, especially at a time when much more aggressive policy options (e.g., direct financing of government spending on infrastructure) are being weighed in the financial press. As such, we see high potential for disappointment and continue to target USDJPY at 95 in three months.

As a technical-based trade, Credit Suisse maintains a short USD/JPY trade from 103.90 targeting 100".

Copyright © 2016 Credit Suisse, eFXnews™

-

12:17

BOE's Forbes: Pounds depreciation since the vote should improve the UK's net foreign asset position by over 20% of GDP

-

Sterling depreciation since Brexit vote is leading to some automatic adjustments in the UK current account balance

-

Depreciation since the vote should improve the UK's net foreign asset position by over 20% of GDP

-

Improvement in the UK's net international asset position should alleviate investor concerns

*via forexlive -

-

11:09

Oil trading lower

This morning, New York crude oil futures for WTI have fallen in price by 0.96% to $ 43.49 and Brent oil futures fell in price by -0.97% to $ 46.15 per barrel. Thus, the black gold is traded lower on the background of concerns about the continuing increase in the number of drilling rigs in the United States, and that the restoration of the supply of oil from Libya and Nigeria exacerbate global oversupply. Data on the number of US rigs from Baker Hughes for the week will be released later today. Recovery of oil supplies from Libya and Nigeria would be an obstacle to the rebalancing of the global oil market.

-

11:06

Wages in eurozone rose 0.9% in Q2

Hourly labour costs rose by 1.0% in the euro area (EA19) and by 1.4% the EU28 in the second quarter of 2016, compared with the same quarter of the previous year. In the first quarter of 2016, hourly labour costs increased by 1.6% in both zones. These figures are published by Eurostat, the statistical office of the European Union. The two main components of labour costs are wages & salaries and non-wage costs.

In the euro area, wages & salaries per hour worked grew by 0.9% and the non-wage component by 1.4%, in the second quarter of 2016 compared with the same quarter of the previous year. In the first quarter of 2016, the annual changes were +1.7% and +1.5% respectively. In the EU28, hourly wages & salaries rose by 1.3% and the non-wage component by 1.6% in the second quarter of 2016. In the first quarter of 2016, annual changes were +1.6% for both components.

-

10:39

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 1.11bln) 1.1200 (526m) 1.1230-35 (1.75bln) 1.1275-80 (382m)1.1300 (473m) 1.1320 (660m)

USD/JPY: 100.00-05 (1.06bln) 101.00 (464m) 101.50 (310m) 102.00 (291m) 102.50 (410m) 102.70-75 (910m) 103.00 (407m) 103.50 (246m) 104.00 (1.53bln)

GBP/USD 1.3250 (756m) 1.3350 (565m) 1.3450 (245m)

AUD/USD: 0.7345-50 (AUD 256m) 0.7600 (553m)0.7530 (250m) 0.7650 (485m)

USD/CAD: 1.2800 (280m) 1.2855 (280m) 1.2870 (280m) 1.3000 (916m) 1.3100 (336m)1.3400 (220m)

AUD/JPY 75.00 (AUD 249m)) 76.25 (250m) 77.25 (228m)

AUD/NZD 1.0440 (AUD 280m)

-

09:58

EU economic summit ongoing. On the agenda Brexit consequences

EU leaders meet today in Bratislava.

France President Hollande:

-

EU leaders will talk security, economy.

-

EU needs to give hope to young generation.

Merkel:

-

EU in critical situation.

-

need to tackle security, defence, protect EU borders.

-

seeks concrete steps at meeting.

-

-

09:43

Major stock markets trading in the red zone: FTSE -0.2%, DAX -0.3%, CAC40 -0.3%, FTMIB -0.5%, IBEX -0.2%

-

09:14

WSE: After opening

WIG20 index opened at 1745.20 points (-0.04%)*

WIG 47254.48 0.12%

WIG30 2010.59 0.13%

mWIG40 3983.23 0.19%

*/ - change to previous close

Yesterday, strong growth, session in the US had no impression on investors in Europe. This is evidenced by cons of contracts for the major European indices in the morning and slightly downward opening of the Warsaw Stock Exchange. Today we have a day of witches - settlement of the September series of futures contracts. This specific session, which usually doing flat character, a real trading occurs only in the last hour.

In the first transactions on the cash market bulls have managed to maintain and even improve the growth of the WIG20 stretched during yesterday's final fixing. Could not however reach and exceed the level of 1750 points, which in the short term technical resistance. As a result, we return to the yesterday's status quo.

-

08:42

Futures point to a negative start of trading on the major stock exchanges in Europe: DAX futures -0.2%, CAC40 flat, FTSE -0.1%

-

08:38

US CPI expected to shake things up in a quiet week so far. 1% anual inflation rise expected vs +0.8% previous ( 2% Fed target)

-

08:34

New Zeeland ANZ consumer confidence index advanced 2.8%

Consumer confidence in New Zealand picked up steam in September, the latest survey from ANZ Bank revealed on Friday as its consumer confidence index advanced 2.8 percent to a reading of 121.0.

That represents an eight-month high for the index, and it follows the 0.4 percent decline in August to 117.7.

The September results shows that economic momentum is continuing at brisk clip, ANZ said in its commentary, as house price expectations hit a new high.

The index continues to flag solid to strong GDP growth in coming months, with projections hitting 4 percent - rttnews.

-

08:32

Asian session review: tight ranges before US CPI

The US dollar traded almost unchanged after yesterday's decline on weak economic data from the United States. The US Commerce Department reported that retail sales fell by 0.3% after rising 0.1% in July. Sales rose by 1.9% compared to last year. Excluding automobiles, gasoline, building materials and food services sales declined by 0.1% after falling 0.1% in July. It was expected that total sales will fall by 0.1%, while core sales to rise by 0.3%.

Meanwhile, the Labor Department said that initial applications for unemployment benefits rose by 1.000 to reach a seasonally adjusted 260,000 for the week ended September 10. Economists had forecast that claims will rise to 265 000. This was the 80 th week in a row with claims below 300 000, the longest period since 1970.

These data led investors to doubt that the US economy is strong enough to withstand a rate hike in the coming months. According to Fed futures the probability of a rate hike in December is 46% compared to slightly more than 53% a day earlier. The probability of a rate hike at the next meeting, to be held September 20-21, is only 12% compared to more than 15% on Wednesday.

Today at 12:30 GMT data on the US consumer price index will be published. According to the average forecast, prices are expected rose by 0.1% after flat in July.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1235-50 range

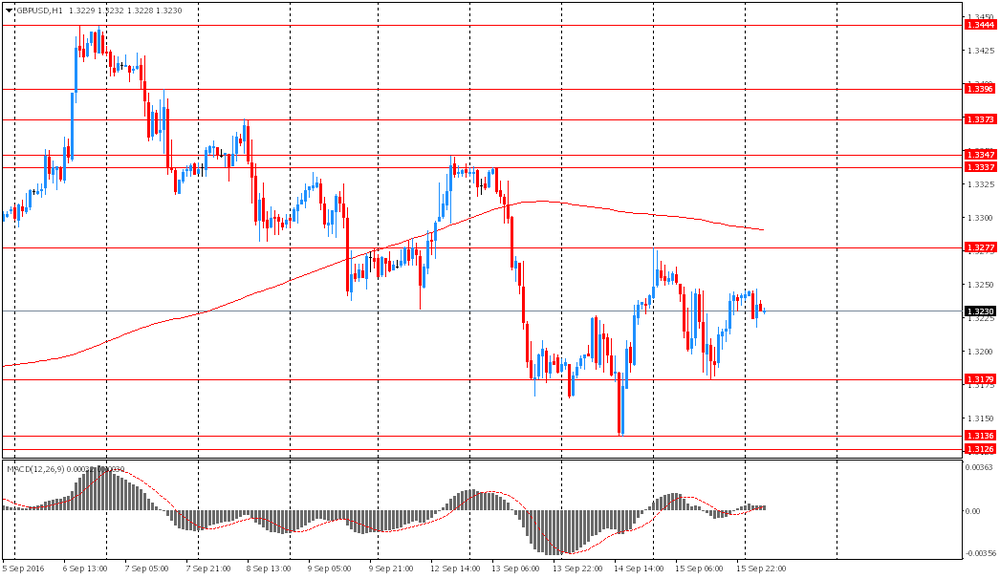

GBP / USD: during the Asian session, the pair was trading in the $ 1.3220-45 range

USD / JPY: during the Asian session, the pair was trading in the Y101.70-10 range

-

08:29

Options levels on friday, September 16, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1374 (2333)

$1.1333 (2080)

$1.1295 (425)

Price at time of writing this review: $1.1237

Support levels (open interest**, contracts):

$1.1184 (3044)

$1.1152 (3831)

$1.1116 (3687)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 35524 contracts, with the maximum number of contracts with strike price $1,1500 (4677);

- Overall open interest on the PUT options with the expiration date October, 7 is 38828 contracts, with the maximum number of contracts with strike price $1,1100 (6199);

- The ratio of PUT/CALL was 1.09 versus 1.06 from the previous trading day according to data from September, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.3503 (1779)

$1.3406 (2156)

$1.3309 (1348)

Price at time of writing this review: $1.3226

Support levels (open interest**, contracts):

$1.3191 (1904)

$1.3095 (766)

$1.2997 (3366)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 22328 contracts, with the maximum number of contracts with strike price $1,3450 (2773);

- Overall open interest on the PUT options with the expiration date October, 7 is 20742 contracts, with the maximum number of contracts with strike price $1,3000 (3366);

- The ratio of PUT/CALL was 0.93 versus 0.95 from the previous trading day according to data from September, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:28

WSE: Before opening

Thursday's session on the New York stock exchange has brought one-percent increase in the major indexes. To the fourth day in a row rising contributed quotes of Apple, higher oil prices as well as positive data from the US economy closely followed by the market.

Markets returned to calm after a period of increased volatility at the beginning of the week, which was caused by speculation on the future of monetary policy in the United States, among others, on a wave of conflicting signals from the speech of Fed members.

In the morning, we see a slight withdrawal of the contract on the S&P500, so we may expect a neutral openings in Europe. Also the oil market and the EURUSD currency pair does not show on some fireworks.

We also may not forget that today's session will be held on the third Friday of September, which simply directs the attention of investors towards the derivative market and the so-called day of three witches, what means shifts in prices associated with the expiration of futures contracts. That is why today's trading in the equity markets may be - and probably will - distorted by noise generated by the players in the derivatives market.

Hence for the return of regular trading we have to wait for the new week, which will bring the most anticipated event of September - a two-day meeting of the FOMC.

Today, markets will get another important US data that will shape expectations before September 21 - reading of the CPI from the US.

On the Warsaw market, investors should move out today the WIG20 over support in the region of 1,750 points, however, trade will be subordinated to the time in which derivative market players will be settled their positions on the WIG20 futures contracts. This usually results in low turnover till the final hour and abrupt increase of activity in the last hour of trading.

-

08:12

EUR/USD, USD/JPY: Reactions If The Fed Disappoints Next Week - BNPP

"Heading into next week's FOMC meeting, markets are pricing just a 20% chance of a rate hike. We think the likelihood of a hike are considerably higher and continue to forecast the Fed delivering 25bp of tightening. Our economists expect the Fed will cushion its delivery with reassurances about gradual tightening going forward, a lower projected terminal Fed funds rate and a shift to the dot plot to signal that further tightening this year is not expected.

However, with rates markets underpriced for tightening heading into the meeting and the market short USD, we expect to see a significant, broad strengthening of the USD in response.

If the Fed does elect to leave policy unchanged, we expect the accompanying message to attempt to keep a December hike in play, but markets are likely to be sceptical, and in this scenario the USD would likely challenge the lower ends of its recent ranges vs the EUR and JPY.

In contrast to the Fed, we expect the Bank of Japan to disappoint expectations for easing this week. Our economists expect no action on the Bank's deposit rate and no significant changes to its QE program at this meeting. Surveys show about half of economists expect a move this week, but we note that our position metrics still show significant long yen positioning, suggesting that either market participants do not expect a move or they are sceptical that new action from the BoJ can weaken the yen.

We do not expect a steady policy call this week to result in sharp yen gains, particularly about 12 hours ahead of the FOMC meeting. However, if the Fed does disappoint our forecast, the combination of a steady Fed and steady BoJ policy would likely see USDJPY test back below 100".

Copyright © 2016 BNP Paribas™, eFXnews™

-

08:08

Chinese banks will be closed today in observance of the Mid-Autumn Festival

-

08:06

Japanese Finance Minister Aso: Our goal is to eradicate deflation

During his speech today, Japanese Finance Minister, Taro Aso, has once again pointed out that the most important task for his Ministry and the Bank of Japan is to eradicate deflation. However, the minister said that the policy process requires coordinated fiscal and monetary actions of the two institutions.

-

06:45

Global Stocks

European stocks snapped a losing streak Thursday, as soft U.S. economic data underscored expectations that borrowing rates in the world's largest economy will be held at ultra-low levels a while longer.

U.S. stocks finished higher Thursday, near their intraday highs, as an Apple-inspired rally in the tech sector helped to lift the broader market following a deluge of macroeconomic reports. Earlier in the session, investors were training their focus on retail sales, which showed a decline in August-the first since March. Meanwhile a weekly report on jobless claims ticked higher but remained at historically low levels. And, producer prices remained flat, suggesting lack of inflation pressures.

Gains in Asian markets followed a sharp rise in Apple shares overnight which boosted major U.S. indexes. Apple began shipping its new iPhone models Friday. Markets in China, Hong Kong, Taiwan, South Korea and Malaysia were closed for the mid-autumn festival.

-

00:30

Commodities. Daily history for Sep 15’2016:

(raw materials / closing price /% change)

Oil 43.70 -0.48%

Gold 1,317.80 -0.02%

-

00:29

Stocks. Daily history for Sep 15’2016:

(index / closing price / change items /% change)

Nikkei 225 16,405.01 0.00 0.00%

Shanghai Composite 3,002.67 -20.84 -0.69%

S&P/ASX 200 5,239.86 0.00 0.00%

FTSE 100 6,730.30 +56.99 +0.85%

CAC 40 4,373.22 +2.96 +0.07%

Xetra DAX 10,431.20 +52.80 +0.51%

S&P 500 2,147.26 +21.49 +1.01%

Dow Jones Industrial Average 18,212.48 +177.71 +0.99%

S&P/TSX Composite 14,503.67 +137.21 +0.96%

-

00:28

Currencies. Daily history for Sep 15’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1242 -0,05%

GBP/USD $1,3241 0,00%

USD/CHF Chf0,9717 -0,11%

USD/JPY Y102,04 -0,28%

EUR/JPY Y114,42 -0,61%

GBP/JPY Y135,12 -0,28%

AUD/USD $0,7516 +0,57%

NZD/USD $0,7323 +0,42%

USD/CAD C$1,3151 -0,33%

-

00:00

Schedule for today,Friday, Sep 16’2016

12:30 Canada Manufacturing Shipments (MoM) July 0.8% 1%

12:30 Canada Foreign Securities Purchases July 9.02 10.12

12:30 U.S. CPI, m/m August 0% 0.1%

12:30 U.S. CPI, Y/Y August 0.8% 1%

12:30 U.S. CPI excluding food and energy, m/m August 0.1% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y August 2.2% 2.2%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) September 89.8 90.8

20:00 U.S. Total Net TIC Flows July -202.8

20:00 U.S. Net Long-term TIC Flows July -3.6 30.2

-